Are you looking for the best crypto staking platforms to earn passive income with your digital assets? Staking is a popular way to earn interest on your crypto holdings, and there are many platforms to choose from. But with so many options, it can be hard to know where to start.

In this post, we’ll run through a few of the major players in the crypto staking space, including well-known exchanges that support multiple PoS cryptocurrencies. We’ll also cover different types of staking, such as locked staking and DeFi staking, so you can make an informed decision about where to stake your crypto. Keep reading to find the best crypto staking platforms for your needs.

Here is how you should choose (Quick overview)

- In the United States: Ledger, Kraken, and Coinbase are the best

- For No-KYC users: Ledger and MEXC are the best

- Fully Licensed and FDIC Insurance: Kraken is the best

- Staking along with futures trading: Bybit, MEXC, Kraken, and Binance are best

Highest APY Crypto Staking Platforms: Our Top Picks

Here is the list of the 10 best cryptocurrency staking platforms to earn passive income and high APY rates:

- Ledger Wallet App: Safest crypto staking app along with a cold storage solution

- Kraken: Top Staking Provider for Multiple Cryptocurrencies (Best for U.S. and Europe users)

- Coinbase: High APY staking platform for U.S. users

- MEXC: Best crypto staking platform with the highest APY in 2025 (no-KYC required)

- Bybit: Top staking pools with the best returns

- Bitget: Best staking platform for small investors

- Binance: Top staking provider for multiple tokens

- KuCoin: Best crypto auto-staking platform

- Gate.io: Best centralized staking platform with flexible earnings

- Crypto.com: Earn up to 20% APY on crypto

- Nexo: Top Staking Provider For Multiple Tokens

Best Crypto Staking Platforms 2025 Reviewed

Ledger Wallet App: Safest crypto staking app, along with a cold storage solution

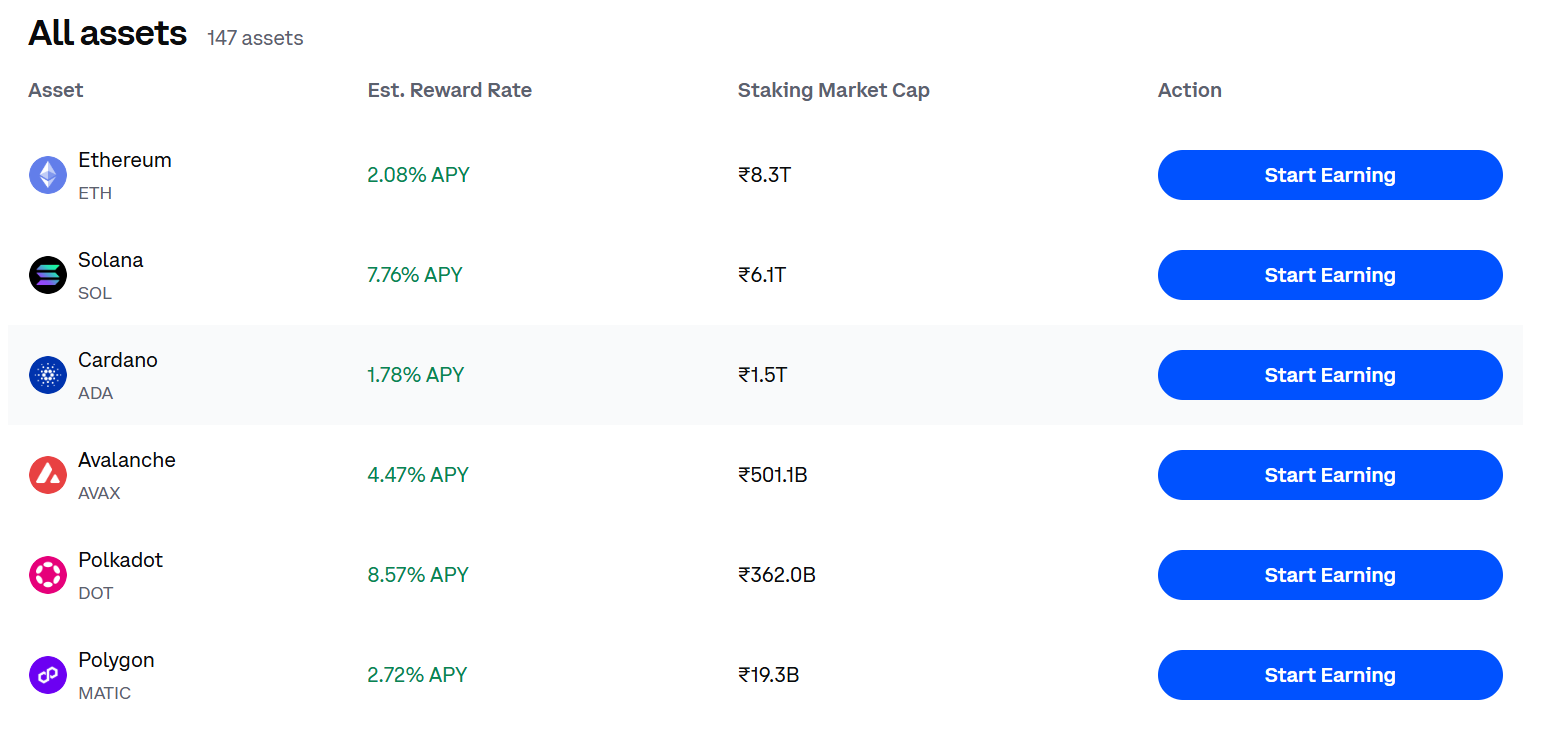

Ledger Wallet is best understood as a self-custodial hardware wallet + app (Ledger Wallet) that lets you stake 20+ coins while keeping control of your private keys. The hardware device holds your keys offline, while the app connects to staking providers and validators. Ledger supports 15,000+ crypto assets in total, and a subset of these can be staked directly via the Earn / Staking section in the app.

You can currently stake assets like Cardano (ADA), Celo (CELO), Cosmos (ATOM), and Ethereum (ETH) via dedicated partners (e.g., Figment for ETH). Staking is done by delegating your tokens to validators while your keys remain on the device.

Ledger supports many major staking coins (ETH, SOL, DOT, MATIC, ATOM, etc.), with yields that vary by asset and validator, roughly ~3–3.5% APY for ETH and up to ~20% for ATOM at the time of writing.

Kraken: Top Staking Provider for Multiple Cryptocurrencies

(FinCEN and SEC registered in the US and MiCA licensed in Europe)

Kraken is a licensed crypto exchange for staking multiple tokens. It is licensed to operate in the U.S. and Europe. In Europe, Kraken has significantly expanded its operations by securing a MiCA license from the Central Bank of Ireland, enabling it to offer services across all 30 countries of the European Economic Area (EEA). In the US, Kraken is registered as a Money Services Business (MSB) with FinCEN, and it is a registered broker-dealer with the SEC and FINRA.

You can earn up to 21 % APR on assets like ATOM (Cosmos). Flexible staking gives lower but flexible yields, while bonded staking offers higher rates if you lock assets for a set period. You can earn weekly rewards. You choose “Auto Earn” for flexible staking or pick a bonded term to boost yield. Kraken pays your earnings every week, and you can see your full history.

For example, you can stake Ethereum (ETH) and earn up to 6.5 % APR with a 14-day bonded term and up to 3 % APR if you use flexible staking. You can also stake Bitcoin (BTC) via the Babylon protocol and earn up to 1 % APR, paid weekly.

Kraken handles all technical steps. You just sign up, deposit a supported asset, and choose your staking method. You keep control of your crypto the whole time.

Key Features

- Flexible and bonded staking options: You choose “Auto Earn” for flexible staking with instant access. Or you pick “bonded staking” to lock assets for a higher yield.

- Wide selection of assets supported: Kraken supports many cryptocurrencies, including BTC, ETH, FLOW, SUI, GRT, and more. You can stake dozens of assets across on-chain and opt-in yield products.

- Restaking (Ethereum restaking via EigenLayer): You can restake ETH to earn extra rewards across multiple protocols. You keep ownership of your ETH while earning more.

- Easy interface and integrated platform: You just log in, deposit, and stake from the Kraken or Kraken Pro app. The same login lets you buy, trade, and stake crypto easily.

- Fast payouts and clear rates: You earn rewards weekly, with clear APR info before fees. Kraken shows projected rates based on recent averages and applies fees transparently.

Pros

- Multiple tokens supported for diversified staking rewards

- Flexible staking gives you full control of your funds

- Bonded staking offers a higher yield for a willing lock-up.

- Restaking option adds extra earning layers on ETH

- Simple interface makes staking easy for all users

Cons

- Bonded periods may restrict access to your crypto when needed

- Staking rewards are estimated, not guaranteed and may change.

Disclaimer: Services for U.S. and U.S. territory customers are provided by Payward Interactive, Inc. (“PWI”) dba Kraken, a FINCEN-registered money services business and subsidiary of Payward, Inc. Also, Payward Europe Solutions Limited t/a Kraken is authorised by the Central Bank of Ireland.

Coinbase: High APY staking platform

Coinbase is one of the most popular and trusted crypto staking platforms in the world, with over 100 million verified users. Founded in 2012, it’s known for being beginner-friendly while still offering advanced features for experienced traders.

The platform supports more than 250 cryptocurrencies, including Bitcoin, Ethereum, and Solana. Coinbase stands out because of its strong focus on security – over 98% of customer funds are stored in offline cold storage, which helps protect against hacks.

It’s also publicly traded on NASDAQ under the ticker “COIN,” giving it an added layer of transparency. What makes Coinbase especially appealing to investors is its staking feature, where users can earn rewards by simply holding certain cryptocurrencies like ETH or ADA.

With annual percentage yields (APYs) ranging from 2% to over 15%, depending on the asset, Coinbase has become a go-to platform for earning passive income through crypto staking.

Coinbase Earn

Coinbase partners with various blockchain projects that want to spread awareness about their tokens. In exchange for watching short educational videos or completing quizzes about these projects, you earn free crypto. For example, you could earn $3–$10 worth of a specific token just by spending 10–15 minutes learning about it.

In the past, Coinbase Earn campaigns have featured popular coins like Stellar Lumens (XLM), Tezos (XTZ), and Algorand (ALGO). Some users have even earned hundreds of dollars worth of crypto this way when those tokens increased in value later.

Pros

- User-friendly interface, perfect for beginners.

- High security with 98% cold storage.

- Supports over 250+ cryptocurrencies.

- Regulated, publicly traded company (NASDAQ: COIN).

- Offers staking rewards up to 15% APY.

- The educational “Earn” program pays to learn crypto.

Cons

- Higher fees compared to competitors like Binance.

- Limited advanced trading tools for pros.

- Staking options are fewer than some platforms.

MEXC: Best Crypto Staking Platform with Highest APY in 2025

(Staking without KYC)

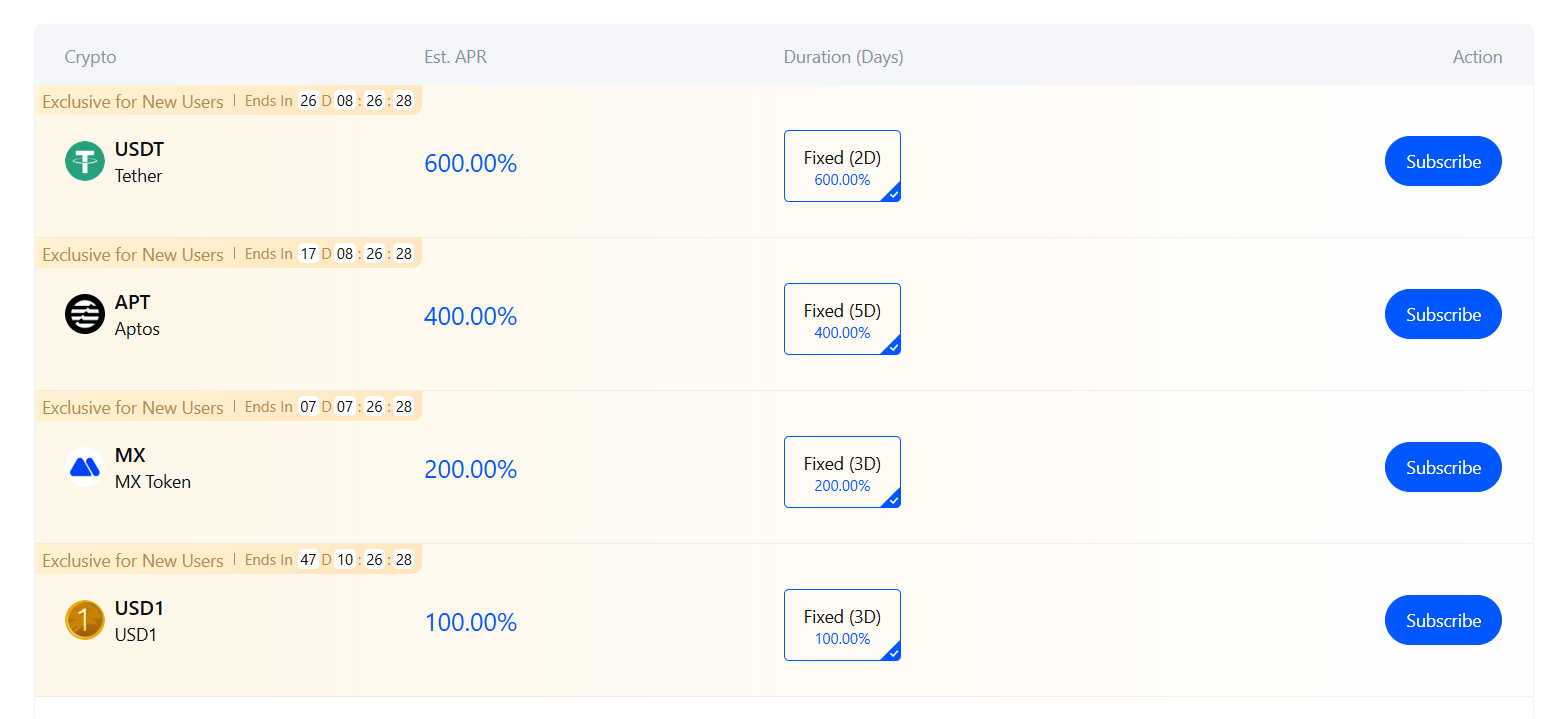

MEXC is the best crypto staking platform that’s been gaining attention for its high-yield staking options and focus on security without KYC requirements. It’s designed to be user-friendly, offering daily compound interest accounts for major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDT, USDC, and USD1, with annual percentage yields (APYs) ranging up to 10%. However, new users can also get up to 600% APY on USDT for 2 days.

You can stake stablecoins like USDT and earn up to 6% APY (after 2 days), which is pretty lucrative for assets pegged to fiat currencies like USD. The platform also offers a $8,000 welcome bonus for new users, plus additional bonuses for existing customers, which sweetens the deal. Another big plus is its security – MEXC insures all deposits.

Related: Best no-KYC cryptocurrency exchanges

Key Features

- Supported Assets: Major cryptocurrencies (BTC, ETH, etc.) and stablecoins (USDT, USDC, USD1).

- APY Range: Up to 10% annually. Stablecoins like USDT can hit 6% APY, and 600% APY for first 2 days for new users

- Bonuses: $8,000 welcome bonus for new users, plus additional bonuses for existing customers.

- Security: Full asset insurance and most assets stored in cold wallets.

- Global Reach: Available in over 220 jurisdictions

- Assets Under Management: $2.3 billion (according to DeFillama).

Pros

- High APYs (up to 600% for 2 days for new users), beating competitors

- Strong security with full insurance and cold storage.

- Flexible staking options, unlike some platforms with strict lock-ups.

- User-friendly for beginners, with clear terms.

- Staking without KYC measures

Cons

- Limited to major cryptos and stablecoins, not ideal for niche tokens.

Bybit: Top staking pools with best returns

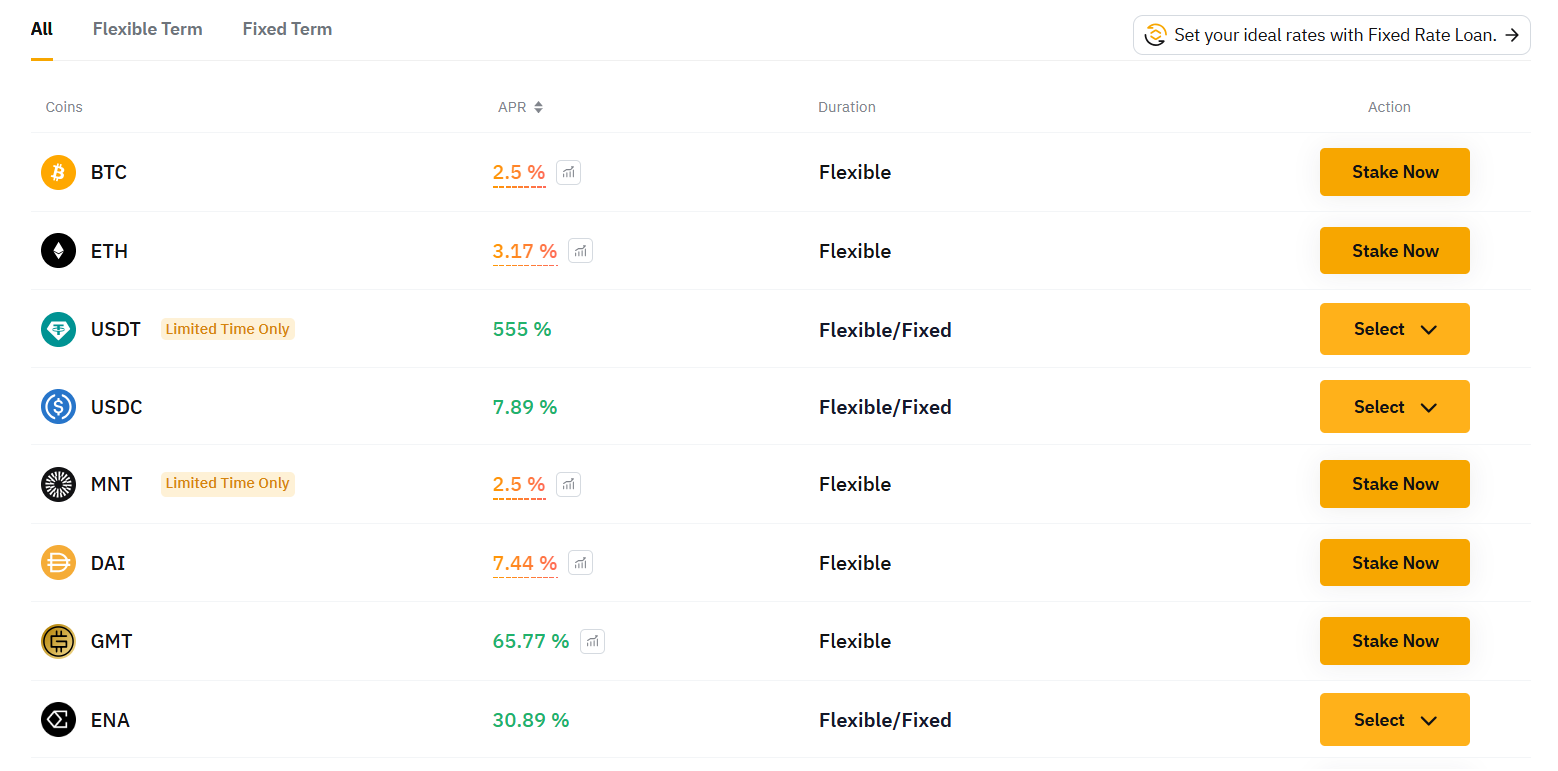

Bybit is among the best crypto staking platforms founded in 2018. It is known for its user-friendly interface and robust trading tools. With over 10 million users globally, it offers many services, including spot trading, futures trading, and staking options.

Bybit stands out for its high liquidity, low fees (as low as 0.1% per trade), and 24/7 customer support. The platform is trusted for its security measures, such as two-factor authentication (2FA) and cold wallet storage, ensuring user funds are safe.

In addition to trading, Bybit has expanded into decentralized finance (DeFi) solutions through its “Earn” products, allowing users to stake their crypto assets and earn passive income. Bybit supports over 1600 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Related: best crypto options trading platforms

Bybit Earn Products

- Bybit Savings: Bybit Savings offers two options: Fixed and Flexible. In the Fixed Savings plan, users lock their crypto for a specific period (e.g., 7, 15, or 30 days) to earn higher APYs, which can range from 5% to 20%, depending on the asset and duration. Flexible Savings allows users to deposit and withdraw funds anytime without locking them but with slightly lower APYs.

- On-Chain Earn: It is designed for users who want to stake their assets directly on blockchain networks to earn rewards. Bybit supports staking for popular Proof-of-Stake (PoS) cryptocurrencies like ETH 2.0 and SOL, offering APYs that can go as high as 8-10%.

- Liquidity Mining: It allows users to provide liquidity to decentralized finance (DeFi) pools and earn rewards in return. Bybit partners with various DeFi protocols, enabling users to stake assets like USDT, BTC, or ETH in liquidity pools.

- Dual Assets: It is an innovative product where users stake two different cryptocurrencies (e.g., BTC and USDT) to earn higher yields, with APYs reaching up to 60%. The catch is that the final payout depends on market conditions at maturity: you’ll receive either one of the two assets based on their performance.

Pros

- Low fees (0.1% per trade) save user costs.

- High liquidity for seamless trading and staking.

- 24/7 customer support ensures quick issue resolution.

- Wide range of supported cryptos (300+ coins).

- Secure platform with 2FA and cold wallet storage.

Cons

- Limited fiat payment options compared to competitors.

- Restricted access in some countries (e.g., U.S.).

- Liquidity Mining involves risks like impermanent loss.

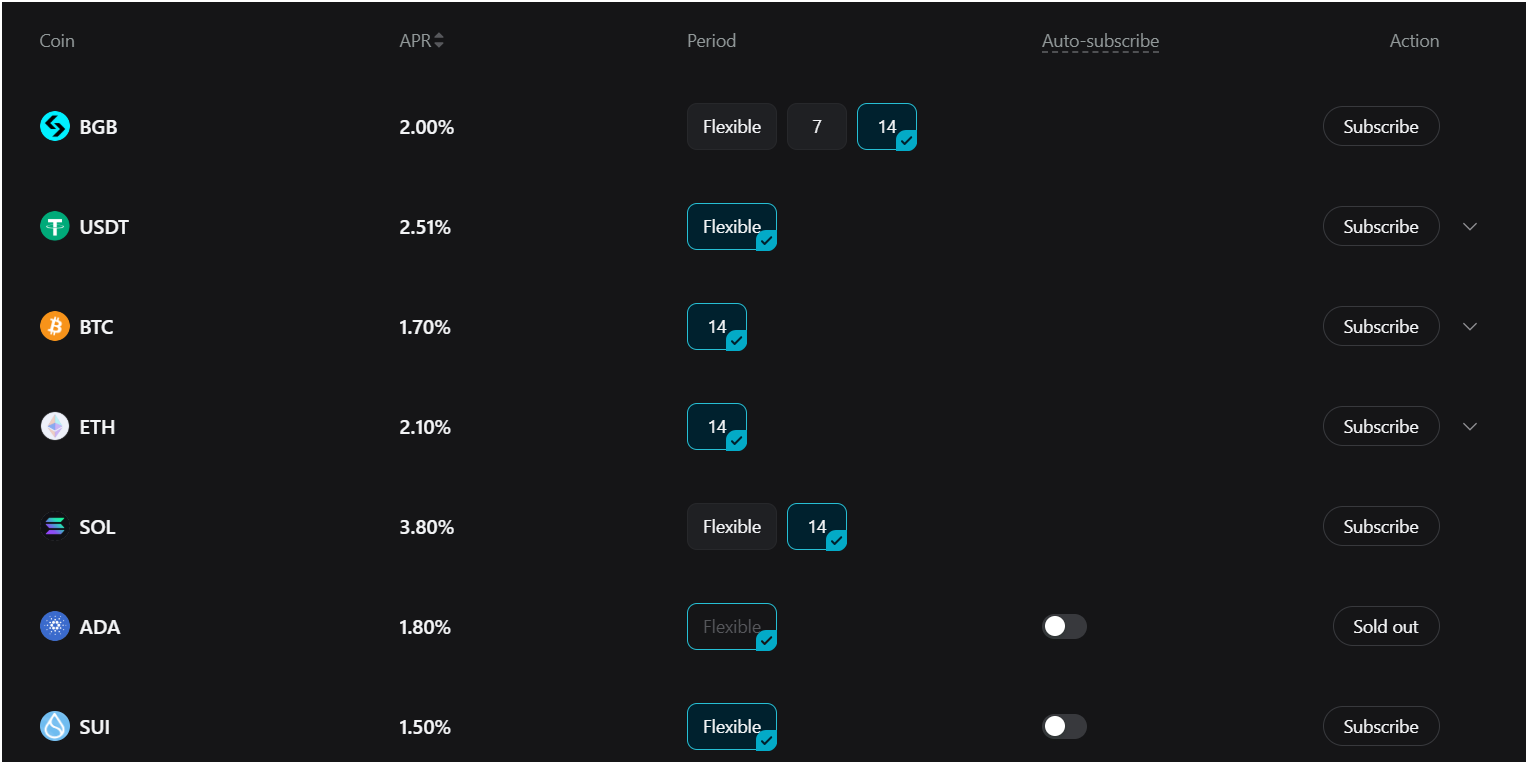

Bitget: Best staking platform for small investors

Bitget is a popular crypto staking exchange with its user-friendly interface and diverse earning opportunities. Launched in 2018, the platform boasts over 40 million users globally and supports more than 1200 cryptocurrencies.

With annual percentage yields (APYs) ranging from 5% to over 100%, depending on the product and cryptocurrency, it’s no wonder Bitget is considered one of the best platforms for crypto staking. The platform also emphasizes security, using advanced encryption and cold storage to protect user funds. It also has over $500 million in insurance funds.

Bitget Earn Products

- Fixed and Flexible Savings: Fixed savings let you lock up your crypto for a set period (e.g., 7, 30, or 90 days) in exchange for guaranteed interest rates, often higher than flexible savings. For example, locking BTC might yield up to 6% APY, while flexible savings allow you to withdraw anytime but offer lower rates like 2-3% APY.

- On-Chain Earn: This feature lets you stake directly on blockchain networks supported by Bitget, such as Ethereum 2.0 or Polkadot. You earn rewards based on network activity, with typical APYs ranging from 5-15%.

- Shark Fin: A structured product where you deposit crypto and receive payouts if the asset price stays within a specific range. Returns can reach up to 20% APY, but there’s a risk of lower earnings if the price moves outside the range. Best suited for market-neutral strategies.

- Dual Investment: Here, you choose between two assets at maturity (e.g., USDT or BTC). If your chosen asset performs well, you get higher returns, often exceeding 30% APY. However, if it underperforms, you may end up with a less favorable asset.

- Crypto Loans: Use your crypto as collateral to borrow stablecoins or fiat. Interest rates start at 0.02% per day, allowing you to access liquidity without selling your assets. Perfect for leveraging your portfolio during market dips.

Pros

- High APYs on staking and earn products.

- Wide range of supported cryptocurrencies.

- Intuitive mobile app for trading on the go.

- Strong focus on security with cold storage.

- Diverse earning options like Shark Fin and Dual Investment.

Cons

- Some features are restricted in certain countries.

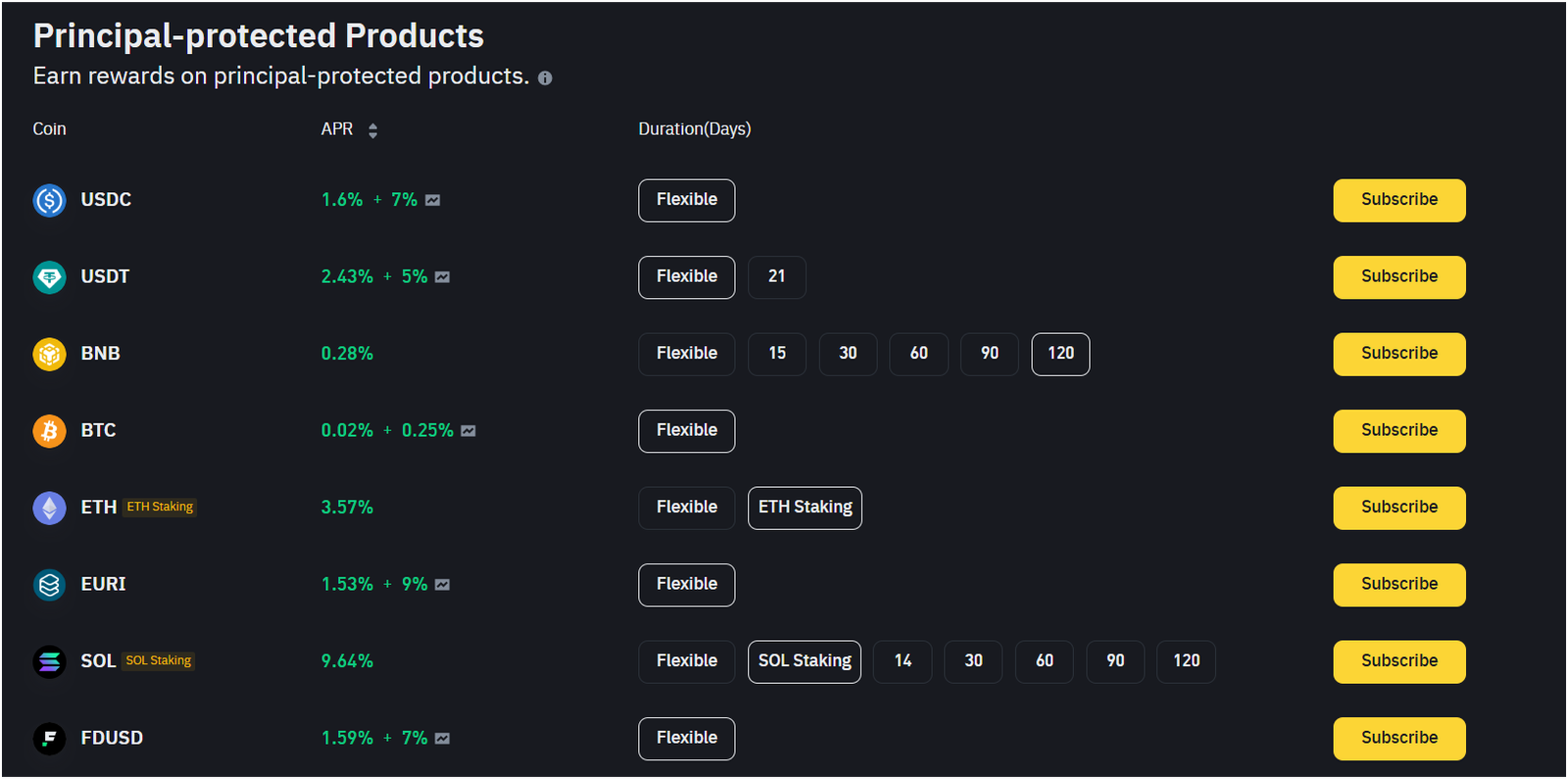

Binance: Top staking provider for multiple tokens

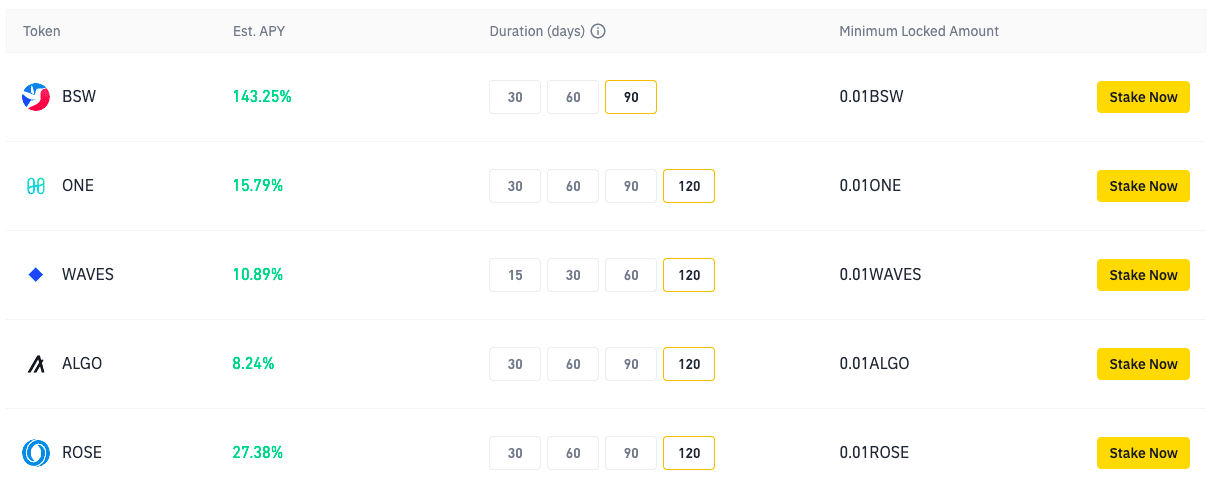

Binance is one of the best crypto staking platforms for individuals who want to make a lot of money. This well-known trading platform can handle approximately 120 distinct staking currencies, encompassing a wide range of coins and APYs.

Furthermore, Binance provides a variety of settings for how long you want to keep your tokens locked up. This usually lasts for ten, thirty, sixty, or ninety days.

There are two different types of Staking on Binance:

Locked Staking

Locking up supporting coins will reward you more. The money is not accessible for redemption or trade during the lockup period (you can unlock the coins in advance but no rewards will be distributed).

For people who want to hold for a while, this is a great choice.

Benefits of Locked Staking

- It offers a high APY of up to 200%.

- The staking period can be 15, 30, 60, 90, or 120 days

- If you want to redeem your staked coins before the completion period, you won’t be rewarded with interest.

- best for short-term holders

Defi Staking

Defi (Decentralized Finance) uses smart contracts to offer customers financial services. Existing Defi initiatives seek to increase yearly profits for particular currencies.

The entry point for Defi product consumers is rather high. Binance Defi Staking gathers and distributes realized earnings on behalf of users, acts on their behalf to engage in certain Defi products, and enables users to do so with a single click.

Earnings are computed starting at 0:00 (UTC) the next day after the money has been successfully allocated to Defi Staking. Earnings for a period of less than one day will not be included in the earnings distribution since the minimum earnings computation period is one day.

Advantages of Binance Defi Staking

- Easy to Use

- Funds are Safe

- High yields and earnings

- high liquidity

- fast redeem available

Pros and Cons of Binance Staking

| Pros | Cons |

|---|---|

| Potential for higher returns compared to traditional savings accounts | Not as safe as keeping funds in a savings account or a stablecoin |

| Opportunity to earn passive income on idle cryptocurrency holdings | May not be suitable for short-term investment goals or liquidity needs |

| Easy-to-use platform with a user-friendly interface | Not all cryptocurrencies are available for staking, limiting investment options |

| Binance offers a variety of staking options with varying lock-up periods, allowing for flexibility |

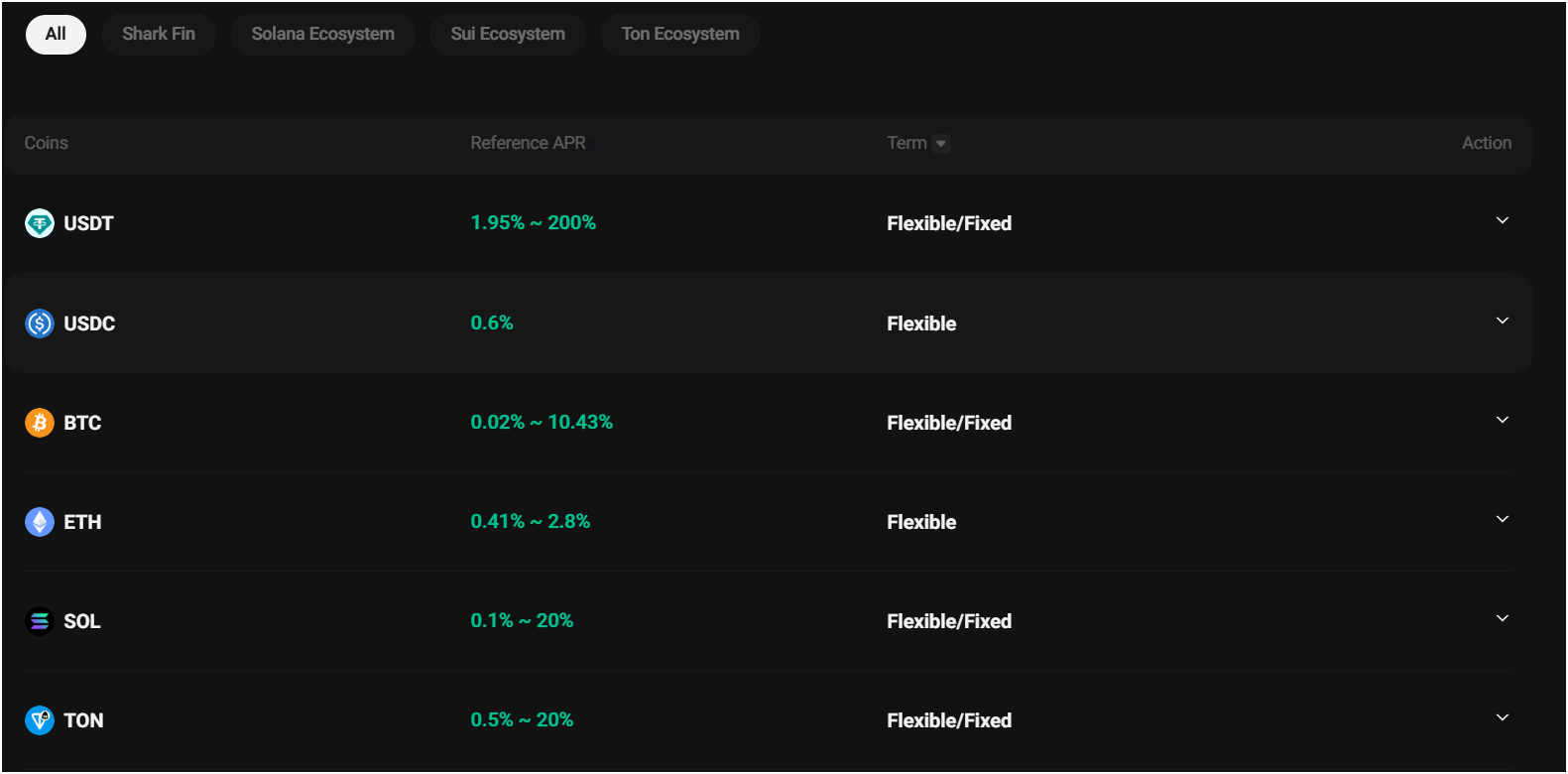

KuCoin: Best crypto auto-staking platform

KuCoin staking is available for a variety of cryptocurrencies, including but not limited to, Bitcoin, Ethereum, Litecoin, and KuCoin’s own KCS token. Each cryptocurrency has its own staking requirements and rewards, which can be found on the KuCoin exchange.

Services including Flexible Savings, Staking, Polkadot, and ETH 2.0 are offered by KuCoin Earn in both flexible and fixed terms. Users of flexible-term services can withdraw their money at any time.

When a fixed-term investment matures, the money will be automatically redeemed to the customer’s account. Fixed-term assets provide a greater yield or Interest than flexible-term ones.

There are three types of staking-

- Flexible staking

- Locked staking

- Fixed duration-based staking i.e. 30 days, 60 days, 90 days, and 120 days.

Key Features of Kucoin Staking

- High returns: Users can earn staking rewards of up to 20% per year for some supported cryptocurrencies.

- Easy to use: Staking can be done directly from the user’s Kucoin account, with no need for additional technical knowledge or setup.

- Support for multiple cryptocurrencies: The program supports a wide range of cryptocurrencies, including popular ones like Ethereum and EOS.

- Flexibility: Users can choose to stake for a set period of time or indefinitely, and can also choose to unstake at any time.

- Low minimum requirements: Users can stake as little as 1 unit of a supported cryptocurrency.

- Safety: Kucoin is a regulated exchange and takes security measures to ensure the safety of users’ assets.

Pros & Cons of Kucoin Staking

| Pros | Cons |

|---|---|

| Best exchange and staking services | centralized control |

| perks for using the KCS token | shorter period |

| supports more than 600+countries | |

| staking rewards based on time duration | |

| No fees |

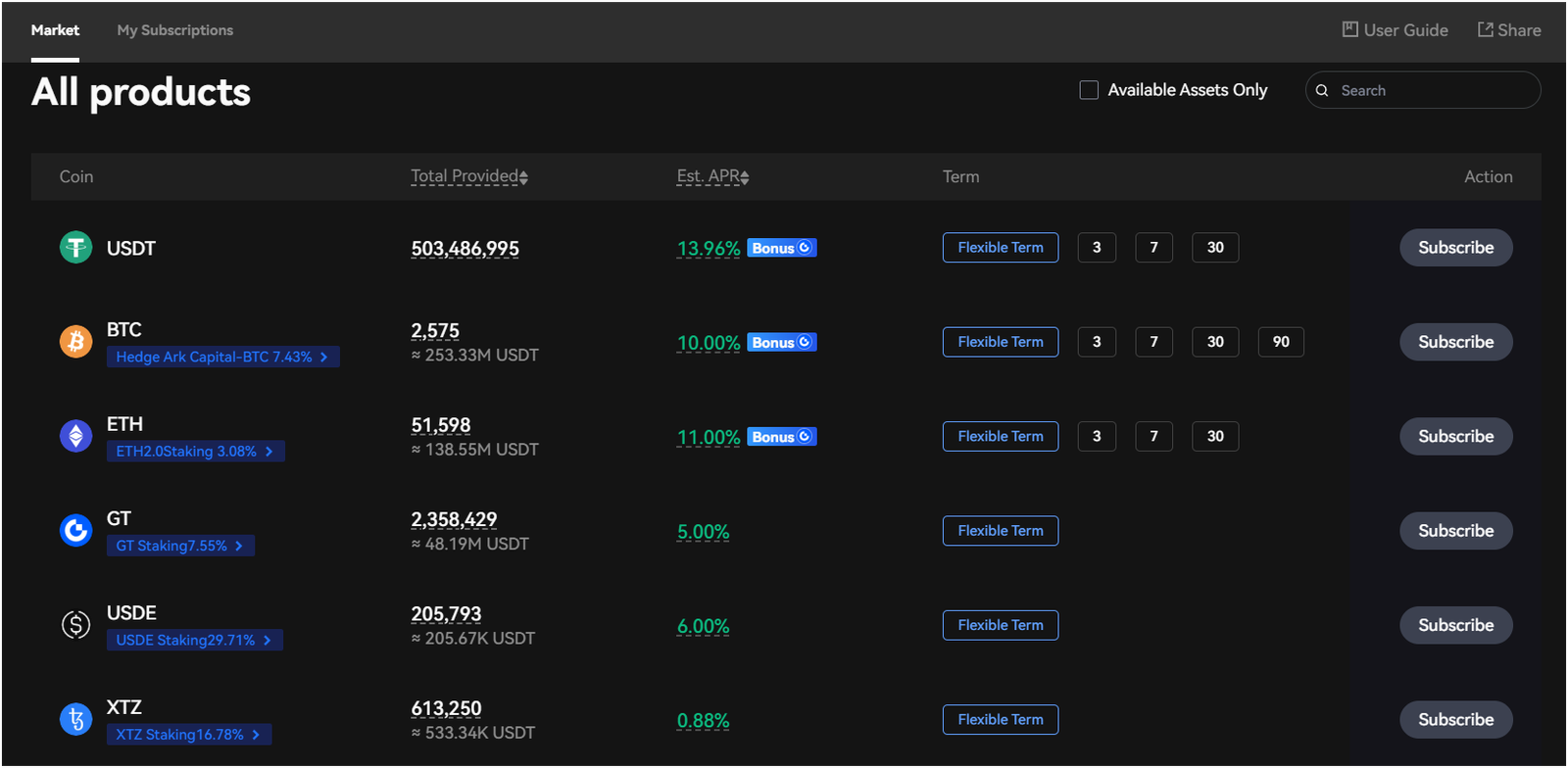

Gate.io: Best centralized staking platform with flexible earnings

Gate.io is one of the best crypto staking platforms with many additional features including borrowing and lending services. Users of Gate.io HODL&Earn have access to several options to generate passive income by just holding.

For the lock-up and earn product, which is comparable to a term deposit, users must lock up cryptocurrency for a predetermined amount of time. Early withdrawal is not permitted. When the period is over, interest and principal amount will be immediately released.

PoS staking products are also available, which function similarly to checking account deposits in that you can spend the cryptocurrency whenever you choose and still earn daily interest on the remaining cryptocurrency (if no less than a minimum threshold).

Gate.io aims to add the most currencies to the PoS staking list and provide users with the highest staking interest possible.

Key Features of Gate.io HODL & EARN

- Support for multiple cryptocurrencies: Users can earn interest on a variety of digital assets, including Bitcoin, Ethereum, and stablecoins.

- Flexible interest rate: The interest rate for HODL & EARN varies depending on the coin and the duration of the deposit.

- No lock-up period: Users can withdraw their funds at any time without penalty.

- High security: Gate.io uses multi-signature and cold storage to ensure the safety of users’ assets.

- Daily interest: Interest is paid out daily, allowing users to compound their earnings over time.

Pros and Cons of Gate.io

| Pros | Cons |

|---|---|

| No hidden fees | Non-regulated |

| No minimum deposit and withdrawals | high loan volatility |

| own exchange available | Limited free withdrawals |

| loan, staking, and borrowable available |

Crypto.com: Stake to Earn up to 20% APY on stablecoins

Crypto.com is primarily a cryptocurrency exchange that offers a variety of services including staking, loans, borrowing, lending, and low-fee transactions.

In a word, once you’ve deposited your virtual currencies, Crypto.com will use the proceeds to give loans to account holders who need money. After that, the end-borrower will refund the cash plus interest, which you will get daily.

The following three holding term choices are available:

- Modular holding period

- 30-day fixed term

- 3.0 month fixed term

- When CRO is locked up, users can benefit from a higher yearly rewards rate.

Key Features

- The ability to earn interest on a variety of cryptocurrencies, including Bitcoin, Ethereum, and other popular coins.

- The ability to earn CRO rewards, which is the native token of the crypto.com platform.

- Flexible staking options, including the ability to choose the amount of time to stake for and the ability to unstake at any time.

- No minimum staking amount and no lock-up period.

- Staking rewards are paid out daily, allowing for compound interest to be earned over time.

- Staking rewards can be used to pay for trading fees on the crypto.com exchange or to purchase other cryptocurrencies.

Crypto.com Staking: At a Glance

| APY | 14.5% on cryptocurrencies, 10% p.a. on stablecoins |

| Staking Thresholds | Depends on the type of cryptocurrencies |

| Fixed staking | 30, 90 days, or flexible staking |

| security | High security with zero staking fees |

| Additional Rewards | Using native token CR0 |

| Payouts | 7 days |

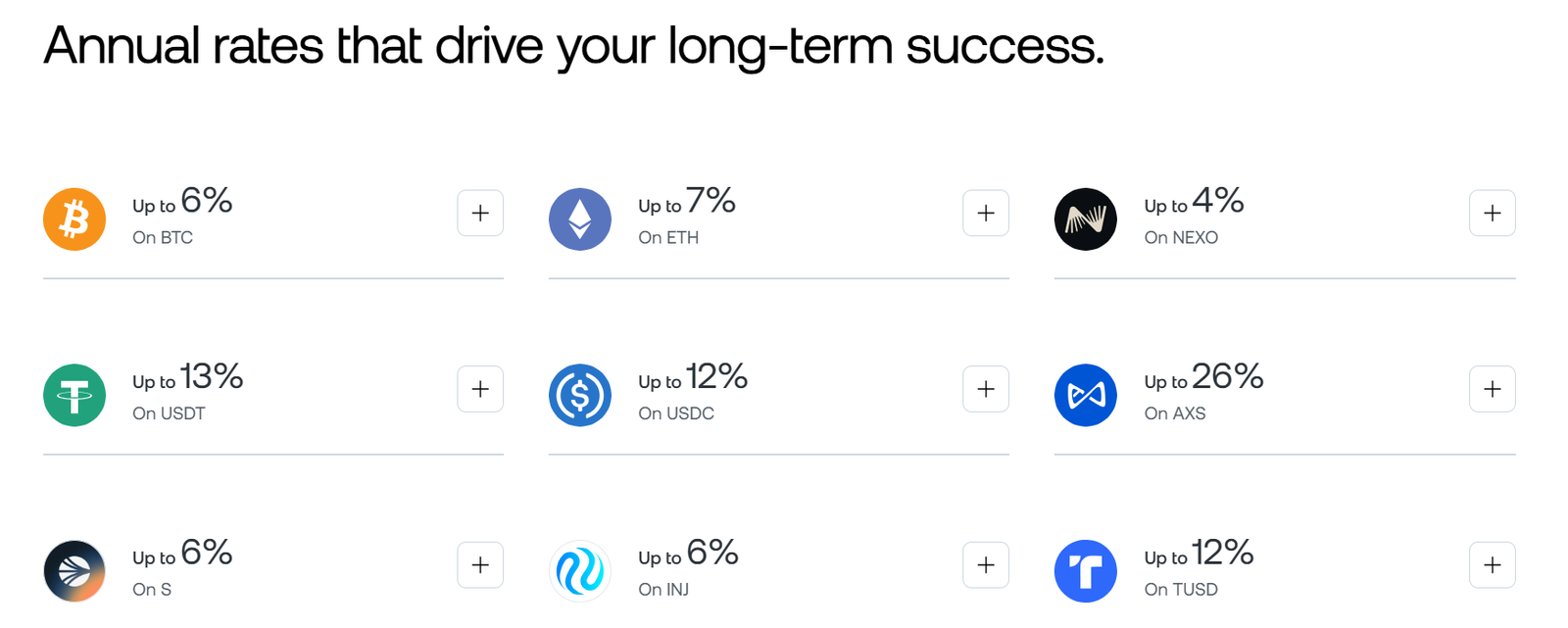

Nexo: Top Staking Provider For Multiple Tokens

Nexo is the best crypto staking platforms in the industry. It provides Flexible Savings accounts for various cryptocurrencies, offering up to 20% annual interest with daily compounding and no lock-up periods. For instance, you can earn up to 6% on Bitcoin (BTC), 13% on USDT stablecoin, and up to 7% on Ethereum (ETH). These features make Nexo a compelling platform for crypto staking and earning interest on digital assets.

Nexo offers competitive staking options for Ethereum (ETH) through its Smart Staking tool. By swapping your ETH for Nexo Staked Ethereum (NETH) at a 1:1 ratio, you can earn between 4% and 12% annual percentage yield (APY), with daily payouts. This rate is consistent across all loyalty tiers and applies regardless of the staked amount. You can start staking with as little as $1 worth of ETH. Additionally, Nexo covers gas fees and allows for instant unstaking by swapping NETH back to ETH at the same 1:1 ratio.

Key Features of the Nexo Platform

- Earn Interest

- Up to 20% annual interest on crypto staking

- Unique daily payout available

- $375 million insurance on all custodial assets

- Deposit or withdraw funds at your convenience

- Borrow Assets

- Interest rate starting from 0% APR

- $375 million insurance on all custodial assets

- A minimum of $50 and a maximum of $2 million cash borrowed available

- Automatic approval, no credit checks

- Nexo card

- Accepted by 40+ million merchants worldwide

- Instant 2% cashback on all purchases

- Flexible repayment options

- Free virtual cards

- Payments in local currencies

- No monthly/annual fees, no FX fees

Pros and Cons of Nexo Staking

| Pros | Cons |

|---|---|

| High returns on staked ETH tokens. | Staked tokens cannot be used for loans or other services |

| Potential for bonuses and other incentives. | |

| Safest platform with transparent solvency |

Comparison Between Best Staking Platforms for Crypto

Here’s a comparison of nine top crypto staking platforms based on supported coins, staking fees, earn product types, and maximum APY:

| Platform | Supported Coins | Staking Fees | Earn Product Types | Maximum APY |

|---|---|---|---|---|

| CoinDepo | 19+ crypto assets | Zero fees | Flexible and Fixed | Up to 24% |

| Bybit | Multiple major cryptocurrencies | Varies by asset | Flexible and fixed staking | Up to 15% |

| Coinbase | Over 200 cryptocurrencies | 15-35% commission on rewards | Staking and lending | Up to 957.13% on Yearn.Finance; 4.90% on Ethereum |

| Bitget | Multiple cryptocurrencies | Varies by asset | Flexible and fixed staking | Up to 4.2% |

| Binance | Over 100 assets | No staking fees | Flexible, locked, DeFi staking | Up to 36% (principal protected), 540% (high yield) |

| KuCoin | Multiple cryptocurrencies | Varies by asset | Auto-staking and flexible staking | Varies by asset |

| MEXC | Multiple cryptocurrencies | 0% | Flexible and fixed staking | Up to 100% |

| Gate.io | Wide range of tokens | Varies by asset | Flexible earnings | Varies by asset |

| Crypto.com | Multiple cryptocurrencies | Varies by asset | Flexible and fixed staking | Up to 20% on stablecoins |

| Nexo | Multiple cryptocurrencies | Varies by asset | Staking and borrowing | Varies by asset |

What is a Crypto Staking Platform?

A crypto staking platform is a service that lets you stake your cryptocurrencies. Staking is when you lock up your coins to help a blockchain network run smoothly. In return, you earn rewards, usually in the form of more coins.

These platforms make staking easy for you. You don’t need to be a tech expert or run your own computer (called a node) to participate. Platforms like Binance, Coinbase, and MEXC handle all the complicated stuff for you.

They provide a simple interface, manage the technical side of staking, and give you your rewards. Think of it like putting your money in a savings account, but instead of a bank, it’s a blockchain network, and instead of interest, you earn crypto rewards.

What is Staking?

Staking is a way to help a blockchain network work while earning rewards. Some blockchains, like Ethereum 2.0, use a system called Proof-of-Stake (PoS) instead of mining.

In PoS, you lock up some of your coins in a wallet to support the network. This is called your “stake.” The more coins you stake, the higher your chances of being chosen to validate transactions. When you validate transactions, you earn rewards.

Staking is like being a banker for the blockchain. You help keep the network secure and running, and in return, you get paid in crypto. It’s a way to earn passive income while holding onto your coins.

How Do Crypto Staking Platforms Work?

The best crypto staking platforms make staking simple for you. Here’s how they usually work:

- Sign Up: You create an account on the platform and deposit your cryptocurrency.

- Pool Your Coins: The platform combines your coins with others to increase the chances of being chosen to validate transactions. This is called a staking pool.

- Run Nodes: The platform runs the computers (nodes) that do the actual work of validating transactions on the blockchain.

- Earn Rewards: When the platform earns rewards from staking, it shares them with you based on how much you’ve staked.

- Withdraw: After a certain period, you can withdraw your staked coins and the rewards you’ve earned.

These platforms handle all the technical details, so you don’t have to worry about running your own node or understanding complex blockchain tech.

Proof-of-Stake Consensus

Proof-of-Stake (PoS) is a system some blockchains use to validate transactions and keep the network secure. Unlike Proof-of-Work (PoW), which Bitcoin uses, PoS doesn’t require powerful computers or lots of energy.

Instead, it relies on validators – people like you who lock up their coins as a stake. The more coins you stake, the higher your chances of being chosen to validate transactions and earn rewards.

PoS is faster, cheaper, and more eco-friendly than PoW. It also encourages you to hold onto your coins, which can help keep the price of the cryptocurrency stable. In short, PoS is a smarter, greener way to run a blockchain.

Lock-Up Terms

Lock-up terms are the rules about how long your staked coins are locked and can’t be withdrawn. Different platforms have different lock-up terms. Some let you unstake your coins after a few days, while others require you to lock them up for months or even years.

Longer lock-up periods usually mean higher rewards because they give the network more stability. But they also mean you can’t access your coins during that time. Some platforms offer flexible staking with no lock-up period, but the rewards are usually lower.

Before you stake, make sure you understand the lock-up terms. If you think you might need your coins soon, flexible staking might be a better option.

What are APY and APR in Staking?

APY (Annual Percentage Yield) and APR (Annual Percentage Rate) are both ways to measure the performance of an investment over time.

APY is a metric that is commonly used to measure the returns on a staking investment. It takes into account the interest earned on an investment, as well as any compounding that occurs over time.

For example, if you stake a token for a year and earn a 10% return, the APY would be 10%.

APR, on the other hand, is a metric that is most commonly used to measure the cost of borrowing, such as credit card or loan interest.

APR reflects the annual cost of borrowing, expressed as a percentage of the loan amount. It includes the interest rate and any additional fees or charges associated with the loan.

Types of Crypto Staking Exchanges

There are different types of best crypto staking platforms, each with its own pros and cons. Here’s a breakdown:

- Centralized Exchanges (CEXs): These are big platforms like Binance, Coinbase, and Kraken. They’re easy to use and often have low minimum staking requirements. But you don’t have full control over your coins because the exchange holds them for you.

- Decentralized Exchanges (DEXs): These platforms let you stake directly on the blockchain without a middleman. You have more control and privacy, but they can be harder to use if you’re not tech-savvy.

- Staking-as-a-Service Platforms: These platforms do all the technical work for you. They’re a good choice if you want to stake but don’t want to run your own node.

- Wallet Staking: Some crypto wallets, like Trust Wallet and Atomic Wallet, let you stake your coins directly from the wallet. It’s simple and convenient, but the rewards might not be as high as on other platforms.

Each type has its own benefits, so choose the one that fits your needs and comfort level.

Here are some other staking types:

High APY Rates Staking Platforms

High APY (Annual Percentage Yield) crypto staking platforms offer bigger rewards compared to other options. APY is the rate of return you can expect to earn on your staked coins over a year, including the effect of compounding.

Platforms with high APY rates are often newer or smaller networks trying to attract more users. While high APY sounds great, it comes with risks. These platforms might be less stable or more volatile. Always do your research before staking on a high APY platform.

Look into the team behind the project, the technology, and the community. High rewards can be tempting, but they’re not worth it if the platform isn’t trustworthy.

Cross-Chain Staking Pools

Cross-chain staking pools let you stake coins from different blockchains in one place. This is great if you hold multiple cryptocurrencies and want to earn rewards from all of them without using different platforms.

Cross-chain staking is often offered by decentralized finance (DeFi) platforms. It requires blockchains to work together, which can be complicated. But it gives you more flexibility and the chance to earn higher rewards. If you’re comfortable with DeFi and want to diversify your staking, cross-chain pools are worth exploring.

Flexible and Fixed Terms Staking

Flexible and fixed terms staking are two ways to stake your coins. Flexible staking lets you unstake your coins anytime, so you have more access to your money. But the rewards are usually lower.

Fixed terms staking requires you to lock up your coins for a set period, like a few weeks, months, or even years. The longer the lock-up, the higher the rewards. Fixed terms are a good choice if you don’t need your coins right away and want to maximize your earnings.

Self-Custodial Staking

Self-custodial staking means you keep full control of your coins while staking them. Instead of letting a platform hold your coins, you use your own wallet.

This gives you more security and privacy because you don’t have to trust a third party. But it also means you’re responsible for keeping your wallet safe and following the right staking steps.

If you’re tech-savvy and want full control over your coins, self-custodial staking is a great option. Just make sure you understand how to secure your wallet and manage your private keys.

On-chain and Off-chain Staking

On-chain staking happens directly on the blockchain. Your coins are locked in a smart contract or a special staking wallet on the blockchain itself. This is more transparent and secure because everything is recorded on the blockchain. But it can be harder to set up and manage.

Off-chain staking happens outside the blockchain, usually through centralized exchanges or staking-as-a-service platforms. It’s easier to use, but you have to trust the platform to handle your coins. If you value transparency and security, go for on-chain staking. If you want something simpler, off-chain staking might be better for you.

Crypto Mining vs Staking

| Crypto Mining | Crypto Staking | |

|---|---|---|

| How It Works | Miners use powerful computers to solve complex math problems to validate transactions and add them to the blockchain. | You lock up your coins in a wallet to support the network and validate transactions. |

| Energy Use | High energy consumption (requires powerful hardware and electricity). | Low energy consumption (no need for powerful hardware). |

| Cost | Expensive (requires buying mining equipment and paying for electricity). | Low cost (you only need to own the cryptocurrency). |

| Rewards | Earn block rewards and transaction fees. | Earn staking rewards based on the amount of coins you stake. |

| Technical Knowledge | Requires advanced technical skills to set up and maintain mining rigs. | Easy to start; most platforms handle the technical details for you. |

| Accessibility | Not accessible to everyone due to high costs and technical barriers. | Accessible to anyone with cryptocurrency and an internet connection. |

| Network Security | Secures the network through computational power (Proof-of-Work). | Secures the network through staked coins (Proof-of-Stake). |

| Risk | High risk due to hardware costs, electricity bills, and market volatility. | Lower risk since you only need to hold and stake your coins. |

| Examples | Bitcoin (BTC), Litecoin (LTC), and other Proof-of-Work blockchains. | Ethereum 2.0 (ETH), Cardano (ADA), and other Proof-of-Stake blockchains. |

Crypto Lending vs Staking

| Crypto Lending | Crypto Staking | |

|---|---|---|

| How It Works | You lend your crypto to others (like borrowers or platforms) and earn interest. | You lock up your crypto in a wallet to support the network and earn rewards. |

| Risk | Higher risk (borrowers may default, or the platform may face issues). | Lower risk (your coins are locked but still yours; no third-party dependency). |

| Rewards | Earn interest (APY) based on the lending platform’s terms. | Earn staking rewards based on the network’s rules. |

| Control Over Funds | You give up control of your coins to the lending platform or borrower. | You retain control of your coins (in self-custodial staking). |

| Lock-Up Period | Flexible or fixed terms, depending on the platform. | Fixed or flexible terms, depending on the staking platform. |

| Purpose | Helps others borrow crypto while you earn passive income. | Helps secure the blockchain network while you earn passive income. |

| Technical Knowledge | Easy to use; most platforms are user-friendly. | Easy to use, but requires some understanding of staking rules. |

| Examples | Platforms like Nexo and Aave offer crypto lending. | Platforms like Binance, Coinbase, and Kraken offer staking services. |

Benefits of Cryptocurrency Staking

Below are the key benefits of staking cryptocurrency:

Earn Passive Income

Staking allows you to earn rewards without actively trading or selling your cryptocurrency. By simply holding and locking your coins in a staking wallet, you can earn additional coins over time. This is like earning interest in a bank, but the returns are often higher.

Support the Blockchain Network

When you stake your coins, you help secure and maintain the blockchain network. Staking is essential for validating transactions and ensuring the network runs smoothly. By participating, you contribute to the decentralization and security of the blockchain.

Lower Energy Consumption

Staking is more energy-efficient compared to mining, which is used in Proof of Work (PoW) blockchains like Bitcoin. Mining requires powerful computers and consumes a lot of electricity. Staking, on the other hand, requires minimal energy, making it an eco-friendly option.

Easy to Start

Staking is beginner-friendly. You don’t need expensive equipment or technical knowledge to start. Many wallets and exchanges offer simple staking options where you can stake your coins with just a few clicks.

Potential for Price Appreciation

When you stake your coins, you hold onto them for a longer period. If the price of the cryptocurrency increases over time, you not only earn staking rewards but also benefit from the price appreciation.

Incentives for Long-Term Holding

Staking encourages long-term investment. Since your coins are locked up for a specific period, you are less likely to sell them during market fluctuations. This can help you avoid impulsive decisions and stay focused on your investment goals.

Access to New Projects

Some new blockchain projects offer staking opportunities to early participants. By staking, you can get involved in promising projects from the beginning and potentially earn higher rewards as the project grows.

Risks of Staking Crypto

While staking offers many benefits, it also comes with risks. It’s important to understand these risks before you start staking your cryptocurrency.

Price Volatility

Cryptocurrencies are known for their price volatility. The value of your staked coins can go up or down significantly during the staking period. If the price drops, the rewards you earn may not compensate for the loss in value.

Lock-Up Periods

Many staking programs require you to lock up your coins for a specific period. During this time, you cannot sell or transfer your coins, even if the market conditions change. This lack of liquidity can be a disadvantage if you need access to your funds.

Slashing Risks

In some blockchain networks, validators (those who stake coins) can be penalized for malicious behavior or going offline. This penalty, known as slashing, can result in a loss of a portion of your staked coins. While this risk is low, it’s important to be aware of it.

Technical Risks

Staking requires you to use a wallet or a staking platform. If the platform experiences technical issues, hacks, or security breaches, you could lose your staked coins. Always choose reputable platforms and wallets to minimize this risk.

Network Risks

The success of staking depends on the health and growth of the blockchain network. If the network faces issues like low adoption, security vulnerabilities, or competition from other blockchains, the value of your staked coins and rewards could decrease.

Reward Variability

Staking rewards are not fixed and can vary based on several factors, such as the number of participants, network activity, and the total amount of coins staked. If more people join the staking pool, your rewards may decrease.

Regulatory Risks

Cryptocurrency regulations are still evolving in many countries. Changes in laws or government policies could impact staking activities. For example, staking rewards might be taxed differently, or staking could be restricted in certain regions.

Validator Risks

If you choose to stake through a validator (a third party that manages staking on your behalf), you are trusting them to act honestly and efficiently. If the validator makes mistakes or acts maliciously, it could affect your rewards or staked coins.

How to Stake Cryptocurrency on Exchanges?

Staking cryptocurrency on exchanges is an easy way to earn rewards. Many exchanges offer staking services, so you don’t need technical knowledge. Here’s a step-by-step guide on how to stake crypto on exchanges.

Step 1: Choose a Reliable Exchange

Not all crypto exchanges support staking. Choose a trusted exchange with a good reputation. Some popular exchanges that offer staking include:

- Binance

- Coinbase

- Bitget

- KuCoin

- Bybit

How to Pick the Right Exchange:

✅ Check if the best crypto staking platform you choose is secure and well-known.

✅ Compare staking rewards (APY) for different coins.

✅ Make sure the exchange supports the cryptocurrency you want to stake.

✅ Read reviews to avoid scam platforms.

Step 2: Create an Account on the Exchange

If you don’t have an account, you need to sign up.

How to Sign Up:

- Go to the exchange’s official website.

- Click on the “Sign Up” or “Register” button.

- Enter your email and create a password.

- Verify your email by clicking the link sent to your inbox.

- Complete identity verification (KYC) if required. This may include submitting an ID and a selfie.

💡 Tip: Use a strong password and enable two-factor authentication (2FA) for extra security.

Step 3: Deposit or Buy Crypto

To stake, you need cryptocurrency in your exchange wallet.

Option 1: Deposit Crypto from Another Wallet

- Go to your exchange’s wallet section.

- Click “Deposit” and choose the cryptocurrency you want to stake.

- Copy the deposit address and paste it into your external wallet.

- Send the crypto to your exchange wallet.

Option 2: Buy Crypto on the Exchange

- Go to the “Buy Crypto” section.

- Choose the payment method (credit card, bank transfer, etc.).

- Select the cryptocurrency you want to buy.

- Enter the amount and confirm the purchase.

💡 Tip: Some exchanges have a minimum staking amount. Make sure you have enough crypto before staking.

Step 4: Go to the Staking Section

Once you have crypto in your exchange wallet, find the staking option.

How to Find Staking on an Exchange:

- Log into your account.

- Look for “Earn,” “Staking,” or “Finance” in the menu.

- Click on “Staking” to see available coins and rewards.

Step 5: Choose a Crypto to Stake

Different cryptocurrencies offer different staking rewards (APY). Some have higher returns, while others are more stable.

How to Choose the Right Coin:

✅ Check the APY (annual percentage yield) to see potential earnings.

✅ Look at the lock-up period (some require you to lock your crypto for weeks or months).

✅ Consider the risk—smaller projects may offer higher rewards but have more risk.

Step 6: Select Staking Terms

Some best crypto staking platforms offer flexible and locked staking.

- Flexible Staking: You can withdraw your crypto anytime, but the rewards may be lower.

- Locked Staking: Your crypto is locked for a set time (e.g., 30, 60, 90 days) and gives higher rewards.

How to Select Staking Terms:

- Click on the crypto you want to stake.

- Choose the staking period (e.g., 30 days, 60 days, etc.).

- Check the expected rewards.

- Click “Stake” or “Confirm.”

Step 7: Start Staking

After confirming the staking terms, your crypto is now staked. The exchange will take care of everything, and you will start earning rewards.

What Happens Next?

✅ Your crypto stays locked (if you chose locked staking).

✅ You receive staking rewards daily, weekly, or monthly.

✅ You can track your earnings in the “Staking” or “Earnings” section.

Step 8: Withdraw Staked Crypto (If Needed)

If you choose flexible staking, you can withdraw anytime. If you selected locked staking, you must wait until the staking period ends.

How to Unstake Crypto:

- Go to the “Staking” section.

- Find the crypto you staked.

- Click “Unstake” or “Redeem.”

- Confirm the withdrawal.

💡 Tip: Some exchanges charge a fee for early unstaking. Check the terms before unstaking.

Crypto Staking Taxes and Rules in the U.S.

The IRS considers staking rewards as taxable income, and you must report them on your tax return. Below is a detailed explanation of staking taxes and rules.

1. Tax Treatment of Staking Rewards

The IRS classifies cryptocurrencies as property, meaning staking rewards are taxed like income. When you receive staking rewards, they are subject to ordinary income tax based on their fair market value at the time of receipt.

- If you earn $1,000 worth of staking rewards, you must report $1,000 as taxable income for that year.

- The tax rate depends on your income bracket, ranging from 10% to 37% for federal income tax.

- If you later sell your staked crypto, you may also owe capital gains tax on any profits.

For example, if you receive 2 ETH from staking when ETH is $2,500 each, your taxable income is $5,000. If you later sell those ETH for $3,000 each, you will owe capital gains tax on the $1,000 profit per ETH.

2. Reporting Requirements

All crypto-related income, including staking rewards, must be reported to the IRS. Taxpayers are required to answer a digital asset question on their tax return.

- Form 1040 now asks whether you received digital assets as a reward.

- Staking income is reported as “Other Income” on Schedule 1 (Form 1040).

- If you sell staked crypto, you must report the transaction on Form 8949 and Schedule D.

Failing to report staking income can result in penalties, audits, and additional taxes owed.

3. Short-Term vs. Long-Term Capital Gains

If you sell staked crypto for a profit, you must pay capital gains tax. The rate depends on how long you held the crypto before selling:

- Short-term capital gains (held for less than 1 year) are taxed at the same rate as ordinary income (10%–37%).

- Long-term capital gains (held for more than 1 year) are taxed at 0%, 15%, or 20%, depending on income.

For example, if you stake 5 SOL when it’s worth $50 each and later sell it for $100 each, your taxable gain is $250. If you held it for less than a year, you pay short-term capital gains tax; if you held it for over a year, you qualify for long-term capital gains tax.

4. Self-Staking vs. Exchange Staking

Staking can be done through an exchange (like Binance, Coinbase, or Kraken) or by running your own validator node.

- Exchange Staking: Easier to use, but the exchange may issue a 1099 form reporting your rewards to the IRS.

- Self-Staking (Validator Node): More control but requires technical setup and direct tax reporting.

Exchanges that issue 1099-MISC forms report your staking income to the IRS if you earn over $600 per year. This makes it harder to avoid reporting taxable income.

5. Estimated Tax Payments

If you earn large staking rewards, you may need to pay estimated taxes during the year.

- If you owe over $1,000 in taxes, the IRS requires quarterly estimated tax payments.

- Payments are due in April, June, September, and January of the following year.

Failure to pay estimated taxes can result in penalties.

6. IRS Scrutiny and Audits

The IRS is increasing its enforcement of crypto tax compliance. In 2023, over 1,200 taxpayers received warning letters about unpaid staking income. The IRS also partners with crypto exchanges to track transactions.

If you fail to report staking rewards, you could face:

- Failure-to-file penalty: 5% per month on unpaid taxes.

- Failure-to-pay penalty: 0.5% per month on unpaid taxes.

- Interest on unpaid taxes, compounding daily.

In extreme cases, tax evasion can lead to criminal charges and fines of up to $250,000.

7. Future Tax Regulations

Crypto tax laws are evolving, and new rules may apply in the future:

- The Bipartisan Infrastructure Law (2021) expanded tax reporting for digital assets.

- New proposals may require staking platforms to report all transactions to the IRS.

- Some lawmakers are pushing to exempt staking rewards from immediate taxation until they are sold.

Taxpayers should stay updated on changes to avoid penalties.

8. Best Practices for Tax Compliance

To avoid tax issues, follow these steps:

✔ Keep records of staking transactions, including dates, amounts, and market value.

✔ Use crypto tax software like CoinTracker, Koinly, or TaxBit for automatic reporting.

✔ Consult a tax professional if you earn significant staking rewards.

✔ Pay estimated taxes if required to avoid penalties.

Is Crypto Staking Safe and Legal?

Crypto staking is safe and legal, but it depends on the platform, network security, and regulations in your country. In the U.S., staking is legal, but it is subject to taxation.

The IRS considers staking rewards as taxable income, and some exchanges issue tax forms for reporting. However, regulatory scrutiny is increasing, and new rules may impact staking services in the future.

The safety of staking depends on the platform you choose. Trusted exchanges like Coinbase, Binance, and Bybit offer secure staking options, but using unreliable platforms can lead to scams or loss of funds. There is also a risk of slashing, where validators lose a portion of staked funds due to network violations.

Additionally, staking involves locking your funds, meaning you may not be able to withdraw them during the staking period. Overall, staking is safe if done through reputable platforms and with proper risk management.

How to Choose a Best Cryptocurrency Staking Platform?

- Security and Trust: Always choose a platform with a strong security system. Check if the platform has been hacked before. Look for features like two-factor authentication (2FA) and cold storage for funds. A trusted platform should also have a good reputation and positive reviews from users.

- Regulation and Compliance: A legal and regulated platform is safer. Some countries have strict crypto rules, and regulated platforms follow these laws. Platforms like Coinbase and Kraken follow U.S. regulations, making them safer choices. Avoid platforms that operate in unclear legal areas, as they may shut down suddenly.

- Supported Cryptocurrencies: Not all platforms offer staking for every cryptocurrency. Some platforms support many staking coins, while others have limited options. Check if your preferred cryptocurrency is available for staking before choosing a platform.

- Staking Rewards (APY): Different platforms offer different rewards. APY (Annual Percentage Yield) shows how much you can earn per year. Some platforms offer high APY, but always check if the rewards are realistic. Extremely high rewards may mean high risk.

- Lock-up Periods: Some platforms require you to lock your crypto for a fixed period. During this time, you cannot withdraw or sell your crypto. Lock-up periods can range from a few days to several months. Flexible staking allows you to withdraw anytime but may offer lower rewards. Choose a platform that matches your needs.

- Payout Frequency: Platforms pay staking rewards at different times. Some give rewards daily, while others pay weekly or monthly. If you want frequent payouts, check the payment schedule before staking.

- Minimum Staking Amount: Some platforms require a minimum amount to start staking. If you have a small amount of crypto, choose a platform with a low minimum staking requirement.

- Fees and Charges: Platforms may charge fees for staking, withdrawals, or early unstaking. High fees can reduce your earnings. Always check the fee structure before staking.

- Liquidity and Withdrawal Options: Some platforms make it hard to withdraw your staked crypto before the staking period ends. Others allow early withdrawals but charge a penalty. Make sure you understand the withdrawal rules before staking.

- User Experience and Support: A good platform should be easy to use. Check if the website or app is user-friendly. Also, test the customer support. Reliable platforms offer fast and helpful support through email, chat, or phone.

- Platform Reputation: Read reviews and check user experiences. Platforms with many complaints about delayed payments or poor security should be avoided. Look for platforms that have been in business for a long time.

- Extra Features: Some platforms offer extra benefits like staking insurance, automatic restaking, or additional earning programs. These features can improve your staking experience.

What is Ethereum 2.0 Staking?

The Ethereum network has undergone an update called Ethereum 2 (ETH2) that seeks to increase scalability and security. With this update, Ethereum’s mining model (Proof-of-Work) will change to a staking model (Proof-of-Stake).

As a reward for assisting with network security, you are eligible to get yield on any ETH that you stake. According to the amount of verified ETH and the incentives the network is giving at any given time, ETH staking rewards are delivered.

The protocol payouts will be greater when there is very little ETH staked as a motivator for more ETH to come online. The payoff decreases as more and more ETH is staked.

Conclusion

Staking is seen by crypto investors as a method to make their assets work for them by creating profits rather than accumulating dust in their accounts.

It also contributes to the security and effectiveness of the crypto assets you support. By Staking a portion of your assets, you increase the blockchain’s capacity to withstand cyberattacks and conduct transactions.

Many “best crypto staking platforms” also provide staking players “governance tokens,” which allow them a say in future protocol updates and upgrades.

FAQs

What are Crypto Staking Pools?

A staking pool is a community of stakers that combined their initiatives to strengthen their chances of getting selected as block validators.

Staking pools often generate bigger returns than single stakes, and these gains are shared equally with the pool’s members’ efforts in cryptocurrencies.

The majority of coins that support staking and employ the proof-of-stake consensus process have a large number of active staking pools.

However, as maintaining a staking pool involves a great deal of knowledge and work, most well-known pools charge their users a commission, which is deducted from the staking compensation they get.

Can a Beginner Stake Crypto?

Yes, you can earn staking rewards as a beginner. I will suggest you (not investment advice) consider using flexible staking in centralized exchanges like Binance, and Kucoin.

However, the majority of stake pools are also very beginner-friendly.

To join the staking pool, they have a very minimal minimum investment requirement. They don’t charge withdrawal fees either, so joining a pool and beginning to get returns on your investment is incredibly simple.

The majority of pools also give their participants freedom over how and when they may withdraw their staked assets to a cryptocurrency wallet.

What are some crypto staking risks?

Staking sometimes necessitates a lockup or “vesting” period during which your cryptocurrency cannot be moved. This might be a disadvantage since even if prices change, you won’t be able to swap staked tokens during this time.

Before staking, it is crucial to familiarize yourself with the individual standards and regulations for any project you are considering participating in.

Which is the best crypto-staking platform for the highest rewards?

Top-tier exchanges like Binance, FTX, Kucoin, etc. have the highest staking rewards with 10, 30, and 60-day locking periods.

Is crypto staking safe?

Yes, crypto staking is safe but always use trusted platforms. Many long-term cryptocurrency owners view staking as a means to put their holdings to use by producing rewards rather than letting them sit dormant in their wallets.

Staking also helps the cryptocurrency projects you promote by enhancing their effectiveness and reliability. You may increase the blockchain’s security and transaction processing capacity by staking some of your money.

How can I begin to stake?

In general, everyone who wishes to engage in stakes is welcome. Having said that, turning into a full validator may demand a little financial outlay, technical expertise, and a dedicated computer that can do validations continuously, day and night.

Participating at this level involves security concerns and carries a heavy responsibility because downtime can result in a validator’s stake being reduced.

However, there is a more straightforward approach to engaging the great majority of individuals. You may make any contribution through an exchange such as Binance, or Kucoin without having to buy or maintain pricey validator gear. Most Coinbase users in the US and many other nations can stake their coins also.

Why Staking rewards are not Fixed?

The exact incentive given to staking participants is decided at the moment rewards are provided. Staking payouts are a result of many supply and demand variables on the network.

For instance, staking payouts are higher with fewer node operators and vice versa since the quantity of freshly created tokens is often a predetermined amount in a specified duration.

On each successful checkpoint submission, incentives are given proportionately to each delegator depending on their stake in relation to the total staked by all validators and delegators.

What is the best way to stake crypto?

The best way to stake crypto depends on your experience level and risk tolerance. For beginners, using a centralized exchange like Binance, Bitget, or Coinbase is the easiest option. These platforms handle the technical side and distribute staking rewards automatically. Simply deposit your crypto and choose a staking option.

For more experienced users, running a validator node offers more control and higher rewards. However, this requires technical knowledge, a dedicated computer, and a large amount of crypto. Delegated staking is another option, where you delegate your coins to a trusted validator without managing a node yourself.

Liquid staking platforms like Lido and Rocket Pool allow you to stake without locking your funds. You receive a liquid token (like stETH for Ethereum) that you can trade while still earning staking rewards. This method is useful if you want flexibility while staking.

To choose the best way, consider security, lock-up periods, staking rewards, and platform reliability before staking your crypto.

Is staking worth it crypto?

Staking can be worth it if you want to earn passive income on your crypto holdings. Instead of keeping your crypto idle, staking lets you earn rewards over time. Some cryptocurrencies offer annual percentage yields (APY) between 5% and 20%, which can be much better than traditional bank savings.

However, staking is not risk-free. Your crypto is often locked for a set period, meaning you cannot withdraw it during that time. If the market price drops, you may lose more than you earn in rewards. Some staking programs also involve slashing penalties, where a portion of your funds can be lost if the validator misbehaves.

Staking is worth it if you plan to hold crypto long-term and choose a safe, reputable platform. If you need quick access to your funds or are worried about price drops, flexible staking or liquid staking may be better options.

What is the best crypto staking for beginners?

For beginners, the best staking platforms are Binance and Bitget because they are user-friendly, secure, and offer flexible staking options.

Binance is one of the largest crypto exchanges, providing both locked and flexible staking. Users can stake popular cryptocurrencies like Ethereum (ETH), Solana (SOL), and Cardano (ADA) with just a few clicks. Binance also offers Auto-Staking, allowing users to automatically restake their rewards for compound earnings.

Bitget is another great choice for beginners because of its simple interface and high staking rewards. It supports various staking options and even offers zero-fee staking, making it more attractive for new users.

Both Binance and Bitget handle the technical side of staking, meaning beginners don’t have to worry about running validator nodes or managing security keys. These platforms also offer liquid staking, allowing you to trade staked assets while earning rewards.

Can You Get Rich from Staking Crypto?

Staking crypto can provide steady passive income, but it is not a quick way to get rich. Your earnings depend on the amount of crypto you stake, the APY, and market conditions.

For example, if you stake 10,000 USDT in a staking program with 10% APY, you will earn 1,000 USDT per year. While this is a good return, it may not make you wealthy unless you stake a large amount of crypto.

Some high-yield staking programs offer 20% or more APY, but these often come with risks, such as inflation or unstable projects. To maximize earnings, many investors use compound staking, where they reinvest their staking rewards to grow their holdings over time.

While staking can build wealth over the long term, it is not a guaranteed path to becoming rich. Diversifying investments and choosing safe, high-quality staking projects is the best approach.

What is the Best Crypto for Staking?

The best crypto for staking depends on security, reward rates, and network stability. Some of the most popular staking cryptocurrencies include:

Ethereum (ETH): Offers around 4-6% APY through Ethereum 2.0 staking. It is highly secure and widely adopted.

Cardano (ADA): Provides 3-6% APY, and staking is flexible with no lock-up period.

Solana (SOL): Offers 6-8% APY, but the network has faced reliability issues in the past.

Polkadot (DOT): Has high staking rewards of 10-14% APY, making it attractive for long-term investors.

Cosmos (ATOM): Provides 15-20% APY but requires delegating to a trusted validator.

Choosing the best crypto for staking depends on your risk tolerance, expected returns, and how long you plan to stake.

What is the Average Return on Crypto Staking?

The average return on crypto staking varies depending on the cryptocurrency and staking method.

Low-risk staking (Ethereum, Cardano, Solana): 4-8% APY

Medium-risk staking (Polkadot, Avalanche, Near): 8-12% APY

High-risk staking (Cosmos, smaller projects): 12-20% APY

Some platforms offer higher yields, up to 25% APY, but these often come with higher risks, such as inflation or unstable projects.

Flexible staking usually has lower rewards (2-6%) but allows easy withdrawal. Locked staking offers higher rewards (8-20%), but funds are locked for a set period.

Rewards are paid in the staked cryptocurrency, meaning market price changes can affect your total earnings.

What is the Minimum Amount Required to Stake?

The minimum amount required to stake depends on the platform and cryptocurrency.

Ethereum (ETH2.0 Staking): Requires 32 ETH (about $75,000 at current prices) to run a validator node. However, you can stake smaller amounts on platforms like Binance or Lido.

Cardano (ADA): No minimum staking amount. You can stake any amount through a wallet like Daedalus or Yoroi.

Solana (SOL): Some validators require 1 SOL, while exchanges allow staking with as little as 0.1 SOL.

Polkadot (DOT): Requires at least 1 DOT on exchanges but 120 DOT for self-staking.

Most centralized exchanges allow staking with as little as $1, making it accessible to everyone. Always check the platform’s requirements before staking.

Can I Lose my Staked Cryptocurrency?

Yes, it is possible to lose staked cryptocurrency, but the risks depend on the staking method.

Slashing: If you stake with a validator that behaves incorrectly (goes offline, validates fraudulent transactions), a portion of your funds may be slashed (penalized) by the network.

Platform Risks: If you stake on a centralized exchange and it gets hacked or shuts down, your funds may be at risk. Always choose trusted platforms.

Market Volatility: Even if you earn staking rewards, the value of your crypto may drop. If the price falls 50%, your staking rewards may not cover the loss.

Lock-up Risk: Some staking programs require you to lock your crypto for weeks or months, meaning you cannot sell it during a market crash.

To reduce risks, stake on secure platforms, choose reliable validators, and avoid staking all your funds in one place.