As the world of cryptocurrency continues to evolve, so too do the methods by which we trade and invest in these digital assets. One of the latest and most promising innovations in the crypto trading world is the development of decentralized exchanges (DEXs).

These exchanges allow for peer-to-peer trading without the need for intermediaries, making the process faster, more secure, and more cost-effective.

Perpetual DEXs, in particular, offer traders the ability to enter long or short positions on a given asset without expiration. This feature makes them an increasingly popular choice for those looking to engage in futures trading.

In this blog post, we’ll take a deep dive into the top 7 best perpetual DEXs for future trading in crypto. We’ll examine their unique features, advantages, and limitations to help you make an informed decision when it comes to trading in the ever-changing world of cryptocurrency.

Our Recommended Exchange for Anonymous Leverage Trading

MEXC

What is a Perpetual DEX?

A Perpetual DEX is a type of decentralized exchange that offers the ability to trade perpetual contracts, which are settled in the underlying cryptocurrency and do not have an expiration date.

It enables trading 24/7 since there are no market hours to worry about. DEX also uses an automated market maker system, which maintains a liquidity pool of two different cryptocurrencies to facilitate trades without requiring a counterparty.

A perpetual DEX often has a native governance token that allows users to vote on platform changes and receive rewards for providing liquidity. This incentivizes users to hold the token and helps ensure the stability and growth of the platform.

Comparison Table between best Perpetual DEXs

| Vertex | GMX | Gains Network | dYdX | Perpetual Protocol | Metavault trade | |

|---|---|---|---|---|---|---|

| Market Cap | $800 M | $710M | $334M | $483M | $60M | $11M |

| Trading Volume | $700m | $60M | $8M | $18M | $1.6M | – |

| Governance Token | VRTX | GMX | GNS | DYDX | PERP | MVX |

| Total Value Locked | $83.94m | $617.7m | $48.23m | $382.54m | $17.01m | $6,705,332 |

- Market cap Data Source: CoinmarketCap

- Volume Source: Dappradar

- Total Value Locked (TVL) Source: Defillama

List of Best Perpetual DEXs For Leverage Trading

- Vertex: Overall Best Perpetual DEX with High Trading Volume and Multi-Chain Support

- GMX: Best Perpetual DEX on Arbitrum Ecosystem

- Gains Network (GNS): A New DeFi Leveraged Trading Platform

- dYdX: Top Perpetual DEX on Ethereum

- Perpetual Protocol (PERP): Best Derivatives DEX with high leverage

1. Vertex: Overall Best Perpetual DEX with High Trading Volume and Multi-Chain Support

Vertex Protocol is a decentralized exchange (DEX) built on the Arbitrum blockchain. It provides a seamless trading platform that combines spot and perpetual futures trading with a lending and borrowing market. This integration allows traders to manage their positions efficiently with a single, cross-margined account.

Vertex Protocol is designed to offer low-latency trading, making it comparable to centralized exchanges in speed. It achieves this using a hybrid model that merges an Automated Market Maker (AMM) with an order book. This design enables efficient capital use and a smooth trading experience.

The platform emphasizes security and transparency while delivering high performance. Vertex uses Chainlink Data Streams for real-time, reliable market data. This enhances price accuracy and protects against issues like manipulation or data delays.

Traders can use Vertex for leveraged trading through perpetual contracts. The integrated lending market enables users to borrow against their assets or earn returns by lending. With its unique features, Vertex aims to address common issues in DeFi, such as liquidity fragmentation and inefficiencies.

2. GMX: Best Perpetual DEX on Arbitrum Ecosystem

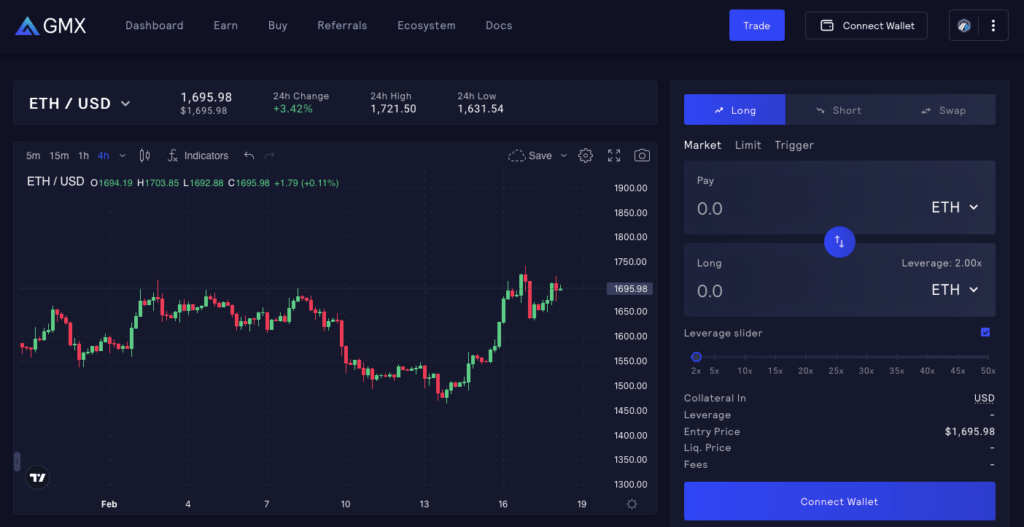

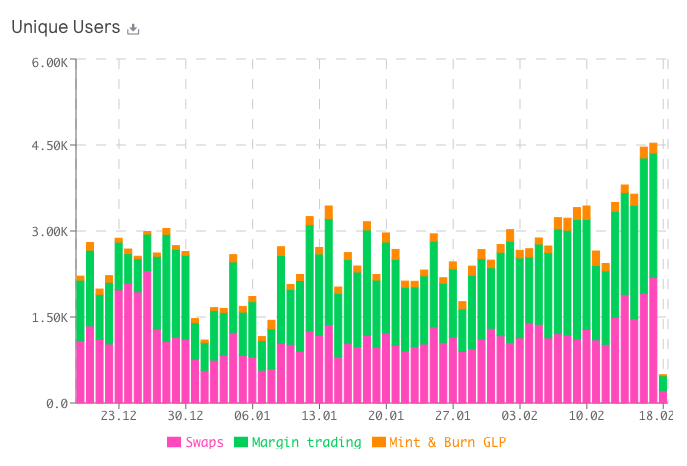

GMX is a decentralized exchange that has gained popularity on both the Arbitrum and Avalanche networks for its fast-growing spot and perpetual leverage trading options.

The platform offers low trading fees and zero price-impact trades for a wide range of assets. Additionally, it supports leveraged trading with up to 50x leverage.

GMX has a unique capital efficiency model that aims to optimize the capital locked in the protocol. Unlike many other decentralized exchanges that rely on multiple single-asset pools, GMX utilizes a single multi-asset pool known as GLP.

This pool contains several large-cap tokens and stablecoins to facilitate trades for all assets.

How does GMX DEX Work?

GMX has a dual token model that consists of GLP, which stands for liquidity pool token, and GMX, the platform’s governance token. The fees generated by GMX come from swaps, borrow fees from leveraged trading, liquidations, and the creation and burning of GLP. These fees are then shared between GLP and GMX stakers.

Since GLP stakers bear the risk of trades on the platform, 70% of the platform’s fees are distributed to liquidity providers, and the remaining 30% goes to GMX stakers. GMX is unique from other DEXs since it awards incentives in ETH on Arbitrum and AVAX on Avalanche, unlike other platforms that give rewards in their native tokens.

Liquidity providers can benefit from the high leverage offered by the platform, which makes their liquidity provision highly efficient. GLP stakers can enjoy high APRs on GMX since the current APR is about 20%.

Note: Use GMX referral code “amitcha” while signing up to get a 30% trading fee discount for a lifetime.

3. Gains Network (GNS): A DeFi Leveraged Trading Platform

Gains Network (GNS) is a Defi Perpetual DEX For leverage Trading. One of the unique features of gTrade is that traders can start trading without having to create an account or deposit funds with the platform. A simple wallet connection is all that is required to get started, and traders’ funds remain in their wallets, only moving on the wallet owner’s authorization, guided by smart contracts.

The platform provides a diverse range of assets that traders can trade, including cryptocurrencies, company stocks, and forex. gTrade offers leverage up to 150x on crypto assets, 100x on stocks, and 1000x on forex trades. Users contribute to a pool from which leverage requests are served, and the pool is structured to generate profits for the contributors as part of an incentivization and interest-generating plan.

To make gTrade work this way, Gains Network introduces four “tools” that work together. These include a decentralized vault and liquidity pool, a multi-functional token, a protocol that aggregates other facilities and controls their functioning, and unique NFTs that offer holders certain advantages and incentives on the platform.

The platform’s asset prices are provided by a modified version of Chainlink’s Decentralized Oracle Network (DON). In summary, gTrade aims to provide traders with a decentralized, secure, and efficient trading experience that is not limited by undue centralization or thin leverage limits found on other platforms.

4. dYdX: Top Perpetual DEX on Ethereum

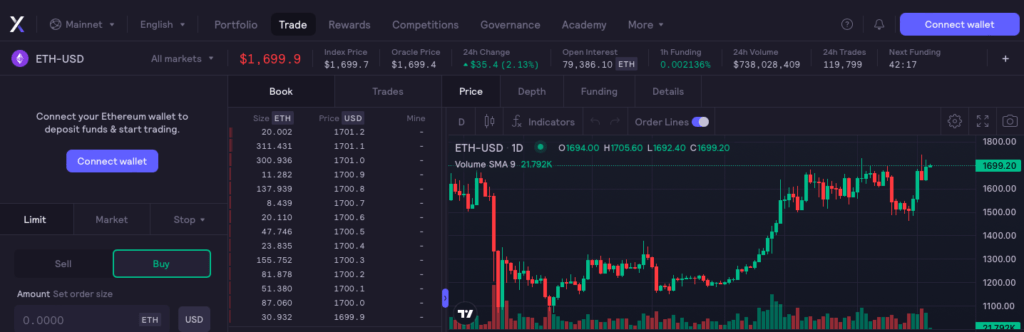

dYdX is a decentralized exchange (DEX) that allows users to trade perpetual contracts, margin trade, and lend and borrow crypto assets. The platform is built on the Ethereum blockchain and uses smart contracts to facilitate transactions.

dYdX’s perpetual contracts are fully collateralized, meaning that traders must post collateral in the form of crypto assets to open a position. The amount of collateral required is based on the size of the position and the volatility of the underlying asset. Traders can use a variety of crypto assets as collateral, including Bitcoin, Ethereum, and USDC.

Exchange also allows users to margin trade on their platform. Margin trading is the practice of using borrowed funds to trade larger positions than a trader could with their own funds. This can increase profits, but it also increases the risk of losses. dYdX’s margin trading system is fully collateralized, meaning that traders must post collateral to open a position.

dYdX has a lender and borrows feature. Users can earn interest by lending out their crypto assets to other users, and borrowers can use the borrowed assets to trade on the platform. dYdX’s lending system is also fully collateralized, meaning that borrowers must post collateral to borrow assets.

5. Perpetual Protocol (PERP): Best Derivatives DEX

Perpetual Protocol is a decentralized blockchain protocol designed to facilitate the trading of derivatives known as perpetual contracts. These contracts enable traders to take long or short positions on a wide range of highly liquid assets. By operating entirely on the blockchain, Perpetual Protocol seeks to make these valuable financial instruments accessible to everyone.

At its core, Perpetual Protocol employs Uniswap v3 as the underlying execution layer to offer perpetual swaps with incredibly efficient concentrated liquidity.

In other words, each perpetual market managed by Perpetual Protocol represents a unique Uniswap v3 pool, and users can solely access this pool through the Perpetual Protocol clearinghouse – a smart contract that tracks all trading activities.

Additionally, with up to 10x leverage, traders have increased opportunities to profit from market movements. As a decentralized exchange, Perpetual Protocol ensures that users retain control of their funds at all times.

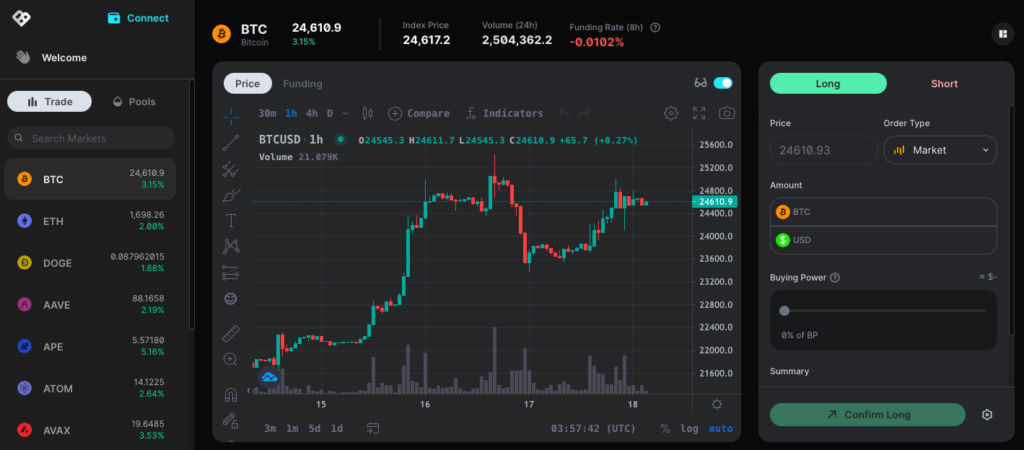

6. Metavault Trade (MVX): Decentralized spot & perpetual exchange

Metavault.Trade is a new decentralized exchange that offers extensive liquidity and a wide range of trading features for large-cap crypto assets. The platform offers two modes of trading: spot trading that allows swaps and limit orders, and perpetual futures trading that features up to 30x leverage on short and long positions.

The key objective of Metavault.Trade is to offer traders complete control over their funds while keeping their personal information private. The platform boasts a unique design that provides several benefits over other DEXs. Firstly, it offers incredibly low transaction fees, enabling traders to maximize their profits.

Additionally, the pricing mechanism design ensures that large orders do not impact prices, allowing traders to execute trades of any size without affecting the market.

Another significant advantage of Metavault.Trade is its protection against liquidation events, such as sudden price changes that can occur on a single exchange (“scam wicks”). The platform’s innovative pricing mechanism helps to mitigate such fluctuations, providing a secure and stable trading environment.

Finally, the platform provides an all-in-one solution that combines both spot and leverage trading, making it a convenient and efficient option for traders.

7. Vela Exchange (VELA): Newest Perpetual DEX

Vela Exchange is a decentralized trading platform that focuses on perpetuals trading, community-based incentives, and scalable infrastructure. Although Vela Exchange currently only supports perpetual futures trading, it plans to include other marketplaces such as spot and OTC trading in the future. Compared to centralized exchanges, Vela Exchange provides users with fair access to platform rewards, and self-custody of assets, and eliminates the need for a centralized clearing house.

Legacy decentralized applications and exchanges have struggled with inefficiencies such as high execution costs, low performance, front-running, slippage, asset limitations, and a lack of risk management features. However, Vela Exchange was developed as a “next-gen” platform to overcome these common DEX issues.

Vela Exchange has two types of trading fees: Position and Funding fees. Position fees are determined by the size of the position opened and closed, with a maximum fee of 0.1% for Crypto Assets and 0.01% for Forex Assets.

Funding fees, on the other hand, are calculated based on how much is being borrowed from the vault and the current funding rate, which is reset every four hours and varies depending on whether the position is Long or Short. The longer a position is held open, the higher the funding fee will be, and it will be paid out when the position is closed.

How Do Perpetual DEXs Work?

Perpetual DEXs are built on blockchain technology, and they use smart contracts to execute trades and manage positions. When a trader enters into a perpetual swap contract, they are essentially entering into a smart contract that mirrors the behavior of a traditional futures contract.

The smart contract that governs the perpetual swap has several key features. First, it has an index price that is used to determine the settlement price of the contract. The index price is usually based on the price of the underlying asset on several different centralized exchanges. This helps to ensure that the index price is accurate and not subject to manipulation.

Second, the smart contract has a funding rate that is used to calculate the cost of holding a position in the perpetual swap. The funding rate is calculated based on the difference between the index price and the current price of the perpetual swap.

If the perpetual swap is trading at a premium to the index price, the funding rate will be positive, and long positions will pay funding to short positions. If the perpetual swap is trading at a discount to the index price, the funding rate will be negative, and short positions will pay funding to long positions.

Third, the smart contract has a liquidation mechanism that is used to protect traders from losing more than their initial margin. If a trader’s position falls below a certain threshold, the smart contract will automatically close its position and use its margin to pay any outstanding losses.

How to Choose the Best Perpetual DEXs

🔍 Factors to Consider for Best Perpetual DEX for Leverage Trading 🔍

1️⃣ Security: Look for a DEX with a strong track record of security measures, such as multi-signature wallets, cold storage, and rigorous audits.

2️⃣ Liquidity: A high level of liquidity is crucial for smooth trading, so choose a DEX with ample trading volume and active market makers.

3️⃣ Leverage Options: Consider the leverage options offered by the DEX, including maximum leverage, margin requirements, and funding rates, to ensure they align with your trading strategy.

4️⃣ User Interface and Experience: A user-friendly interface and seamless trading experience are important for efficient leverage trading, so choose a DEX with an intuitive platform and responsive customer support.

5️⃣ Asset Variety: Look for a Perpetual DEX that offers a wide range of assets for leverage trading, including popular cryptocurrencies and other emerging tokens.

6️⃣ Fees: Consider the fee structure of the DEX, including trading fees, funding fees, and withdrawal fees, as they can impact your overall trading costs.

7️⃣ Community and Reputation: Check the DEX’s community and reputation, including user reviews and feedback, to ensure it has a trustworthy and reliable reputation in the crypto community.

8️⃣ Compliance and Regulations: Consider whether it complies with relevant regulations in your jurisdiction, as this can affect the legal aspects of your leverage trading activities.

9️⃣ Technology and Reliability: Look for a DEX with robust technology infrastructure, high uptime, and minimal downtime, to ensure smooth trading operations.

🔟 Past Performance: Evaluate the historical performance of the perpetual DEX, including its trading volume, trading activity, and price slippage, to gauge its reliability and performance.

Advantages of Perpetual DEXs Over Centralized Exchanges

- They provide traders with access to advanced trading options, such as leverage and margin trading, which were previously only available on centralized exchanges.

- Perpetual DEXs are decentralized, which means that there is no need for intermediaries or centralized authorities. This reduces the risk of hacks, fraud, and other types of manipulation.

- Perpetual DEXs are open 24/7, which means that traders can enter and exit positions at any time. This provides traders with more flexibility and allows them to take advantage of market opportunities as they arise.

How to Perform Leverage Trading on DEXs

Here are some steps to follow for leveraging trading on DEXs:

- Choose a decentralized exchange that supports leverage trading.

- Connect your wallet to the DEX and deposit funds into your account.

- Choose the asset you want to trade and select the leverage option. Typically, leverage options range from 2x to 50x.

- Enter the amount of capital you want to trade and adjust the leverage accordingly. Be mindful of the risks involved and only trade with funds that you can afford to lose.

- Place your trade and monitor it closely. Keep in mind that leverage trading can magnify potential gains, but it can also increase losses if the trade doesn’t go as planned.

- Close your trade when you’re ready to exit and withdraw your funds from the DEX back into your wallet.

Conclusion: Which Should You Choose?

Decentralized exchanges (DEXs) have become popular in the crypto space. They’re more secure and transparent than centralized exchanges. Perpetual DEXs allow traders to trade perpetual contracts with no expiration date. This provides greater flexibility and risk management.

Six of the best perpetual DEXs for crypto trading were highlighted in this article. Each platform offers unique features and benefits. These cater to different traders’ needs. Traders can find low fees, high liquidity, or a wide range of trading pairs on these platforms.

It’s important to remember that trading cryptocurrencies can be risky. Traders should always do their due diligence and understand the risks involved. This is true whether trading on centralized or decentralized platforms. Perpetual DEXs give traders more options than ever to trade cryptocurrencies securely and in a decentralized manner.