Finding the best altcoin exchanges can be confusing when hundreds of platforms promise low fees and fast trades. I’ve spent days comparing the top exchanges – looking at fees, coin selection, safety, ease of use, and whether you can buy altcoins using fiat money.

After checking all that, I’ve listed only the most trusted and beginner-friendly altcoin trading options for 2025.

Top 8 Best Altcoin Exchanges in 2025

We have reviewed over 30 top altcoin exchanges based on supported altcoins, trading fees, security measures, licensing, and trading features. Here are our top 8 best altcoin exchanges to use right now:

- Bitget: Overall best altcoin exchange of 2025

- MEXC: Best exchange for no-KYC altcoin trading (full privacy)

- KuCoin: Best for both beginners and experienced traders

- Binance: Best for high liquidity altcoin trading

- Bybit: Best for altcoin derivatives trading

- Gate.io: Crypto exchange with most altcoins

- Coinbase: Best altcoin exchange in the USA

- HTX: Best for buying altcoin and Bitcoin instantly

My Picks: Best Exchanges to Trade Altcoins

Best Crypto Exchanges for Altcoins in 2025 (Reviewed)

Here is an in-depth review of the 8 best altcoin exchanges to buy safely and securely:

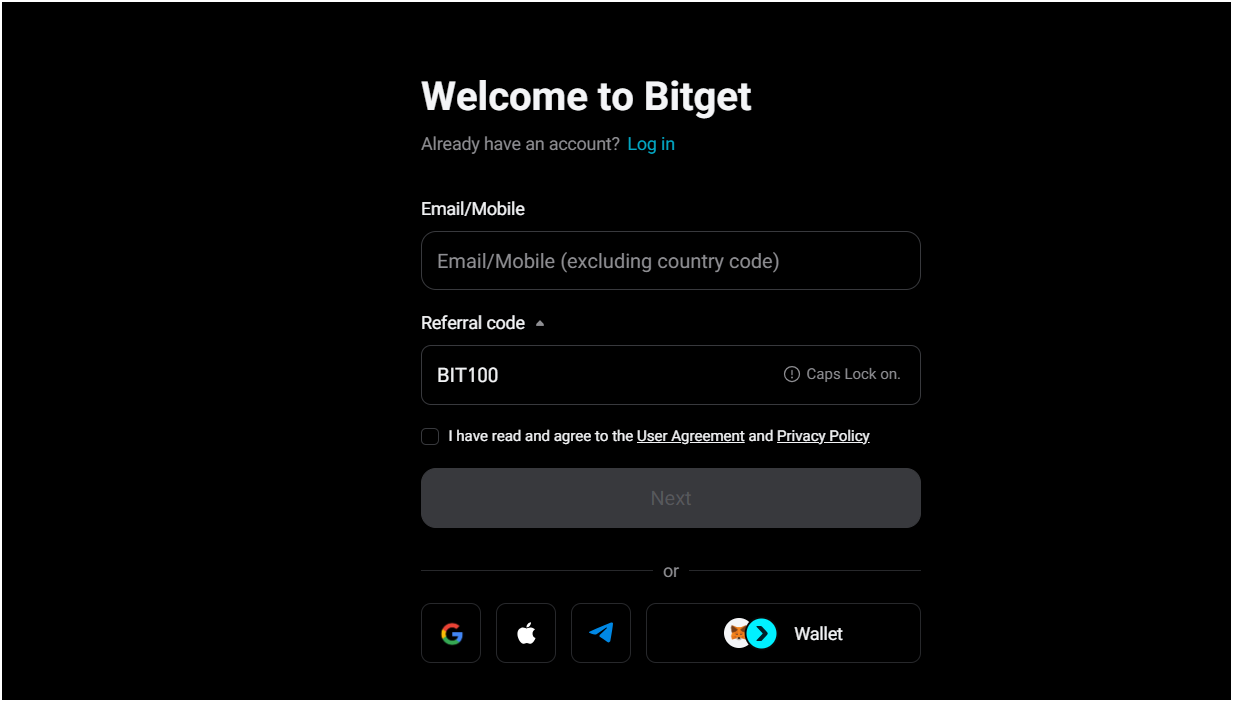

1. Bitget: Overall Best Altcoin Exchange of 2025

| Our ranking | #1 |

| Regulated and Licensed | Yes (Poland, El Salvador, USA, and Lithuania) |

| Insurance | Yes ($600M protection fund) |

| Supported altcoins | 700+ altcoins |

| Trading fees | Spot: 0.1% maker/taker (20% off with BGB). Futures: 0.02% maker, 0.06% taker |

| Features | Copy trading, automated trading bots, spot and futures trading, |

| Maximum leverage | Up to 125x for futures contracts (varies by asset) |

| Trading volume and liquidity | Over $10 billion USDT (24-hour); strong altcoin liquidity |

| Payment methods | Credit/Debit card (Visa, Mastercard), Bank Transfer, Apple Pay |

| Minimum deposit | $1 USD |

| KYC Required | Yes (Mandatory) |

| Withdrawal limits | $6 million for regular users (increases with KYC levels) |

Why Is Bitget the Best Altcoin Exchange?

Bitget is a global cryptocurrency altcoin exchange that’s been around since 2018. It’s become quite popular, especially for its strong focus on derivatives trading and copy trading features. They’ve grown to serve over 120 million users across more than 150 countries.

Bitget offers a wide range of cryptocurrencies, with over 700 tokens listed for spot trading, as well as 500+ futures contracts. They have competitive fees, with standard spot trading fees at 0.1% for both makers and takers, and can be reduced if you use their native token, BGB. For futures, maker fees start at 0.02% and taker fees at 0.06%.

Bitget prioritizes security through the segregation of cold and hot wallets, as well as multi-signature authorizations, to safeguard user funds. They also hold regulatory licenses in several regions like the USA, Canada, and Australia, and are registered as a VASP in Poland. Their 24-hour trading volume often surpasses $10 billion USDT, and a recent CoinGecko report even highlighted them as a leader in altcoin liquidity.

Note: Use our Bitget referral code “BIT100” during registration to unlock $6,200 sign-up bonus and get a 20% trading fee discount for life.

2. MEXC: Best exchange for KYC-free altcoin trading

| Our ranking | #2 |

| Insurance | $100 Million Guardian Fund |

| Supported altcoins | Over 2,900 cryptocurrencies. |

| Trading fees | Spot trading: 0% maker, 0.02% taker Futures trading: 0% maker, 0.01% taker |

| Features | Spot trading, futures trading (USDT-M and COIN-M), staking, lending |

| Maximum leverage | Up to 200x on futures trading. |

| Trading volume and liquidity | Over $4.1 billion |

| Payment methods | Fiat-to-crypto purchases via third-party partners using Visa and Mastercard. |

| Minimum deposit | $1 |

| KYC Required | No (Trade with just an email) |

| Withdrawal limits | No-KYC: 10 BTC per 24 hours. Primary KYC: up to 80 BTC. Advanced KYC: up to 200 BTC. Institutional KYC: up to 400 BTC. |

Why is mEXC the Best Altcoin Exchange?

MEXC, which started in 2018, has become quite popular, serving over 40 million users across more than 170 countries. A big reason people choose MEXC is its flexibility regarding “Know Your Customer” (KYC) verification.

It is one of the best no-KYC crypto exchanges. You can actually start trading spot and even futures on MEXC without immediately going through the full identity verification process. This makes it a go-to choice for traders who value their privacy or just want a quicker setup.

MEXC is also known for its wide selection of trending altcoins, they’ve been listing a lot of new ones, and the trading volume for these new listings has seen significant growth. Plus, their trading fees are pretty competitive, with 0% maker fees on spot and futures, which is a big draw for active traders. (Read my MEXC review)

Note: Use our MEXC referral code “mexc-1b9QM” during registration to unlock $1,000 sign-up bonus and get a 30% trading fee discount.

3. KuCoin: Best for both beginners and experienced traders

| Our Ranking | #3 |

| Licensed | FIU India and Europe |

| Insurance | Yes (amount not publicly disclosed) |

| Supported Altcoins | 900+ cryptocurrencies. |

| Trading Fees | Spot: 0.1% (maker/taker); 20% KCS discount Futures: 0.02% maker and 0.05% taker |

| Features | Spot trading, Margin trading, Futures trading, Trading Bot |

| Maximum Leverage | Up to 100x on futures for some pairs. |

| Trading Volume & Liquidity | $5.87 billion per day |

| Payment Methods | Credit/debit card, P2P trading, bank transfers |

| Minimum Deposit | As little as $1 |

| KYC Required | Yes (Mandatory) |

| Withdrawal Limits | 1 BTC daily for KYC-1 users |

Why is KuCoin the Best Exchange for Altcoins?

KuCoin is the best altcoin exchange that’s been around since 2017. It’s known as a “people’s exchange” because it offers a really wide variety of altcoins, especially a lot of smaller, newer altcoins that you might not find elsewhere.

They claim to have over 30 million users globally across more than 200 countries. KuCoin supports trading for over 900 coins, which is a big number compared to many other exchanges.

Their trading fees are generally considered low, starting at 0.1% for spot trading, and you can even get discounts if you pay with their native token, KCS. They offer various trading options like spot, margin, futures, and a trading bot for automated strategies. KuCoin also has its own Web3 wallet for managing assets and exploring decentralized applications (DApps).

Note: Use our KuCoin referral code “QBSSSFC3” during registration to unlock $11,000 welcome bonus and get a 20% trading fee off.

4. Binance: Best for high liqudity altcoin trading

| Our Ranking | #4 |

| Licensed | Yes (Europe, Asia, the Middle East, and the Americas) |

| Insurance | $1 billion Secure Asset Fund for Users (SAFU) |

| Supported Altcoins | 500+ crypto tokens |

| Trading Fees | Spot: 0.1% or lower Futures: 0.02% maker and 0.05% taker |

| Features | Spot trading, futures, margin trading, staking, Launchpad |

| Maximum Leverage | Up to 125x |

| Trading Volume | Over $20 billion per day |

| Payment Methods | Bank transfer, debit/credit card, P2P |

| Minimum Deposit | $10 USD |

| KYC Required | Yes, mandatory |

| Withdrawal Limits | $8 million for regular users |

Why is Binance the Best Altcoin Exchange?

Binance is a really big name in the crypto world, probably the largest crypto exchange for altcoins out there by trading volume. It was started in 2017 by Changpeng Zhao, also known as CZ.

Right from the start, Binance aimed to be a fast and easy-to-use platform for trading digital currencies. They actually raised about $15 million through an Initial Coin Offering (ICO) when they first launched, which helped them grow super quickly.

Today, Binance is used by a huge number of people, with over 275 million users globally. They handle a massive amount of trades every day across hundreds of different cryptocurrencies. One of the main reasons crypto traders use Binance is for its low trading fees, which usually start around 0.1% and can even go lower if you use their own coin, BNB. Beyond just buying and selling, Binance has grown into a full ecosystem with things like a blockchain (BNB Chain), a wallet, and even educational resources.

Note: Use our Binance referral code “KNQRCYIH” during registration to unlock $100 welcome bonus and get a 10% trading fee off.

5. Bybit: Best for altcoin derivatives trading

| Our Ranking | #5 |

| Licensed | Canada and Kazakhstan, and custody in Cyprus |

| Insurance | Yes (amount not disclosed) |

| Supported Altcoins | Supports over 1,280 cryptocurrencies |

| Trading Fees | Spot trading: 0.1 maker/taker Futures: 0.2% maker and 0.55% taker |

| Features | Spot trading, derivatives (futures, perpetuals), options, and copy trading |

| Maximum Leverage | Up to 100x on perpetual futures |

| Trading Volume and Liquidity | $15 billion USD. |

| Payment Methods | Bank cards (Visa, Mastercard, JCB), Google Pay, Apple Pay |

| Minimum Deposit | $10 |

| KYC Required | Yes (for trading) |

| Withdrawal Limits | Non-KYC: 20,000 USDT equivalent daily, 100,000 USDT equivalent monthly. KYC users have much higher limits. |

Why is Bybit the Best Altcoin Exchange?

Bybit has become a well-known name in the crypto exchange world since it started in 2018. It’s especially popular for altcoin derivatives trading, like futures and perpetual contracts, and often ranks in the top 10 globally for these.

Bybit focuses on providing a fast and efficient trading experience, handling up to 100,000 transactions per second. They’ve built a solid reputation for security, using cold storage for most user funds and requiring two-factor authentication.

While they initially focused on crypto-to-crypto trading, Bybit has expanded to allow fiat currency deposits in several currencies, making it more accessible. They also offer a testnet platform, which is great for new traders to practice without real money, and have a wide range of educational materials available.

Note: Use our Bybit referral code “OKCRYPTO” during registration to unlock $30,000 welcome bonus and get a 20% trading fee off.

6. Gate.io: Crypto exchange with most altcoins

| Our ranking | #6 |

| Licensed | Yes (Malta, Australia, Hong Kong, Dubai, Bahamas) |

| Insurance | 128% PoR |

| Supported Altcoins | Over 3,800 cryptocurrencies |

| Trading fees | Spot trading: 0.2% flat for maker/taker Futures trading: 0.020% maker, 0.050% taker |

| Features | Spot and futures trading, margin trading, trading bots, staking, crypto loans |

| Maximum leverage | Up to 100x on futures |

| Trading volume and liquidity | $2.75 billion |

| Payment methods | Debit/credit card, bank transfer |

| KYC Required | Yes |

| Withdrawal limits | KYC1: up to $2 million USDT equivalent KYC2: up to $5 million USDT equivalent |

Why is Gate.io the Best Altcoin Platform?

Gate.io has been around since 2013, making it one of the older altcoin exchanges in the market. It’s known for offering a huge variety of digital assets, with over 3,800 cryptocurrencies available for trading, which is more than many competitors.

Its 24-hour trading volume was about $2.75 billion, showing it’s a pretty active platform. Gate.io operates globally, serving users in over 130 countries, though it’s restricted in places like the United States and Canada due to local rules.

They’ve been focusing on transparency, even releasing a Proof of Reserves audit. Recently, their total reserves were reported at $10.328 billion with a 128.58% reserve ratio, which means user assets are well-backed.

They offer various trading options like spot trading, futures, staking, and even crypto loans, aiming to provide a wide range of services for both new and experienced traders.

Note: Use our Gate.io referral code “OKCRYPTO” during registration to unlock $6,666 welcome bonus and get a 30% trading fee off.

7. Coinbase: Best altcoin exchange in the USA

| Our Ranking | #7 |

| Licensed | Yes (US and Europe) |

| Insurance | $250,000 per depositor (only fiat money) |

| Supported Altcoins | Over 250 cryptocurrencies |

| Trading Fees | 0.4% maker and 0.6% taker (up to 3.99% for fiat purchases) |

| Features | Easy buy/sell, staking, Coinbase Card, NFT marketplace. |

| Maximum Leverage | Up to 10x on perpetual futures |

| Trading Volume | over $15 billion |

| Payment Methods | Bank account (ACH), wire transfer, debit card, PayPal for deposits Withdrawals to bank account (ACH, wire), PayPal. |

| Minimum Deposit | $1 |

| KYC Required | Yes |

Why is Coinbase the Most Secure Altcoin Exchange?

Coinbase is one of the biggest and most well-known altcoin exchanges globally, and it’s particularly popular in the U.S. It started back in 2012 and has since grown to serve over 100 million users.

What makes it a go-to for many, especially beginners, is its user-friendly platform that simplifies buying, selling, and managing cryptocurrencies like Bitcoin and Ethereum. While it supports more than 250 different cryptocurrencies, it might not have every single obscure coin out there.

Coinbase also offers a “Coinbase Advanced Trade” platform for more experienced users, providing deeper trading tools and charting features. They emphasize security with measures like two-factor authentication and storing most customer assets in cold storage, which means offline.

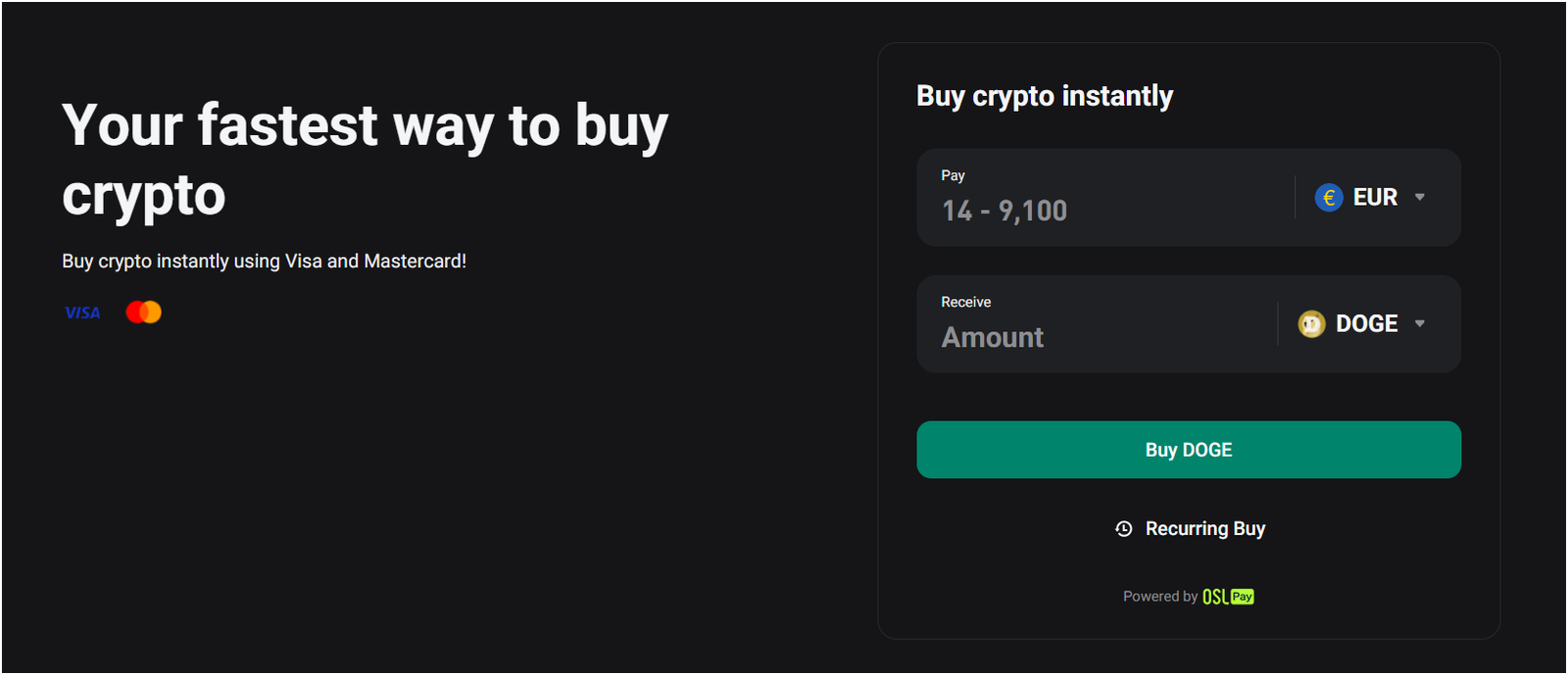

8. HTX: Best for buying altcoin and Bitcoin Instantly

| Our ranking | #8 |

| Insurance | Proof of Reserves, continuously above 100% |

| Supported Altcoins | Over 1,700 cryptocurrencies |

| Trading fees | Base 0.2% maker and taker fees; discounts with HTX token |

| Features | Spot trading, futures, margin trading, trading bots, mobile app |

| Maximum leverage | Up to 200x for crypto futures, 5x for cross margin |

| Trading volume and liquidity | Over $4 billion daily trading volume (as of recent data) |

| Payment methods | Credit/debit cards, bank transfers, crypto deposits, Alipay, WeChat Pay |

| KYC Required | Yes |

| Withdrawal limits | 5 BTC daily |

Why is HTX the Best Altcoin Site?

HTX, which was formerly known as Huobi Global, is a well-established altcoin exchange that started back in 2013. It’s grown quite a bit since then and is now considered one of the larger global exchanges for altcoins, serving over 50 million users.

They really focus on providing a wide variety of digital assets for trading, with over 1,700 cryptocurrencies available. This includes popular ones like Bitcoin (BTC), Ethereum (ETH), and USDT.

HTX offers competitive trading fees, which can be further reduced if you hold their native token, HTX. They also emphasize security, using measures like two-factor authentication and keeping a good portion of user assets in cold storage. Recently, HTX reported a 92% increase in new users, and their total platform assets went over $6.4 billion.

Note: Use our HTX referral code “bnmtb223” during registration to unlock $1,500 welcome bonus and get a 10% trading fee off.

Best Altcoin Trading Platforms Compared

| Exchange | Best For | Supported Coins | Trading Fees | Is It Safe? |

|---|---|---|---|---|

| Bitget | Overall altcoin exchange | 700+ | Spot: 0.1% / Futures: 0.02%-0.06% | Yes |

| MEXC | No-KYC altcoin trading | 2,900+ | Spot: 0% maker / 0.02% taker Futures: 0% / 0.01% | Yes |

| KuCoin | Beginners and experienced traders | 900+ | Spot: 0.1% / Futures: 0.02%-0.05% | Yes |

| Binance | High liquidity trading | 500+ | Spot: 0.1% / Futures: 0.02%-0.05% | Yes |

| Bybit | Altcoin derivatives trading | 1,280+ | Spot: 0.1% / Futures: 0.2%-0.55% | Yes |

| Gate.io | Most altcoins available | 3,800+ | Spot: 0.2% / Futures: 0.02%-0.05% | Yes |

| Coinbase | Altcoin exchange in the USA | 250+ | Spot: 0.4%-0.6% Fiat buys: up to 3.99% | Yes |

| HTX | Instant altcoin + Bitcoin buying | 1,700+ | Spot/Futures: 0.2% base (discount with HTX token) | Yes |

How to Choose the Top Altcoin Exchanges?

1. Security Measures

This is probably the most crucial factor when picking the best altcoin exchange. You’re entrusting your hard-earned digital assets to them, so their security needs to be top-notch.

Look for exchanges that use things like two-factor authentication (2FA). Also, check if they use “cold storage” for the majority of their funds. This means keeping the crypto offline, making it much harder for hackers to get to. Regular security audits and insurance policies also show an exchange is serious about keeping your altcoins safe.

Read: Safest crypto exchanges

2. Supported Altcoins

What’s the point of an altcoin exchange if it doesn’t offer the altcoins you’re interested in? A top altcoin exchange will have a wide variety of cryptocurrencies available for trading, from the major ones like Ethereum and Solana to newer, emerging altcoins.

Make sure the exchange lists the specific altcoins you want to buy, sell, or trade. Check for diverse trading pairs as well, as this directly impacts your ability to exchange different altcoins easily.

3. Fees and Costs

Nobody likes paying more than they have to, right? Exchange fees can really add up, especially if you’re trading often. You’ll usually encounter different types of fees: trading fees (often split into “maker” and “taker” fees), deposit fees, and withdrawal fees.

Some best altcoin exchanges also have hidden fees or complicated structures, so it’s essential to read their fee schedule carefully. Compare these costs across different top crypto altcoin exchanges to find one with competitive rates that fit your trading style.

You can also check out our guide on the best crypto exchanges with lowest fees.

4. Liquidity and Trading Volume

Imagine trying to sell something quickly in a market with no buyers – that’s what low liquidity feels like. High liquidity means there are plenty of buyers and sellers on the exchange, making it easy to buy or sell your altcoins at fair market prices without causing big price swings.

This is directly related to trading volume. The best altcoin exchange with high trading volume for specific altcoins means more activity and a healthier market for those assets. This helps prevent “slippage,” where your order fills at a different price than you expected.

5. User Interface and Experience

The platform should be intuitive and easy to navigate. Can you find what you need quickly? Is placing a trade straightforward? Does it offer advanced charting tools if you need them?

Many of the best altcoin exchanges also offer mobile apps, allowing you to manage your altcoin portfolio and trade on the go, which is super convenient for staying on top of the fast-paced crypto world.

6. Customer Support

Even the best altcoin exchanges can have issues, or you might just have a question. That’s when good customer support becomes vital. Look for exchanges that offer multiple ways to get help, like live chat, email, or a comprehensive FAQ section.

Ideally, they should offer 24/7 support. Quick and helpful responses can save you a lot of headaches, especially when dealing with your altcoin investments. Reading reviews about their customer service can give you a good idea of what to expect.

7. Regulatory Compliance

The crypto space is evolving, and regulations are becoming more common. Choosing an altcoin exchange that complies with local and international regulations is important for your peace of mind. This often includes Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, which are designed to prevent illicit activities.

While these might seem like extra steps, they contribute to a safer and more trustworthy trading environment for all altcoin traders. Compliant exchanges are generally more stable and less likely to face sudden shutdowns.

What is an Altcoin Exchange?

An altcoin exchange is basically an online marketplace where you can buy, sell, and trade various cryptocurrencies other than Bitcoin.

These platforms allow users to swap one altcoin for another, or sometimes trade altcoins for traditional money like US dollars or Indian Rupees. They’re essential for anyone looking to get into the broader altcoin market, offering access to thousands of different digital currencies and trading pairs beyond just Bitcoin.

Also read: Best Bitcoin exchanges

How to Buy Altcoins From a Crypto Exchange?

Step 1: Pick the Right Altcoin Exchange

First things first, you need to choose an exchange. Not all exchanges offer all altcoins, so this is important. Look for an exchange that:

- Lists the altcoin you want: Do a quick check to see if the specific altcoin you’re eyeing is available on that platform.

- Is reputable and secure: Remember, you’re trusting them with your money. Look for exchanges with strong security measures, good reviews, and a solid track record. Think about what we talked about earlier regarding security, like 2FA and cold storage.

- Has reasonable fees: Check their fee structure for deposits, withdrawals, and trading. You don’t want your initial investment eaten up by high charges.

- Is easy to use: Especially if you’re a beginner, a simple and clear interface will make your life much easier.

Related: Best crypto sign-up bonus

Step 2: Create and Verify Your Account

Once you’ve picked your best altcoin exchange, you’ll need to create an account. This is usually pretty standard, like signing up for any online service:

- Sign up: You’ll typically need to provide your email address and create a strong password.

- Verify your email: They’ll send you an email to confirm your address.

- Complete KYC (Know Your Customer): This is a mandatory step for most regulated exchanges. You’ll need to provide identity documents. This helps prevent fraud and keeps things legal. It might take a little time for them to verify your documents, so be patient.

Step 3: Fund Your Account (Deposit Money)

Now that your account is set up and verified, you need to put some money into it. This is how you’ll pay for your altcoins.

- Choose your deposit method: Most of the best altcoin exchanges allow you to deposit fiat using methods like cards or bank transfers. Some exchanges might offer credit/debit card options or other payment methods, but they often come with higher fees.

- Enter the amount: Decide how much money you want to start with. Remember to only invest what you can afford to lose, as crypto markets can be quite volatile.

- Complete the deposit: Follow the instructions on the exchange to complete the transfer. It might take a few minutes or even an hour for the funds to show up in your exchange wallet.

Step 4: Find Your Desired Altcoin and Trading Pair

This is where you finally get to buy your chosen altcoin!

- Navigate to the “Markets” or “Spot Trading” section: On the exchange, you’ll find a list of all available cryptocurrencies and their trading pairs.

- Search for your altcoin: Type in the ticker symbol of the altcoin you want (e.g., SOL for Solana, ADA for Cardano).

- Select the correct trading pair: You’ll usually see pairs like “ALTCoin/BTC” (if you bought Bitcoin) or “ALTCoin/USDT” (if you bought Tether). Make sure you pick the pair that matches the base currency you have.

Step 5: Place Your Order

Now, it’s time to actually buy the altcoin. You’ll typically have a few options:

- Market Order: This is the simplest. You choose to buy the altcoin immediately at the current market price. It’s fast, but the price might fluctuate a tiny bit. Good for beginners who want a quick purchase.

- Limit Order: This is for when you want to buy the altcoin at a specific price, or even lower. You set your desired price, and the order will only go through if the market reaches that price. If the price never hits your target, your order won’t execute.

- Enter the amount: Specify how much of the altcoin you want to buy (or how much of your base currency you want to spend).

- Review and confirm: Double-check all the details – the altcoin, the trading pair, the amount, and the price. Then, hit that “Buy” button!

Where to Store Your Altcoins After Buying?

For everyday use or small amounts, you can keep them in a hot wallet. These are connected to the internet, like the wallet on the exchange you just used, or a mobile app wallet. They’re super convenient for quick trades.

But for bigger amounts or if you’re holding for the long term, a cold wallet is your best friend. These are offline, making them much safer from online hacks. The top choice here is a hardware wallet, a small physical device (like a USB stick) that stores your altcoins securely offline. If you lose it, you can recover your altcoins using a special “seed phrase” – just keep that phrase super safe and secret.

Check this out: Best altcoin wallets

Tips For Trading Altcoins Safely

- Do Your Homework (Research!): Before you buy any altcoin, always learn about it. What does it do? Who made it? Does it solve a real problem? Don’t just follow hype; understand what you’re investing in.

- Start Small: Don’t put all your money into altcoins at once, especially when you’re new. Begin with a small amount you’re okay with losing. This way, you learn how things work without big financial stress.

- Use Strong Security: Always turn on two-factor authentication (2FA) on your exchange and wallet. It’s like having a double lock. Also, pick exchanges with a good reputation for keeping funds safe, like those using “cold storage.”

- Diversify (Don’t Put All Eggs in One Basket): Instead of buying just one altcoin, spread your money across a few different ones. If one altcoin doesn’t do well, your whole investment isn’t wiped out. It balances your risk.

- Understand Market Changes: Altcoin prices can go up and down very fast. Try to learn why prices change. News, new features, or even what Bitcoin is doing can affect altcoins. Being aware helps you make better decisions.

- Don’t Trade Emotionally: It’s easy to get excited when prices rise or scared when they fall. But try to stick to your plan and not make sudden decisions based on feelings. Emotional trading often leads to mistakes.

- Consider a Hardware Wallet: For larger amounts of altcoins that you plan to hold for a long time, get a hardware wallet. It’s the safest way to store your crypto because it keeps your digital keys offline, away from hackers.

FAQs on Best Altcoin Exchanges

Which altcoin exchange offers the lowest trading fees today

MEXC offers the lowest trading fees today for crypto trading among the best altcoin exchanges. It charges 0% for maker orders and just 0.02% for taker orders on spot trading. For futures, it’s even cheaper—0% maker and 0.01% taker. You don’t need to pay extra if you’re just placing orders.

Also, you can trade without completing KYC. Many traders like MEXC because it lists new coins early and supports over 2,900 altcoins.

Are altcoin exchanges safe?

Yes, most big and best altcoin exchanges today are safe to use. Exchanges like Binance, Bitget, KuCoin, and Coinbase use cold storage, two-factor authentication, and strong security systems. Many are regulated and insured as well.

Can I buy altcoins using fiat currency safely?

Yes, you can buy altcoins using fiat currency safely on many exchanges.

Trusted altcoin platforms like Binance, Coinbase, Bitget, and KuCoin allow you to buy altcoins directly using your credit card, debit card, or bank account. These best altcoin exchanges use secure payment methods like Visa, Mastercard, and bank wires. Your payment data is encrypted and protected.

Where can I find altcoins to invest in?

You can find altcoins to invest in on large exchanges like MEXC, Gate.io, and KuCoin.

These top platforms list thousands of altcoins, including new coins not yet available elsewhere. MEXC has over 2,900 altcoins, and Gate.io supports 3,800+. These are good places to discover trending or small-cap altcoins. You can also check trending tabs or “new listing” sections on these platforms.

Coin listing websites like CoinGecko and CoinMarketCap also help you track altcoin prices, volume, and new launches.

Where is the best place to trade altcoins?

Bitget is the best place to trade altcoins right now.

It offers over 700 altcoins and 500+ futures pairs. It supports spot, futures, and copy trading. Trading fees are low—just 0.1% for spot and as low as 0.02% for futures. It is licensed in the USA, Europe, and other regions. Bitget also has a $600 million insurance fund to protect users.

What is the best altcoin staking platform?

The best altcoin staking platform today is KuCoin Earn.

It offers many altcoins for staking and flexible earning options. You can stake popular coins like ETH, ADA, DOT, and many new altcoins too.

KuCoin also shows how much interest (APY) you will earn before you stake. You can choose fixed or flexible plans, depending on how long you want to lock your coins. The process is simple, and your coins start earning rewards quickly. Other best altcoin exchanges for staking include Binance and Gate.io.

What are the benefits of trading altcoins?

Trading altcoins offers higher profit opportunities compared to Bitcoin.

Many altcoins are still cheap (meaning low market cap), so even a small price jump can bring good returns.

Altcoins like Solana, XRP, or new meme coins have shown big moves in a short time. You can trade them on spot or futures markets. Some altcoins also give rewards through staking or holding.

Altcoins support different projects – some focus on gaming, AI, or finance. This gives you many choices to invest based on your interest. But remember, they can also drop fast, so use stop-loss and manage your risk while trading them on the best altcoin exchanges.