Cryptocurrency trading bots can help traders automate their trading strategies and execute trades automatically. Cryptohopper and Shrimpy are two of the most popular trading bots available in the market today.

Cryptohopper was launched in 2017, while Shrimpy was launched in 2018. Both platforms have gained popularity due to their ease of use, competitive pricing, and wide range of features.

Key Takeaways:

- Cryptohopper focuses on trading automation bots, while Shrimpy focuses on portfolio management and rebalancing automation.

- Cryptohopper has a simpler and more user-friendly interface compared to Shrimpy with more strategies and a marketplace for buying signals.

- Cryptohopper supports 16+ crypto exchanges, while Shrimpy supports 10 Exchanges and 13 DeFi wallets to manage your portfolio in one place.

We Recommend: Best Crypto Trading bots

Best Manually Customized Trading bot

- 75+ CEX and DEX cryptocurrency exchanges

- Support over 300,000 crypto coins and 50+ DEX coins supported

- Insider information on where it is profitable to buy and sell tokens

- Free training and cases for clients of service

Proven Success Rate with 1M+ Users

- 16+ Exchange support

- Crypto-signals in Telegram

- Trading view Integration

- DCA, GRID, options, HODL, Smart trading bots

- Marketplace to buy automated trading strategies with success rate

Cryptohopper vs Shrimpy: Comparison

| Points | Cryptohopper | Shrimpy |

|---|---|---|

| Launched Date 📅 | 2017 | 2018 |

| Headquarters 🏢 | Amsterdam, Netherlands | Palo Alto, California, USA |

| Active Users 👥 | 200,000 | 100,000 |

| Type 📝 | Trading Bot | Trading Bot |

| Is it a Scam or Legit? 🔍 | Legit | Legit |

| Best For 🏆 | All-in-one Trading Platform | Beginners and Experts |

| Operating countries 🌍 | Worldwide | Worldwide |

| Supported Exchanges 💱 | 16 | 10 |

| Trading Pairs 💱 | 1000+ | 500+ |

| Fiat currency Supported 💲 | Yes | Yes |

| Types of trading bots 🤖 | Technical Analysis, Algorithmic Trading, Copy Trading, Market Making, Arbitrage Trading, and TradingView Strategies | Smart Rebalancing, Dollar-Cost Averaging, Portfolio Stop Loss, Threshold Rebalancing, Spread/Slippage Control, and Fee Optimization with Maker Trades |

| Payment Method 💳 | Credit Card, Crypto | Credit Card, Crypto |

| Pricing 💰 | $16.58 – $83.25 per month | Free – $15 per month |

| Are there any Extra Trading Fees? 💸 | No | Yes (maker and taker fees) |

| Mobile App 📱 | Android and iOS | No |

| Paper Trading (Demo) 📝 | Yes | Yes |

| Backtesting with Strategies 🔙 | Yes | Yes |

| Customer Support 📞 | 24/7 Live Chat Support | Email Support |

| KYC 🔍 | Not Required | Not required |

| Cryptohopper review | Shrimpy Review |

What is Cryptohopper?

Cryptohopper is a cloud-based trading bot that is designed to help traders automate their trading strategies. It supports multiple exchanges and allows users to connect to their accounts through API keys.

It allows users to automatically rebalance their portfolios based on their preferred asset allocation. This can help to reduce risk and improve overall portfolio performance.

Key Features of cryptohopper are:

- TradingView Signals integration

- Backtesting

- Paper Trading

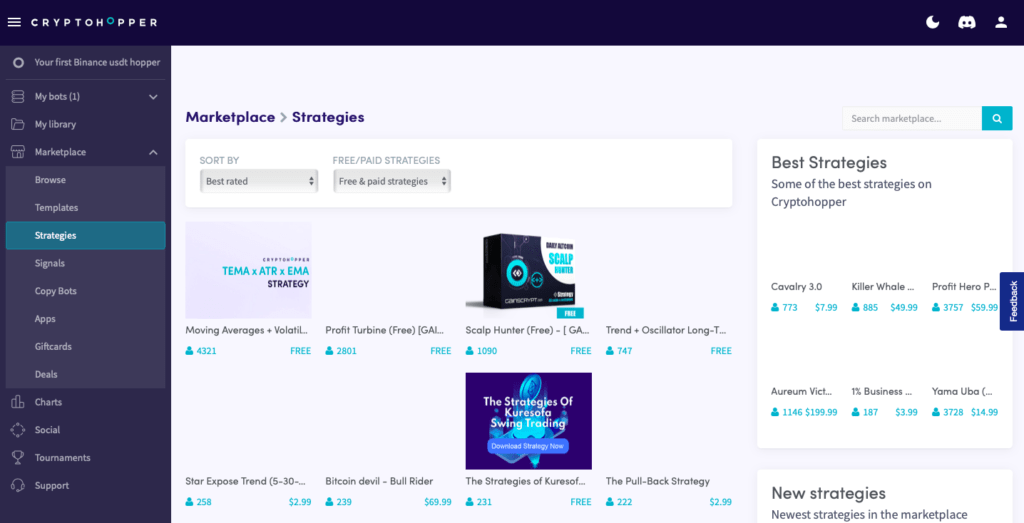

- Trading strategies marketplace

- Mobile App

- Multiple exchanges integration

- Technical indicators

- Customizable notifications

- Portfolio management

- Trading simulator

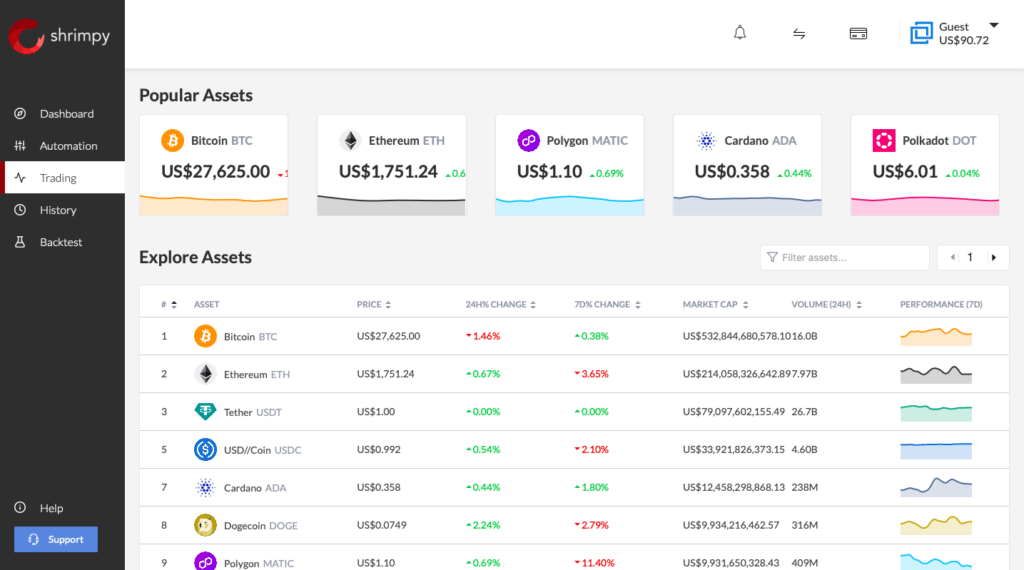

What is Shrimpy?

Shrimpy is another cloud-based trading bot that supports several cryptocurrency exchanges, including Binance, BitMEX, and Pionex. The platform allows users to automate their trading strategies, monitor their portfolios, and track their investments’ performance.

Shrimpy offers several features, including:

- Portfolio rebalancing

- Social trading

- Performance tracking

- Portfolio management

- Advanced order types

- Multiple exchanges integration

- Paper Trading

- TradingView integration

Related: Best Crypto Trading bots

Cryptohopper and Shrimpy: Features Compared

Trading Strategies and Tools

Both Cryptohopper and Shrimpy offer a wide range of features that allow users to automate their trading strategies and monitor their portfolios. However, Cryptohopper offers more technical indicators than Shrimpy and has a trading strategies marketplace that allows users to buy and sell trading strategies. On the other hand, Shrimpy offers portfolio rebalancing, social trading, and advanced order types, which might be worth considering.

Pricing and Plans

Cryptohopper’s pricing plans are based on levels of access to the platform’s features.

- The Pioneer plan is free and allows for unlimited copy bots, 20 open positions per exchange, and portfolio management.

- The Explorer plan, priced at $16.58 per month, adds more open positions per exchange, as well as backtesting, strategy design, and paper trading.

- The Adventurer plan, at $41.58 per month, adds even more open positions, shorter strategy interval checks, and event-based triggers.

- The Hero plan, priced at $83.25 per month, offers the most features, including AI strategies and designers, all coins for trading signals, market making and arbitrage, and extra technical indicators.

Shrimpy’s pricing starts with a free plan that includes unlimited spot trades but limits the user to one exchange, portfolio, and automation. As users move up to the-

- The standard plan for $19 per month, and they gain access to five exchanges, portfolios, and automation, as well as customizable rebalance periods and dynamic indexing.

- The Plus plan, priced at $49 per month, offers even more exchanges, portfolios, and automation, along with shorter balance refresh times and reduced fees for maker trades.

Supported Exchanges and Wallets

Cryptohopper supports over 16 different cryptocurrency exchanges, including Binance, Coinbase Pro, Kraken, and Bitfinex, among others. Shrimpy also supports over 10 different exchanges, including Binance, Bittrex, and Gate.io, among others. Both platforms offer a wide range of popular exchanges, making it easy for users to trade on their preferred exchange.

Cryptohopper does not support direct wallet integration but offers integration with third-party wallet providers, such as Coinbase and BitGo. Shrimpy, on the other hand, supports direct wallet integration with several popular wallets, including ELLIPAL Titan, Safepal, and Guarda wallet.

Security

Cryptohopper offers several security features, such as two-factor authentication (2FA) and Secure Socket Layer (SSL) encryption, to protect users’ accounts and data. The platform also offers IP whitelisting and Secure Shell (SSH) tunneling, which can provide additional security for advanced users.

Shrimpy also offers several security features, including 2FA and SSL encryption, to protect users’ accounts and data. The platform also uses cold storage to store users’ assets, which can provide an additional layer of security. Furthermore, Shrimpy has a dedicated security team that monitors the platform for potential security threats and takes appropriate measures to prevent them.

Ease of Use

Both platforms are user-friendly, with intuitive interfaces and several video tutorials, knowledge bases, and community forums. However, Cryptohopper’s interface may be more complex for beginners than Shrimpy’s interface but has more advanced features.

Cryptohopper vs Shrimpy: Portfolio Management

Cryptohopper and Shrimpy offer robust portfolio management features that can help users make informed trading decisions and manage their portfolios more effectively. However, Cryptohopper’s Strategy Designer feature provides users with greater flexibility and control over their trading strategies, while Shrimpy’s social trading feature allows users to follow and learn from successful traders.

Additionally, Shrimpy’s range of portfolio rebalancing options may be more appealing to users who prefer a hands-off approach to portfolio management.

Paper Trading and Backtesting Compared

Cryptohopper and Shrimpy offer a paper trading feature that allows users to simulate trades using fake money. This can be a useful tool for users who want to test their trading strategies in a risk-free environment. The platforms also offer a backtesting feature that allows users to test their trading strategies using historical data.

Users can select a time period and trading pair, and the platform will simulate trades using the user’s chosen strategy. This can be a useful tool for users who want to see how their strategy would have performed in different market conditions.

Related:

Cryptohopper or Shrimpy: Best Trading Strategies Explained

Cryptohopper Trading bots

Cryptohopper offers a wide range of trading bot strategies that users can utilize to automate their trading. Here are some of the most popular strategies:

- Technical Analysis: This strategy uses indicators such as moving averages, MACD, and RSI to identify trends and predict market movements.

- Mean Reversal: It takes advantage of the natural ebb and flow of markets by buying low and selling high.

- Momentum: This bot seeks to take advantage of upward trends by buying high and selling higher.

- Arbitrage: It involves buying and selling the same asset on different exchanges to take advantage of price discrepancies.

- Ping Pong: This strategy involves setting buy and sell orders at certain price levels to capture small profits as the market moves up and down.

- Market Making: This strategy involves placing buy and sell orders at specific price levels to provide liquidity to the market and capture small profits.

- Dollar Cost Averaging: It involves buying a fixed dollar amount of an asset at regular intervals, regardless of the market price.

- Bollinger Bands: This bot uses Bollinger Bands, which are volatility indicators, to identify overbought and oversold conditions in the market.

- Fibonacci Retracement: This strategy uses Fibonacci retracement levels to identify potential support and resistance levels in the market.

- Ichimoku Cloud: This strategy uses the Ichimoku Cloud, which is a collection of indicators, to identify potential trend reversals and entry/exit points.

Shrimpy Trading bots

Shrimpy offers a variety of trading bot strategies that users can employ to automate their trading activities. Here are some of the most popular strategies:

- Index the Market: This strategy allows users to automatically index the DeFi market, copy the portfolios of top funds, or build a custom index based on their preferred assets.

- Smart Rebalancing: With this strategy, Shrimpy’s advanced smart order routing engine precisely executes every rebalance, ensuring that portfolios stay balanced and optimized for maximum returns.

- Dollar-Cost Averaging: This strategy automatically invests funds into a portfolio with desired allocations each time they are deposited, helping users to gradually build their portfolio over time.

- Portfolio Stop Loss: This feature allows users to set a stop-loss order to limit their portfolio’s downside risk.

- Threshold Rebalancing: This feature ensures that portfolios are rebalanced only when they exceed a certain threshold, reducing unnecessary trading activity.

- Spread/Slippage Control: This feature enables users to control the spread and slippage of trades, ensuring that they get the best possible price for their trades.

- Fee Optimization with Maker Trades: This feature helps users to optimize trading fees by executing trades as Maker trades on exchanges that offer lower fees for Maker trades.

Final Thoughts: Which is better?

Cryptohopper and Shrimpy are excellent trading bots that offer a wide range of features, competitive pricing, and excellent security. However, which platform is better suited to your needs depends on your trading strategies, preferences, and budget.

If you are looking for a platform with more technical indicators and a trading strategies marketplace, Cryptohopper may be a better option for you. On the other hand, if you prefer portfolio rebalancing, social trading, and advanced order types, Shrimpy may be a better option.

FAQs

How does Cryptohopper differ from Shrimpy?

Cryptohopper and Shrimpy have different focuses. Cryptohopper is primarily a trading bot that automates trading strategies across exchanges, while Shrimpy is primarily a portfolio management tool that automates portfolio rebalancing and asset allocation strategies.

Which is better for trading, cryptohopper or Shrimpy?

Cryptohopper is better for trading as it is specifically designed for trading strategies and offers more advanced technical analysis tools.

Can I use both Cryptohopper and Shrimpy together?

Yes, you can use both Cryptohopper and Shrimpy together to automate both your trading and portfolio management strategies.