BloFin has quickly become one of the better‑known cryptocurrency trading platforms. Founded in 2019 by Tao “Matt” Hu and headquartered in the Marshall Islands, the company promises deep liquidity, powerful trading tools, and a transparent approach to custody. Today, it serves customers in more than 150 countries, offers over 500 spot and futures markets, and supports high leverage for experienced traders.

This BloFin review explains everything you need to know about the crypto exchange, including its fees, supported assets, security features, and how to get started. We will also discuss whether it is safe, legit, or a scam. You’ll also see honest pros and cons, user feedback, and a comparison with competing exchanges like Coinbase and MEXC.

Table of Contents

First, here is a quick BloFin exchange review…

BloFin

BloFin is the best crypto exchange for leverage trading without KYC and with deep liquidity and low fees. It is highly secure with $5 billion daily trading volume, and the interface is smooth for both new and advanced traders. The exchanges’ withdrawals are straightforward, but limited fiat support and no KYC trading may be negative for some users.

Pros

Allows trading without KYC

Very low trading fees

150x leverage trading in US

Strong institutional-grade security

Cons

Limited fiat deposit option

Not regulated in the US or Europe

Customer support response is slow

BloFin Key Takeaways

- BloFin offers more than 500 spot assets and 350+ perpetual futures contracts, giving users access to major coins, tokens, and stablecoins.

- Maximum leverage reaches 1:150 on selected futures pairs, appealing to high-risk traders.

- The platform supports no-KYC trading with a daily withdrawal limit of 20,000 USDT, while higher withdrawal limits require different KYC tiers.

- Maker and taker fees start at 0.1% for spot trading and 0.02% / 0.06% for futures. Fees drop significantly for VIP tiers and high-volume traders.

- Deposits in cryptocurrency are free, but fiat on-ramps via partners typically cost 3.5%–5%.

- BloFin’s security infrastructure includes Fireblocks’ MPC wallets, 1:1 proof-of-reserves, ISO 27001 certification, and AI-driven KYC/KYT monitoring.

- The exchange is not regulated by any major financial authority and is unavailable in North Korea, China, Russia, and several other jurisdictions.

Who Is BloFin Best For?

BloFin positions itself as a professional crypto trading platform aimed at traders who want advanced tools, high leverage, and deep liquidity. That said, its simple interface and copy‑trading features also attract newcomers who prefer to follow experienced traders rather than trade on their own.

In our BloFin review, we found it is best for –

- Experienced derivatives traders: The availability of up to 150x leverage and a wide selection of perpetual contracts appeals to users comfortable with margin. They can deploy advanced order types and hedging strategies not offered on many beginner‑focused exchanges.

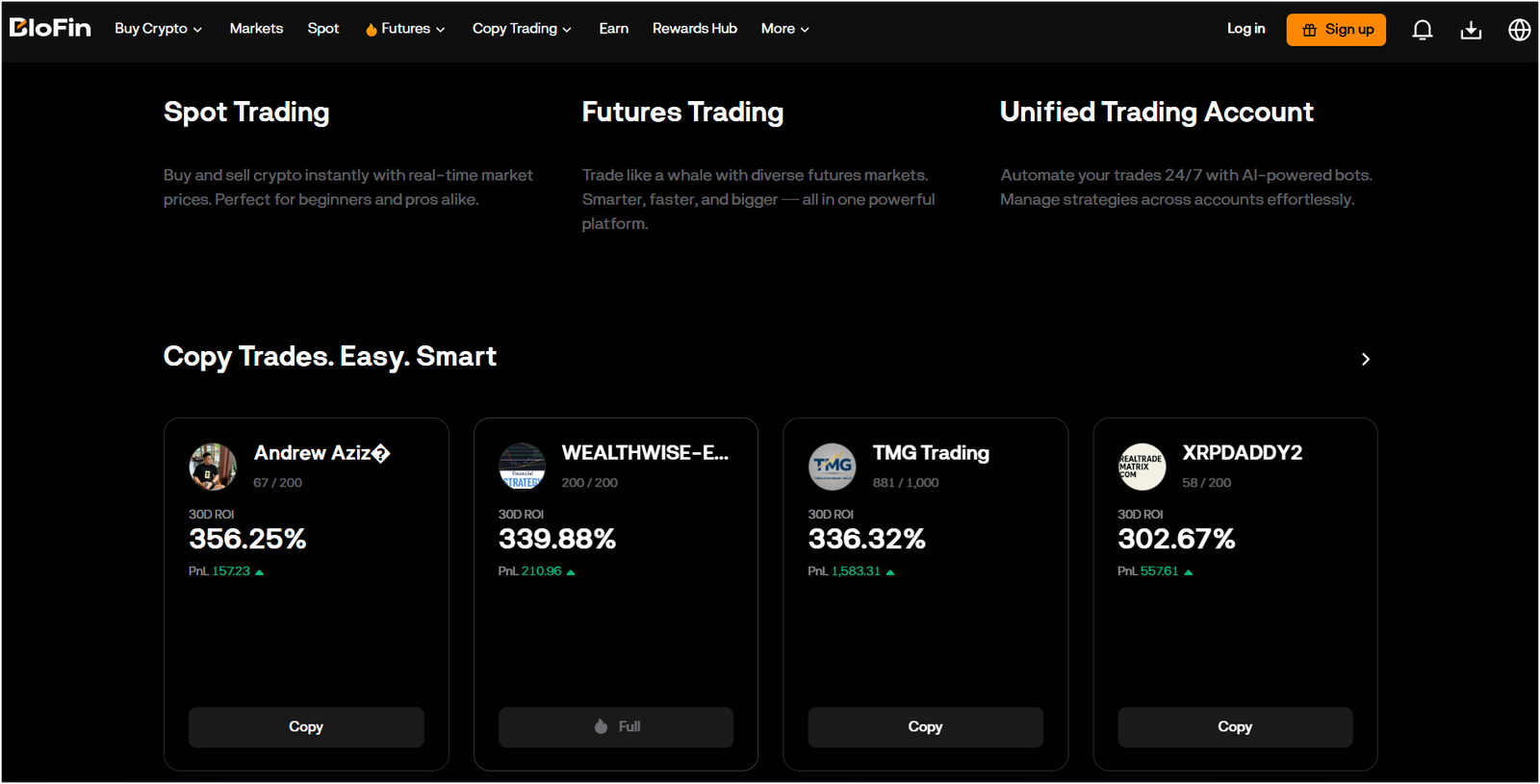

- Copy traders: BloFin ranks profitable traders on a public leaderboard and allows less‑experienced users to copy their trades with one click. Profit‑sharing fees apply, but it’s a convenient way to learn from seasoned traders without deep knowledge.

- Privacy‑conscious users: Traders who only need modest withdrawal limits can use the platform without completing full KYC. BloFin permits daily withdrawals up to 20,000 USDT for unverified accounts.

- Crypto‑only users: People who already hold digital assets and want to swap or margin trade them will find BloFin’s free crypto deposits and wide asset support convenient. On the other hand, fiat‑only users may find the reliance on third‑party on‑ramps frustrating.

BloFin Exchange Review: Quick Overview

BloFin launched its exchange platform in September 2019 and quickly expanded its product lineup. Today, it operates globally (excluding certain restricted jurisdictions) with a focus on perpetual futures contracts. The company touts itself as a high‑liquidity venue for derivatives trading and emphasises security and transparency.

BloFin’s key features include:

- Spot trading: More than 500 coins and tokens, from Bitcoin and Ethereum to smaller altcoins and stablecoins.

- Perpetual futures: Over 350 contracts with leverage up to 150x. Both cross and isolated margin modes are supported.

- Copy trading: A leaderboard of top performers allows users to automatically mirror their trades. Profit‑sharing fees apply to the copied profits.

- Demo trading: A simulated environment lets new users practise trading without risking real funds.

- Earn products: Flexible and fixed‑term staking options are available for a few major assets, such as BTC, ETH, and USDT.

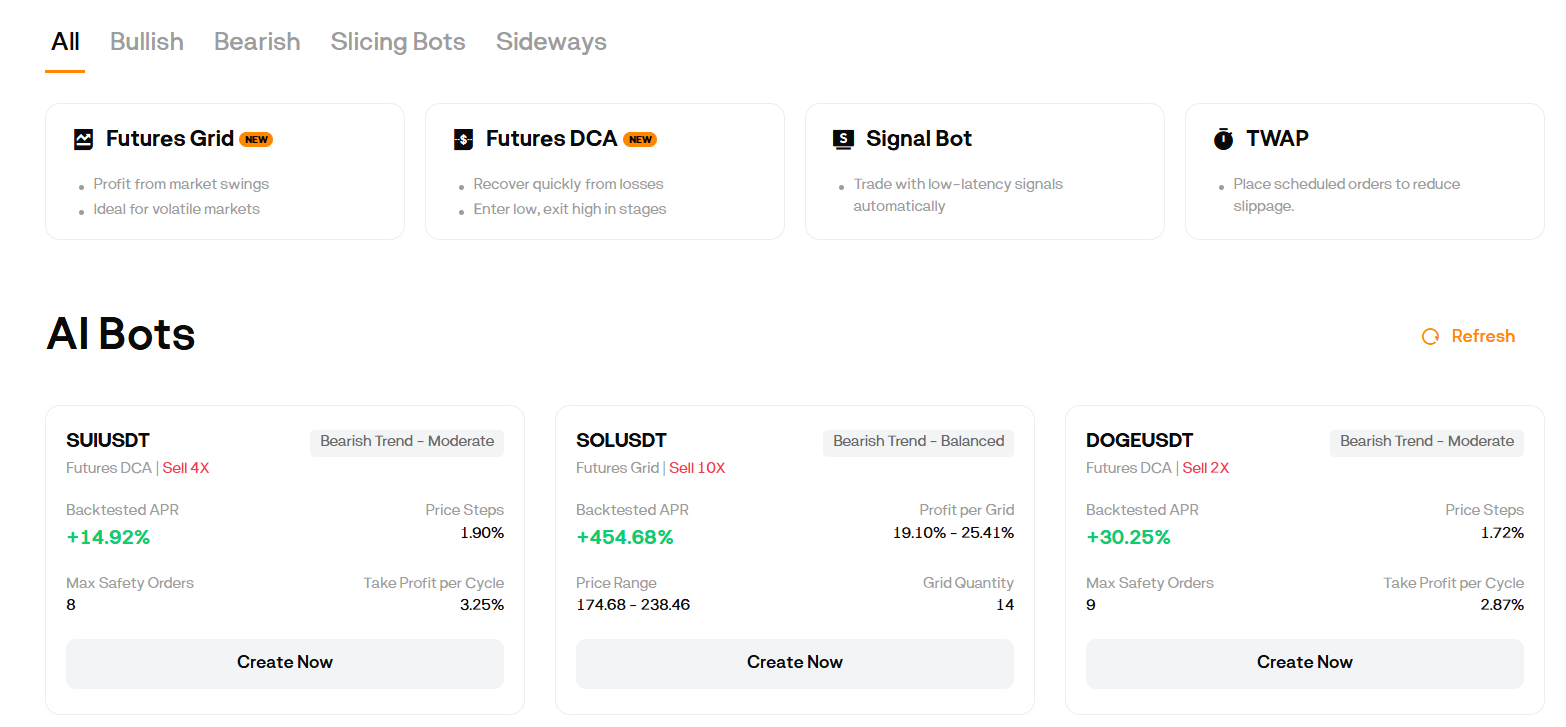

- Trading bots: Signal bots and TWAP bots assist with automation and systematic strategies, though the selection is limited compared with more established competitors.

Read: Best centralized crypto exchanges

BloFin Registration and KYC Tiers

Signing up for BloFin is straightforward. You can register using an email address or mobile number, set a strong password, and enable two‑factor authentication. No documents are required at this stage. Once registered, you immediately gain access to trading, deposits, and withdrawals.

BloFin divides identity verification into several tiers:

| KYC Level | Requirements | Daily Withdrawal Limit | Leverage Limit |

|---|---|---|---|

| Tier 0 (No KYC) | Create an account with email/phone; enable 2FA | 20,000 USDT | No limit |

| Tier 1 | Basic personal information (name, nationality, date of birth) | 20,000 USDT | No limit |

| Tier 2 | Government ID and selfie verification | 2,000,000 USDT | No limit |

| Tier 3 | Proof of address (utility bill or bank statement) | No specified limit | No limit |

For each tier, BloFin uses automated KYC/KYT tools to validate documents and screen transactions for suspicious activity. In my Bloin review, I found that verification can take from a few minutes to several days, depending on current demand and the clarity of submitted documents.

It is important to note that unverified accounts are limited to a cumulative 20,000 USDT withdrawal per day and may be blocked from certain promotions.

Related: Best no KYC crypto exchanges

Restricted Countries and Availability

Note: BloFin is available in almost all countries for leverage trading due to its no-KYC access, including the U.S., UK, Australia, and more.

BloFin serves customers in more than 150 countries, but regulatory restrictions mean some users cannot access the platform. Residents of China, Russia, Singapore, Venezuela, Cuba, Iran, North Korea, and a handful of other jurisdictions are blocked.

Traders in sanctioned countries might still attempt to bypass restrictions with VPNs, but that behaviour violates BloFin’s terms of service and could lead to account closure.

The exchange recently expanded support for various payment methods such as Apple Pay, Google Pay, and SEPA bank transfers via partnered providers. Nevertheless, BloFin does not hold a formal licence from U.S. regulators, so American residents can trade, but there is no legal support.

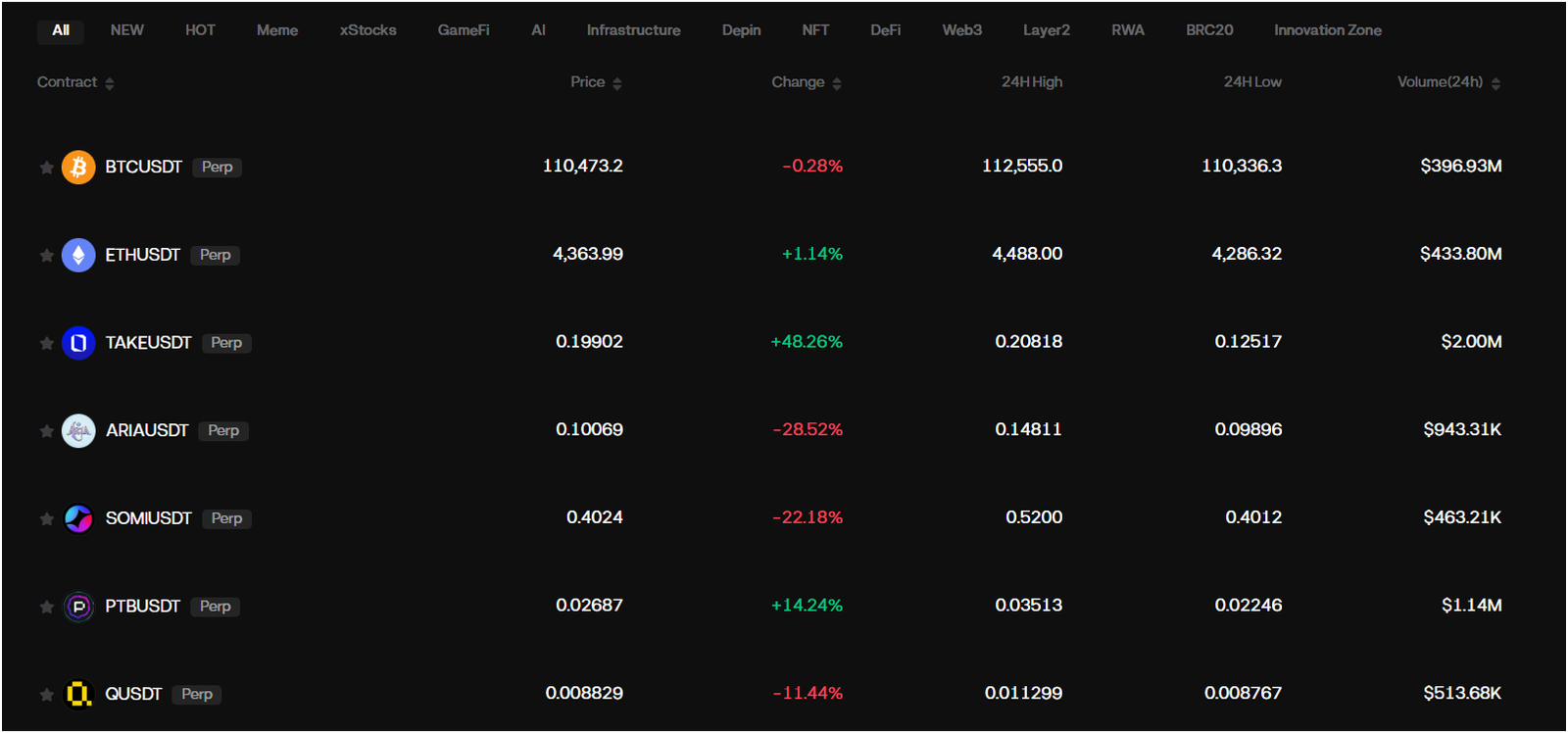

BloFin Supported Cryptocurrencies and Markets

BloFin’s asset selection has grown steadily. The platform lists over 500 trading pairs across spot and futures markets. Users can buy, sell, or trade the following categories:

- Major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), XRP, Solana (SOL), Dogecoin (DOGE), and more.

- Stablecoins: Tether (USDT), USD Coin (USDC), Dai (DAI), and TrueUSD (TUSD).

- Altcoins: Cardano (ADA), Avalanche (AVAX), Polkadot (DOT), Polygon (MATIC), and hundreds of smaller-cap tokens.

- Perpetual contracts: Over 350 contracts tracking major and minor coins with leverage up to 150x.

BloFin’s spot markets show deep liquidity for major pairs, while less liquid altcoins might incur slippage. Perpetual futures markets enjoy high liquidity and allow cross margin, isolated margin, and hedge mode to manage long and short positions simultaneously.

BloFin Review: Trading Products and Tools

Spot Trading

Spot trading on BloFin functions like a traditional crypto exchange: users buy and sell assets at current prices or set limit orders for desired entry points. The interface includes TradingView charts, an order book, market depth, and customisable layouts.

Also, advanced order types such as stop‑loss, take‑profit, trailing stop, time‑weighted average price (TWAP), and iceberg orders are available. Maker/taker fees for spot trades start at 0.1% for both sides. These rates drop to as low as 0.01% maker and 0.0325% taker for top VIP tiers.

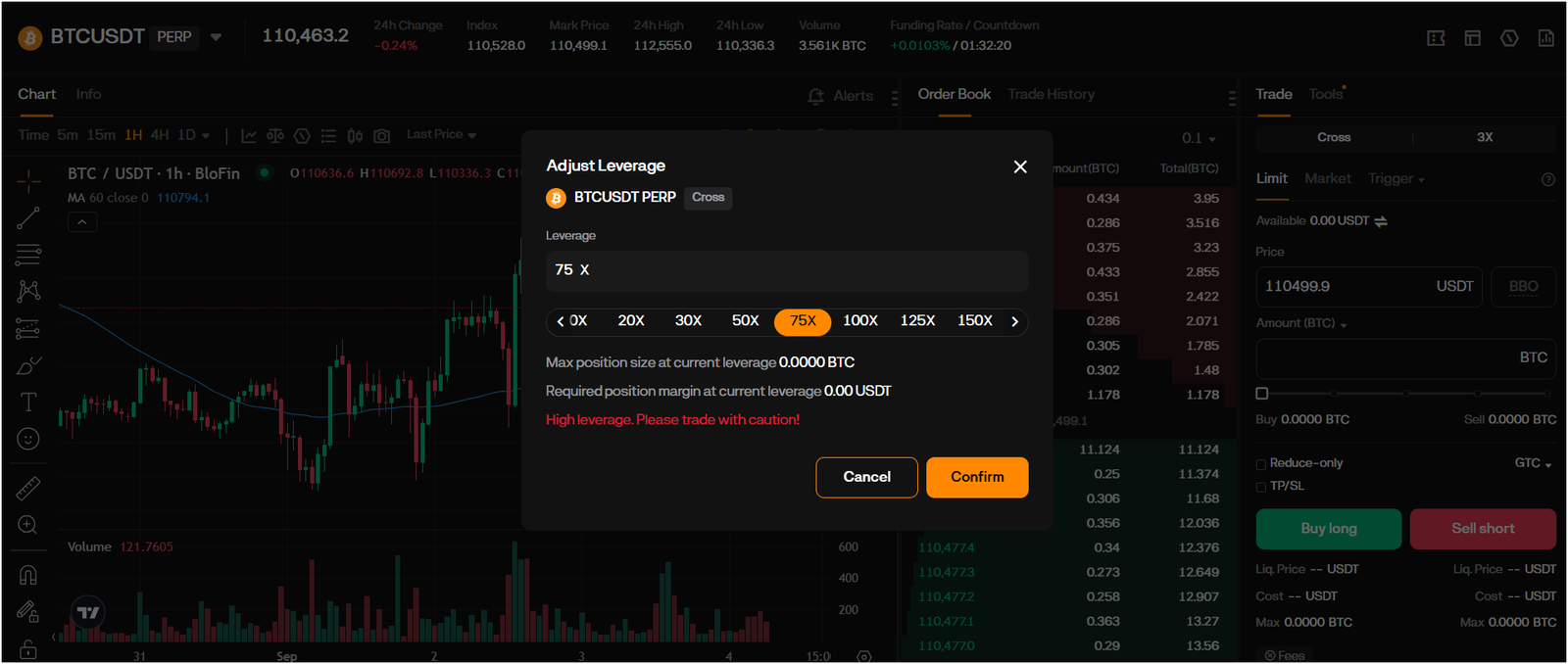

Perpetual Futures Trading (150x leverage)

Futures trading is BloFin’s flagship product. The platform offers perpetual contracts settled in USDT or USD Coin with leverage options up to 150x. Traders can choose between Cross Margin (using the entire account balance to support positions) and Isolated Margin (separating collateral per position). Hedge mode allows simultaneous long and short positions on the same contract, useful for risk management.

BloFin calculates funding rates every 8 hours. Long positions pay funding fees when the perpetual price is above the spot index price; short positions pay when the price is below. These funding fees are transferred between long and short traders, ensuring the perpetual price converges with the spot price. Funding rates vary by pair and market conditions, but BloFin displays them transparently before order placement.

Copy Trading

Copy trading lets novice users follow top traders automatically. BloFin’s leaderboard ranks traders by profitability, risk score, and number of followers. Copy traders can allocate a portion of their balance to mirror trades from a selected leader.

Profit‑sharing fees (usually around 10% of profits) are deducted from successful trades. While this feature can help beginners, it carries risk: copying a volatile strategy can result in losses, and past performance does not guarantee future returns.

Demo Account

BloFin provides a demo or “paper trading” account funded with virtual tokens. This tool is ideal for new users to familiarise themselves with the interface, test strategies, or practise using leverage without risking real money. Traders can switch between the demo and live accounts at any time through the platform’s interface.

Trading Bots

The exchange offers built‑in trading bots to automate repetitive tasks. Two main bots are available:

- Signal bot: This bot follows trading signals generated by experienced analysts or third‑party providers. Users subscribe to signals and allow the bot to execute trades accordingly. The service is still evolving and may have limited signal providers.

- TWAP bot: The time‑weighted average price bot slices large orders into smaller segments to minimise market impact. It executes trades at regular intervals to achieve an average entry price close to the market benchmark.

BloFin plans to add more bots in future updates, including grid and arbitrage strategies. At present, these bots are basic compared with dedicated automated trading platforms.

Earn Products and Staking

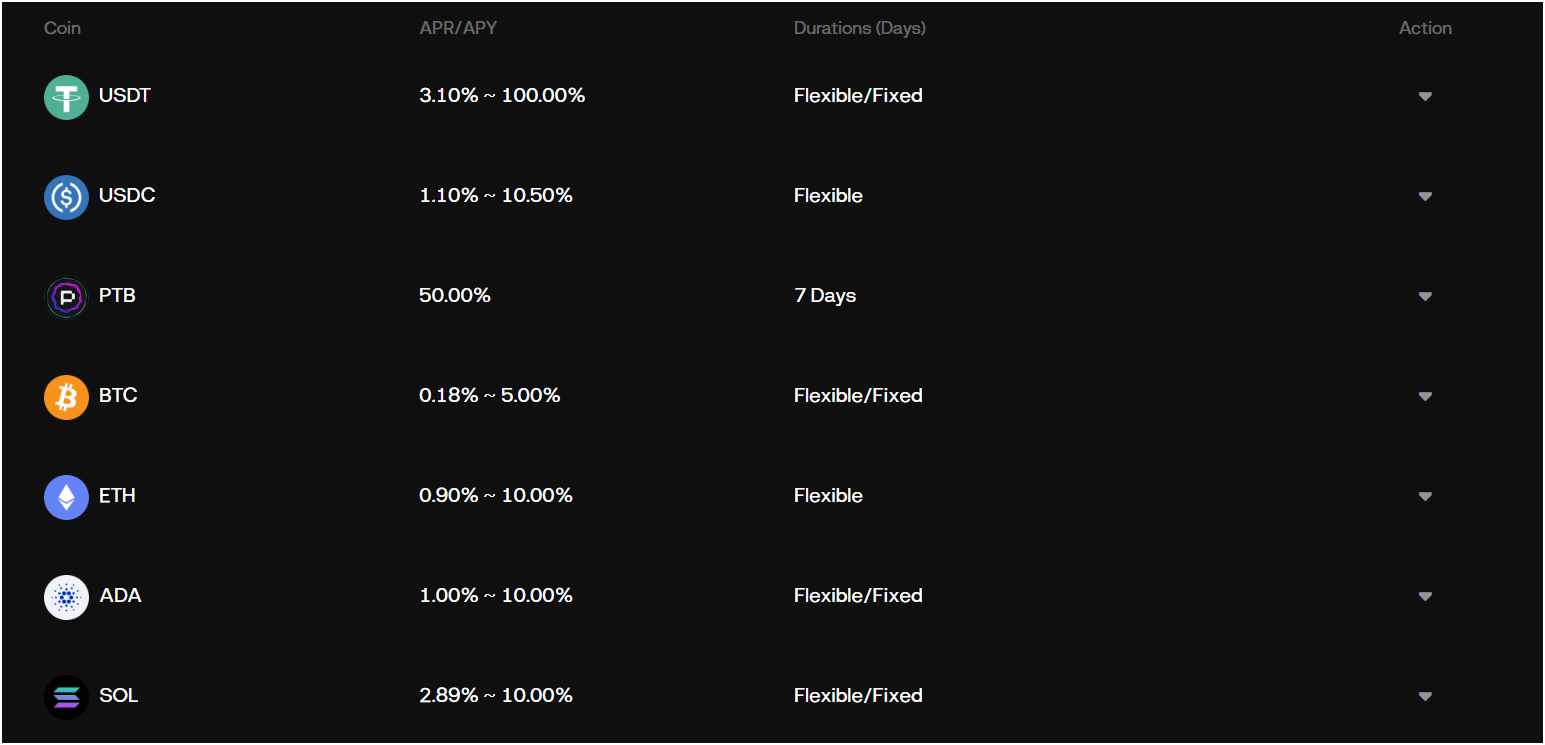

BloFin’s earn section offers staking for a handful of assets. There are two primary options:

- Flexible staking: Users deposit tokens and earn a variable yield that can be withdrawn at any time. For example, flexible USDT staking yields around 1.4%-2.56% per year, while ETH yields around 1.32% and BTC yields a modest 0.02%.

- Fixed‑term staking: Users lock funds for a fixed period (e.g., 7, 30, 90, or 180 days). In exchange for the lock‑up, yields increase slightly, reaching up to 4% annually for some stablecoin products. BloFin may offer promotional rates from time to time.

BloFin does not provide a large selection of staking assets compared with platforms such as Binance or Kraken. There is no yield farming or liquidity mining, and the earn program primarily serves long‑term holders of BTC, ETH, and stablecoins.

Rewards Hub and Promotions

To attract new users, BloFin operates a Rewards Hub featuring mystery boxes, trading competitions, and referral bonuses. New registrants can complete simple tasks (e.g., deposit, first trade, daily log‑in) to earn mystery boxes that contain small amounts of USDT or discount coupons.

Top performers in trading competitions may share prize pools worth thousands of dollars. An affiliate program allows existing users to earn up to 50% commission on trading fees generated by their referrals.

BloFin Fee Structure Review

Understanding BloFin’s fees is crucial for cost‑conscious traders. Fees are generally competitive but vary by market type and user tier.

Trading Fees (Maker/Taker)

BloFin uses a traditional maker/taker model. The base fee structure is:

| Market | Maker Fee (VIP 0) | Taker Fee (VIP 0) | Lowest VIP Maker Fee | Lowest VIP Taker Fee |

|---|---|---|---|---|

| Spot | 0.10% | 0.10% | 0.01% | 0.0325% |

| Futures | 0.02% | 0.06% | 0.00% | 0.035% |

VIP levels depend on a user’s 30‑day trading volume or holdings of BloFin’s native token (BXT). As volume increases, fees drop. Institutional traders may negotiate even lower rates.

Funding and Borrowing Costs

Perpetual futures incur funding fees to keep contract prices aligned with spot indices. Funding occurs three times per day (08:00, 16:00, and 00:00 UTC). Depending on the market, either long or short traders will pay funding; the other side receives a rebate.

Deposit and Withdrawal Fees

- Crypto deposits: Free of charge. Users only pay network fees when sending funds from an external wallet.

- Fiat deposits: Processed by third‑party services like Simplex or Alchemy. Fees range from 3.5% to 5% depending on the payment method, currency, and provider.

- Crypto withdrawals: Charged network fees according to the blockchain of the asset. For example, withdrawing BTC might cost 0.0005 BTC, whereas USDT on the Tron network may cost a few USDT. BloFin does not impose additional withdrawal fees beyond network costs.

- Fiat withdrawals: Not supported directly. Users must first convert crypto to fiat on a different platform or through a P2P marketplace.

Payment Methods and Fiat On‑Ramps

BloFin supports multiple ways to buy crypto with fiat, though all fiat transactions are routed through external partners. Available options include:

- Credit/debit cards: Visa, MasterCard, and UnionPay via Simplex, Alchemy, OnRamp, and other providers. Card purchases settle instantly but may trigger a 3.5%–5% fee.

- Apple Pay and Google Pay: Available for supported currencies, offering convenience and similar fees to card transactions.

- SEPA bank transfers: European customers can use SEPA to transfer euros into a partner service, which then credits USDT or USDC to their BloFin account. Transfer times range from a few hours to one business day.

- Asia‑Pacific payment methods: Depending on your region, you may find support for local banking systems or e‑wallets via partner providers.

Importantly, BloFin does not handle fiat funds directly. Partners convert your currency to stablecoins and deposit them into your account. Because of this, fiat withdrawals are not available; you must withdraw crypto and then convert it elsewhere if you need fiat.

User Experience and Interface

BloFin’s web interface and mobile app are designed for both beginners and professionals. The dashboard is divided into sections: Buy Crypto, Spot, Futures, Earn, Copy Trading, and Rewards. Users appreciate the following aspects:

- Intuitive layout: The platform clearly separates markets and allows you to customise the trading page with different chart styles, timeframes, and technical indicators.

- Unified trading account: All products – spot, futures, staking, and copy trading – draw from a single wallet balance, simplifying fund management.

- Charting tools: Integrated TradingView charts support hundreds of indicators, drawing tools, and comparison features. Depth charts and order books give insight into liquidity.

- Mobile app: Available on iOS and Android, the app replicates almost all web features, including copy trading and derivatives. Users can manage positions and withdrawals on the go.

- Educational content: BloFin Academy offers articles and tutorials covering basic crypto concepts, order types, and risk management, although the material is relatively limited compared with larger exchanges.

In my BloFin review, I found that while the user interface is generally praised, there are occasional complaints about latency during high‑volume events and about some features (like advanced bots) being hidden behind multiple menus. In addition, some users report that KYC verification statuses do not update immediately, leading to confusion.

BloFin Security and Proof of Reserves: Is it Safe?

Security remains one of BloFin’s strongest selling points. The exchange highlights transparency and relies on institutional-grade custody systems. Some of the main protections include:

- MPC and HSM custody: BloFin works with advanced custody platforms that use multi-party computation (MPC) and hardware security modules (HSM) to safeguard private keys. Assets are stored in cold wallets and backed by insurance coverage.

- Proof-of-reserves audits: BloFin regularly publishes Merkle-tree proof-of-reserves with third-party audits. As of 2025, the platform confirms holding at least 100% reserves for all customer deposits, with reserve ratios exceeding 150% for USDT and 170% for BTC.

- ISO 27001 certification: The exchange has achieved ISO 27001 certification, showing compliance with international information security standards.

- Real-time KYT monitoring: BloFin integrates AI-powered compliance systems to monitor transactions for money-laundering activity or sanction risks.

- User-side protections: Accounts come with two-factor authentication options (email, SMS, authenticator apps), biometric login on mobile, anti-phishing codes, and withdrawal whitelist addresses. Recently, passkey login (passwordless authentication) was also introduced to enhance account safety.

Is BloFin Legit or a Scam?

Many users ask, “Is BloFin a scam?” and “Is BloFin legit?” Based on my BloFin review, it appears to be a legitimate crypto exchange rather than a fly‑by‑night operation. It employs reputable custody solutions, maintains proof‑of‑reserves, publishes audits, and has been operating since 2019. At the same time, BloFin is not regulated by major financial watchdogs and has attracted some negative reviews.

Concerns from users include allegations of unfair liquidation of leveraged positions, sudden spikes in funding rates, platform outages during volatile markets, and difficulties withdrawing funds when large profits are made. Some traders claim that the exchange manipulates price wicks on less liquid pairs, while others argue these are simply the result of low liquidity and market volatility.

There are also complaints about changing KYC requirements: some users who originally signed up without KYC later received e‑mails demanding verification or face account suspension.

On the other hand, BloFin’s transparency around proof‑of‑reserves and its partnership with Fireblocks suggest a genuine effort to protect user funds. Large crypto custodians and institutional clients may attest to the platform’s reliability.

Ultimately, BloFin is legit but not without risk. Traders should use proper risk management, maintain only trading balances on the exchange, and consider regulated alternatives if they prioritise consumer protection.

BloFin Customer Support and Community

BloFin offers 24/7 customer support through live chat, email tickets, and an online knowledge base. Response times vary: some users report receiving help within minutes, while others complain about delayed replies during busy periods or after major updates. The support center includes FAQ articles about deposits, withdrawals, trading rules, and KYC. Community channels, such as Telegram and Discord, host official moderators and provide announcements.

User reviews on forums and review sites are mixed. Positive feedback highlights the friendly support agents and prompt resolution of simple issues. Negative comments mention challenges with account recovery, identity verification delays, and inconsistent responses between support agents. It’s wise to document conversations and request clarity when dealing with sensitive issues.

BloFin Pros and Cons

The following lists summarise the advantages and disadvantages of BloFin crypto exchange.

Advantages

- Competitive fees: Maker/taker fees as low as 0.01%/0.0325% for spot and 0.00%/0.035% for futures, lower than many rivals.

- Deep liquidity and high leverage: More than 350 perpetual contracts with up to 150x leverage for advanced traders.

- No-KYC option: Daily withdrawals up to 20,000 USDT without submitting documents.

- Copy trading and demo account: Beginners can follow professionals or practise in a risk-free environment.

- Unified trading account: All products share the same balance, making fund management simple.

- Institutional-grade security: Custody with MPC/HSM, proof-of-reserves, ISO 27001 certification, and AI-driven compliance.

- Mobile app and cross-platform access: Trade conveniently on iOS, Android, or desktop.

Disadvantages

- Limited fiat support: Deposits rely on third-party providers with extra fees; fiat withdrawals are not supported.

- Limited staking options: Only BTC, ETH, USDT, and USDC are supported for staking.

- Not regulated: The platform lacks licences from major financial regulators, limiting consumer protection.

- Mixed user reviews: Complaints about liquidation, slippage, manipulative wicks, and KYC policy changes appear in forums.

User Feedback: Praise and Criticism

Searching through Reddit threads, Quora posts, and BloFin review sites reveals a mix of positive and negative experiences:

- Positive comments: Users appreciate BloFin’s simple registration, generous welcome bonuses, and responsive mobile app. Experienced traders highlight the deep liquidity on perpetual contracts, low funding rates, and the ability to hedge positions. Copy trading receives praise for helping newcomers profit without much knowledge.

- Negative comments: Several traders report sudden liquidation of positions even when they believed they had sufficient margin. Some allege that BloFin triggers extreme wicks on low‑volume coins, causing margin calls. There are complaints about delayed withdrawals, especially when profits are large. Others mention that customer support sometimes provides inconsistent information or pushes users to complete additional KYC checks unexpectedly.

- Trustpilot BloFin reviews: The company’s Trustpilot score is low, reflecting dissatisfaction among some users. Some one‑star reviews claim that BloFin is a “scam” due to alleged price manipulation or withheld funds. However, other users report no problems and praise the platform’s performance. The polarised feedback suggests that experiences vary widely depending on trading style and compliance status.

Given these contrasting opinions, it’s wise to approach BloFin cautiously. Test the platform with small amounts, withdraw profits regularly, and contact support immediately if issues arise.

BloFin Alternatives: Coinbase, MEXC, WEEX, and Zoomex

| Criteria | BloFin | Coinbase | MEXC | WEEX | Zoomex |

|---|---|---|---|---|---|

| Tradable Assets | ~590+ (coins/pairs) | ~300+ | 2,000+ | 600+ pairs | >200 perpetual futures |

| Spot Fees (maker/taker) | 0.1% | 0.40% / 0.60% | 0.05% | 0.1% | 0.1% |

| Futures Leverage | Up to 150× | 10x | 200x | 400x | 1,000x |

| No-KYC Access | Yes (daily up to 20k USDT) | No | Yes (10BTC/day) | Yes | Yes |

| Fiat Support | Limited (via partners; fees) | Full (bank/credit card) | Limited | Limited | Limited |

| Security & Audits | Strong (custody, reserves, ISO) | Very high (insurance, cold storage) | Robust (2FA, cold storage, audits) | Basic | Audited by Hacken (2024), cold storage |

| Copy Trading | Yes | No | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes | Yes | Yes |

| Regulation / Licensing | No | Regulated (U.S.) | No | No | No |

Read our in-depth crypto exchange reviews

How to Get Started on BloFin

Opening an account and making your first trade is simple. Here’s a step‑by‑step guide:

- Register an account: Visit BloFin’s website or download the app. Click “Sign Up” and enter your email or mobile number, create a password, and accept the terms.

- Enable security features: After logging in, enable two‑factor authentication. You can choose SMS, email, or an authenticator app. Set up an anti‑phishing code to protect against phishing emails.

- Deposit funds: Click “Deposit” and choose whether to deposit crypto or buy with fiat. For crypto deposits, copy your wallet address and send funds from your external wallet. For fiat purchases, select a partner (Simplex, Alchemy, etc.), choose a currency, enter an amount, and follow the payment prompts.

- Start trading: Navigate to the spot or futures market. Use the order form to place market or limit orders. For futures, select cross or isolated margin and set your leverage. Consider using the demo account first if you’re new to derivatives.

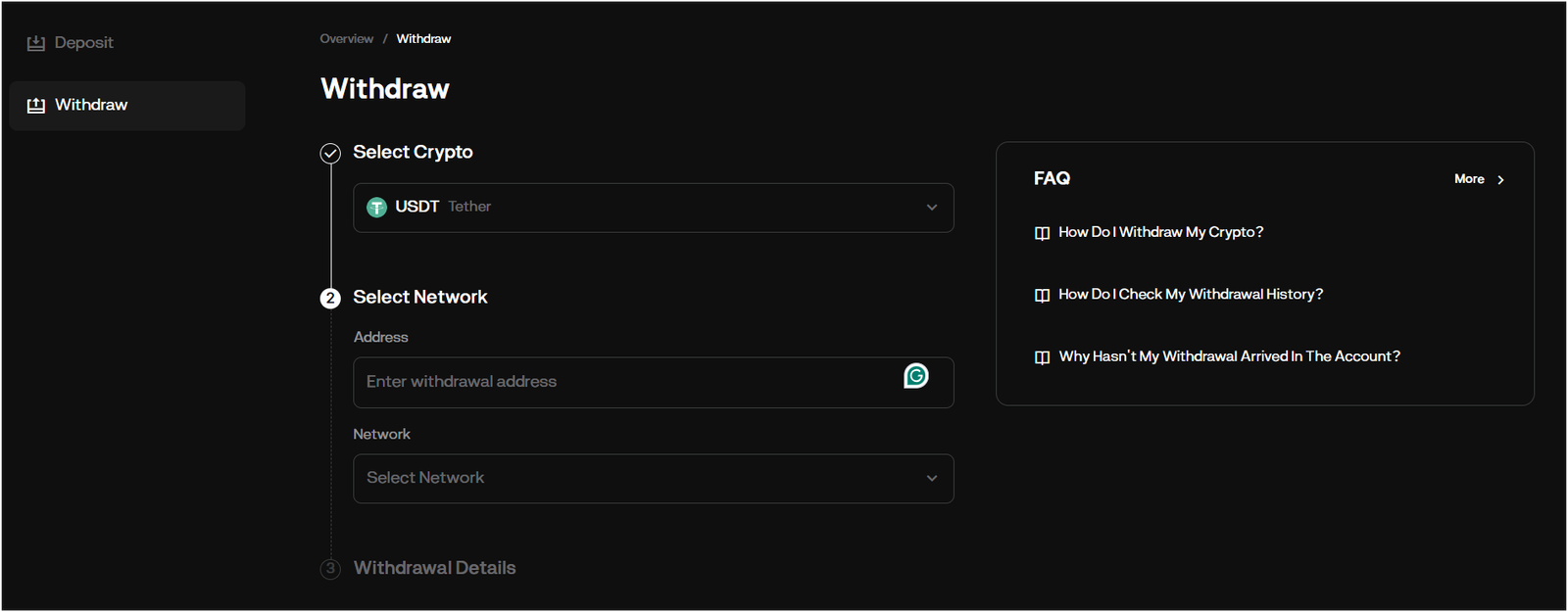

- Withdraw profits: When you’re ready to withdraw, click “Withdraw,” select your asset, enter the destination address, and confirm the withdrawal via 2FA. Always double‑check addresses to avoid losing funds.

How to Withdraw from BloFin

Withdrawals are straightforward but follow security protocols:

- Log in and navigate to the wallet page.

- Select the asset you want to withdraw.

- Enter the destination address. You can save favourite addresses on your withdrawal whitelist.

- Choose the network. For example, USDT can be withdrawn over the Ethereum (ERC‑20), Tron (TRC‑20) or Binance Smart Chain (BEP‑20) networks. Selecting a cheaper network reduces fees.

- Enter the amount and click “Submit.” A confirmation code will be sent to your email or phone. Enter the code and complete any 2FA prompts.

- Wait for processing. BloFin typically processes withdrawals within minutes, but large withdrawals may require manual review. Network congestion can also affect timing.

Frequently Asked Questions

Is BloFin available in the US?

Yes. BloFin accepts users from the United States only for crypto leverage trading. You can withdraw up to 20K USDT per day.

Is BloFin legit?

Yes, BloFin operates a genuine exchange with proof-of-reserves, Fireblocks custody, and ISO 27001 certification. Still, it is unregulated, and users have reported issues such as liquidation and withdrawal delays. Exercise caution and test the platform before committing large funds.

Is BloFin a scam?

BloFin is not a scam in the sense of being a fraudulent website. It’s a functioning exchange used by thousands of traders. However, some users feel scammed when they experience rapid liquidations or unexpected KYC demands. These experiences often stem from high leverage and volatility rather than deliberate fraud.

What are BloFin’s fees?

Spot trading fees start at 0.10% for both makers and takers. Futures fees start at 0.02% for makers and 0.06% for takers. Fees decrease for VIP levels. Crypto deposits are free, but fiat purchases via partners cost 3.5%–5%. Withdrawals incur network fees.

How can I withdraw from BloFin?

Withdrawals require navigating to the wallet page, selecting your asset, entering the destination address, choosing a network, and completing 2FA. There is no minimum withdrawal amount beyond network fees. Unverified users are limited to 20,000 USDT per day.

What currencies does BloFin support?

BloFin offers more than 500 spot tokens and 350+ futures contracts. Major coins like BTC, ETH, and USDT are supported alongside many altcoins. You can deposit and withdraw using networks such as ERC-20, TRC-20, and BEP-20.

Does BloFin have staking?

Yes. BloFin offers flexible and fixed-term staking for BTC, ETH, USDT, and USDC. Yields range from 0.02% for BTC to around 4% for USDT, depending on the lock-up period.

What is BloFin’s native token?

BloFin issues the BXT token, which gives holders access to trading fee discounts and VIP levels. Holding more BXT or trading higher volumes lowers maker/taker fees according to the VIP tier table.

Does BloFin offer leverage?

Yes. BloFin’s perpetual futures support leverage up to 150x on selected pairs. Spot margin trading is not available; only perpetual contracts provide leverage.

Does BloFin have a referral program?

Yes. Users can invite friends via referral links and earn up to 50% commission on the trading fees generated by those referrals.

BloFin Crypto Exchange Review: Final Verdict

To sum up our BloFin review, it is best for crypto traders looking for deep liquidity, high leverage, and the ability to trade without immediately submitting personal documents. Its unified trading account, copy trading feature, and competitive fees make it appealing to both novices and seasoned traders.

Add in strong security measures like Fireblocks custody, proof‑of‑reserves, and ISO 27001 certification, and BloFin looks like a robust platform for derivatives trading.

There are downsides. BloFin is not regulated in major jurisdictions, limiting legal recourse if something goes wrong. The platform does not support direct fiat withdrawals and relies on pricey third‑party on‑ramps for purchases. High leverage introduces significant risk, and a portion of user BloFin reviews cite issues with liquidations, slippage, and customer support.

Ultimately, BloFin is legit but not without controversy. If you live outside restricted countries and want access to high‑leverage perpetual contracts or copy trading, BloFin might be worth exploring.

According to my BloFin review, those prioritising regulation, comprehensive fiat services, and a large staking selection may prefer more established competitors like Coinbase or Kraken.