Are you tired of manually trading cryptocurrencies and missing out on potential profits? If so, it might be time to consider using a crypto trading bot. These automated programs can analyze market trends and execute trades on your behalf, freeing up your time and potentially increasing your profits.

So, let’s discuss the best crypto trading bots on the market and how they can make you profit in your trading.

How to choose the best crypto trading bot: Our Methodology

- 💰 Profitability: Look for a bot that has a proven track record of generating consistent profits.

- 🔒 Security: Ensure that the bot has robust security measures in place to protect your funds and personal information.

- 📊 Customizability: Choose a bot that can be customized to suit your trading style and preferences.

- 🌍 Supported exchanges: Check if the bot supports the exchanges you trade on.

- 👨💼 Developer Reputation: Choose a bot developed by a reputable team with a solid track record in the crypto industry.

- 💬 Community support: Look for bots with active and supportive communities that can provide guidance and support.

- 👨💻 User interface: Choose a bot with a user-friendly interface that is easy to navigate and understand.

- 📈 Strategy options: Choose a bot that offers a variety of trading strategies to suit different market conditions.

- 📈 Backtesting: Look for a bot that allows you to backtest your strategies using historical data to evaluate their effectiveness.

- 👍 Reviews and ratings: Read reviews and ratings from other users to gauge the effectiveness and reliability of the bot.

List of Top Crypto Trading Bots 2025

Here is the list of best automated cryptocurrency trading bots:

- Pionex: Best Crypto Trading Bot

- HaasBot: Most Advanced Crypto Trading Bot

- CryptoHopper: Cloud-based Trading bot

- ZenBot: Best Command-line Trading Bot

- 3Commas: Most Popular Crypto Trading Bot

- Bybit: Top Grid Trading Bot

- Naga: Advanced Crypto Trading bot

- GunBot: Customizable Crypto Trading Robot

- ArbitrageScanner: Best for trading price difference across crypto exchanges

Pionex: Best Crypto Trading Bot

Pionex is a cryptocurrency trading platform that offers a variety of tools and features for traders, including automated trading bots.

The platform claims to offer “the most powerful and flexible trading bots on the market,” which can be used to execute a variety of trading strategies.

- Type of Trading Bots: DCA bot, Rebalancing bot, Grid Trading Bot, Spot and Futures Trading bot, and other 16 free trading bots

- Cost: Free and 0.05% Trading Fees

- Availability: Web App (Mac, Windows, Ubuntu, etc.), Mobile App (IOS, Android)

- Supported Exchanges: Binance, Pionex exchange, Huobi Global, etc.

Key Features of Pionex

- Multiple Exchange Support: Pionex bots can be traded on multiple exchanges including Binance, Huobi, and Bitfinex.

- Customizable Trading Strategies: It allows traders to customize their trading strategies by setting parameters such as profit and stop-loss levels and the amount of capital to invest in each trade.

- Backtesting: The bots can be tested using historical data to see how they would have performed in the past. This can help traders evaluate the effectiveness of their strategies and make necessary changes.

- Risk Management: Pionex bots have built-in risk management features to help traders minimize their risk of loss.

- Advanced Technical Analysis: It uses advanced technical analysis techniques to identify trading opportunities and execute trades.

Pros and Cons of Pionex Trading Bot

| Pros | Cons |

|---|---|

| Automation saves time and effort | Dependence on technology increases the risk of errors or glitches |

| Backtesting allows for the optimization of trades | Lack of personal control may be disadvantageous for some traders |

| Customization allows for tailored trading strategies | Fees may be a drawback for traders on a tight budget |

| Supports multiple exchanges for more trading options | Lack of human interaction may not be suitable for all traders |

| State-of-the-art security measures protect accounts and funds |

HaasBot: Most Advanced Crypto Trading Bot

Haasbot is a cryptocurrency trading bot that was developed by HaasOnline, a company that specializes in developing automated trading software for the cryptocurrency market.

Haasbot trading bot can integrate with various technical indicators and charting tools, such as Moving Averages, Bollinger Bands, and the Ichimoku Cloud.

This allows users to customize their trading strategies and make more informed decisions based on market data.

- Type of Trading Bots: arbitrage, index, trend trading, and many more.

- Cost: 0.013 BTC Per Annum

- Availability: Windows, Linux, and Mac

- Supported Exchanges: Binance, Bitfinex, BitMEX, Bittrex, CEX.IO, and 22+ other exchanges.

Key Features of HaasBot

In addition to its trading capabilities, Haasbot also offers a range of other features, including:

- Order execution: Haasbot can execute trades on multiple exchanges simultaneously, allowing users to take advantage of price differences across different exchanges.

- Automated portfolio management: Haasbot can manage and rebalance a user’s portfolio based on their predetermined risk tolerance and investment strategy.

- Advanced order types: Haasbot supports a range of advanced order types, including stop-loss orders, take-profit orders, and trailing stop orders.

- Backtesting: Haasbot includes a backtesting feature that allows users to test their trading strategies on historical market data.

Pros and Cons of HaasBot

| Pros | Cons |

|---|---|

| Execute trades on multiple exchanges simultaneously | Subscription fees or upfront costs |

| Backtest trading strategies using historical data | Require some technical knowledge to set up and customize |

| Customized trading rules and parameters | May not always make profitable trades due to market volatility or incorrect strategy implementation |

| Execute trades based on technical indicators |

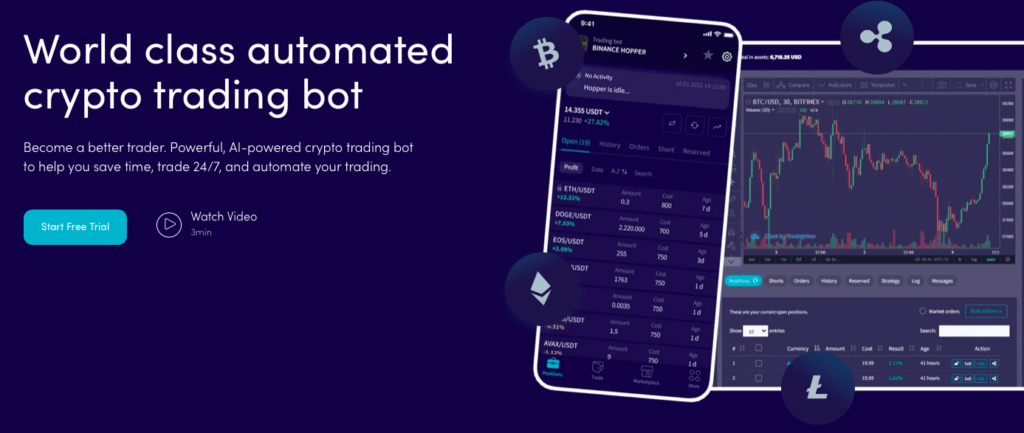

CryptoHopper: Cloud-based Trading bot

Cryptohopper is a cloud-based cryptocurrency trading bot that allows users to automate their trading strategies using technical indicators, arbitrage opportunities, and a variety of other features.

The platform offers a range of subscription plans, with the most basic version providing access to the bot, backtesting tools, and a demo trading account.

Cryptohopper is a powerful and flexible platform that can be used by both novice and experienced traders to automate their trading strategies and manage their portfolios more effectively.

- Type of Trading Bots: Market Making bot, a Trend Trading bot, and an Arbitrage bot.

- Cost: Free 20 Positions per month

- Availability: Windows, Linux, Mac, and Mobile app (Android and IOS)

- Supported Exchanges: Binance, Coinbase, Kraken, and Bitfinex, among others

Key Features of CryptoHopper

- Automated trading: Cryptohopper allows users to automate their trading strategies using technical indicators, arbitrage opportunities, and other features.

- Customizable dashboard: Cryptohopper offers a customizable dashboard that allows users to track their portfolios, set up alerts, and manage their trades.

- Backtesting tools: The platform includes backtesting tools that allow users to test their trading strategies on historical data before putting them into practice.

- Social trading: Cryptohopper offers a range of social trading features, including the ability to follow and copy the trades of successful traders and connect with other traders in the community.

- Market analysis tools: The platform includes a range of tools for market analysis, including technical indicators, charting tools, and news feeds.

Pros and Cons of Cryptohopper Trading Bot

| Pros | Cons |

|---|---|

| Automated and social trading features | Requires setup and configuration |

| Connect all popular crypto exchanges | Risk of losses |

| Provides various technical indicators | Charges a monthly subscription fee |

| Offers to backtest |

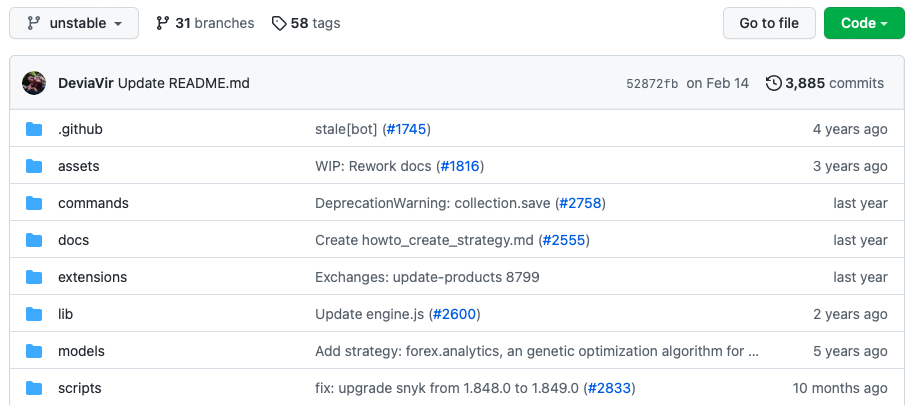

ZenBot: Best Command-line Trading Bot

ZenBot is a command-line cryptocurrency trading bot that is designed to be lightweight and easy to use.

It is an open-source project that is available on GitHub and is written in JavaScript, making it easy to customize and extend.

ZenBot uses technical analysis and machine learning to make trading decisions.

- Type of Trading Bots: DCA bot, Arbitrage, Grid bot

- Cost: Free

- Availability: Github Source Code

- Supported Exchanges: API Connectivity

Key Features of ZenBot

- Open-source: ZenBot is an open-source project that is available on GitHub, which means that it is free to use and customize.

- Backtesting: ZenBot allows users to backtest their trading strategies on historical data.

- Real-time trading: ZenBot supports real-time trading, so users can set it up to trade automatically on their behalf.

- Customization: ZenBot has several customization options, including the ability to set the risk level for trades, the frequency of trades, and the amount of capital to use for each trade.

- Community support: ZenBot has an active community of developers and users who contribute to the project and help improve it.

Pros and Cons of ZenBot

| Pros | Cons |

|---|---|

| Completely free-to-use and open source | Not beginner-friendly |

| Customizable to the user’s requirements | Complex and convoluted |

| Integration with messenger | |

| Compatible with popular exchanges | |

| Multiple analytical tools |

3Commas: Most Popular Crypto Trading Bot

3Commas is a cryptocurrency trading platform that offers a range of tools and features to help traders automate and optimize their trades.

3Commas allows users to create and set up automated trading strategies, or “bots,” that execute trades on their behalf based on pre-determined rules and conditions.

This can help traders save time and remove the emotional element from their trading decisions.

- Type of Trading Bots: Rebalancer, Options bot, Grid bot, HODL bot

- Cost: $8 and $20 per month plans

- Availability: Mobile and Web apps supported

- Supported Exchanges: Bybit, Binance, OKx, Bitfinex, Coinbase pro, Kucoin, Gate.io, Gemini, etc.

Key Features of 3Commas

- Portfolio management: 3Commas offers a range of portfolio management tools, including the ability to set up stop-loss and take-profit orders, as well as a “trailing” feature that adjusts these orders based on the changing value of a trade.

- SmartTrade: This feature allows users to set up advanced trades using a variety of different criteria, including the use of multiple exchanges, multiple pairs, and multiple order types.

- Arbitrage: 3Commas provides tools for users to find and capitalize on arbitrage opportunities across different exchanges.

- Social trading: 3Commas offers a range of features to help traders follow and copy the trades of successful traders on the platform.

Pros and Cons of 3Commas Bot

| Pros | Cons |

|---|---|

| Automation | Cost |

| Increased efficiency | Risk of loss |

| Improved diversification | Dependence on technology |

| Backtesting | Lack of personal control |

| Customization | Complexity |

| Multiple exchange support | Lack of flexibility |

Bybit: Top Grid Trading Bot

Bybit is a cryptocurrency exchange that offers a grid trading bot as one of its trading tools.

The Bybit grid trading bot allows users to set up a grid of buy and sell orders around a certain price level, and the bot will automatically execute these orders as the market moves.

The Bybit grid trading bot also allows users to set stop-loss and take-profit orders, which can help to minimize potential losses and maximize profits.

- Type of Trading Bots: Spot, Options bot, Grid bot

- Cost: Free

- Availability: Android, IOS, and Web apps supported

- Supported Exchanges: Only inbuilt Bybit Exchange

Key Features of Bybit Bot

- The Bybit platform includes a feature that sends alerts when a bot’s margin falls outside of a predetermined price range or when a stop-loss/take-profit order is triggered.

- The Futures Grid Bot also offers higher leverage, which can potentially increase profits and reduce the risk for futures traders.

- Additionally, the Futures Grid Bot includes an automated AI strategy feature that simplifies the process of entering a trade by pre-populating all necessary information.

- To use this feature, users simply need to select the contract pair they wish to trade, choose a neutral, long, or short position, and specify the amount they want to invest.

Read: Is Bybit the best crypto Exchange?

Pros and Cons of Bybit

| Pros | Cons |

|---|---|

| Automated trading features | Requires technical analysis knowledge |

| Zero fees | Risk of losses |

| Reputable crypto exchange | limited trading bots and strategies |

| High market liquidity for bots | No backtesting |

Naga: Advanced Crypto Trading bot

Naga trading bot is a software program that uses algorithms to analyze financial markets and execute trades automatically on behalf of the user.

It is designed to help traders make more informed decisions by providing real-time market data, technical analysis, and other tools.

There are a variety of different trading bots available, including those that focus on specific markets or asset classes, such as stocks, forex, or cryptocurrencies.

Some trading bots are designed to be user-friendly and can be set up and configured with little technical knowledge, while others may require more advanced programming skills.

- Type of Trading Bots: Spot, Options bot, Grid bot

- Cost: Free

- Availability: Mobile and Web apps supported

- Supported Exchanges: Only inbuilt Naga Exchange

Key Features of Naga

- Automated trading: The Naga trading bot can be configured to automatically execute trades based on predefined rules and conditions, allowing traders to take advantage of market movements without needing to constantly monitor their portfolios.

- Customizable trading strategies: Naga allows traders to create and customize their own trading strategies using a variety of indicators and technical analysis tools.

- Advanced charting: Naga provides advanced charting tools, including a variety of chart types, technical indicators, and drawing tools, to help traders analyze market trends and make informed trading decisions.

- Social trading: Naga offers a social trading feature that allows traders to follow and copy the trades of other successful traders on the platform.

- Advanced security: Naga uses advanced security measures, including encryption and secure servers, to protect the personal and financial information of its users.

Pros and cons of Naga

| Pros | Cons |

|---|---|

| Automated Copy trading | Dependence on technology |

| Customization | Lack of human judgment |

| Backtesting | |

| Free of cost |

GunBot: Customizable Crypto Trading Robot

GunBot is a cryptocurrency trading robot that allows users to automate their trading strategies on various cryptocurrency exchanges.

It is customizable, allowing users to set their own trading rules and parameters, such as the number of funds to be used for each trade, the indicators to be used for decision-making, and the frequency of trades.

To use GunBot, users need to install the software on their computer or server, and then connect it to their exchange account using API keys.

Once set up, the GunBot software will continuously monitor the market and execute trades based on the user’s specified rules.

- Type of Trading Bots: Spot, Options bot, Grid bot

- Cost: 0.014 BTC (One-time payment)

- Availability: Windows, Mac, Linux

- Supported Exchanges: Binance, Bittrex, Bitfinex, and Coinbase Pro, many others

Key Features of GunBot

- Automated Trading: GunBot allows users to automate their cryptocurrency trading by setting custom trading strategies and rules.

- Multiple Exchanges: GunBot supports trading on multiple crypto exchanges including Binance, Bittrex, and Poloniex.

- Backtesting: GunBot includes a backtesting feature that allows users to test their trading strategies against historical data to see how they would perform.

- Customizable: GunBot allows users to customize their trading strategies and rules to their specific needs and preferences.

- security features: GunBot includes security features such as automatic stop-loss and take-profit orders and the ability to set a maximum number of trades per day.

- Multiple Licenses: GunBot offers multiple licenses ranging from a single exchange license to a full license that includes access to all exchanges and features.

Pros and Cons of GunBot

| Pros | Cons |

|---|---|

| Automation of trades | Dependence on the bot to make trades |

| Ability to backtest strategies | Risk of loss if the bot makes a mistake |

| Potential for increased profits | Potential for increased losses |

| Can trade 24/7 | May be difficult to set up and configure |

| Can be customized with different strategies | May require ongoing maintenance and updates |

ArbitrageScanner: Best for trading price difference across crypto exchanges

ArbitrageScanner.io is a cryptocurrency arbitrage bot that works without an API request. You can track price differences between 75+CEX, 25 DEX, and 40 blockchains and add any other platform token to track. The only bot in the world that tracks the difference between DEX exchanges where spreads reach 30-40% on large coins.

It is a tool that will be a great option for beginners with little capital. How does it work? You buy a coin on one exchange and then transfer it to another exchange where the price is higher. You sell the coin on the second exchange and earn on the price difference.

You can make up to 150 transactions per day on different coins and the income can reach up to 130% per day. The service team gives free detailed training to its clients.

- Type of Trading Bots: Arbitrage bot

- Cost: $69/month

- Availability: Web CMS

- Supported Exchanges: Binance, Kucoin, Huobi Global, and 75+ more.

Here are some Case Studies:

- Simple example with XRP: when it started to rise, the spread between the major exchanges Bybit and Binance was 15% each. There was no need to hold XRP. You just bought it on the exchange where it was cheaper, transferred it to where the rate was higher, and sold it. A good way for people with little capital.

- Example of another case: when the Akhram coin was listed on Binance, the rate was $0.5 and held for 5 minutes, on other exchanges the price was $0.75, and the screener (a unique bot product that automatically searches for bundles) showed this difference and any client of the service could earn in 5 minutes under 50% on arbitrage. There are many such situations, study the project.

Key Features of ArbitrageScanner

- Supports over 75 DEX and CEX (international, local in each country)

- A manual bot with no API request, so all your capital is safe

- Trade notifications are sent every 4 seconds, so you will always know about changes in the market. You can choose any coin and any exchange to follow.

- Screener that looks for bundles between exchanges and sends notifications about the difference. You can earn up to 80% per day without holding tokens for a long time.

- Personal mentor when you pay for the Expert plan, who will customize the bot on a turnkey basis and answer all your questions.

- ArbitrageScanner Message is a tool that allows you to find news through your keywords in Telegram/Twitter.

- WhiteLabel: You can buy a bot license starting from $19999. You can implement Ready-made IT solutions in your own business or launch in any other region and get 100% of the sales. Setting up the service on your website is turnkey and included in the price. This is an excellent solution for those who dream of starting their own business but do not know where to start.

What is a Crypto Trading Bot?

A crypto trading bot is software that automatically buys and sells cryptocurrencies on exchanges according to rules and parameters defined by the user.

These robots can be programmed to execute trades based on various indicators and signals, such as the volume and price of a particular cryptocurrency or technical analysis patterns.

Trading bots can be useful for traders who want to take advantage of market opportunities but don’t have the time or expertise to do them manually.

They can also be useful for executing trades faster than a human trader, which can be especially important in fast-moving markets.

Advantages of Using Trading Bots

- Speed: Trading bots can make decisions and execute trades much faster than humans, which can be useful in fast-moving markets.

- Accuracy: Trading robots can execute trades with high accuracy because they follow predetermined rules and do not get nervous or make decisions based on subjective feelings.

- Consistency: Robots can execute trades consistently without breaks or holidays. This can be useful for traders who want to maintain a consistent trading strategy.

- Risk Management: Trading bots can be programmed to follow risk management strategies such as stopping loss orders to minimize the possibility of large losses.

- Diversification: Bots can be programmed to trade multiple assets simultaneously, allowing traders to diversify their portfolios and potentially reduce risk.

- Automation: Trading bots handle tedious and time-consuming market monitoring and trade execution tasks, freeing traders to focus on other activities.

Disadvantages of Trading bots

- Dependency: Traders can become overly dependent on their trading bots, which can lead to a lack of market understanding and flexibility in trading strategies.

- Limited Understanding: Trading bots are unable to interpret market conditions or make subjective decisions according to set rules. This can lead to missed opportunities or suboptimal deals.

- Lack of Control: Trading bots follow programmed rules.

- Vulnerability to Hacking: Trading bots are vulnerable to hacking and other forms of cyberattacks due to their reliance on software and internet connectivity.

- Potential technical failures: Trading bots rely on technology and are subject to technical failures. This can lead to missed or incorrect trades.

- Legal and Regulatory Risks: In some jurisdictions, the use of trading bots may be subject to legal and regulatory restrictions. Traders should be aware of these risks and ensure compliance with all applicable laws and regulations.

How to Use a Crypto Trading Bot?

To use a crypto trading bot, you will need to follow these steps:

Choosing a Crypto Trading Bot: There are a variety of crypto trading bots available, each with its unique features and functionality.

Research and compare different bots to find the one that fits your needs and trading strategy.

Account Setup: Most cryptocurrency trading bots require you to set up an account before you can use them. This typically involves creating a username and password and providing personal information such as B. Your name and email address.

Connect your exchange account: For the trading bot to execute trades on your behalf, you need to connect your exchange account. This typically involves providing the bot with an Exchange API key. This allows the bot to access your account and make transactions.

Configuring trading parameters: After connecting your exchange account, you need to configure your trading parameters. This includes deciding which cryptocurrencies to trade, the amount of funds to use for each trade, and the indicators to use for trading.

Start trading: Once you have set up and configured your crypto trading bot, it can start executing trades on your behalf. The bot analyzes the market using the trading parameters you set and executes trades according to your strategy.

Types of Crypto Trading Bots

There are several types of cryptocurrency trading bots, each with its own set of features and capabilities. Here is a brief overview of some of the most common types of crypto trading bots:

Options bots

These bots are specifically designed to trade options contracts, which are financial derivatives that give the holder the right (but not the obligation) to buy or sell an underlying asset at a specific price on or before a certain date.

Options bots can be used to implement a variety of trading strategies, such as selling options to generate premium income or buying options as a speculative play.

Dollar-cost averaging (DCA) bots

These bots follow a DCA strategy, which involves buying a fixed amount of an asset at regular intervals (e.g., every week or month) rather than all at once. This can help to reduce the impact of volatility on the overall value of an investment.

DCA bots can be used to automatically execute these regular purchases according to a specific schedule.

Grid trading bots

These bots follow a grid trading strategy, which involves placing a series of buy and sell orders at predetermined price levels above and below the current market price. The goal of this strategy is to profit from the natural oscillation of prices within a certain range. Grid trading bots can be used to automate this strategy, continuously adjusting the buy and sell orders as the market moves.

Market-making bots

These bots places buy and sell orders on exchanges to help create liquidity in the market. They can also be used to take advantage of price discrepancies between different exchanges.

Arbitrage bots

These bots scan multiple exchanges for price discrepancies and execute trades to profit from the difference.

For example, if Bitcoin is being sold for a higher price on one exchange and a lower price on another exchange, an arbitrage bot could buy the Bitcoin on the cheaper exchange and sell it on the more expensive exchange, effectively arbitraging the price difference.

Trend-following bots

These bots follow a specific trading strategy, such as buying and holding a particular asset or selling when it reaches a certain price. They can be used to take advantage of long-term trends in the market.

News-based bots

These bots use natural language processing and machine learning algorithms to analyze news articles and social media posts related to specific cryptocurrencies. They can be used to predict price movements and execute trades based on this analysis.

High-frequency trading bots

These bots use advanced algorithms to execute trades at extremely high speeds, taking advantage of small price movements and attempting to profit from them.

Conclusion

In conclusion, crypto trading bots can be a useful tool for traders who want to take a more automated approach to their trading strategy.

These bots can be programmed to execute trades based on a variety of parameters, such as the price of a particular cryptocurrency or the volume of a particular exchange.

While there are many different crypto trading bots available, it is important to do your research and choose a reputable and trustworthy bot. Some things to consider when selecting a crypto trading bot include the cost of the bot, the features it offers, and the level of support provided by the developer.

Ultimately, the best crypto trading bot for you will depend on your specific trading needs and goals.

FAQs

Are crypto trading bots legal?

Yes, In most cases, crypto trading bots are legal to use. However, it is important to check the laws and regulations of your country or region to make sure that using a crypto trading bot is not prohibited.

Are crypto trading bots safe to use?

Like any software, crypto trading bots can have vulnerabilities that could potentially be exploited by hackers. However, reputable bot providers take steps to secure their systems and protect users’ accounts and funds. It is important to do your research and choose a reputable bot provider with a good track record of security.

Can I make a profit using a crypto trading bot?

It is possible to make a profit using a crypto trading bot, but there are no guarantees. The success of a crypto trading bot will depend on many factors, including the accuracy of the algorithms it uses, the effectiveness of the trading strategy it follows, and the overall state of the market.