Are you tired of constantly monitoring the market, trying to time your trades just right? Do you find yourself struggling to keep up with the latest trends and market movements? Look no further than 3Commas and Shrimpy. These two trading platforms offer a range of tools and features designed to help you stay ahead of the game.

3Commas offers a range of advanced trading tools, including automated trading bots, portfolio management tools, and more. Shrimpy takes a more holistic approach to trading, offering a range of features designed to help you manage your entire crypto portfolio.

From rebalancing your holdings to automatically Portfolio DCA, Shrimpy offers a range of features that make it easy to stay on top of your investments.

Quick Verdict 👍: 3Commas is best for automated trading strategies and bots, whereas Shrimpy is better for only Portfolio Management.

We Recommend: Best Crypto Trading bots

Best Manually Customized Trading bot

- 75+ CEX and DEX cryptocurrency exchanges

- Support over 300,000 crypto coins and 50+ DEX coins supported

- Insider information on where it is profitable to buy and sell tokens

- Free training and cases for clients of service

Proven Success Rate with 1M+ Users

- 16+ Exchange support

- Crypto-signals in Telegram

- Trading view Integration

- DCA, GRID, options, HODL, Smart trading bots

- Marketplace to buy automated trading strategies with success rate

3Commas vs Shrimpy: The Complete Comparison

| Points | 3Commas | Shrimpy |

|---|---|---|

| 🗓️ Launched Date | 2017 | 2018 |

| 🏢 Headquarters | United States | United States |

| 🧑💼 Active Users | 1 million+ | 50,000+ |

| 📈 Type | Trading bot and Portfolio Rebalancing | Portfolio Management |

| 💰 Is it a Scam or Legit? | Legit | Legit |

| 👍 Best For | Advanced traders | Beginner and Intermediate traders |

| 🌎 Operating countries | Global | Global |

| 💱 Supported Exchanges | 16 | 25 |

| 💱 Trading Pairs | 1,000+ | 1,000+ |

| 💱 Fiat currency Supported | USD, EUR | USD, EUR |

| 🤖 Types of the trading bot | Grid, DCA, Options, Futures, Composite | Rebalancing, Asset Management, Social Trading |

| 💵 Payment Method | Credit/debit card, bank transfer, cryptocurrencies | Credit/debit card, bank transfer, cryptocurrencies |

| 💰 Pricing | Starting from $15/month | Starting from $15/month |

| 💸 Extra Trading Fees | Yes | No |

| 📱 Mobile App | Android and iOS | Android and iOS |

| 📝 Paper Trading (Demo) | Yes | Yes |

| 📊 Backtesting with Strategies | Yes | Yes |

| 📞 Customer Support | 24/7 | 24/7 |

| 🔒 KYC | No | No |

| 3Commas Review | Shrimpy Review |

3Commas Overview

3commas is a cloud-based trading platform that enables traders to connect to multiple exchanges and execute trades using a range of powerful tools and features. This platform is designed to simplify the trading process, reduce risk, and improve the profitability of crypto trading.

3commas has risk management tools, which allow traders to set stop-loss orders, trailing stop orders, and other types of orders that can help reduce risk and protect profits.

The Trading bots can automatically execute trades based on a wide range of indicators, such as GRID trading, DCA Trading, smart trade, Options bot, and HODL bot.

Key Features of 3commas

- Automated Trading: 3Commas allows users to automate their trading strategies through its advanced trading bots.

- Smart Trade: This feature enables users to buy and sell cryptocurrencies at the best possible price by utilizing advanced algorithms.

- Trading Terminal: The platform offers a user-friendly trading terminal that allows traders to monitor their portfolios, execute trades, and analyze their performance.

- Portfolio Management: 3Commas offers portfolio management tools that help traders track their holdings and adjust their strategy accordingly.

- TradingView Integration: The platform integrates with TradingView, a popular charting and analysis platform, allowing traders to access a wide range of technical analysis tools.

- Risk Management: 3Commas provides risk management tools such as stop-loss orders, take-profit orders, and trailing stops, which help traders minimize their losses and maximize their profits.

- Multiple Exchanges: The platform supports trading on multiple cryptocurrency exchanges, including Binance, Coinbase Pro, Huobi, and many more.

- Social Trading: 3Commas offers a social trading feature that allows users to follow and copy the trades of successful traders.

Shrimpy Overview

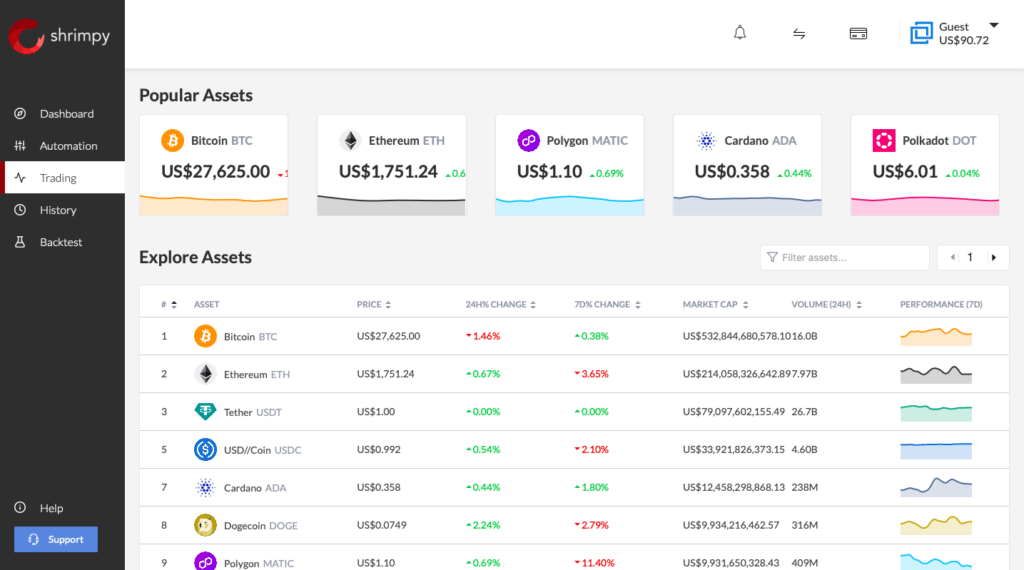

Shrimpy is a cryptocurrency trading platform that offers a suite of tools for both novice and experienced traders. It’s designed to help you manage your crypto portfolio with ease, so you can make more informed decisions and achieve better results.

With Shrimpy, you can connect to multiple cryptocurrency exchanges and manage your portfolio from one central location. It’s a one-stop shop for all your trading needs, offering a range of features such as rebalancing, portfolio tracking, and social trading.

The platform supports over 20 different exchanges, including Binance, Kraken, and Coinbase, so you can easily trade across multiple markets.

Key Features of Shrimpy

- Portfolio Management: Shrimpy allows users to easily manage their cryptocurrency portfolio across multiple exchanges in one place.

- Automated Trading: The platform includes automated trading tools, such as rebalancing and dollar-cost averaging, to help users optimize their portfolio performance.

- Social Trading: It enables users to follow and copy the trades of other successful traders on the platform, making it easier for beginners to learn from experts.

Related: Best Crypto Trading bots

3Commas and Shrimpy: Similarities and Differences

Types of Trading Bots and Strategies

When it comes to trading bots and strategies, 3Commas and Shrimpy are two popular options that offer a range of tools to help traders automate their strategies and maximize their profits.

3Commas offers a variety of trading bots, including Simple, DCA, composite bots, and GRID bots. Simple bots are ideal for beginner traders and execute one trading pair at a time, while composite bots allow traders to create more complex trading strategies by combining multiple simple bots.

Shrimpy also offers a range of trading bots, including rebalancing bots and indexing bots. Rebalancing bots automatically adjust the allocation of assets in a portfolio to maintain a desired level of risk, while indexing bots replicate the performance of a particular market index.

Winner: 3Commas is suitable for trading strategies, while Shrimpy is suitable for Portfolio management.

3Commas vs Shrimpy: Supported Exchanges

The number of supported exchanges is an important factor when choosing a trading bot, as it affects the variety of trading pairs available to users.

3Commas supports 16 crypto exchanges, including Binance, Bitfinex, and Kucoin, among others. Shrimpy also supports 25+ exchanges, including Binance, Bittrex, and Kraken, to name a few.

Winner: Shrimpy – It supports a wider range of exchanges compared to 3commas.

3Commas vs Shrimpy: Portfolio Management

Portfolio management is an essential feature of any trading bot, and both 3Commas and Shrimpy offer tools to help users manage their portfolios effectively.

3Commas offers a range of portfolio management tools, including smart trade, which automatically buys and sells assets based on pre-set conditions, and trailing stop loss, which automatically adjusts the stop loss price as the asset’s price moves.

Shrimpy’s portfolio management features include rebalancing, which ensures that the portfolio remains balanced according to the user’s preferred allocation, and asset management, which automatically manages the user’s portfolio to achieve the best performance.

Winner: Shrimpy – Its portfolio management features are more focused and offer more automated asset management compared to 3Commas.

3Commas and Shrimpy: Pricing and Plans

Pricing is an important factor to consider when choosing a trading bot, as it can significantly impact profitability.

3Commas offers three different plans: Starter, Advanced, and Pro. The Starter plan costs $15 per month and offers basic trading features, while the Advanced and Pro plans offer more advanced features and cost $49 and $99 per month, respectively.

Shrimpy offers two plans, starting at $15 per month and includes all features, including rebalancing, asset management, and more.

Winner: 3Commas because it offers more features at the same pricing level as Shrimpy.

3Commas or Shrimpy: Customer Support

Customer support is crucial when choosing a trading bot, as technical issues can arise at any time.

3Commas offers 24/7 customer support via email, chat, and phone, with dedicated support teams for each language. Shrimpy offers email support, a knowledge base, and a community forum.

Winner: Tie, both prioritize customer issues and focus on solving them.

Security Measures

3Commas uses two-factor authentication (2FA) and encrypts all data to prevent unauthorized access. The platform also employs several other security features, including IP whitelisting, withdrawal restrictions, and email notifications for login attempts and withdrawals. Additionally, 3Commas has a bug bounty program that rewards users who identify and report security vulnerabilities.

Shrimpy also uses 2FA to secure users’ accounts and encrypts all data in transit and at rest. The platform has implemented additional security measures, such as withdrawal restrictions and email notifications for account activity. Shrimpy also undergoes regular third-party security audits to ensure that its security measures are up-to-date and effective.

Winner: Tie – Both 3Commas and Shrimpy take security seriously and have implemented measures to protect their users’ accounts and funds.

3Commas vs Shrimpy: Pros and Cons

3Commas Pros and Cons

Pros:

- More advanced trading bots and customization options for experienced traders

- Advanced portfolio management features like rebalancing and backtesting

- More social trading features, including custom trading signals

- User-friendly interface

Cons:

- Expensive pricing plans start from $15 per month

- May be overwhelming for beginners

Shrimpy Pros and Cons

Pros:

- Cheaper pricing plans starting from $15 per month

- Easier to set up, user-friendly platform, portfolio management, and social trading features

- Supports 25+ exchanges, including Coinbase Pro and Kraken

Cons:

- Less advanced trading bots and customization options

- Not suitable for active trading

- Less advanced social trading features, including no custom trading signals

- Less polished interface compared to 3Commas

Final Thoughts [Which Should You Choose]

While 3Commas may be more suited for experienced traders who require advanced trading bots and customization options, Shrimpy offers a more affordable and user-friendly option for beginners or those who don’t require as many advanced features.

Note: If you Need Portfolio Manager, go for Shrimpy, if you need Trading bots with lots of custom-built strategies, 3Commas might be a better choice.

Related:

- 3Commas Vs Bitsgap

- 3commas Vs Quadency

- Cryptohopper Vs Shrimpy

- 3Commas vs Cryptohopper

- Pionex vs 3Commas

FAQs

Which platform is best for long-term investing?

Shrimpy may be better suited for long-term investing as it offers portfolio rebalancing and asset allocation tools, which can help users maintain a diversified portfolio over time. However, 3commas also offers portfolio tracking and risk management tools that can be useful for long-term investors.

Which platform is better for beginners?

3commas may be more suitable for those looking for advanced automation features, while Shrimpy may be more appropriate for those looking for portfolio management tools.

What are the main features of 3commas?

3commas offers a wide range of features, including automated trading bots, smart trading terminal, portfolio tracking, risk management tools, and a marketplace for trading signals and strategies.

What are the main features of Shrimpy?

Shrimpy’s main features include portfolio rebalancing, indexing, and asset allocation tools, trading automation, advanced analytics, and social trading.