You know, finding the most liquid crypto exchanges is key if you want to trade large amounts of cryptocurrency quickly and at fair prices. High liquidity means you can buy or sell without waiting around or causing big price swings.

In this guide, we’ll review 6 of the top crypto exchanges by liquidity. Each of these platforms handles huge trading volumes and offers deep order books, but they each have their own strengths. By the end, you’ll know which of these high liquidity crypto exchanges might suit your trading needs.

Quick Summary: The most liquid crypto exchanges of 2025 are Kraken, Coinbase, Binance, Bybit, MEXC, and KuCoin due to their deep order books, very high daily trading volume, tight bid-ask spreads, low slippage on large trades, wide range of supported coins, and strong global user participation.

Most Liquid Crypto Exchanges in 2025 (Ranked)

- Kraken: The most liquid crypto exchange overall (FinCEN licensed in the U.S. and MiCA in Europe)

- Coinbase: A high-volume spot trading platform for U.S. users (Best in the United States)

- Binance: Best crypto exchange by volume (Best for large orders or OTC orders)

- Bybit: Most Liquid exchange for derivatives trading (100x leverage)

- MEXC: Most liquid exchange for no-KYC trading (Zero maker-fee trading)

- KuCoin: Best crypto exchange for altcoin liquidity

Comparing Top Liquid Crypto Exchanges

| Exchange | Liquidity Score | 24h Trading Volume (USD) | Avg Bid-Ask Spread | Order Book Depth (BTC +2%) | US Availability |

|---|---|---|---|---|---|

| Kraken | 4.5 / 5 | $10B+ | 0.19% | $30.5M | Yes (most states, except NY & ME) |

| Coinbase | 4.6 / 5 | $20B+ | 0.24% | $28.7M | Yes (fully available, US-based) |

| Binance (Global) | 4.9 / 5 | $100B+ | 0.14% | $8.28M | No (Binance.US is separate, lower liquidity) |

| Bybit | 4.2 / 5 | $12B+ | 0.25% | $6.24M | No |

| MEXC | 4.0 / 5 | $10B+ | 0.62% | $8.94M | Yes (no KYC) |

| KuCoin | 4.0 / 5 | $7B+ | 0.63% | $5.30M | No |

6 Most Liquid Crypto Trading Platforms Reviewed: Best Cryptocurrency Exchanges by Volume

1. Kraken: The most liquid crypto exchange overall in 2025

Kraken stands out as the most liquid crypto exchange overall. You’ll find that Kraken’s order books are deep and active, meaning you can execute large trades of Bitcoin, Ethereum, and other top coins with minimal price impact.

It consistently ranks among the top crypto exchanges by liquidity thanks to billions in daily trading volume and tight bid-ask spreads on major pairs. Honestly, Kraken’s focus on real trading volume (not wash trading) and its long-standing reputation make it a go-to platform for traders seeking reliability and high liquidity.

Why we picked it

- Supports 500+ cryptocurrencies and many fiat pairs (USD, EUR, GBP, etc.)

- Offers spot trading, up to 5× margin trading, and even futures markets

- Highly regulated in the US, UK, EU, and more (licensed and compliant)

- Strong security record with proof-of-reserves audits and fund insurance measures

- Advanced trading interface (Kraken Pro) with fast execution and API access

Pros

- Very high liquidity with tight spreads on major crypto pairs

- Trusted exchange with a long track record (est. 2011)

- Available to U.S. users and many countries worldwide

- Robust security and compliance (regulated and regularly audited)

- Wide range of coins plus multiple fiat on-ramp options

Cons

- Trading fees (up to 0.26%) higher than some competitors

- Fewer extremely new or meme coins compared to some platforms

2. Coinbase: High spot trading volume platform for U.S. users

Coinbase offers high spot trading volume and liquidity, especially for U.S. users. You can think of Coinbase as one of the best cryptocurrency exchanges by volume in the United States, where it’s a household name for buying and selling crypto.

The platform provides deep liquidity in major USD pairs like BTC/USD and ETH/USD, so when you place an order on Coinbase, it’s likely to fill quickly at a predictable price. Coinbase’s strength lies in combining liquidity with a very user-friendly experience, which is perfect if you’re newer to crypto or just prefer a simpler interface without sacrificing market depth.

Why We Picked It

- Lists 300+ cryptocurrencies on its spot exchange (all the big names and many mid-tier altcoins)

- Easy for beginners: simple buy/sell interface, plus an advanced trade view for pros

- U.S.-based and publicly traded company (NASDAQ: COIN) with transparent operations

- Quick fiat on-ramps: link your bank for ACH transfers or use debit card/PayPal for purchases

- High security: stores 98% of assets offline, has insurance on custodial funds, and strict compliance (full KYC)

Pros

- Top-tier liquidity for USD trading pairs (great for cashing in/out to fiat)

- Extremely easy to use – a clean interface ideal for new traders

- Strong regulatory compliance and trust (regulated in the U.S., audited financials)

- Supports convenient deposits and withdrawals in USD, EUR, GBP, etc.

- Offers staking and earn programs for popular coins within the platform

Cons

- Higher fees for small trades (Coinbase’s standard purchase fees can be steep)

- Fewer altcoins than some global exchanges (focuses on quality over quantity of listings)

- No built-in futures or margin trading for U.S. customers

- Customer support has been criticized as slow via email (limited live support)

3. Binance: Top crypto exchange by volume (Best for Large Trade Orders)

Binance is the world’s largest crypto exchange by trading volume, making it arguably the most liquid global platform. It often handles $100B in daily trades – no way any other exchange comes close.

This massive activity means you can trade on Binance with virtually zero slippage on major coins. Whether you’re swapping Bitcoin, Ethereum, or a smaller altcoin, Binance’s huge user base and market maker network ensure there are plenty of orders to match with yours. In short, if you want sheer scale, Binance is the best crypto exchange by volume and a top choice for liquidity across many markets.

Why We Picked It

- Over 550+ cryptocurrencies listed internationally (a vast array of coins and tokens)

- Comprehensive offerings: spot trading, margin up to 10×, and futures up to 125× leverage

- Very low fees (0.1% spot trading fee by default, plus discounts if you hold BNB or are high-volume)

- Ecosystem of services: staking, savings accounts, crypto loans, NFT marketplace, Launchpad for new tokens

- Huge global user base (100+ million users) and high availability with multi-language support

Pros

- Highest liquidity and trading volumes of any exchange globally

- Tight spreads and large order books even for many altcoins

- Competitive fees (among the lowest, especially with VIP tiers or BNB discounts)

- Offers advanced trading tools and products (derivatives, options, earn programs)

- Strong security features (SAFU insurance fund, 2FA, cold storage for most assets)

Cons

- Not available to U.S. users (U.S. residents must use the separate Binance.US, which has lower liquidity)

- Past regulatory scrutiny in multiple countries (creates some uncertainty or trust concerns for some users)

- KYC verification required for full access and higher withdrawal limits (anonymity is not an option here)

4. Bybit: Most Liquid exchange for derivatives trading (Best for high leverage)

Bybit shines as the most liquid crypto exchange for derivatives trading, offering up to 100x leverage on futures contracts. If you’re into perpetual swaps or leveraged trading, Bybit provides a trading experience with high volume and minimal order book gaps.

You’ll notice very tight spreads on Bitcoin and Ethereum futures; Bybit’s BTC perpetual contract, for example, is one of the most traded in the world after Binance.

This means you can enter and exit large leveraged positions on Bybit without worrying much about slippage, which is crucial for short-term traders. Generally, Bybit is the place for high-liquidity futures outside of the Binance ecosystem.

Key Features

- Focus on perpetual swaps and futures: trade BTC, ETH and many altcoin contracts with up to 100× leverage

- Also supports spot trading for 1,000+ coins (for when you need to buy actual crypto, not just trade contracts)

- Advanced trading interface with TradingView charts, depth charts, and multiple order types (ideal for technical traders)

- Fast trade execution and reliable uptime: Bybit is known for not crashing during volatile spikes, which is critical for leveraged trading

- Regular trading competitions, bonuses, and an active community (you’ll see a lot of engagement if you like social trading aspects)

Pros

- Deep liquidity in major crypto futures markets (BTC, ETH, and top alt contracts)

- Allows high leverage for those who want it (experienced traders can trade big with relatively small capital)

- Intuitive and modern platform design, tailored for active traders

- Low fees for derivatives (maker fees can even be zero or negative for high-tier users)

- Offers some passive income features (e.g., Bybit Earn, launchpads) alongside trading, adding versatility

Cons

- Not available to traders in the U.S. and certain other restricted countries

- KYC verification has become required for large withdrawals and certain features (reducing the anonymity it once had)

- Limited fiat on-ramp: you generally have to deposit crypto (or use a third-party service) since Bybit isn’t a traditional fiat exchange

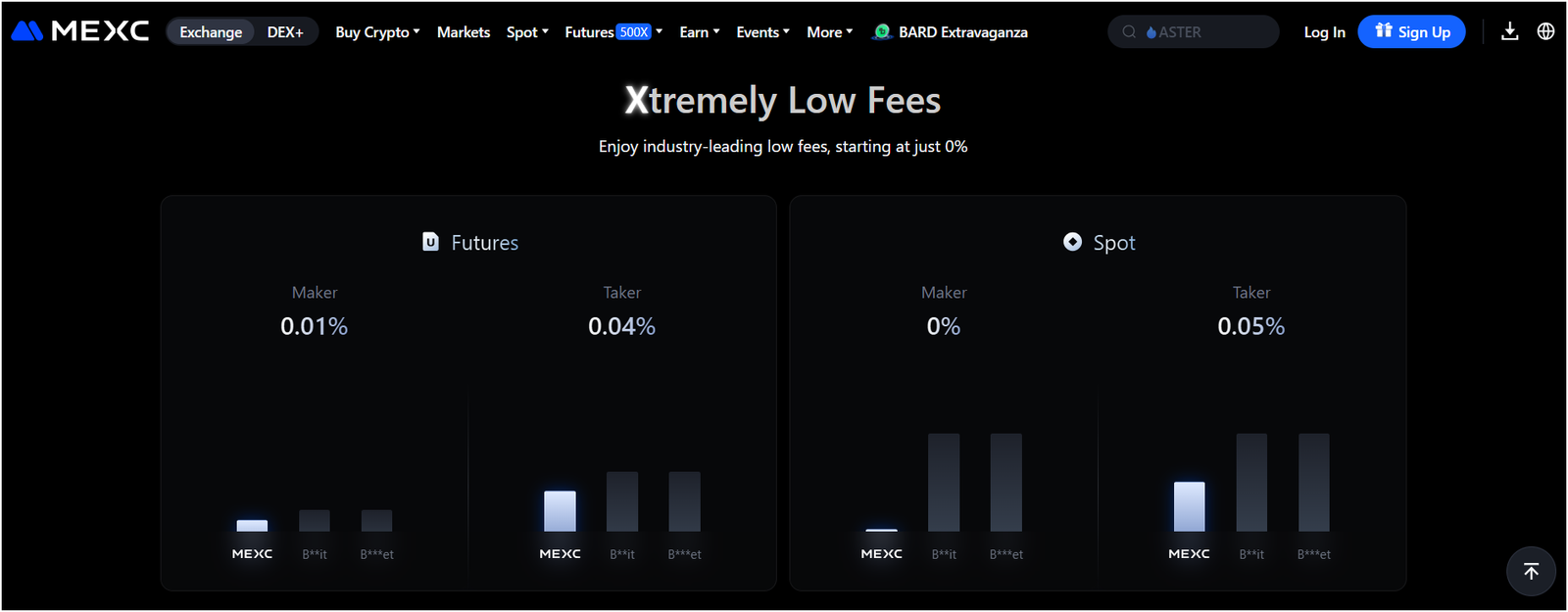

5. MEXC: Most liquid exchange for no-KYC trading and Low Fees

MEXC stands out as a top liquid crypto exchange that does not require KYC for trading. If you value privacy or just don’t want to go through an ID verification process, MEXC lets you trade a massive range of cryptocurrencies while still enjoying high liquidity.

This platform lists thousands of coins: seriously, about 3,000+ cryptocurrencies, and is often among the first to list new tokens. Despite being more under the radar in the West, MEXC’s volume is impressively high on many pairs, partly thanks to zero-fee promotions that attract heavy traders. (Read: Best no-KYC crypto exchanges)

Key Features

- No KYC required for up to 10 BTC per day withdrawals

- Huge selection of markets: ~3,000+ cryptos available, including very new and niche altcoins

- Competitive trading fees (often 0% maker and 0.05% taker on spot trades; frequent fee reduction events)

- Futures trading offered with up to 200× leverage, plus unique features like ETF tokens and a DEX aggregator built-in

- Emphasis on speed and performance: the exchange handles high throughput, so orders execute fast even during peak times

Pros

- Privacy-friendly trading: you can start trading with just an email (no lengthy verification)

- Extensive altcoin listing: great for finding and trading low-cap gems with liquidity

- High liquidity on many pairs due to a large user base and market-maker programs

- Very low fees and even zero-fee campaigns on popular trading pairs

- Quick and easy account setup and deposits (just deposit crypto and you’re ready to trade)

Cons

- Less regulated than major exchanges: operate with caution, as it doesn’t have the same oversight as Coinbase/Kraken

- Some volume on obscure tokens may be inflated by promotions (liquidity can drop after zero-fee events end)

- The interface can be a bit overwhelming with so many coins and features presented at once

6. KuCoin: Best crypto exchange for altcoin liquidity

KuCoin is often called “The People’s Exchange,” and it’s the best crypto exchange for altcoin liquidity in the eyes of many traders. If you love trading a wide variety of smaller coins, KuCoin probably has the market for you: with nearly 700+ cryptocurrencies listed, it provides active order books for tokens you won’t find on Coinbase or even Binance.

The liquidity on KuCoin is impressive considering its focus on altcoins; you can usually get decent fills on trades even for mid-market cap coins. It might not match Binance’s volume on the biggest coins, but for breadth of markets and solid liquidity across that breadth, KuCoin is a top choice.

Key Features

- Over 700 cryptocurrencies and 1,000+ trading pairs, including lots of DeFi, GameFi, and newer project tokens

- Spot trading, margin trading (up to 5× on certain pairs), and futures are all available on the platform

- Low trading fees (0.1% base fee on spot, similar to Binance; discounts if you pay with KuCoin Token (KCS))

- KuCoin Earn offerings like staking, savings, and an on-platform lending marketplace for users to earn interest

- Community-focused features: KuCoin Shares (KCS) token rewards, trading competitions, and an active social media presence

Pros

- Excellent altcoin liquidity: many smaller coins have active trading on KuCoin

- Large international user base (over 29 million users), which helps keep volumes up

- Competitive fees and extra discounts using the KCS token or high-volume tiers

- Offers a suite of features beyond just trading (earn products, NFT marketplace, IEO launchpad)

- Proven track record of handling high traffic during crypto market surges (generally stable performance)

Cons

- Not licensed for U.S. operation: U.S. traders may be barred or have to use workarounds (always a risk)

- Experienced a major hack in 2020 (funds were recovered, but it’s a past security incident to note)

- Mandatory KYC for all new users as of late 2023 (anonymity is no longer an option here)

- Offshore registration (Seychelles-based), which can be a concern if you prefer heavily regulated exchanges

What Is Cryptocurrency Exchange Liquidity?

Liquidity, in simple terms, describes how easily you can trade an asset without affecting its price. On a cryptocurrency exchange, liquidity means there are plenty of buy and sell orders in the order book at any given time.

So, if an exchange has high liquidity for say, Bitcoin, you can sell a large amount of BTC and you’ll still get a price very close to the current market rate. There are lots of buyers and sellers, so the trade happens fast and without the price slippage.

Think of it this way: On a highly liquid exchange, the bid-ask spread (the gap between what buyers bid and sellers ask) is very small. You might see only a few cents difference between the price someone is willing to buy Bitcoin and the price someone is willing to sell. Also, the order book will have depth: large volumes available at each price level. This is what you experience on the most liquid crypto exchanges like the ones we covered: you can enter or exit positions quickly.

In contrast, on a low-liquidity exchange, you might place an order and find there aren’t enough buyers or sellers at the current price. Basically, you’d have to accept a much worse price to complete your trade, or wait a long time. That’s called slippage when the price moves against you due to insufficient liquidity. It’s generally something you want to avoid.

Read: Best crypto exchanges UK

Why Liquidity Matters for Traders and Institutions

Here’s why it’s so important:

- Quick Trade Execution: On a high-liquidity exchange, when you place an order, there’s a good chance it gets filled almost instantly. You’re not left hanging. For a day trader or scalper, this is crucial; you want to enter and exit at the prices you expect, without delay.

- Minimal Slippage: As mentioned, liquidity means you won’t move the price much when you trade. On a low-liquidity platform, that same buy could drive the price up several percent before your order fills completely. High liquidity saves you money and makes pricing more predictable.

- Better Prices and Tighter Spreads: More liquidity leads to competition between buyers and sellers, which tightens the spread. You effectively get a better deal whether you’re buying or selling.

- Stability and Lower Volatility: With lots of trading activity and deeper order books, prices on liquid exchanges tend to be more stable. You’ll notice fewer crazy jumps from a single trade.

- Confidence and Trust: Liquidity can be a virtuous cycle, an exchange that has liquidity attracts more traders, which further increases liquidity. When you see an exchange with high volume, it generally signals a level of trust and popularity in the marketplace.

Read: Best lowest fee crypto exchanges

Our Methodology for Ranking Crypto Exchanges’ Liquidity

You might be wondering how we picked these six exchanges as the most liquid. We didn’t just grab the ones with the biggest headlines: we took a balanced look at several factors to rank crypto exchanges by liquidity-

Reported Trading Volume

We started by looking at volume data (how much value changes hands on the exchange daily). Exchanges like Binance clearly lead by this metric. However, we know volume alone can be misleading due to fake or wash trading on some platforms, so volume was just one consideration.

Order Book Depth and Spreads

We examined how deep the order books go and how tight the spreads are for key trading pairs. In other words, if you tried to buy $100k of Bitcoin, how much would the price move on Exchange A vs Exchange B? The most liquid crypto exchanges show very little slippage for large orders. Kraken, for instance, scored well here with solid depth on its books, and Binance of course excels too.

Variety of Liquid Markets

An exchange might be super liquid for Bitcoin but dead for altcoins, or vice versa. We gave props to exchanges that offer liquidity across a range of coins. KuCoin and MEXC, for example, made the list because they provide reliable liquidity for many smaller tokens that would be hard to trade elsewhere. It’s not just about the top coins, but liquidity in the markets you care about.

Trusted Volume (Quality of Liquidity)

We leaned on third-party ratings and our own experience to judge whether the volume is “real.” Platforms like Kraken and Coinbase are known for high trust score volume (more organic trading, less bot manipulation).

Binance and Bybit have immense volume, and while there have been questions on some alt pairs, their major market liquidity is undeniably real. If an exchange had a reputation for massively inflated numbers, we’d take that into account and not rank it as high.

Institutional and Retail Mix

Liquidity comes from having a lot of participants. Exchanges that cater to both retail traders and institutions got bonus points, because that mix often leads to steadier, round-the-clock liquidity.

Kraken and Binance, for instance, serve both segments; Coinbase does too (with Coinbase Prime for institutions). Bybit and MEXC are more retail-focused but have some bigger players and market makers participating actively. The broader the user base, the more confident we are in an exchange’s liquidity resilience even during market stress.

Regional and Niche Considerations

We also intentionally included platforms that excel in certain niches: Bybit for derivatives liquidity, and MEXC for no-KYC altcoin liquidity.

While Binance or Coinbase might have more volume overall, these niche exchanges are the most liquid in their specific domain. Our methodology wasn’t just “who’s biggest.” It was “who’s biggest or best in each category that matters.”

Read: Best places to buy Binance coin (BNB)

Conclusion

Each of these platforms is one of the best cryptocurrency exchanges by volume or depth in the areas they specialize. So, when choosing, consider what matters most to you: Is it pure volume and lowest fees (Binance)? Regulatory safety (Kraken/Coinbase)? Altcoin variety (KuCoin/MEXC)? Or derivatives trading (Bybit)?

- Kraken offers an overall balance of very high liquidity, trust, and compliance, a fantastic choice for both serious retail and institutional traders who want deep markets and peace of mind.

- Coinbase brings high liquidity in a user-friendly package, especially great for U.S. traders who want a reliable fiat on/off ramp with plenty of volume behind it.

- Binance is the volume monster globally – if you need the absolute highest trading volumes and don’t mind the sprawling feature set, it’s hard to beat for liquidity on almost any coin.

- Bybit caters to derivatives enthusiasts, giving you a liquid playground for futures trading with leverage. It’s where you go when you want to trade big contracts with minimal slippage (outside the U.S., of course).

- MEXC shows that even without strict KYC, an exchange can have substantial liquidity – it’s a haven for altcoin hunters and those who prefer to trade under the radar, without sacrificing active markets.

- KuCoin proves its worth by supporting so many altcoin markets with decent liquidity. It’s the best friend of any trader who likes to venture beyond the top 50 coins; you’ll often find the volume you need for those hidden gems on KuCoin.

FAQs: Top Crypto Exchanges by Liquidity

What are the top crypto exchange liquidity providers?

Binance, Coinbase, and Kraken would be considered among the top liquidity providers in the crypto exchange world; Binance for its sheer global volume, Coinbase and Kraken for their high-quality, trusted liquidity, especially in fiat markets

What is the most liquid crypto exchange right now?

Binance is the most liquid crypto exchange in the world. It consistently has the highest trading volumes and very deep order books for the vast majority of trading pairs.

So, if you place a trade on Binance, whether it’s a market order for Bitcoin or an altcoin, it’s likely to get filled almost instantly due to the number of active traders and robots (market makers) on the platform.

Which crypto exchange has the highest trading volume?

Binance has the highest trading volume of any crypto exchange. On a typical day, Binance’s trading volume can be tens of billions of dollars, far exceeding the next closest competitor. It’s been the volume leader for several years running.

Are decentralized exchanges (DEXs) as liquid as centralized ones?

Generally, decentralized exchanges are less liquid than centralized exchanges. The largest DEXs (like Uniswap on Ethereum or PancakeSwap on BSC) do have significant volume and liquidity in their pools, but they still can’t match the super-tight spreads and deep order books of top centralized exchanges like Binance or Kraken for major trades.

Which crypto exchanges are best for altcoin liquidity?

For altcoin liquidity, meaning smaller-cap or less mainstream coins, KuCoin and MEXC are two of the best exchanges. They list hundreds or thousands of altcoins and tend to have active communities trading those coins, giving you better liquidity than you’d find elsewhere for many tokens.

Are high-liquidity exchanges safer for large trades?

Well, high liquidity itself doesn’t automatically mean an exchange is safer in terms of security, but it’s often a sign that the exchange is well-established.

Many of the high-liquidity exchanges (like the ones we discussed) have strong security track records. For example, Kraken and Coinbase are known for robust security practices, and Binance, despite a few incidents, has security funds and systems in place.