Looking for an efficient and profitable way to trade cryptocurrencies in 2023? Pionex Trading Bot might be the solution you’ve been looking for.

With its advanced algorithms and user-friendly interface, It allows even novice traders to automate their trading strategies and maximize their profits. But are trading bots really worth and safe?

In this Pionex trading bot review, we’ll take a closer look at its features, pricing, and performance, so you can make an informed decision about whether or not to try it out.

Pionex Review: Key Specifications

Pionex is a cryptocurrency exchange that offers a variety of free trading bots for automatically executing trades based on rules or technical indicators.

| Information | Description |

|---|---|

| website URL | https://www.pionex.com/ |

| Type | Crypto Exchange and built-in trading platform |

| Launched | 2019 |

| Payment methods | SEPA, Express, Crypto deposits, and Withdrawals |

| Trading bots | 16 types of trading bots including Grid, Rebalancing, DCA, etc. |

| Supported cryptocurrencies | 120+ |

| Mobile App | Android and iOS |

| Fees | 0.05% Spot fees, 0.1% Futures (Grid bots are free) |

| Demo account | Yes |

| Referral Program | Yes |

| Customer Support | Live Chat, Email, FAQs, Social Community Support |

What is a Pionex Trading Bot 🤖?

Pionex Trading Bot is an automated trading software that executes trades on behalf of users based on predefined strategies.

The platform offers a wide range of pre-built trading bots that cater to various market conditions and trading styles.

Users can also create their custom bots using the platform’s drag-and-drop interface. The bots are designed to monitor the market 24/7 and execute trades automatically.

It has its own cryptocurrency exchange and built-in trading platform, eliminating the need for an external API connection.

Pionex Free Bot also offers features such as backtesting, paper trading, and social trading. It is the biggest market maker of Binance and Huobi Global.

Must Read: Best Crypto Trading Bots

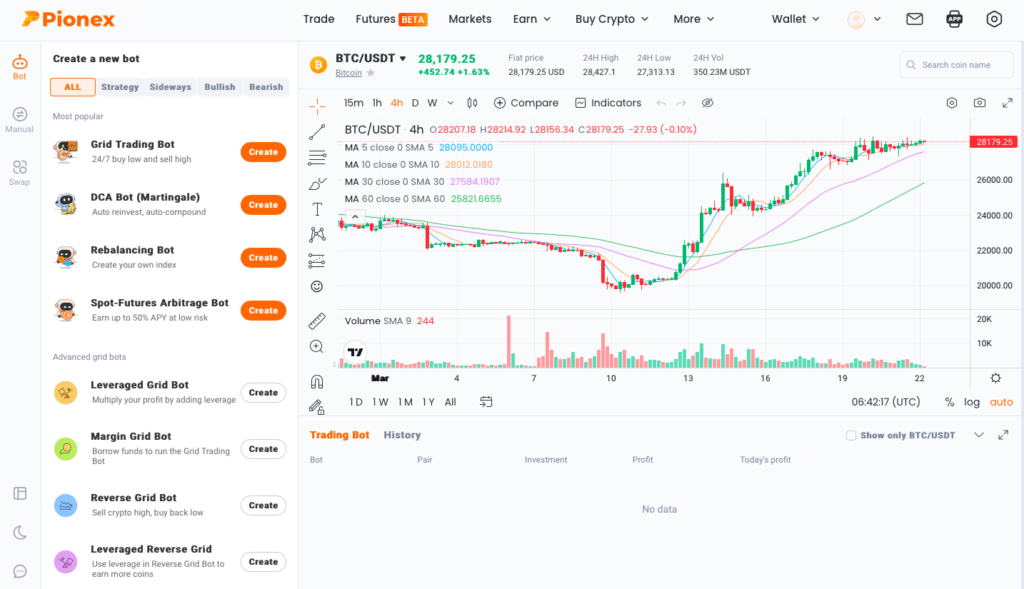

Types of Pionex Trading Bots

Pionex currently supports 16 Automated Trading bots. some popular Pionex Trading bots are:

1. Grid Trading Bot

The bot creates a grid of buy and sell orders at predetermined intervals, and as the price fluctuates, it executes the trades automatically.

It is designed to help traders “buy low and sell high” by taking advantage of market volatility.

Pionex Grid Trading Bot has several features, including customizable parameters such as the grid size, price range, and trading pairs.

2. Leverage Grid bot

This bot uses a grid trading strategy, where it places buy and sell orders at specific price levels, but this time with leverage (3X).

It is important to note, however, that this also increases the risk of liquidation, and caution should be exercised before using this feature.

3. Margin Grid Bot

Margin Grid Bot is a type of trading bot used in cryptocurrency trading that uses a grid trading strategy while also incorporating margin trading.

Margin trading allows traders to borrow funds from an exchange to increase their buying power.

4. Infinity Grid bot

If you are using GRID Bot, there is a possibility that you may miss out on the lucrative profits when the price surges.

However, Infinity Grids Bot can help you in such situations. Although it is similar to GRID Bot in functionality, it does not have an upper limit.

It can assist you in buying low and selling high around the clock, but the percentage of funds allocated to this function is lower compared to GRID Bot.

5. Reverse Grid Bot

The reverse grid bot is unique in that it uses a “reverse” strategy, where it sells high and buys low, as opposed to the traditional grid trading strategy of buying low and selling high. (Read again carefully)

For example, if the bot establishes a grid with sell orders at $55, $60, and $65, it would sell the cryptocurrency at each of these levels as the price increases.

However, if the price starts to decrease, the bot would start buying the cryptocurrency at each of the same levels, starting with the highest level, in order to accumulate more coins at a lower price.

6. DCA Bot

DCA (Dollar-cost averaging) is an investment strategy that involves investing a fixed amount of money at regular intervals.

With this bot, investors can set up a plan specifying the amount of money they want to invest and the frequency of their investments.

The DCA bot will then automatically execute trades on the specified schedule, regardless of whether the market is up or down.

By investing a fixed amount of money at regular intervals, investors can take advantage of market fluctuations and potentially lower the average cost of their investments over time.

7. Rebalancing Bot

A Pionex rebalancing bot is a type of trading bot that automatically adjusts an investor’s portfolio to maintain a desired asset allocation.

Rebalancing involves periodically buying and selling assets to ensure that the portfolio’s weightings remain in line with the target allocation.

For instance, suppose an investor has a target allocation of 60% Bitcoin and 40% Ethereum. If Bitcoin has outperformed ETH over a specific period, the portfolio’s allocation might shift to 70% BTC and 30% ETH.

To rebalance the portfolio, the rebalancing bot would sell some BTC and buy some ETH to return the portfolio to the target allocation of 60/40.

8. Spot-Futures Arbitrage Bots

A Pionex spot-futures arbitrage bot aims to profit from price discrepancies between a cryptocurrency’s spot price (current market price) and its futures price.

The bot works by simultaneously buying the cryptocurrency in the spot market and selling it in the futures market (or vice versa) to take advantage of the price difference. This process is also known as internal arbitrage trading.

9. TWAP Bot

Pionex TWAP bot is designed to execute trades based on the Time-Weighted Average Price (TWAP) of a cryptocurrency over a specified time period.

TWAP is a commonly used benchmark for measuring the average price of a security over a certain period, and it is often used in algorithmic trading.

A TWAP bot can be set up to buy or sell a specified amount of a cryptocurrency over a certain period, with the goal of achieving an execution price as close to the TWAP as possible.

Let’s say, if an investor wants to buy 100 Bitcoin over a period of 24 hours, they could use a TWAP bot to execute trades throughout that period.

The bot adjusts the order size and timing of the trades to try to match the TWAP.

10. Trailing Take Profit Bot

The bot works by setting a trailing stop order that adjusts to a certain percentage or dollar amount below the current market price of the cryptocurrency.

As the market price rises, the trailing stop order follows it, keeping a set distance below the market price.

When the market price reaches the take profit level set by the trader, the bot executes the trade and locks in the profit.

This allows traders to capitalize on upward price movements while protecting their profits in the event of a sudden price drop.

There are many other trading bots available on Pionex cryptocurrency Exchange including:

- Pionex market maker bot

- Signal bot

- Buy-the Dip bot

Pionex Trading Fees Review

The transaction fees for Regular Users on Pionex depend on the type of trade.

- For spot trades, the Maker fee and Taker fee are both 0.05%.

- For leveraged trades, both the Maker fee and Taker fee are 0.1%.

- Zero deposit and Withdrawal fees.

Note: There are no extra fees for using Pionex bots. However, a regular maker-taker fee will be applied to each trade.

Pionex Crypto Exchange and Trading Platform Review

Pionex Withdrawal Limit

The maximum daily withdrawal amount also varies depending on the KYC level of the user.

For KYC Level 0, the maximum daily withdrawal limit is 0 USDT. This means you can not withdraw without doing basic identity verification on Pionex.

However, for KYC Level 1, the limit is 2,000 USDT, and for KYC Level 2, it is 1,000,000 USDT.

Pionex Supported Cryptocurrencies

Pionex supports 120+ cryptocurrencies and 200+ trading pairs, including popular coins like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and Bitcoin Cash (BCH).

In addition to these well-known cryptocurrencies, It also supports a variety of altcoins and stablecoins.

Here is a non-exhaustive list of some of the cryptocurrencies that Pionex supports:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Bitcoin Cash (BCH)

- Tether (USDT)

- Binance Coin (BNB)

- Dogecoin (DOGE)

- Chainlink (LINK)

- Polkadot (DOT)

- Uniswap (UNI)

- Cosmos (ATOM)

- Cardano (ADA)

- Stellar (XLM)

The crypto exchange constantly adds new cryptocurrencies to its platform, so it’s worth checking its website to see the full list of supported assets.

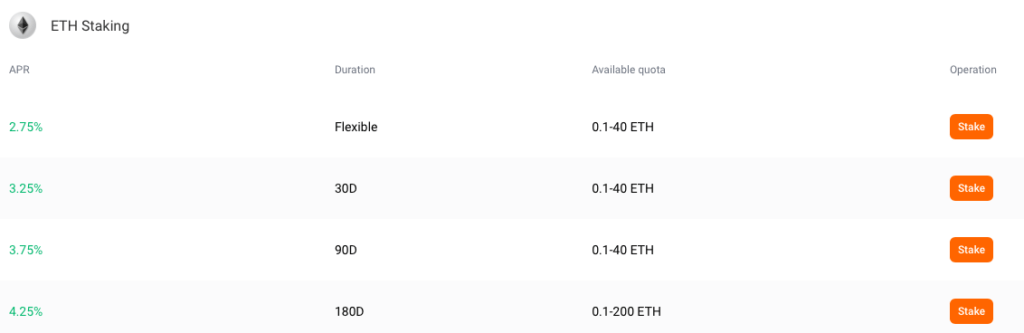

Pionex Staking and Earn

Pionex crypto exchange provides a user-friendly and transparent ETH staking program that enables both new and existing traders to invest in crypto assets through the Curve or Lido platform, without the use of leverage.

This investment option offers a simple way for traders to earn passive income using Ethereum liquid staking coins.

The process of staking and earning rewards on Pionex is straightforward, without any complicated formulas or income parameters to consider.

Traders only need to complete a Curve investment on the Ethereum blockchain to start earning through Pionex’s ETH staking program.

Related: Best Crypto staking platforms

Pionex Security Review

If you’re considering using Pionex as your trading platform, you may be wondering how secure it is. After all, security should be a top priority when it comes to handling financial assets online.

Firstly, it’s worth noting that Pionex is a centralized crypto exchange, meaning that it holds custody of users’ assets.

As such, the platform has implemented several security measures to protect its users’ funds. These measures include 2-factor authentication, SSL encryption, and IP whitelisting.

It also distributes its servers to prevent hacks and DDoS attacks.

Are Pionex trading bots strategies Backtested?

Backtesting a Pionex trading bot involves testing its performance on historical market data to see how well it would have performed in the past.

This can help you evaluate the bot’s effectiveness and make informed decisions about whether to use it for live trading.

Here’s an example of how to backtest a Pionex trading bot

Let’s say you want to backtest a Grid Trading Bot on the BTC/USDT trading pair for the period from January 1, 2022, to March 1, 2022, using 1-hour candlesticks.

- Create a new bot: Select the “Trading Bot” option from the menu on the left-hand side of the platform and choose the “Grid Trading Bot” option. Set the bot’s parameters, such as the number of grids, the price range, and the order size.

- Select the backtesting option: Click on the “Backtesting” button on the bot’s page.

- Set the backtesting parameters: In the backtesting menu, select the BTC/USDT trading pair, the time range from January 1, 2022, to March 1, 2022, and the 1-hour candlestick interval.

- Start the backtesting process: Click on the “Start Backtest” button.

- Review the backtesting results: Once the backtesting is complete, review the bot’s performance metrics, such as profit and loss, number of trades executed, average holding time, and maximum drawdown.

- Adjust the bot’s parameters: If you are not satisfied with the bot’s performance, adjust its parameters (such as the number of grids or the price range) and run the backtesting process again to see if the changes improve its performance.

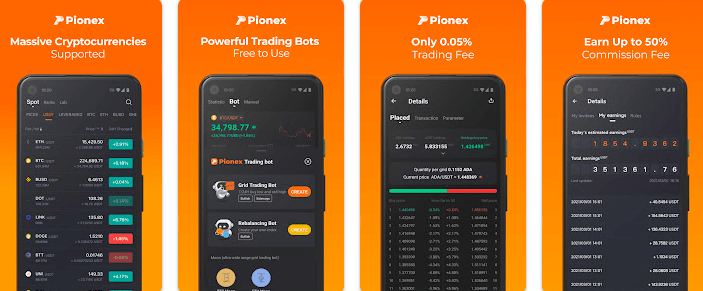

Pionex Mobile App and Ease of Use

The Pionex app provides users with all the basic functionalities they need to trade, including the ability to buy and sell cryptocurrencies, view their portfolio balances, and monitor market prices in real time. Traders can also set price alerts to stay on top of market movements.

You can also use Pionex trading bots using the Mobile app. It also supports staking and earning programs.

This means that traders can stake their cryptocurrency holdings or earn interest on their balances directly from the Pionex app, without having to switch to the desktop platform.

Customer Support and Reviews

Its customer support has received mixed reviews, with some users praising its responsiveness while others criticize its lack of helpfulness.

On Trustpilot, Pionex has a rating of 4.2 out of 5 stars based on over 800 reviews, with many users citing fast and efficient service.

On G2, Pionex has a rating of 4.6 out of 5 stars based on over 110+ reviews, with users generally praising its user interface and trading features but noting some issues with customer support.

Alternatives and Comparison

We Recommend: Best Crypto Trading bots

Best Manually Customized Trading bot

- 75+ CEX and DEX cryptocurrency exchanges

- Support over 300,000 crypto coins and 50+ DEX coins supported

- Insider information on where it is profitable to buy and sell tokens

- Free training and cases for clients of service

Proven Success Rate with 1M+ Users

- 16+ Exchange support

- Crypto-signals in Telegram

- Trading view Integration

- DCA, GRID, options, HODL, Smart trading bots

- Marketplace to buy automated trading strategies with success rate

Related: Pionex vs Binance and Pionex vs Kucoin

Pros and Cons of Pionex Trading Bots

| Pros | Cons |

|---|---|

| Easy to Use | Some bots may have suboptimal performance in certain market conditions |

| Wide range of pre-set trading strategies | Limited number of supported assets |

| Free trading bots | Limited backtesting functionality |

| Low fees compared to competitors | |

| Social trading features allow for copying other users’ strategies |

How to Use Pionex Trading Bots?

Step 1: Create a Pionex Account

To use the Pionex grid trading bot, you need to create an account on the Pionex platform. You can sign up for an account on the Pionex website by providing your email address and creating a password.

Step 2: Fund your Pionex Account

To start trading with the Pionex grid trading bot, you need to fund your Pionex account. You can do this by depositing funds into your account using one of the supported cryptocurrencies or Debit/credit cards.

Step 3: Choose the Trading Pair

Choose the cryptocurrency pair you want to trade. The Pionex platform supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, and many more.

Step 4: Set Trading Parameters

Next, you need to set the trading parameters. You can set the following parameters for the Pionex grid trading bot:

- Grid distance: This is the distance between the buy and sell orders. For example, if the current market price of the cryptocurrency is $10,000 and you set the grid distance to $100, the bot will place buy orders at $9,900, $9,800, and so on, and sell orders at $10,100, $10,200, and so on.

- Upper price: This is the highest price at which the bot will place sell orders.

- Lower price: This is the lowest price at which the bot will place buy orders.

- Quantity: This is the amount of the cryptocurrency you want to trade.

- Base price: This is the price at which you want the bot to start placing buy and sell orders.

Step 5: Monitor and Adjust

Once you have set the parameters, the bot will start trading automatically. However, it is important to monitor the bot’s performance and adjust the parameters as needed.

One important thing to note is that grid trading is a low-risk, low-reward trading strategy. It is designed to make small profits over a long period of time.

Therefore, you should not expect to make large profits in a short amount of time.

A complete strategy for using the Pionex grid trading bot

- Choose a cryptocurrency pair with high volatility and high trading volume.

- Set the grid distance to a percentage of the current market price, such as 1% or 2%.

- Set the upper and lower prices to a range that you are comfortable with, based on your analysis of the cryptocurrency’s price history and current market conditions.

- Set the quantity to a percentage of your available funds, such as 10% or 20%.

- Set the base price to the current market price.

- Monitor the bot’s performance and adjust the parameters as needed, based on market conditions and your trading goals.

Final Thoughts: Is Pionex Worth it?

In Pionex Review’s conclusion, It is a reliable and user-friendly cryptocurrency trading platform that offers a wide range of trading tools and features.

With its low fees, high liquidity, and advanced trading bots, It is an excellent choice for both beginner and experienced traders.

The platform’s intuitive interface and helpful customer support make it easy to navigate, while its robust security measures ensure that your funds are always safe.

FAQs

Is Pionex trading bot safe?

The Pionex trading bot is safe to use as it is developed by a reputable team of engineers and undergoes rigorous security testing. The bot also uses API keys to trade on your behalf, which means that it cannot withdraw funds from your account.

Additionally, Pionex implements security measures such as two-factor authentication and SSL encryption to ensure that your trading activity and personal information are kept secure.

How profitable is the Pionex trading bot?

The profitability of the Pionex trading bot depends on several factors, including the trading pair, grid distance, and market conditions.

However, grid trading is a low-risk, low-reward trading strategy that is designed to make small profits over time.

What is the most profitable bot in Pionex?

The most popular bots on the platform are the Grid Trading Bot, Infinity Grids, and Leveraged Grid Bot.

How much is the Pionex withdrawal fee?

The withdrawal fee on Pionex varies depending on the cryptocurrency. The platform charges a minimum withdrawal fee that ranges from 0.0005 BTC to 0.01 ETH, depending on the cryptocurrency.

Are Pionex bots suitable for beginners?

Yes, Pionex bots are suitable for beginners. The bots themselves are easy to set up and use, with pre-built templates and customizable parameters that can be adjusted based on your trading goals and risk tolerance.

What is a Crypto Trading bot?

A Crypto trading bot is a computer program designed to execute trades automatically. It follows pre-determined rules and algorithms to make trading decisions without human intervention.

These bots are commonly used in the financial markets, including cryptocurrency exchanges. They can be programmed to buy or sell assets based on specific indicators or market trends.