Kraken are Coinbase are two of the most popular crypto exchanges in the world. Both are highly regulated in the U.S. and Europe. So, which is better for you?

I have used both platforms for trading, staking, depositing, withdrawing, and even testing their support, so I can share my real experience with you. At first glance, both look very similar, but once you dive deeper, the differences become clear.

Coinbase feels easier for beginners, while Kraken gives more control to advanced traders. In this guide, I’ll break down the Kraken vs Coinbase comparison based on fees, features, security, user experience, and customer support so you can see which exchange truly fits your needs.

Key takeaways 🔑

- Coinbase is better for beginners thanks to its simple interface and easy-to-use buy/sell features.

- Kraken is better for advanced traders with margin trading, futures trading, and lower trading fees.

- Kraken supports more cryptocurrencies (450+) compared to Coinbase’s ~300.

- Coinbase is more regulated in the U.S., while Kraken holds broader international licenses across the EU, UK, Canada, and Asia.

- Kraken has never been hacked, giving it a stronger security track record than Coinbase.

- Coinbase has higher global adoption, with more users and monthly traffic than Kraken.

- Kraken supports more fiat currencies and payment methods, making it better for international traders.

Kraken vs Coinbase: Comparison (Key Difference)

| Criteria | Kraken | Coinbase |

|---|---|---|

| Founded Year | 2011 | 2012 |

| Headquarters | San Francisco, USA | Remote only |

| User Base | ~15 million users | ~108 million users |

| Countries Served | ~190+ | 100+ |

| Fee Structure (Maker/Taker) | Maker: 0 – 0.25% Taker: 0.10 – 0.40% | Maker: 0 – 0.40% Taker: 0.05 – 0.60% |

| Pro Member Fee Incentives | Kraken+ → Zero fees up to $20K/month | Coinbase One → Zero fees up to $500–$10K |

| Cryptocurrency Support | 450+ coins | ~280–300 coins |

| Fiat Payment Options | ACH, wire, debit/credit cards, SEPA, SWIFT | ACH, wire, debit/credit cards |

| Margin/Futures Trading | Available (margin up to 5x, futures up to 50x) | Available (futures up to 20x) |

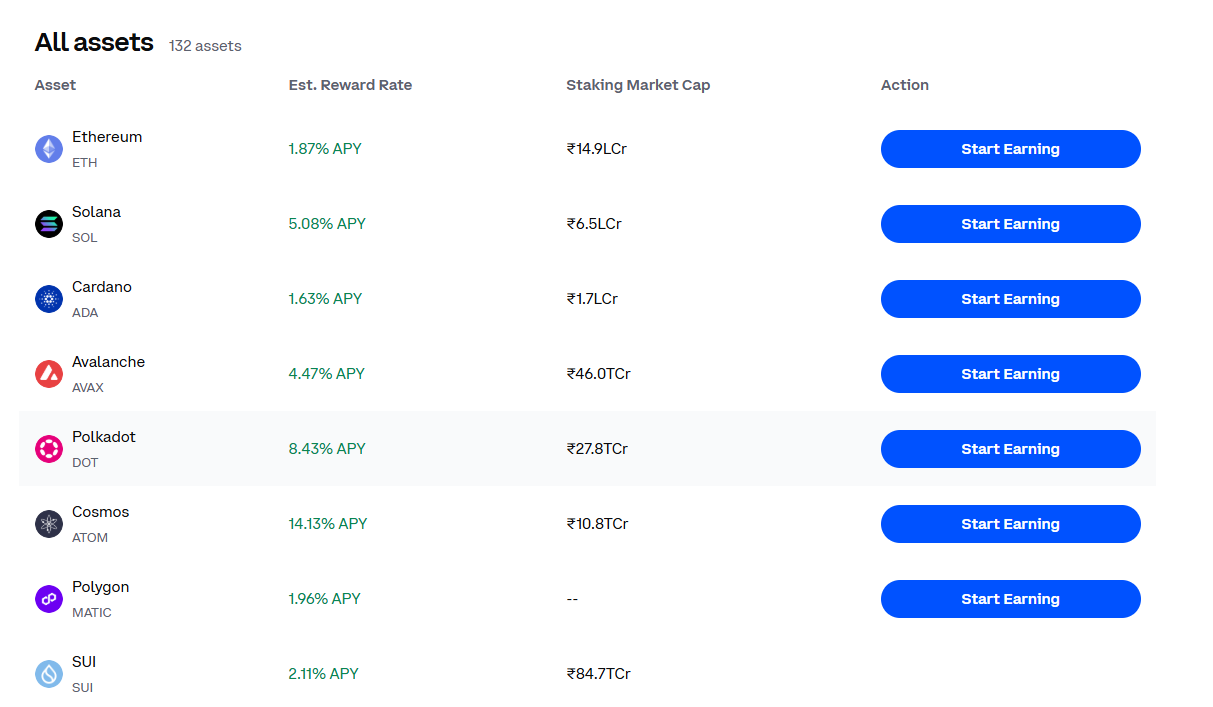

| Staking & Earn Availability | Broad asset support, yields up to ~21% | Major PoS assets, yields up to ~14% |

| Staking Restrictions in US | Some restrictions by state | Available depending on state regulations |

| Proof of Reserves | Yes, publicly audited | Yes, but not always publicly audited |

| Security Features | 2FA, PGP email encryption, Master Key, cold storage | 2FA, AES-256 encryption, FDIC insured USD, cold storage |

| Regulatory & Legal Status | Private company, subject to US investigations | Publicly traded on NASDAQ |

| Mobile App | iOS and Android (advanced features) | iOS and Android (beginner friendly) |

| Supported Wallet Type | Kraken Wallet (exchange + self-custody) | Coinbase Wallet (self-custody) |

| Customer Support | 24/7 live chat, email, phone, 12+ languages | Live chat, email, phone in select regions, 5 languages |

| UI & Ease of Use | Complex, designed for advanced traders | Simple, designed for beginners |

| Learn & Earn / Education | Limited resources | Coinbase Earn program, tutorials |

| Institutional Offerings | Kraken Institutional | Coinbase Prime |

| Deposit/Withdrawal Limits | Up to $100K/day (Intermediate), $10M/day (Pro) | Up to $100K/day (wire or ACH) |

| Fee for Recovery Service | Variable, case-based | Flat 5% for assets above $100 |

Which crypto exchange has more users and most trusted?

Coinbase ranks higher globally with a daily trading volume of $10B, compared to Kraken’s $8B. It also attracts far more traffic, with 64M monthly visits and over 7M Twitter followers, while Kraken records 10M visits and 2M followers. Kraken, however, has been around longer, established in 2011 versus Coinbase in 2012.

| Feature | Coinbase | Kraken |

|---|---|---|

| Category rank | 3rd | 5th |

| Registered | United States | United States and Europe |

| 24-hr trading volume | $10B | $8B |

| Most active trading pair | BTC/USD | BTC/USDT |

| Monthly visits | 64M | 10M |

| Social media followers | 7M+ | 2M+ |

Who is better regulated, Kraken or Coinbase?

Coinbase stands out as one of the most regulated crypto exchanges, especially in the United States. It has been granted a BitLicense by the New York Department of Financial Services and is registered as a Money Services Business with FinCEN.

As a public company listed on NASDAQ, Coinbase is subject to strict U.S. securities and financial regulations and actively engages with regulators.

However, it has faced its share of legal challenges, including a lawsuit from the SEC regarding its staking service (which was later dismissed), as well as fines from regulators in New York, the UK, and the Netherlands for anti-money laundering and customer onboarding violations. Despite these issues, Coinbase remains one of the most institutionally compliant exchanges globally.

Kraken, in contrast, has forged a wide regulatory footprint across both Europe and North America. It holds licenses from the UK’s Financial Conduct Authority (FCA) to operate as an electronic money institution and, more recently, secured a MiCA license from the Central Bank of Ireland, enabling it to operate across the entire EU.

It is also licensed in Canada, Australia, and Japan, and became the first crypto firm to obtain a bank charter in Wyoming (SPDI). Kraken is known for performing regular proof-of-reserves audits and maintains ISO/IEC 27001 and SOC 2 certifications, enhancing its credibility, though it has settled regulatory investigations with U.S. authorities totaling over $30 million. (Read: best anonymous crypto exchanges without KYC)

Verdict – Both are highly regulated (Coinbase offers deeper compliance within the U.S. due to its public status and focus on U.S. regulations. Meanwhile, Kraken holds broader international licenses across the EU, UK, Canada, Asia, and Wyoming, making it a more globally regulated exchange.)

Kraken Pro vs Coinbase Advanced

| Criterion | Kraken Pro | Coinbase Advanced Trade |

|---|---|---|

| Number of Trading Pairs | 400+ assets (crypto, stablecoins, fiat) | 500+ spot trading pairs |

| Charting & UI | Full-featured charting, 25+ customizable widgets, live order books | TradingView-powered interactive charts, real-time order books |

| Order Types | Stop-loss, take-profit, IOC, reduce-only, drag-on-chart edits | Limit, market, stop-limit, bracket, plus real-time order books |

| Fees | Low, volume-based rates (as low as 0%) | Volume-based fees with maker rates as low as 0% |

| Platform Customization | Custom dashboards with layouts and modules | Intuitive layout, but less customizable than Kraken’s modular design |

| Mobile/Desktop Access | Kraken Pro app (mobile-first) and Desktop app for power users | Access via web/app with unified Advanced Trade interface |

| Developer Tools / APIs | API support via Kraken API | Advanced Trade API with SDKs (Go, Python, TypeScript, Java) |

Kraken Pro is built for seasoned traders who need deep control and customization. You get access to 400+ assets, advanced charting tools, and customizable dashboards with 25+ widgets, plus powerful order types like stop-loss, take-profit, IOC, and drag-on-chart edits.

They also offer both mobile (Pro app) and desktop apps, enabling a serious, flexible trading setup.

Coinbase Advanced Trade, on the other hand, offers over 500 spot pairs and sleek TradingView charts right within its interface. While it may not let you build your own layout, it provides a clean and intuitive experience with bracket, limit, stop-limit, and market orders.

Fees are competitive and volume-based, with maker rates starting as low as 0%. Developers benefit strongly here too, Coinbase backs its Advanced Trade with APIs and official SDKs in multiple languages (Go, Python, TypeScript, and Java), making automation and integration smoother.

Overview of Kraken and Coinbase

| Feature | Kraken | Coinbase |

|---|---|---|

| Founded | 2011 | 2012 |

| Founders | Jesse Powell, Thanh Luu | Brian Armstrong, Fred Ehrsam |

| Headquarters | USA | Remote only |

| Users | 30+ million | ~100 million estimated |

| Available countries | 190+ countries | 100+ countries |

| Mobile app | iOS (4.7★), Android (4.4★) | iOS (4.7★), Android (4.5★) |

| Customer support | 24/7 Live chat, Email, Phone support | 24/7 Live chat, Email, Phone support in select regions |

| Third party reviews | Kaiko: #2 exchange Coingecko: 10/10 G2 rating: 4.1 Capterra: 4.8 | Kaiko: #1 exchange Coingecko: 10/10 G2 rating: 3.8 Capterra: 4.1 |

What is a Kraken Exchange?

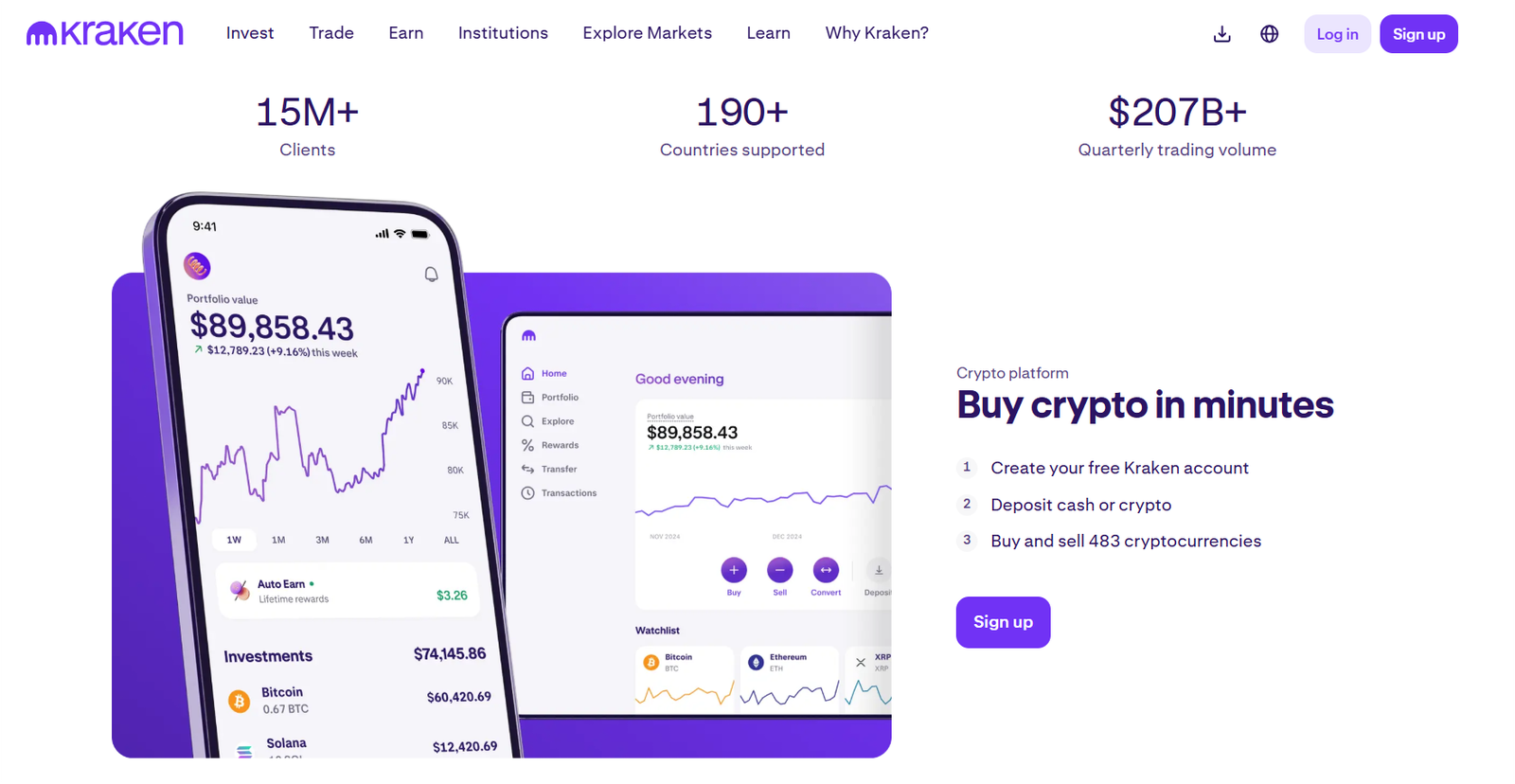

Kraken started in 2011 and is one of the oldest crypto exchanges still running today. Over the years, it has become known as a safe and trusted place to trade, used by millions of people. The company is based in Wyoming, USA, but it is available in more than 190 countries, giving it a strong global reach while also following strict rules and regulations.

Kraken offers different options for different kinds of users. Regular investors can use its simple and easy main platform, while experienced traders can use Kraken Pro with more advanced tools. For big institutions, Kraken also provides special services to help them access larger markets.

Also, Kraken is popular with people who care most about safety, honesty, and strong trading tools. The company does regular “Proof of Reserves” checks to show users that their money is safe. In fact, Kraken was one of the first crypto exchanges to launch “PoR” transparency.

For anyone looking for a trusted and rule-focused place to trade, Kraken gives a smooth experience. It supports spot trading, futures, margin trading, crypto staking, and even special OTC services for bigger trades.

Disclaimer: Crypto markets are volatile and may result in loss of funds. Some products are unregulated and may lack government or regulatory protection. Services for U.S. and U.S. territory customers are provided by Payward Interactive, Inc. (“PWI”) dba Kraken, a FINCEN-registered money services business and subsidiary of Payward, Inc. View PWI’s disclosures here.

What is a Coinbase Exchange?

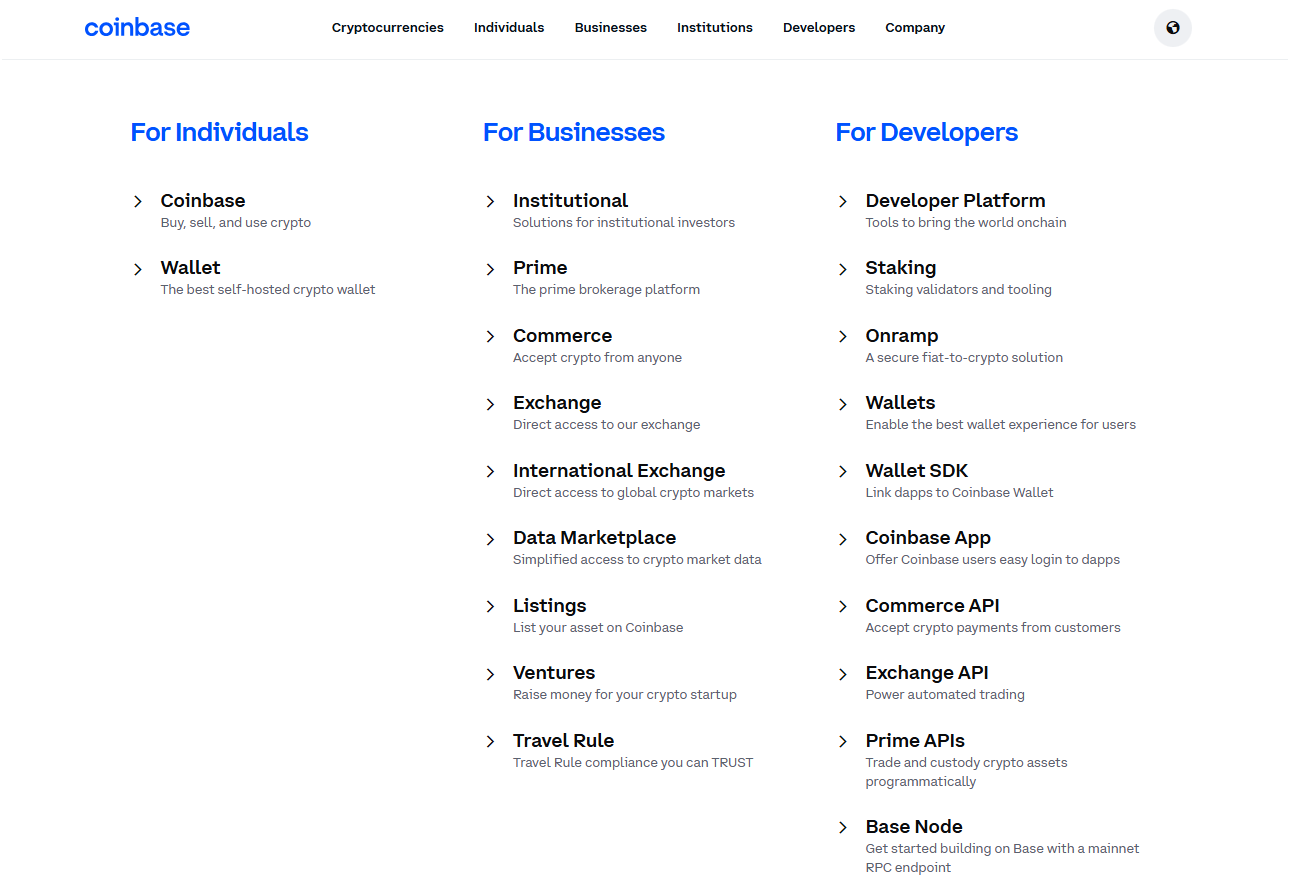

Coinbase is a cryptocurrency exchange started in 2012, and in 2021, it became a public company on Nasdaq with the symbol COIN. At first, it had a main office in the U.S., but now it works fully online without one central location. Today, people in over 100 countries can use Coinbase.

Since it is a public company, Coinbase must follow strict rules and share reports about its business. This affects how the platform is run and how it offers services.

Coinbase gives users many tools to buy, sell, and manage crypto. It has a simple app for everyday users, Coinbase Advanced for skilled traders, options for staking, learning materials, and APIs for developers.

Verdict – Kraken Wins (Coinbase clearly has more users worldwide, but Kraken serves in more countries and offers full phone support. If global reach and better customer service matter more than sheer size, Kraken comes out ahead here.)

Kraken vs Coinbase: Products and Services

| Feature | Kraken | Coinbase |

|---|---|---|

| Educational resources | Kraken Learn | Coinbase Learn |

| Spot trading | ✔ | ✔ |

| Margin trading | Up to 5x | ✘ |

| Futures trading | Up to 50x | Up to 20x |

| Staking | 21+ assets Up to 17% APY | ~8 assets APY details unavailable |

| Payment services | Krak | ✘ |

| Advanced features | Technical analysis Charting tools Advanced order types Price alerts | Technical analysis Charting tools Advanced order types Price alerts |

| API trading | ✔ | ✔ |

Kraken Products and Features

Kraken offers many tools to fit different types of traders, from beginners to experts. People can trade easily using its mobile app, or use Kraken Pro for more advanced features like detailed charts, special order types, and live market data.

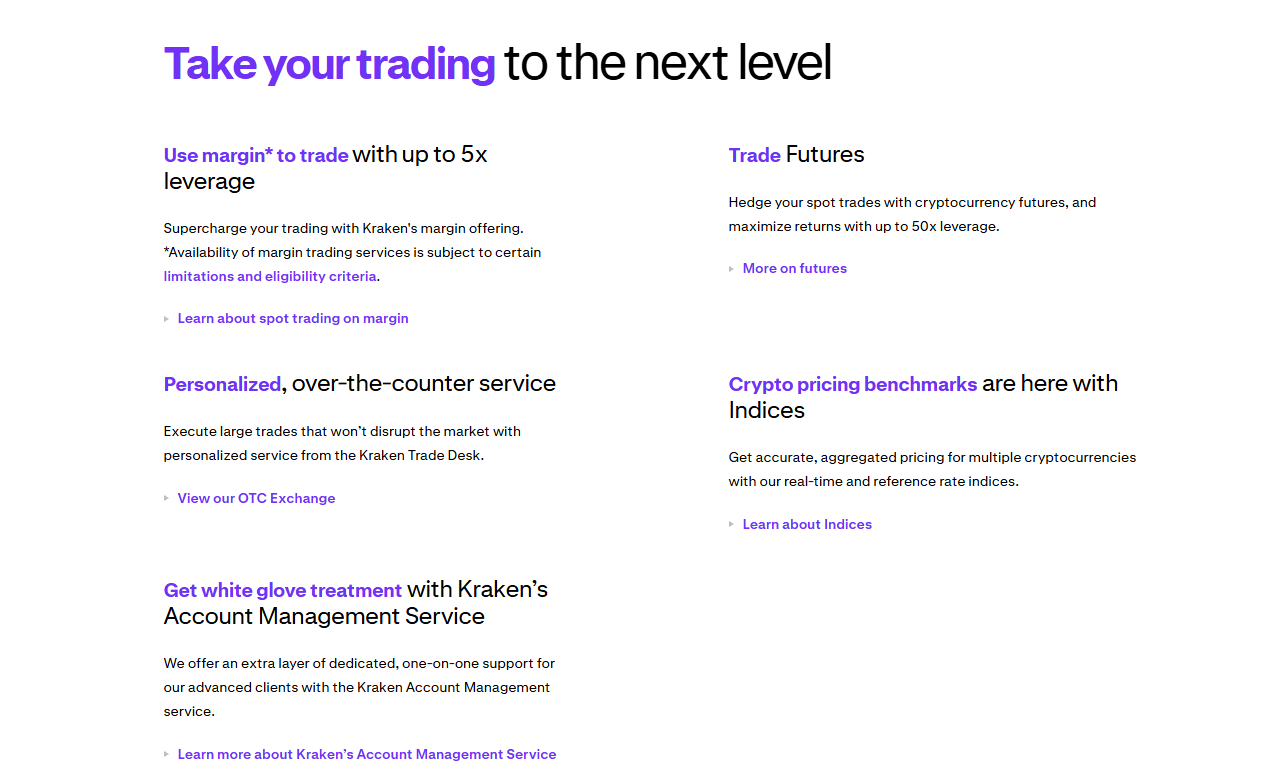

The platform supports regular spot trading for everyone. In some regions, it also allows margin trading (up to 5x leverage) and futures trading (up to 50x leverage). For larger investors and institutions, Kraken has extra services through its OTC desk and Kraken Prime.

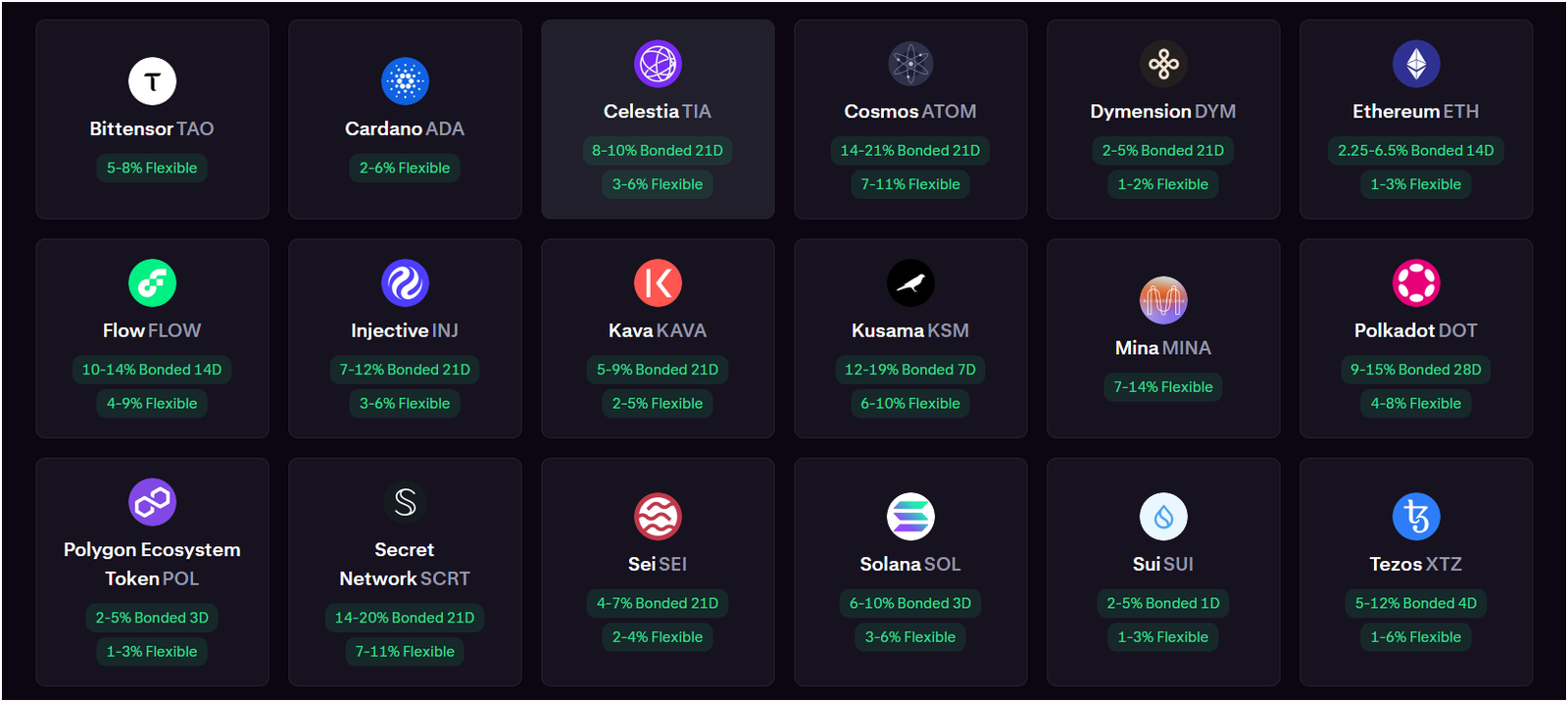

Besides trading, users can stake more than 21 different cryptocurrencies and earn rewards that may reach up to 17% APY, depending on the coin and network. Popular assets for staking include Ethereum (ETH), Solana (SOL), and Cardano (ADA).

Kraken also makes sending money simple with Krak, a feature that lets users transfer crypto or cash worldwide with no extra fees.

In 2024, Kraken launched its own Ink Layer-2 network, built on Optimism’s SuperChain. This helps connect centralized exchanges with decentralized finance (DeFi) systems. For learning, Kraken Learn provides free resources to help users understand crypto basics and even advanced trading strategies.

Coinbase Product and Features

Coinbase is a platform where people can buy, sell, and manage crypto. It works for both beginners and advanced users. The main site lets you do normal trading, while Coinbase Advanced gives extra tools like live charts, order books, and different order options.

The company stopped margin trading in 2020, but now some users in certain places can trade futures. These futures allow up to 20x leverage on some commodities and up to 5x leverage on crypto. Coinbase also has an API, which lets people create their own apps or set up automatic trading.

Besides trading, Coinbase allows staking on at least eight different coins. The rewards (APY) depend on the coin and the network.

In 2023, Coinbase introduced Base, its own Layer-2 network built on Ethereum. This system is designed to make Ethereum faster and cheaper to use.

Verdict – Kraken Wins (Kraken provides more advanced trading tools, higher leverage for margin and futures, and better staking options. Coinbase is simpler, but if you want serious trading flexibility, Kraken is the stronger choice.)

Kraken vs Coinbase: Supported Crypto Assets

For many people, the number of coins and currencies a platform offers is very important. Both Kraken vs Coinbase give users access to hundreds of different options. Let’s see how they compare.

| Feature | Kraken | Coinbase |

|---|---|---|

| Cryptocurrencies | 450+ | ~300 |

| Fiat currencies | 10 major currencies | 3 supported currencies |

| Stablecoins | 15 available | Lists some stablecoins including USDC and USDT |

| Stocks & ETFs | 11,000+ | None |

Kraken supported cryptocurrencies

Kraken gives users access to more than 450 different cryptocurrencies. This includes big names like Bitcoin (BTC) and XRP, plus many smaller altcoins connected to areas like DeFi, gaming, and blockchain projects.

Kraken often adds new coins and even shares a public list showing which tokens are being reviewed or may be added soon. This helps users know what’s coming while also keeping things open and transparent.

When it comes to money transfers, Kraken supports 10 major fiat currencies. This makes it easier for people in different countries to add or withdraw money without only using crypto.

The supported fiat currencies are:

- USD (US Dollar)

- EUR (Euro)

- CAD (Canadian Dollar)

- AUD (Australian Dollar)

- GBP (British Pound)

- CHF (Swiss Franc)

- JPY (Japanese Yen)

- BRL (Brazilian Real)

- ARS (Argentine Peso)

- MXN (Mexican Peso)

On top of that, Kraken also works with 15 stablecoins such as Tether (USDT), USD Coin (USDC), and Dai (DAI).

Coinbase supported cryptocurrencies

Coinbase gives users access to around 300 different cryptocurrencies. It also has an “experimental” tag for new coins, letting people try them early while they are still fresh on the platform.

For money transfers, Coinbase allows deposits and withdrawals in a few main fiat currencies like USD, EUR, and GBP. This makes it easier for users in supported countries to move money between crypto and cash.

Stablecoins are also important on Coinbase, especially USDC. Coinbase helped create USDC and continues to support it across its platform.

Verdict – Kraken Wins (Kraken supports over 450 cryptocurrencies, 15 stablecoins, and even 11,000+ stocks and ETFs. Coinbase has fewer options, so Kraken is the better pick for asset variety and diversification.)

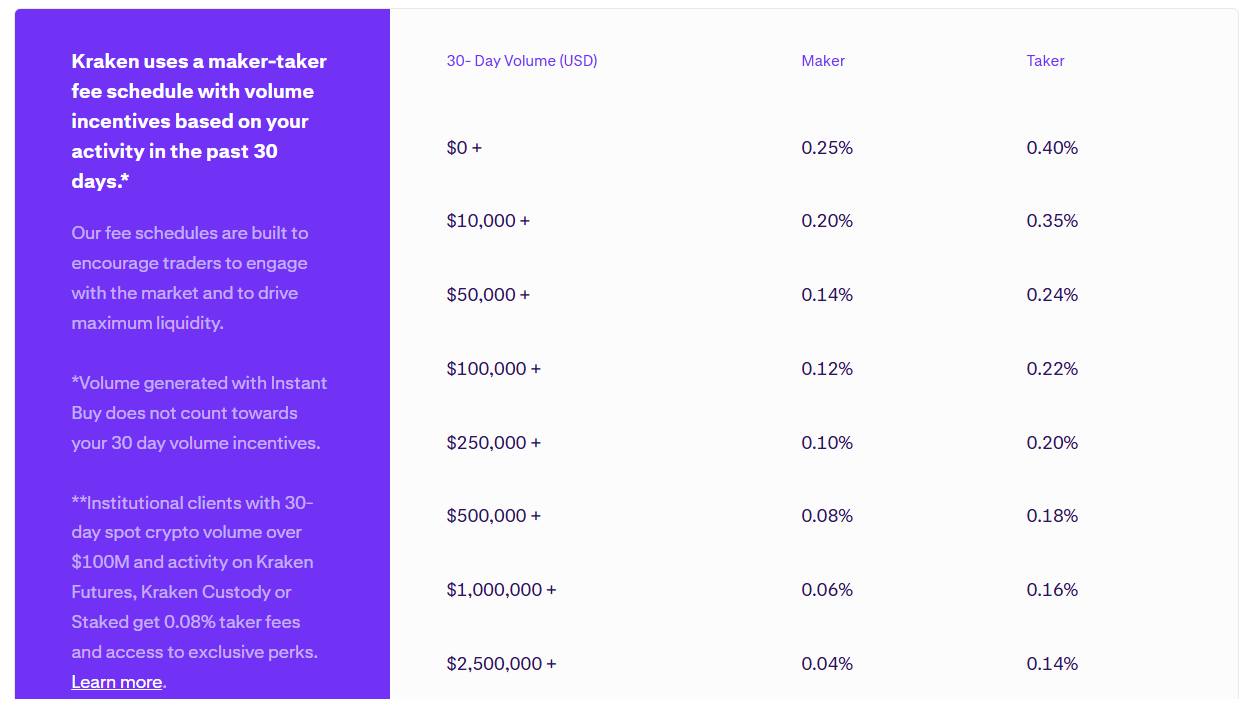

Kraken vs Coinbase Fees and Pricing

Kraken and Coinbase charge fees in different ways. These fee styles can affect both casual traders and people who trade often. The chart below shows how Kraken vs Coinbase fees comparison:

| Feature | Kraken | Coinbase |

|---|---|---|

| Maker fees | Starting at 0.25% Zero trading fees for Kraken+ | Up to 0.40% |

| Taker fees | Starting at 0.40% Zero trading fees for Kraken+ | Up to 0.60% |

| Deposit fees | Free for most crypto and fiat deposits | Free for ACH $10 for wire (USD) €0.15 for SEPA (EUR) Free for Swift (GBP) |

| Withdrawal fees | Fixed Competitive | Varies Free for ACH $25 for wire (USD) £1 GBP for Swift (GBP) |

Kraken fees and pricing

Kraken uses a clear volume-based fee system that works for both new traders and those who trade a lot. On the main platform, maker fees start at 0.25% and taker fees at 0.40%.

With Kraken Pro, fees get lower as you trade more. There’s also a Kraken+ plan for $4.99 that can remove trading fees completely.

Most deposits in fiat or crypto are free, but a few may have charges depending on the method or coin. Withdrawals have fixed fees, and the cost is always shown before you confirm a transaction. Kraken is known for being transparent with no hidden fees, making it easier for users to plan their trades.

Coinbase fees and pricing

Coinbase charges fees in different ways depending on the product. On the regular platform, trades include both a spread and a flat fee. These amounts change based on trade size, payment method, and where you live.

On Coinbase Advanced, fees follow a maker-taker system. Maker fees can go up to 0.40% and taker fees up to 0.60%, depending on how much you trade in 30 days.

For fiat transfers, costs also vary. ACH bank transfers are usually free, but wire transfers and card payments often cost more. Because Coinbase uses spreads and changing fees, it can be harder for users to know the final cost compared to platforms with fixed pricing. (Read: Lowest fee crypto exchanges)

Verdict – Kraken Wins (Kraken starts at lower maker-taker fees and keeps deposits mostly free, while Coinbase charges more and has variable withdrawal fees. For cost-conscious traders, Kraken is the clear winner on fees.)

Coinbase vs Kraken: Security and custody

Keeping accounts safe is one of the most important parts of any crypto exchange. Both Kraken and Coinbase use multiple security layers and also go through outside audits. However, their security history and methods are not exactly the same. Here’s a look at how each Kraken vs Coinbase platform handles protection.

| Feature | Kraken | Coinbase |

|---|---|---|

| Account security features | Two-factor authentication PGP email encryption Account master key Withdrawal address whitelist | Two-factor authentication Multi-approval withdrawals AES-256 encryption Cold wallet storage |

| Security history | No breaches No incidents resulting in loss of client funds | Breaches reported |

| Proof of reserves | Pioneered practice in 2014 | Published regularly |

| Bug bounty program | ✔ | ✔ |

| ISO/IEC 27001:2013 certified | ✔ | ✔ |

| SOC 2, Type 2 examination | ✔ | ✔ |

Kraken security and custody

Kraken is known as one of the safest crypto exchanges. Since it started, there has never been a case where customer money was stolen because of a hack. To keep accounts safe, Kraken uses many strong security tools, such as:

- Two-factor login (2FA)

- Encrypted emails (PGP) for safe communication

- Whitelisting withdrawal addresses (only chosen addresses can be used)

- A special master account key for extra control

These steps make it very hard for anyone to break in or misuse accounts.

Kraken also works hard to be open and honest. In 2014, it became one of the first exchanges to run a “Proof of Reserves” check. This system lets users confirm by themselves that all funds are really backed and safe.

The company has earned big security certifications like ISO/IEC 27001:2013 and passed a SOC 2 Type 2 audit, which means it follows strict rules for data safety and operations. Kraken also has a “bug bounty” program where experts can report problems and help keep the platform even stronger.

All these actions show that Kraken puts trust, security, and transparency first, making it a reliable place for users.

Coinbase security and custody

Coinbase is a crypto exchange that focuses a lot on safety. It uses many layers of security to protect users. Some of these include:

- Two-factor login (2FA)

- Encrypted messages for secure communication

- Keeping most customer funds in cold storage (offline)

- Withdrawal address whitelisting

- Biometric login (like fingerprint or face scan)

For extra trust, Coinbase has important certifications such as SOC 1 and SOC 2 Type II for its custody services. It also carries insurance that covers certain security risks.

Since Coinbase is a public company, it must follow strict rules, share financial reports, and stay under government oversight. The platform also holds licenses and meets compliance standards in many countries.

Verdict – Both are secure (Both exchanges follow strong security practices, but Kraken has never reported breaches, pioneered proof-of-reserves, and holds more certifications. Coinbase is secure, but Kraken has the better track record overall.)

Krakens vs Coinbase: Earn and Staking

| Feature | Kraken Staking & Earn Features | Coinbase Staking & Earn Features |

|---|---|---|

| Reward Rates | Up to ~21% APR depending on asset and staking type | Up to ~14% APY depending on blockchain |

| Asset Variety | Supports dozens of PoS coins, plus Bitcoin, stablecoins, and fiat-like rewards | Covers major PoS assets like ETH, SOL, ADA, DOT, and USDC |

| Flexible vs Locked | Flexible (instant unstake) or bonded (higher yield, fixed term) options | Flexible unstaking; network-imposed wait periods may apply |

| Additional Innovations | Bitcoin staking, auto-earn feature, ETH restaking via EigenLayer | Liquidity for staked ETH using cbETH; boosted yields with membership |

| Ease of Use & Safety | Weekly payouts, clear Earn dashboard, flexible staking allocations | User-friendly staking with full custodial safety and easy access |

Kraken Earn and Staking

Kraken offers extensive staking options with a wide range of assets and flexible choices. Users can pick between flexible staking, which allows access to funds at any time, or bonded staking, which locks assets for higher yields. Reward rates can reach up to around 21% on some assets.

A standout feature is Bitcoin staking, where users can earn additional tokens while holding BTC. Kraken also supports ETH restaking through EigenLayer and includes an auto-earn option for effortless rewards, with payouts made weekly.

Coinbase Earn and Staking

Coinbase focuses on making staking simple and safe, which is ideal for beginners. It supports popular assets such as Ethereum, Solana, Cardano, Polkadot, and USDC, with reward rates reaching up to about 14% APY.

Users can unstake anytime, although some networks may impose waiting periods. In my Kraken vs Coinbase comparison, I also found that Coinbase offers liquid staking for ETH through cbETH, and premium members can access boosted yields along with extra benefits like zero trading fees.

Read more: best crypto staking platforms

Verdict – Kraken Wins (Kraken is the better choice for users who want flexibility, higher returns, and a wider selection of staking assets, including Bitcoin. Coinbase is better suited for those who prefer simplicity, ease of use, and a safer, more beginner-friendly approach.)

Customer Support and User Experience

| Feature | Kraken | Coinbase |

|---|---|---|

| 24/7 live chat | ✔ | ✔ |

| Email support | ✔ | ✔ |

| Phone support | ✔ | ✔ |

| Support languages | 12+ languages | 5 languages |

| Awards & recognition | Winner of the Customer Insight & Feedback category at the Customer Centricity World Series | ✘ No customer-centric awards or recognition identified |

Kraken Customer Support

Kraken is known for having quick and helpful customer service. Users can get help in different ways, such as:

- 24/7 live chat with real support agents

- Email support for questions or issues

- Phone calls with a specialist in some cases

Kraken’s support team speaks more than a dozen languages, making it easier to assist people around the world. The company has also won awards for its customer service, including recognition for using AI to improve customer experience. Kraken focuses on clear answers, empathy, and fast solutions, which helps it stand out from other crypto exchanges.

More articles to explore:

- Best fiat-to-crypto exchanges

- Safest crypto exchanges

- Best Bitcoin exchanges

- Most liquid crypto exchanges

Coinbase Customer Support

Coinbase also gives several support options, including 24/7 live chat, email, and toll-free phone numbers in the U.S., U.K., and some other regions.

Phone support is available in English, Spanish, French, German, and Portuguese. In the U.S., Canada, the U.K., and the EU, phone support is available all day, every day. But in places like France, Germany, Spain, and Brazil, phone help is only open Monday to Friday, 9 a.m. to 6 p.m. local time.

Even though Coinbase has been the first crypto exchange for many new users, not everyone is happy with its support. Some customers complain about long wait times and unhelpful automatic replies. Because crypto is fast-moving and full of new terms, beginners sometimes feel frustrated or confused when they don’t get clear answers right away.

Verdict – Kraken Wins (Kraken supports more languages and even earned awards for customer experience, while Coinbase has fewer language options and no major customer awards. For better multilingual support and recognition, Kraken wins here.)

How user-friendly are Kraken and Coinbase?

Kraken and Coinbase both aim to be user-friendly, but they appeal to slightly different types of users.

- Coinbase is designed with beginners in mind. Its app and website are simple, clean, and easy to navigate, even for people new to crypto. Buying, selling, and storing coins is very straightforward, and features like instant buy options and clear pricing make it beginner-friendly. However, some users say that the fees are higher compared to other platforms.

- Kraken, on the other hand, offers a more advanced experience. While it has improved its interface over time, it is often considered better suited for users who want more control, trading tools, and lower fees. It may take a little longer for complete beginners to get used to, but once they do, many appreciate its depth, security, and professional features.

Conclusion: Kraken vs Coinbase Differences

To sum up Kraken vs Coinbase, both big names in the crypto world, with many years of experience and users all over the globe. But they are built with different ideas in mind, which makes the “best” choice depend on what you need most.

If you care about low fees, wide coin choices, and strong trading tools, Kraken may be the better fit. It is known for high security, clear Proof of Reserves checks, and advanced features that give traders more control. This makes it popular with people and institutions who want both safety and professional tools.

On the other hand, Coinbase is all about being easy and welcoming to beginners. Its simple design and well-known brand help new users feel comfortable. Many people choose it as their first step into crypto because of how simple it is to buy, sell, and manage coins.

In short:

- Kraken = better for those who want strong security, lower costs, and advanced features.

- Coinbase = better for those who want a simple, beginner-friendly experience with a trusted brand.

Both Kraken vs Coinbase exchanges are trusted by millions worldwide; the right one for you depends on your goals, budget, and comfort level.

FAQs: Coinbase vs Kraken Comparison

Who offers a better trading platform?

Kraken offers a better trading platform for advanced users. It provides features like margin trading, futures contracts, advanced charting tools, and multiple order types. This makes it ideal for professional traders who need flexibility and power.

Coinbase, on the other hand, is easier to use and designed for beginners. It has a simple dashboard and quick buy/sell options but fewer advanced features. So, if you want a strong trading system with deep tools, Kraken is better. If you are just starting, Coinbase may feel more comfortable.

Who offers more cryptocurrencies?

Kraken offers more cryptocurrencies compared to Coinbase. Kraken supports over 450 coins, including many small altcoins and stablecoins. This gives traders more opportunities to explore new projects and diversify their portfolios.

Coinbase supports around 280–300 coins, focusing more on popular and mainstream assets like Bitcoin, Ethereum, and Solana. While both exchanges cover the top coins, Kraken clearly has a wider selection overall. If you want access to a large number of crypto assets, Kraken is the better choice. Coinbase may be better if you only need the major coins.

Who offers more deposit methods?

Kraken offers more deposit methods than Coinbase. With Kraken, users can deposit funds through ACH, wire transfers, debit cards, credit cards, SEPA, and SWIFT in many regions.

Coinbase also supports ACH, wire transfers, and debit/credit cards but does not have as many international payment options. This makes Kraken a stronger choice for global users who want multiple ways to fund their accounts.

For U.S. users, both exchanges work well, but Kraken’s wider coverage gives it an advantage for traders outside the U.S. who need more local deposit solutions.

What are the fee differences between Coinbase and Kraken?

Kraken has lower fees compared to Coinbase. On Kraken, maker fees start at 0% and can go up to 0.25%, while taker fees range from 0.10% to 0.40%. On Coinbase, maker fees can reach 0.40%, and taker fees can go up to 0.60%. This means trading costs are generally cheaper on Kraken.

Coinbase also charges higher fees for deposits and withdrawals in some cases. For traders making frequent trades or handling large amounts, Kraken is usually the cheaper platform. Coinbase is better suited for small, casual trades despite the higher costs.

Which exchange is more appealing to institutional traders?

Kraken is more appealing to institutional traders. It offers Kraken Institutional, a service designed for professional and large-scale traders. Features include deep liquidity, futures trading, OTC (over-the-counter) desks, and advanced security.

Coinbase also has Coinbase Prime for institutions, which is strong in the U.S. market, but Kraken’s international licenses and wide asset support make it attractive to global institutions. In addition, Kraken was the first to launch proof-of-reserves audits, which helps big investors trust their funds are safe. Overall, Kraken has more tools and flexibility for institutions.

Is Coinbase better than Kraken?

Coinbase is better than Kraken if you are a beginner who values simplicity. It has a very easy-to-use interface, quick buy/sell options, and educational tools like Coinbase Earn. This makes it the best choice for new users entering crypto.

Kraken, however, is better for more advanced traders who want lower fees, more assets, and professional trading features. Both exchanges are safe, regulated, and trusted worldwide. So, Coinbase is better for ease of use, while Kraken is better for professionals. The choice depends on your experience and trading needs.

Which exchange is better for beginners, Coinbase or Kraken?

Coinbase is better for beginners than Kraken. Its platform is simple, clean, and designed for people who are new to cryptocurrency. Features like one-click buy and sell, educational content, and easy wallet integration make it friendly for first-time users.

Kraken is more complex, with advanced trading features that may confuse beginners. However, once users gain experience, Kraken offers more options at lower costs. For someone starting out, Coinbase is easier to understand and use. For long-term growth, traders may later move to Kraken for its wider features.

Which platform is better than Coinbase?

Kraken is often considered better than Coinbase, especially for serious traders. While Coinbase focuses on simplicity, Kraken provides lower fees, more trading pairs, margin and futures trading, and broader international support. For traders who want depth and flexibility, Kraken is a stronger platform.

That said, Coinbase still has advantages for absolute beginners and for those who prefer a U.S.-regulated public company. But when comparing features, costs, and global reach, many experienced traders view Kraken as a better platform overall compared to Coinbase.

Which is cheaper, Coinbase or Kraken?

Kraken is cheaper than Coinbase in most cases. Kraken’s maker fees start at 0% and taker fees at 0.10%, while Coinbase’s fees can be as high as 0.40% for makers and 0.60% for takers. This means active traders save more money on Kraken.

Coinbase also has higher deposit and withdrawal fees in certain regions, while Kraken keeps most deposits free. For users making frequent trades or handling larger amounts, Kraken is much more cost-efficient. Coinbase may be better for small, simple purchases but is more expensive overall.

Which crypto exchange has never been hacked?

Kraken is one of the few major exchanges that has never been hacked. Since its launch in 2011, Kraken has maintained a strong record of security, using proof-of-reserves audits, cold storage, and strict account protections.

Coinbase is also highly secure but has faced breaches and reported incidents over the years. Both exchanges use strong safeguards like two-factor authentication and cold storage. However, Kraken’s clean record makes it stand out as one of the safest exchanges in terms of user funds never being lost to hacks.

Which exchange has a better reputation for reliability?

Kraken has a better reputation for reliability, especially among experienced traders. Its uptime, security track record, and professional services make it trusted worldwide. Coinbase also has a strong reputation, especially in the United States, where it is a public company listed on NASDAQ.

However, Coinbase has faced downtime during high trading periods, which frustrates users. Kraken has a history of handling heavy volumes more smoothly and without major outages. For global users, Kraken is often seen as more reliable, while Coinbase is viewed as more mainstream and beginner-friendly.

Which exchange is better for privacy-conscious traders?

Kraken is better for privacy-conscious traders. It offers features like PGP email encryption, account master keys, and withdrawal address whitelisting. Kraken has also been less strict with KYC in some regions compared to Coinbase, which follows very strict U.S. compliance rules.

Coinbase collects a lot of customer data as part of its regulatory obligations, and being a public company, it must share reports with regulators. Privacy-focused users generally prefer Kraken since it balances compliance with stronger user-side security features, making it the more privacy-friendly exchange.

Read: Best places to buy Binance coin

Are there differences in how Coinbase and Kraken handle tax reporting?

Yes, there are differences in how Coinbase and Kraken handle tax reporting. Coinbase automatically provides tax forms like Form 1099-MISC to U.S. customers and directly reports data to the IRS.

Kraken also provides tax documents but has more advanced tools for exporting trade history, which can be used with third-party tax software. This makes Kraken slightly more flexible for traders who want detailed reporting across many assets.

However, Coinbase’s direct IRS integration makes it more straightforward for U.S. taxpayers. The choice depends on whether you prefer automatic reporting or flexibility.

Which platform supports more fiat currencies for trading?

Kraken supports more fiat currencies compared to Coinbase. Kraken offers trading in over 10 major fiat currencies, including USD, EUR, GBP, CAD, AUD, CHF, and JPY. This makes it attractive for global users who want to trade directly in their local money.

Coinbase, on the other hand, supports only a few fiat currencies, mainly USD, EUR, and GBP. This limited selection makes it less flexible for non-U.S. users. For global traders who want broader fiat access, Kraken is clearly the better choice. Coinbase is more U.S.-focused.

Which platform has a better API for developers?

Kraken has a better API for developers than Coinbase. Kraken provides both REST and WebSocket APIs, with high limits and advanced trading functions. Developers can access live market data, trade automation, and account management tools.

Coinbase also has an API but is seen as less advanced and more restrictive for high-frequency trading. Professional developers and algorithmic traders generally prefer Kraken’s API for its speed, reliability, and flexibility. Coinbase’s API is simpler and works fine for basic integration, but Kraken is the stronger platform for serious developers.