When it comes to trading or storing digital assets, choosing the safest crypto exchange is absolutely critical. With security breaches, scams, and regulatory uncertainty still affecting parts of the industry, not all platforms are created equal. That’s why we’ve thoroughly reviewed and tested many of the most trusted cryptocurrency exchanges on the market.

Our evaluations for the safest place to buy crypto are based on a range of stringent criteria, including:

- Security ratings from leading platforms like Cer.live and CertiK

- Regulatory compliance and licensing in key jurisdictions

- Proof of Reserves (PoR) and transparency practices

- Past hacking incidents and platform responses

- Cold wallet storage, insurance funds, and real-time monitoring systems

- KYC policies and availability in the U.S. and other major markets

In this guide, we’ll cover the top 8 safest crypto exchanges of 2026, explain what makes them secure, and help you decide how to pick a reputable crypto exchange.

Top 8 Best Safest Crypto Exchanges of 2026

We have reviewed over 20 different popular crypto exchanges based on features such as security measures, past hacking incidents, licensing, and more. Here is our list of the top 7 safest crypto exchanges:

- Kraken – Best for U.S. and EU users (Licensed by FinCEN and MiCA)

- Bitget – Best for beginners (High liquidity)

- MEXC – Best for anonymity (Trade without KYC)

- Gate.io – Best for altcoins (3,000+ supported altcoins)

- KuCoin – Best for futures trading

- Binance – Best for high-volume trading (Trusted by 280M users globally)

- XT.com – Best for U.S. users (no-KYC trading)

- Bybit – Best for derivatives trading

Note: U.S. customers can use Kraken for a full licensed exchange or MEXC and XT.com for no-KYC trading. Remember, you can not deposit fiat to a no-KYC exchange. So, if you want to use fiat, Kraken is the safest place to buy crypto.

Our Pick: Most Secure Crypto Exchange for Safe Trading

Most Trusted Ways to Buy Crypto in 2025 (Platforms or Apps Reviewed)

1. Kraken: Overall safest crypto exchange 2025 (U.S. & Europe)

Kraken is often seen as one of the safest crypto exchanges in the industry. Founded in 2011 and based in the U.S., Kraken has built a strong reputation by emphasizing security, transparency, and compliance. It has earned the ISO/IEC 27001:2013 certification and passed a SOC 2 Type 1 examination, showing that its cybersecurity and data protection systems meet high international standards.

Kraken’s regulatory credibility further increases safety. It holds a special-purpose depository institution (SPDI) charter in Wyoming and has recently obtained a MiCA license from the Central Bank of Ireland, readying it to operate under enhanced European crypto regulation.

Kraken supports deposits and withdrawals in multiple fiat currencies, including USD, EUR, and AUD, making it easy for users to fund accounts with bank transfers and other payment methods. It lists more than 300 cryptocurrencies. The platform also offers advanced trading options such as margin and futures trading with up to 50x leverage.

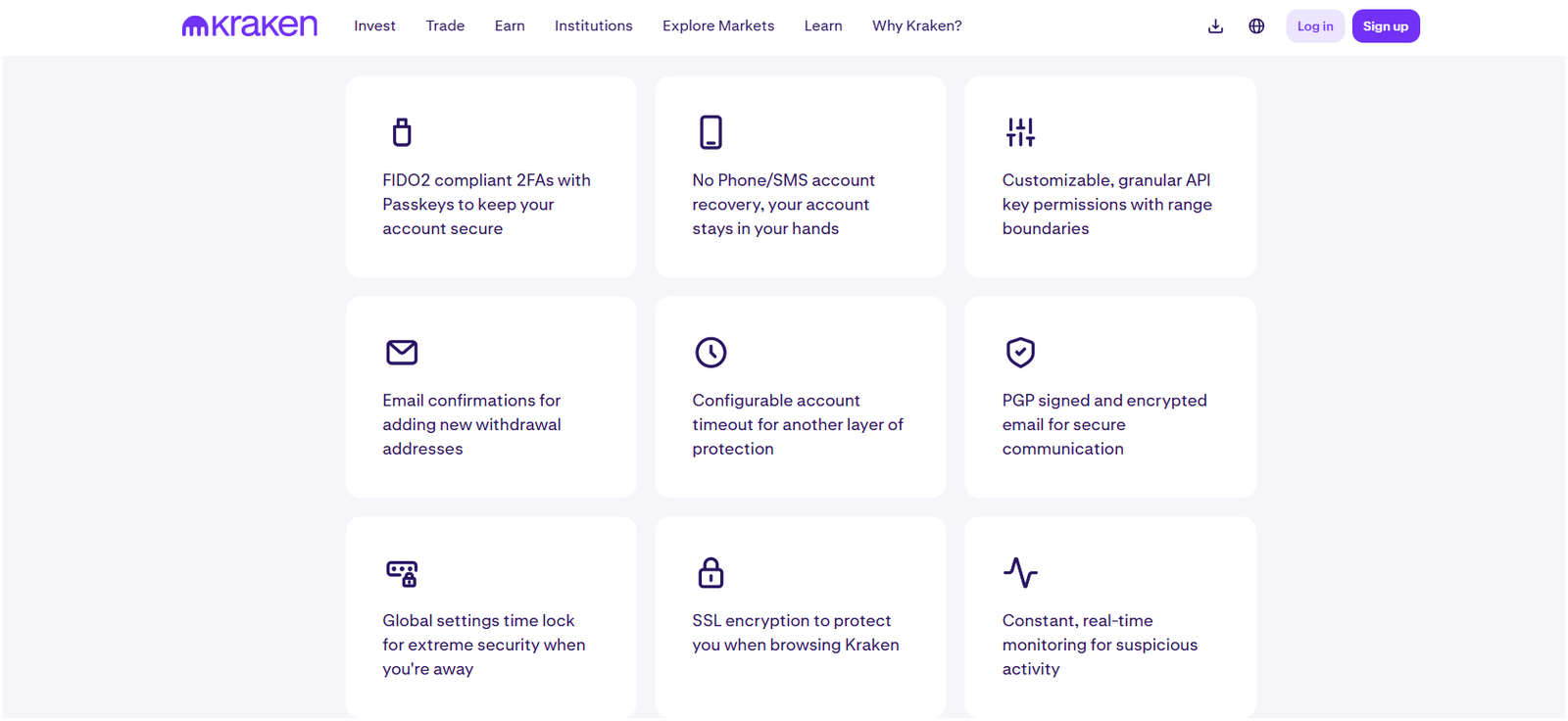

Why Kraken is the safest crypto exchange?

- International Security Certifications: Kraken has earned ISO/IEC 27001:2013 certification and completed a SOC 2 Type 1 audit, proving it maintains high standards for cybersecurity and data protection.

- Proof of Reserves (PoR) Audits: Kraken regularly publishes PoR audits, showing that user funds (covering a portion of assets) are verifiably held, which increases transparency and trust.

- Robust Technical Security Practices: The platform enforces two-factor authentication (2FA), stores most assets in cold storage, and conducts continuous security audits to guard against hacks and theft.

- Strong Regulatory and Institutional Compliance: Kraken was the first crypto exchange to gain a SPDI bank charter in the U.S., and has also secured a MiCA license in Europe – demonstrating its commitment to regulatory compliance and investor protection across jurisdictions.

- Long Track Record Without Major Hacks: Since launching in 2011, Kraken has maintained a clean security record, without major successful hacks, and was trusted in industry recovery efforts due to its reputation for safety.

Disclaimer: Services for U.S. and U.S. territory customers are provided by Payward Interactive, Inc. (“PWI”) dba Kraken, a FINCEN-registered money services business and subsidiary of Payward, Inc. Also, Payward Europe Solutions Limited t/a Kraken is authorised by the Central Bank of Ireland.

2. Bitget: Safest Crypto Exchange for Beginners

Bitget is the safest crypto exchange founded in 2018 and headquartered in Seychelles. It serves over 20 million users across 100+ countries, offering spot, futures, and copy trading services. Bitget supports more than 814 cryptocurrencies, 15 fiat currencies, and over 1,096 trading pairs, making it one of the most diverse platforms globally.

The platform is known for its low trading fees (0.1% for spot trading) and advanced features like trading bots and copy trading. Bitget has gained popularity for its user-friendly interface and strong focus on security. While it’s not regulated in major jurisdictions like the U.S. or U.K., it complies with global KYC and AML standards. Bitget also maintains a Proof of Reserves system and a Protection Fund valued at $577 million, which helps compensate users in case of a breach.

Why Is Bitget a Safe Crypto Exchange?

- Cold Wallet Storage: Bitget stores over 90% of user funds in cold wallets, which are kept offline and protected by multi-signature technology. This significantly reduces the risk of hacking or unauthorized access.

- $577 Million Protection Fund: Established in 2022, Bitget’s Protection Fund acts as an insurance pool to cover user losses in case of platform failure or cyberattacks. It’s one of the largest self-insured funds in the crypto industry.

- Two-Factor Authentication (2FA): Bitget enforces 2FA for logins, withdrawals, and account changes. Users can choose between Google Authenticator, SMS, or Passkey for added security.

- Proof of Reserves (PoR): Bitget publishes monthly Proof of Reserves reports using Merkle Tree verification. This ensures that all user assets are fully backed and available for withdrawal at any time.

3. MEXC: Trusted Exchange for anonymous Trading

MEXC is a centralized safest crypto exchange founded in 2018 and headquartered in Seychelles. It serves over 10 million users across 170+ countries, offering access to more than 2,700 cryptocurrencies and 300+ futures trading pairs. The platform is known for its zero spot trading fees, low futures fees (0.01% taker fee), and high leverage options (up to 200x). MEXC supports spot, margin, and futures trading, along with features like copy trading, staking, and launchpad access.

One of its standout features is no mandatory KYC for basic trading and withdrawals. Users can sign up with just an email and withdraw up to 30 BTC per day without identity verification. This makes it especially attractive to privacy-conscious users and those in regions with strict regulations. Even US users can access MEXC using a VPN, although the platform officially restricts US IPs. (MEXC review)

Why is MEXC the Safest Crypto Exchange?

- Strong Security Infrastructure: MEXC uses cold wallet storage, multi-signature wallets, and two-factor authentication (2FA) to protect user funds. It also offers anti-phishing codes, withdrawal address whitelisting, and real-time risk monitoring to prevent unauthorized access and fraud.

- Proof of Reserves and Transparency: The exchange publishes Proof of Reserves, showing that user assets are backed 1:1 and not lent out or rehypothecated. This adds transparency and trust, especially for users who prefer not to complete KYC.

- Access for US Users Without KYC: Although MEXC geo-blocks US IPs, many US users still trade using VPNs without completing KYC. This workaround allows Americans to benefit from MEXC’s features while maintaining privacy.

Related: Best KYC-free crypto exchanges

4. Gate.io: Best Reputable App for altcoins

Gate.io is another safest cryptocurrency exchange founded in 2013, now headquartered in the Cayman Islands. It serves over 21 million users across 175+ countries, offering access to more than 3,800 cryptocurrencies and 1,000+ trading pairs. The platform supports spot, margin, and futures trading, along with staking, copy trading, and DeFi services. Gate.io’s native token, GateToken (GT), provides fee discounts and VIP benefits.

Gate.io ranks among the top 10 exchanges by trading volume, with daily volumes often exceeding $4.95 billion. It offers a tiered fee structure, starting at 0.1% for spot trading, and supports advanced trading tools like bots and perpetual contracts with up to 125x leverage. Gate.io has obtained licenses in countries like Malta, Italy, and Lithuania. It’s known for its wide asset selection and strong liquidity. (Gate.io review)

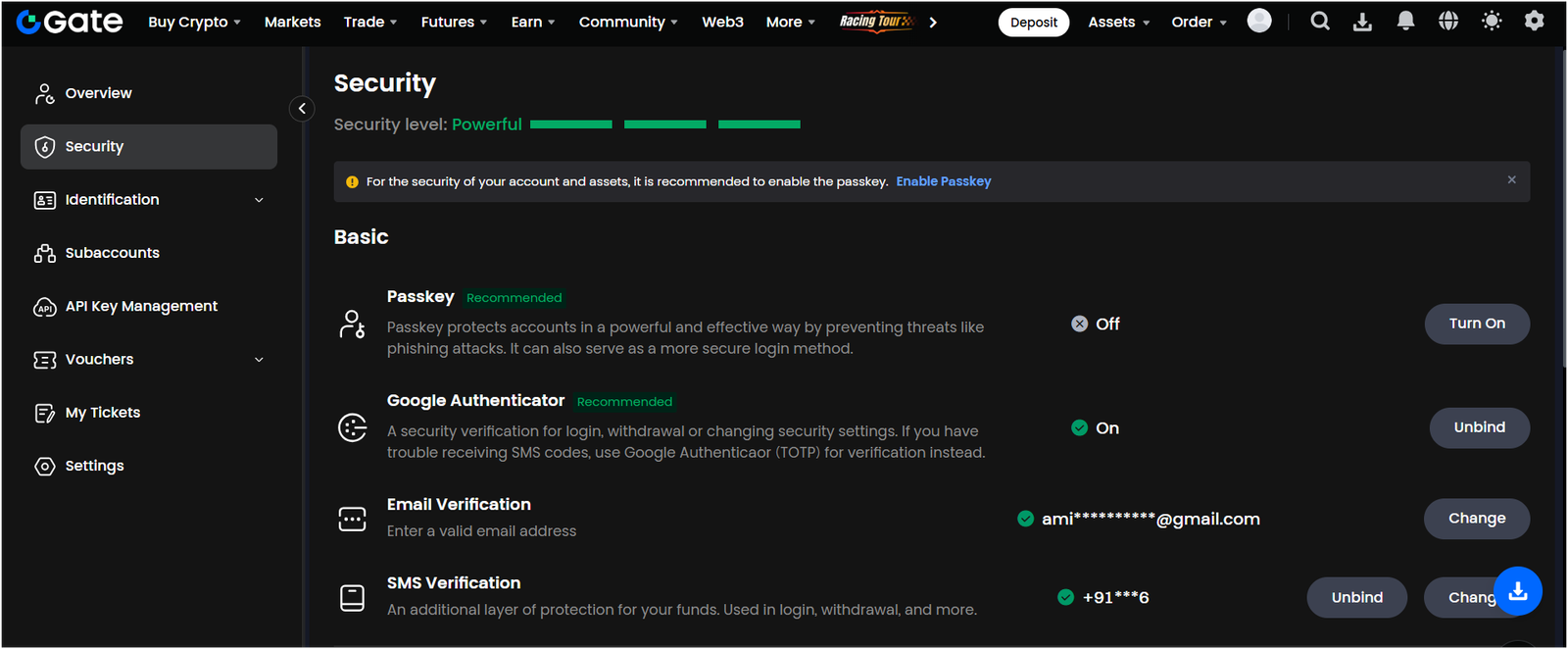

Why Is Gate.io a Safe Exchange?

- Long-Term Track Record: Gate.io has operated for over 12 years with no major hacks since 2019. It responded quickly to past incidents, such as reimbursing $2 million to users affected by an external attack in 2021. Its proactive security stance and longevity build user trust.

- Insurance Fund (SAFU): The platform maintains a $100 million Security Asset Fund for Users (SAFU). This fund is designed to compensate users in case of extreme events or platform failures, similar to what Binance offers.

- Multi-Layered Security Infrastructure: Gate.io uses cold storage for most user funds, multi-signature wallets, and two-factor authentication (2FA). It also includes anti-phishing codes, withdrawal whitelists, and fund passwords to protect user accounts.

5. KuCoin: Safest Exchange for futures trading

KuCoin is another safest crypto exchange for altcoins launched in 2017 and headquartered in Seychelles. It offers access to more than 900 cryptocurrencies and 1,300+ trading pairs, second only to Binance. KuCoin is known for its low trading fees (starting at 0.1%), advanced trading tools, and support for 48 fiat currencies, the highest among major exchanges. It provides spot, margin, futures, and P2P trading, along with staking and lending options.

Despite a major hack in 2020 involving $285 million, KuCoin recovered 84% of the stolen funds and covered the rest through insurance. Since then, it has significantly upgraded its security systems. KuCoin is not licensed in the U.S., but it partners with Onchain Custodian (backed by Lockton Insurance) to safeguard user assets. It also publishes Proof of Reserves reports to verify 1:1 asset backing. (Read KuCoin review)

Why Is KuCoin the Safest crypto Exchange?

- Reserve backing above 100 %: KuCoin maintains fully backed on‑chain reserves with ratios over 100 % for BTC, ETH, USDT, and USDC (e.g. 116 % for ETH) verified by audits. That ensures deposit liabilities are always fully covered, not using fractional reserves.

- International security certifications: It has achieved SOC 2 Type II and ISO 27001:2022 certifications, meaning its data protection, privacy, and availability controls meet enterprise‑grade global standards after lengthy independent audits.

- Insurance Partnership: KuCoin has partnered with Onchain Custodian, a Singapore-based custody service, and is backed by Lockton, the world’s largest private insurance broker.

6. Binance: Most Secure for high-volume Trading

Binance is the world’s largest and safest crypto exchange by trading volume. It was launched in July 2017 by Changpeng Zhao and Yi He. Today, it serves nearly 240 million users across more than 20 regulated markets.

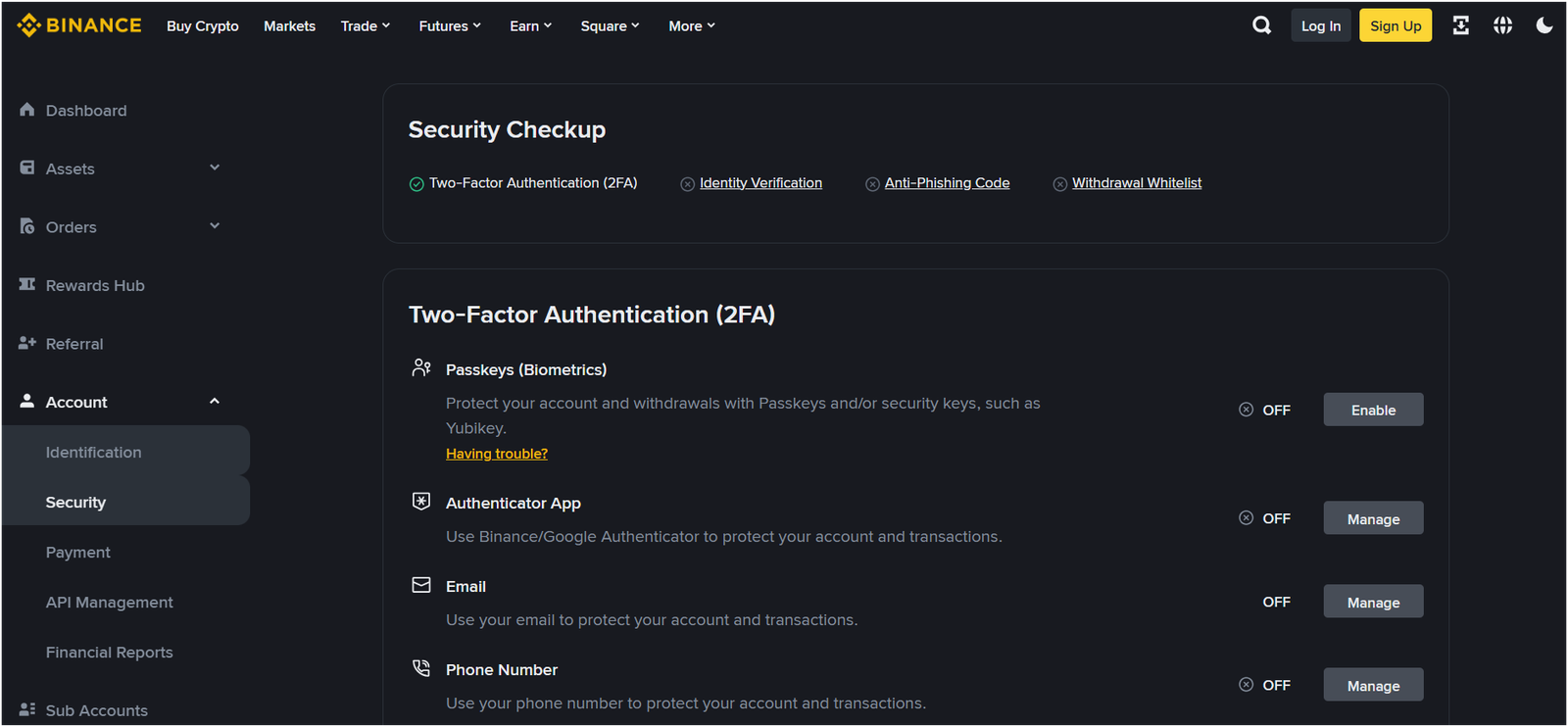

Since November 2023, Richard Teng has been the CEO, focusing heavily on improving compliance and global standards. Binance secures most customer funds in cold wallets, which are offline and protected by multi-signature or threshold signature systems. Its internal risk system monitors high-risk actions like withdrawals, password resets, and 2FA changes in real-time, using AI to detect suspicious activity.

Binance also runs a $1 billion emergency insurance fund called SAFU (Secure Asset Fund for Users), which is backed mainly by stablecoins. In 2024 alone, Binance’s systems reportedly blocked over $4.2 billion in attempted fraud and scam-related withdrawals, protecting around 2.8 million users from losses. (Read Binance review)

Why Is Binance a Safe Exchange?

- Real‑time risk monitoring with AI and withdrawal holds: Binance uses AI to monitor all key actions like logins, withdrawals, and security changes. If any suspicious behavior is detected, withdrawals can be paused for 24–48 hours to allow time for investigation.

- $1 billion SAFU emergency insurance fund: Binance created the SAFU fund in 2018 and funds it using 10% of trading fees. The fund is worth around $1 billion and is used to cover user losses in emergencies, such as during the 2019 security breach.

- Law enforcement collaboration & recovery record: Binance has a dedicated team that responds quickly to law enforcement requests. In 2024, it helped recover over $88 million in stolen or misallocated funds by working with agencies and using blockchain tracking tools.

7. XT.com: Best for U.S. users (without ID verification)

XT.com is another safest crypto exchange that lists over 800 cryptocurrencies and supports 1,000+ trading pairs across spot, margin, futures, staking, NFTs, and OTC trading. The platform’s spot trading volume typically places XT.com in the top 20, with derivatives ranking in the top 10 globally.

XT.com holds a US MSB license and a DMCC license in UAE. For US residents, XT.com remains operable under its no‑KYC policy, offering privacy and anonymity for standard limits, and US users are not required to submit ID just to trade and withdraw. (Read XT.com review)

Why is XT.com The Safest Exchange?

- Cold‑storage multi‑sig with strong reserves: Nearly all assets are kept offline with multi‑signature control and a reserve fund equal to 150 % of user deposits, mitigating loss risk.

- External audits, bug bounty and proof‑of‑reserves: Regular third‑party security testing plus Merkle‑tree proofs add transparency and timely vulnerability fixes.

- Incident containment with no user impact: In the Nov. 28, 2024 event, XT froze withdrawals instantly, performed investigation, and ensured user funds stayed intact.

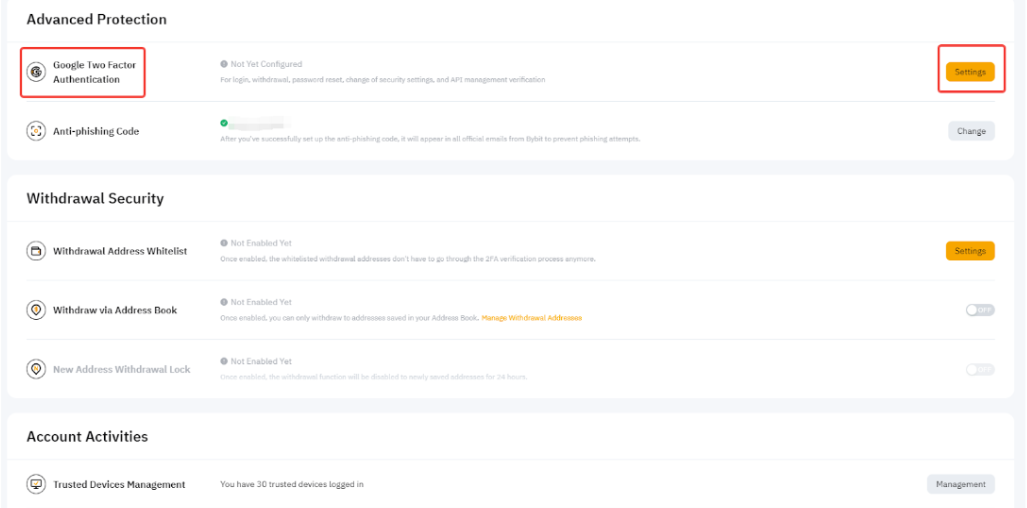

8. Bybit: Best for derivatives trading

Bybit is a top exchange with highest grade security. The platform’s key security architecture includes cold storage for most customer assets, multi‑signature wallets, Threshold Signature Schemes (TSS), and Trusted Execution Environment (TEE) technologies. User data is encrypted at rest and in transit, with real‑time monitoring of logins, withdrawals, and account changes.

Bybit maintains strong compliance: in June 2024 it registered with India’s FIU‑IND under PMLA, paying a ₹9.27 crore fine (around USD 1.06 million), and in November 2024 it gained VASP licensing in Georgia. Although it endured the largest crypto theft on record in February 2025, USD 1.5 billion stolen, it covered the loss within three days using reserves and emergency loans while restoring client assets fully to USD 14 billion. (Read Bybit review)

Why Is Bybit a Safe Exchange?

- Real‑time behavior monitoring: Every login, withdrawal, or change triggers risk control systems; suspicious actions are flagged immediately and may require extra verification.

- Regulatory compliance steps: Bybit formally registered as a VASP in India on June 26, 2024 and in Georgia in November 2024, showing its commitment to legal frameworks in key markets.

- Proven crisis response: After the USD 1.5 billion hack in February 2025, Bybit activated a crisis plan, borrowed around USD 280 million from other firms, used its reserves, and fully restored customer funds within three days.

Comparing Safest Exchanges for Crypto Trading

| Exchange | Security Rating | KYC Required | Regulated | Past Hacking Issues | US Availability |

|---|---|---|---|---|---|

| Kraken | AAA | Yes | Highly (US and Europe) | Never | Yes (Fully available) |

| Bitget | AAA | Yes | ❌ Not in major jurisdictions (e.g., U.S./U.K.) | No major hacks reported | ❌ Not officially available |

| MEXC | A+ | ❌ No (optional; up to 30 BTC/day without KYC) | ❌ Unregulated | No major incidents noted | ✅ (Without KYC) |

| Gate.io | AA | Yes | ✅ Licensed in Malta, Italy, Lithuania | Minor incident in 2021 (external attack, reimbursed) | ❌ Not officially supported |

| KuCoin | A+ | Yes | ❌ Not licensed in U.S. | ✅ Major hack in 2020 ($285M, fully resolved) | ❌ Not available |

| Binance | AAA | Yes | ✅ In 20+ regulated markets | ✅ 2019 breach, now has SAFU and AI risk systems | ❌ U.S. users must use Binance.US |

| XT.com | AA | ❌ No (for standard limits) | ✅ U.S. MSB & UAE DMCC licenses | ✅ Incident in 2024 (no user losses) | ✅ Available without KYC |

| Bybit | AA | Yes | ✅ Licensed in India & Georgia | ✅ $1.5B hack in 2025 (fully compensated in 3 days) | ❌ Not officially supported |

How to Pick a Reputable Crypto Exchange?

You can pick a reputable crypto exchange by looking at its licensing, security measures, past hacking issues, insurance coverage, solvency data, and user reviews.

Kraken, Bitget, Binance, and KuCoin are the most trusted and reputable crypto exchanges to buy Bitcoin and other altcoins.

Regulation and Licensing

First, check if the safest crypto exchange is licensed and regulated in your country or region. This means it follows legal rules made by the government or financial authorities. A regulated exchange is more likely to follow proper practices and protect users.

If an exchange isn’t regulated or hides this information, that’s a red flag. You should be able to find this detail on the exchange’s website, usually at the bottom of the page or in the “About” section.

Security Measures

Security is key when dealing with digital money. A good exchange will use strong security methods to protect your account and funds. Look for things like:

- Two-factor authentication (2FA)

- Cold storage for crypto (offline wallets)

- Encryption of data

- Regular security audits

If an exchange doesn’t have 2FA or hasn’t explained how it protects your crypto, that’s not a good sign. The safest crypto exchange will always be clear about its safety steps.

Solvency (PoR)

Solvency simply means that the exchange has enough assets to cover all user funds. Some exchanges now show something called “Proof of Reserves” (PoR). This shows that they actually hold the money or crypto that users see in their accounts.

A trustworthy crypto exchange won’t have a problem showing this data. If an exchange avoids sharing these details, it may be hiding something. You want to use a platform that can prove it is not using customer funds for other things.

Insurance Coverage

Some safest crypto exchanges offer insurance to protect your assets in case of a hack or loss. This doesn’t mean your money is 100% safe, but it adds another layer of protection. Always check what is covered and what’s not.

For example, insurance might only apply if the platform itself is hacked, not if you lose your password. Make sure to read the fine print.

Reputation and Reviews

Finally, don’t ignore what other users are saying. Look for reviews online, in forums, or social media. You’ll quickly get a sense of how the exchange treats its users, especially when problems happen. Watch out for exchanges with a long history of bad customer service, withdrawal issues, or sudden outages.

Also, check how long the safest crypto exchange has been operating. If it’s been around for many years without major problems, that’s a good sign.

Read more

How to Trade Crypto Safely in 2025?

Step 1: Choose a Trusted and Secure Exchange

Start by picking a reliable crypto exchange. Make sure the platform is regulated, has a good history, and strong security measures like two-factor authentication and cold storage.

Read online reviews and avoid exchanges with many complaints or withdrawal issues. Don’t go for the cheapest or newest platform without doing research. Safety is more important than saving a small fee.

Related: Best crypto sign-up bonus

Step 2: Create a Strong Account

Once you choose the safest crypto exchange, sign up using a strong and unique password. Always enable two-factor authentication (2FA) to add another layer of protection. Don’t reuse passwords from other accounts, and never share your login details with anyone.

Keep your email account secure too, as it’s usually linked to your exchange account. Avoid logging in on public Wi-Fi or shared computers.

Step 3: Verify Your Identity

Most regulated crypto exchanges will ask you to verify your identity (this is called KYC – Know Your Customer). You’ll need to upload a photo ID and sometimes a selfie or a utility bill. This might feel like a hassle, but it helps prevent fraud and adds trust to the platform.

Make sure the site is real before uploading any documents. If a platform doesn’t ask for KYC, be cautious, it might not be fully safe.

Step 4: Use Secure Payment Methods

When buying crypto on the safest crypto exchanges, use safe payment methods like bank transfers or debit cards through the exchange. Avoid sending money through sketchy apps, cash deals, or unknown third parties. Be sure the payment page is secure (check for “https” in the web address).

Watch out for fake apps or phishing links. Only make payments from your own account, and double-check all the details before confirming.

Step 5: Transfer to a Private Wallet

After buying crypto, don’t leave it all on the safest crypto exchange. For better safety, transfer your coins to a personal wallet (hardware or software). Hardware wallets (cold wallets) are safest because they keep your coins offline.

If you use a software wallet, protect it with a strong password and back up your recovery phrase. Keeping your crypto in a private wallet gives you more control and reduces the risk of losing it if the exchange gets hacked.

Related: Best low-fee crypto exchanges

Most Secure Crypto Exchanges for Different Types of Traders

Beginners

- Bitget is beginner-friendly with a clean layout and easy-to-use features. It offers spot trading, simple futures, and copy trading, which helps new users follow experienced traders. Bitget also has strong security and follows regulations in several regions. It’s a good starting point without feeling too complex.

- MEXC is also a great choice for beginners who want to explore more options later. It supports many coins and has lower trading fees. The platform offers beginner guides and demo trading for practice. Security is solid, and it doesn’t require deep technical knowledge to start.

Experienced Traders

- Kraken is designed for users who already understand trading and want access to a wide variety of coins and features. It supports advanced tools like margin trading, futures, and different order types. While the interface can feel overwhelming at first, experienced traders will find it powerful. The platform also focuses on strong security and regular updates.

- KuCoin offers a good mix of advanced tools and a large range of assets. It’s popular for its futures trading, trading bots, and rich features like staking and lending. KuCoin is secure, but it’s better suited for users who already understand the risks and tools in crypto. The platform is fast and responsive, with helpful charts and data.

High-Volume Investors

- Binance is one of the safest crypto exchanges in the world, and it handles very high trading volumes smoothly. It’s a top choice for serious investors who move large amounts of crypto. Binance offers strong liquidity, which means your orders can be filled quickly without much price change. Security and compliance are taken seriously, especially in major regions.

- Kraken, besides being beginner-friendly, also works well for large-volume trading. It has deep liquidity, competitive fees, and stable trading systems. Kraken also provides insurance protection on certain products, which adds confidence for high-stakes users. It’s a flexible option for both new and serious investors.

Related: Best altcoin exchanges

High-Leverage Traders

- MEXC allows users to trade with high leverage, especially in futures markets. It offers up to 200x leverage on some assets, which is attractive for aggressive traders. The platform is built to handle fast trades and has useful risk tools. It’s important to trade carefully, but MEXC gives the options for those who understand leverage.

- XT.com is another option for users who want high-leverage futures trading. It offers many trading pairs and supports advanced features for margin trading. The platform focuses on speed, flexibility, and user security. XT.com is better suited for experienced users who understand the risks of high-leverage positions.

Related

How to Keep Your Crypto Safe on a Centralized Exchange?

1. Use 2FA

Two-Factor Authentication (2FA) is one of the most important steps to secure your account on a centralized crypto exchange. It adds an extra layer of protection by requiring a code from your phone (like Google Authenticator) in addition to your password.

Even if someone knows your password, they can’t log in without the 2FA code. Most of the safest crypto exchanges recommend or require it. Always enable 2FA and avoid using SMS, which can be less secure. It helps reduce the risk of unauthorized access and keeps your crypto funds safer.

2. Set Up Anti-phishing code

An anti-phishing code is a unique code that appears in all official emails from your crypto exchange. This helps you know which emails are real and which are fake. Scammers often send fake emails that look like they’re from the exchange, trying to steal your login details.

By setting up an anti-phishing code, you can easily spot phishing attempts and avoid getting tricked. The secure crypto exchanges offer this feature to help users stay protected from online scams. Always check for this code before clicking on any links in emails.

3. Enable Withdrawal Address Whitelisting

Withdrawal address whitelisting lets you lock your account so that funds can only be sent to approved wallet addresses. If someone hacks your account, they won’t be able to withdraw your crypto unless they use a whitelisted address.

This adds strong protection, especially for long-term holders. Most trusted crypto exchanges support this feature. Make sure to activate it and only use your personal wallet address. It’s one of the best ways to prevent theft from your account.

4. Other Security Measures and Practices

Besides 2FA and whitelisting, there are more steps you can take to stay safe on a centralized exchange. Always use a strong, unique password and never share it with anyone. Avoid logging in on public Wi-Fi or unknown devices.

Keep your email account secure, as it’s linked to your safest crypto exchange account. Regularly check your login activity for any suspicious behavior. The safest crypto exchanges also offer login alerts, withdrawal confirmations, and device management. Staying alert and using all available security tools will help you keep your crypto safe at all times.

Read More: Best Bitcoin exchanges

FAQs: Safest Places to Buy Crypto

What are the safest crypto exchanges in 2025?

The safest crypto exchange 2025 include Bitget, MEXC, Binance, and Bybit. Binance uses cold storage, two-factor authentication (2FA), and a $1 billion SAFU fund to protect users. Bitget stores 98% of assets in cold wallets, offers 2FA, and insures certain crypto losses.

MEXC uses encrypted systems, regular security audits, and insures cold storage funds. Bybit includes multi-factor authentication, cold storage, and international security certifications, making it one of the most trusted options for users looking for maximum safety.

Which crypto exchanges offer the best security features?

Bitget and MEXC are known for offering strong security features. Bitget uses 2FA, cold storage, anti-phishing codes, and withdrawal address whitelisting to protect users.

MEXC offers similar protection with regular security checks, cold wallet systems, and secure withdrawal processes. Both platforms are designed to reduce the risk of hacks and fraud, and they continue to be recommended for users who prioritize safety in crypto trading.

Are regulated crypto exchanges safer than unregulated ones?

Yes, regulated crypto exchanges are generally safer than unregulated ones. They follow legal requirements like KYC (Know Your Customer), AML (Anti-Money Laundering), and regular financial audits.

These rules help protect users from fraud, insider abuse, and fund mismanagement. Unregulated exchanges may skip these steps, making them more risky. Most of the safest and most trusted crypto platforms are regulated and operate under government-approved licenses.

Read more: Best Ethereum exchanges

What security measures do the safest Bitcoin exchanges use?

The safest Bitcoin exchanges use strong, layered security. These include 2FA, biometric logins, storing 95% or more of funds in cold wallets, withdrawal address whitelisting, and anti-phishing systems.

They also run real-time security monitoring and threat detection systems. Some platforms hold insurance funds to protect user assets in case of emergencies. These combined features help create a secure environment for Bitcoin trading and long-term holding.

Is Binance considered a safe crypto exchange?

Yes, Binance is considered one of the safest crypto exchanges. It offers advanced security tools like two-factor authentication, anti-phishing protection, cold wallet storage, and wallet whitelisting.

Binance also maintains a $1 billion insurance fund (called SAFU) to protect users in case of a major hack or system failure. It serves over 250 million users worldwide and has passed multiple third-party audits to ensure security and transparency.

Is Coinbase safe to buy cryptocurrency?

Yes, Coinbase is the safest crypto exchange to buy cryptocurrency. It stores 98% of user funds in cold storage, uses two-factor authentication, and offers biometric logins for added account security.

Coinbase also provides insurance coverage for certain types of losses from platform breaches. As a publicly traded company operating in over 100 countries, it meets high compliance and security standards, which adds to its reliability.

Can I trust new crypto exchanges to be safe?

New crypto exchanges can be riskier than established ones. Many new platforms lack proper licensing, full security features, or proof of reserves. They may also be more vulnerable to technical issues or hacking attempts.

Without a proven track record, it’s harder to verify their safety. While some may offer good services, it’s best to do careful research and choose exchanges that are transparent, regulated, and have a clear security policy.

What are the risks of using unsafe crypto exchanges?

Using unsafe crypto exchanges can result in losing your funds to hacks, fraud, or scams. In the first half of 2025 alone, over $2.1 billion worth of crypto was stolen from insecure platforms.

Risks include exchange shutdowns, withdrawal freezes, and fake apps that steal your login information. Without regulation or audits, these platforms may misuse customer funds or disappear without warning. Always avoid exchanges that lack clear safety practices.

Do the safest crypto platforms offer insurance for user funds?

Yes, most of the safest crypto apps or platforms offer some form of insurance. For example, some exchanges hold user protection funds worth hundreds of millions or even billions of dollars to cover losses from hacks.

Others insure cold wallet holdings or cover specific account breaches. While insurance doesn’t cover everything, it provides an extra layer of safety. This makes users more confident that their funds are protected in case of emergencies.

How do I verify if a crypto exchange is safe before signing up?

To verify if a crypto exchange is safe, check if it is regulated and licensed in your country. Look for proof-of-reserves audits, cold wallet storage, 2FA, withdrawal whitelisting, and other advanced security tools. See if the platform has insurance for user funds and a history of handling security incidents well. Also, review third-party feedback and community opinions. A safe exchange will clearly publish its security features and policies for users to see.

What is the safest way to buy crypto coins?

The safest way to buy crypto coins is through a regulated and reputable cryptocurrency exchange like Krake or Binance. You should choose platforms that comply with financial regulations, have insurance coverage for assets, and enforce strong security measures like two-factor authentication and cold storage. Using bank transfers or trusted payment methods is recommended instead of third-party services to reduce risks.

What are the most secure DeFi platforms?

The most secure DeFi platforms are those that undergo regular third-party security audits, maintain open-source smart contracts, and have proven records of safe operations. Examples often include platforms like Aave, MakerDAO, and Uniswap, which have established reputations in lending, stablecoins, and decentralized trading.

What is the safest crypto exchange in U.S.?

Kraken is widely considered the safest crypto exchange in the United States. Founded in 2011, it has never been subject to a major hack and is known for strict compliance with U.S. regulations. Kraken holds banking-level security certifications, performs regular proof-of-reserves audits, and uses advanced protections like two-factor authentication and cold storage.

It also offers insurance coverage on certain assets, providing additional peace of mind. With its transparent practices, clean track record, and strong institutional trust, Kraken has built a reputation as the most reliable and secure platform for buying, selling, and trading cryptocurrencies in the U.S.