If you’re looking to automate your trading strategy and save time, then a crypto trading bot might be just what you need. With a trading bot, you can execute trades 24/7 without having to be glued to your computer screen all day.

But with so many trading bots available in the market, how do you know which one to choose? And more importantly, how do you avoid falling prey to scams and fake bots that promise the moon but fail to deliver?

In this blog post, we’ll be discussing the best free crypto trading bots that you can use to trade your favorite cryptocurrencies. From beginner-friendly bots to advanced trading algorithms, we’ve got you covered.

List of 10 Best Free Crypto Trading Bots

Looking for a free crypto trading bot? Here’s a list of 10 of the best options available.

- Pionex: Best Free Trading bot with built-in Exchange

- Cryptohopper: Free Automated Crypto Trading Strategies

- 3Commas: Best Smart Bitcoin Trading Bot

- Bitsgap: Free Binance Trading Bot

- HaasBot: Top BTC Trading Bot Software

- Shrimpy: Powerful Automated Portfolio Management

- Coinrule: Rule-based Trading bot

- Kucoin: Best Crypto Exchange with Trading Bots

- Quadency: Free Crypto Trading Automation

- Bybit: Best Copy Trading bots

Free Crypto Trading Bots Compared

| Trading Bot | Types of Trading Bot | Supported Exchanges | Free Features | Website Link |

|---|---|---|---|---|

| Pionex | Grid Trading, Smart Trade, Leveraged Tokens, Spot-Futures Arbitrage | Built-in Exchange (Liquidity from Huobi Global and Binance) | Completely Free | Visit Pionex |

| Cryptohopper | Market Making, Technical Analysis, Copy Trading, Arbitrage | 20+ | -20 open positions/exchange -Portfolio Management -Free manual trading on all exchanges | Visit Cryptohopper |

| 3commas | Grid Trading, Smart Trade, Copy Trading, Options Trading, Futures Trading | 16+ | 1 DCA bot, 1 GRID bot, 1 Options bot, Unlimited scalper terminal, smartTrade | Visit 3commas |

| Bitsgap | Arbitrage, Portfolio Management, Automated Trading, Technical Analysis | 20+ | -2 Active GRID Bots -10 Active DCA Bots – unlimited smart trades | Visit bitsgap |

| Haasbot | Technical Analysis, Arbitrage, Market Making, Scalping | 24 | 1 Trade Bot, Paper trading, 15 max order per bot, portfolio manager | Visit Haasbot |

| Shrimpy | Portfolio Rebalancing, Social Trading, Backtesting, Automation | 25 | 1 Trade Bot, Paper trading, 15 max orders per bot, portfolio manager | Visit Shrimpy |

| Coinrule | Rule-based Trading, Automated Trading, Stop-loss and Take-profit | 10+ | -2 Live Rules -2 Demo Rules -7 Template Strategies -1 Connected Exchange | Visit Coinrule |

| Kucoin | Technical Analysis, Trading Automation, GRID, DCA | Built-in Exchange | completely Free | Visit Kucoin |

| Quadency | Automated Trading, Portfolio Management, Technical Analysis, Backtesting | 20+ | completely Free | Visit Quadency |

| Bybit | GRID trading, DCA, Copy Trading | Built-in Exchange | Completely Free | Visit Bybit |

We Recommend: Best Crypto Trading bots

Best Manually Customized Trading bot

- 75+ CEX and DEX cryptocurrency exchanges

- Support over 300,000 crypto coins and 50+ DEX coins supported

- Insider information on where it is profitable to buy and sell tokens

- Free training and cases for clients of service

Proven Success Rate with 1M+ Users

- 16+ Exchange support

- Crypto-signals in Telegram

- Trading view Integration

- DCA, GRID, options, HODL, Smart trading bots

- Marketplace to buy automated trading strategies with success rate

Let’s Review Crypto Trading bots in detail

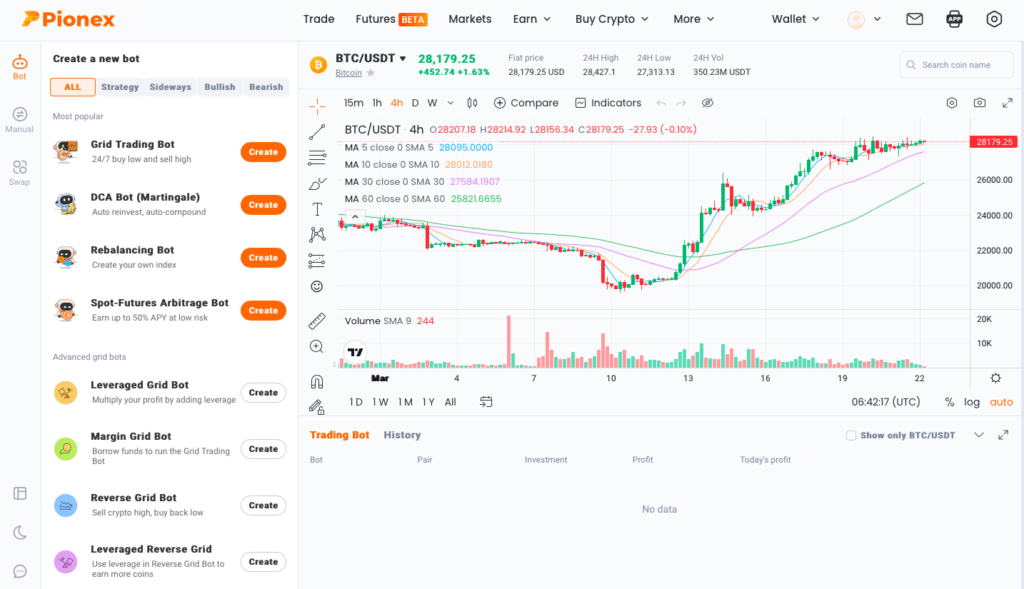

1. Pionex: Best Trading bot with built-in Exchange

Pionex is a cloud-based crypto trading bot that offers a variety of trading bots for users to choose from. One of its most popular bots is the Grid Trading Bot, which allows users to set up a grid of buy and sell orders to take advantage of market volatility.

It also offers a Smart Trade bot that uses machine learning algorithms to analyze market trends and make trades based on those trends.

Pros 👍: Pionex is free to use, and users can take advantage of a variety of bots to meet their trading needs.

Cons 👎: It has its Built-in exchange, so doesn’t allow you to connect to External Exchanges.

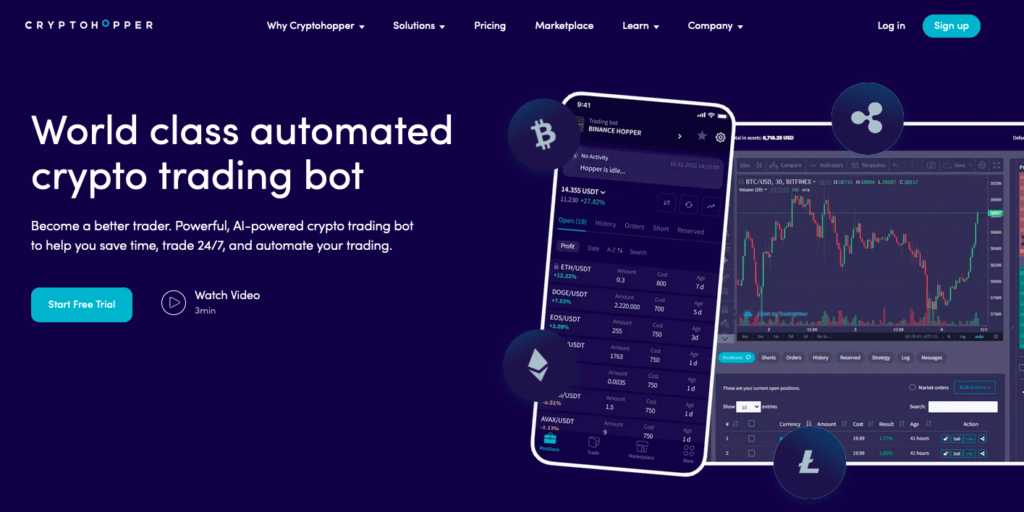

2. Cryptohopper: Free Automated Crypto Trading Strategies

Cryptohopper is a cloud-based trading bot that offers a variety of bots for users to choose from, including market-making bots, arbitrage bots, and technical analysis bots. One of its most popular bots is the Strategy Designer, which allows users to design their trading strategies using a drag-and-drop interface.

Pros 👍: Cryptohopper offers a wide range of bots to meet the needs of all kinds of traders, and its Strategy Designer allows users to create their own custom bots.

Cons 👎: Cryptohopper is not completely free, and users will need to pay a monthly subscription fee to access some of its more advanced features.

3. 3Commas: Best Smart Bitcoin Trading Platform

There are several different strategies available on the 3commas platform, including trend trading, grid trading, and scalping. Trend trading involves identifying and following trends in the market, while grid trading involves placing a series of buy and sell orders at set intervals.

Scalping is a high-frequency trading strategy that involves making multiple trades in a short period to take advantage of small price movements.

Pros 👍: It supports a wide range of exchanges, including Binance, Coinbase, and Kraken, among others.

Cons 👎: 3Commas can be complex and overwhelming for beginners

4. Bitsgap: Free Binance Trading Bot

Bitsgap offers several trading strategies, including arbitrage and market-making. These bots can be programmed to execute trades automatically based on certain criteria, such as price movements or technical indicators. This can be a great way to take emotion out of trading and ensure that trades are executed consistently and quickly.

Pros 👍: Bitsgap offers leverage trading using its futures bot.

Cons 👎: Less number of built-in trading strategies compared to other Exchanges.

5. HaasBot: Top BTC Trading Bot Software

Haasbot comes with several built-in trading strategies, including trend following, scalping, and market-making. It can use various indicators, such as moving averages, to identify these trends and execute trades accordingly.

Market-making is a strategy used by more advanced traders. This strategy involves placing both buy and sell orders on either side of the current market price. By doing so, market makers create liquidity and earn a small profit on the spread between the bid and ask prices.

Pros 👍: Haasbot allows users to customize their trading strategies using various indicators and parameters.

Cons 👎: It requires users to have some knowledge of trading and technical analysis to set up and optimize their strategies

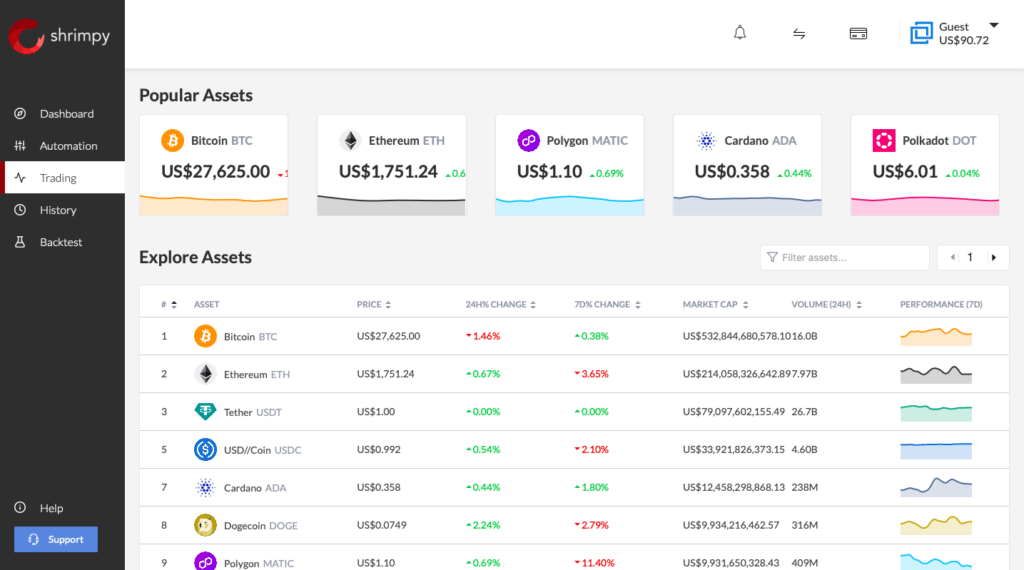

6. Shrimpy: Powerful Automated Portfolio Management

Shrimpy is a cloud-based trading bot that allows users to automate their trading strategies. It offers a range of bots for different trading strategies, including portfolio management and rebalancing. Shrimpy also offers a feature called “Social Trading,” which allows users to follow and copy the trades of successful traders.

Pros 👍: Its range of bots and features make it suitable for both beginners and experienced traders. Its Social Trading feature also makes it a unique and engaging platform.

Cons 👎: Shrimpy is only available on a limited number of exchanges, and it may not be suitable for users who prefer to trade on other exchanges.

7. Coinrule: Rule-based Trading bot

Coinrule offers a range of bots for different trading strategies, including market making, trend following, and mean reversion. Coinrule also offers a feature called “If-This-Then-That,” which allows users to create custom trading rules based on a variety of technical indicators and events.

Pros 👍: Coinrule is user-friendly, and its range of bots and features makes it suitable for both beginners and experienced traders.

Cons 👎: It is not a completely free trading bot. Users are required to pay a monthly subscription fee to access some of its more advanced functionalities.

8. Kucoin: Best Crypto Exchange with Trading Bots

KuCoin is a cryptocurrency exchange that offers a range of trading bots for its users. These bots allow traders to automate their trading strategies and take advantage of market opportunities around the clock. Some of the bots offered by KuCoin include spot and Futures grid trading, DCA, and algorithmic trading bots.

Pros 👍: KuCoin’s trading bots are user-friendly and easy to set up, even for beginners

Cons 👎: The bots are not as customizable as some other trading bots on the market, which may limit their usefulness for more advanced traders.

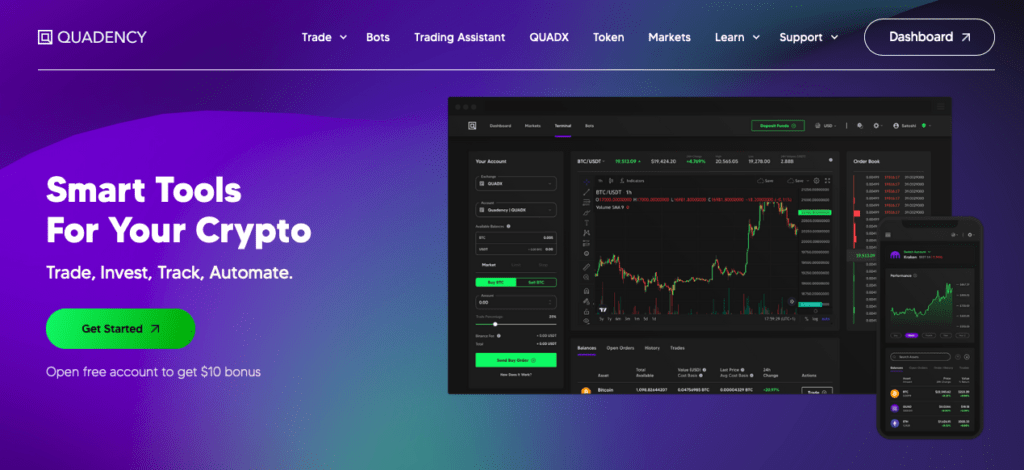

9. Quadency: Free Crypto Trading Automation

Quadency is a multi-exchange crypto trading platform that offers a suite of tools and services for traders, including portfolio management, automated trading, and social trading. It allows users to connect and trade across multiple exchanges, as well as backtest and automate trading strategies.

Pros 👍: Quadency also offers a user-friendly interface and access to a wide range of technical indicators and charting tools, making it a popular choice for both beginner and experienced traders.

Cons 👎: Not Completely Free to use

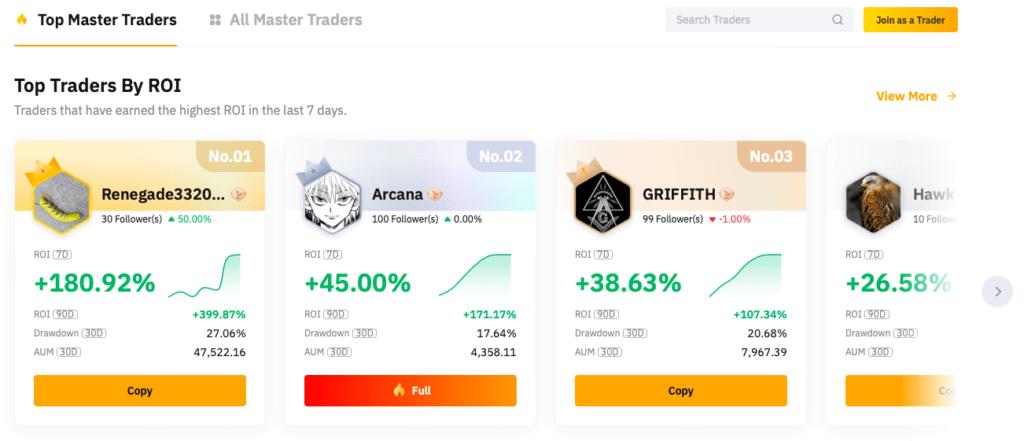

10. Bybit: Best Copy Trading bots

Bybit offers a range of trading bots that can execute automated trades on its platform. These bots use advanced algorithms to analyze market trends and make trades based on pre-set parameters. Bybit’s trading bots are designed to be user-friendly, with easy-to-use interfaces and customizable settings.

Pros 👍: Bybit offers three popular bots- Spot Grid Bot, DCA, and social trading bot.

Cons 👎: Does not support integration with external Exchanges due to built-in trading platform with high liquidity.

Read: Bybit Trading bots Guide

What is a Crypto Trading Bot?

A crypto trading bot is a software program that automatically executes trades based on a pre-determined set of rules and parameters. The bot is designed to analyze market trends and patterns and make trades on behalf of the user, based on their predetermined strategy.

The bot can be programmed to buy, sell, or hold specific cryptocurrencies based on a variety of factors, including price, volume, and market trends.

How does a Crypto Trading Bot work?

A crypto trading bot works by connecting to an exchange platform’s API (Application Programming Interface). Once connected, the bot can access real-time market data and execute trades on behalf of the user.

The bot’s algorithms can analyze large amounts of data and identify patterns and trends that humans may not be able to recognize. Based on the pre-determined rules and parameters, the bot can execute trades automatically, without any intervention from the user.

Advantages of Using a Crypto Trading Bot

There are several advantages of using a crypto trading bot, including:

- 24/7 Trading: Unlike humans, bots can trade 24/7, which means they can take advantage of market opportunities that may arise at any time, even when the user is not actively monitoring the market.

- Speed and Accuracy: Bots can execute trades much faster than humans and can do so with a high degree of accuracy. This can help users take advantage of market trends and make profitable trades quickly.

- Eliminates Emotion: Emotions can cloud judgment and lead to bad investment decisions. Bots can eliminate emotion from the trading process and stick to the predetermined rules and parameters, which can lead to better investment decisions.

- Backtesting and Optimization: Users can backtest their strategies on historical market data and optimize their parameters to improve their trading strategies.

Disadvantages of Using a Crypto Trading Bot

While there are advantages to using a crypto trading bot, there are also some disadvantages to consider, including:

- Technical Expertise Required: Setting up and configuring a bot can be a complex process and may require technical expertise that not all users have.

- Limited Flexibility: Bots can only execute trades based on pre-determined rules and parameters. If market conditions change, the bot may not be able to adapt quickly enough, which could lead to missed opportunities or losses.

- Risk of Malfunction: Bots are software programs, and like any software, they can malfunction or experience bugs. If the bot malfunctions or makes an error, it could lead to significant losses.

Factors to Consider Before Choosing a Free Crypto Trading Bot

Before choosing a crypto trading bot, there are several factors that users should consider, including:

- Security 🔒: Look for a bot that provides top-notch security measures to protect your trading account and personal information.

- User-Friendliness 🧑💻: Choose a bot that is easy to use and understand, with an intuitive interface that makes it simple to navigate and customize your trading strategies.

- Reliability 🏋️♂️: Ensure that the bot you select is reliable and performs consistently over time, with a proven track record of success.

- Customization 🛠️: Look for a bot that allows you to customize your trading strategies, set your own parameters, and adjust your trading settings according to your preferences.

- Supported Exchanges 🏦: Check that the bot supports the exchanges where you prefer to trade and that it offers the trading pairs you need.

- Trading Strategies 📈: Consider the bot’s trading strategies, and whether they align with your own investment goals and risk tolerance.

- Community Support 👥: Look for a bot that has an active and supportive community, with user forums, social media channels, and other resources where you can get help and advice.

- Price 💰: Although you’re looking for a free bot, some may have hidden costs or limitations that could affect your overall profitability. Make sure you understand the pricing structure and any associated fees.

Types of Crypto Trading Bots

There are several types of crypto trading bots available, including:

- Trend Following Bots: These bots analyze market trends and patterns and make trades based on those trends.

- Arbitrage Bots: These bots take advantage of price differences between different exchanges and make trades to profit from those differences.

- Mean Reversion Bots: These bots make trades based on the idea that prices will eventually return to their mean or average value.

- Market-Making Bots: These bots make trades based on the bid-ask spread, intending to earn a profit on the spread.

Setting up a Crypto Trading Bot

Setting up a crypto trading bot can be a complex process, but it generally involves the following steps:

- Choose a bot that meets the user’s needs and budget.

- Create an account on the exchange(s) that the bot supports.

- Connect the bot to the exchange(s) using the API keys provided by the exchange(s).

- Configure the bot’s parameters and rules based on the user’s trading strategy.

- Test the bot on a small scale before using it to trade with real funds.

How to Monitor Your Crypto Trading Bot

Once the bot is up and running, it’s important to monitor its performance to ensure that it’s executing trades according to the user’s strategy. Some tips for monitoring a crypto trading bot include:

- Monitor the bot’s trades in real-time and keep track of any errors or malfunctions.

- Check the bot’s performance regularly and adjust its parameters as needed.

- Keep an eye on market conditions and make sure that the bot is adapting to any changes in the market.

- Keep track of the bot’s profits and losses and adjust the trading strategy as needed.

Best Practices for Using a Crypto Trading Bot

To get the most out of a crypto trading bot, it’s important to follow some best practices, including:

- Choose a bot that meets the user’s needs and budget.

- Take the time to configure the bot’s parameters and rules based on the user’s trading strategy.

- Monitor the bot’s performance regularly and adjust its parameters as needed.

- Use risk management tools to minimize losses and protect the user’s funds.

- Keep track of the bot’s profits and losses and adjust the trading strategy as needed.

Legal and Ethical Considerations

When using a crypto trading bot, it’s important to consider the legal and ethical implications. Some factors to consider include:

- Make sure that the bot is compliant with local laws and regulations.

- Be aware of potential risks and pitfalls, such as market volatility and security breaches.

- Ensure that the bot is not being used for illegal activities, such as money laundering or market manipulation.

- Be transparent about the use of a trading bot, especially if the user is trading on behalf of others.

Final Thoughts: Which is better Trading bot

After reviewing and analyzing various free crypto trading bots, we have come to the conclusion that the best ones are those that offer a range of customizable features and integrate well with popular cryptocurrency exchanges. Some examples of such bots include Pionex, Cryptohopper, 3Commas, Kucoin bots, and Bybit copy trading bots.

However, it is important to note that while these bots can be useful tools for traders, they should not be solely relied upon for making trading decisions. Ultimately, a trader’s success in the cryptocurrency market will depend on a combination of market knowledge, experience, and smart decision-making.

In addition, it is essential to always keep security in mind when using any trading bot, as they often require access to your cryptocurrency exchange accounts. Make sure to only use bots from reputable sources and always enable two-factor authentication on your accounts.

FAQs

Are there any hidden costs associated with using free crypto trading bots?

While many free crypto trading bots do not charge any upfront fees, it’s important to be aware of any potential hidden costs such as fees charged by exchanges or additional features that may require payment.

Can these free crypto trading bots be used on multiple exchanges?

Many best crypto trading bots support multiple exchanges, making it easier for traders to manage their portfolios across different platforms such as Bitfinex, Bitstamp, Bittrex, Bitget, Bybit, Pionex, and more.

How reliable are these free crypto trading bots in terms of uptime, data accuracy, and security?

Free crypto trading bots can vary widely in terms of reliability, uptime, data accuracy, and security. While some free bots may perform adequately, others may suffer from serious deficiencies that could put your trades and your personal information at risk.

In terms of uptime, free crypto trading bots may not have the same level of reliability as paid bots. Free bots may have limited server resources, which could lead to slow performance or downtime during periods of heavy traffic. Additionally, free bots may not be as well-supported as paid bots, meaning that technical issues may take longer to resolve.

Data accuracy is another important consideration when using a crypto trading bot. While many bots rely on accurate and up-to-date market data to make trading decisions, free bots may not have access to the same level of data as paid bots. This could result in inaccurate or incomplete trading signals, which could lead to poor trading performance.

Security is perhaps the most critical consideration when using a free crypto trading bot. Free bots may not have the same level of security as paid bots, and may not be subject to the same level of scrutiny or oversight. This could make them more vulnerable to hacking, phishing attacks, or other security breaches. Additionally, free bots may not have the same level of privacy protections as paid bots, meaning that your personal information could be at risk.