Decentralized exchanges (DEXes) have been gaining popularity in recent years, offering users a trustless and permissionless platform to trade cryptocurrencies. Two of the most well-known DEXes are Gains Network (GNS) and GMX, each with its own unique features and benefits. But which one is the better perpetual DEX?

We’ll explore the similarities and differences between these two platforms, including their features, functionality, security, liquidity, and more. By the end of this post, you’ll have a better understanding of which platform may be better suited for your specific needs as a crypto trader or investor.

What is a Perpetual DEX?

Perpetual contracts are a distinct type of futures contract that differ from traditional futures contracts mainly in their expiration dates. In contrast to regular futures contracts, which have fixed expiration dates, perpetual contracts are indefinite and do not expire. A trader’s position in a perpetual contract remains open and active for as long as they choose to hold it.

Any gains or losses incurred by a trader on a perpetual contract continue to accumulate until they decide to close their position or the exchange liquidates their account if losses go unresolved.

Unlike other forms of futures contracts, the price of perpetual contracts is typically closely tied to the spot price of the underlying asset. While there may be instances where the perpetual contract price deviates from the spot price, such occurrences are infrequent compared to traditional futures contracts.

GNS Vs GMX: Key Differences

| Feature | GNS | GMX |

|---|---|---|

| Blockchains | Polygon network | Avalanche and Arbitrum |

| Tradable Assets | Crypto, stocks, forex | Crypto |

| Leverage Levels | Up to 150x for crypto, 100X for stocks, 1000X for forex | Up to 30X leverage for crypto |

| Leverage Pool Structure | Single collateral (DAI), decentralized vault, and liquidity pool | Multiple collaterals, decentralized vault, and liquidity pool |

| Contract Type | Leveraged perpetual contract | Leveraged perpetual contract |

| NFT Integration | GNS NFT gives users extra benefits | No NFT integration |

| Platform Fees | 0.008% to 0.006% | 0.1% |

| Incentive Programs | Staking pools, NFT boost, Liquidity mining | Staking pools, Liquidity mining, and Multiplier points |

Must Read: Top Perpetual DEXs in crypto Space for Leverage Trading

Supported Blockchain

The host network is the blockchain on which the platform is built. It is important to consider the host network as it affects the speed and cost of transactions, the level of security, and the availability of assets to trade. GNS is currently deployed on the Polygon network, while GMX is deployed on Avalanche and Arbitrum.

While both networks are known for their fast transaction speeds and low fees, GMX’s deployment on two networks provides users with greater flexibility in choosing where to trade.

Tradable Assets

The range of assets available for trading is another crucial factor when choosing a perpetual DEX. GNS offers a wide range of assets, including crypto, stocks, and forex. In contrast, GMX currently only offers crypto. GMX may be more limited in the types of assets available, but it does have a broader range of cryptocurrencies available for trading.

Leverage Levels

Both GMX and GNS offer leverage for their contracts, which allows traders to increase their potential profits. GNS offers up to 150x leverage for crypto, 100x leverage for stocks, and 1000x leverage for forex. GMX, on the other hand, offers up to 30x leverage for crypto. While GNS offers greater leverage, it is important to remember that high leverage can also lead to significant losses.

Leverage Pool Structure

The leverage pool structure is the mechanism by which leverage is provided to traders. GNS uses a single collateral (DAI) decentralized vault and liquidity pool structure, while GMX uses a multiple collateral decentralized vault and liquidity pool structure. This means that GMX can support a wider range of collateral options, providing more flexibility for traders.

Contract Type

Both GMX and GNS offer leveraged perpetual contracts. This means that the contracts do not expire and can be held indefinitely, as long as the trader has sufficient collateral to support their position. However, it is important to note that perpetual contracts are not suitable for all traders and may carry greater risks than other types of contracts.

NFT Integration

GNS offers NFT integration, allowing users to gain additional benefits by holding GNS NFTs. These benefits include access to exclusive features, lower fees, and improved trading conditions. GMX does not currently offer NFT integration.

Platform Fees

Both GMX and GNS charge fees for trading on their platforms. GNS charges a variable fee ranging from 0.008% to 0.006%, while GMX charges a fixed fee of 0.1%. While GNS may be cheaper for high-volume traders, GMX’s fixed fee structure can be more predictable and transparent.

Rewards

Both GMX and GNS offer incentive programs to encourage users to stake their tokens and provide liquidity to the platform. GNS offers staking pools, NFT boosts, and liquidity mining, while GMX offers staking pools, liquidity mining, and multiplier points. Both programs can be an attractive way for users to earn additional rewards beyond their trading profits.

What is Gains Network (GNS)?

Gains Network is a decentralized trading platform for derivatives, initially built on the Polygon network, and with plans to expand to other decentralized networks. At gTrade, traders dealing in crypto derivatives can utilize leverage up to 150 times their investment, and forex trades can leverage up to 1000 times.

The platform’s leverage system is powered by synthetic assets and a decentralized lending protocol, resulting in cost savings for users compared to other platforms that charge loan fees.

The platform’s financial system is underpinned by GNS, its native token, which will have an important role in its decentralized governance structure. Once the governance system goes live, GNS tokens will be used for DAO voting.

How to Get Started With Gains Network (GNS)

Here’s a step-by-step guide on how to get started with Gains Network (GNS):

- Head over to Gains Network’s trading platform and open the gTrade app.

- To get started, click on the ‘Connect Wallet’ button to begin setting up your wallet.

- If you haven’t already done so, follow the step-by-step guide provided by Gains Network to add the Polygon network to your wallet.

- You can switch between Polygon mainnet and Testnets by selecting the Polygon dropdown located beside your wallet address at the top right corner of your device. You can also select the Arbitrum network from this location once gTrade is deployed to the network.

- Double-check that you’re on the intended network before proceeding with your trade.

- Customize the user interface to suit your preferences by clicking the ‘Settings’ icon located beside your wallet address.

- Choose between ‘Long’ or ‘Short’ depending on the direction of your trade.

- Select the asset pairs you’d like to trade by clicking on the asset list and scrolling down to your preferred asset.

- Keep in mind that leverage limits differ for stocks, forex, and crypto. Use the leverage slider to adjust accordingly.

- Enter the amount of DAI you wish to deposit as your collateral and drag the slider to set your leverage.

- Set your ‘Stop loss’ and ‘Take profit’ levels by clicking on the Price box and entering your exit levels and the percentage of your trade value you wish to trade at each point.

- Check the calculated fees for your trade and liquidation price in the indicated area. If satisfactory, approve DAI and complete your trade.

- If DAI is already approved, there’s no need to repeat this step.

What is GMX?

GMX is a new platform for trading perpetual contracts and cryptocurrency spots, which has been developed on the Ethereum Layer 2 solution known as Arbitrum One and later on the Avalanche blockchain. GMX is the updated version of the now-defunct Gambit exchange.

The decentralized protocol for spot trading provided by GMX enables investors to perform cryptocurrency exchanges seamlessly right from their personal wallets. However, its most popular product is its decentralized platform for trading perpetual contracts. The GMX exchange permits perpetual contract traders to use up to 30X leverage.

The GMX exchange has many advantages, such as a fantastic tokenomics and rewards program for traders and liquidity providers, minimal fees for trading and swapping, and an excellent user experience due to the high-throughput blockchain technology and optimized protocols that power the platform.

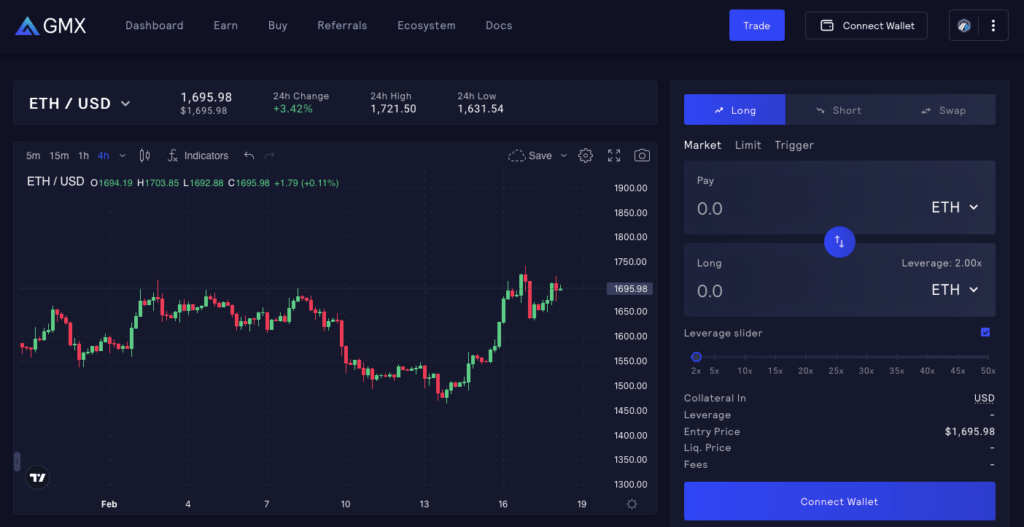

How to use GMX’s trading platform

here’s a step-by-step guide on how to use GMX’s trading platform:

- Start by going to the GMX website and setting up your wallet by selecting “Connect Wallet.”

- If you haven’t added the Arbitrum or Avalanche chain to your wallet, the system will prompt you to do so after connecting. You can also learn how to add these networks to your MetaMask wallet.

- Switch between the Arbitrum and Avalanche networks by clicking the three dots in the top right corner of your device. Make sure you’re on the right network before proceeding.

- To perform decentralized token swaps on GMX, click “Swap” on the screen’s right corner. Then, choose the swap pair, enter the amount of tokens you want to swap, and complete the process.

- For trading perpetual contracts on GMX, select the pair you want to trade and choose either “Long” or “Short,” depending on the trade direction.

- Set the parameters of your trade, including the asset to be used as collateral, the amount you want to pay, and the asset you’re betting on. Use the slider to adjust your leverage.

- Verify your entry price, liquidation price, and entry fee. If everything looks good, confirm your position.

- After you confirm your position, manage it by clicking “Position.” From there, you can view your active trades and manage them accordingly.

- To close your position, click “Close.”

- To set a stop-loss or take-profit order, click “Trigger” and establish a price at which your trade will automatically close.

Final Thoughts

In conclusion, both GNS and GMX have their strengths and weaknesses, making it difficult to declare one as a better perpetual DEX than the other. GNS offers lower trading fees and a better user Interface, while GMX boasts more trading pairs and high liquidity.

Ultimately, the choice between the two depends on individual preferences and trading strategies. It’s always advisable to conduct proper research and due diligence before choosing a perpetual DEX that best aligns with your trading goals and objectives.