Crypto options trading is gaining popularity as traders look for new ways to profit from market movements while managing risk. Whether you’re a beginner or an experienced trader, choosing the right platform is key to maximizing your success. The best crypto options exchanges offer strong security, multiple trading tools, low fees, and a user-friendly experience.

In this guide, we’ll explore the best crypto options trading platforms, their key features, and what makes them stand out. If you’re wondering where to trade Bitcoin, Ethereum, or other altcoin options with ease, keep reading to find the best platform for options trading.

Best Cryptocurrency Options Trading Platforms: Top Picks

We have reviewed over 30 best crypto options trading platforms in the crypto market based on fees, supported coins for options trading, security, and ease of use. Here are the top 6 best crypto options trading platforms:

- Bybit: Best crypto options trading platform in 2025

- Binance: Cheapest platform to trade options contracts

- KuCoin: Best Bitcoin options trading platform

- HTX: Best for both American and European options

- Deribit: High liquidity platform for options trading

- OKX: Safest crypto options trading platform

Recommended: Best Crypto Options Trading Platforms

These are our 2 best options platform for crypto trading

Best Crypto and Bitcoin Options Trading Platforms Reviewed

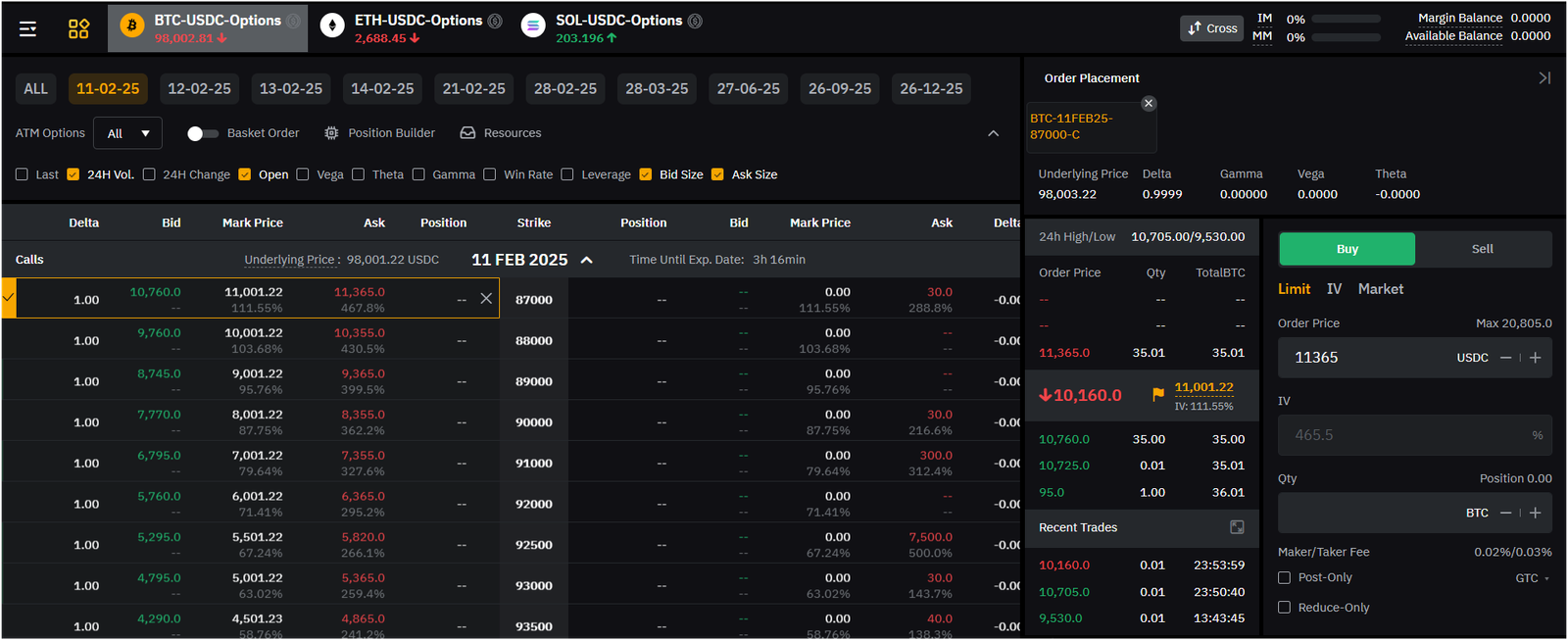

1. Bybit: Best crypto options trading platform in 2025

- Supported Assets: Bitcoin (BTC), Ethereum (ETH), Solana (SOL)

- Options Collateral: USD Coin (USDC)

- Options Trading Fees: 0.02% maker and 0.03% taker

Bybit is the best crypto options platform where you can trade crypto options using USDC. The options here are European-style, which means you can only exercise them when they expire. When the contract ends, it’s settled in cash, so there’s no need to deal with the actual cryptocurrency.

On Bybit, you can trade options for Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). They offer various expiration dates: daily, two-day, weekly, bi-weekly, monthly, bi-monthly, and quarterly.

The platform has a feature called Portfolio Margin. This system looks at the overall risk of your trades and can lower the amount of money you need to keep as a margin, especially if you have positions that balance each other out. Bybit is known for its strong liquidity and deep markets. This means you can trade large amounts without causing big price changes, which is good for getting fair prices.

Related: best crypto staking platforms

Key Features

- European-style Options can only be exercised at expiration.

- There is no requirement for the actual physical delivery of the underlying asset.

- Bybit’s European Options automatically exercise upon expiration.

- The Option’s payoff at settlement is determined by the difference between the final settlement price and the strike price, with the final settlement price calculated using the average index price 30 minutes before the Option’s expiration.

- USDC Options is currently only supported in Unified Trading Account.

2. Binance: Cheapest platform to trade options contracts

- Supported Assets: BTC, ETH, BNB, XRP, DOGE, and SOL

- Options Collateral: Tether (USDT)

- Options Trading Fees: 0.03% maker/taker

Binance is another one of the best crypto options trading platforms. Binance offers European-style options, which can only be exercised at the expiration date. These options are settled in USDT, a stablecoin pegged to the US dollar. You can choose from various expiration dates, ranging from 10 minutes to 1 day, allowing for flexible trading strategies.

The platform provides detailed options trading data, including open interest, trading volume, and the put-call ratio. This information helps you make informed decisions by understanding market trends and sentiment.

In terms of fees, Binance charges a premium when you purchase an option. This premium is the cost of the option and varies based on factors like the strike price, expiration date, and market volatility. There are no additional transaction fees for options trading on Binance.

Security is a top priority for Binance. The platform uses advanced security measures, including two-factor authentication and withdrawal whitelist, to protect your funds and personal information.

Read More: Best crypto futures trading platforms

Key Features

- Contract Type: Binance offers Call and Put Options with European-style settlement.

- Assets Available: Trade options on BTC, ETH, BNB, XRP, DOGE, and SOL, all settled in USDT.

- Expiration & Trading Hours: Options expire at specific dates and trade 24/7.

- Pricing & Settlement: Prices are calculated using the Black-Scholes model, and settlement is in USDT.

- Minimum Order Size: BTC, ETH, BNB, DOGE – 0.01; XRP, SOL – 0.1 per order.

3. KuCoin: Best Bitcoin options trading platform

- Supported Assets: BTC, ETH, and SOL

- Options Collateral: Tether (USDT)

- Options Trading Fees: 0.03% maker/taker

KuCoin offers crypto options trading, allowing you to buy or sell cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) at a set price on a future date.

Key Features

- European-Style Options – These options can only be exercised on the expiration date, but you can close your position anytime before that.

- Supported Cryptos – Options trading is available for BTC, ETH, and SOL, with all contracts settled in USDT.

- Contract Format – Contracts are labeled as [Asset-Expiration Date-Strike Price-Option Type]. For example, “BTC-241205-75000-C” is a call option for BTC with a strike price of 75,000 USDT, expiring on December 5, 2024.

- Trading Fees – KuCoin charges a 0.03% trading fee and an exercise fee of 0.02% of the settlement price or 10% of the profit, whichever is lower.

- Minimum Order Size – You need at least 10 USDT to start trading options.

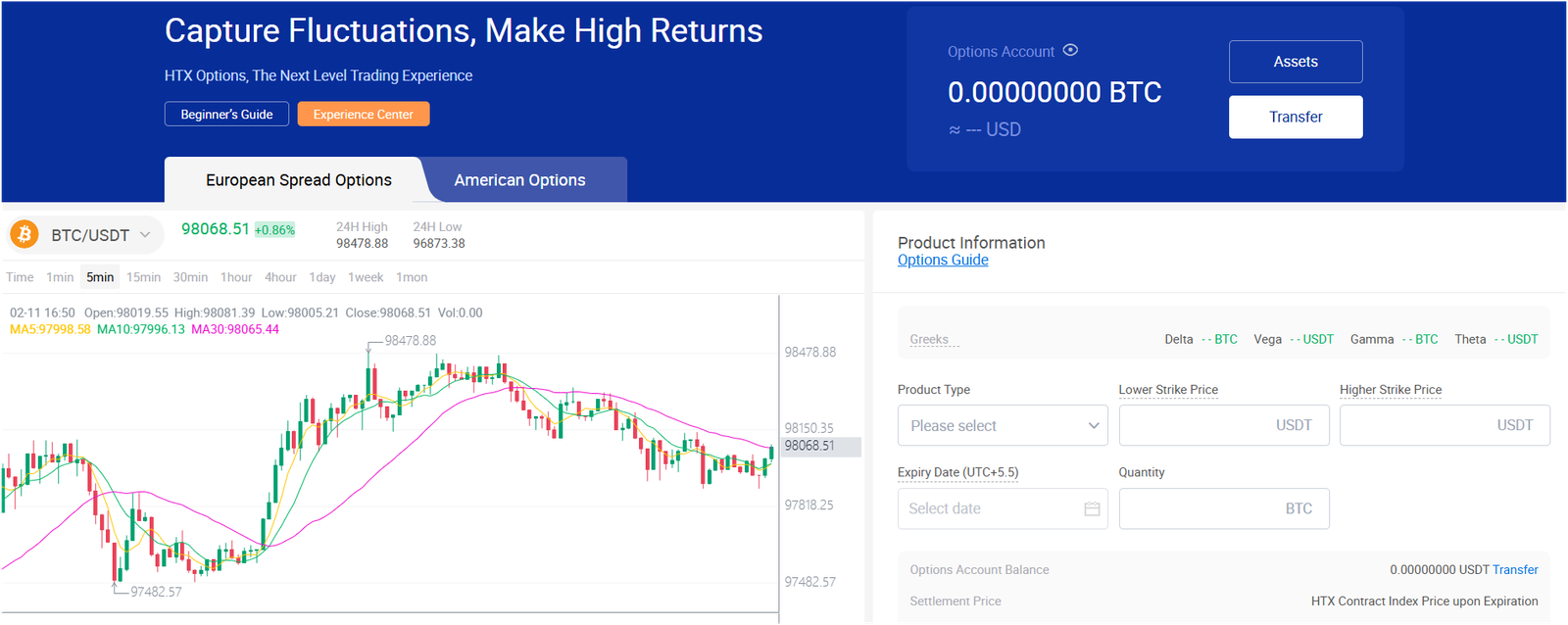

4. HTX: Best for both American and European options

- Supported Assets: BTC and ETH only

- Options Collateral: Tether (USDT)

- Options Trading Fees: 0.02% maker/taker

HTX is another one of the best crypto options trading platforms. Since starting in 2013, it has built a reputation as a secure and reliable platform. It offers strong security and helpful customer support, making it a great place to trade crypto options with confidence.

One key feature of HTX is its flexibility in offering both European and American options. Most platforms provide only one type, but HTX allows you to choose between the two. This gives you more trading opportunities and strategies to explore.

If you prefer lower risk, European options let you set up vertical spreads, pay lower premiums, and lock in profits before the option expires. On the other hand, American options give you more freedom to choose the strike price and exercise the option at any time.

HTX is considered one of the best platforms for crypto options trading. It serves different types of traders by offering various risk levels and trading strategies.

Beyond flexible trading styles, HTX provides multiple order types to help you optimize your trades:

- Limit Order – Set the maximum price you want to pay when buying or the minimum price you want to accept when selling. The market will match your order at the best available price.

- Trigger Order – Pre-set the quantity and trigger price. When the market reaches your set trigger, the system places an order automatically.

- Best Bid Offer (BBO) Order – Enter only the quantity, and the system will execute the trade at the best current price.

- Flash Close – Uses the top 30 best prices in the market to execute your order quickly. This is useful in fast-moving markets to avoid unfilled orders.

The platform is user-friendly and well-designed, so you can easily find advanced tools and execute trades without hassle.

Key Features

- Supports Both European & American Options – Trade with more flexibility by choosing your preferred option style.

- Multiple Order Types – Includes Limit Order, Trigger Order, BBO Order, and Flash Close for better trading control.

- Strong Security & Reliability – Established in 2013, known for its stable and secure platform.

- User-Friendly Interface – Easy-to-use design with advanced trading tools readily available.

- Focus on Major Crypto Pairs – Offers options trading for BTC/USDT and ETH/USDT pairs.

5. Deribit: High liquidity platform for options trading

- Supported Assets: BTC, ETH, BNB, XRP, MATIC, and SOL

- Options Collateral: USD Coin (USDC)

- Options Trading Fees: 0.03% maker/taker

Deribit is a crypto options trading platform that stands out for its focus on derivatives. While some exchanges offer a mix of services like staking and NFTs, Deribit specializes in futures, perpetual contracts, and options trading.

Unlike many platforms that limit options trading to Bitcoin and Ethereum, Deribit supports additional altcoins like Binance Coin, Solana, and XRP. This variety makes it a great choice for traders looking to take advantage of short-term market movements.

Deribit provides several advanced order types, including market and limit orders, to help you customize your trades. It also offers tools to optimize trading fees, which is a big advantage for active traders.

One of its standout features is the Option Wizard, which simplifies options trading by suggesting strategies based on real-time market data. By entering details like price expectations and timeframes, you can receive insights on:

- Expected Profit – The potential earnings if your prediction is correct.

- Return Percentage – The possible return on investment.

- Maximum Loss – The worst-case scenario for your trade.

This tool is especially helpful for beginners who want to trade crypto options without dealing with complex strategies.

Deribit also has a risk management system that prevents full liquidation of your trades. Instead of closing your entire position at once, it sells smaller portions to help maintain your balance. This approach gives traders a better chance to recover from market swings.

Security is another strong point. Deribit stores 99% of user funds in cold wallets, keeping them safe from online threats. Other security measures include:

- 24/7 server monitoring

- Two-factor authentication (2FA)

- Yubikey integration

- IP whitelisting

With its advanced trading features, altcoin options, and strong security, Deribit is a solid choice for anyone looking for a reliable crypto options trading platform.

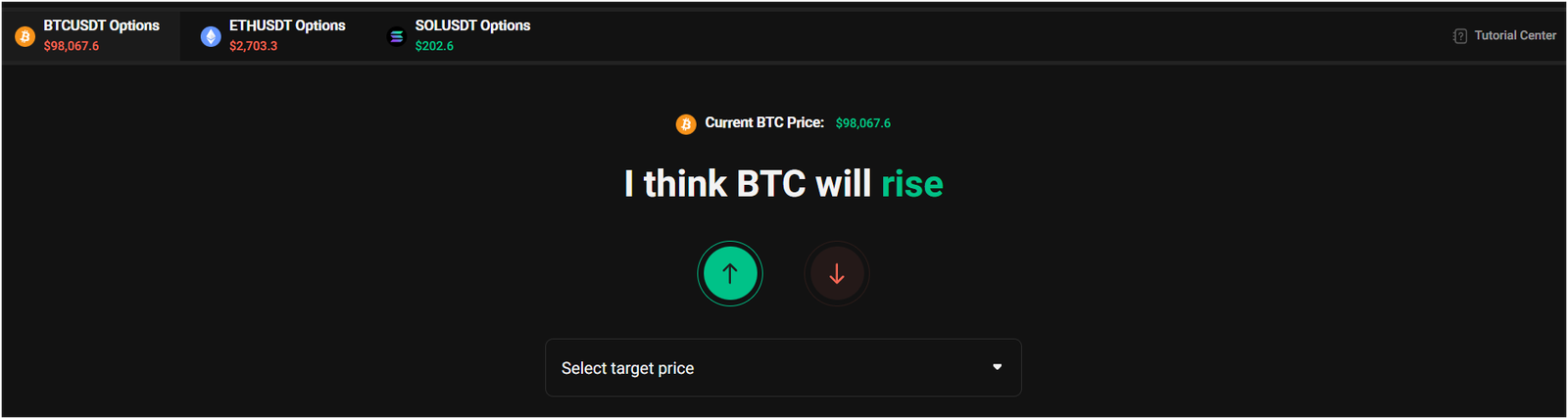

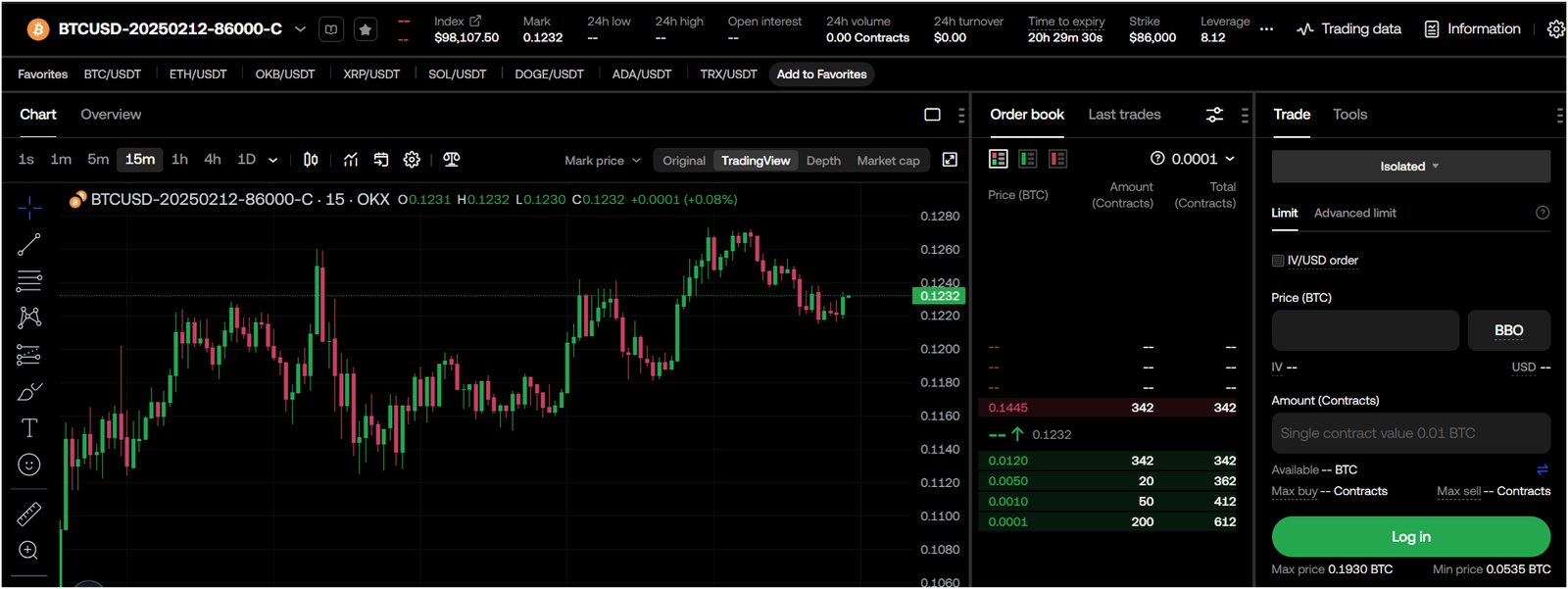

6. OKX: Safest crypto options trading platform

- Supported Assets: BTC and ETH

- Options Collateral: Tether (USDT)

- Options Trading Fees: 0.02% maker/taker

OKX, rebranded in 2022, is one of the best platforms for crypto options trading. It serves millions of users in over 180 regions and offers strong security features.

Along with options trading, OKX provides spot trading, P2P transactions, lending, borrowing, and earning programs. While the variety of services may seem overwhelming, the platform is designed to be beginner-friendly.

Easy-to-Use “Simple Options” Feature:

If you’re new to options trading, the Simple Options tool makes it easy to get started. It removes complicated terms and helps you trade with clear instructions.

You can select a coin pair (BTC/USD or ETH/USD), predict if the price will rise or fall, and set a target amount. Based on your choices, OKX suggests the best contracts for you. This makes the process straightforward and ideal for beginners.

However, it’s still important to understand the basics of options trading, as it carries risks.

Advanced Features for Experienced Traders:

For experienced traders, OKX provides an organized and efficient interface. You can quickly access price data, order history, and bid/ask details. The options section is structured separately for Bitcoin and Ethereum, making navigation simple.

The platform also includes risk management tools to protect your trades:

- Mark Price Mechanism – Calculates fair contract values to prevent price manipulation and reduce liquidation risks.

- Auto-Deleveraging – Helps manage extreme market volatility to minimize potential losses.

These tools create a safer trading experience, even in uncertain market conditions.

Fees & Availability:

OKX uses a tiered fee structure, with rates ranging from 0.020% to -0.010%, depending on your account level. Withdrawal limits also vary, from $10 million to $40 million per day.

Although OKX operates in many countries, it is not available in the United States or Canada due to regulations. If you’re in these regions, you’ll need to look for other exchanges.

For traders in supported locations, OKX is a powerful choice. It offers strong security, risk management tools, low fees, and a user-friendly design, making it one of the best crypto options trading platforms available. You can also read our OKX review.

Key Features

- Simple Options Feature – Beginner-friendly tool that simplifies options trading with clear instructions.

- Supports BTC & ETH Options – Trade Bitcoin and Ethereum options with an easy-to-navigate interface.

- Advanced Risk Management – Includes Mark Price Mechanism and Auto-Deleveraging for safer trading.

- Multiple Trading Services – Offers spot trading, P2P transactions, lending, and earning programs.

- Tiered Fee Structure – Competitive fees ranging from 0.020% to -0.010%, with high withdrawal limits.

Comparing Top Crypto Options Trading Exchanges

| Platform | Supported Coins | Fees (Maker/Taker) | Settlement Currency | Liquidity |

|---|---|---|---|---|

| Bybit | BTC, ETH, SOL | 0.02% / 0.03% | USDC | Very High |

| Binance | BTC, ETH, BNB, XRP, DOGE, SOL | 0.03% / 0.03% | USDT | Very High |

| KuCoin | BTC, ETH, SOL | 0.03% / 0.03% | USDT | Moderate |

| HTX | BTC, ETH | 0.02% / 0.02% | USDT | Moderate |

| Deribit | BTC, ETH, BNB, XRP, MATIC, SOL | 0.03% / 0.03% | USDC | High |

| OKX | BTC, ETH | 0.02% / 0.02% | USDT | High |

What is a Crypto Options Trading?

Crypto options trading is a way to trade cryptocurrencies by using options contracts. These contracts give you the right—but not the obligation—to buy or sell a cryptocurrency at a set price before a certain date. Options trading is different from regular crypto trading because you don’t have to own the actual cryptocurrency. Instead, you trade contracts based on price movements.

Crypto options are useful for traders who want to:

- Protect their investments from big price drops (hedging).

- Make profits by predicting price changes.

- Use leverage to trade with less money but higher risk.

Types of Crypto Options Market

There are two main types of crypto options markets on the best crypto options platforms:

- European Style Options – You can only exercise (use) the option on the expiration date.

- American Style Options – You can exercise the option anytime before the expiration date.

Both types of options have two main categories:

- Call Option – This gives you the right to buy a cryptocurrency at a set price. You buy this if you think the price will go up.

- Put Option – This gives you the right to sell a cryptocurrency at a set price. You buy this if you think the price will go down.

Now, let’s look at both types of options trading in detail.

European Style Options Trading

In European-style options trading, you can only exercise your option on the expiration date. This means that even if the price moves in your favor before that date, you cannot use the option early.

How It Works:

- You buy a European-style option (either call or put).

- You wait until the expiration date.

- If the price is favorable, you exercise your option.

- If not, the option expires, and you lose the premium (the cost of the option).

Example:

Let’s say Bitcoin is currently at $40,000. You buy a call option with a strike price of $42,000, expiring in one month. If Bitcoin reaches $45,000 by expiration, you can buy it at $42,000 and make a profit. If Bitcoin stays below $42,000, your option expires worthless, and you lose only the premium you paid.

Pros of European Options

✔️ Usually cheaper than American options.

✔️ Less market manipulation because you can’t exercise early.

✔️ Lower trading fees.

Cons of European Options

❌ You can’t take advantage of price movements before expiration.

❌ Less flexibility compared to American options.

American Style Options Trading

In American-style options trading, you can exercise the option anytime before the expiration date. This means you have more flexibility to take profits early if the market moves in your favor.

How It Works:

- You buy an American-style option (either call or put).

- If the price moves favorably, you can exercise your option at any time.

- If you don’t exercise, you can wait until expiration.

- If the price is unfavorable, the option expires, and you lose the premium.

Example:

Let’s say Bitcoin is at $40,000. You buy a put option with a strike price of $38,000, expiring in one month. If Bitcoin drops to $35,000 within two weeks, you can exercise early and sell at $38,000 for a profit.

Pros of American Options

✔️ More flexibility—you can exercise anytime.

✔️ Can take profits earlier if the price moves favorably.

✔️ Good for short-term traders.

Cons of American Options

❌ More expensive than European options.

❌ Higher risk of early exercise affecting price movements.

❌ Higher trading fees.

Key Differences Between European and American Crypto Options

| Feature | European Options | American Options |

|---|---|---|

| Exercise Time | Only on expiration | Anytime before expiration |

| Cost | Lower premiums | Higher premiums |

| Flexibility | Less flexible | More flexible |

| Best For | Long-term traders | Short-term traders |

Both styles have their own advantages, and the choice depends on your trading strategy. If you want lower costs and can wait until expiration, European options are better. If you want flexibility and the ability to take profits early, American options are better.

How to Choose the Best Crypto Options Trading Platform

Here are the most important factors to consider when choosing a crypto options trading platform:

1. Security 🔒

Security is the most important factor when selecting a crypto options platform. Since you are dealing with money and sensitive data, you must ensure that the crypto options platform is safe from hacks and fraud.

Key Security Features to Look For:

✔️ Two-Factor Authentication (2FA): Adds an extra layer of protection by requiring a second form of verification (such as an SMS code or Google Authenticator).

✔️ Cold Storage: The platform should store most user funds in offline wallets to prevent hacking.

✔️ Encryption & SSL Security: Protects your personal and financial information from cybercriminals.

✔️ Withdrawal Whitelisting: Allows you to set specific wallet addresses where withdrawals can be sent. This prevents unauthorized transactions.

✔️ Audit & Transparency: The platform should be regularly audited by security firms to ensure it follows best practices.

Why Security Matters:

A platform without strong security is at risk of hacking, scams, or even shutting down unexpectedly. If a platform gets hacked, you could lose your funds permanently. Always check a platform’s past security record before signing up.

Read more: Best Ethereum exchanges

2. Trading Fees 💰

Every crypto options platform charges fees for trading. These fees can affect your profits, so it’s important to understand how they work.

Types of Fees:

📌 Trading Fees: A percentage charged on each trade (either a fixed rate or a percentage of the trade amount).

📌 Maker & Taker Fees:

- Maker Fee: Charged when you add liquidity to the market (by placing a limit order).

- Taker Fee: Charged when you take liquidity from the market (by placing a market order).

📌 Premium Costs: If you buy options, you need to pay a premium (the cost of the option contract). This varies based on market conditions.

📌 Withdrawal Fees: Some platforms charge fees when you withdraw funds.

📌 Hidden Fees: Always check if the platform has any hidden charges for inactivity or deposits.

How to Compare Fees:

- Look at the fee structure and compare it with other platforms.

- Consider if the fees are reasonable based on the services provided.

- Lower fees are good, but security and reliability matter more.

3. Supported Coins 🪙

Not all crypto options platforms offer the same cryptocurrencies for trading. Some only support major coins like Bitcoin (BTC) and Ethereum (ETH), while others offer options on altcoins.

Why Supported Coins Matter:

- If you want to trade options on specific cryptocurrencies, make sure the platform supports them.

- More supported coins mean more trading opportunities.

- Crypto options platforms with a variety of coins allow you to diversify your strategies.

Popular Cryptocurrencies for Options Trading:

- Bitcoin (BTC): The most common option trading asset.

- Ethereum (ETH): Second most popular due to its large market presence.

- Solana (SOL), Binance Coin (BNB), Cardano (ADA): Available on some platforms.

- Stablecoins (USDT, USDC): Used for settlements.

Some platforms focus only on BTC and ETH, while others include smaller coins. If you prefer trading altcoins, choose a platform that supports them.

4. User Interface & Trading Tools 🖥️

A good trading platform should be easy to use, even for beginners. The user interface (UI) and tools provided will affect your trading experience.

What to Look For in a Trading Interface:

✔️ Easy Navigation: A clean and simple design helps you place trades quickly.

✔️ Advanced Charting Tools: Look for platforms with charts, indicators, and analysis tools.

✔️ Mobile & Desktop Access: Make sure the platform works well on both web and mobile apps.

✔️ Customization: Some platforms let you adjust the layout to suit your needs.

Important Trading Tools:

📌 Real-Time Market Data: Live prices, charts, and market trends help you make better trading decisions.

📌 Risk Management Tools: Stop-loss, limit orders, and automated strategies help manage your risks.

📌 Backtesting Features: Lets you test trading strategies using past market data.

A bad user interface can make trading difficult and cause mistakes. If a platform is too complicated, it may not be suitable for beginners.

5. Regulatory Compliance 📜

Regulatory compliance means the platform follows legal and financial rules set by government authorities. A well-regulated platform is safer and more trustworthy.

Why Compliance Matters:

✔️ Reduces the risk of fraud and scams.

✔️ Ensures fair trading practices.

✔️ Protects your funds in case of disputes.

✔️ Some regulated platforms offer insurance on deposits.

How to Check for Compliance:

📌 Licensing: See if the platform is registered with financial regulators like the SEC (USA), FCA (UK), or MAS (Singapore).

📌 KYC & AML Policies: Platforms that require identity verification (KYC – Know Your Customer) are usually more compliant.

📌 Legal Restrictions: Some platforms may not be available in certain countries due to regulations.

If a platform is not regulated, you take a higher risk of losing money if something goes wrong.

6. Reputation ⭐

The reputation of a trading platform is a good indicator of its reliability. A platform with a strong reputation is usually safer and provides better service.

How to Check a Platform’s Reputation:

📌 User Reviews: Look at online reviews from real traders on forums like Reddit, Trustpilot, and Twitter.

📌 Past Security Incidents: Check if the platform has ever been hacked or involved in fraud.

📌 Trading Volume: A high trading volume means many users trust the platform.

📌 Support & Customer Service: Reliable platforms provide good customer support in case of issues.

Red Flags to Watch Out For:

🚨 Too Many Negative Reviews: If many traders complain about withdrawals, security, or support, avoid the platform.

🚨 Unclear Ownership: If the company behind the platform is secretive, it could be a scam.

🚨 Unrealistic Promises: Any platform promising guaranteed profits or extremely low fees is suspicious.

Always do research before using a platform. If something seems too good to be true, it probably is.

How to Trade Crypto Options Safely?

Below are the detailed steps to help you trade crypto options safely.

Step 1: Learn How Crypto Options Work

Before trading, you must understand how crypto options work. Options are financial contracts that give you the right—but not the obligation—to buy or sell a cryptocurrency at a fixed price before a certain date.

Types of Crypto Options:

- Call Options: You buy a call option when you believe the price of a cryptocurrency will go up.

- Put Options: You buy a put option when you believe the price of a cryptocurrency will go down.

Step 2: Choose a Safe and Reliable Trading Platform

Not all the best crypto options trading platforms are safe. Some are poorly regulated or have a history of security breaches.

How to Choose a Safe Platform:

✔️ Regulated Exchange: Choose platforms that follow financial regulations (e.g., Binance, Deribit, Bybit).

✔️ Strong Security Features: Look for two-factor authentication (2FA), cold storage for funds, and encryption.

✔️ User Reviews & Reputation: Check online reviews to see if users report problems with withdrawals or fraud.

✔️ Insurance & Fund Protection: Some platforms offer insurance in case of hacking incidents.

💡 Tip: Avoid platforms that make unrealistic promises, such as “guaranteed profits” or “zero risks.” These are usually scams.

Step 3: Manage Your Risk Before Trading

Crypto options trading is risky because cryptocurrency prices are highly volatile. You must manage your risk carefully to avoid losing too much money.

Risk Management Techniques:

📌 Never Invest More Than You Can Afford to Lose: Only trade with money you can afford to lose without financial hardship.

📌 Use a Stop-Loss Strategy: This automatically closes your position if the market moves against you.

📌 Diversify Your Trades: Don’t put all your money into a single trade. Spread it across multiple options.

📌 Understand Implied Volatility (IV): High IV means higher option prices but also higher risk. Low IV means cheaper options but lower chances of profit.

💡 Tip: Start with a small amount when learning to trade. Many traders lose money because they take large risks too early.

Step 4: Select the Right Option Contract

When trading crypto options, you need to select a contract that matches your trading goals.

Key Factors to Consider:

📌 Strike Price: The price at which you can buy or sell the cryptocurrency. Choose a strike price based on your market prediction.

📌 Expiration Date: The date when your option contract ends. Short-term contracts expire quickly, while long-term contracts give you more time.

📌 Premium Cost: The price you pay to buy the option. If the premium is too high, your trade may not be profitable.

Choosing the Right Expiration Date:

- Short-Term Options (1 week or less): Good for quick trades but very risky.

- Medium-Term Options (1 month): Gives you time for the market to move in your favor.

- Long-Term Options (3+ months): More stable but usually have higher premiums.

💡 Tip: If you’re a beginner, start with medium-term options because they balance risk and reward.

Step 5: Place Your Trade Carefully

Once you choose your option contract, you need to place your trade correctly.

How to Place a Trade on the Best Crypto Options Trading Platforms:

1️⃣ Go to the Options Trading Section of your platform.

2️⃣ Select the Cryptocurrency you want to trade (e.g., BTC, ETH).

3️⃣ Choose an Option Type: Call option (if you think the price will go up) or put option (if you think it will go down).

4️⃣ Set Your Strike Price and Expiration Date.

5️⃣ Enter the Amount You Want to Trade. Make sure you don’t risk too much.

6️⃣ Review the Premium Cost and Fees. Make sure the cost is reasonable.

7️⃣ Confirm and Place Your Trade.

💡 Tip: Double-check your order before confirming. A small mistake can lead to unnecessary losses.

Step 6: Monitor Your Trade and Adjust If Needed

Once your trade is active, you must monitor the market and be ready to adjust your strategy.

What to Watch After Placing a Trade:

✔️ Price Movements: If the price moves in your favor, consider selling early to lock in profits.

✔️ Volatility Changes: If the market suddenly becomes volatile, your option price could change rapidly.

✔️ News & Events: Crypto prices react to news like regulations, hacks, or big company investments.

💡 Tip: If the trade is going against you, don’t panic. Have a plan and stick to your strategy.

Step 7: Exit the Trade at the Right Time

You can exit an options trade in two ways:

1. Exercise Your Option (If Profitable)

- If your option is profitable at expiration, you can exercise it.

- Example: If you bought a call option for BTC at $42,000 and the price reaches $45,000, you can buy BTC at $42,000 and sell at $45,000 for a profit.

2. Sell the Option Before Expiration

- If your option is already profitable, you can sell it on the market instead of waiting.

- Example: If you bought an option for $500 and its value rises to $1,500, you can sell it and take your profit.

💡 Tip: Selling early is often safer because crypto prices can change quickly before expiration.

Step 8: Review Your Trades and Improve Your Strategy

After completing a trade, always review your performance. This helps you learn from mistakes and improve your strategy.

Questions to Ask After a Trade:

📌 Did I follow my risk management plan?

📌 What went right or wrong in this trade?

📌 How can I improve my entry and exit strategy next time?

💡 Tip: Keep a trading journal to record your trades and track your progress.

Final Tips for Trading Crypto Options Safely

✔️ Start Small: Trade with small amounts until you become comfortable.

✔️ Avoid Overtrading: Too many trades can lead to losses.

✔️ Stay Updated: Follow crypto news and market trends.

✔️ Use a Reliable Platform: Choose an exchange with good security and reputation.

✔️ Manage Emotions: Don’t let greed or fear control your decisions.

Is Crypto Options Trading Risky?

Yes, crypto options trading is risky. The price of cryptocurrencies changes very quickly, making options highly unpredictable. If the price does not move as you expected, you can lose all the money you paid for the option (called the premium).

Options trading also involves leverage, meaning you can trade with more money than you have. This increases potential profits but also increases losses. If you don’t manage risk properly, you could lose a lot of money very fast.

Another risk is liquidity. Some crypto options have low trading activity, making it hard to buy or sell at the right price.

Security is also a concern. If you trade on an unsafe crypto options trading platform, your funds could be stolen due to hacks or scams. Always use a well-known and secure exchange.

To reduce risk, you should:

- Start with a small amount of money.

- Use a trading strategy and set stop-loss limits.

- Choose a reliable and regulated platform.

- Stay updated on crypto news and market trends.

What is a Good Crypto Options Trading Strategy?

- Covered Call – You own the cryptocurrency and sell a call option. If the price stays below the strike price, you keep the premium as profit. If the price rises above the strike price, you sell at that price, limiting your gains but still making money.

- Protective Put – You buy a put option while holding the cryptocurrency. If the price drops, the put option increases in value, protecting you from losses. If the price rises, you only lose the premium paid for the put.

- Straddle Strategy – You buy both a call and a put option with the same strike price and expiration date. If the price moves sharply in either direction, you make a profit. This works well in highly volatile markets.

- Strangle Strategy – You buy a call option with a higher strike price and a put option with a lower strike price. The price must move significantly in either direction for a profit. This strategy costs less than a straddle but requires bigger price movements.

- Iron Condor – You sell both a lower-strike put and a higher-strike call while buying further out-of-the-money options to limit risk. This strategy works best in a stable market with little price movement.

- Butterfly Spread – You buy one call at a lower strike price, sell two calls at a middle strike price, and buy another call at a higher strike price. This limits both risk and profit, making it useful for predicting stable price movements.

- Calendar Spread – You buy a long-term option and sell a short-term option with the same strike price. If the price remains stable in the short term, you collect the premium while keeping the long-term option.

Benefits and Drawbacks of Crypto Options Trading

Benefits of Crypto Options

- Leverage and Big Potential Returns: One of the main attractions of crypto options trading is leverage. You can control a larger position in the market with just a small initial investment. For example, with options, you can get exposure to the price movement of a cryptocurrency without needing to buy the full amount. If the market moves in your favor, your profits can be much higher compared to traditional crypto trading.

- Hedging Against Volatility: The crypto market can swing wildly, and this unpredictability can cause major losses. But if you own crypto, you can use options as a hedge. By buying a put option, for instance, you can protect yourself from a sudden drop in price, without needing to sell your crypto. This strategy acts like an insurance policy for your investments.

- Flexibility and Strategy Options: One of the coolest things about options is the flexibility they offer. You’re not stuck with one strategy. Whether you’re using a covered call, a protective put, or a spread, you can adapt your strategy based on market conditions. This means you have more ways to profit, no matter whether the market is rising, falling, or staying flat.

- Limited Risk for Buyers: If you’re buying options, your risk is capped at the premium you paid for the option. So, even if the market doesn’t move in your favor, the most you’ll lose is the amount you spent on the option. This gives you a level of protection that direct crypto trading doesn’t offer.

- Profit from Both Up and Down Markets: Another big advantage of options is that you can profit whether the market goes up or down. If you think the price of a crypto will rise, you can buy a call option. If you think it will drop, you can buy a put option. This gives you more opportunities to make money regardless of which way the market is headed.

Drawbacks of Crypto Options

- It’s Complicated for New Traders: Crypto options can be confusing, especially if you’re just starting out. There’s a lot to learn, from the different strategies you can use to how the pricing of options works. If you don’t understand the basics, it’s easy to make mistakes that could cost you money.

- Time is Always a Factor: One thing to remember with options is that they have expiration dates. This means you’re racing against time for the market to move in your favor. If it doesn’t happen in time, the option becomes worthless, and you lose the premium you paid. This time sensitivity can be stressful, especially if you’re still figuring things out.

- Risk of Losing Everything: If the market moves against your position, your options can end up worthless. In the worst-case scenario, you lose the entire amount you paid for the option. This can be tough, especially if the price doesn’t reach your predicted strike price. You’re betting on a price movement, and if it doesn’t happen, you’re out of luck.

- Crypto Volatility Can Be Unpredictable: The volatility of the crypto market is both a blessing and a curse. While it can lead to big profits, it also means the market is unpredictable. Prices can shift rapidly in ways you might not expect, which makes trading options a bit like a rollercoaster. Even experienced traders can face losses if the market behaves unpredictably.

- Premiums Can Get Expensive: When the market is highly volatile, options premiums can become expensive. If you’re paying a high premium for an option, the price movement has to be significant enough to offset the cost. Sometimes, even a favorable price move may not result in a profit after you factor in how much you paid for the option.

- Low Liquidity Can Be a Problem: Not all crypto options markets have high liquidity. This means it might be difficult to buy or sell your options at your desired price. When liquidity is low, you may face issues with slippage—where you end up getting a worse price than you were aiming for. This is something to watch out for if you’re trading on a platform with low volume.

- Security Risks with Platforms: As with any kind of crypto trading, there are security risks involved. If you choose an unreliable or unregulated platform, you risk losing your funds to hacks or scams. Always use well-known, secure platforms to avoid potential issues. Even if you have a successful trade, a platform with weak security could still cost you your profits.

Is Trading Crypto Options Legal?

Yes, trading crypto options is legal in most countries including the US and Europe, but it also depends on where you are located. In some countries, crypto options are regulated, while in others, they are either banned or not yet fully regulated. It’s important to check the laws in your specific country or region before trading.

Many major crypto exchanges offer options trading in jurisdictions where it’s legal, but always ensure the platform you use complies with local regulations. Trading on an unregulated platform could put you at legal and financial risk.

How Crypto Options Work: A Step-by-Step Guide

Crypto options are financial contracts that allow traders to speculate on the future price of a cryptocurrency like Bitcoin or Ethereum without actually owning the asset. These contracts give the trader the right, but not the obligation, to buy or sell the cryptocurrency at a fixed price before a specific date.

Options are commonly used for speculation, where traders attempt to profit from price movements, or for hedging, where investors protect their portfolios from potential losses.

To trade crypto options, a trader first chooses the cryptocurrency they want to trade options on, such as Bitcoin. They then decide whether to buy a call option, which is a bet that the price will go up, or a put option, which is a bet that the price will go down.

Once they choose the type of option, they select a strike price, which is the price at which they can buy or sell the cryptocurrency when the contract expires. They also select an expiry date, which determines how long the contract is valid.

After selecting these details, the trader pays a premium, which is the cost of entering the options contract. If the market moves in their favor, they can either exercise the option or sell it before expiration to lock in profits. If the market moves against them, they simply lose the premium they paid, and the option expires worthless.

The final step in the trade is settlement, which determines how the option is finalized—either through receiving actual cryptocurrency or a cash payout.

Call Option Contract (Right-to-Buy Contract)

A call option is a contract that gives the trader the right (but not the obligation) to buy a cryptocurrency at a set price before the expiry date.

👉 You buy a call option if you believe the price will go up.

Example of a Call Option Trade

Let’s say Bitcoin is trading at $40,000, and you believe it will rise to $45,000 in the next month.

- You buy a BTC Call Option with a strike price of $42,000 and an expiry date of one month.

- The premium (cost) for this contract is $500.

- If BTC goes to $46,000, you can use your call option to buy BTC at $42,000, then sell it at market price ($46,000) for a $4,000 profit (minus the $500 premium).

- If BTC stays below $42,000, your option expires worthless, and you only lose the $500 premium.

📌 Key takeaway: Call options profit when prices go up.

Put Option Contract (Right-to-Sell Contract)

A put option is a contract that gives the trader the right (but not the obligation) to sell a cryptocurrency at a set price before the expiry date.

👉 You buy a put option if you believe the price will go down.

Example of a Put Option Trade

Let’s say Bitcoin is trading at $40,000, and you think it will drop to $35,000 in the next month.

- You buy a BTC Put Option with a strike price of $38,000 and an expiry date of one month.

- The premium (cost) for this contract is $600.

- If BTC drops to $34,000, you can use your put option to sell BTC at $38,000, then buy it back at the lower market price ($34,000) for a $4,000 profit (minus the $600 premium).

- If BTC stays above $38,000, your option expires worthless, and you only lose the $600 premium.

📌 Key takeaway: Put options profit when prices go down.

How are Crypto Options Settled?

The best crypto options trading platforms allows two settlement options:

1. Physical Settlement

- The trader receives the actual cryptocurrency when the option is exercised.

- Example: If you exercise a BTC call option, you receive real Bitcoin at the agreed strike price.

2. Cash Settlement

- Instead of receiving crypto, you get the profit in cash (USD, USDT, etc.).

- Example: If you profit from a BTC put option, the exchange credits your account with the difference between the market price and strike price.

Most crypto options on platforms like Deribit, Binance, and OKX use cash settlement since it’s easier than transferring real crypto.

In-the-Money (ITM), At-the-Money (ATM), Out-of-the-Money (OTM)

The profitability of an option depends on whether it is in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM).

A call option is in-the-money when the current market price is higher than the strike price, while a put option is in-the-money when the current market price is lower than the strike price. For example, if a trader has a Bitcoin call option with a strike price of $40,000 and Bitcoin is trading at $42,000, the option is in-the-money because the trader can buy Bitcoin at $40,000 and sell it at $42,000 for a profit.

An option is at-the-money when the current market price is equal to the strike price. In this case, the option has no intrinsic value, but it may still hold some time value before expiration.

On the other hand, an option is out-of-the-money when it has no value because the market price is not in the trader’s favor. A call option is out-of-the-money when the current price is below the strike price, while a put option is out-of-the-money when the current price is above the strike price.

For example, if a trader has a Bitcoin call option with a strike price of $40,000 but Bitcoin is trading at $38,000, the option is worthless because it allows the trader to buy at a price higher than the current market price.

Conclusion

The best crypto options trading platforms provide a combination of liquidity, security, and user-friendly features. Exchanges like Bybit, Bitget, Binance, and Deribit stand out for their advanced trading tools, competitive fees, and a wide range of contract options.

Whether you are an experienced trader or just starting, choosing the right platform is crucial for maximizing your trading potential. Always consider factors like platform security, trading volume, and available crypto options before making a decision.

FAQs

Can you trade options on crypto?

Yes, you can trade options on cryptocurrencies. Crypto options are financial derivatives that grant you the right, but not the obligation, to buy or sell a specific cryptocurrency at a predetermined price before a set expiration date. This allows you to speculate on price movements or hedge existing positions.

Which cryptos have options contracts?

The most prominent cryptocurrencies with options contracts are Bitcoin (BTC) and Ethereum (ETH). These digital assets have established options markets due to their significant market capitalization and liquidity. Some exchanges also offer options contracts for other cryptocurrencies like Solana (SOL), Binance Coin (BNB), and Cardano (ADA). However, the availability of options contracts for these altcoins is limited and varies by platform.

Where to trade Bitcoin options?

You can trade Bitcoin options on several reputable exchanges. Platforms like Binance, Bybit, and Bitget offer Bitcoin options trading with varying features and fee structures. Binance provides a user-friendly interface and a range of expiration dates and strike prices. Bybit is known for its feature-rich platform and competitive fees. Bitget specializes in crypto derivatives and offers a comprehensive suite of options trading tools. When choosing an exchange, consider factors such as security, fees, liquidity, and the range of available contracts.

How to trade Bitcoin options on Binance?

Binance is one of the best crypto options trading platforms. To trade Bitcoin options on Binance, follow these steps:

Create an Account: Register on Binance and complete the necessary verification processes.

Deposit Funds: Transfer funds into your Binance account.

Access Options Trading: Navigate to the ‘Derivatives’ section and select ‘Options’.

Select Contract: Choose the desired options contract, specifying parameters like expiration date and strike price.

Execute Trade: Enter the amount you wish to trade and confirm the transaction.

Binance offers various expiration times and strike prices to suit different trading strategies. It’s crucial to familiarize yourself with the platform’s interface and understand the terms of the contracts before trading.

What are the best crypto options exchange?

The best crypto options trading exchanges include Binance, Bybit, and Bitget. Binance is renowned for its extensive range of cryptocurrencies and user-friendly platform. Bybit offers a feature-rich trading environment with competitive fees. Ditget specializes in crypto derivatives and provides advanced trading tools for options traders. When selecting an exchange, consider factors such as security measures, fee structures, liquidity, and the range of available contracts to ensure it aligns with your trading needs.

Does Coinbase offer options trading?

No, Coinbase does not offer options trading. The platform primarily focuses on spot trading and other services such as staking and lending. For options trading, you might consider other exchanges like Binance, Bybit, or Deribit, which specialize in crypto derivatives.

How do you trade F&O in crypto?

Trading Futures and Options (F&O) in crypto involves engaging in contracts that derive their value from underlying cryptocurrencies. Futures contracts obligate you to buy or sell an asset at a predetermined price on a specific future date, while options contracts provide the right, but not the obligation, to do so. To trade F&O in crypto:

Choose a Reputable Exchange: Select a platform that offers crypto derivatives trading, such as Binance, Bybit, or Deribit.

Create and Verify Your Account: Register and complete any necessary identity verification processes.

Deposit Funds: Transfer the required cryptocurrency or fiat into your trading account.

Understand the Instruments: Familiarize yourself with the specific futures and options products offered, including their terms, expiration dates, and leverage options.

Develop a Trading Strategy: Based on your market outlook, decide whether to go long or short on futures, or whether to buy call or put options.

Execute and Monitor Trades: Place your trades according to your strategy and monitor them closely, considering the high volatility of crypto markets.