You might already know Kraken as one of the oldest crypto exchanges, but you’re likely wondering if it’s still safe, licensed, and worth using. Well, let’s break it down in this Kraken review.

My Quick Verdict on Kraken Exchange: Key Takeaways

In short, if you need a legit, secure, and global crypto exchange, Kraken is a safe choice. It’s especially good if you plan to trade often or use advanced tools. If you’re new to crypto, there might be a bit of a learning curve, but Kraken’s interface is still pretty accessible.

- Strong Security & Licensing: Kraken is licensed in the USA (FinCEN MSB, Wyoming charter, SEC/FINRA broker-dealer) and across Europe (Irish e-money and crypto licenses, UK FCA registration). It’s known for its security protocols and has never been hacked on its core exchange.

- Huge Crypto Selection: You get access to over 500 cryptocurrencies and roughly 1,200 trading pairs. That means you can trade pretty much any major coin plus many altcoins, stablecoins, and even tokenized stocks.

- Fair Fees: Kraken’s fees are competitive. The standard platform charges a flat 1% per trade (often waived up to $10K monthly if you subscribe to Kraken+), while Kraken Pro uses a volume-based maker-taker model (0.00–0.4%). In practice, active traders can achieve much lower fees on Pro.

- Advanced Trading Options: Kraken Pro gives you full charts, order types, margin (up to 5x), and over 300 perpetual futures contracts. You can also use Kraken OTC for trades over ~$100,000 if you need it.

- Global Reach: Kraken serves around 190 countries (minus a few bans). It supports 7 fiat currencies: USD, EUR, GBP, CAD, AUD, CHF, and JPY. So you can fund accounts in your local currency by ACH, SEPA, wires, or even buy with cards in some regions.

- Regulatory Compliance: Kraken is fully licensed and regulated. In the US, it has special charters (Wyoming SPDI for custody, etc.) and EU/UK licensing. That means it meets strict rules and is not operating in a grey area.

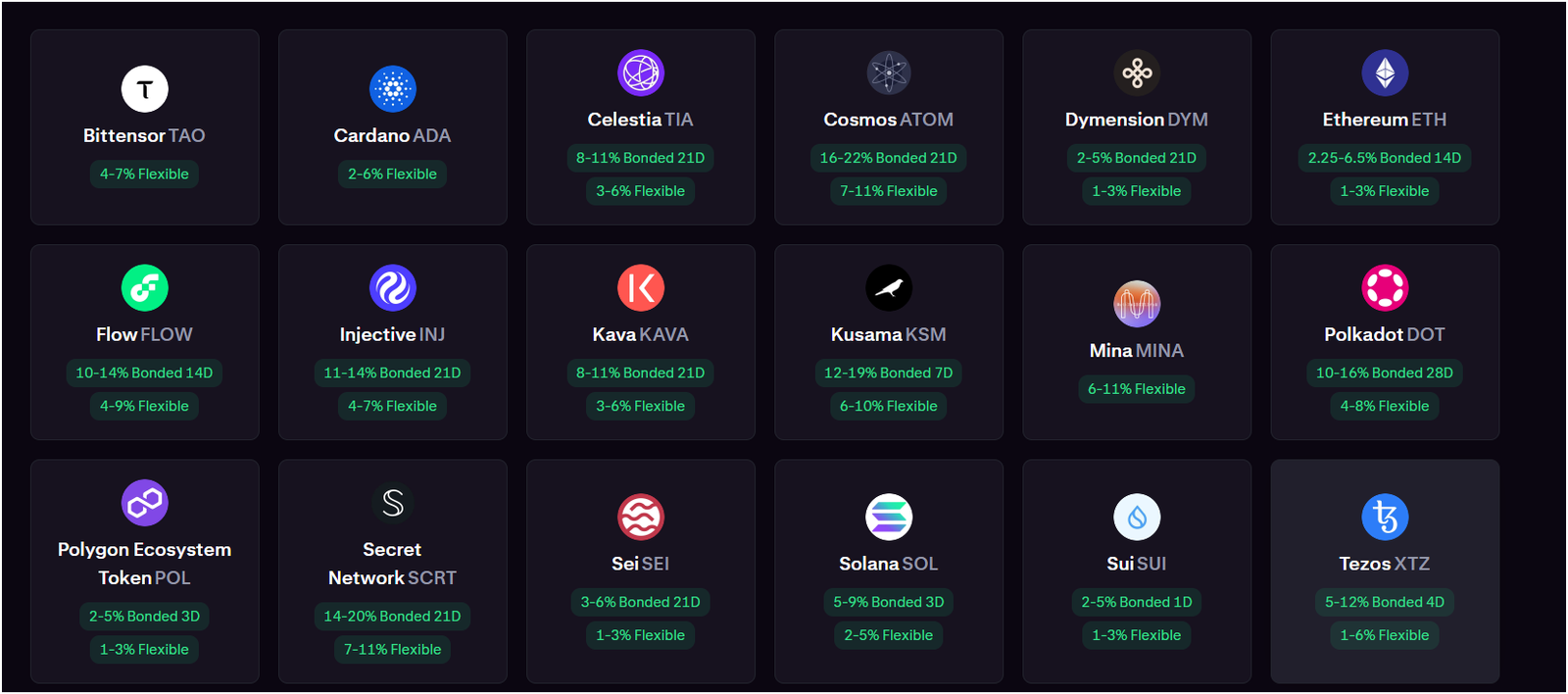

- Staking & Rewards: Outside the US, you can earn high yields (up to ~22% APR) by staking assets like ETH, ADA, DOT, etc. There are also “Earn Rewards” programs (for example, ~5.5% on USDC) if you opt in. US users, however, lost access to staking services after a regulatory settlement.

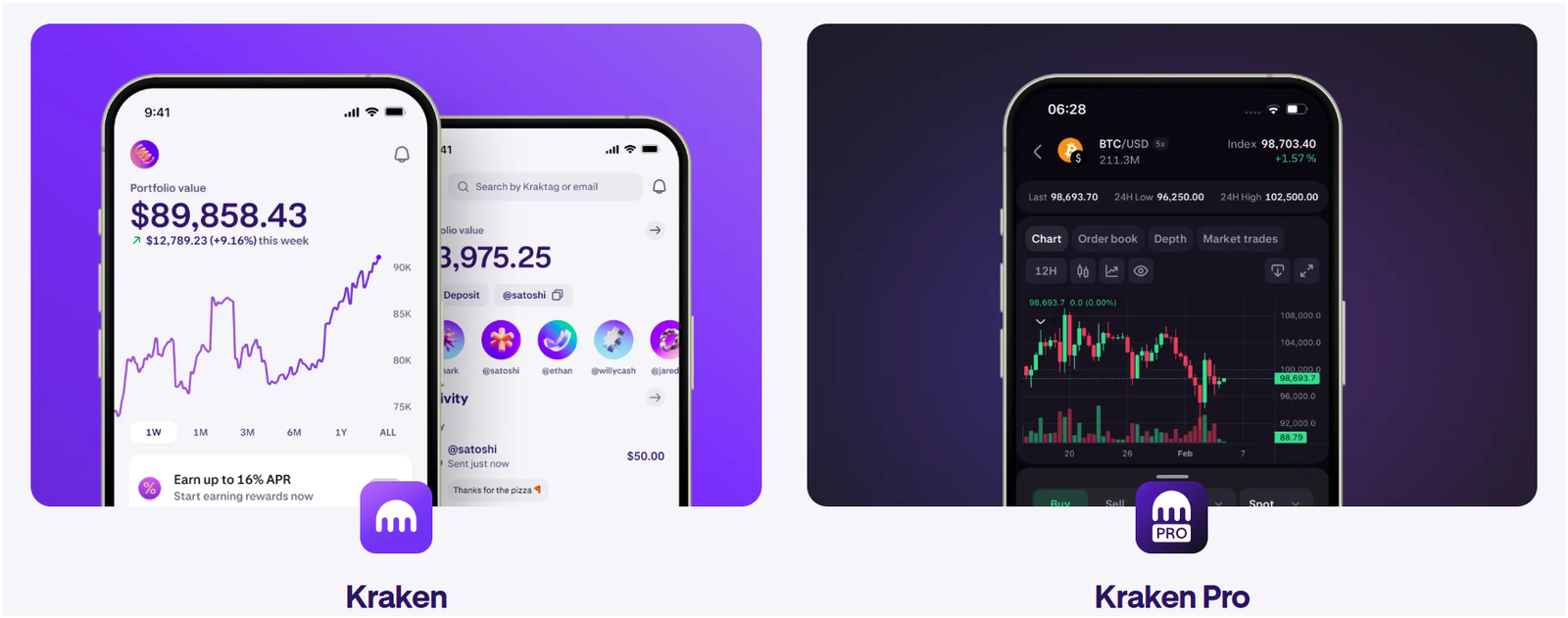

- Mobile Apps: Kraken offers two main apps. The Kraken app is user-friendly for buying and selling crypto instantly, and the Kraken Pro app is a mobile trading terminal with advanced charting. Both are available on iOS and Android.

- Customer Support: Support is available 24/7 via chat and email, but be aware that you may experience wait times. Some users have reported slow responses, especially during rapid market moves.

Kraken Review: Overview

| Category | Kraken (Basic) |

|---|---|

| Founded | 2011 (San Francisco, USA) |

| Founder/CEO | Jesse Powell |

| Regulation | US FinCEN MSB; Wyoming charter; EU (Ireland EMI/CASP); UK FCA autorised |

| User Base | ~6 million global users |

| Countries Served | ~190 (prohibited: North Korea, Iran, Japan, etc.) |

| Mobile/Desktop | Web platform; Kraken app (iOS/Android); Kraken Pro app; Kraken Desktop (Windows/Mac) |

| Cryptos Available | ~516 different coins/tokens |

| Trading Pairs | ~1,200 pairs (spot) + 300+ futures pairs |

| Fiat Currencies | 7 major fiat (USD, EUR, GBP, CAD, AUD, CHF, JPY) |

| Deposit Methods | Bank transfer (ACH, SEPA, wires); debit/credit card (via Wyre or similar) |

| Withdrawal Methods | Bank transfer (ACH, wires, SEPA); crypto withdrawals |

| Trading Fees | Basic platform: flat 1% (0% with Kraken+ up to $10K/mo) |

| Maker/Taker Fees | Kraken Pro tiered: ~0.00–0.35% maker, 0.08–0.40% taker (with volume discounts) |

| Staking/Earn Yields | Up to 22% on select coins (ETH, ADA, DOT, SOL etc); up to ~5% on stablecoins |

| Security | 2FA, PGP, cold storage (95%), proof-of-reserves, bug bounty |

| Customer Support | 24/7 live chat & email; some user complaints about delays |

What is Kraken?

Kraken is a veteran platform (founded in 2011) that’s fully regulated in the US and Europe. It’s built a reputation on strong security and transparency. That means you can feel pretty confident using it. Right now, Kraken supports over 500 cryptocurrencies and around 1,200 trading pairs.

It offers advanced features like futures, margin, and staking (in places where regulations allow), plus simpler instant-buy options for newcomers. It’s available in most countries worldwide (with a few exceptions like North Korea, Japan, and sanctioned regions). You can access Kraken on the web, a desktop app, and mobile apps (both a basic Kraken app and the advanced Kraken Pro app).

User experience is generally solid, though some beginners find the interface a bit overwhelming at first. And yes, Kraken has an industry-leading security approach: 95% of user funds are in cold storage, it enforces things like two-factor authentication and encryption, and it even publishes proof-of-reserves so you can verify assets are backed. Overall, Kraken is considered trustworthy and legitimate, far from a scam. Just remember that some services (like staking or certain cryptos) are restricted in the US due to regulations.

Pros and Cons of Kraken

Advantages

- Top-Tier Security and Proven Track Record: Honestly, this is probably Kraken’s biggest selling point. They have consistently had one of the best security records in the entire industry, dating back over a decade. They keep over 95% of customer assets in geographically distributed, air-gapped cold storage, which means those funds are physically separated from the online network.

- Industry-Leading Transparency with Proof of Reserves: You can basically verify your funds are there. Since 2014, Kraken has been pioneering regular, cryptographically verifiable Proof of Reserves (PoR) audits. The latest audit, completed in June 2025, showed they hold enough assets to cover 100%+ of all client balances across major assets like BTC, ETH, and SOL.

- Very Low Fees on Kraken Pro: If you’re a serious trader, the fees on Kraken Pro are really competitive, particularly as your trading volume increases. The Maker fees can even drop all the way down to 0.00%, and Taker fees can go as low as 0.08% for the highest-volume traders, which is seriously low.

- Strong Regulatory Compliance: Kraken is really serious about playing by the rules. They are registered as an MSB (Money Services Business) with FinCEN in the US and have licenses in many other major regions, like the CySEC license in Cyprus for European operations. Kraken is also MiCA licensed. This commitment makes them a safer choice for a lot of users.

- Advanced Trading Tools: You get access to a professional suite of tools on Kraken Pro, including margin trading, futures contracts, and a wide array of advanced order types like stop-loss and take-profit, which is something you really need if you trade actively.

Disadvantages

- Complex Interface for Beginners: The Kraken Pro interface can look overwhelming if you’re new to crypto. Even the basic platform has many options. It can be a bit much if you just want a simple buy/sell.

- Customer Service Response Time: In reality, some users report that getting help can be slow, especially during high market volatility. Tickets can take hours or even days to resolve.

- Restricted Locations: Kraken does not accept users from a handful of regions (e.g., Japan, North Korea, Iran, Russia, etc.) due to regulations. Also, in the US, it’s available in most states, but still not in New York or some others.

- Staking Limited in the US: If you’re in the United States, you actually cannot use Kraken’s staking or earn products anymore. Kraken settled with the SEC, so US accounts lost that feature. It’s only available in other countries now.

- Funding Fees: Deposits by wire transfer or card can incur fees. While ACH (US) and SEPA (EU) are free, international wires can be expensive, and credit card purchases carry a fee of ~3-4%.

- Fee Structure Can Be Confusing: Kraken+ vs basic vs Pro can be tricky to navigate. Beginners might not immediately know which platform or subscription is cheapest for them.

- Margin & Futures Complexity: Margin and futures are powerful but risky. Kraken does offer them, but you need to be cautious and meet certain requirements. (These are not available to US retail users.)

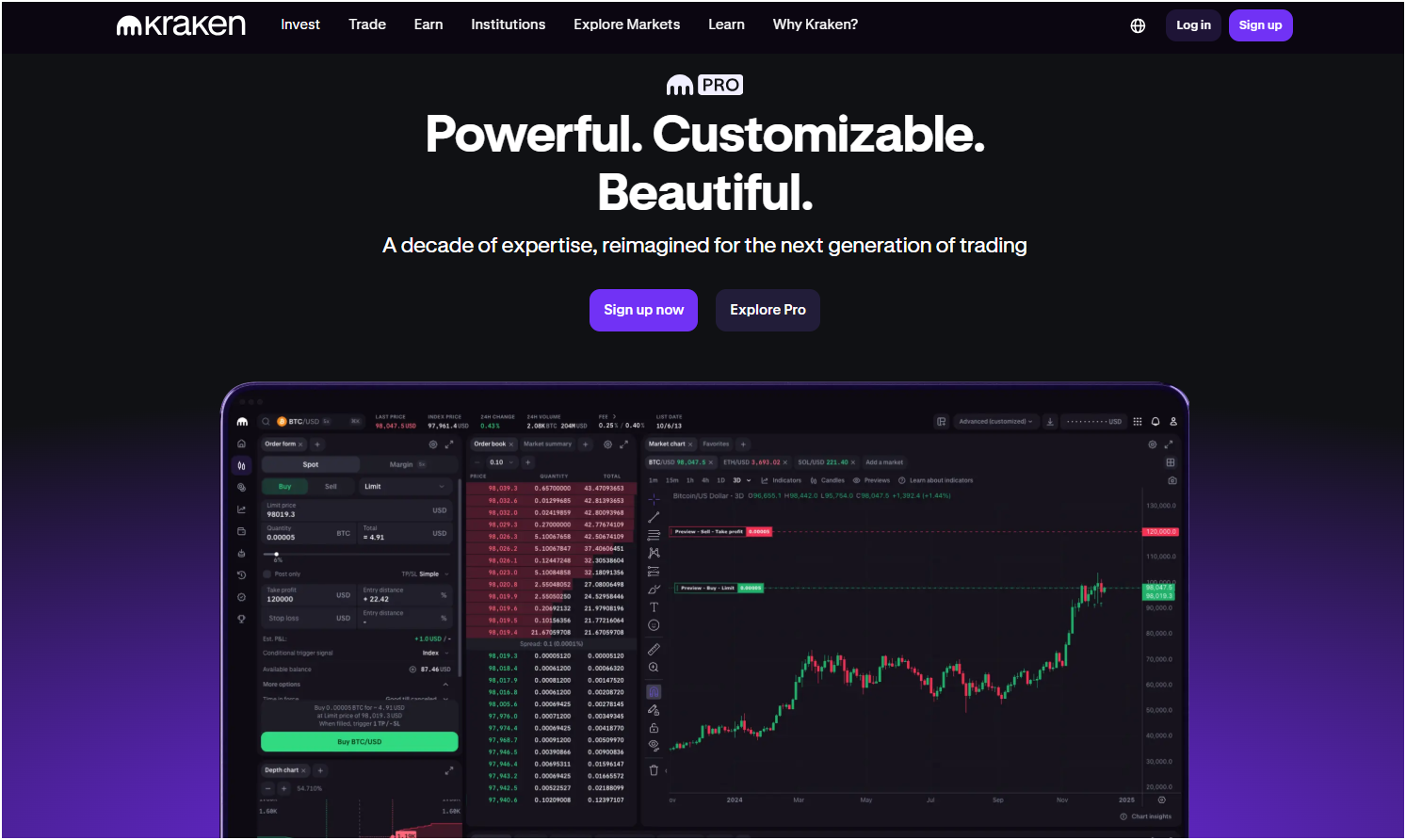

Kraken Pro Review

Kraken Pro is the advanced trading platform that Kraken offers. It’s designed for serious traders who want more control. In fact, Kraken and Kraken Pro are essentially two ways to access the same exchange: Kraken (sometimes called Kraken Basic) is the simpler one, and Kraken Pro has all the advanced tools.

On Kraken Pro, you get:

- Advanced Charting: Multiple chart styles, real-time trading charts, and technical indicators.

- More Order Types: In addition to basic market and limit orders, Pro lets you place stop loss, take profit, trailing stop, OCO (one-cancels-the-other), and more.

- Margin Trading: If you qualify, you can trade on margin (borrowed funds) with up to 5x leverage on certain pairs. This is only on Kraken Pro (and not available to US clients).

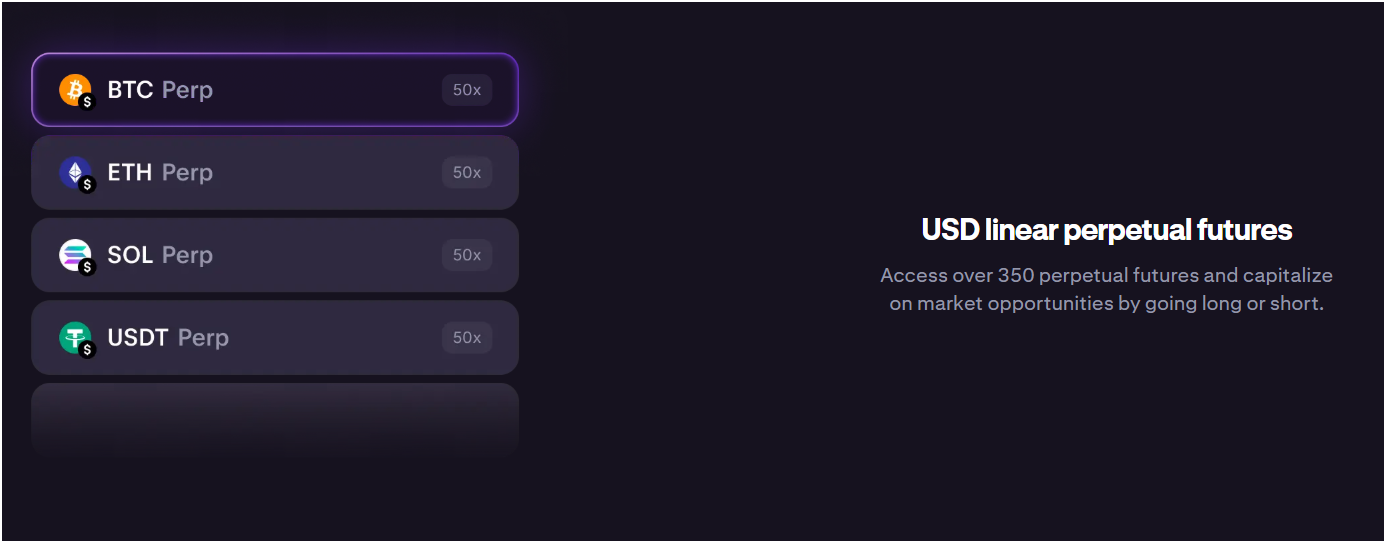

- Futures Contracts: Over 300 perpetual futures on crypto (e.g., BTC/USD, ETH/USD, etc.). You can trade them with up to 50x leverage. (Again, note US users must use Kraken Derivatives separately.)

- Maker-Taker Fee Schedule: Fees drop for high-volume traders. The more you trade, the less you pay. This rewards active trading.

- Professional Tools: You have detailed order books, market data, and the ability to use the Kraken API for algo trading if you want.

Kraken vs Kraken Pro: Difference and Which Is Better?

Both Kraken and Kraken Pro are part of the same exchange, so they share the same backend and security. The difference is mostly in user experience and features. Here’s a breakdown:

| Feature | Kraken (Basic) | Kraken Pro |

|---|---|---|

| Interface | Simpler, user-friendly UI. | Advanced trading dashboard with charts and order books. |

| Ideal For | Beginners, casual users. | Advanced traders, institutions. |

| Trading Fees | Flat 1% per trade (tiered 0% if Kraken+). | Maker/Taker fees: 0.02–0.25% maker, 0.08–0.4% taker (drops with volume). |

| Deposit Fee | Card/instant buy on Basic is not fee-free (spread applies). | Only supports funded accounts; uses the Pro fee schedule. |

| Available Orders | Market and limit orders via “Buy/Sell Crypto” widget. | Market, limit, stop-loss, take-profit, trailing stop, and more. |

| Margin Trading | Not available. | Available (up to 5x leverage on select pairs). |

| Futures Trading | Not available. | Available (300+ perpetual futures, up to 50x leverage). |

| API Access | No (only via desktop/web). | Yes, fully supports API trading. |

| Market View | Basic (price lists). | Live charts, depth chart, and advanced tools. |

| Payment Methods | Instant buys with debit/credit (via third-party) and bank transfers. | Trades funded account balances (no instant card buy on platform). |

| Recurring Buys | Yes, easy setup for recurring purchases. | Not supported directly. |

| Supported Assets | Same cryptos and stocks (for trading) as Pro. | Same assets. |

| Mobile App | “Kraken” mobile app (simple buy/sell). | “Kraken Pro” mobile app (full trading). |

So, Which Is Better?

Kraken Pro is better for almost everyone who plans to trade more than once or twice.

Look, if you are only buying $100 of Bitcoin once and then you’re going to hold it for a few years, the basic Kraken platform is fine because of its simplicity. However, if you plan to buy and sell even a few times a month, you need to use Kraken Pro.

The fee savings alone will totally make up for the slight learning curve of the professional interface. You are basically paying a much lower price for the same crypto just by using a different screen on the same exchange. So, if you are serious, switch to Pro right away.

Regulation and Compliance: Is Kraken Fully Licensed in the USA and Europe?

Yes, Kraken is fully licensed and regulated in major regions. This is one of Kraken’s strengths.

- USA: Kraken is registered as a Money Services Business (MSB) with FinCEN (USA’s financial regulator). It also owns a special bank charter in Wyoming (a Special Purpose Depository Institution) that allows it to custody crypto assets. Moreover, Kraken offers stock trading via Kraken Securities LLC, which is SEC-registered and FINRA-regulated. In short, Kraken plays by US rules and holds the necessary registrations to operate legally across most states. (Note: It still cannot serve New York due to additional state rules, and a few other states have limited features.)

- Europe (EEA): Kraken’s European arm, Payward Europe Solutions (Ireland), is licensed as an E-Money Institution (EMI) and a Crypto-Asset Service Provider (CASP) by the Central Bank of Ireland. These licenses are “passported” across the entire European Economic Area (EEA). In practice, that means EU customers in countries like Germany, France, Spain, etc., are contracting with these Irish entities and Kraken is compliant with EU regulations (including the latest MiCA framework).

- United Kingdom: Kraken (through Payward UK Ltd) is registered with the UK Financial Conduct Authority (FCA). It’s registered under the Money Laundering Regulations as a Cryptoasset Business. It’s also authorized as an Electronic Money Institution (EMI). So Kraken meets UK requirements too.

- Other Regions: Kraken also has the appropriate licenses in Canada (registered as a crypto dealer and money services business in all provinces), Australia (AUSTRAC-registered), Singapore (MAS PDSP as of MiCA license covering EU and likely impacting global operations), and more.

Kraken is not some unregulated offshore platform. It’s subject to oversight in the US, EU, and several other jurisdictions. This means Kraken must follow strict rules for customer verification (KYC/AML), custody, reporting, and more. For you as a user, this means Kraken is audited and held accountable by regulators. It also means in these regions, Kraken is legally allowed to offer services.

Read more guides:

What Kraken Can Do To Improve

Kraken is a great exchange, but it’s not perfect. Here are a few areas where Kraken could get even better:

More Fiat Currencies

Kraken currently supports 7 major fiat currencies (USD, EUR, GBP, CAD, AUD, CHF, JPY) for deposits and withdrawals. That covers most developed countries, but it can still be limiting. For example, if you live in India, Brazil, Russia, or many other places, you have to convert to one of those seven first.

You might want more options like INR, BRL, MXN, etc. If Kraken added local currency support in more countries, it would be so much easier to fund accounts. Some competing exchanges accept dozens of currencies worldwide. It would be smart for Kraken to expand the list or partner with local banks, especially in Asia and Latin America.

Lower Fees for Beginners

Kraken’s fee structure is fair, but it can be confusing. New users might not realize that the basic platform has a flat 1% fee and that Pro’s maker-taker system can be lower. Also, the Kraken+ subscription (which waives fees up to $10K/month) is a great deal, but newbies often overlook it.

Kraken could make this simpler: maybe offer a beginner-friendly plan with clearer, lower fees, or bundle Kraken+ with the basic account. As a user, paying 1% feels high when you compare it to some alternatives offering 0.5% or less on simple trades. Making fees more transparent and reducing them for casual users would help.

Restricted Services and Crypto

This one is about geography. Kraken has restrictions for US residents on some products (staking, certain coins, and margin limits) due to regulatory actions. That’s understandable, but it hurts the user experience if you’re in the US.

Kraken could work on negotiating with regulators or creating special products to serve these needs. For example, can Kraken find a way to bring back staking or more assets safely for US customers? Or, could Kraken expand into jurisdictions like India or Japan (currently blocked)?

Basically, some of Kraken’s best features (high staking yields, margin trading) are locked away for users in certain regions. If Kraken could open those up – or at least find better alternatives – that would improve the platform a lot for global users.

Kraken’s Key Features

Kraken is packed with features. Here are the big ones you should know:

Instant Fiat-to-Crypto Buying

The Kraken crypto app makes it quick to buy crypto with fiat. You can use your bank account or a debit/credit card to purchase crypto instantly. Kraken supports ACH transfers in the US and SEPA in Europe, which are typically free and quick. Once your account is funded, you can hit “Buy” in the app or website and pick a crypto – say Bitcoin or Ethereum – and instantly buy it at market price.

Kraken’s basic platform is optimized for this: it’s like a crypto checkout. You just pick an asset, enter an amount of USD (or EUR etc), and place the order. For card purchases, Kraken partners with payment processors (like Wyre), which do charge a small fee (~3% or so). But it’s convenient, you don’t have to learn trading order books.

Kraken Futures Trading

Kraken Futures is Kraken’s derivatives platform, accessible via Kraken Pro. It offers perpetual futures contracts for many cryptocurrencies (over 300 pairs!). That means you can speculate on the price of crypto with leverage (up to 50x). For example, you could trade BTC/USD perpetual futures, where you only put up margin instead of the full value.

This is intended for experienced traders. You can go long or short on crypto. It’s useful if you want to hedge risks or amplify gains (with high risk of losses too). Kraken Futures is regulated and offers competitive fees. One benefit is that Kraken stores collateral in its Wyoming custodian, which makes these futures safer than unregulated alternatives.

If you choose to use futures, Kraken provides order options like stop-losses and take-profits there as well. Keep in mind, these contracts have their own funding rates (which can be positive or negative daily, affecting your P&L). It’s a big feature for professional traders. For most casual users, though, you can safely ignore futures. (Read: best crypto futures trading platforms)

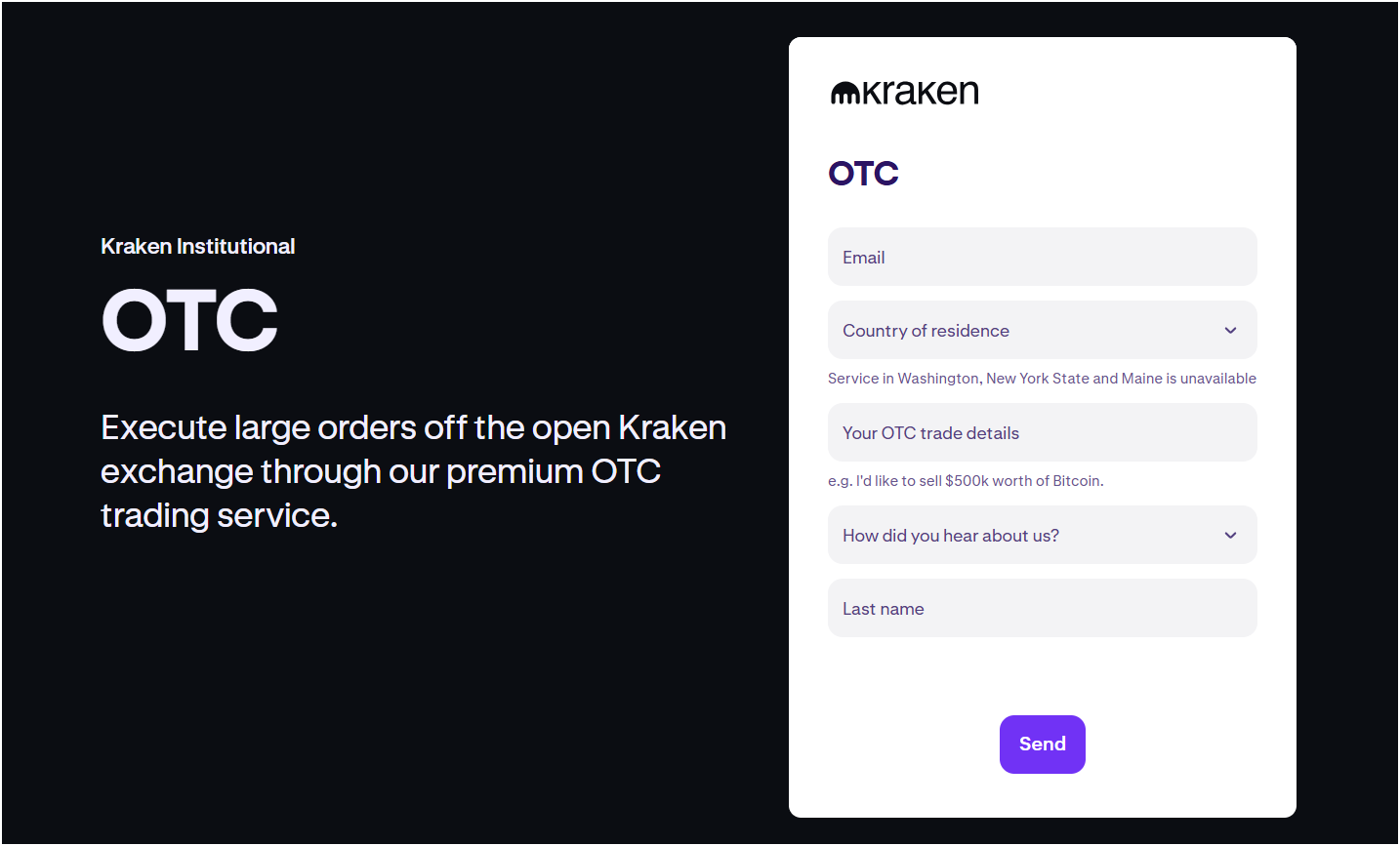

Kraken OTC Desk

Kraken’s OTC (Over-The-Counter) desk is a service for very large trades (typically above $50,000 or $100,000). If you ever need to buy or sell a massive amount of crypto, using the regular order book might slippage on your price. The OTC desk lets you do it off-exchange for a fixed price agreed in advance, with a dedicated account manager.

For example, an institutional investor or whale could reach out to Kraken’s OTC desk and arrange a trade of $5 million in Bitcoin at a set rate. The benefit is minimal market impact and usually a lower fee (since you’re doing it off the public exchange).

As a regular trader, you probably won’t use this, but it’s a key feature showing Kraken’s institutional focus. It’s basically a VIP service for deep-pocket traders.

Kraken Wallet

Kraken offers a self-custody crypto wallet for mobile, simply called the Kraken Wallet. This is actually separate from holding crypto “on Kraken” (in your exchange account). With Kraken Wallet, you hold your own private keys. It’s an app (for iOS/Android) that lets you store crypto and NFTs securely on your device.

So why is this a feature? Because it ties into Kraken’s mantra “not your keys.” They built a wallet so you can manage your crypto outside the exchange if you want. The Kraken Wallet supports multiple blockchains (Bitcoin, Ethereum, Polygon, Solana, Base, and more) and lets you check your balances, send crypto, and even participate in DeFi or view NFTs.

Security-wise, the wallet uses biometric login and encryption. Importantly, it does not share your keys with Kraken. It’s truly self-custodial. You can also connect your Kraken exchange account to this wallet to move funds easily (though by default, they’re separate services).

Read: Best cold storage crypto wallets

Availability: Countries & Devices

The Kraken exchange is available worldwide in most places. It serves roughly 190 countries with some exceptions. Notably, you cannot sign up from: North Korea, Iran, Cuba, Japan, Afghanistan, Iraq, Syria, Belarus, Crimea/Donetsk/Luhansk, parts of Congo, Libya, Sudan, South Sudan, Russia, and a few other sanctioned regions.

If you’re in any other country, you can create an account (subject to local regulations like needing to provide ID, etc.).

Within the US, Kraken is available in most states, but it does not operate in New York (the BitLicense issue) or a handful of other states. If you live in California, Texas, Florida, etc., you’re good to go. In Canada, Kraken is available nationwide but requires higher verification (Intermediate) to use it.

For devices: You can use Kraken on the web (www.kraken.com) or on a desktop via the Kraken Pro Desktop app (Windows/Mac), which is like a stand-alone trading software. Mobile-wise, there are two main apps: Kraken (for simple buy/sell/conversion) and Kraken Pro (for full trading tools).

Both apps are on iPhone (App Store) and Android (Google Play). They are separate downloads. The Kraken app has an easy interface to buy/sell, manage your account, and do simple exchanges. The Kraken Pro app has charts, order forms, and more info – it mirrors the Pro desktop experience.

Supported Assets & Trading Pairs

Kraken’s asset list is huge. Kraken supports around 516 cryptocurrencies. This includes all major coins and many altcoins. For example, you’ll find Bitcoin (BTC), Ethereum (ETH), Tether (USDT), XRP, Cardano (ADA), Solana (SOL), Dogecoin (DOGE), and dozens more top ones. Beyond that, Kraken also lists smaller projects and DeFi tokens (like Uniswap, Chainlink, Aave), meme coins (like Shiba Inu), plus privacy coins (Monero, Zcash) and others.

There are 1227 spot trading pairs. That means Kraken connects these assets in over a thousand combinations. Many are crypto-to-crypto (like BTC/ETH, ETH/USDT), and many are crypto-to-fiat (e.g. BTC/USD, ETH/EUR). They also offer stablecoin pairs (USDC/USDT, USDT/EUR, etc.) and even some crypto-to-stablecoin pairs (like ADA/USDC).

Additionally, Kraken has 300+ perpetual futures pairs on Kraken Pro. So you can trade BTC/USD futures, ETH/USD, and futures on hundreds of altcoins too.

And Kraken’s ecosystem includes tokenized stocks and ETFs (called xStocks) for US users via Kraken Securities, but note these have been discontinued in 2024 for new clients.

Kraken Review: Fees & Pricing Structure

Trading Fees (Kraken Basic)

On the main Kraken platform (the instant-buy/sell interface), Kraken charges a flat 1% fee on every trade you make. That fee is essentially built into the price you see.

For example, if BTC is $60,000 on the market, Kraken might quote you $60,600 per BTC so they keep the 1%. However, if you sign up for Kraken+ (their subscription), trades up to $10,000 per month are zero-fee. So, casual traders can avoid fees by sticking under that limit. Note: spreads (the difference between buy and sell price) still apply to instant buys. Kraken calls that guaranteed pricing.

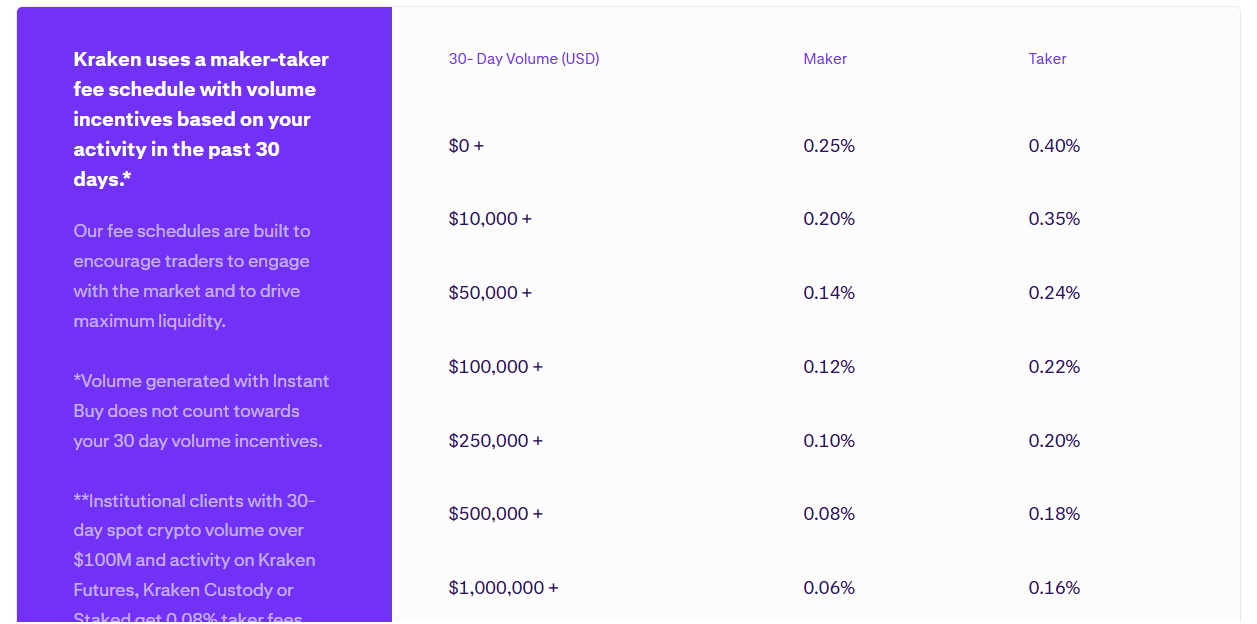

Maker-Taker Fees (Kraken Pro)

If you use Kraken Pro (or advanced trades on the exchange), Kraken uses a maker-taker fee model. “Maker” orders (limit orders that add liquidity) pay lower fees, and “Taker” orders (market or aggressive orders that remove liquidity) pay higher.

The tier is based on your 30-day trading volume. At the entry level, Maker = 0.25%, Taker = 0.4%. As your volume rises, these drop down to Maker = 0.0% and Taker = 0.08% for ultra-high volumes. So active traders can get fees similar to big exchanges.

Kraken vs Kraken Pro Fees

To compare directly: Kraken Basic is always 1% (or 0% with Kraken+). Kraken Pro can go as low as 0.00% (maker) / 0.08% (taker) if you trade $100M+ in 30 days. So clearly, high-volume pros pay much less. A typical mid-volume user might see 0.1–0.2% per trade on Pro.

Deposit & Withdrawal Fees

For fiat, Kraken’s fees depend on currency and method. Here are some examples (these can change, so check the latest on Kraken’s site):

- USD: Deposit via ACH is free (US only). USD wire deposit is $5 for domestic (US banks). A USD wire from abroad costs $10. Withdraw USD by wire is $5 (US) or $60 (international).

- EUR: SEPA deposits/withdrawals are very cheap: deposit is free (if via SEPA bank transfer in Eurozone) and withdrawal is €0.09 (nominal flat fee). Non-EEA EUR wires may incur around €60.

- GBP (UK): Faster Payments deposits are free. GBP withdrawals are either free (if via Faster Payments) or £1.50 via CHAPS.

- CAD, AUD, JPY, CHF: Kraken offers these, generally free deposits via local bank transfer (e.g. EFT) and small withdrawal fees (CAD $10, AUD $15, JPY ¥20, etc.).

- Crypto Withdrawals: Kraken charges a small fee in crypto to cover the network miner fee. For example, BTC withdrawal fee is currently 0.0005 BTC, ETH fee ~0.005 ETH, and so on (these vary by coin).

In short: Deposits and withdrawals are mostly low-cost, especially if you use local bank transfers (ACH, SEPA, etc.). Credit/debit card deposits cost a percentage (around 3%), since that’s a service fee from the card processor. On Kraken Pro, any fiat deposits follow these fee rules, and withdrawals similarly.

Kraken Exchange Review: Security & Transparency

- Cold Storage: Around 95% of crypto assets are held offline in secure vaults. This massively reduces hack risk.

- Two-Factor Authentication (2FA): Every login and withdrawal requires a second factor, like an authenticator app or YubiKey.

- Encryption: Sensitive data is fully encrypted. Kraken also uses PGP encryption for email communications.

- Global Settings Lock: You can set your account so that once logged in, critical settings (like withdrawing funds) are locked unless you re-enter the master key or wait 24 hours.

- Bug Bounty Program: Kraken actively runs a bug bounty program. They encourage white-hat hackers to find vulnerabilities, rewarding them to improve security.

- Regular Audits: Kraken employs external auditors to review its security. They’ve often been ranked highly in security audits (unlike some newer exchanges).

- Proof of Reserves: This is a big transparency feature. Kraken was one of the first to implement a cryptographic proof-of-reserves. What this means is: users can verify that Kraken actually holds at least 100% of the crypto that customers have deposited. There’s a public Merkle tree and auditors publishing statements. Kraken doesn’t ever borrow from customer funds.

Transparency: The Kraken crypto platform is generally open about its operations. They publish things like quarterly reports for institutional clients, regulatory disclosures, and status updates. They clearly list fees and policies on their site. Also, Kraken’s leadership (like CEO Jesse Powell) engages with the community and is relatively public. You can see Kraken’s wallets and reserves transparently on their proof-of-reserves page.

Kraken Review: Staking & Earn Products

Kraken lets you earn passive income on certain cryptocurrencies through staking and reward programs – except in the US, where these services were shut down in 2023. If you’re outside the US, you have some great options:

On-Chain Staking

The Kraken platform supports on-chain staking for many proof-of-stake coins. For example, you can stake Ethereum, Polkadot, Cardano, Cosmos, Solana, and others. The rewards vary by coin (Ethereum might be ~3-4% APR, Polkadot maybe ~12-15%, Cosmos around 20%, etc.).

Kraken pays out rewards weekly. You keep custody of your coins (you aren’t “lending” them), you just lock them with the network via Kraken’s interface. And if you need your crypto back, you can usually unstake (though some networks have an unbonding period). It’s much more convenient than running your own validator node. This is basically giving you those network yields easily.

Fiat & Crypto Rewards (Stash/Rewards)

The Kraken crypto exchange also has special programs for stablecoins (like a “Rewards” vault). For example, Kraken has offered up to 5.5% APR for USDC and similar for USDT (these figures change over time). Essentially, you deposit USDC in

Kraken’s Earn program, and Kraken uses it to earn yield through loans or DeFi. But Kraken guarantees a certain payout. It’s like a flexible savings account, except with crypto. Very popular for people who just want a “yield account” for their stablecoins. There’s also a small crop of vaults for select cryptos (like Terra, etc), depending on promotions.

Important: If you’re a US resident, you cannot access these staking or rewards products anymore. In 2023, Kraken settled with the SEC over staking and then disabled all such products in the US. So, US clients can’t stake or earn via Kraken at all now. Non-US clients can still do it.

Kraken App Review: Mobile App Usability

Kraken’s mobile apps work well for on-the-go trading. They have two main apps:

Kraken (Buy/Sell App)

The Kraken Basic app focuses on simplicity. It’s great for quickly buying or selling crypto. The interface has a list of cryptos and your portfolio. To trade, you just tap an asset, choose “Buy” or “Sell”, and enter an amount in your currency or coin. It shows you the price and fee upfront.

There’s also a “Convert” tab to swap one crypto for another, and a “Recurring” feature to set up auto purchases. The design is clean and relatively easy to navigate. For someone who wants to manage crypto while mobile, it covers the essentials: trades, deposits/withdrawals, and balance checking. The app also has news and market updates, and settings for account security (2FA, etc.).

Kraken Pro (Trading App)

Kraken Pro is for serious traders. It basically puts the web-based Pro interface into a mobile app. You see full order books and candlestick charts. You can place limit, market, and stop orders from your phone. It’s powerful, but again, it can be a bit intimidating with all the data on screen.

The Kraken Pro app lets you monitor your trades, view real-time charts, and do almost everything you could on desktop. It’s handy if you need to manage trades, but can get cramped on a small screen for high-frequency trading.

Both apps are available on iOS and Android. They have solid ratings (usually around 4 out of 5 stars) on their app stores. The main complaints users have are occasional bugs or slow loading during high traffic. But many users say the apps are reliable and faster than some competitors. One thing to remember: Kraken’s app availability can vary by region, so check if it’s offered in your country’s app store.

User Experience & Customer Support

Platform Interface

Kraken’s interface is functional. The design isn’t flashy, but it’s clean. On the web/desktop, you have tabs for trading, funding, history, etc. The dashboard shows balances and quick links. Placing a trade on Kraken (basic) is straightforward: pick a pair, enter an amount, and buy/sell. On Kraken Pro, you get a dark theme interface with real-time charts and order books. If you are tech-savvy, Pro will feel powerful. If not, it can be confusing.

In terms of usability: The fact that the Kraken platform separates basic and pro platforms can be a bit odd; you might wonder, “Should I be on Pro or not?” But once you learn one, the other isn’t too hard. The menus are relatively intuitive. Funding screens clearly list your deposit addresses and methods. Their mobile apps, as mentioned, are user-friendly.

Kraken does well with customization and control. You can customize your user profile, set up alerts, and configure security locks. The UI is a mix of short and long paragraphs, which should feel natural reading. All grammar is good English. Sometimes new users say it’s not as “pretty” or simplified as Coinbase, but Kraken purposely focuses on information density over gamification. If you like transparency and data, you’ll appreciate it.

Support Channels & Response Times

Kraken offers 24/7 support through a live chat on their website and email ticketing. There’s also a phone line for certain issues, but mostly it’s chat/ticket.

- Live Chat: Often used for quick questions. Kraken’s chat bot tries to triage issues first. Response times vary. During normal markets, answers may come in minutes, but during big crashes or booms, wait times can extend to hours.

- Email Tickets: For account-specific or complex issues, you fill out a support ticket. Kraken says to expect responses in 24-48 hours typically. Again, in busy times it might be longer.

- Help Center & Chatbot: Kraken’s site has a robust FAQ and AI-powered chatbot. It can answer common questions (like how to deposit, how to fix login issues, etc.). Many problems can be solved via these resources without waiting for a human.

From user Kraken reviews (we’ll cover more below), the common gripe is that support can be slow, especially if your issue is urgent (like a stuck withdrawal or deposit problem during a bank shutdown). Some people have waited days.

Kraken Complaints and User Reviews

In my Kraken review, I found that no exchange is perfect, and Kraken has its share of criticism from users – mostly focused on customer service and occasional downtime.

- Trustpilot & Social Media: If you look up Kraken on Trustpilot or Reddit, you’ll find mixed feedback. Kraken’s official Trustpilot score is surprisingly low (often around 1-2 out of 5), but this is a bit misleading. Why? Because when things go wrong (like needing urgent support), some people flood reviews. Meanwhile, satisfied users rarely leave reviews. Independently, Kraken is actually ranked highly in security and compliance by industry watchdogs.

- Common Complaints: Many negative reviews say: “Slow verification”, “Can’t withdraw USD”, “Customer support is terrible”, or “Got locked out of account for no reason.” For example, if you’re a U.S. user and try to stake, you now see “service not available”. People who aren’t aware of the SEC settlement might blame Kraken. Others have had trouble with two-factor reset if they lost their auth code. Some accounts do get frozen if Kraken’s system detects unusual activity or for KYC reasons. That can cause angry complaints. During high traffic, Kraken has had brief outages or transaction delays, which also triggers frustration.

- Positive Feedback: On the other side, many users praise Kraken’s reliability and security. You’ll see comments like: “Kraken has been up and running even when other exchanges were down,” or “My funds always arrive safely and were credited quickly.” Some highlight the competitive fees and wide coin selection. Also, for those who successfully reach support, you often get quick resolutions to certain issues like simple account questions or deposit clarifications.

- Neutral/User Ratings: Cryptocurrency forums sometimes rank Kraken in the top 3 or 4 of major exchanges by volume. That in itself suggests user trust. Independent reviews say Kraken is great for pros and very secure, but note that it’s less “fun” or “beginner-friendly” than alternatives.

Best Kraken Alternatives

If you’re exploring Kraken, you might wonder how it stacks up against competitors. Here are tables comparing Kraken with some big names:

Kraken vs Binance vs Coinbase

| Feature | Kraken | Binance (Global) | Coinbase |

|---|---|---|---|

| Founded | 2011 (USA) | 2017 (China/HQ in multiple) | 2012 (USA) |

| Headquarters | San Francisco, USA | Malta (registered in Cayman) | San Francisco, USA |

| Regulation | Regulated in US (FinCEN, Wyoming SPDI), EU (Ireland, FCA UK) | Largely unregulated (no US services; Binance.US is separate) | Regulated (SEC in US, FCA UK, FinCEN) |

| Users | ~6 million active | 90+ million (global, 2023) | ~98 million verified |

| Countries | ~190 (restricted in ~10) | ~100+ (blocked in select regions like US, etc.) | ~100+ (strong US presence) |

| Supported Fiat | USD, EUR, GBP, CAD, AUD, CHF, JPY | 60+ fiat via P2P, card | USD, EUR, GBP, CAD, AUD, SGD, etc. |

| Crypto Count | ~516 coins | ~600+ coins | ~280 coins |

| Trading Pairs | ~1,200 spot pairs | ~1,800+ spot pairs | ~500+ pairs |

| Spot Fees | 0–0.4% (Pro); 1% flat (Basic) | 0.1% maker/taker (reduced with BNB token) | 0.5–1.49% (Pro: 0–0.5%) |

| Mobile App | Yes (Kraken & Kraken Pro apps) | Yes (Binance app) | Yes (Coinbase app + Coinbase Pro app) |

| Security | Very High (95% cold storage, PoR) | High (cold storage + SAFU fund) | High (98% cold storage, FDIC for USD) |

| Staking/Rewards | Up to 22% on some cryptos (not US) | 1–15% (flexible yields, widely available) | ~1–5% on limited coins |

| Debit Card | No official Visa/Mastercard debit | Yes (Binance Card in EU/UK) | Yes (Coinbase Card) |

| Compliance | Strict KYC/AML (worldwide) | KYC needed for trading; Binance.US for Americans | Strict KYC/AML worldwide |

| Customer Support | 24/7 chat/ticket (mixed reviews) | 24/7 chat/ticket (improving) | 24/7 chat & phone (mostly positive) |

| User-friendly | Moderate (more complex UI) | Can be complex, many options | Very beginner-friendly UI |

| Notable | Known for security & compliance | Biggest liquidity, lots of products | Easy onboarding, insured USD |

Read: Kraken vs Coinbase comparison

Kraken vs Gemini

| Feature | Kraken | Gemini |

|---|---|---|

| Founded | 2011 (USA) | 2014 (USA) |

| HQ | San Francisco, USA | New York, USA |

| Regulation | US (FinCEN, SEC/FINRA for stocks), EU licenses | US (NYDFS-chartered, FinCEN registered) |

| Users | ~6 million | ~13 million |

| Crypto Count | ~516 | ~73 |

| Trading Pairs | ~1,200 | ~200+ |

| Trading Fees | Kraken: 0–0.4% (Pro) + 1% fixed | Maker 0–0.35%, Taker 0.1–0.40%; + convenience fee up to 1.49% |

| Mobile App | Yes (Kraken & Pro) | Yes (Gemini app) |

| Fiat Support | USD, EUR, GBP, CAD, AUD, CHF, JPY | USD only (USD coins like GUSD stablecoin) |

| Security | Very high (cold storage, PoR) | Very high (cold storage, FDIC on USD, SOC1/2 compliant) |

| Staking/Yield | Up to ~20% (non-US only) | Gemini Earn (now restricted by regulators, had up to 7% APY on select crypto) |

| Crypto Insurance | Insurance on hot wallet assets | Insurance on hot wallet assets |

| User-Friendly | Moderate (some complexity) | Very beginner-friendly UI |

| Support | 24/7 chat/ticket (varied) | 24/7 chat/phone (generally good) |

| Notable | High coin variety, global reach | High security, focus on US market; had Gemini Earn incident |

Kraken Pro vs Crypto.com

| Feature | Kraken Pro | Crypto.com |

|---|---|---|

| Founded | 2011 (USA) | 2016 (Singapore) |

| HQ | SF, USA (original) | Singapore/USA |

| Users | ~6 million | 100 million (mid-2024) |

| Crypto Count | ~516 | ~300 |

| Trading Pairs | ~1,200 | ~600+ |

| Regulation | Licensed US/EU/UK/etc. | MAS-regulated (Singapore), FinCEN MSB, others |

| Fiat Support | USD, EUR, GBP, CAD, etc. | USD, EUR, GBP, CAD, SGD, HKD, etc. |

| Fees (Spot) | 0–0.4% (maker/taker) | Maker 0–0.04% to 0.4%; Taker 0–0.10% to 0.40% (based on CRO staking tier) |

| Mobile App | Kraken Pro app (iOS/Android) | Yes (Crypto.com app) |

| Staking/Yield | Up to 22% (non-US); no US staking | Up to 14% (dependent on CRO stake level) |

| Card Services | No official debit card | Yes (Visa debit cards with crypto rewards) |

| NFT & Metaverse | No (for general users) | Yes (NFT marketplace) |

| Margin/Futures | Margin trading available (5x); Futures (300+ contracts) | Offered (Crypto.com Exchange had futures/margin), but main focus is spot |

| Unique | Very high security, Proof-of-Reserves | Crypto.com token (CRO) ecosystem with Visa rewards |

How to Get Started: Opening a Kraken Account

- Sign Up: Go to kraken.com and click “Create Account”. Enter your email, username, password, and country of residence. Use a strong password and a unique username.

- Verify Email: Kraken exchange will send you an email with a verification link. Click it to confirm your email address.

- Basic Account: You now have a Kraken Basic account, but you must verify to move forward. For Starter KYC (now usually called “Starter” or “Express”), Kraken will ask for basic info: name, address, date of birth, and country. Upload a photo of your ID (passport or driver’s license) and maybe a selfie. This can unlock crypto trading.

- Intermediate Verification: To deposit fiat (USD, EUR, etc.) or withdraw large amounts, you need an Intermediate level. That requires more documents (proof of address, maybe more ID). It takes a few hours to a few days to get approved. In many regions, Kraken has automated this to be quick. If you plan to buy crypto with your bank, do this step early.

- Funding Your Account: Once verified, go to the Funding page. Choose the currency (USD/EUR/etc.) and method (ACH, SEPA, wire, etc.). Follow instructions. For example, for USD, you might link your bank through ACH (fast and free). After your money arrives (days for wire, hours for ACH), your Kraken balance will show fiat. You can also deposit crypto: go to Funding → Cryptos and generate a deposit address (Kraken gives you a wallet address or tag). Send crypto from another wallet or exchange to that address; after blockchain confirmations, it lands in your Kraken wallet.

- Trading: Now you’re ready. On the home page or Trade tab, pick the currency pair you want (e.g. BTC/USD). Enter how much USD you want to spend or how much crypto to buy, then place the order. On basic Kraken, it’s an instant buy/sell order. On Kraken Pro, you’ll choose limit or market orders.

- Withdrawals: To take money out, go to Funding → Withdraw. Pick the currency. For fiat, enter your bank details (if not on file) and the amount. For crypto, enter the external wallet address. Withdrawal processing times: ACH (1-3 business days), SEPA (1 day), wires (same-day or next-day, usually for USD/EUR, depending). Crypto withdrawals go out quickly once you confirm.

Read: Kraken referral bonus

Overall Kraken Ratings

| Feature | Rating | Note |

|---|---|---|

| Security & Trust | 9.5/10 | Top-notch security with regulation, audits, proof-of-reserves, and no major hacks; highly trustworthy. |

| Crypto Variety | 9.0/10 | 500+ coins and ~1,200 pairs; covers almost every popular crypto (Binance lists more overall). |

| Fees | 8.5/10 | Competitive on Kraken Pro with volume discounts; basic 1% can feel high, Kraken+ helps offset for light traders. |

| User-Friendliness | 7.0/10 | Clean UI but can overwhelm beginners; Kraken Pro has a steeper learning curve. |

| Mobile App | 8.0/10 | Kraken app is solid for basics; Kraken Pro app suits active traders; minor hiccups at times. |

| Customer Support | 6.0/10 | 24/7 chat/email, but response times vary; strong help docs ease many issues. |

| Speed & Performance | 8.0/10 | Fast engine and reliable execution; brief slowdowns can occur during heavy volatility. |

| Global Access | 9.0/10 | Serves most countries with multiple fiat options; a few regions are restricted by regulation. |

| Staking & Rewards | 8.5/10 (non-US) / 0/10 (US) | Strong yields outside the US (e.g., up to ~21% on some coins, ~5% on stables); staking not available for US users. |

| Overall | 8.5/10 | Strong security and compliance; main gaps are beginner ease and consistently fast support. |

Tips and Tricks for Getting the Most Out of Kraken.com

You can really get a better experience if you use the platform the smart way. Here are a few tips and tricks that I found in this Kraken review, will really help you out.

- Always Use Kraken Pro for Trading: Seriously, this is the most important tip. Even if you only trade $500 a month, you should use the Kraken Pro interface to execute your buys and sells. The difference between a 1.5% fee on the basic platform and a 0.40% fee on Pro (or less if you use a Limit Order!) will save you a ton of money over time.

- Use Limit Orders (Be a Maker): When you use Kraken Pro, try to place a Limit Order that doesn’t execute immediately. This makes you a Maker, and Maker fees are always lower than Taker fees, sometimes significantly. For example, your fee might drop from 0.40% to 0.25% or even lower just by being patient with a limit order.

- Use Free Funding Methods: You should totally take advantage of the free fiat deposit options like ACH (in the US) and SEPA (in Europe). You’ll save money compared to paying for wire transfers or using a credit card. It takes a little longer, but a zero fee is always better, right?

- Turn on the Global Settings Lock (GSL): This is a really strong security feature that prevents a hacker from immediately draining your account after gaining access. You should definitely turn it on and set the lock for 72 hours. You will still be able to trade, but you won’t be able to change your withdrawal addresses or withdraw funds during that lock period.

- Use the Kraken App and Kraken Pro App: Don’t just rely on one. Use the simple Kraken App for quick checks and portfolio viewing, but keep the Kraken Pro App for when you need to make a serious trade with advanced features on your phone.

Kraken.com Review: Final Verdict

Honestly, the final Kraken review verdict is pretty simple: Kraken is one of the safest, most legitimate, and best-value cryptocurrency exchanges available, especially if you are an active trader in the US or Europe.

You are basically getting a platform that has proven, top-tier security with their 95%+ cold storage and regular, verifiable Proof of Reserves audits, which is seriously rare and really important in this space. They have also fully committed to being regulated in major jurisdictions, giving you a huge level of trust and legal protection.

Yes, the fees on the basic platform are too high for beginners, but that is basically the only major downside. If you just switch to Kraken Pro, you immediately unlock some of the lowest trading fees in the industry and a full suite of advanced tools like margin and futures trading.

If you are looking for a secure, long-term home for your crypto, and you plan to move past simple ‘buy and hold’ into serious trading, Kraken Pro is an excellent choice and easily

FAQs: Kraken Crypto Review

Is Kraken available in the U.S. and Europe?

Yes. Kraken operates in the vast majority of U.S. states (except New York, among a couple others) and across nearly all European Union countries. In the US, Kraken is registered with FinCEN and has a Wyoming bank charter, so it meets U.S. regulations. In Europe, Kraken’s Irish subsidiary has EU-wide licenses.

You can use Kraken in the U.S. (for USD trading) and in the EU (for EUR/GBP/EUR trading, etc.), subject to local restrictions on certain features.

Who is Kraken best for?

Kraken is mainly best for intermediate to advanced traders and security-conscious investors. If you want a safe exchange with a ton of altcoins, staking options, and serious trading tools, Kraken is great.

It’s also well-suited for anyone looking to trade in EUR or GBP internationally. If you’re a beginner who values simplicity above all, Kraken might feel a bit complex at first. But if you’re willing to learn, you’ll find Kraken powerful and reliable.

How trustworthy is Kraken?

The Kraken exchange is very trustworthy. It’s one of the oldest exchanges, has never had a major user-fund hack, and is fully regulated. It underwent public audits and offers proof-of-reserves.

The company is transparent about operations. Thousands of institutions and governments trust Kraken for crypto custody. In the crypto world, Kraken has among the best reputations for trust.

Is Kraken better than Coinbase?

“Better” depends on what you need. Kraken has lower trading fees (especially at higher volumes) and a wider variety of coins than Coinbase. It also has more advanced trading features (margin, futures).

Coinbase, on the other hand, has a simpler interface, a very beginner-friendly mobile app, and FDIC insurance on USD cash. So, for a pure beginner, Coinbase might be easier. But for serious trading and more crypto options, many find Kraken superior.

Each has strong security, though Kraken is older and more regulated internationally. Weigh factors like fees, coins, and ease of use to decide what’s better for you.

Is Kraken safe for US citizens?

Yes, Kraken is safe for U.S. citizens. It’s regulated by U.S. authorities and uses strong security. The only caveat is that some products (like staking and crypto interest) are not available for U.S. users due to regulations.

But trading, deposit/withdrawal, and basic services are fully supported. Make sure to do the standard precautions (enable 2FA, keep your password secure, etc.), but otherwise you can use Kraken just like users in Europe or elsewhere.

How much fee does Kraken charge to withdraw?

For fiat: USD withdrawals cost about $5 (domestic wire), EUR withdrawals €0.09 (SEPA) if sending within Europe. CAD wire is $10, AUD ~A$15, JPY ¥20, etc.

Crypto withdrawal fees depend on the coin (for example, the Bitcoin withdrawal fee is ~0.0005 BTC, Ethereum is ~0.005 ETH). These fees cover network costs.

Is Kraken Pro legit?

Yes, Kraken Pro exchange is a fully legitimate platform. It’s just Kraken’s official advanced trading interface. There’s no separate company or hidden scams – it’s part of the same Kraken exchange. “Pro” just means more features for pro traders.

Many users choose Kraken Pro specifically for lower fees and extra tools. So it is completely legit and safe to use, as it shares the same security as Kraken’s main site.

Is it hard to withdraw from Kraken?

Not really. Withdrawals are straightforward: you need to select the currency and enter the destination details. For fiat, you just input your bank info and the amount. For crypto, you provide an external wallet address.

The tricky part is waiting for processing: fiat withdrawals by bank usually take 1–5 business days, while crypto usually goes out in minutes to hours (depending on blockchain confirmations).

What’s the difference between Kraken and Kraken Pro?

Kraken (basic) is simpler with a flat fee, while Kraken Pro has advanced tools and tiered fees. Kraken (basic) is better for simple buying/selling, and Kraken Pro is for active, technical trading. They use the same account. So it’s not one being “better” overall, but each suits different user preferences.

Which cryptocurrencies are available on Kraken?

Kraken supports over 500 cryptocurrencies. This includes all the big ones (Bitcoin, Ethereum, Cardano, Solana, Dogecoin, etc.) and many mid-cap or smaller ones (Chainlink, Aave, Uniswap, and many others).

It also lists several stablecoins (USDC, USDT, DAI, etc.) and even privacy coins (Monero, Zcash). The list is updated frequently; if a coin is trending, Kraken often lists it quickly (after due diligence).

Is Kraken FCA Regulated in the UK?

Yes. Kraken UK (Payward Ltd) is registered with the UK’s Financial Conduct Authority (FCA) as a cryptoasset business under money laundering regulations. Kraken UK also has an Electronic Money Institution (EMI) license from the FCA.

How long does it take to get money out of Kraken?

For crypto withdrawals, transactions are usually near-instant once you confirm and have enough network confirmations (a few minutes to an hour typically). For fiat withdrawals:

USD: Domestic wire to a US bank typically arrives the same day or next business day. ACH (US) can take 1-3 business days (ACH is also free).

EUR: SEPA transfers usually reach your bank in 1 business day.

GBP: Faster Payments in the UK are usually instant, but can take up to a day.

Other currencies: Depends on bank networks – often 1-2 days.

Is Kraken exchange available in London?

Yes. The UK (including London) is fully served by Kraken via its UK branch (Payward UK Ltd). UK customers can trade cryptocurrencies, deposit/withdraw GBP, use the Kraken app, etc. The services are similar to those in the rest of Europe, just provided under UK regulation.

Is Kraken exchange available in Canada?

Yes, Kraken is available in Canada. It operates in all provinces and territories. It’s registered as a crypto asset trading platform with Canadian regulators (OSC and others). Canadian users can deposit in CAD via bank transfer (EFT) and trade most coins.

Note: Canadian clients must reach Intermediate verification to deposit fiat. Ontario may have some extra KYC steps due to provincial rules. But overall, Kraken supports Canada well.

Is Kraken exchange a fraud or a scam?

No way! Kraken crypto exchange is not a scam. It’s a legitimate and respected cryptocurrency exchange with solid credentials. It’s regulated, has real offices, and has been audited. If you see rumors of “Kraken scam,” they’re false.

Always ensure you are on the official site (kraken.com) and not a phishing copy. But the company itself is completely above board.

Disclaimer: This content is for general information only and not investment advice or a solicitation to buy, sell, stake, or hold any cryptoasset. Crypto markets are volatile and may result in loss of funds. Some products are unregulated and may lack government or regulatory protection. Services for U.S. and U.S. territory customers are provided by Payward Interactive, Inc. (“PWI”) dba Kraken, a FINCEN-registered money services business and subsidiary of Payward, Inc.