Tron (TRX) and Ethereum (ETH) are both popular blockchain platforms that have captured the attention of investors, developers, and the general public.

While both platforms share similar features and functions, there are some significant differences that set them apart.

This blog post will provide an in-depth comparison between “Tron vs Ethereum”, exploring their strengths, weaknesses, and unique features.

Key Takeaways:

- Tron uses a Delegated Proof of Stake (DPoS) consensus mechanism while Ethereum uses Proof of Work (PoW).

- Tron has a larger block size, allowing for faster transactions compared to Ethereum.

- Tron has a lower average transaction fee compared to Ethereum, making it a more cost-effective option for users.

- Tron has a faster block time, with blocks being produced every 3 seconds compared to Ethereum’s block time of 15 seconds.

Tron (TRX) and Ethereum Explained

TRON is a blockchain platform that allows for decentralized applications and smart contracts. It was established in 2017 by the Tron Foundation and initially used the Ethereum network before switching to its own.

TRON’s cryptocurrency is TRX and it operates using a transaction model similar to Bitcoin, with all transactions recorded on a public ledger.

Ethereum is a decentralized platform that enables the creation of decentralized applications (dApps) and smart contracts. Key features of Ethereum include:

- Smart Contracts: self-executing contracts with terms of agreement encoded in code

- Decentralized Applications (dApps): deployment and execution of dApps on the Ethereum platform

- Turing-Complete Programming Language: supports complex dApp development

- Gas Mechanism: incentivizes miners to process transactions and execute smart contracts

- Immutable Ledger: transparent and secure record of all transactions on the network

- Ethereum Virtual Machine (EVM): a virtual machine that executes Ethereum code and runs on all nodes in the network, providing a secure environment for smart contract execution.

TRON (TRX) vs Ethereum: Key Differences

Here’s a comparison table between Tron (TRX) and Ethereum:

| Feature | Tron (TRX) | Ethereum |

|---|---|---|

| Launched Date | September 2017 | July 2015 |

| Founders | Justin Sun | Vitalik Buterin, Gavin Wood, Joseph Lubin |

| Market Cap | $5.8 billion | $200 billion |

| Consensus Mechanism | Delegated Proof of Stake | Proof of Stake |

| Transaction Speed | ~ 2000 TPS (transactions per second) | ~ 15-25 TPS |

| Smart Contracts Language | Solidity (similar to Ethereum’s language), Java | Solidity |

| Transaction Fees | Typically lower than Ethereum | Varies, but typically higher than Tron |

| Security | High | High |

Note: Market cap and transaction fees are subject to change and are not constant.

Transaction Speed

Tron and Ethereum are two popular cryptocurrencies that differ in terms of transaction throughput and block time. Tron has a higher transaction throughput compared to Ethereum, with a reported transaction speed of approximately 2000 transactions per second (TPS), while Ethereum has a transaction speed of approximately 15-25 TPS. This results in faster transaction times and lower latency for users on the Tron network.

Tron’s block time is also significantly faster than Ethereum’s, with a reported block time of approximately 3 seconds, compared to Ethereum’s block time of roughly 15 seconds.

Smart Contracts

Tron and Ethereum both support the development and deployment of smart contracts, with Tron focusing on scalability and high performance and supporting contracts written in both Solidity and Java. Ethereum, on the other hand, has a strong focus on security and a large developer community, with contracts written solely in Solidity Programming language.

Tron (TRX) has a growing ecosystem of Decentralized Applications (DApps), Whereas Ethereum (ETH) Has a large and established ecosystem of DApps, including gaming, DeFi, and NFTs.

Consensus Mechanism and Network Security

Both Tron (TRX) and Ethereum utilize consensus algorithms to provide network security.

Ethereum has recently transitioned from a Proof-of-Work (PoW) consensus algorithm to a Proof-of-Stake (PoS) consensus algorithm called Ethereum 2.0. In PoS, instead of solving mathematical puzzles, nodes are selected to validate transactions and create new blocks based on the amount of stake they hold in the network. This makes it more energy-efficient and scalable compared to PoW.

Tron, on the other hand, uses a delegated Proof-of-Stake (DPoS) consensus algorithm. In DPoS, token holders vote for a limited number of nodes called “super representatives” to validate transactions and create new blocks. This allows for faster transaction processing and confirmation times compared to PoW and PoS.

Ethereum PoS Vs. Tron (TRX) Delegated-PoS

Both PoS and DPoS aim to increase network efficiency, reduce energy consumption, and provide more secure networks than PoW.

Ethereum PoS allows validators to earn rewards based on their stake, while Tron (TRX) DPoS allows token holders to have more direct control over the network through voting.

| Feature | Proof-of-Stake (PoS) | Delegated Proof-of-Stake (DPoS) |

|---|---|---|

| Validation | Validators are selected randomly based on the amount of cryptocurrency they hold and stake. | Token holders vote for delegates to perform network validation and maintenance tasks. |

| Rewards | Validators earn rewards based on the amount of cryptocurrency they hold and stake. | Delegates receive rewards in the form of transaction fees. |

| Selection Process | Proportional to the amount of cryptocurrency held and staked by validators. | Through voting by token holders. |

| Decentralization | Higher, as validators are selected randomly based on their stake. | Lower, as a limited number of delegates are elected through voting. |

Tron Vs Ethereum: DApps Ecosystem

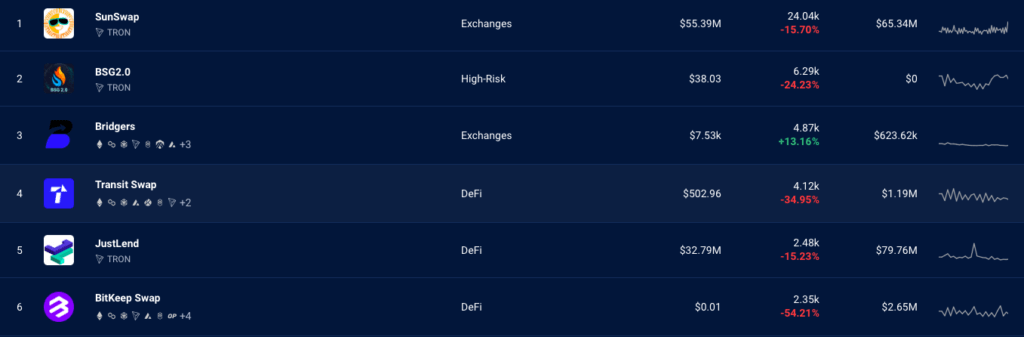

Tron (TRX) has a large Ecosystem for Decentralized applications (DApps) in Gaming, Defi, Gambling, Exchanges, and Marketplaces. As of January 2023, Tron has over 100 live DApps on its Network.

Some Popular DApps of the TRON Ecosystem are:

- JustLend: Defi Platform

- Sunswap: Decentralized Exchange

- Token BatchSender

- BitKeep Swap: Defi

- Keep: Defi

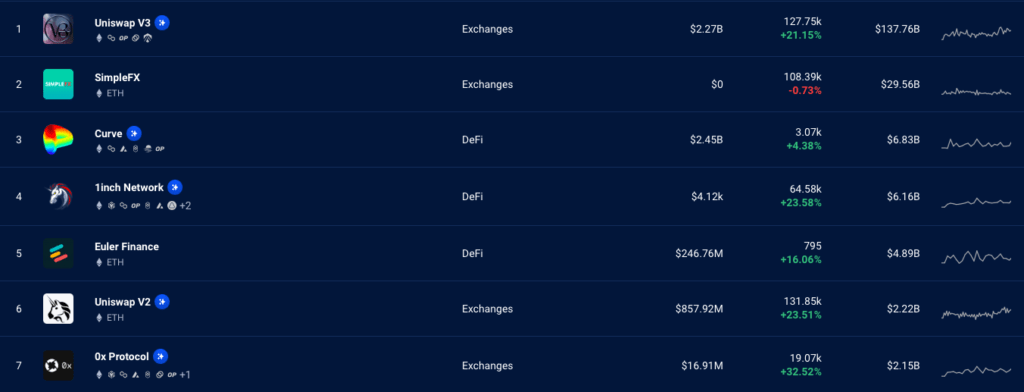

The Ethereum blockchain is home to a thriving and diverse decentralized application (DApp) ecosystem.

These applications can be broadly categorized into several categories including DeFi (Decentralized Finance) apps, gaming apps, social media and content sharing apps, prediction market, and governance apps, healthcare and wellness apps, and real estate and property management apps.

DeFi apps such as Uniswap, Aave, and Compound have gained significant traction in recent times, offering decentralized finance solutions such as lending, borrowing, and trading digital assets.

Popular DApps of Ethereum (ERC) Ecosystem:

- Uniswap

- OpenSea

- Aave

- Lido DAO Liquid Staking

- MakerDAO Stablecoin lending

USDT Stablecoin on TRON and Ethereum Network

Tether (USDT) is a stablecoin that aims to maintain a value of 1:1 with the US dollar. USDT can exist on multiple blockchain platforms, including Tron and Ethereum, as a token that represents a claim on the underlying assets held in reserve by Tether Limited.

USDT on Tron is a TRC-20 token, which means it operates on the Tron blockchain network and follows the Tron protocol for token transfers and smart contract execution.

USDT on Ethereum is an ERC-20 token, which means it operates on the Ethereum blockchain network and follows the Ethereum token standards.

USDT on TRON also offers several advantages over Ethereum networks, such as faster transaction processing times and lower transaction fees, thanks to the high-throughput capacity and low-cost structure of the TRON network.

This makes it a convenient and cost-effective option for users who want to transfer and store value in a stable, secure, and decentralized manner.

TRON Vs Ethereum: Token Economics and Price Analysis

Token economics refers to the design and mechanics of the token system within a blockchain network, including the creation, distribution, and incentivization mechanisms.

Tron (TRX) is the native token of the Tron blockchain, used to pay for transactions, smart contract execution, and as a store of value. Tron has a circulating supply of 91,755,767,098 TRX and a market capitalization of $5.8 billion. The total supply of TRX is capped at 100 billion.

The token was initially distributed through an initial coin offering (ICO) and the remaining tokens are set to be distributed through mining, rewards, and a token buyback and burn mechanism.

Ethereum (ETH) is the native token of the Ethereum blockchain, used to pay for transactions, and computational services and for participating in decentralized applications and governance. Ethereum has a circulating supply of 122,373,866 ETH and a market capitalization of $200 billion.

Conclusion

In conclusion, Tron and Ethereum are both popular cryptocurrencies that offer unique benefits. Tron focuses on scalability and high performance and has a growing ecosystem of DApps. It also supports smart contracts written in both Solidity and Java.

On the other hand, Ethereum places emphasis on security and has a large developer community. It also has a mature and established ecosystem of DApps and supports smart contracts written in Solidity.

The choice between these two cryptocurrencies will depend on individual needs and priorities. This includes the type of applications they want to build, language preference, and the importance placed on ecosystem maturity and security.

Both Tron and Ethereum have the potential to bring about positive change in the world of blockchain and cryptocurrency. It will be interesting to see how each evolves in the coming years.