The world of cryptocurrency is always changing. One of the latest trends is Liquid Staking Coins.

With Liquid Staking, you can earn rewards by holding and staking your coins, without needing to be an expert or lock up your coins for a long time. Lots of people are investing in Ethereum Liquid Staking Coins (LSDs) because of the high amount of money locked up in them (Total Value Locked or TVL).

In this blog post, we will look at the 5 best Ethereum Liquid Staking Coins in 2023. We’ll consider how much money is locked up in them, how easy it is to use them, and how good they are for investment.

List of Top 5 Best Liquid Staking Derivatives (LSDs) Coins

Here is the list of some Platforms that Offer high APR Ethereum 2.0 Liquid Staking Services-

- Lido DAO (LDO): Multi-Chain Liquid Staking Coin

- Rocket Pool (RPL): New ETH liquid staking Platform

- Frax Finance (FXS): Tokenized Stablecoin Liquid Staking

- StakeWise (SWISE): Best Liquid Staking Platform for High APR

- Ankr (ANKR); Top Ethereum Liquid Staking Coins

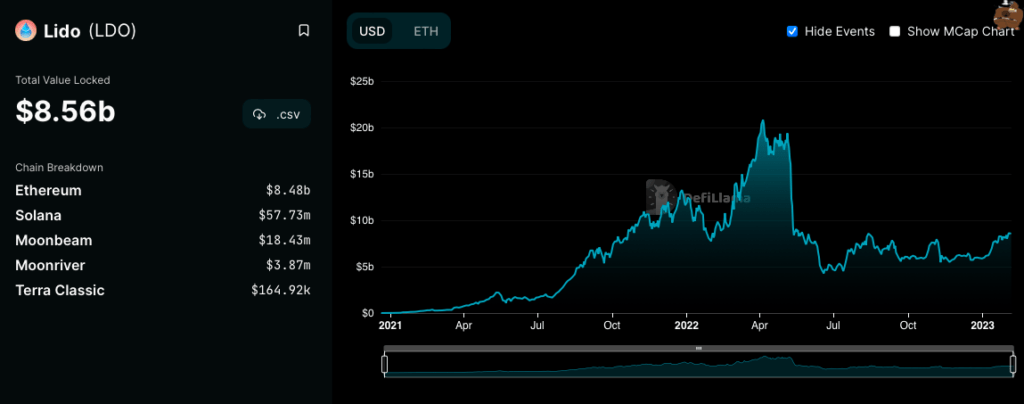

1. Lido Finance (LDO)

Total Value Locked in Lido DAO Liquid Staking: $8.56 billion (Source: Defillama)

- Ethereum: $8.48b

- Solana: $57.73m

- Moonbeam: $18.43m

- Moonriver: $3.87m

- Terra Classic: $164.92k

Lido Finance (LDO) is a decentralized organization (DAO) that provides a liquid staking solution for Ethereum. It lets people earn rewards for holding and staking their Ethereum, without needing to be an expert or lock up their coins for a long time.

The rewards come from fees earned by DeFi protocols that work with Lido. This means stakers can earn passive income. The Lido DAO is controlled by people who own LDO tokens and can vote on proposals to make the platform better.

They also receive a share of the platform’s fees. In short, Lido Finance offers a simple and easy way for people to earn rewards by participating in the Ethereum staking system.

Staking APR Depends on your Network and blockchain. Currently, Lido Finance offers a 4.5% APR on Ethereum, 6.4% APR on Solana, 6.3% APR on Polygon, 18% APR on Polkadot, and 17% APR on Kusama.

Website URL: Lido DAO

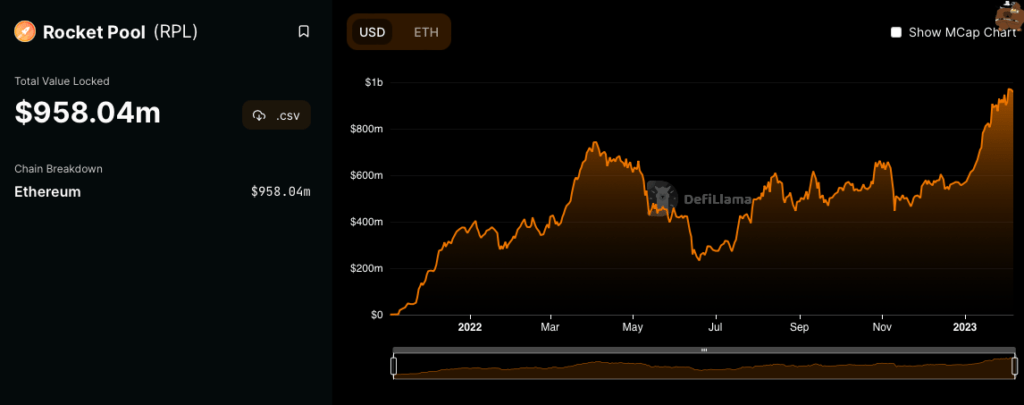

2. Rocket Pool (RPL)

Rocket Pool Total Value Locked (TVL) in Defi is $958 million as of 5 Feb 2023.

Rocket Pool is a decentralized Ethereum staking network that rewards customers for staking ETH2 with high returns of up to 4.86% APR. Customers can either run their own nodes with just 16 ETH or join the network through decentralized node operators and earn even more rewards, up to 7.26% APR for ETH and RPL incentives.

The platform offers a liquid staking solution that benefits from rising exchange rates, instead of rebasing the staked collateral which can lead to tax events. Rocket Pool also provides smart nodes, which allow anyone to join the network with tailored node software.

The open-source and verified smart contracts ensure non-custodial staking and maximum decentralization, reducing the risk of fines.

Website URL: Rocket Pool

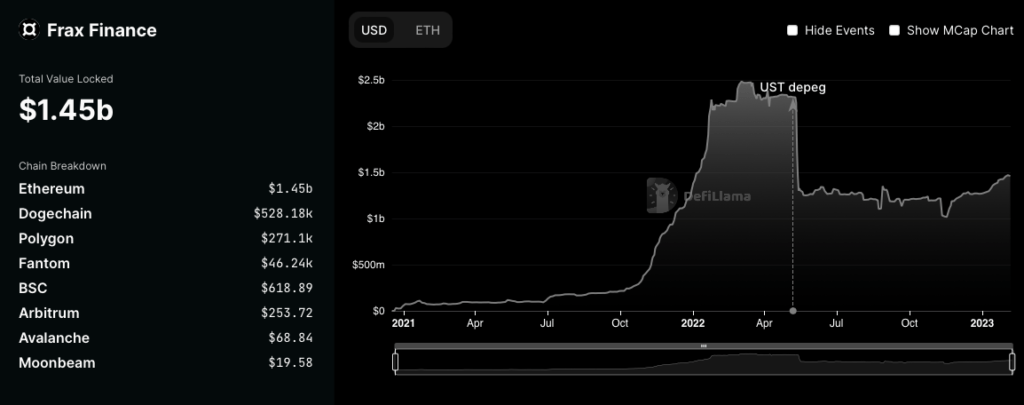

3. Frax Finance (FXS)

The total Value Locked in Frax Finance is $1.45 billion. But, This is not an Ethereum liquid staking amount.

Actually, Frax Finance Ecosystem Consists 4 Platforms-

- Frax

- Frax Swap

- Fraxlend

- Frax Ether

Frax Ether is an Ethereum Liquid Staking Platform with a TVL of $142 million.

Frax Ether is a Liquid ETH staking derivative designed to enhance the Frax Finance ecosystem in a unique way. Its purpose is to optimize staking returns and simplify the Ethereum staking process, offering a more convenient, secure, and DeFi-friendly way to earn interest on ETH.

It is a decentralized finance (DeFi) platform built on the Ethereum blockchain. It is designed to offer tokenized fractional ownership of assets, including but not limited to, stocks, commodities, and foreign exchange (Forex) markets.

Frax is an algorithmic stablecoin that uses a combination of token collateralization, algorithmic monetary policy, and real-world market data to maintain its stability. The platform also provides decentralized lending and borrowing services, as well as trading opportunities for its users.

Website URL: Frax Ether

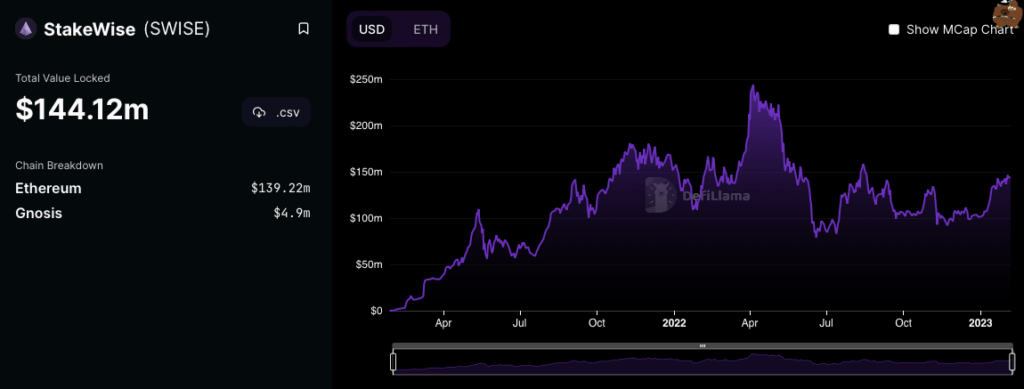

4. StakeWise (SWISE)

Total Value Locked (TVL): $144 million

When you deposit ETH with StakeWise, you’ll receive both Deposit Tokens and Reward Tokens, which can be stored, traded, and transferred using any ERC-20 compatible wallet or protocol. By joining a staking pool, you can pool your ETH with others and share a validator.

With StakeWise, there are no limits on how much you can stake. You can track your earnings in real-time, and use your staked ETH in DeFi with StakeWise tokens.

Website URL: StakeWise

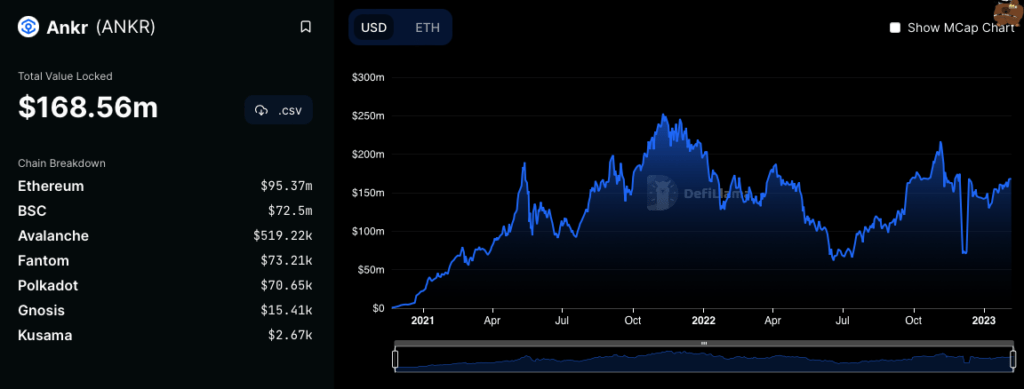

5. Ankr (ANKR)

Total Value Locked (TVL): $168 Million

- Ethereum $95.37m

- BSC $72.5m

- Avalanche $519.22k

- Fantom $73.21k

- Polkadot $70.65k

- Gnosis $15.41k

- Kusama $2.67k

Ankr is a decentralized blockchain infrastructure provider with a global network of nodes spread across over 50 Proof-of-Stake networks. They contribute to the development of the crypto economy and offer a comprehensive suite of multi-chain tools for Web3 users. Their offerings include traditional APIs, a decentralized public RPC node network, and tools such as Ankr Scan to view on-chain information.

Ankr Earn simplifies staking, liquid staking, and other yield-generating opportunities for crypto investors. It provides a scalable and decentralized staking infrastructure solution. This aims to tackle the inefficiency of capital in Proof-of-Stake networks and other similar blockchain consensus mechanisms.

Website URL: Ankr Protocol

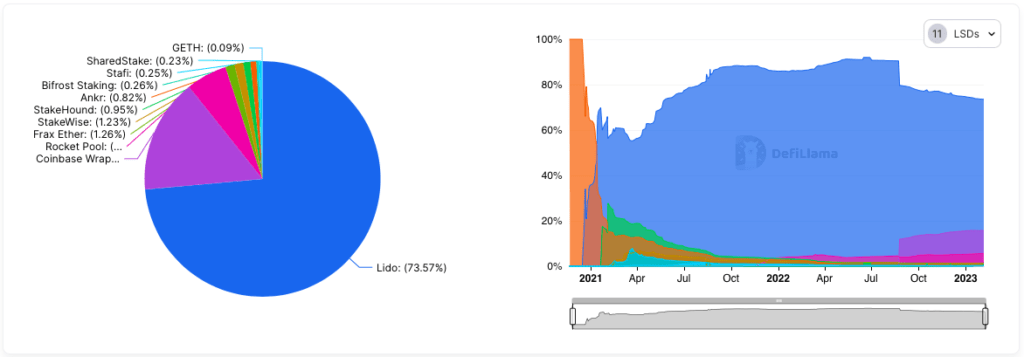

Total Value Locked in Ethereum LSDs

The Total value Locked In Ethereum Liquid Staking Protocols is $6.87 billion.

| Name | Staked ETH | TVL | Market Share | Mcap/TVL | LSD APR |

|---|---|---|---|---|---|

| Lido DAO | 5,055,209 | $8.34b | 73.57% | 0.21 | 4.60% |

| Rocket Pool | 385,768 | $636.38m | 5.61% | 1.16 | 4.86% |

| Frax Ether | 86,193 | $142.12m | 1.25% | 5.17 | 7.39% |

| Stakewise | 84,395 | $139.22m | 1.23% | 0.22 | 5.69% |

| Ankr | 56,508 | $93.17m | 0.82% | 2.46 | 3.86% |

Must Read: Top 5 ZK-Rollup Projects for Ethereum scalability

What is Ethereum Liquid Staking?

Ethereum Liquid Staking refers to a new way of participating in Ethereum 2.0 staking, which is the process of holding and validating transactions on the Ethereum network.

Liquid Staking allows users to delegate their Ethereum assets to validators without having to actually transfer ownership or lock up their funds for a certain period of time.

This makes staking more accessible and flexible for users, as they can still use their funds while participating in network security and earning staking rewards.

Liquid Staking Vs. Exchange Staking

| Feature | Liquid Staking | Exchange Staking |

|---|---|---|

| Security | Decentralized | Centralized |

| Control Over Funds | Users have full control over their funds as they are stored in a wallet controlled by the user | Funds are controlled by the exchange |

| Rewards | Rewards are usually higher as there is no need to share with the exchange | Rewards are usually lower as a portion goes to the exchange for providing the staking services |

| Complexity | The staking process can be complex and requires technical knowledge | The staking process is usually easier and requires less technical knowledge |

Is Ethereum Liquid Staking Coins a Good Investment?

Ethereum Liquid Staking coins are good Investment for long-term Ethereum (ETH) Holders. You can earn a high APR Upto 7% on your Ethereum tokens while holding your own funds in your own wallets.

Ethereum is the second largest cryptocurrency by market capitalization and has a large and active developer community working on its ecosystem. Liquid staking is a relatively new concept in the crypto space, but it has the potential to offer advantages over traditional staking methods, such as greater flexibility and increased liquidity.

However, the success and future of Ethereum Liquid Staking will also depend on factors such as the overall demand for Ethereum, the level of adoption of liquid staking, and the ability of the Ethereum network to scale and handle increasing transaction volumes.

Conclusion

In conclusion, Ethereum Liquid Staking is a new trend in the world of cryptocurrency that offers investors a way to earn passive income by holding and staking their coins.

By participating in Liquid Staking, Ethereum holders can benefit from the security of the network, as well as earn rewards for helping to secure it. This new development in the Ethereum ecosystem provides a unique opportunity for investors to diversify their portfolios and earn rewards for doing so.

With Ethereum Liquid Staking, investors can expect to earn a competitive return on their investments and help to contribute to the growth and development of the Ethereum network.