Decentralized exchanges, also called DEXs, let you trade crypto without relying on any middleman. These platforms work on blockchain, so you stay in control of your funds. You just connect your wallet, choose the token you want to trade, and the exchange happens directly with another user. No sign-ups, no custody of your coins, and no third-party risks.

Many people now prefer decentralized crypto exchanges over traditional ones. The reason is simple—more privacy, full control, and no trust issues. When you use a DEX, your crypto stays with you. That means no exchange can freeze, block, or lose your assets. This guide will cover the best decentralized exchanges for beginners based on factors like ease of use, multiple network support, trading fees, wallet compatibility, and overall security.

Note: If you want anonymous trading without KYC with full privacy, check out our list of the best no-KYC crypto exchanges. They allow you to trade with just an email.

Top 15 Best Decentralized Exchanges (Multi-Chain Support)

We have reviewed over 30+ top decentralized exchanges for crypto trading based on security, ease of use, multi-chain support, cross-chain support, and wallet compatibility. Here is our list of the top 15 best decentralized exchanges:

- edgeX: Overall best futures trading decentralized exchange (farm airdrop as well)

- Hyperliquid: Most popular and best decentralized exchange (50M+ traders)

- Vertex: Best Perpetual DEX with High Trading Volume and Multi-Chain Support

- GMX: Best Perpetual DEX on Arbitrum Blockchain

- Uniswap: Best Ethereum Blockchain Decentralized Crypto Exchange

- dYdX: High Trading Volume Decentralized Exchange

- Curve Finance: High TVL Best Decentralized Exchange

- Kine Protocol: Top-Rated and Secure DEX

- Balancer: Best Decentralized Exchange for Beginners

- Pancakeswap: Best DEX on Binance Smart Chain

- DoDo: Best DEX on the Arbitrum blockchain

- ApolloX DEX: High liquidity Decentralized Exchange

- Perpetual Contract: DEX For Top Cryptocurrencies

- Sushiswap: ERC-20 Fork of Uniswap

- TraderJoe: Best Decentralized Exchange on Avalanche

Our Recommended: Top DEXes With 100x Leverage Futures Trading

- edgeX: Overall best decentralized exchange for beginners in 2025

- Hyperliquid: best decentralized exchange for perpetual futures ($2B+ Daily Volume)

- Vertex Protocol: Best DEX on Ethereum and Arbitrum

- GMX: Best Decentralized Perpetual Trading Exchange with 50x Leverage

Here is our in-depth review of the top decentralized exchanges for crypto trading, including spot and futures trading:

1. edgeX: Overall best decentralized exchange for beginners 2025

EdgeX is a high-performance, order-book-based perpetual DEX, built to offer a “native trading experience” for derivatives and perpetuals, but with the autonomy and transparency of DeFi. So, you connect a wallet, keep custody of your assets, and trade perpetual contracts in a decentralized fashion (instead of a centralized exchange).

EdgeX launched in 2023 and supports many trading pairs (169+), with large open interest activity. It offers features like sub-10ms execution speed, 100x leverage, self-custody of assets, and hybrid multi-chain access, while currently operating on a points-based system with a token expected to launch.

Why edgeX is the best DEX

- Self-Custody: EdgeX lets you trade without giving your funds to anyone else. It follows the simple rule: your keys, your assets.

- High Performance: The platform is built for speed and smooth trading. It can handle more than 200,000 orders every second with a delay of less than 10 milliseconds, giving you a fast and responsive trading experience.

- Deep Liquidity: EdgeX offers very strong liquidity, meaning you can trade large amounts without much price change. Even during high market activity, it keeps tight spreads and stable prices.

- Mobile and Web Access: You can trade anytime and anywhere. EdgeX works on both desktop browsers and mobile apps for iOS and Android, so you can easily access your account from any device.

- Easy Login and Setup: Getting started is simple. You can connect popular wallets like MetaMask, Coinbase Wallet, or OKX Wallet, or even use quick social logins for faster access.

2. Hyperliquid: best decentralized exchange for perpetual futures

(Multi-chain: You can deposit assets on chains like Arbitrum, Solana, Ethereum, and more, and then trade without worrying about the chain because it works like a centralized exchange)

Hyperliquid is a decentralized perpetuals exchange built on its own Layer 1 blockchain. It launched in 2023 and quickly became popular due to its fast speeds, zero gas fees, and native on-chain orderbook. The platform supports over 100 perpetual trading pairs, including top crypto assets like ETH, BTC, SOL, AVAX, and more. You don’t need any tokens to use the platform, and there are no gas fees because transactions happen directly on Hyperliquid’s custom Layer 1 chain.

It uses a unique architecture that allows instant trade execution with very low latency, close to centralized exchanges. According to their official stats, the platform crossed over $10 billion in cumulative trading volume within the first few months. Hyperliquid offers up to 50x leverage on certain markets and does not require KYC. You can connect wallets like MetaMask or any EVM-compatible wallet to start trading. The protocol also supports liquidations, insurance fund protection, and cross-margin trading features.

Read: Safest crypto exchanges

Why is Hyperliquid the best DEX?

- Custom Layer 1 Chain: Hyperliquid runs on its high-speed blockchain that allows fast transactions with zero gas fees, unlike most DEXs that depend on slow Layer 1s like Ethereum.

- Native On-Chain Orderbook: It offers a fully on-chain orderbook system that feels like a centralized exchange, with real-time updates, deep liquidity, and no off-chain dependencies.

- High Leverage Options: You get up to 50x leverage on top trading pairs like ETH/USDC or BTC/USDC, which is useful for advanced perpetual trading strategies.

- No KYC and Full Privacy: You don’t need to complete KYC to trade. Just connect your wallet and trade anonymously, which suits privacy-focused traders.

- Strong Community and Token Utility: The HL token supports staking, voting, and rewards. Active traders and liquidity providers can earn HL for contributing to the ecosystem.

3. Vertex Protocol: Best DEX on Ethereum

Vertex Protocol is a decentralized exchange (DEX) built on Arbitrum. It combines spot trading, perpetual futures, and money market features into one platform. Launched in 2023, Vertex offers an on-chain order book and an off-chain matching engine. This hybrid model gives you low-latency trading while keeping custody and settlement on-chain.

You can trade over 35 perpetual markets and multiple spot pairs directly from your wallet. The platform also includes cross-margining and portfolio margin support. This helps you manage risks better and use capital more efficiently. Vertex has its own token called VRTX, which is used for staking, governance, and incentives.

The protocol processes trades using sequencer nodes. This keeps the experience smooth like centralized exchanges. Vertex has processed billions in total trading volume and is one of the most active DEXs on Arbitrum. It does not support multiple chains. Vertex is Arbitrum-only, so if you’re looking for multichain swaps, this platform will not fit.

Why is Vertex Protocol the best DEX?

- All-in-one trading platform: Vertex offers spot, perpetuals, and lending in one place. You don’t need to switch platforms for different trades, which saves time and gas costs.

- High-speed trade execution: Off-chain order matching helps trades settle instantly. This speed is close to centralized exchanges but with full DeFi control and wallet custody.

- Advanced risk tools for traders: Vertex supports portfolio margin and cross-margining. You can manage your margin across assets and reduce liquidation risks during volatile markets.

- Incentive rewards and staking: You can stake the VRTX token to earn rewards and vote in governance. Active traders also get a share of platform incentives based on volume.

- Built only for Arbitrum: Vertex is not multichain. It works only on Arbitrum. This keeps it optimized for speed and cost, but it limits your access to other chains.

4. GMX: Best Decentralized Perpetual Futures Exchange

GMX is a decentralized exchange for perpetual futures and spot trading. It launched in September 2021 and runs on Arbitrum and Avalanche. GMX allows you to trade major cryptocurrencies like BTC, ETH, LINK, and AVAX directly from your wallet.

You can trade with up to 50x leverage using a user-friendly interface. There is no need for a centralized order book. Instead, GMX uses a unique multi-asset pool called GLP. The GLP pool provides liquidity and earns trading fees. This pool is made up of a mix of assets like ETH, WBTC, USDC, and others. GMX charges low swap fees and minimal price impact.

The platform is fully non-custodial. You keep full control over your assets while trading. According to DefiLlama, GMX holds over $600 million in TVL. GMX also has its native token, $GMX, used for governance and earning protocol fees. Holders can stake $GMX to earn 30% of all generated fees. Both Arbitrum and Avalanche versions of the protocol are live and active.

Why is GMX the best DEX?

- Multi-chain access: GMX runs on Arbitrum and Avalanche. You can access the DEX from both chains. It supports cross-chain trading and gives flexibility to users across ecosystems.

- Low trading fees: GMX charges only 0.1% on trades. This is much lower than many other DEXs. Traders save more, especially on high-volume positions.

- Leverage up to 50x: You can trade with leverage up to 50x. GMX supports major assets like BTC and ETH. It suits both retail and pro traders.

- GLP pool provides deep liquidity: Liquidity comes from the GLP pool, made up of assets like USDC, ETH, and BTC. This setup allows instant trade execution without relying on order books.

- Staking rewards for $GMX holders: When you stake $GMX, you earn protocol fees in ETH or AVAX, depending on the chain. Around 30% of platform revenue goes to stakers.

Other Best Crypto Decentralized Exchanges (DEXs) Reviewed

5. Uniswap (V3)

- Average Trading Volume: $760,892,362

- Market Share: 39.9%

- Number of Supported Coins: 884

- Trading Fees: Three fee levels- 0.05%, 0.30%, and 1%

- Supported Cryptocurrencies: Most traded coins on Uniswap are Bitcoin (BTC), Wrapped Ethereum (ETH), and USDC.

Uniswap is one of the best decentralized exchanges (DEX) built on the Ethereum blockchain. It utilizes a unique trading algorithm known as an “automated market maker” (AMM) to allow for fast and easy trading of ERC-20 tokens.

One of the key features of Uniswap is its ease of use. The platform has a simple and user-friendly interface, making it accessible to traders of all experience levels.

Additionally, Uniswap allows for trading without the need for an account or custody of funds, providing an extra layer of security for users.

Uniswap also offers a wide range of trading pairs, with over 3,000 ERC-20 tokens available for trading. This allows for a diverse range of trading options, making it a popular choice among traders.

Another advantage of Uniswap is its liquidity. The platform has a high trading volume, which ensures that trades can be executed quickly and at a fair price.

Uniswap supports many popular crypto wallets like Metamask, Myetherwallet, etc.

Pros and Cons of Uniswap

| Pros | Cons |

|---|---|

| User-friendly interface | High trading fees during network congestion |

| No need for an account or custody of funds | Limited advanced trading features (such as stop-loss orders or margin trading) |

| Wide range of trading pairs (over 3,000 ERC-20 tokens available for trading) | Built on Ethereum blockchain (may be affected by its scalability issues) |

| High liquidity |

Exchange URL: Uniswap

6. dYdX

- Average Trading Volume: $575,730,941

- Number of Supported Coins: 10

- Trading Fees: no gas fees, different maker and taker fees

- supported digital assets: dYdX’s most traded digital currencies are Ethereum, Bitcoin, Solana, Polygon, Avalanche, and Uniswap.

dYdX is a decentralized exchange (DEX) that allows users to trade a variety of assets in a trustless, non-custodial way. It is built on the Ethereum blockchain and utilizes smart contract technology to facilitate trades between users.

One of the unique features of dYdX is its easy-to-use interface. The platform is designed with a user-friendly interface that allows even novice traders to easily navigate and execute trades.

Additionally, dYdX offers advanced trading features such as margin trading and short selling, which can be useful for more experienced traders.

In terms of security, dYdX is a non-custodial exchange which means that users retain full control of their assets at all times.

The platform utilizes smart contracts to execute trades, ensuring that users’ assets are never at risk of being hacked or stolen.

Pros and Cons of dYdX

| Pros | Cons |

|---|---|

| Decentralized | Higher fees |

| High Liquidity | Limited advanced trading features |

| Easy-to-use | No order books |

| Access to a variety of assets (including ERC-20 and ERC-721 tokens) |

7. Curve Finance

- Average Trading Volume: $263,480,861

- Number of Supported Coins: 54

- Trading Fees: 0.04% standard fees

- The platform facilitates the trading of major stablecoins such as DAI, USDC, USDT, FRAX, and TUSD through liquidity pools.

Curve Finance is another best decentralized exchange that allows users to trade various cryptocurrencies with low slippage and high liquidity.

The platform utilizes a unique algorithm called “constant product market maker” which allows for more efficient trading and lower trading fees.

Curve Finance also allows for the creation of custom pools, where users can add their assets and set their trading fees.

This allows for greater flexibility and customization for traders.

Pros and Cons of Curve Finance

| Pros | Cons |

|---|---|

| Low slippage and high liquidity | Limited number of assets available for trading |

| Efficient trading algorithm | Complex platform that may be difficult for new users to navigate |

| Customizable pools | Dependent on the liquidity of the pools created by users |

| Low trading fees | Risk of impermanent loss for liquidity providers |

8. Kine Protocol

- Average Trading Volume: $248,480,861

- Number of Supported Coins: 16

- Trading Fees: 0.1% trading fees fees

The Kine Protocol unlocks a world of possibilities for traders seeking to navigate the derivatives market.

By connecting them to a network of “general purpose” liquidity pools, backed by a diverse array of top-tier crypto assets across multiple blockchain networks, the protocol serves as a steadfast counterpart for traders of perpetual contracts.

With the Kine Protocol, traders can revel in the luxury of zero-slippage execution, bask in the security of guaranteed liquidity, and leverage up to a dizzying 100x with cross margin.

And with the ability to use collateral options such as Ethereum, Binance Smart Chain, Polygon, and Avalanche, the opportunities are limitless.

Participating in the Kine Protocol ecosystem is like being handed the keys to a treasure trove.

Users can choose to take on the role of stakers, traders, or liquidators, each of which opens the door to a unique set of rewards and benefits.

Pros and Cons of Kine Protocol

| Pros | Cons |

|---|---|

| Decentralized | Complexity |

| Synthetic assets | Risk |

| High liquidity | Ethereum network congestion |

9. Balancer (V2)

- Trading Fees: 0.0001% to 10%

- Supports more than 140+ cryptocurrencies

Balancer is a decentralized platform (DEX) that allows users to trade multiple ERC-20 tokens in a single transaction.

It utilizes a unique liquidity pool mechanism, where users can provide liquidity to a pool of tokens and receive a share of the trading fees generated by the pool.

Additionally, Balancer offers a flexible trade execution algorithm that can be customized to suit the needs of different traders.

Pros and Cons of Balancer

| Pros | Cons |

|---|---|

| Decentralized and non-custodial | Limited trading pairs (only ERC-20 tokens) |

| Liquidity pools for efficient trading and reduced slippage | Smart contract risk |

| Flexible trade execution suitable for both novice and advanced traders | Limited scalability due to the Ethereum blockchain |

| Low fees | Less user-friendly compared to centralized exchanges. |

10. ApolloX DEX

- Trading fees: 0.02% maker fee and a 0.07% taker fee

- The ApolloX exchange offers a diverse selection of perpetual trading options for its users, boasting support for over 80 different contract types. Some examples of these contracts include BTC/USDT, ETH/USDT, SOL/USDT, and many others.

ApolloX soars as the ultimate decentralized crypto derivatives destination on the Binance Smart Chain. From its inception in 2021, it has been a beacon for traders seeking a stable, reliable, and robust trading environment.

Its deep liquidity and market depth for perpetual futures trading are second to none. The platform also offers a business-to-business trading solution, the ApolloX DEX Engine, which empowers broker partners to earn commission on transaction fees.

In 2022, ApolloX took decentralization to new heights by announcing its transition to a decentralized autonomous organization (DAO) structure, solidifying its position as a leader in the decentralized trading space.

Pros and Cons of ApolloX dEX

| Pros | Cons |

|---|---|

| Faster and cheaper trades | Limited trading pairs |

| User-friendly interface | Less liquidity compared to centralized exchanges |

| Built-in wallet | order matching issues |

| Mobile app | |

| Token-based referral system |

11. Perpetual Protocol

- DEX Trading Fees: 0.10% maker and taker fee

- Supports Future trading of Bitcoin, Ether, BNB, Cosmos, Avalanche, Cardano, etc.

Perpetual Protocol is a game-changing decentralized exchange (DEX) that empowers traders to delve into the realm of perpetual futures.

The platform was first unveiled on the Ethereum scaling solution xDai and has since undergone an evolution with the launch of V2 on the Ethereum layer-2 (L2) scaling solution Optimism.

Traders on Perpetual Protocol have the opportunity to navigate a plethora of assets with leverage up to 10X and take both long and short positions.

The platform operates on a non-custodial basis, which means traders retain possession of their assets and can execute trades directly from their wallets. This added security and autonomy provide a smooth and hassle-free trading experience for all users.

Perpetual Protocol is an innovative trading arena that offers an unprecedented level of control and freedom to traders.

Pros and Cons of Perpetual Protocol

| Pros | Cons |

|---|---|

| Decentralized perpetual futures trading | Limited blockchain compatibility |

| Leverage and short/long positions | Not suitable for all types of traders |

| Non-custodial | |

| Privacy and open source | |

| Unprecedented control for traders |

12. SushiSwap

- Swap Fees: 0.3%

- It supports all ERC-20 tokens

SushiSwap is a revolutionary decentralized exchange that utilizes the power of automated market makers (AMM) through smart contracts.

This innovative approach allows for the creation of markets for various token trading pairs, all made possible by the tireless efforts of liquidity providers who supply smart contracts with the necessary capital for seamless trading.

SushiSwap was one of the pioneers in this field and was originally a fork of the popular DEX, UniSwap.

Today, it stands tall as one of the largest players in the DeFi ecosystem, available on nearly all EVM-compatible layer-one blockchains and a variety of layer-two solutions for Ethereum.

Pros and Cons of Sushiswap

| Pros | Cons |

|---|---|

| Decentralized exchange (DEX) with no central point of control or failure | Liquidity can be lower compared to centralized exchanges |

| Lower fees than centralized exchanges | User interface can be more complex for new users |

| Built on the Ethereum blockchain, allowing for fast and cheap transactions | Smart contract bugs can lead to loss of funds |

| Community-governed, allowing for decentralized decision making | Potential for front-running or other manipulative trading practices |

| Automated market maker (AMM) |

13. DoDo

- Trading Cost: 0.2-0.8% and network transaction fees

- It supports tokens on Ethereum Virtual Machine supported blockchains like Arbitrum, Avalanche, Optimism, and many others.

DoDo DEX is the best decentralized exchange (DEX) built on the Polygon, Arbitrum, and Binance Smart Chain (BSC) networks.

It allows users to trade various types of assets, including cryptocurrencies, in a trustless and decentralized manner.

One of the main features of DoDo DEX is its fast and low-cost transactions, which are made possible by the high throughput and low fees of the Polygon and BSC networks.

Additionally, the exchange offers a simple and user-friendly interface, making it easy for new users to get started.

Pros and Cons of DODO

| Pros | Cons |

|---|---|

| High throughput and low gas fees | Limited assets available for trading |

| Easy-to-use interface for new users | Less established reputation compared to older exchanges |

| Decentralized platform with trustless nature | Limited features and tools compared to centralized exchanges |

| Built on fast and reliable networks (Polygon and BSC) | Risk of smart contract exploit or security breach |

| High liquidity and trading volume on the platform. | Limited market depth and order book |

14. Pancakeswap

- Transaction Cost: 0.25%

- Supports more than 1300+ coins and tokens including BSC

- Supports digital wallets like Trust Wallet, Atomic wallet, and coinomi wallet.

PancakeSwap is a top-rated decentralized exchange (DEX) built on the Binance Smart Chain (BSC).

It allows users to trade Binance Coin (BNB) and other tokens that are built on BSC, such as Wrapped Binance Coin (WBNB), Aave (AAVE), and more.

PancakeSwap uses an automated market maker (AMM) model, where users can trade tokens without the need for a centralized order book.

Instead, trades are executed against a liquidity pool, which is managed by liquidity providers who earn a share of the trading fees.

PancakeSwap also has its own governance token, CAKE, which can be used to vote on proposals to improve the platform.

Pros and Cons of Pancakeswap

| Pros | Cons |

|---|---|

| High liquidity and low fees | Risk of impermanent loss |

| Large variety of trading pairs | Potential for front-running and flash loan attacks |

| Easy-to-use interface | Lack of regulatory oversight |

| The automated market maker (AMM) model allows for constant liquidity |

15. TraderJOE

- Transaction Fees: 0.3%

- It supports tokens on the Avalanche blockchain as well as ERC-20 Wrapped tokens like WBTC, WETH, etc.

TraderJoe is a decentralized application (dApp) built on the Avalanche blockchain network.

It is a peer-to-peer trading platform that allows users to buy and sell digital assets in a trustless and decentralized manner. It utilizes smart contracts to automate the process of trading, making it faster and more efficient than traditional centralized exchanges.

The Avalanche blockchain provides a high level of scalability, enabling TraderJoe to handle a large number of transactions simultaneously.

Additionally, the use of Avalanche’s subnets allows for increased privacy and security for users.

Pros and Cons of TraderJOE

| Pros | Cons |

|---|---|

| Decentralized exchange (DEX) | Limited selection of trading pairs |

| User control of private keys | Lower liquidity compared to centralized exchanges |

| Reduced risk of hacking or theft | Higher trading fees |

| Increased privacy and security | Limited features and tools compared to centralized exchanges |

| No need for KYC/AML procedures | Possible latency and slow trade execution |

What is Multi-Chain DEX?

A multi-chain DEX is a decentralized exchange that works on more than one blockchain. It lets you trade tokens on different networks like Ethereum, Arbitrum, BNB Chain, or Avalanche. But trading happens only within the same chain.

For example, on a multi-chain DEX, you can swap ETH for USDC on Ethereum or AVAX for BTC on Avalanche—but not between them directly. You have to switch networks using your wallet. Multi-chain DEXs provide access to separate ecosystems from one platform, but they don’t connect them directly in a single transaction.

Read More: How to buy crypto under 18

The best multi-chain DEXs in 2025 are Hyperliquid, GMX, and Vertex Protocol due to their support for multiple networks.

What is Cross-Chain DEX?

A cross-chain DEX goes one step further. It allows you to swap tokens between two different blockchains in one step. You don’t need to manually bridge or switch networks. Cross-chain DEXs use special protocols, wrapped tokens, or relayers to complete these swaps.

For example, you can trade ETH from Ethereum for BNB on BNB Chain using a cross-chain DEX without using a bridge yourself. These DEXs help save time and reduce risks linked to bridges. Some use LayerZero or THORChain to support this function. Cross-chain trading is more complex but gives true interoperability between networks. It connects liquidity and assets across chains directly and efficiently.

Hyperliquid is one of the best cross-chain DEXs in 2025 due to its support for multiple networks like Solana, Arbitrum, Ethereum, and more. You can deposit funds on any of these supported chains and then trade without worrying about protocol or network like CEXs.

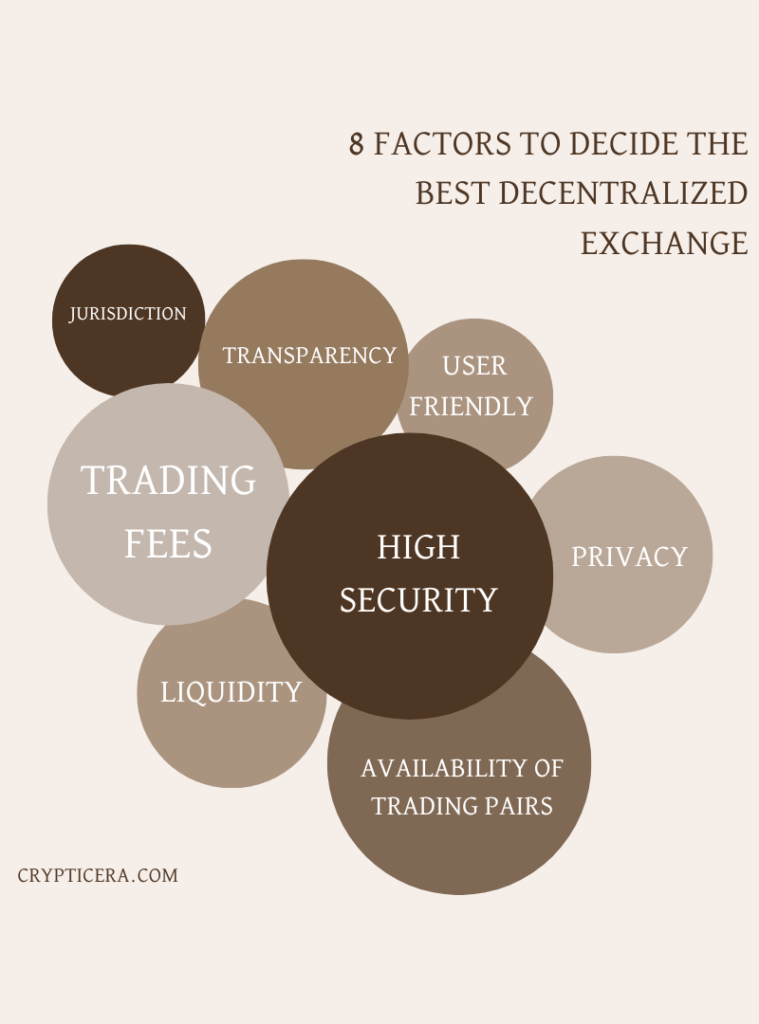

How to Decide the Best Decentralized Exchange?

When deciding on the best decentralized exchange (DEX), there are a few key factors to consider. These include:

- Liquidity: A DEX with high liquidity will ensure that you can easily buy and sell the assets you are interested in.

- Security: It is important to choose a DEX that has a strong track record of security and has taken steps to protect users’ assets.

- User interface: A DEX with a user-friendly interface will make it easier for you to navigate and trade on the platform.

- Trading fees: Compare the trading fees of different DEXs to find the one that offers the best value for your trades.

- Variety of tokens: A DEX that offers a wide range of tokens and assets will give you more options for trading.

- Jurisdiction: Some of the DEX are restricted in some countries, make sure to check the availability of the exchange in your country.

Comparison between the Best Decentralized Exchanges of 2025

| No. of Coins | Exchange type | |

|---|---|---|

| edgeX | 150+ | Perpetual DEX |

| Hyperliquid | 130+ | Both spot and futures trading |

| Vertex | 100+ | Perpetual DEX |

| GMX | 140+ | Perpetual DEX |

| Uniswap | 883 | Swap |

| dYdX | 10 | Orderbook |

| Curve Finance | 129 | Swap |

| Kine protocol | 16 | |

| Balancer | 147 | |

| Pancakeswap | 3812 | Swap |

| DoDo | 80 | Swap |

| ApolloX DEX | 66 | orderbook |

| Perpetual Protocol | 13 | |

| Sushiswap | 434 | Swap |

| TraderJOE | 242 | peer to peer |

What Is a Decentralized Exchange (DEX)?

A decentralized exchange, or DEX, is a digital asset trading platform that operates on a blockchain network.

Unlike centralized exchanges, where users must entrust their funds to a third-party intermediary, DEXs allow for peer-to-peer trading without the need for a centralized authority.

This enables greater security and autonomy for traders, as they have full control over their own private keys and funds.

Furthermore, DEXs offer unparalleled transparency and immutability, thanks to the immutable nature of blockchain technology.

Every transaction is recorded on a public ledger, providing a clear and unchangeable record of all trades.

Types of Decentralized Exchanges

There are several types of decentralized exchanges (DEXs) that operate in different ways, each with its own unique features and benefits.

The main types of DEXs include:

- Automated Market Maker (AMM) DEXs: These DEXs use algorithms to determine the prices of assets and facilitate trades. Popular examples include Uniswap and SushiSwap.

- Order Book DEXs: These DEXs use a traditional order book to match buyers and sellers. Orders are placed on a public ledger and are matched when a buyer and seller agree on a price. Examples include Kyber Network and 0x.

- Hybrid DEXs: These DEXs combine elements of both AMM and order book DEXs. They use a combination of algorithms and order books to facilitate trades.

- Decentralized Finance (DeFi) DEXs: It is built on the Ethereum blockchain and offers a wide range of financial services, including lending, borrowing, and yield farming. They enable users to earn interest on their assets and access various financial products.

- Centralized-Decentralized (CeDe) Exchanges: They use a centralized order book to match buyers and sellers, but settle trades on the blockchain, providing a degree of decentralization.

How to Trade Crypto on Decentralized Exchanges?

Trading on a decentralized exchange (DEX) is simple if you follow a few clear steps. You do not need to create an account. You only need a crypto wallet, some funds, and access to a supported blockchain. Here is a detailed step-by-step guide to help you trade on a DEX like Hyperliquid, one of the best decentralized exchanges.

Step 1. Connect Your Wallet

To start trading on Hyperliquid, you must connect a crypto wallet. The platform supports wallets like MetaMask, Rabby, and WalletConnect. Visit hyperliquid.xyz, click on “Connect Wallet”, and approve the connection. You do not need to provide personal details or register. Your wallet will act as your identity. Make sure your wallet holds funds on supported chains like Ethereum, Arbitrum, or Solana.

Step 2. Choose the Market and Trading Pair

After connecting your wallet, go to the “Trade” section. You will see a list of available markets like ETH-USDC, BTC-USDC, SOL-USDC, and many others. Choose the pair you want to trade. Hyperliquid supports spot and perpetual trading.

If you want to trade with leverage, go to the perpetuals section. You can choose to leverage up to 20x for many assets. Make sure you understand the risk before using high leverage.

Step 3. Set Order Type and Trade Amount

Now select your order type—Market, Limit, or Stop-Limit.

- A Market order will execute instantly at the current price.

- A Limit order lets you set your preferred buy/sell price.

- Stop orders can help you reduce losses or lock profits.

Enter how much you want to trade. Hyperliquid shows margin usage, liquidation price, and fees in real-time before placing the order. You can also enable reduce-only or TP/SL (take profit/stop loss) settings for better control.

Step 4. Approve and Confirm the Trade

After setting the details, click “Buy” or “Sell”. Since Hyperliquid is a gasless DEX, you do not pay gas fees. The transaction will be signed directly through your wallet without any blockchain confirmation wait time.

You will see your position under the “Positions” tab. You can monitor PnL (profit and loss), set TP/SL, or close the trade any time instantly.

5. Close the Position and Withdraw Profits

To end the trade, go to your open position and click “Close”.

You can choose to close fully or partially. Once closed, profits or losses are settled in USDC instantly. You can withdraw your funds directly from the wallet or keep them ready for the next trade.

Hyperliquid does not hold your assets. All trades and balances remain in your wallet. This gives you full control with no lock-ins or custodial risk.

Conclusion on Best DEXes

In conclusion, decentralized exchanges (DEXs) are rapidly becoming a popular alternative to centralized exchanges. They offer a higher level of security and autonomy, as well as a wider range of trading options.

The best decentralized exchanges currently on the market are Uniswap, Sushiswap, and Curve, which have proven to be reliable and user-friendly platforms. However, it’s worth noting that DEXs are still a relatively new technology, and the market is constantly evolving. As such, it’s important to do your own research and due diligence before investing in any DEX.

FAQs on the best Decentralized Exchanges for Crypto

What is the best DEX for crypto?

The best decentralized exchanges (DEXs) are Hyperliquid, GMX, Vertex Protocol, Uniswap, Sushiswap, Pancakeswap, and Kyber Network. These DEXs have high fund security, smart contract privacy, instant order matching, and support for various decentralized crypto wallets.

Which is the popular DEX on Solana?

Serum is the most secure and high-liquidity Decentralized exchange on the Solana (SOL) blockchain.

Name Popular DEXs on Ethereum Blockchain?

Hyperliquid, GMX, Uniswap, Sushiswap, and dYdX are popular Decentralized Exchanges that support all ERC-20 Tokens on the Ethereum network.

What are the most trusted DEX platforms in 2025?

Hyperliquid and GMX are the most trusted decentralized exchanges. Both offer secure, non-custodial trading with high liquidity. Hyperliquid is known for its zero-gas and cross-chain features, while GMX stands out for its deep GLP-backed liquidity and leverage options.

These platforms are widely used by professional traders due to strong performance and transparent on-chain data. They support multiple assets and chains, with low slippage and fast execution. You can trade directly from your wallet, with full control over your funds. Their consistent growth and user trust make them top choices this year.

How to choose a reliable DEX?

To choose a reliable DEX, you need to consider these factors: security, trading volume, supported chains, trading fees, liquidity depth, and user control.

A secure DEX must be audited and allow non-custodial access. Higher trading volume means better liquidity and faster trades. Support for major chains like Ethereum, Arbitrum, or BNB gives flexibility. Lower fees help reduce cost per trade. Deeper liquidity pools prevent slippage. Lastly, a reliable DEX keeps your assets in your control at all times. Hyperliquid and GMX score high across all these areas, making them reliable options.

What are the best cross-chain DEX for low fees?

Hyperliquid is the best cross-chain DEX for low fees. It offers gasless trading on every supported chain, including Ethereum, Solana, and Arbitrum. You don’t pay network fees while opening or closing trades. The platform has a fixed low fee structure for perpetual contracts and doesn’t rely on external bridges.

You get fast execution, deep liquidity, and smooth cross-chain experience without extra costs. It supports a wide range of tokens with low slippage. Hyperliquid’s cost-efficiency and user-first design make it the most affordable option for cross-chain traders right now.

Which cross-chain DEX has the largest volume?

Hyperliquid currently handles the largest cross-chain DEX volume. It processes over $1 billion in daily trading volume across supported networks. Traders prefer it for fast, gasless execution and deep liquidity. The platform supports direct trading across chains like Arbitrum, Ethereum, and Solana.

No need to bridge manually. Hyperliquid uses advanced infrastructure to settle trades instantly and securely. Its rising user base, institutional-grade performance, and massive liquidity pools push it to the top of volume rankings among decentralized exchanges. It’s the most active cross-chain trading platform right now.

What are the most popular decentralized exchanges?

The most popular decentralized exchanges are Hyperliquid, GMX, Uniswap, and dYdX. Among these, Hyperliquid and GMX stand out due to unique features and consistent user growth. Hyperliquid offers cross-chain gasless trading with high-speed execution.

GMX provides leverage trading with deep liquidity through its GLP pool. Both platforms are used widely by traders due to strong reliability, low fees, and ease of use. Uniswap remains popular for basic swaps. dYdX is known for perpetuals. But if you want a modern, fast, and secure experience, GMX and Hyperliquid are the top choices.

What are the top decentralized exchanges by Volume?

Hyperliquid, GMX, and dYdX are leading DEXs by trading volume. Hyperliquid handles over $1 billion in daily volume due to fast cross-chain support. GMX has around $300–500 million daily volume on Arbitrum and Avalanche, supported by its GLP-backed model.

dYdX is active but moving to its own chain. These platforms have high liquidity and large active user bases. They offer serious trading environments and are trusted by pro-level traders. For consistent high-volume trading, Hyperliquid ranks at the top across multiple chains, followed by GMX on Arbitrum.

Is trading on a Decentralized exchange safe?

Yes, trading on a decentralized exchange is safe if the platform is secure, audited, and fully non-custodial. You control your own funds through your wallet. Platforms like Hyperliquid and GMX use on-chain systems, strong smart contracts, and no middlemen. This removes the risk of centralized exchange hacks or frozen accounts.

Always check audit status and platform transparency. Also avoid unknown DEXs with low volume or limited community support. If you use trusted platforms like GMX or Hyperliquid, your funds and trades stay secure and under your full control.