Zoomex burst onto the cryptocurrency scene in 2021 and quickly gained a reputation for high‐leverage futures trading and optional anonymity. By 2025, the platform claims more than 10 million users across over 30 countries, and it balances a centralized exchange (CEX) with a decentralized exchange (DEX).

Traders are drawn in by leverage that can reach 150x or even 1,000x on some contracts, a no‑KYC policy for most services, and an ever‐expanding list of more than 500 spot tokens and 300 derivatives pairs.

A strong marketing push and partnerships with football clubs and Formula 1 teams give the Zoomex brand recognition. This Zoomex review dives deep into what the platform does well, where it falls short, how its fees work, and the real experiences of traders.

Quick Zoomex review: Zoomex is a 100% safe and legit crypto exchange with over 10 million registered users and $3B daily trading volume. The exchange is popular for its no-KYC trading feature and allows up to 100 BTC daily deposit and withdrawal limits without ID verification. It is available in most countries due to anonymous trading, including the US, Europe, Australia, and more. However, it has limited fiat deposit options, and that too using third-party payment providers. So, Zoomex is mostly best for crypto-to-crypto trading, or I would say 1,000x leverage trading.

Zoomex Review: Quick Summary or Overview

| Launched | 2021 |

| Headquarters | Singapore |

| User Base | 10M+ registered users |

| Supported Assets | 500+ cryptocurrencies |

| Trading Pairs | 1,000+ spot & futures pairs |

| Max Leverage | Up to 1000x |

| Spot Trading Fee | 0.1% maker/taker |

| Futures Fee | Maker 0.02%, Taker 0.06% |

| Deposit Fees | Free for crypto deposits |

| Withdrawal Fees | Network dependent (BTC ~0.0005 BTC) |

| KYC Requirement | Optional (No KYC for basic trading) |

| No KYC Withdrawal Limit | 100 BTC per day |

| Copy Trading | Yes (top trader ranking system) |

| Trading Competitions | Regular futures and copy trading contests |

| Mobile App | Available on iOS & Android |

| Customer Support | 24/7 live chat + email |

Zoomex Exchange Review: Background and Future Outlook

Zoomex emerged during the last major crypto bull market with a simple premise: provide high‐speed derivatives trading with deep liquidity and minimal barriers to entry. I mean trade without KYC and full anonymity.

By 2025, the company says it operates out of Hong Kong and Singapore, holds a Canadian Money Services Business (MSB) license, and offers services through subsidiaries around the world.

The exchange promotes a privacy‑first model. Traders can sign up using only an email address or phone number, and they can withdraw up to 100 BTC per day without identity verification.

In a crypto world increasingly focused on compliance, this no‑KYC option stands out. At the same time, the platform has begun introducing optional verification levels for higher withdrawal limits and to access fiat deposit channels via third‑party providers.

Zoomex’s dual structure of CEX and DEX appeals to different users. The CEX provides the full features of spot and derivatives trading with tight spreads and multiple order types. The DEX allows users to connect a wallet, trade perpetual contracts directly from it, and keep custody of their coins.

How Zoomex Works: Centralized and Decentralized in One

Zoomex operates a traditional centralized exchange alongside its own decentralized trading venue. On the CEX, you can create an account, deposit crypto or fiat (via partners), and trade spot pairs, perpetual contracts, and inverse contracts.

The CEX aggregates liquidity from market makers and other crypto exchanges, offering trading speeds advertised at under 10 milliseconds. Advanced charting from TradingView, cross‑margin and isolated‑margin options, and API access make it appealing to active traders.

The DEX is a separate platform built into Zoomex where you connect a wallet (MetaMask, WalletConnect, or the native plugin) and trade perpetual contracts without depositing funds. It shares order books with the CEX, so spreads remain tight, but the DEX currently supports perpetual contracts only, with leverage up to 150x rather than the highest CEX levels. It’s ideal for those who value full self‑custody and anonymity, though liquidity can thin out on smaller pairs.

Why Traders Are Turning to Zoomex: Key Features

People often look for specific benefits when choosing a crypto exchange. Here are the most significant advantages I found in this Zoomex exchange review:

No KYC Required for Basic Use

Zoomex lets you open an account with just an email or phone number. You can deposit crypto and withdraw up to 100 BTC per day without supplying any identification. That privacy is rare among major cryptocurrency exchanges and is a key reason many traders choose Zoomex.

Read more about no KYC platforms:

High Leverage and Varied Products

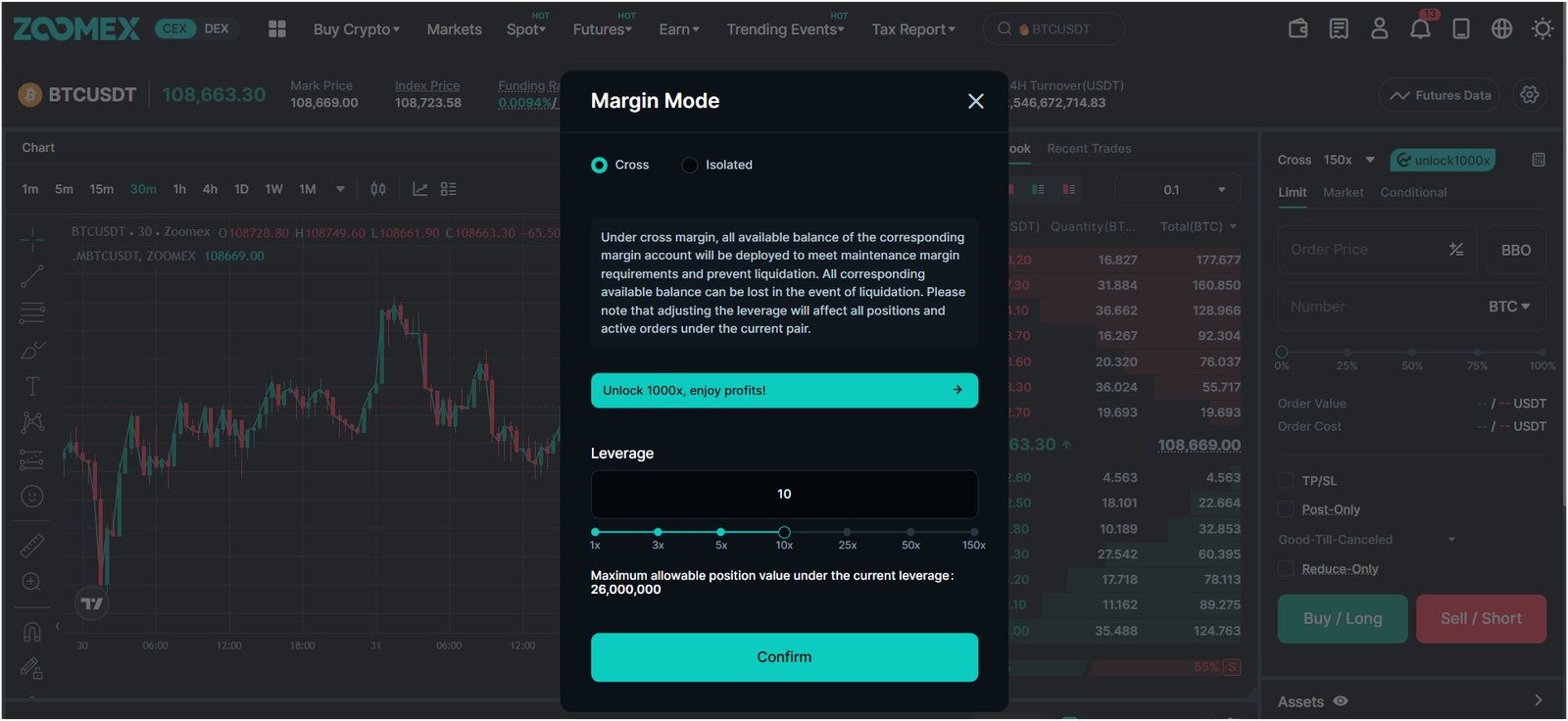

Zoomex offers leverage up to 150x on most USDT‑margined perpetual contracts and has marketed maximum leverage of 1,000x on certain instruments.

You can choose between USDT‑margined perpetuals, where profits and losses are settled in Tether, and inverse contracts that settle in the underlying cryptocurrency (available for coins like BTC, ETH, XRP, and EOS). Also, cross‑margin and isolated‑margin settings let you decide how much capital is at risk on each trade.

Read: best crypto leverage trading platforms USA

Wide Selection of Coins and Markets

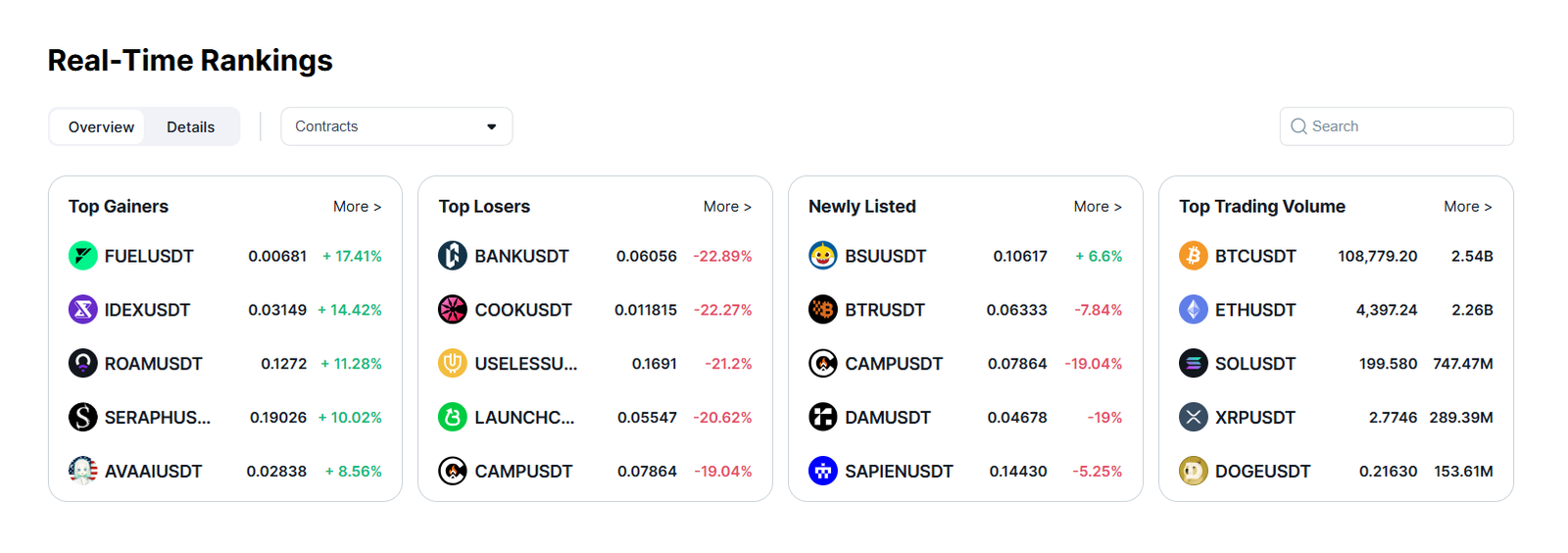

The platform lists more than 500 spot cryptocurrencies and over 300 perpetual futures contracts. You can trade popular coins like Bitcoin, Ethereum, Solana, and XRP, as well as newer altcoins, DeFi tokens, and meme coins. The large selection means you don’t have to maintain accounts on multiple exchanges to access niche markets.

Integrated DEX for Self‑Custody Trading

Zoomex’s decentralized exchange shares liquidity with its CEX. You can connect a wallet and trade perpetual contracts directly without ever transferring funds to Zoomex.

The DEX supports leverage up to 150x and offers tight spreads on popular pairs. While copy trading isn’t available on the DEX yet, the ability to trade without depositing funds or completing KYC gives privacy‑focused traders an appealing option.

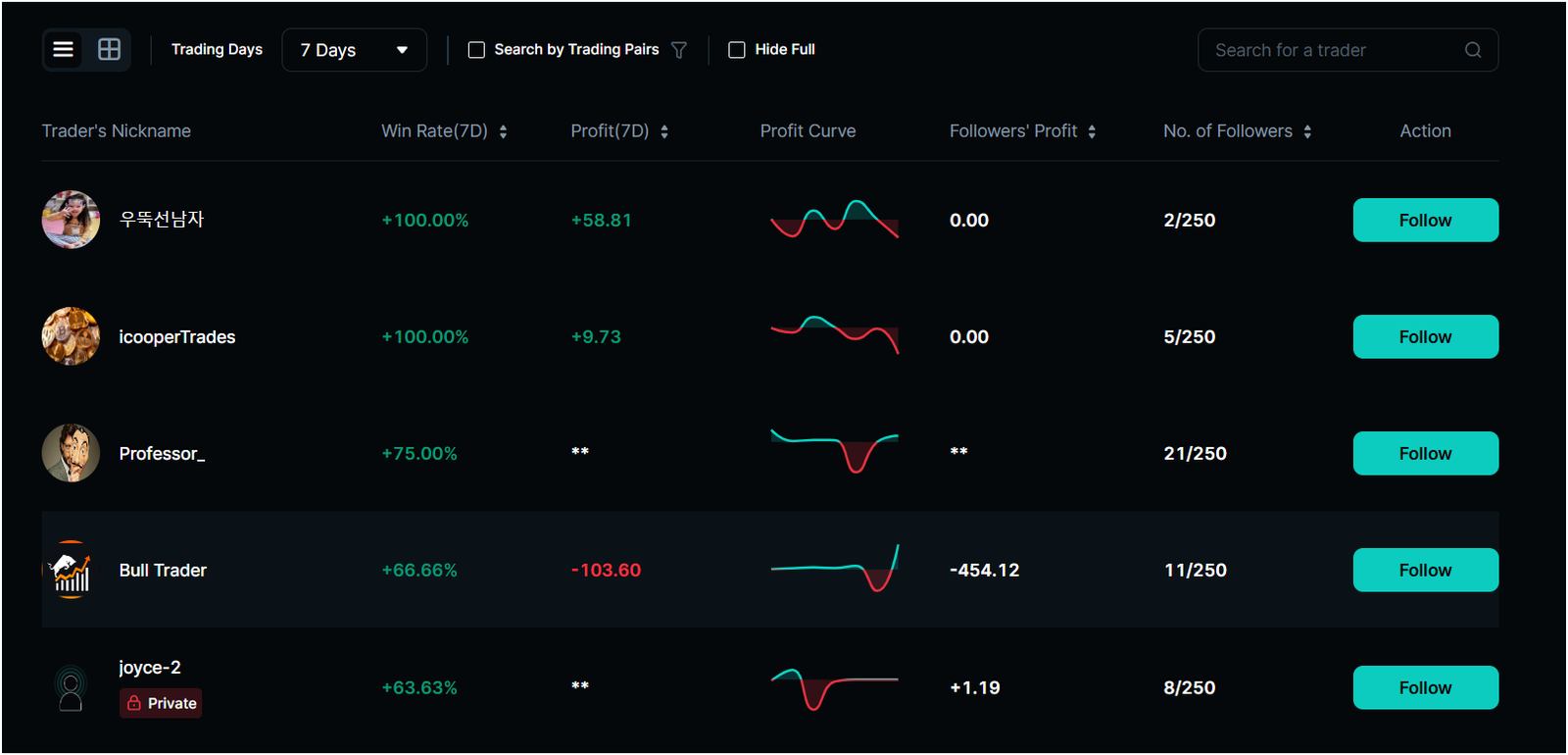

Copy Trading for Beginners and Busy Traders

Copy trading on Zoomex enables you to follow the trades of experienced “master” traders. You can browse profiles showing each master’s return history, drawdown, win rate, and follower count. Once you pick a master, you allocate part of your balance to automatically replicate their trades.

Performance fees typically range from 10%-20% of profits and are paid only when you make money. This system offers a hands‑off approach for beginners, though it comes with risks (covered later in this Zoomex exchange review).

User‑Friendly Interface and Mobile App

The web platform and mobile app are designed with simplicity in mind. You can switch between spot and futures trading with a single click, see advanced charts with indicators, and set stop‑loss or take‑profit levels quickly.

The mobile app for iOS and Android supports full trading functionality, copy trading, and notifications. While the app lacks some advanced charting features found on the desktop interface, most everyday tasks are easily accessible on the go.

Robust Security Measures

Even though it prides itself on anonymity, Zoomex says it takes security seriously. Funds are stored in cold wallets with multi‑signature authorization. Two‑factor authentication (2FA) is available for logins and withdrawals, and you can create a withdrawal whitelist to ensure funds only go to approved addresses.

Zoomex also maintains an insurance fund of roughly US$50 million to cover extreme market events. The platform has not reported any major hacks since launch.

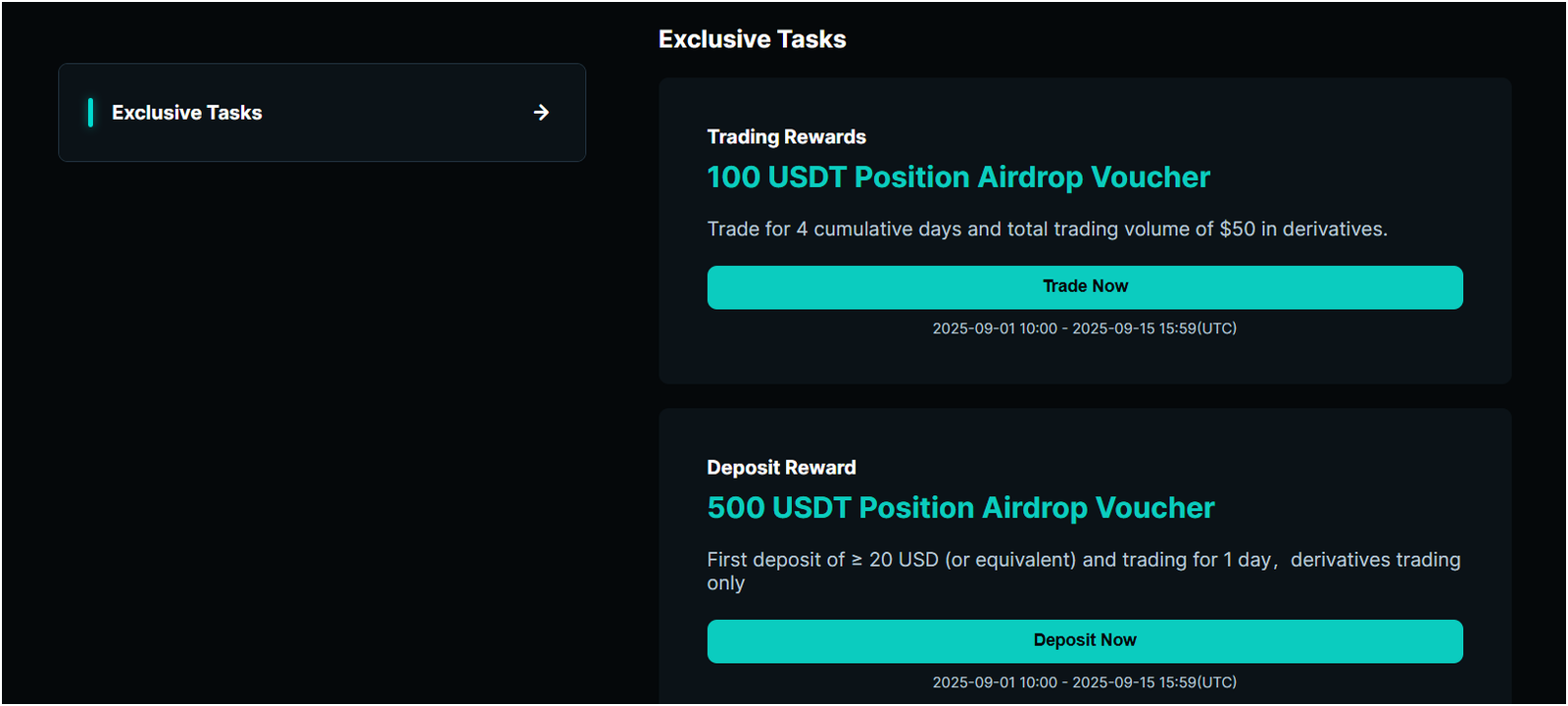

Promotions and Bonuses

Zoomex regularly runs promotions such as trading competitions, Z‑Challenge events with multi‑million‑dollar prize pools, and “Lucky Draws” tied to partnerships with sports teams.

A rewards hub provides volume‑based coupons and deposit bonuses that can reach thousands of USDT. The exchange also offers referral and affiliate programs for users who want to share the platform with others.

Areas Where Zoomex Falls Short: Critical Warnings

No exchange is perfect, and this Zoomex review highlights several drawbacks and risks. Understanding these will help you decide whether Zoomex fits your needs.

Limited Fiat Support

Zoomex doesn’t directly support fiat deposits or withdrawals. To buy crypto with fiat, you must use a third‑party provider such as Onramper, Transak, LegendTrading, MoonPay, or Alchemy Pay.

These partners charge their own processing fees (often 1%–3%) and typically require you to complete KYC verification. There is currently no way to withdraw fiat directly to a bank account through Zoomex; all withdrawals are in cryptocurrency.

Thin Liquidity on Smaller Tokens

The exchange boasts deep liquidity for major pairs, but lesser‑known coins often have thin order books. Zoomex crypto reviews mention slippage and price gaps when placing large orders on new or low‑cap tokens. Traders interested in obscure coins should be prepared for wider spreads and possible delays in order execution.

Restricted Regions and Confusing Legality

Zoomex is not available in some jurisdictions such as mainland China, Iran, North Korea, Cuba, Syria, Sudan, and Crimea. There is also confusion about whether the exchange is legal in the United States.

Some say that Zoomex holds a U.S. MSB registration and states that U.S. residents can sign up, while another clarifies that the exchange lacks direct regulatory approval and therefore isn’t officially legal.

But in my Zoomex review, I found that since the platform operates with minimal KYC, regulators could target it in the future. Prospective U.S. users should be cautious and consider using a regulated platform instead.

High Withdrawal Fees for Some Tokens

Withdrawals incur fixed network fees plus a service fee. For example, common withdrawal fees as of 2025 are 0.00005 BTC, 0.0005 ETH, 10 USDT (ERC‑20), 0.01 SOL, or 0.25 XRP.

These amounts fluctuate with blockchain congestion and are relatively high for smaller withdrawals. There are no fiat withdrawals; you must transfer crypto to another exchange or wallet to convert it to cash.

No Staking or Interest Products

Unlike many competitors, Zoomex doesn’t offer staking or savings programs. You can’t earn passive income on idle tokens within the exchange. This is a significant drawback for long‑term holders who want to accrue interest on coins like ETH or stablecoins.

Zoomex tries to compensate with high‑yield promotions and a 100% APY campaign tied to trading volume, but this requires active trading.

Limited Education and Beginner Content

User feedback suggests that Zoomex lacks comprehensive educational materials for new traders. The platform’s help center covers basic topics, but there are fewer tutorials and guides compared to larger exchanges. New traders must rely on external resources or community forums to learn about risk management and leverage.

Past Complaints and Negative Reviews

Some Reddit discussions and unofficial Zoomex review sites contain accusations that Zoomex is a scam. Common complaints include accounts being frozen, missing withdrawal requests, and aggressive marketing with unrealistic returns.

While there are also many positive Zoomex reviews, potential users should remember that the platform is not regulated in major jurisdictions and therefore does not offer the same legal protections as licensed crypto exchanges. So, I would say, always start with a small amount and avoid storing large sums on any exchange.

Zoomex Fees Explained: Spot, Futures, Deposit, and Withdrawal

Spot Trading Fees

Zoomex charges 0.10% maker and 0.10% taker fees on spot trades. There is no tiered structure tied to your holdings or token balance; the fee is the same regardless of your volume.

However, Zoomex occasionally runs promotions; for example, a 50 % discount on spot fees every Saturday, which reduces costs to 0.05%. (Read: best exchanges with low fees)

Futures Trading Fees

Futures trading on Zoomex is cheaper than spot trading. Makers pay 0.02% per contract and takers pay 0.06%. These rates compete with other derivatives exchanges like MEXC, Bitget, and Binance.

High‑volume traders who qualify for Zoomex’s VIP program can get discounts that reduce futures fees as low as 0.002% maker and 0.024% taker. Funding rates on perpetual contracts apply every eight hours and can either cost or earn you money depending on market conditions.

Deposit Fees

There are no fees for depositing cryptocurrencies on Zoomex. You only pay the usual blockchain transaction fee from your wallet. Fiat deposits through third‑party processors carry their own charges, which usually range between 1% and 3% of the purchase amount. Zoomex doesn’t add extra fees for these transactions.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency and are fixed regardless of amount. The table below lists typical withdrawal costs and network minimums. Since blockchains are subject to congestion and price changes, always check the current fee schedule before withdrawing:

| Asset | Approximate Fee | Notes |

|---|---|---|

| Bitcoin (BTC) | 0.00005 BTC | Equivalent to a few dollars; actual cost fluctuates with network demand |

| Ethereum (ETH) | 0.0005 ETH | High gas fees on ERC‑20 tokens can increase the total cost |

| Tether (USDT) – ERC‑20 | 10 USDT | Cheaper on other chains (e.g., TRC‑20), but Zoomex may not support all networks |

| Solana (SOL) | 0.01 SOL | Low fee, but it depends on network activity |

| Ripple (XRP) | 0.25 XRP | Minimal cost compared to ERC‑20 tokens |

Funding Rates and Hidden Costs

On perpetual contracts, the funding rate ensures prices converge with spot markets. Funding payments occur every eight hours and may either credit or debit your account.

In this Zoomex review, I found that highly volatile pairs often have higher funding rates, so check the contract details. Copy trading followers also pay the same futures trading fees and an additional performance fee when they profit.

Zoomex Review: Supported Cryptocurrencies and Markets

Zoomex’s market coverage is a key selling point. Here’s how it breaks down:

- Spot Market: Over 500 cryptocurrencies are available, mostly paired against USDT, USDC, BTC, and ETH. You can trade majors like BTC, ETH, BNB, XRP, and SOL, layer‑1 projects like DOT and ADA, and trending memecoins like DOGE, SHIB, and PEPE.

- Perpetual Futures: More than 300 USDT‑margined perpetual contracts cover popular coins and trending tokens. Contract sizes vary, and leverage typically ranges from 1× to 150× depending on the asset. Zoomex also lists four inverse perpetuals (BTC, ETH, XRP, and EOS) that settle in the underlying coin. Leverage on inverse contracts is usually lower (50×–100×).

- Indexes: Zoomex offers sector indexes like BTC, ALT, AI, and QUICKLER (a five‑second trading index). Indexes let you bet on entire sectors or narratives instead of individual coins. Typical profitability rates claimed are 70 % for BTC and 85 % for the other indexes, though these figures may be marketing estimates rather than guarantees.

- DEX Tokens: The decentralized exchange lists a subset of perpetual contracts, focusing on high‑liquidity coins. Additional tokens may be available on the DEX that aren’t offered on the CEX spot market.

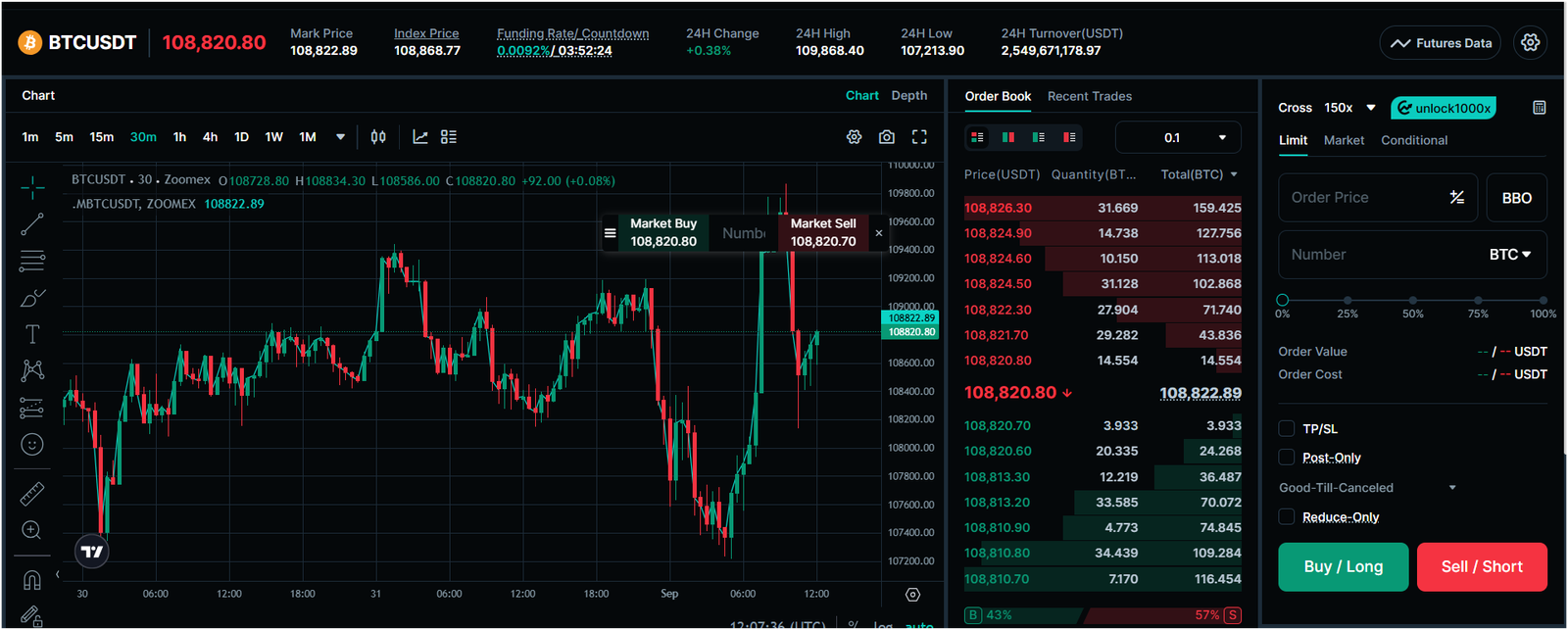

Futures Trading on Zoomex: Tools and Leverage

Derivatives are Zoomex’s primary focus, and the platform offers a suite of tools designed to appeal to high‑frequency and professional traders.

- USDT‑Margined Perpetual Contracts: These are the most popular products on Zoomex. You trade with USDT as collateral, and profits and losses are settled in USDT. Leverage goes up to 150×, although some promotions advertise 1,000× on specific pairs.

- Inverse Perpetual Contracts: Inverse contracts are settled in the base asset, allowing traders to earn in the coin itself. Zoomex offers inverse contracts for BTC, ETH, XRP, and EOS. Leverage is lower (usually 50× to 100×), reflecting the increased risk of settlement in the volatile asset.

- Order Types: Market, limit, stop‑limit, stop‑market, take‑profit, and one‑cancels‑the‑other (OCO) orders are all supported. You can add post‑only and reduce‑only flags to control how orders interact with the order book.

- Risk Controls: You can choose between isolated margin, which limits risk to the funds allocated to a position, and cross margin, which uses your entire account balance to support multiple positions. Real‑time liquidation price calculations help you see how close your positions are to being closed.

- Liquidity and Execution Speed: Zoomex aggregates liquidity from multiple market makers and external exchanges. Orders are processed with an average latency of under 10 milliseconds, according to company claims. High liquidity on major pairs reduces slippage, though smaller contracts may see delays.

- API Access: Programmatic trading is available via REST and WebSocket APIs. You can build automated strategies or connect third‑party trading bots to the exchange. Just remember that using high leverage in a bot without proper risk controls can lead to rapid losses.

Spot Trading on Zoomex: What You Need to Know

Although Zoomex is known for derivatives, its spot market shouldn’t be overlooked.

- Trading Pairs: Most spot pairs are against USDT or USDC, with some BTC and ETH pairings. The platform lists large‑cap coins along with mid‑caps and memecoins. However, only around 57 spot tokens have meaningful liquidity compared to larger exchanges that list hundreds.

- Fees: Spot trading fees are a flat 0.1% maker and 0.1% taker, with occasional fee‑discount events and VIP discounts.

- Liquidity: High liquidity is available for major coins. Mid‑cap and memecoins often have lower volumes. Traders looking for deep order books should compare volumes before executing large spot trades.

- Trading Interface: The spot interface shares the same TradingView charts as the derivatives section. You can see order books, trade history, and a simple order entry panel. Beginners may find it easier to place market or limit orders here before venturing into leveraged products.

Exploring the Zoomex DEX: Anonymous Trading and Liquidity

Zoomex’s decentralized exchange is unique among major platforms because it shares liquidity with the CEX while offering self‑custody trading. Here’s how it works:

- Wallet Connection: You connect a supported wallet, such as MetaMask or through WalletConnect. A browser extension or the Zoomex wallet plugin is required.

- No Account Needed: There’s no need to sign up with an email. You simply sign messages with your wallet to place orders.

- Perpetual Contracts Only: The DEX currently only offers USDT‑margined perpetual contracts. There’s no spot trading, copy trading, or inverse contracts, and leverage is limited to 150x.

- Liquidity: Because the DEX shares order books with the CEX, you still benefit from aggregated liquidity. However, less popular pairs can be illiquid.

- Security and Privacy: You retain full control over your assets until a trade is executed. This reduces counterparty risk and eliminates the need for KYC. On the downside, you must manage your wallet security and gas fees.

The DEX is ideal for traders who want to stay anonymous or who distrust centralized custody. Still, the feature set is narrower than the main exchange.

Copy Trading on Zoomex: Following Experienced Traders

Copy trading appeals to both beginners and busy professionals. Here’s how it works on Zoomex:

- Browse Master Traders: The copy trading dashboard lists hundreds of master traders with performance data: total return, drawdown, number of followers, and profit share fees.

- Select a Master: You choose a master whose strategy aligns with your risk tolerance. You can see their historical performance and trade frequency.

- Allocate Funds: You decide how much to allocate. The minimum investment is low, but your total allocation cannot exceed $50 000 per master. You can also follow multiple masters to diversify.

- Set Parameters: You can mirror the master’s settings exactly (leverage, margin, stop‑loss, and take‑profit) or customize certain factors like leverage.

- Pay Performance Fees: Performance fees (10%–20%) are deducted only when you profit.

- Manage Risk: Zoomex allows you to pause copying, close all copied positions manually, and set daily loss limits.

Getting Started with Zoomex: Registration and Verification

Opening a Zoomex account is straightforward:

- Register: On the Zoomex website or mobile app, click “Sign Up.” Enter your email or phone number and choose a strong password. Read and accept the terms of service, then submit. A verification code will be sent to your contact method.

- Verify Contact: Enter the code to confirm you own the email or number. Without verifying, you can’t use the account.

- Secure Your Account: After logging in, enable two‑factor authentication via Google Authenticator or a similar app. Add a withdrawal whitelist so funds can only be sent to approved addresses. Set up an anti‑phishing code that appears in official Zoomex emails to guard against phishing scams.

- Optional KYC: If you plan to deposit fiat via Onramper or withdraw more than 100 BTC per day, complete Level 1 KYC by uploading identification documents. Additional KYC tiers may unlock higher limits and other features.

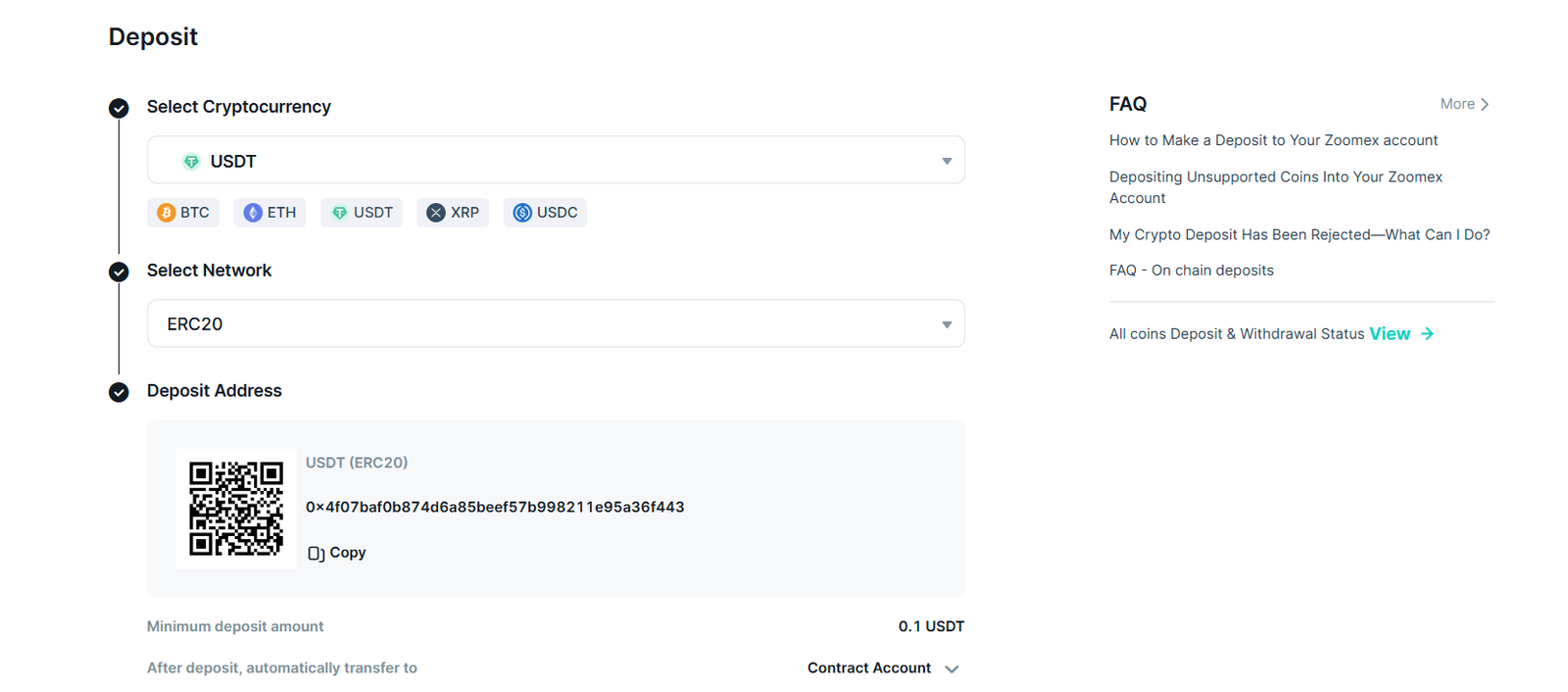

Making Deposits on Zoomex: Crypto and Fiat Options

Depositing Cryptocurrency

- Select Asset: On the “Assets” page, choose “Deposit” and pick the cryptocurrency you want to deposit.

- Choose Network: Select the blockchain network that matches your wallet (e.g., ERC‑20, TRC‑20, BEP‑20). Make sure the token and network match to avoid loss of funds.

- Generate Address: Zoomex will provide a deposit address and a QR code. Copy the address or scan the code in your external wallet.

- Send Funds: Send the desired amount from your wallet. Check network fees and ensure the address is correct.

- Confirmation: Deposits are credited after the required number of blockchain confirmations. You can track the progress in your deposit history.

There is no minimum deposit on Zoomex for cryptocurrencies. However, transaction fees on the blockchain can cost several dollars, so sending very small amounts may not be cost‑effective.

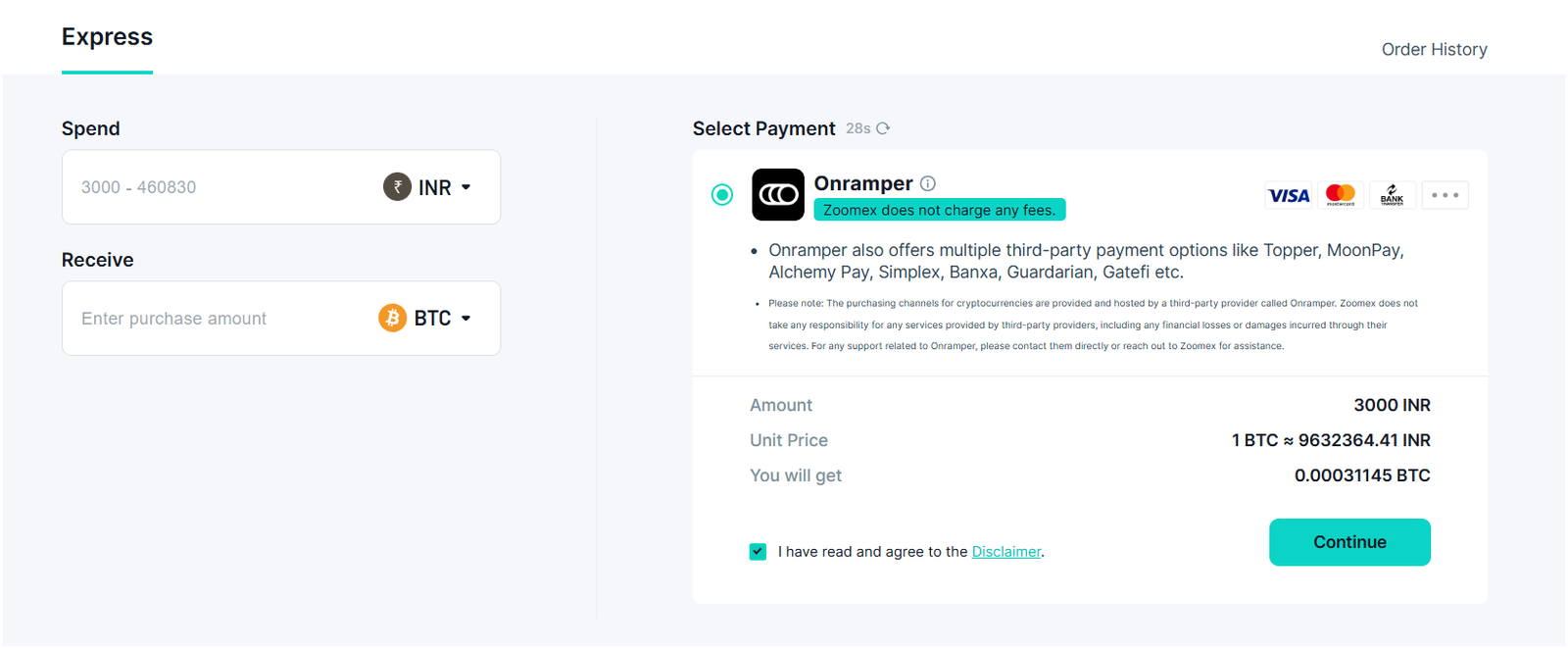

Depositing Fiat

Zoomex itself doesn’t accept fiat directly, but it integrates with third‑party services like Onramper, LegendTrading, MoonPay, Alchemy Pay, and Transak. These services allow purchases via credit cards, debit cards, bank transfers, ACH, Google Pay, and Apple Pay. Steps include:

- Go to the “Buy Crypto” or “Fiat Deposit” section.

- Choose your local currency and the cryptocurrency you want to buy.

- Enter the amount you wish to spend.

- Select a payment method.

- Complete KYC if required by the provider.

- Review the quoted exchange rate and processing fee.

- Confirm the transaction.

Withdrawing Funds from Zoomex: Step‑by‑Step Guide

Understanding how to withdraw funds is crucial for any trader. Here’s how to do it:

- Navigate to “Assets”: Click on “Withdraw.”

- Select Cryptocurrency: Choose the coin you want to withdraw. Remember that fiat withdrawals are not supported; you must withdraw crypto.

- Choose Network: Select the network carefully (for example, ERC‑20 for USDT). Different networks have different fees and processing times.

- Enter Address: Paste the destination wallet address. Use the withdrawal whitelist if you set one up.

- Enter Amount: Specify the amount you want to withdraw. The system will show the fee and the net amount you will receive.

- Complete 2FA: Enter your two‑factor code and email or SMS verification code.

- Confirm: Review the details and confirm the withdrawal. Most withdrawals are processed within a few minutes, but high network congestion can cause delays.

Payment Methods and Buying Crypto with Fiat

Zoomex doesn’t handle fiat directly, but its partners offer multiple payment options. Here is a quick overview:

- Credit and Debit Cards: Visa and Mastercard are accepted through Onramper, MoonPay, and LegendTrading. Processing fees range from 1 % to 4 %.

- Bank Transfers: Available in certain regions through LegendTrading and Transak. These can take up to a few days but often carry lower fees.

- E‑Wallets: Google Pay, Apple Pay, and other local e‑wallets are supported in some countries. Fees vary depending on the provider.

- Alternative Gateways: Services like Alchemy Pay and MoonPay support additional local payment methods and may offer regional promotions.

Jurisdiction and Availability: Zoomex in the USA and Worldwide

Availability is a frequent question in every Zoomex exchange review. The platform serves traders across Asia, Europe, and parts of the Americas, but some regions are excluded or subject to conflicting information.

- United States: Zoomex claims to hold a U.S. MSB registration, and some sources say U.S. residents can sign up. Because the exchange does not require KYC, enforcement is difficult, but using it from the U.S. might violate local laws. If you are a U.S. resident, consider regulated platforms like Coinbase, Kraken, or Binance.US.

- Europe and Asia: Zoomex is widely available, although certain countries such as China, Iran, North Korea, Cuba, Syria, Sudan, and Crimea are restricted.

- Other Regions: Always check local regulations. Some countries ban or restrict crypto derivatives trading. If your jurisdiction disallows high‑leverage products, you might be barred from using Zoomex.

Security Measures and Compliance at Zoomex

Zoomex markets itself as a secure exchange despite its lax identification requirements. Key security features include:

- Cold Storage: The majority of customer funds are stored offline in cold wallets. Multi‑signature procedures require several staff members to approve withdrawals.

- Two‑Factor Authentication: Users can enable 2FA for login and withdrawals. This adds a second layer of security beyond a password.

- Withdrawal Whitelist: You can restrict withdrawals to pre‑approved addresses. Even if your account is compromised, funds can only be sent to your own wallets.

- Anti‑Phishing Code: You can create a unique code that appears in all official Zoomex emails. This helps you spot phishing attempts.

- Insurance Fund: An insurance fund valued at roughly US$50 million is available to cover extreme market events and losses from liquidations.

- External Audits: The exchange claims regular security audits by third parties such as Hacken. It also states that there have been no major security breaches since its launch.

- Regulatory License: Zoomex holds a Canadian MSB license under FINTRAC. This license requires the company to comply with anti‑money laundering and counter‑terrorism financing regulations. However, it does not equate to full regulation by financial authorities like the SEC or FCA.

The Zoomex Mobile App: Features and Limitations

Zoomex offers mobile apps for both iOS and Android. The app mirrors most of the desktop functionality and has a clean, intuitive interface. Key features include:

- Full Trading Access: You can trade spot and futures, adjust leverage, and set advanced order types directly from the app.

- Copy Trading Hub: A dedicated section lists master traders with performance statistics. You can follow them and manage your copy trading allocations on the go.

- Deposit & Withdrawal: Deposit addresses, QR codes, and withdrawal forms are all accessible.

- Fiat Purchases: The app integrates with Onramper and LegendTrading, allowing you to buy crypto with a card or bank transfer.

- Push Notifications: Price alerts and order notifications help you keep track of positions.

Despite these strengths, there are some limitations:

- Limited Advanced Analysis: Level 2 order book data and certain charting tools are not available on the app. High‑frequency traders may prefer the desktop interface.

- Complex Order Entry: Setting up OCO orders or multiple conditional orders is more cumbersome on a small screen.

- Performance Variability: Some users report lag or freezing during periods of high volatility. Make sure your device and internet connection can handle heavy loads.

Overall, the app suits most retail traders, especially those who value convenience. Professional traders may still rely on the web interface or API for complex strategies.

Customer Support and Community Engagement

Good support can make or break a trading experience. Zoomex offers several channels:

- 24/7 Live Chat: A chat button on the website and app connects you to support agents around the clock. Many users say responses are prompt and knowledgeable.

- Email Support: You can submit detailed queries by email. Response times range from minutes to a few hours.

- Help Center: A searchable knowledge base covers topics like how to deposit, how to withdraw, and how to use copy trading.

- Community Forum: Zoomex hosts an online forum where users answer questions and suggest features. According to some reviews, the exchange actively monitors the forum and implements user requests.

- Social Media: Zoomex has a presence on platforms like X (Twitter), Telegram, and Discord. Updates about promotions, maintenance, and new listings are posted regularly.

Despite these resources, some customers complain about unresolved issues, particularly concerning withdrawals or account verification. As with any exchange, it’s wise to test the support system with small transactions before committing significant funds.

Bonuses, Promotions, and VIP Programs on Zoomex

Zoomex leverages promotions to attract and retain traders. Here are the current highlights:

Rewards Hub

The Rewards Hub offers coupons and bonuses tied to trading volume. For instance, trading 200,000 USDT in futures may earn a $100 coupon. There is no time limit to reach the volume threshold, allowing both high‑frequency and occasional traders to earn rewards.

Trading Competitions

Large competitions like Z‑Challenge and ZWTC feature prize pools in the millions of USDT. Top performers can win hundreds of thousands of dollars in prizes, while smaller rewards may go to participants who achieve certain milestones. Entry fees and contest rules vary, so read the terms carefully.

Deposit and Welcome Bonuses

New users may be eligible for sign‑up bonuses. In one promotion, a deposit of $500 unlocked a reward of up to $45,115 USDT. Another promotion doubles your USDT balance if you maintain a minimum of 500 USDT in your account. Such offers often come with trading volume requirements and expiry dates.

Affiliate and Referral Programs

Zoomex pays commissions to affiliates and users who refer others to the exchange. Commissions can be a percentage of the referred user’s trading fees. Additional incentives, such as bonus coupons, are sometimes offered for hitting referral milestones.

VIP Program

Traders with monthly futures volume exceeding $5 million can apply for the VIP program. Benefits include deeper fee discounts, monthly bonuses (up to $1,500), and personalized support. VIP levels scale with trading volume and may include exclusive access to events and test products.

Promotions change frequently, and some offers may be region‑specific. Always check the official announcements for current details and terms.

Comparing Zoomex to Competitors: MEXC, Bitget, and Binance

When choosing an exchange, it’s helpful to compare features and fees. The table below contrasts Zoomex with three top competitors.

| Feature | Zoomex | MEXC | Bitget | Binance |

|---|---|---|---|---|

| Launch Year | 2021 | 2018 | 2018 | 2017 |

| Supported Coins | 500+ | 3,500+ | 1,200+ | 350+ |

| Max Leverage | 150× (advertised up to 1,000×) | 200× | 125× | 125× |

| Spot Trading Fee | 0.10 % | 0.05% | 0.10 % | 0.10 % |

| Futures Trading Fee | 0.02 % maker / 0.06 % taker | 0.02 % / 0.06 % | 0.02 % / 0.06 % | 0.02 % / 0.05 % |

| KYC Requirement | Optional (up to 100 BTC/day without KYC) | Optional (10 BTC/day without KYC) | Mandatory | Mandatory |

| Copy Trading | Yes | Yes | Yes | Yes (via third parties) |

| Fiat Support | Via third‑party processors | Yes (limited) | Yes | Yes |

| U.S. Availability | Yes | VPN only | Not available | Available via Binance.US |

| Unique Features | Integrated DEX, high leverage, indexes, gaming, no KYC | Large coin selection | Copy trading emphasis, derivatives | Largest global exchange, multiple services |

This comparison shows that Zoomex’s strengths lie in anonymity and leverage, but it falls behind in overall coin selection compared to MEXC and in global regulatory recognition compared to Binance.

Read: Best no KYC crypto exchanges

User Reviews and Community Sentiment

A complete Zoomex review would be incomplete without listening to real traders. Feedback from users around the world offers a mixed picture:

- Positive Experiences: Many users praise the smooth interface, fast order execution, and responsive customer support. Comments on forums and review sites mention that the no‑KYC approach is refreshing and that withdrawals are processed quickly. Traders enjoy the frequent promotions and bonus offers, and some have reported significant profits from copy trading.

- Negative Experiences: On the flip side, some traders recount issues with withdrawals and account freezes. There are reports of high withdrawal fees, lack of clarity around the legitimacy of certain promotions, and difficulties with customer support during peak times. A few Reddit threads even label Zoomex a scam, citing a lack of transparency about the company’s leadership and regulatory status. While these accounts could be isolated or misinformed, they highlight the importance of cautious engagement.

- Liquidity Concerns: Several reviewers note that liquidity on smaller tokens is thin, leading to slippage and partially filled orders. This is particularly problematic for high‑leverage traders who may find their positions liquidated unexpectedly.

- Learning Curve: Beginners occasionally complain that the platform has limited educational materials and that the high-leverage environment is risky. Copy trading can help new users learn, but it doesn’t replace fundamental knowledge of crypto markets.

Reading multiple Zoomex reviews and testing the platform with small amounts is the best way to form your own opinion. Keep in mind that satisfied users often stay quiet while disgruntled ones voice their frustration loudly.

Is Zoomex Legit or a Scam? Balancing the Evidence

The question “Is Zoomex a scam?” appears frequently. Here’s a balanced look at the evidence:

Reasons People Consider Zoomex Legit (Pros)

- Operational History: Zoomex has been operating since 2021 with no major security breaches or reported loss of customer funds.

- MSB License: The platform holds a Canadian Money Services Business license, requiring compliance with anti‑money laundering rules.

- Security Measures: Cold storage, 2FA, withdrawal whitelisting, and an insurance fund indicate a commitment to protecting user assets.

- Public Partnerships: Sponsorships with European football clubs and Formula 1 teams suggest the company invests heavily in its brand and is not a fly‑by‑night operation.

Reasons Some Users Are Suspicious (Cons)

- Lack of Full Regulation: Zoomex isn’t regulated by major financial authorities like the SEC (U.S.) or the FCA (U.K.). Without that oversight, recourse for disputes may be limited.

- Limited Transparency: The company provides little information about its executives and corporate structure. Attempts to verify its registration in Singapore (as some marketing materials claim) have been met with silence, causing suspicion.

- Aggressive Marketing: The platform’s high‑risk promotions, extremely high leverage, and gaming features could attract inexperienced users who may lose money quickly.

- Negative User Reports: Scattered online reports mention account freezes, delayed withdrawals, and poor customer support. These might be isolated issues, but they add to a sense of uncertainty.

Zoomex Review: Final Verdict

Zoomex stands out in the crowded crypto exchange space with its no‑KYC policy, high leverage, and integrated DEX. For traders who prioritize privacy and want access to hundreds of tokens, it can be a compelling choice. The simple fee structure, responsive user interface, and generous promotions add to its appeal. At the same time, limited fiat support, thin liquidity for smaller tokens, high withdrawal fees, and regulatory uncertainties temper the enthusiasm.

The platform suits experienced traders comfortable with leverage and willing to manage the risk. Beginners may enjoy copy trading and the user‑friendly interface, but they should educate themselves thoroughly and start with small amounts. Anyone concerned about regulation or long‑term asset safety should consider alternatives like Binance, Kraken, or Coinbase.

In summary, my Zoomex review finds a platform with exciting features and significant potential, balanced by notable drawbacks and warnings.

So, Is Zoomex legit or a scam?

It appears legitimate, yet it operates in a grey zone that demands caution.