KYC, or “Know Your Customer,” is a rule that most crypto exchanges follow. It means you must verify your identity by submitting documents like a passport, Aadhaar, or driver’s license. This process helps prevent fraud, scams, and money laundering. But not everyone likes it. Many people want to keep their identity private while trading crypto. They don’t want their personal data stored on central servers, which can be hacked or misused.

Because of this, more traders now look for no-KYC crypto exchanges. These platforms let you trade, deposit, and withdraw crypto without showing any ID. You can sign up with just an email, and some don’t even ask for that.

In this guide, you’ll learn why people prefer non-KYC crypto exchanges, how these platforms work, and which ones are the best to use for safe, anonymous crypto trading.

Quick Summary: The best anonymous crypto exchanges for 2025 are MEXC, XT.com, BloFin, Hyperliquid, LBank, CoinEx, and WEEX, which allow for Bitcoin purchases without ID verification.

Best Anonymous Crypto Exchanges Ranked: Top KYC Free Options

I have reviewed over 30+ best no KYC crypto exchanges based on fees, features, anonymity, privacy, security measures, withdrawal limits, and supported coins. Here is our list top 10 best anonymous crypto exchanges:

- MEXC: Overall Best No KYC Crypto Exchange for 2025

- XT.com: Best Anonymous Crypto Platform for Futures Trading

- WEEX: Best Anonymous Exchange for Trading With 400x Leverage

- BloFin: Best KYC-Free Exchange for Perpetual Contracts Trading

- LBank: Top-Rated Anonymous Crypto Exchange for Bitcoin Trading

- CoinEx: Best for Buying Crypto Without ID Verification

- Deepcoin: Best Crypto App With No KYC Requirement for Copy Trading

- CoinW: Best Anonymous Exchange for Crypto Whales and High-Net-Worth Individuals

- Zoomex: Best Private Crypto Exchange to Trade Bitcoin and Altcoins Secretly

- Hyperliquid: Top Decentralized Exchange to Do a Private Crypto Swap

Here are my 2 most trusted anonymous no-KYC exchanges to trade Bitcoin with full privacy…

Top Non-KYC Crypto Exchanges Compared in 2025

We’ve analyzed all the best no KYC crypto exchanges. Here’s a comparison between the top 10 providers:

| Exchange | Cryptocurrencies | Location Restrictions | Custodial? | Trading Fees |

|---|---|---|---|---|

| MEXC | 2,900+ | None | Yes | 0% maker / 0.02% taker |

| XT.com | 980+ | None | Yes | ~0.02% maker / 0.06% taker |

| WEEX | 1,600+ | None | Yes | 0.02% maker / 0.08% taker |

| BloFin | 1,550+ | No access from U.S., Canada, China | Yes | 0.02% maker / 0.06% taker |

| LBank | 750+ | Available in 210 countries | Yes | 0.02% maker / 0.06% taker |

| CoinEx | 1,153+ | U.S. and sanctioned regions restricted | Yes | 0.02% maker / 0.05% taker |

| Deepcoin | 510+ | Available globally; unclear U.S. status | Yes | 0.02% maker / 0.05% taker |

| CoinW | 510+ | None | Yes | ~0.02% maker / 0.05% taker |

| Zoomex | 500+ | Licensed in Canada (MSB); global except sanctioned countries | Yes | 0.02% maker / 0.06% taker |

| Hyperliquid | 130+ | Restricted in U.S., Russia, sanctioned regions | No (DEX) | 0.01% maker / 0.035% taker |

Best No KYC Crypto Exchanges – Full Reviews (Platforms Without ID Verification)

In crypto, a no-KYC exchange means you don’t need to complete identity verification before trading. This allows you to protect your privacy and skip handing over personal details, making the setup quicker, more discreet, and simpler to use. The trade-off is that some anonymous crypto exchanges may restrict features or impose lower withdrawal limits.

For instance, exchanges like Binance enforce KYC, while platforms such as MEXC or XT.com let you trade without it.

If keeping your privacy and speed of access matter more than higher withdrawal thresholds, check out our detailed reviews of the 10 top no-KYC crypto exchanges In these reviews, we compare crucial factors like fees, coin support, platform security, and ease of use.

1. MEXC – Overall Best No KYC Crypto Exchange for 2025

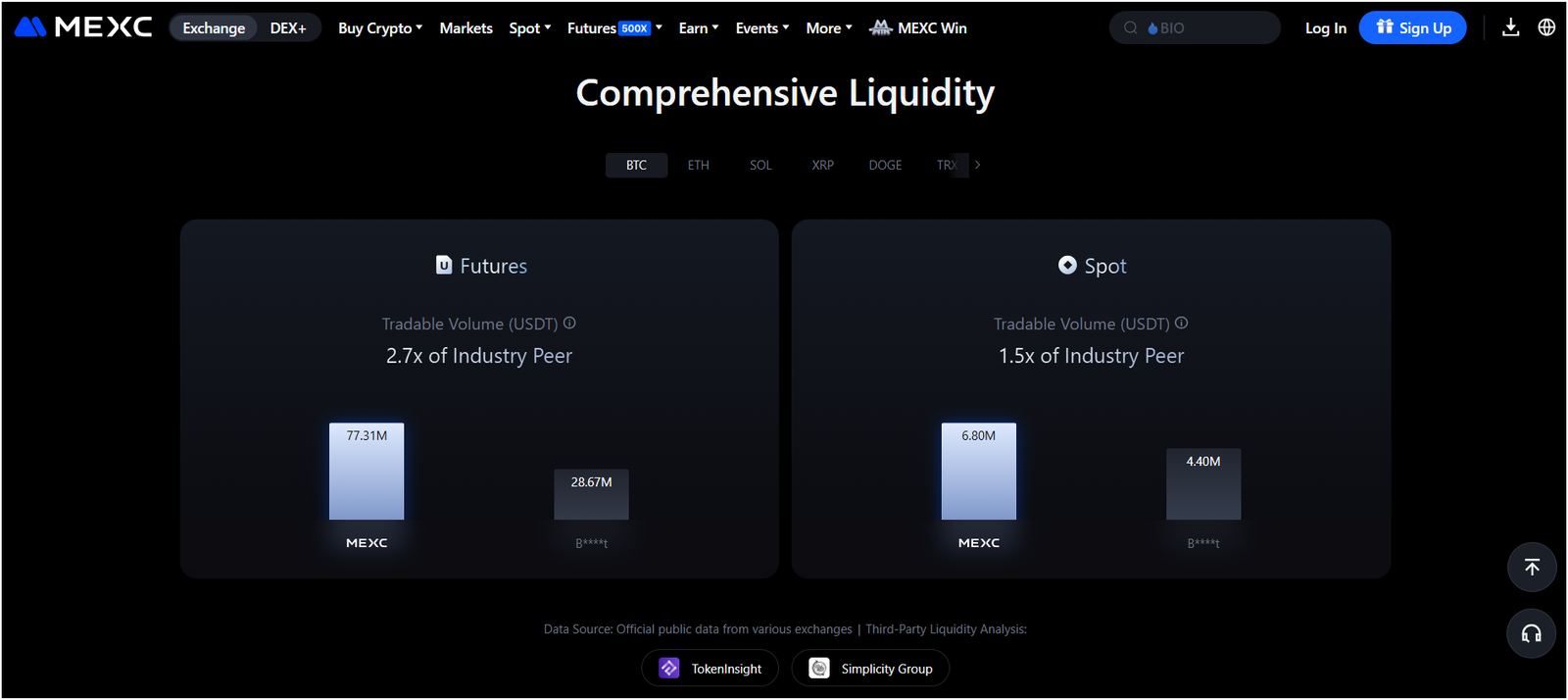

MEXC is one of the best no KYC crypto exchanges for global users. It was launched in 2018 and is operated by MEXC Global Ltd. The platform supports over 2,900 cryptocurrencies, making it one of the largest crypto listings in the world. It offers fast trading, zero-KYC registration, and high withdrawal limits without identity verification.

MEXC is known for offering spot, futures, ETFs, staking, and copy trading on a single platform. The maker fee is 0%, and the taker fee is just 0.05% for spot trading. Futures trading comes with a maker/taker fee of 0.00%/0.02%. You can reduce fees further using the MEXC native token MX, which also offers staking and launchpad benefits.

You do not need to complete KYC to start trading or withdrawing. MEXC allows up to 10 BTC withdrawals per day without any verification, which is very high compared to other platforms. This makes it ideal for privacy-focused crypto users. Hence, this is our #1 best anonymous crypto exchange for Bitcoin trading.

The exchange handles over $2 billion in daily trading volume, supports margin trading, and offers 3x to 200x leverage on futures. MEXC also provides auto-invest, launchpad, and DeFi staking for passive income. The mobile app and web platform are clean and beginner-friendly. MEXC is available in 170+ countries and supports multiple languages. The customer support is live 24/7, and ticket response times are usually under 1 hour. (Read our in-depth MEXC review)

Why we picked it

- Supported Coins: 2,900+ cryptocurrencies, 3,000+ trading pairs

- Trading Fees: Spot: 0% maker, 0.05% taker; Futures: 0% maker, 0.02% taker

- Mobile App: iOS, Android, web browser, desktop app

- KYC Required: No (optional for higher limits)

- Withdrawal Limits Without KYC: 10 BTC per day

- Top Features: High-speed trading engine, copy trading, demo trading, low fees, high withdrawal limits

2. XT.com – Best Anonymous Crypto Platform for Futures Trading

XT.com is the best anonymous crypto exchange no KYC platform that started in 2018. It is registered in Seychelles and headquartered in Hong Kong. It offers spot, margin, and futures trading to over 6 million users worldwide. XT.com supports more than 980+ crypto coins and tokens. KYC is not required to trade or withdraw up to $20,000 USDT per day, making it one of the best no-KYC crypto exchanges in the United States and Europe.

The platform has listed popular tokens like BTC, ETH, SOL, XRP, SHIB, DOGE, and many others. New trending tokens are added regularly. It also offers copy trading, staking, and spot grid trading. You can also access Launchpad projects, DeFi tokens, and IEOs. XT.com has a web platform and mobile apps for both Android and iOS devices. Its user interface is clean and simple, which makes it suitable for beginners.

The trading fee on XT.com depends on the pair. It ranges from 0.1% to 0.2%, which is higher than average, but often includes liquidity service fees. XT.com does not charge deposit fees. Withdrawal fees depend on the asset but are usually fixed.

Security is maintained through cold wallets, DDOS protection, and two-factor authentication. Users can access features like spot grid, futures contracts, and derivatives. If you are looking for the best no-KYC crypto trading platforms, XT.com is a good option for anonymous trading. It supports major altcoins and allows you to trade without ID verification up to a decent daily withdrawal limit.

Why we picked it

- Supported Coins: 980+ cryptocurrencies, including Bitcoin, Ethereum, and altcoins

- Trading Fees: 0.1% for spot trading (maker/taker), discounts for XT token holders

- Devices: iOS, Android, Windows, and web browser apps

- KYC Required: No, optional for basic trading; required for fiat services

- No-KYC Withdrawal Limit: 20,000 USDT per day

- Top Features: High liquidity, 125x futures leverage, staking, copy trading, P2P market

3. WEEX – Best Anonymous Exchange for Trading With 400x Leverage

WEEX, established in 2018 in Singapore, is another best KYC-free crypto exchanges, offering a secure, user-friendly platform for trading over 1,600 cryptocurrencies.

Its no-KYC policy allows privacy-conscious users to trade and withdraw up to 50,000 USDT per transaction and 500,000 USDT daily without identity verification, making it a top choice for anonymous crypto trading. For those who complete KYC, withdrawal limits increase to 100,000 USDT per transaction and 2 million USDT daily, unlocking advanced features like fiat on/off-ramps.

The platform’s competitive fee structure includes 0.10% for spot trading (maker/taker) and 0.02% (maker) / 0.08% (taker) for futures, with zero-fee spot trading on select pairs like RENDER/USDT. WEEX’s mobile app, available on iOS and Android, offers a seamless trading experience with advanced charting tools and fast order execution. Features like copy trading allow users to replicate expert strategies, while WE-Launch enables participation in token airdrops. Security is robust, with a 1,000 BTC protection fund, Proof of Reserves, two-factor authentication (2FA), and cold wallet storage.

WEEX supports high-leverage futures trading (up to 400x), appealing to experienced traders. However, it lacks fiat deposit/withdrawal options, requiring users to transfer crypto from other wallets. The platform’s intuitive interface, multilingual 24/7 support, and referral programs (up to 50% commission) enhance user experience.

Why we picked it

- Supported Coins: Over 1,600 (BTC, ETH, SOL, DOGE, etc.)

- Trading Fees: Spot: 0.10% maker/taker; Futures: 0.02% maker, 0.08% taker

- KYC Required: No (optional for higher limits)

- No-KYC Withdrawal Limit: 50,000 USDT per transaction, 500,000 USDT daily

- Top Features: Copy trading, WE-Launch airdrops, 400x leverage, zero-fee spot pairs

4. BloFin – Best KYC-Free Exchange for Perpetual Contracts Trading

BloFin is a top-tier no-KYC Bitcoin exchange for futures platform, designed for traders prioritizing anonymity and advanced trading tools. With a focus on futures trading, it offers over 1,550 cryptocurrencies, including Bitcoin, Ethereum, and emerging altcoins, across spot and futures markets.

BloFin’s no-KYC investing allows users to trade and withdraw up to 20,000 USDT daily without identity verification, making it ideal for anonymous crypto trading. For those needing higher limits, KYC verification unlocks withdrawals up to 2,000,000 USDT daily. The platform supports over 150 countries but restricts users from the US, Canada, China, and others due to regulatory compliance.

BloFin stands out with its low trading fees: 0.1% for spot trading (maker and taker) and 0.02% maker/0.06% taker for futures, with VIP tiers offering even lower rates. It’s 150x leverage on perpetual futures contracts appeals to high-risk traders, while copy trading and AI-powered trading bots simplify strategies for beginners.

Security is robust, with Fireblocks custody, Merkle Tree proof of reserves, and ISO 27001 certification ensuring asset safety. The platform’s TradingView-integrated interface is user-friendly, and its mobile app supports seamless trading on iOS and Android. BloFin also offers passive income through staking (up to 5.5% APY on USDT) and a referral program with up to 50% commission.

Why we picked it

- Supported Coins: 1,550+ cryptocurrencies, including BTC, ETH, USDT

- Trading Fees: Spot: 0.1% maker/taker; Futures: 0.02% maker, 0.06% taker

- KYC Required: No, optional for higher withdrawal limits

- Withdrawal Limit Without Verification: 20,000 USDT per 24 hours

- Top Features: 150x leverage, copy trading, trading bots, staking, secure custody

5. LBank – Top-Rated Anonymous Crypto Exchange for Bitcoin Trading

LBank is another one of the best crypto exchanges without KYC needs, offering a user-friendly platform for trading over 750 cryptocurrencies, including Bitcoin, Ethereum, Solana, and trending meme coins like PEPE and SNEK. Headquartered in Hong Kong, it serves over 7 million users across 210 countries.

LBank’s no-KYC crypto trading makes it a top choice for privacy-focused traders, allowing anonymous trading with a high daily withdrawal limit of up to 10 BTC for non-verified users. The platform supports spot trading, futures trading with up to 200x leverage, and advanced tools like copy trading and grid trading bots, ideal for both beginners and experienced traders.

LBank’s trading fees are competitive, with spot trading at 0.1% for makers and takers, and futures trading at 0.02% for makers and 0.06% for takers. It supports over 100 fiat currencies, including USD, EUR, and AUD, with free deposits via bank transfers, Apple Pay, and P2P methods. Withdrawals incur network-specific fees, like 0.001 BTC for Bitcoin.

The platform offers staking with APY ranging from 2% to 290%, depending on the asset, and a flexible earning tool for daily interest without lock-up periods. LBank’s mobile app, available on iOS and Android, ensures seamless trading on the go, while its web platform provides advanced charting via TradingView. Security features include 2FA, cold wallet storage, and Merkle tree proof-of-reserves for transparency.

Why we picked it

- Supported Coins: 750+ (Bitcoin, Ethereum, Solana, PEPE, SNEK)

- Trading Fees – Spot: 0.1% maker/taker; Futures: 0.02% maker, 0.06% taker

- KYC Required: No (Optional for higher limits)

- Withdrawal Limit Without Verification: 10 BTC per day

- Top Features: No-KYC trading, 200x leverage futures, copy trading, staking, NFT marketplace

6. CoinEx – Best for Buying Crypto Without ID Verification and User-Friendly Interface

CoinEx, the best non-KYC exchange, is a Hong Kong-based platform founded in 2017 by Haipo Yang, part of the ViaBTC Group. Known for its privacy-focused crypto trading, CoinEx allows users to trade without mandatory KYC verification, making it ideal for those seeking anonymous cryptocurrency trading. With over 2 million users across 200+ countries, it supports 15 languages, ensuring global accessibility.

The platform’s high-speed trading engine handles up to 10,000 transactions per second, offering a seamless experience for spot trading, margin trading, and futures trading. CoinEx lists over 1,153 cryptocurrencies, including Bitcoin, Ethereum, Solana, and niche altcoins like Kekius and Gigachad, with 1,021+ trading pairs. Its user-friendly crypto platform interface suits both beginners and seasoned traders, featuring TradingView-powered charts for technical analysis.

For no-KYC crypto trading, CoinEx allows withdrawals up to 10,000 USDT daily without verification, while verified users can withdraw up to 1,000,000 USDT. The platform’s trading fees are competitive, starting at 0.2% for spot trading and dropping to 0.16% with CET, CoinEx’s native token, which also reduces gas fees on the CoinEx Smart Chain.

Security is robust, with cold wallet storage, HTTPS encryption, two-factor authentication (2FA), and a 100% reserve-backed Shield Fund. CoinEx’s mobile app, available on iOS and Android, mirrors the web platform’s functionality, enabling crypto trading on the go. It supports fiat deposits via third-party processors like Banxa, but fiat withdrawals are unavailable. Despite a 2023 hot wallet hack of $70 million, user funds remained safe, showcasing CoinEx’s commitment to security.

Why we picked it

- Supported Coins: 1,153+ coins, including BTC, ETH, SOL, and niche altcoins like Kekius

- Trading Fees: 0.2% spot, 0.16% with CET; futures maker/taker: 0.02%/0.05%

- KYC Required: No, optional for higher withdrawal limits

- No-KYC Withdrawal Limit: 10,000 USDT daily; 50,000 USDT over 30 days

- Top Features: Spot, margin, futures trading; TradingView charts; CET token fee discounts

7. Deepcoin – Best Crypto App With No KYC Requirement for Copy Trading

Deepcoin is a centralized no-KYC cryptocurrency exchange founded in 2018 and based in Singapore. It allows users to start trading without mandatory KYC, so you can register with just an email and begin quickly.

You can trade both spot and derivatives markets on Deepcoin. It offers over 510 cryptocurrencies, including USDT perpetual and inverse perpetual contracts. Derivatives traders may use up to 125× leverage.

Deepcoin stands out with its advanced trading tools, such as copy trading, demo trading, flexible position merging and splitting, and sophisticated order types like TP/SL and conditional setups. It uses a high-performance matching engine and COBO custody, and includes standard safeguards like 2FA, cold storage, SSL encryption, and a three-tier wallet system.

While KYC isn’t required for basic trading, Deepcoin does require identity checks if you want to access fiat services or higher withdrawal limits.

Why we picked it

- Supported Coins: 510+ coins, including BTC, ETH, SOL, and niche altcoins like Kekius

- Trading Fees: 0.1% spot, futures maker/taker: 0.02%/0.05%

- KYC Required: No, optional for higher withdrawal limits

- No-KYC Withdrawal Limit: 1 BTC per day

- Top Features: Spot, margin, futures trading, copy trading, and more

8. CoinW – Best Anonymous Exchange for Crypto Whales and High-Net-Worth Individuals

CoinW is another one of the best no KYC crypto exchanges that allows users to start trading without mandatory KYC (Know Your Customer) verification. You just need to sign up with an email or phone number, and you can begin spot and futures trading right away. Non‑KYC users fall under the lowest level (C0) and enjoy a generous withdrawal limit of up to 2 BTC per day without needing to verify identity.

If you choose to complete KYC verification, you gain access to higher withdrawal thresholds: Level 2 (C2) unlocks withdrawal up to 10 BTC per day, and Level 3 allows up to 100 BTC daily.

CoinW supports a wide range of services, including spot, margin, futures trading, ETFs, and a copy‑trading feature that allows beginner traders to follow more experienced ones. It serves millions of users in over 150 countries and is licensed in several jurisdictions.

Why we picked it

- Supported Coins: 510+ coins, including BTC, ETH, SOL, and niche altcoins like Kekius.

- Trading Fees: approximately 0.02% maker-taker model for futures, with spot trading free at level 1.

- KYC Required: No, optional for higher withdrawal limits.

- Withdrawal Limit Without Verification: Up to 2 BTC per day (C0 level).

- Top Features: Spot, futures, ETFs, margin trading, copy trading, and more.

9. Zoomex – Best Private Crypto Exchange to Trade Bitcoin and Altcoins Secretly

Zoomex is a modern zero-KYC crypto exchange founded in 2021, operating globally with both centralized (CEX) and decentralized (DEX) trading options. You can register with just an email or phone number – no mandatory KYC is required to start trading.

Users without KYC can withdraw up to 100 BTC per day, while completing basic verification (KYC Level 1) raises the limit to 200 BTC daily. This makes it one of the best anonymous crypto exchanges for Bitcoin.

Zoomex supports over 500 cryptocurrencies, including major ones like BTC, ETH, SOL, and many smaller altcoins. Traders can access spot, futures, and perpetual swaps with leverage up to 1,000×, plus advanced tools like copy trading and access to both CEX and DEX within the same platform.

The platform emphasizes security and reliability, offering features like cold storage, two‑factor authentication (2FA), a $50 million insurance fund, and regular third‑party security audits. Zoomex holds a Money Services Business (MSB) license from FINTRAC in Canada and is certified by Hacken, reinforcing its compliance and safety.

Zoomex Key Takeaways

- Supported Coins: 500+ cryptos, including BTC, ETH, SOL, and niche altcoins.

- Trading Fees: 0.1% maker/taker spot fees; futures fees from 0.02% maker / 0.06% taker.

- KYC Required: No, optional if you want higher daily withdrawal limit.

- Withdrawal Limit Without Verification: Up to 100 BTC per day with no KYC.

- Top Features: Spot, futures, DEX/CEX hybrid, advanced tools, and copy trading.

10. Hyperliquid – Top Decentralized Exchange to Do a Private Crypto Swap

Hyperliquid is a top-tier no-KYC decentralized cryptocurrency exchange (DEX) built on its own high-performance Layer-1 blockchain, HyperEVM, launched in 2023 by Harvard alumni Jeff Yan and Iliensinc. It’s among the exchanges that do not require a KYC process, offering privacy-focused trading with no identity verification, making it ideal for users seeking anonymous crypto trading platforms.

Hyperliquid combines centralized exchange (CEX) speed with decentralized finance (DeFi) transparency, processing up to 200,000 transactions per second using its HyperBFT consensus algorithm. It specializes in perpetual futures trading, supporting over 130 crypto assets, including BTC, ETH, and AVAX, with up to 50x leverage for advanced traders.

The platform’s fully on-chain order book ensures transparent crypto trading, recording all trades on the blockchain for verifiable security. Hyperliquid offers zero gas fees, a major draw for cost-effective crypto trading, with low maker fees at 0.01% and taker fees at 0.035%.

Its Hyperliquidity Provider (HLP) vault allows users to deposit USDC and earn 0-15% APR by sharing trading revenue. The platform supports cross-margin and isolated-margin trading, advanced order types like stop-loss and take-profit, and copy trading via user vaults. Hyperliquid is accessible in over 180 countries but restricts users from the U.S., Russia, and sanctioned regions.

Hyperliquid Key Takeaways

- Supported Coins: 130+ (BTC, ETH, AVAX, etc.)

- Trading Fees Maker: 0.01%, Taker: 0.035%

- Devices: Web browser, mobile-optimized via MetaMask/Trust Wallet

- KYC Required: No

- No-KYC Withdrawal Limit: No limits

- Top Features: Zero gas fees, on-chain order book, 50x leverage, HLP vault

Best No KYC Wallets to Store Crypto Assets Anonymously

Now we have discussed the best no-KYC crypto exchanges for trading and investing, here are the top 2 anonymous wallets for cryptocurrency storage:

ELLIPAL Titan 2.0: Anonymous Wallet

Ledger Nano X: Private Crypto Storage Device

How to Pick the Best No KYC Exchange to Trade Crypto Anonymously?

Choosing the best crypto no-KYC exchange can feel like picking the perfect pizza—everyone’s got different tastes, and you want one that hits all the right spots. But with so many options out there, how do you pick the right one?

Don’t worry, I’ve got you covered with 7 key criteria to help you find the best no-KYC crypto exchange in 2025.

1. Privacy and Anonymity

Why It Matters: The whole point is to keep your identity private. The best exchanges let you trade without asking for personal details like your name, ID, or selfie. This is super important if you value anonymity and don’t want your data stored or shared.

What to Look For:

- No ID Required: The exchange should only ask for an email or let you trade by connecting a crypto wallet (like MetaMask). Platforms like MEXC or XT.com are great examples; they’re fully anonymous decentralized exchanges (DEXs).

- Data Security: Check if the platform has a clear privacy policy and doesn’t store unnecessary data. Centralized exchanges (CEXs) might offer no-KYC trading but could still collect some info, so read the fine print.

- IP Protection: Some exchanges might track your IP address. For max privacy, use a VPN or pick a platform that doesn’t log your activity.

2. Security and Reliability

Why It Matters: When you’re trading crypto, your funds need to be safe. A secure non-KYC exchange protects your money from hacks, scams, or shady practices. Since no-KYC platforms often have less regulation, security is a big deal.

What to Look For:

- Platform Type: Decentralized exchanges (DEXs) like Uniswap or Hyperliquid are non-custodial, meaning you control your funds in your own wallet. Centralized exchanges (CEXs) like XT.com hold your funds, so they need strong security measures.

- Track Record: Look for exchanges with a good reputation and no major hacks. Check X posts or reviews on sites like CoinBureau to see what users say. For example, MEXC has been around since 2018 with a solid track record.

- Security Features: Ensure the platform offers two-factor authentication (2FA), encryption, and secure wallet integration. For DEXs, make sure you understand how to secure your private keys or seed phrase.

- Transparency: Trusted exchanges share info about their team or operations. Avoid platforms with no online presence or sketchy vibes.

3. Supported Cryptocurrencies and Trading Pairs

Why It Matters: You want the best no-KYC cryptocurrency exchange that lets you trade the coins you’re interested in. Some exchanges only support a few big coins like Bitcoin (BTC) or Ethereum (ETH), while others offer thousands of tokens, including new or niche ones.

What to Look For:

- Coin Variety: Check if the exchange supports the cryptocurrencies you want. For example, MEXC supports over 3,000 coins across 100+ blockchains, while Hyperlliquid focuses on established coins.

- Trading Pairs: Look for pairs like BTC/USDT or ETH/BNB. More pairs mean more trading options. MEXC shines here with over 3,000 coins and tons of pairs.

- New Tokens: If you’re into new or trending coins (like meme coins), platforms like Uniswap or Changelly are great for finding them.

- Cross-Chain Support: For DEXs, check if they support multiple blockchains (like Ethereum, Solana, or Binance Smart Chain).

4. Fees and Costs

Why It Matters: Nobody likes paying high fees! The best no-KYC crypto exchanges keep trading costs low so you can keep more of your profits. Fees can vary a lot, especially between CEXs and DEXs.

What to Look For:

- Trading Fees: CEXs like MEXC have super low fees (0% maker, 0.02% taker for spot trading). DEXs like Uniswap charge a small percentage (usually 0.3%) per swap.

- Network Fees: On DEXs, you’ll pay “gas fees” for blockchain transactions. These can be high on Ethereum during busy times, so check if the exchange supports cheaper chains like Polygon or Solana.

- Hidden Costs: Some platforms charge extra for withdrawals or swaps. Zoomex has slightly higher fees for convenience, so compare rates before trading.

- Fee Discounts: Some CEXs offer lower fees if you use their native token (like MX) for payments.

5. Withdrawal Limits and Restrictions

Why It Matters: No-KYC exchanges often limit how much you can withdraw without verifying your identity. The best no-KYC exchange will have high or no withdrawal limits so you can access your funds easily.

What to Look For:

- High Limits: MEXC lets non-KYC users withdraw up to 10 BTC daily, which is huge.

- No Limits on DEXs: Decentralized platforms like Uniswap or GhostSwap have no withdrawal limits since you control your wallet.

- Fiat Withdrawals: Most no-KYC exchanges don’t support fiat withdrawals (like to your bank) without KYC. If you need fiat, you might need a third-party service, which could require ID.

6. Ease of Use and Interface

Why It Matters: A user-friendly non-KYC crypto exchange makes trading quick and stress-free, especially if you’re new to crypto. A clunky or confusing platform can lead to mistakes or frustration.

What to Look For:

- Mobile Apps: If you trade on your phone, pick an exchange with a great app.

- Wallet Integration: For DEXs, check how easy it is to connect your wallet (like MetaMask or Trust Wallet).

- Support and Guides: Look for exchanges with 24/7 customer support or clear tutorials.

7. Availability in Your Country

Why It Matters: Not all BITCOIN exchanges without KYC are available everywhere. Some block users from countries like the USA or the UK due to regulations. Picking an exchange that works in your region is key.

What to Look For:

- Global Access: DEXs like Uniswap and Hyperliquid are usually available worldwide since they’re decentralized and don’t rely on a central company.

- VPN Risks: Using a VPN to bypass country restrictions (like accessing Bybit from the USA) can get your account banned or funds frozen. Avoid this unless you’re sure it’s allowed.

- USA-Friendly Options: MEXC is one of the few no-KYC CEXs available in the USA, making it a solid pick for American users.

What Is a No KYC Crypto Exchange?

First, let’s talk about what “KYC” means. KYC stands for “Know Your Customer.” It’s a process where cryptocurrency exchanges ask you to share personal info like your name, address, ID, or even a selfie to verify who you are. This is usually to follow rules that stop things like money laundering or fraud.

A no-KYC exchange is a platform where you can buy, sell, or trade cryptocurrencies without sharing any of that personal stuff. You can stay anonymous, which is awesome for people who value privacy. These exchanges let you trade with just an email or a crypto wallet address, making things quick and private.

But here’s the catch: no-KYC doesn’t mean “no rules.” Some platforms might still have limits, like how much you can withdraw, or they might ask for KYC if you want to use certain features. Plus, there are risks, like less regulation or security concerns, so you gotta be careful.

How does a non-KYC exchange work?

First, you don’t need to go through any ID verification process. You just visit the website or app, create a simple account using your email, and start trading. Some no-KYC platforms even allow full trading and withdrawals without asking you to create an account. You can just connect your wallet and trade directly.

Most no-KYC platforms work with crypto-to-crypto trading pairs. This means you can exchange Bitcoin to Ethereum, or USDT to BNB, without using bank transfers or fiat currency. But some also support crypto purchases using debit cards or P2P methods without KYC.

You are given full control of your crypto funds. Many of these exchanges are decentralized or semi-centralized. That means you can connect your wallet and keep your funds safe on your own. You don’t need to trust a third-party with your private keys. Also, your trading history stays private because there is no name or ID attached to your account.

There are two main types of best no-KYC crypto exchanges, and they work a bit differently:

- Centralized Exchanges (CEXs): These are run by a company, like MEXC, XT.com, or BloFin. You usually sign up with an email, deposit crypto, and start trading. They hold your funds while you trade, which is convenient but means you’re trusting them to keep your money safe. They might have withdrawal limits for non-KYC users, and some features (like fiat deposits) might require KYC.

- Decentralized Exchanges (DEXs): These are peer-to-peer no KYC platforms, like Uniswap, Hyperliquid, or GMX. You connect a crypto wallet (like MetaMask or Trust Wallet), and trades happen directly between users through smart contracts. You always control your funds, but you need to have crypto already to start trading (no fiat options on most DEXs).

Read: Lowest fee crypto exchanges

Benefits of Using a No KYC Crypto Exchange

The biggest advantage of using a no KYC crypto exchange is freedom. You don’t need to go through lengthy identity checks before buying or selling digital assets. This makes the process faster and more convenient, especially for users who value privacy.

Many traders also choose best no KYC exchanges because they don’t want to risk sharing sensitive ID documents online. Another major benefit is the ability to get started immediately. You simply create an account with an email and begin trading, which is far more convenient compared to KYC-based platforms.

You Can Trade Cryptocurrencies Anonymously

One of the most attractive features of a KYC -free crypto exchange is the ability to trade cryptocurrencies anonymously. Traditional exchanges require users to provide ID proofs, address verification, and sometimes even biometric data.

With no KYC platforms, you can buy, sell, or transfer crypto without linking your personal details. This makes it easier for privacy-focused users to manage their holdings without surveillance. Anonymous trading also protects you from data leaks, which are common in centralized financial systems. For many, anonymity is not just convenience, but a key principle of decentralized finance and crypto ownership.

There’s No Account Registration Required

Some best no-KYC crypto exchanges allow trading without even creating a full account. Instead of signing up with detailed personal information, you can often start by simply entering an email or using a crypto wallet address.

This “instant access” is a huge benefit for users who want to trade quickly or only make a one-time transaction. It eliminates unnecessary barriers and speeds up the trading process. By removing account registration requirements, no KYC platforms create a simple way for both beginners and advanced users to trade efficiently, while also reducing risks tied to storing identity data online.

You Can Trade Crypto in a Country With Strict Regulations (Like U.S. and UK)

Many countries, including the U.S. and UK, enforce strict KYC and AML rules on cryptocurrency exchanges. For residents of these regions, access to global trading platforms becomes limited. A best non-KYC crypto exchange can bypass these restrictions and let you trade freely, even if your country has harsh regulations.

By not requiring government ID, these exchanges open the door to international trading without compliance barriers. However, users should remain aware of local laws, as some regulators actively monitor crypto activity. Still, for many traders, the ability to access global markets without KYC remains a strong advantage.

You Will Avoid Exchange Risks Related to Hacks and Bankruptcy

Another reason to use the best no-KYC cryptocurrency exchange is reduced exposure to hacks and bankruptcies. When an exchange stores your identity data, it creates a new target for hackers. Many high-profile data leaks in the past involved stolen KYC documents, which were later sold online.

By avoiding KYC, you limit the personal information stored by exchanges, minimizing this risk. Furthermore, no KYC users often rely more on self-custody wallets for holding funds, reducing dependence on centralized platforms. In case an exchange faces bankruptcy, you are safer if your personal data was never linked to your account.

You Can Keep Your Personal Data Private and Secure

In the digital age, data privacy is more important than ever. A anonymous crypto exchange ensures that you can trade while keeping your personal details secure. Unlike KYC platforms, which demand passport scans, driver’s licenses, or even selfies, no KYC platforms require minimal to no personal information.

This prevents your data from being stored on centralized servers that can be hacked or misused. Privacy-focused users see this as one of the strongest reasons to choose a no KYC exchange. By protecting your identity, you gain peace of mind while enjoying fast, secure, and flexible crypto trading.

Risks of Using a KYC-Free Crypto Exchange

- Limited Withdrawal Limits – Most no KYC crypto exchanges restrict how much you can withdraw daily, often capping at 1–2 BTC without identity verification.

- No Fiat Support – Many KYC-free exchanges do not support bank transfers or fiat deposits, forcing users to rely only on cryptocurrencies.

- Higher Regulatory Risk – Operating without KYC may lead to sudden restrictions or shutdowns if regulators target the platform.

- Potential for Scams – Some small KYC-free exchanges are less transparent, which increases the risk of fraud or exit scams.

- Lower Customer Protection – If funds are lost due to hacks or system issues, users may have fewer legal options to recover them.

- Country Access Restrictions – Even though they don’t require identity checks, some exchanges without verification still block users from regions like the U.S. or UK.

Are Non-KYC Exchanges Safe and Legal?

No-KYC crypto exchanges can be safe, but you must be careful while using them. These platforms give you more privacy, but they also come with some risks. You need to understand both sides clearly before trusting them with your funds.

A no-KYC exchange does not ask for your personal documents like ID proof, address, or selfie. This keeps your identity private and protects you from data leaks or government tracking. If privacy is your priority, no-KYC platforms are a good choice. You also avoid the risk of your personal details being stolen or misused, which can happen on big centralized exchanges with KYC.

Many of the best no-KYC crypto trading exchanges are safe and well-known in the crypto world. They use strong security systems like cold wallet storage, two-factor authentication, encryption, and anti-phishing protection. Some platforms even let you trade directly from your own wallet without ever giving control of your crypto to the exchange. This makes it harder for hackers to steal your funds.

But not all no-KYC exchanges are safe. Some may be shady or poorly built. A few may disappear with your funds because they are not regulated or verified. That’s why you must always check the platform’s background, trading volume, online reviews, and reputation before using it. It’s also important to see if the exchange has had any hacks or major issues in the past.

Another thing to understand is that if your funds are lost or frozen, there’s no KYC identity to help you recover your account. No-KYC means more freedom, but it also means you are fully responsible for your crypto and your safety.

So yes, no-KYC exchanges can be safe, but only if you use the trusted ones. Always do your own research. Start with small amounts. Keep your crypto in your own wallet whenever possible. And never store large funds on any exchange, KYC or no-KYC.

Read More: Best crypto cold storage wallets

How to Buy Crypto Without KYC or ID Verification?

You can buy crypto without showing ID by using no-KYC exchanges like MEXC. These platforms let you trade without asking for documents.

- Use No-KYC Exchanges like MEXC: You can register on MEXC with just an email. No ID or selfie is needed to start trading or depositing crypto.

- Use P2P (Peer-to-Peer) Platforms: Some platforms offer peer-to-peer trading where buyers and sellers connect directly. You can pay using bank transfer or other methods.

- Buy with Crypto Vouchers or Gift Cards: In some regions, you can buy crypto vouchers from local stores and redeem them online. No KYC is required in this method.

- Use Decentralized Exchanges (DEXs): You can connect a crypto wallet like MetaMask and trade tokens without an account or ID.

- Avoid Bank Transfers or Cards: These payment methods often trigger KYC checks. Instead, use stablecoins or crypto transfers to stay anonymous.

Read More: Best Bitcoin exchanges

How to Buy Crypto Anonymously in 2025?

Today, many tools help you buy crypto without revealing your identity. Follow these safe and private steps:

- Choose a No-KYC Exchange like MEXC: MEXC lets you register using only an email. You can trade Bitcoin, Ethereum, or other coins without ID.

- Use Privacy Coins Like Monero (XMR): Coins like XMR are designed for privacy. You can buy them on platforms that don’t ask for identity proof.

- Use Decentralized Platforms (DEXs): Platforms like Uniswap or PancakeSwap allow wallet-based trading. You don’t need to register or complete KYC.

- Use P2P with Caution: P2P platforms let you buy from other users using local payment methods. Make sure to pick trusted sellers to avoid scams.

- Avoid Linking to Your Real Identity: Don’t use emails or phone numbers linked to your personal accounts. Use privacy tools like VPNs and burner emails.

How to Send Crypto without KYC?

Sending crypto anonymously needs care and the right tools. You can follow these simple methods to keep your identity hidden.

- Use Privacy Coins Like Monero (XMR): XMR hides sender and receiver info. It is the best option for anonymous transactions.

- Use Mixers or Tumblers (If Legal in Your Area): Crypto mixers mix your coins with others and send them to the final address. This breaks the link between you and your funds.

- Use Wallets that Don’t Track Identity: Choose non-custodial wallets like Trust Wallet or MetaMask. They don’t store personal data or KYC info.

- Avoid Centralized Exchanges for Sending: Platforms like MEXC don’t ask for KYC, but most centralized exchanges keep logs. Withdraw to a private wallet first before sending.

- Use VPNs and Private Networks: Your IP can link back to you. Using a VPN helps hide your location and activity while sending crypto.

How to Buy DeFi Tokens Anonymously?

You can buy DeFi tokens without revealing your identity by using the right tools. Here’s how you can do it step-by-step.

- Use DEXs (Decentralized Exchanges): Platforms like Uniswap or PancakeSwap allow you to swap tokens from your wallet without sign-up.

- Connect a Non-Custodial Wallet: Use wallets like MetaMask, Trust Wallet, or SafePal. These don’t ask for any ID or KYC.

- Fund Wallet Using No-KYC Exchange Like MEXC: Buy a popular token like USDT or ETH on MEXC, then send it to your DeFi wallet. From there, use DEXs to buy DeFi tokens.

- Swap Using Privacy Tools: Some DEXs offer private swapping or bridges. This helps mask your token swap history.

- Avoid Using Identifiable Payment Methods: Don’t use cards or bank transfers. Use crypto-to-crypto methods to stay fully anonymous.

How to Swap Tokens Securely Without KYC?

You can easily swap tokens without sharing ID. Just follow these simple and private steps.

- Use DEXs Like Uniswap or PancakeSwap: These let you swap tokens directly from your wallet. No sign-up or verification is needed.

- Choose a No-KYC Exchange like MEXC for Funding: You can buy stablecoins or ETH on MEXC, then send them to your private wallet for swapping.

- Use a Secure Wallet for All Swaps: Trust Wallet or MetaMask allows direct DEX connections. You hold the keys and stay in control.

- Check Smart Contract Safety: Always check the contract address of a token before swapping. Avoid scam tokens with fake names.

- Use VPN and Avoid Tracking Tools: Swap tokens on private networks to avoid linking your IP with wallet addresses.

Read More: How to buy crypto under 18

How to Withdraw Cryptocurrency No-kYC?

Withdrawing crypto without revealing your identity is possible. But you must use trusted platforms and follow a few rules.

- Withdraw to a Private Wallet First: Use MEXC or another no-KYC exchange to send crypto to wallets like MetaMask or Trust Wallet.

- Use Privacy Coins for Extra Security: Convert your crypto to Monero or similar coins before sending. These coins don’t show sender or receiver info.

- Avoid Bank Transfers: Withdrawing to a bank usually needs KYC. Stick to crypto-to-crypto transfers for privacy.

- Use P2P or Crypto ATMs: In some cities, you can use Bitcoin ATMs or P2P services to turn crypto into cash without ID. Always pick trusted sources.

- Always Use VPN or Tor for Extra Privacy: Mask your IP while withdrawing to prevent connection to your real identity.

Related: Best fiat-to-crypto exchanges

Conclusion: What is The Best Anonymous Crypto Exchange?

The best anonymous crypto exchange is the one that balances privacy, security, and usability for your needs. Non KYC crypto exchanges let you trade freely without handing over personal documents, making them ideal for users who value anonymity and faster access.

Hence, the best no-KYC crypto exchanges are MEXC, XT.com, WEEX, BloFin, Zoomex, and more due to full anonymous trading without ID verification.

However, they also come with risks like withdrawal limits and lower regulatory protection. If you prioritize anonymous trading, choose platforms with strong security features, good liquidity, and a solid reputation. Ultimately, the right no KYC exchange depends on your trading goals, whether it’s spot, futures, or simply keeping your identity private while using crypto.

FAQs: Buy Crypto Instantly No KYC

What are the best no-KYC crypto exchanges?

The best no-KYC crypto trading exchanges include MEXC, XT.com, LBank, and BloFin. These platforms let you trade, deposit, and withdraw crypto without verifying your identity.

MEXC and XT.com are the most trusted and user-friendly options. You can register with just an email and start trading quickly. These exchanges support many trading pairs, offer low fees, and allow crypto-to-crypto transfers with full privacy.

What is KYC in crypto?

KYC in crypto means “Know Your Customer.” It’s a process where exchanges ask for your identity documents, such as a passport, Aadhaar, or driving license. KYC is used to follow government rules and stop illegal activity. But it removes privacy from your crypto use.

Do I have to report my transactions on no-KYC exchanges?

Even if you use a no-KYC crypto trading exchange, you may still need to report your trades, depending on your country’s tax laws. In most countries, crypto transactions are taxable, even if done anonymously. Exchanges don’t report your activity to governments, but you are responsible for following your local tax rules.

Why use a non-KYC exchange?

Non-KYC exchanges give you more privacy, control, and faster access to crypto trading. You don’t have to share your personal documents, which lowers your risk of data leaks or identity theft.

Is it Safe to use no-KYC exchanges?

Yes, no-KYC exchanges can be safe if you use trusted platforms like MEXC or XT.com. These exchanges use strong security features like two-factor authentication, cold wallet storage, and regular updates.

But since you don’t verify your identity, you can’t recover your account easily if you lose access. Always use secure passwords and keep your funds in your own wallet when not trading. Avoid unknown or suspicious exchanges to stay safe.

Can I use Binance without KYC?

No, Binance now requires KYC for most features, including deposits and trading. You cannot trade or withdraw crypto on Binance without verifying your identity. If you want to trade without submitting documents, use from out list of the best no-KYC crypto exchanges.

What’s the safest no-KYC cryptocurrency exchange?

MEXC is one of the safest no-KYC crypto platforms. It offers advanced security tools, a large number of crypto pairs, and a strong reputation in the market. XT.com is also safe and widely used for private trading. Both platforms support trading without asking for ID and allow fast withdrawals.

What crypto sites don’t require ID?

Popular crypto sites that don’t require ID include MEXC, XT.com, LBank, and BloFin. These exchanges let you create an account using just your email address. You can start trading crypto without identity checks or document uploads. They are best for those who want privacy and fast trading access.

Is there a no-KYC Exchange?

Yes, there are many best no KYC exchanges where you can trade crypto without giving your ID. Platforms like MEXC and XT.com allow users to register and trade without any KYC checks. You can deposit and withdraw crypto freely with only email-based accounts.

Why would anyone want to avoid KYC?

KYC means handing over your ID, address, or even a selfie to trade crypto, and some folks just aren’t into that. Why? Privacy is a big deal; nobody wants their personal info floating around, especially with data leaks happening.

Avoiding KYC keeps your identity safe and lets you trade without sharing sensitive information. It’s also faster; you can start trading right away without waiting for verification. For some, it’s about freedom, crypto’s supposed to be decentralized, right? KYC can feel like big banks snooping in. Plus, in places with strict rules, no-KYC platforms give access to crypto without hassle

Is MetaMask Non-KYC?

Yup, MetaMask is totally no-KYC. It’s a crypto wallet, not an exchange, so it doesn’t ask for your ID, name, or any personal info. You just download it, set up a wallet with a seed phrase, and you’re good to go. It’s non-custodial, meaning you control your funds, not some company. You can use MetaMask to store, send, or swap crypto (like on decentralized platforms) without anyone knowing who you are.

Can you buy cryptocurrencies without a KYC account?

Absolutely, you can buy crypto without a KYC account! No KYC platforms let you trade or buy coins using just an email or a wallet address, no ID needed. You can deposit crypto you already own, swap it for other coins, or sometimes buy with a credit card (though fiat purchases might involve third-party KYC).

Decentralized platforms are the most anonymous; just connect a wallet like MetaMask and trade. Centralized platforms also offer no-KYC options with limits on withdrawals.

What are the best centralized no-KYC crypto exchanges?

The best centralized no-KYC crypto exchanges include MEXC, XT.com, and LBank. These platforms give you access to a large variety of tokens and crypto trading pairs without requiring KYC.

MEXC offers low fees, deep liquidity, and strong security, while XT.com is easy to use and fast. You can create an account using just your email and start trading right away. These exchanges are trusted and popular for anonymous crypto trading.

Why should you use a no-KYC exchange for trading?

You should use a no-KYC platform if you want faster access, better privacy, and fewer restrictions. The best crypto no-KYC trading exchanges like MEXC and XT.com allow you to trade without giving your ID. This protects your personal data and avoids delays caused by document checks.

It also helps people from restricted countries access crypto markets freely. These exchanges are ideal for traders who want speed, privacy, and control without complicated sign-up steps.