As you know, finding the best crypto leverage trading platforms in the US has been a challenge over the years due to strict regulations. As a U.S.-based crypto trader, you’ve had to navigate strict regulations and limited choices when it comes to trading with leverage.

In this article, I’ll share my personal experiences and honest take on the top exchanges that let you trade crypto with leverage in the USA. I’ll cover both fully regulated U.S. platforms and a few offshore exchanges that many Americans use (albeit at their own risk).

By the end, you should have a clear picture of the best crypto exchanges for leverage trading and know the pros and cons of each. This way, you can decide which is the best leverage trading platform crypto for your needs.

5 Best Crypto Leverage Trading Platforms USA in 2025

- Kraken: Overall best crypto leverage trading platform in the US (FinCEN registered)

- MEXC: Best for no KYC leverage trading in crypto (200x leverage without KYC)

- Coinbase: Safest US-regulated leverage trading platform (Licensed by FinCEN and MSB)

- LBank: Crypto exchange with highest leverage (best for meme coin leverage trading)

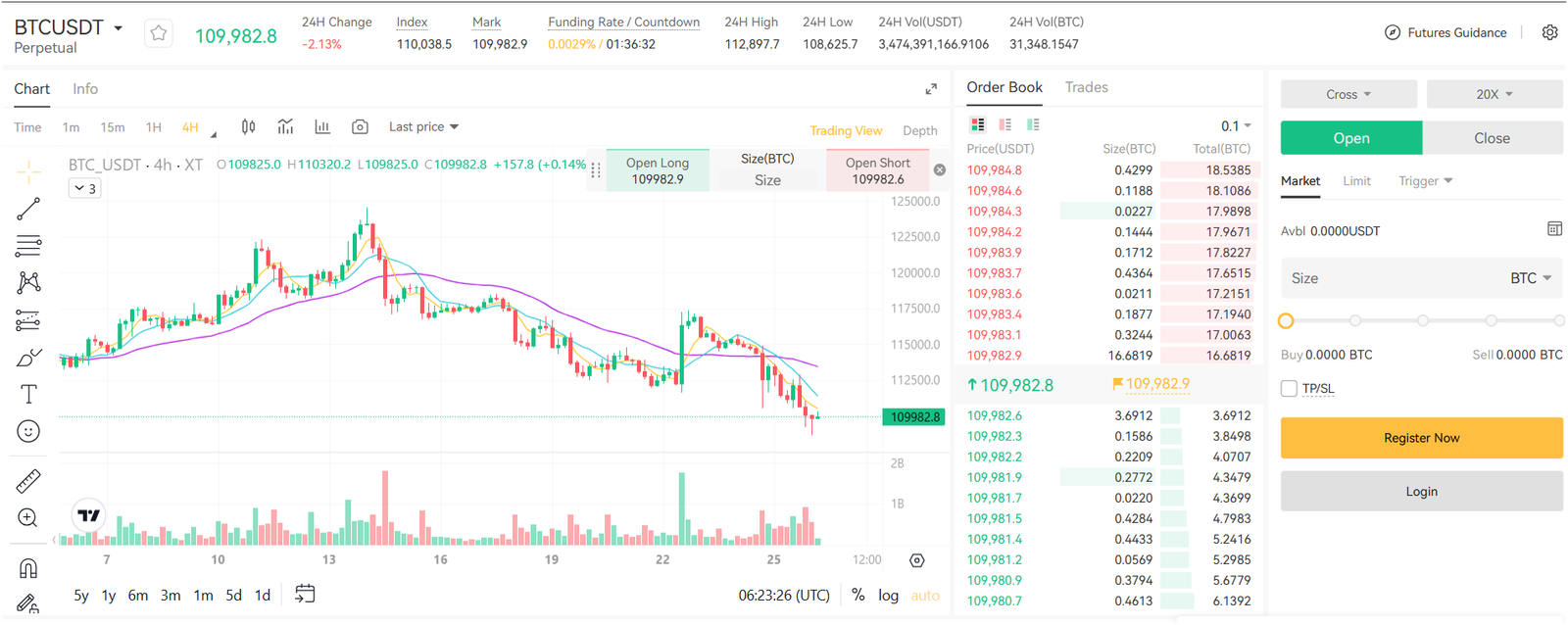

- XT.com: Leverage trade altcoins without ID verification (Trade multiple cryptocurrencies)

My Picks: Top Bitcoin Leverage Trading Platforms in the US

My list of the best crypto leverage trading platforms in the United States:

Kraken: Best for U.S. users

MEXC: Best for no-KYC traders

Comparing Best Crypto Leverage Trading Platforms in the U.S.

| Exchange | Max Leverage | Supported Coins | Trading Fees (Futures) | KYC Requirement |

|---|---|---|---|---|

| Kraken | Spot: 5x / Futures: 50x | 100+ major coins (BTC, ETH, ADA, DOT, XRP) | 0.02% maker / 0.05% taker | Full KYC required |

| MEXC | Up to 200x (500x on BTC/ETH) | 2,000+ coins / 3,000+ pairs | 0.00% maker / 0.02% taker | No KYC (10 BTC daily withdrawal) |

| Coinbase | Futures up to 10x | 240+ coins (7 futures pairs) | 0.4% maker / 0.6% taker | Full KYC required |

| LBank | 125x (200x on meme tokens) | 800+ coins (strong meme coin listings) | 0.02% maker / 0.06% taker | Optional KYC (higher limits with ID) |

| XT.com | Margin 20x / Futures 125x | 800+ coins / 1,000+ pairs | 0.04% maker / 0.08% taker | No KYC (very high withdrawal limits) |

Best Leverage Crypto Exchanges in the USA (Reviewed)

Let’s dive in and review the top leverage trading platforms for crypto. I won’t shy away from pointing out the good and the bad of each exchange among these best crypto leverage trading platforms. So, whether you’re looking for high leverage, no KYC hurdles, or simply a safe place to trade, I’ve got you covered.

1. Kraken: Overall best crypto leverage trading platform in the US

- Supported Coins: 100+ major cryptocurrencies (BTC, ETH, ADA, DOT, XRP, and many more)

- Maximum Leverage: Spot trading up to 5x; Crypto futures up to 50x

- Leverage Trading Fees: ~0.02% maker fee, 0.05% taker fee on margin/futures trades

- Tools Available: Advanced order types (stop-loss, take-profit, limit), real-time margin monitoring, two-factor authentication for security

Kraken is a trusted crypto exchange with leverage trading in the USA. For regular spot trading, you can use leverage up to 5x, and for derivatives, the leverage can go as high as 50x. This gives traders the chance to increase their market exposure, taking both long and short positions across more than 100 different markets.

One of Kraken’s biggest strengths is its security. The platform includes tools like two-factor authentication (2FA), cold storage, and follows strict regulatory rules. Its trading screen is easy to use but also packed with advanced order types, which help traders manage their positions better. Compared to Coinbase, Kraken usually charges lower trading fees, making it more affordable for active users.

The exchange is also known for its clear fee system, so you know exactly what you’re paying. Rollover fees for holding positions are stable and low, around 0.01%-0.02%. On top of that, Kraken provides useful risk-control tools, such as stop-loss orders and live market data.

Since its launch in 2011, Kraken has been operating under strict regulatory supervision. The platform requires KYC verification right after account creation, unlike Coinbase, where you can sign up first and verify later. This ensures extra safety for all users’ funds. (Read in-depth Coinbase vs Kraken comparison).

Pros of Kraken

- Derivatives trading offers up to 50x leverage

- Strong security with 2FA and cold storage

- Runs under US regulations with transparent fees

- Stop-loss orders and live data improve risk management

Cons of Kraken

- Spot trading leverage is limited to 5x

- Full KYC is required immediately after sign-up

- Some advanced features may feel complicated for beginners

Disclaimer: Crypto markets are volatile and may result in loss of funds. Some products are unregulated and may lack government or regulatory protection. Services for U.S. and U.S. territory customers are provided by Payward Interactive, Inc. (“PWI”) dba Kraken, a FINCEN-registered money services business and subsidiary of Payward, Inc. View PWI’s disclosures here.

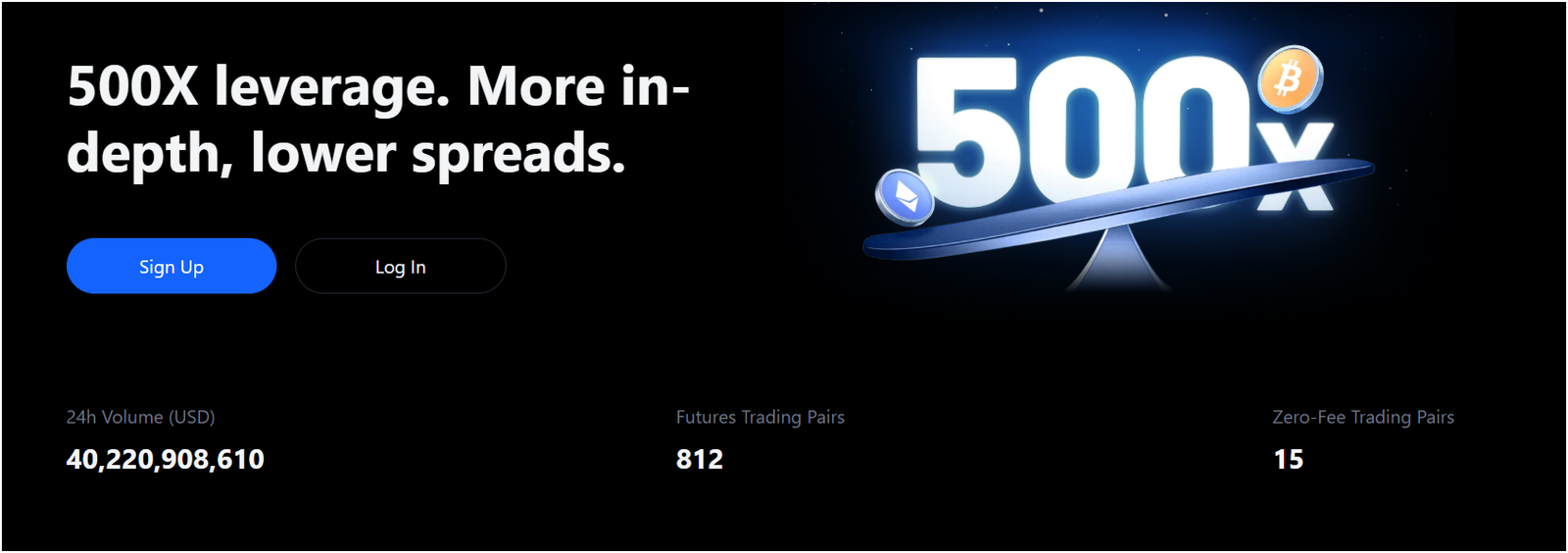

2. MEXC: Best for no KYC leverage trading in crypto

- Supported Coins: 2,000+ cryptocurrencies (from BTC and ETH to tiny altcoins; 3,000+ trading pairs)

- Maximum Leverage: Up to 200x on futures (even 500x on major pairs, though use with caution)

- Leverage Trading Fees: 0.00% maker fee, 0.02% taker fee on futures (extremely low fees); Spot trading 0%/0.05%

- Tools Available: Futures only (no traditional spot margin), advanced charting, stop-loss and take-profit orders, no-KYC signup for basic accounts, plus features like leveraged ETFs and trading contests for futures traders

MEXC is a platform if you value privacy and high leverage. It’s often mentioned as one of the best leverage trading platforms crypto users can choose when they want to avoid KYC. MEXC is an offshore crypto exchange known for letting users trade with no mandatory KYC. You can deposit and withdraw up to 10 BTC per day without verification.

Keep in mind, if you end up withdrawing very large amounts (over 10 BTC per day), they will ask you to verify your identity. But for most traders, the no-KYC route is available and works fine.

MEXC really shines in the leverage department. It offers extremely high leverage on crypto futures – up to 200x on many contracts, and reportedly even up to 500x on BTC/ETH pairs. Let me be honest: I do not recommend using 500x leverage (that’s basically gambling, as even a 0.2% price move could liquidate you). However, the option exists if you’re a thrill-seeker.

Pros of MEXC

- No KYC required for basic trading, you can trade anonymously (up to 10 BTC withdrawal per day without ID)

- Incredibly high leverage available (100x, 200x, even 500x on some markets) for those who want maximum exposure

- Zero-fee maker trades and very low taker fees, making it one of the best crypto leverage trading platforms for cost-conscious traders

- Massive selection of altcoins and trading pairs that you won’t find on U.S. exchanges (great for altcoin enthusiasts)

- Solid security record so far (no major hacks) and proof-of-reserves provided for transparency

Cons of MEXC

- Not regulated in the US, you’re using it at your own risk, and it’s technically not licensed to operate for U.S. residents

- No direct fiat withdrawals (you can’t cash out to USD directly; you must send crypto to another platform to liquidate)

- Recently started enforcing KYC for some activities, so it’s not 100% guaranteed you’ll stay anonymous forever (regulators are tightening, even offshore)

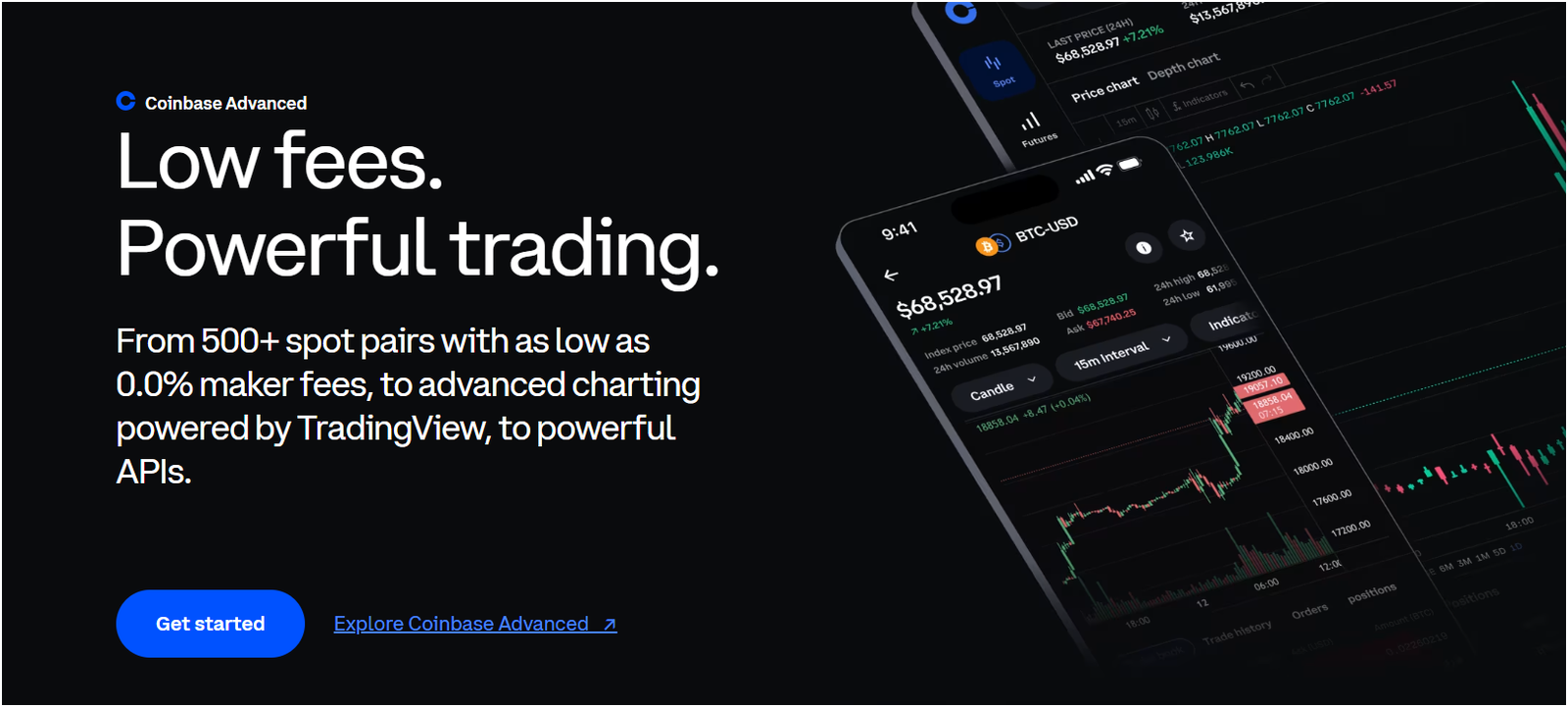

3. Coinbase: Safest US-regulated leverage trading platform

- Supported Coins: Only 7 futures contracts currently (e.g., BTC, ETH, XRP, SOL futures), plus 240+ coins available for regular spot trading (spot trading has no leverage for U.S. users)

- Maximum Leverage: 10x on crypto futures (no leveraged spot margin for U.S. customers)

- Leverage Trading Fees: ~0.4% maker / 0.6% taker on futures by default (significantly higher than most competitors)

- Tools Available: Coinbase Advanced Trade interface with charting and multiple order types (market, limit, stop); insurance on USD balances; very user-friendly mobile app; strong account security (2FA, biometric login, etc.)

Coinbase is a name almost every crypto user in the US knows. It’s arguably the most regulated and secure crypto exchange in the country, and it has finally dipped its toes into leverage trading.

Coinbase has launched a CFTC-regulated futures trading feature for U.S. customers. This means you can trade a few crypto futures contracts on Coinbase’s platform with up to 10x leverage. It’s a modest amount of leverage, but in typical Coinbase fashion, it’s done in a compliant and relatively conservative way.

On the Coinbase Advanced Trade section (the more pro-oriented interface), you can access futures alongside the regular spot market. I tried out their nano Bitcoin futures and some of the new perpetual futures they launched (like ETH, XRP, SOL futures), and they cap leverage at 10x.

Coinbase is top-notch in terms of security. They famously keep 98% of customer funds in cold storage, have insurance for custodial assets, and even USD balances on Coinbase are FDIC-insured up to $250k (just like a bank account).

Pros of Coinbase

- Fully regulated U.S. exchange, providing maximum compliance and user protection (CFTC-regulated futures, SEC reporting as a public company)

- Extremely secure platform (98% cold storage, insurance coverage, FDIC-insured USD)

- 10x leverage on futures offers a decent balance of risk and reward, suitable for more conservative leverage traders

- Intuitive interface and excellent mobile app, good for beginners who want to try leveraging trading without getting overwhelmed

- Ecosystem of crypto services (wallet, staking, custody) and a long-standing reputation in the industry

Cons of Coinbase

- Only up to 10x leverage, which may not satisfy traders looking for 50x or 100x thrills

- Very limited number of futures markets (just a handful of coins available for leverage trading)

- High trading fees for leverage trades, making it expensive to trade frequently on futures (Coinbase’s convenience comes at a cost)

- No traditional margin trading on spot markets for U.S. users (you can’t, for example, borrow funds to short an altcoin on the spot exchange)

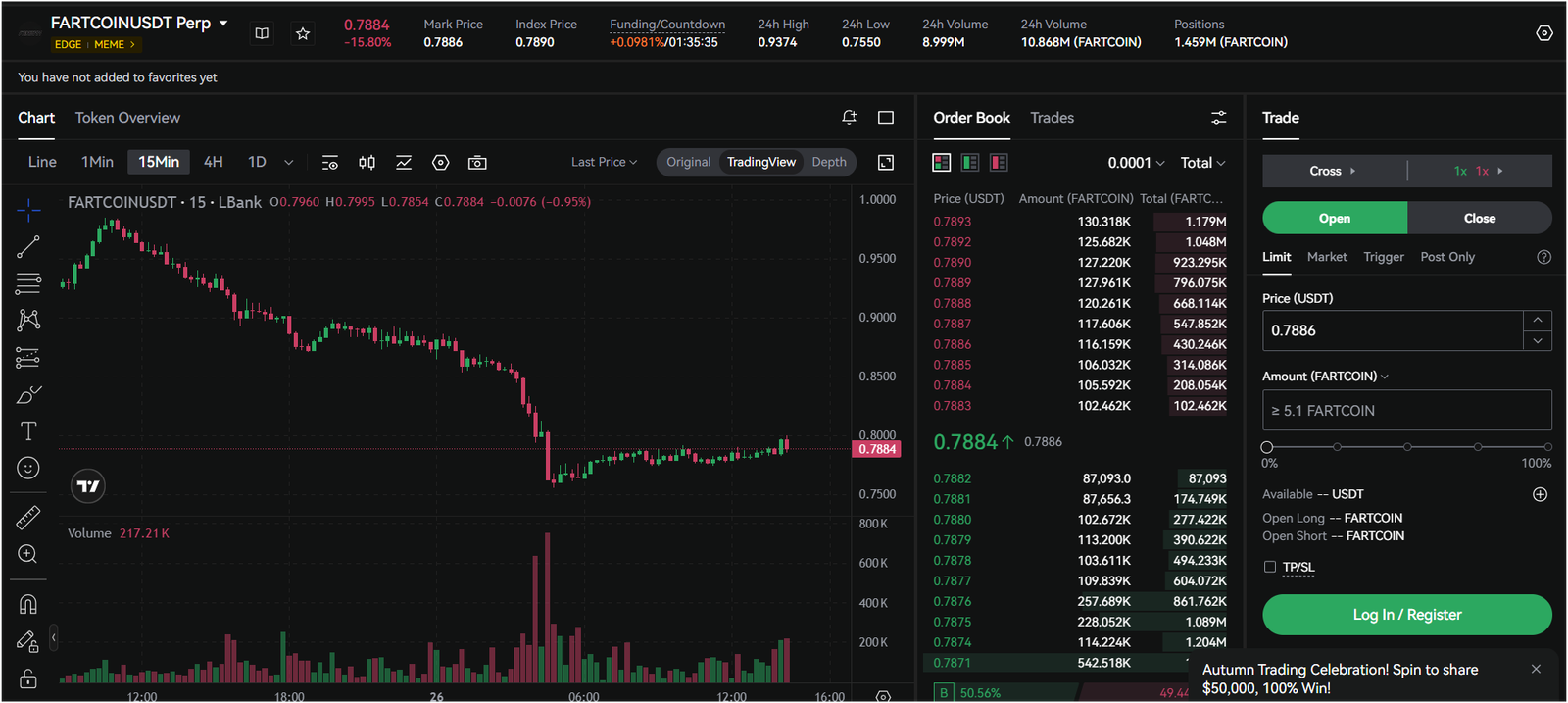

4. LBank: Crypto exchange with highest leverage and Meme Coin Trading

- Supported Coins: 800+ cryptocurrencies listed (especially strong selection of meme coins and new tokens)

- Maximum Leverage: Generally up to 125x on futures; up to 200x on specific meme token futures

- Leverage Trading Fees: ~0.02% maker / 0.06% taker on futures; Spot trading fees 0.1% for big coins (0.2% for some small caps)

- Tools Available: Perpetual futures trading with cross and isolated margin modes, basic risk management orders (stop-loss, take-profit), copy trading feature, security audits by CertiK, partial U.S. licensing efforts (e.g., state-level licenses)

LBank might not be as well-known in the U.S. as Kraken or Coinbase, but it’s a platform that offers some of the highest leverage in the crypto market, arguably the best leverage trading platform crypto traders have for maximum exposure.

In fact, LBank allows up to 125x leverage on most of its futures contracts, and on certain special “meme token” futures they even go up to 200x leverage. Because of this, I’d call LBank the exchange with the highest leverage options among our list of best crypto leverage trading platforms.

They have over 800 cryptocurrencies supported, and they are particularly known for listing new meme coins and trending tokens quickly. For example, they have an exclusive section for “meme futures” where you can trade emerging meme tokens with high leverage.

Pros of LBank

- Allows very high leverage (125x normally, and even 200x on certain tokens) – one of the highest in the market

- Huge variety of coins, including many small altcoins and meme tokens, great for finding niche assets to trade with leverage

- Competitive futures fees (flat and low), plus a $100M protection fund to cover extreme losses (adds a layer of confidence for traders)

- Offers copy trading and other features like Launchpad, giving users multiple ways to engage beyond just trading

- Taking steps toward regulatory compliance (secured some licenses, improved KYC process), which is a good sign for its legitimacy

Cons of LBank

- Not fully regulated in the USA yet, using it means you don’t have the guarantees that come with U.S. law (funds are not FDIC-insured, etc.)

- KYC is optional for only small withdrawals, if you end up using LBank heavily, you’ll eventually need to verify identity, which some may find inconvenient

5. XT.com: Leverage trade altcoin without ID verification

- Supported Coins: 800+ cryptos available; 1000+ trading pairs (tons of altcoins on both spot and futures)

- Maximum Leverage: 20x on margin trading (spot), up to 125x on futures trading (perpetual contracts)

- Leverage Trading Fees: Spot fees 0.05% maker / 0.20% taker (can be reduced via tiered levels or XT token); Futures fees roughly 0.04% maker / 0.08% taker at base (lower with high volume)

- Tools Available: Margin and futures trading, copy trading feature, leveraged ETFs (e.g., 3x long/short tokens), demo trading mode, advanced orders (stop-loss, etc.), and an optional KYC system (basic trading doesn’t require ID)

XT.com is another exchange that deserves a spot among the best leverage trading platforms, especially for those who want to trade a variety of altcoins without immediately doing ID verification.

It provides spot, margin, futures, and even some unusual products like crypto ETFs and a social trading option. What caught my attention with XT.com is that they allow users to trade with just an email account, no KYC needed for basic use. In fact, you can withdraw up to about $500,000 (or 10 million USDT worth of crypto) per day as an unverified user, which is an insanely high limit by industry standards.

Of course, the flip side is that XT.com is not regulated in the U.S. and officially lists the United States as a restricted region. In practice, I’ve seen U.S. traders use it (usually via VPN). It’s a grey area; use at your own discretion and risk.

Pros of XT.com

- You can trade with leverage without ID verification, which is great for privacy-focused users (basic accounts have very high withdrawal limits without KYC)

- Supports a wide range of altcoins and lesser-known tokens, one of the best crypto exchanges for leverage trading if you want to trade obscure coins

- High leverage available (125x on futures), similar to top exchanges, so you’re not limited in that regard

- Offers extra features like copy trading, leveraged ETFs, and even an auto-invest bot – a versatile platform for experienced traders

- Generally fast execution and decent liquidity on major pairs, plus the interface is packed with charting tools (catered to advanced users who enjoy technical analysis)

Cons of XT.com

- Not licensed or regulated in the U.S. (or most places), meaning if something goes wrong, you have limited recourse; you’re basically trusting the exchange’s word

- Customer support and transparency have some question marks (some users report slow support; no clear proof-of-reserves published)

- Officially, U.S. residents aren’t allowed to use XT.com (it’s on their restricted list), so using it likely involves a VPN and breaking the terms of service, but many are using it this way.

What is Crypto Leverage Trading?

Crypto leverage trading is basically trading cryptocurrencies with borrowed funds to increase your exposure. In simpler terms, leverage lets you control a larger position size with a smaller amount of your own money (called your margin). For example, if you have $1,000 and use 10x leverage, you can trade as if you had $10,000. The exchange lends you the extra $9,000 in that scenario.

Leverage is described as a ratio like 2x, 5x, 10x, 100x, etc. If you see “10x leverage,” it means you can trade with ten times your capital. This can amplify your profits and your losses. I often explain it to friends like this: leverage is like a double-edged sword or a power-up in trading; it gives you more firepower, but if you make a wrong move, the damage to your account can be just as big.

When you open a leveraged trade, you have to maintain a certain amount of funds in your account as collateral. This is known as the margin requirement. The higher the leverage, the smaller the margin required for a given position size. That sounds great, but it also means you have less buffer before your money is gone.

The exchange will monitor your trade, and if the market moves against you too much, you may hit a point where your collateral isn’t enough to cover the losses. At that point, a process called liquidation happens – the exchange will automatically close your position to prevent you from going into debt. I’ve been liquidated before in my early trading days, and trust me, it’s not a fun experience seeing your position closed and your loss locked in.

Read: Best crypto futures trading platforms

How Does Crypto Leverage Trading Work?

So, how does it actually work in practice? Let me break down the mechanics in a simple way. Imagine you have $100 and want to trade Bitcoin with 10x leverage. You go to an exchange (say, Kraken or MEXC) and you open a leveraged position. The exchange will “lock up” your $100 as margin, and then effectively lend you an additional $900 so that you can buy $1,000 worth of Bitcoin.

Now, let’s say Bitcoin’s price is $25,000. With your $1,000 position, you’ve effectively bought 0.04 BTC. If Bitcoin’s price rises to $26,000 (a $1,000 increase per BTC, which is a 4% increase), your 0.04 BTC is now worth $1,040. If you close the position, you pay back the $900 loan, and you’re left with $140.

You started with $100, so you made a $40 profit. That’s a 40% return on your money, even though the price only went up 4%. That’s the power of 10x leverage in a winning scenario – it magnified the 4% market move into a 40% gain for you.

Now, consider the downside: if instead Bitcoin fell by 4% to $24,000, your 0.04 BTC would be worth about $960. If you closed the trade there, after paying back the $900 loan, you’d have $60 left – meaning you lost $40 (40% of your starting capital) from just a 4% price drop. And if Bitcoin dropped slightly more, say 10%, the value of your 0.04 BTC would drop to $900, which is exactly the amount you borrowed.

At that point, your $100 margin is basically all loss. The exchange won’t let the trade go beyond this because then you’d be unable to repay the loan. So around that point (it might actually liquidate a bit before the full 10% drop, to account for fees), the exchange will liquidate your position. They’ll sell the BTC, take $900 to pay themselves back, and you get whatever is left (which could be nearly zero). This is how people get completely wiped out – a 10% adverse move on 10x leverage can theoretically lose you 100% of your money.

To manage this, exchanges use margin levels and maintenance margin rules. You’ll often see a “liquidation price” indicated when you place a trade with leverage. That’s the price at which your position will auto-close because your margin is exhausted.

In practice, you can also add more margin to a losing trade to avoid liquidation (kind of like adding collateral – I’ve done this on a few occasions when I believed the market would turn around and I didn’t want to get liquidated at the worst price). But adding margin is usually just throwing good money after bad if you misjudged the trade – so be careful with that.

In short, an exchange provides you with a loan (in crypto or stablecoins) to increase your trading size. The trade happens in a separate “margin account” or “futures account,” isolated from your main holdings. Profits and losses in that account fluctuate much faster relative to your initial margin. The key components are:

- Initial Margin: the amount you put down to open a trade.

- Leverage: the multiplier on your trade size.

- Liquidation Price: the price at which the system will close your trade due to insufficient margin.

- P&L (Profit and Loss): calculated on the full position size, so a small market move can result in a big percentage P&L on your margin.

That’s the gist of how crypto leverage trading works: you borrow funds to open a larger position, and your margin is at stake to cover any losses.

Read: Best crypto trading apps

Leverage vs Margin Trading: What’s the Difference?

| Aspect | Leverage | Margin Trading |

|---|---|---|

| Definition | Borrowing funds to amplify investment size and potential returns/losses. | Using borrowed funds from a broker to trade, with your account as collateral. |

| Concept | A tool to increase exposure to an asset without paying full cost upfront. | A method of trading where you borrow funds to buy assets, using margin as collateral. |

| How It Works | Expressed as a ratio (e.g., 10:1), indicating how much your investment is multiplied. | You deposit a percentage (margin) of the trade value, broker covers the rest. |

| Risk | High; amplifies both gains and losses, potentially exceeding initial investment. | High; losses can exceed margin, leading to margin calls or liquidation. |

| Cost | Interest or fees on borrowed funds, varies by platform. | Interest on borrowed funds, plus potential fees (e.g., maintenance margin). |

| Collateral | Not always required; depends on platform (e.g., futures vs. spot leverage). | Requires initial margin deposit (e.g., 10-50% of trade value). |

| Use Case | Common in forex, crypto, stocks, and derivatives (e.g., futures, options). | Common in stocks, forex, and crypto; often tied to broker accounts. |

| Regulation | Varies by market; crypto often less regulated, stocks/forex stricter. | Heavily regulated in traditional markets (e.g., SEC, FINRA rules). |

| Example | With 10:1 leverage, $1,000 controls $10,000 in assets. | With 50% margin, $5,000 deposit lets you trade $10,000 in assets. |

| Profit/Loss Impact | A 1% price move with 10:1 leverage = 10% gain/loss on your capital. | A 1% price move affects the full position value, but loss limited to margin (unless called). |

| Broker Involvement | May or may not involve a broker; some platforms offer built-in leverage. | Always involves a broker who lends funds and sets margin requirements. |

| Liquidation Risk | High; position may be closed if market moves against you. | High; margin calls or forced liquidation if equity falls below requirements. |

Is Crypto Leverage Trading Safe? The Risks

Leverage trading in crypto is risky business, no sugar-coating here. Is it “safe”? I would say it is as safe as the trader using it. The mechanism itself is not a scam or anything – it’s a tool. But it’s a tool that can either help you or absolutely wreck you.

Amplified Losses: The Biggest Risk in Leverage Trading

The primary risk is obvious: amplified losses. If you trade without leverage, a 10% drop in price means a 10% loss for you (if you held that asset). If you trade with 10x leverage, that same 10% drop can mean a 100% loss (as illustrated earlier). Crypto markets are notoriously volatile. Double-digit percentage swings can happen in a day.

I’ve seen Bitcoin drop 50% in a single day (March 2020 crash) – imagine being 10x long then, you’d be beyond broke; even 2x leverage would have liquidated you in that scenario. So, the volatility of crypto makes high leverage especially dangerous. It’s not like forex, where currencies move 1% and people use 50x leverage to get a 50% result. In crypto, a 50x leverage on a coin that can move 5–10% in a day regularly is flirting with disaster.

Liquidation Cascades and Quick Price Wicks

Another risk is liquidation cascades and wicks. Sometimes, especially on offshore exchanges with less liquidity, the price can “wick” down (or up) suddenly, hitting a bunch of stop losses and liquidation points, and then bounce back.

If you had a tight margin, you could get liquidated in a freak move that lasts seconds, and the market then reverses without you. This is a real annoyance – I’ve had a stop loss hit by a quick wick, and then the market went the way I expected, but I was already out. With leverage, those wicks can cause a total loss, not just a stop-out.

Emotional and Psychological Risks in Crypto Leverage Trading

There’s also the aspect of emotional and psychological risk. Trading with leverage is stressful. It can tempt you to revenge trade or double down because the swings in your P&L are so dramatic.

I’ve learned to manage this, but in the early days, I definitely made some bad decisions under pressure. New traders might fall into the trap of overtrading or not managing risk properly when using leverage.

U.S. Regulations and Legal Risks

Now, beyond market risks, since we’re talking about the US: regulatory risk. In the US, many high-leverage platforms are not allowed. If you use them via VPN or other means, there’s always a small risk that your account could get frozen or you violate the terms of service.

I’ve personally never had an account shut down, but I’m aware it’s a possibility. For example, if you openly state you’re a US resident on an unregulated exchange, they might freeze your account pending KYC. There’s also legal risk: technically, using an unregistered platform could be against regulations (though as an individual, you’re unlikely to be targeted; regulators tend to go after the companies, not the traders).

Safe Ways to Manage Crypto Leverage Trading

Is crypto leverage trading safe? I’d say it can be managed safely if you do the following:

- Use low to moderate leverage (like 2x, 3x, maybe 5x), especially as a beginner. This gives you more room for the market to move without wiping you out.

- Always use stop-loss orders. Don’t just ride a leveraged position without a plan for where to exit if it goes wrong. A stop-loss can save you from total ruin (though be mindful of those wicks; don’t place stops exactly at obvious liquidation levels where everyone else has them).

- Only trade with money you can afford to lose. This is cliché but extremely true here. If losing the entire margin you put up would devastate you, you’re using too much.

- Be mindful of fees and funding rates. On perpetual futures, there’s often a funding fee every 8 hours. High leverage means your position size is big, so funding fees on that can eat your account if you hold for days. Make sure to account for those.

- Learn first. I always suggest using a demo account or very small amounts to practice. Experience is a great teacher. After a few close calls with liquidation, you learn respect for leverage.

Conclusion: The Best Leverage Trading Platform for Crypto

After examining all these platforms, you might wonder, which one is actually the best? Honestly, the best leverage trading platform for crypto really depends on your priorities as a trader. But I’ll give you my personal conclusion.

For U.S. traders who prioritize safety and compliance, I would crown Kraken as the best overall. In my view, Kraken is the best leverage trading platform crypto investors in the US can use for overall reliability and trust.

If your goal is to access high leverage and a ton of altcoins, and you’re okay with using an offshore exchange, then MEXC is my top pick in that category. The experience I’ve had with MEXC has been excellent in terms of product offering – the 0% maker fees and huge coin selection really stand out.

LBank and XT.com are also very solid in their niches (LBank for max leverage and new tokens, XT for no-KYC and extra features like copy trading). I would say they are a bit more specialized options.

Overall, these five exchanges are currently the best crypto leverage trading platforms accessible to Americans, each with its own strengths as discussed.

FAQs: Best US-Based Leverage Trading Platforms for Cryptocurrency

What is 10x leverage in crypto?

10x leverage in crypto means you are trading with ten times the amount of money you actually have. For example, if you use 10x leverage on a trade with $100 of your own money, you’ll be controlling a $1,000 position. This can multiply your profit by 10 if the market moves in your favor. However, it also means losses are magnified by 10.

Where can I trade with 100x leverage crypto?

To trade crypto with 100x leverage, you need to use the best US-based crypto leverage trading platforms like LBank, MEXC, Kraken, and Coinbase, which offer such high leverage on their futures markets.

These are among the best crypto exchanges for leverage trading if you seek very high leverage. Among the exchanges I reviewed, LBank and MEXC both allow 100x (or even more) leverage on certain contracts. Keep in mind, major regulated US exchanges do not offer 100x – Kraken tops out at 5x for spot (and 50x for certain futures, but those aren’t accessible to most retail U.S. users), and Coinbase only goes up to 10x on its futures.

Is 1000x leverage trading crypto possible?

1000x leverage in crypto is virtually unheard of on reputable exchanges. Currently, the highest leverage you’ll find is around 200x or maybe 500x on a couple of platforms, and those are more marketing gimmicks than practical trading settings.

A 1000x leverage would mean even a 0.1% price move could liquidate you. I have seen dubious websites or CFD brokers claim absurd leverage like 1000x, but I would be extremely skeptical of those; they’re likely not places you’d want to trust with your money. As of now, no major crypto exchange offers 1000x leverage.

What is liquidation in leverage trading?

Liquidation in leverage trading is when the exchange forcibly closes your position because you’ve run out of margin to sustain it. This usually happens when the market moves against your position enough that your margin (collateral) is nearly used up.

For example, if you opened a leveraged trade and the losses have eaten most of the money you put up, the exchange will liquidate (close) your position to prevent further losses (which would otherwise be the exchange’s problem if your account goes negative).

What is the best leverage for crypto?

Generally, lower leverage is safer and more forgiving. For beginners, I’d say start at 2x or 3x leverage at most. Even though that might not seem exciting, it can still significantly boost your returns without putting you in immediate peril from normal market volatility.

Many experienced traders I know stick to about 5x or below for most of their trades. Using 5x, for instance, a 10% move in the market translates to a 50% gain or loss on your position, which is substantial but not instantly account-killing if you’re wrong.

Once you start going 10x, 20x, or higher, you really need to know what you’re doing and be ready to cut losses quickly. Personally, I rarely exceed 10x leverage on any trade, and even that is with a very specific plan and stop in place. It’s also worth noting that some trading strategies (like short-term scalping) might effectively use higher leverage, whereas long-term trades should use very low leverage or none at all.

Where can I leverage trade crypto in the USA?

In the USA, leverage trading options are limited due to regulations. The main U.S.-based exchanges that allow some form of crypto leverage trading are Kraken and Coinbase.

Kraken offers up to 5x leverage on spot trading for certain coins (although after regulatory changes, only very qualified U.S. users can access margin) and has up to 50x on crypto futures for eligible participants (those futures aren’t available to regular retail traders without meeting high requirements).

Coinbase, on the other hand, offers up to 10x leverage on a small selection of CFTC-regulated perpetual futures contracts via its Coinbase Advanced platform. Both Kraken and Coinbase are fully compliant with U.S. laws and are among the safest choices for American users.

Aside from those, most other crypto best crypto leverage trading platforms in the USA with high leverage (like Bybit, Binance, MEXC, LBank, etc.) are not officially available to U.S. residents. Some U.S. traders do use VPNs or other workarounds to access those exchanges without KYC, but that carries its own risks; you could be violating the exchange’s terms of service, and your account might get frozen if you’re caught.