Solana and Algorand are two popular blockchain platforms that have gained a lot of attention in recent years.

Both platforms offer high-speed transaction processing and low transaction costs, making them attractive options for developers and businesses looking to build decentralized applications (dApps).

In this blog post, we’ll compare Solana and Algorand based on key points such as security, scalability, consensus mechanism, transaction speed, transaction cost, and block size.

We’ll explore the strengths and weaknesses of each platform, so you can make an informed decision about which one is right for your needs.

Solana and Algorand Explained

Solana is a next-generation blockchain platform that stands out for its lightning-fast speed, low transaction fees, and powerful smart contract capabilities. Unlike other blockchains that struggle to process a few dozen transactions per second, Solana can handle thousands of transactions in the same time frame.

Its unique consensus mechanism, called Proof of History, provides a high level of security while enabling high throughput. Solana’s ecosystem is rapidly growing, with developers and projects flocking to the platform to take advantage of its cutting-edge features.

Algorand is a blockchain platform. It’s designed to be fast, scalable, and secure. It uses a unique consensus mechanism called Pure Proof-of-Stake. This eliminates the need for expensive and energy-intensive mining.

Algorand supports smart contracts and atomic swaps. It has a built-in wallet and is interoperable with other blockchains.

Comparison between Solana and Algorand

| Key Points | Solana | Algorand |

|---|---|---|

| Market Cap | $10 billion | $2 billion |

| Security | PoH consensus algorithm | Pure Proof-of-Stake consensus |

| Scalability | 65,000+ transactions per second | 1,000+ transactions per second |

| Consensus Mechanism | PoH and PoS | Pure PoS |

| Block time | 400 millisecond block time | 4.5 second block time |

| Transaction Cost | $0.00001 per transaction | $0.001 per transaction |

| Block Size | 800 MB per second | 1.5 MB per second |

Security

Solana and Algorand have taken significant steps to ensure the security of their networks. Solana employs a unique approach known as Proof of History, which timestamps transactions and prevents the possibility of double-spending attacks.

Moreover, Solana uses dynamic transaction fees, physically secured hardware for nodes, and a transaction confirmation time of less than one second.

Algorand, on the other hand, uses the Byzantine Agreement consensus algorithm to guarantee network security. This algorithm requires two-thirds of the network to validate each block and is resilient to attacks.

Additionally, Algorand rotates its nodes, uses cryptographic sortition, and regularly takes checkpoints to protect its network from attacks.

Despite the extensive security measures implemented by both Solana and Algorand, Solana encountered security concerns in the past. In December 2020, a critical bug was discovered in Solana’s node software, which could have led to network instability and potential loss of funds.

Solana’s team quickly fixed the bug and released a post-mortem report detailing their efforts to prevent similar incidents in the future.

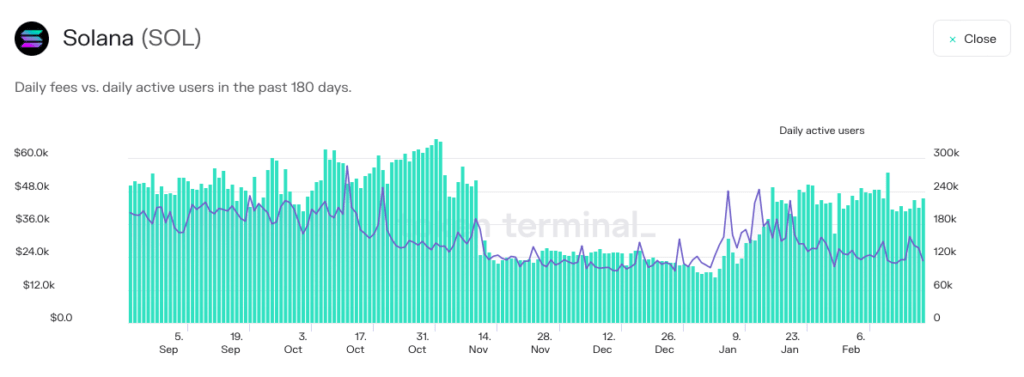

Scalability and TPS

Solana was built with scalability as a top priority, utilizing a unique combination of Proof of History and Proof of Stake consensus algorithms to support a high volume of transactions.

Thanks to this innovative approach, Solana has reached a peak throughput of more than 65,000 transactions per second, solidifying its position as one of the fastest blockchain networks globally.

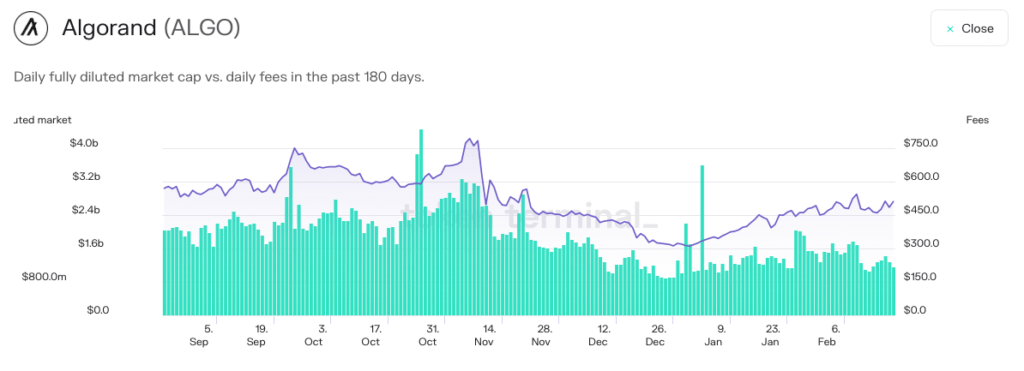

Algorand has also emphasized scalability, relying solely on a Proof of Stake consensus algorithm to enable fast transaction processing.

Although Algorand has achieved a peak throughput of approximately 1,000 transactions per second, this still falls short of Solana’s exceptional performance.

Consensus Mechanism

The consensus mechanism validates transactions on a blockchain network. Solana and Algorand use different mechanisms for consensus. Solana uses proof-of-stake (PoS) for decentralization and allows token holders to participate in block production and validation. Solana also uses Tower BFT algorithm for added security against attacks.

Algorand uses pure proof-of-stake (PPoS) for decentralization and enables all token holders to participate in block production and validation. It also uses cryptographic sortition to select validators randomly for transaction verification.

Transaction Cost

When comparing Solana and Algorand, it is crucial to consider transaction costs. In general, Solana’s transaction fees are lower than those of Algorand. On Solana, a transaction can cost between $0.00001 and $0.0001, whereas on Algorand, it is typically around $0.001.

Solana’s lower transaction costs can be attributed to its unique consensus mechanism, PoH. This mechanism allows the network to process transactions faster and more efficiently, resulting in reduced transaction processing costs.

On the other hand, Algorand’s higher transaction costs are due to its emphasis on security. Algorand’s pure proof-of-stake consensus mechanism requires more computing power and energy to process transactions, leading to higher transaction fees.

Block Size

Solana and Algorand differ in terms of their block sizes. Solana has a block size of approximately 800 kilobytes, while Algorand’s block size is around 1 megabyte.

The larger block size of Solana allows for more transactions to be processed, resulting in faster transaction speeds. However, this also poses a risk of network congestion and centralization.

On the other hand, Algorand’s smaller block size ensures the network’s decentralization and enhances transaction security. However, this smaller block size also leads to a slower transaction speed due to the limited transactions processed per block.

Smart Contract Language

Solana uses a programming language called Rust for developing smart contracts. Rust is a systems programming language that offers high performance and memory safety.

It is designed to prevent common programming errors such as null pointer references and buffer overflows, which can be a security risk. Rust’s syntax is similar to that of C++, making it relatively easy for developers familiar with C++ to learn.

Algorand uses a custom language called TEAL (Transaction Execution Approval Language), a stack-based language designed for fast and efficient transaction execution.

It is similar in syntax to Forth, a programming language that was popular in the 1970s and 1980s. TEAL is optimized for executing transactions quickly and efficiently.

Solana and Algorand in DeFi

Solana has a TVL of $264 million in its DeFi ecosystem. The top DeFi tokens on Solana include Marinade Finance with a market dominance of 59%, as well as Orca, Radium, and Solend.

Additionally, Solana has made strides in the NFT space, with marketplaces like Magic Eden and Solanart.

Algorand has a Total Value Locked (TVL) of $202.28 million in its DeFi ecosystem, which refers to the total value of all assets locked in DeFi protocols on the Algorand blockchain.

Algorand’s top DeFi tokens include Algofy, Lofty, Folksfinance, Tinyman, and others, with Algofy having the highest market dominance of 64%.

How to Build Your First DApp on Algorand

Developers who want to build decentralized applications (dApps) on the Algorand network can use the Reach programming language. Reach is an easy-to-learn language that is similar to JavaScript, and it prioritizes user experience over low-level logic.

Before getting started with Reach, developers should ensure that their system has the necessary tools, such as Docker, make, and Docker Compose. Docker Desktop can be used to install Docker on Windows or Mac, and developers can check whether they have all the tools installed by running commands like “make –version,” “docker –version,” and “docker-compose –version.”

After the installation is complete, it’s recommended to create a project directory in “~/reach/AlgoReach.” The Reach program can then be downloaded by running the command “curl https://docs.reach.sh/reach -o reach ; chmod +x reach,” and developers can confirm that the installation was successful by running “./reach version.”

Once everything is set up, developers can begin building their first dApp using Reach. To get started, they can open a text editor and begin coding. Visual Studio Code has a Reach extension that can be used.

To begin the project, developers can create a file named “index.rsh.” They can use the “reach init” command to generate a sample file for the back end and front end, but it’s recommended to keep these files in the current directory “~/reach/AlgoReach”.

How to Build Your First DApp on Solana

Building your first DApp on Solana can seem intimidating at first, but it’s actually quite straightforward. Here are the steps you can follow:

Familiarize yourself with the Solana ecosystem: Start by reading the Solana documentation and exploring the Solana network. You should also have a basic understanding of blockchain technology and how it works.

Choose your development environment: You can choose to develop your DApp on Solana using a variety of programming languages and development tools. The most popular language for developing on Solana is Rust, but you can also use languages like C, C++, and JavaScript.

Set up your development environment: Install the Solana CLI tool, Rust, and any other necessary dependencies for your chosen programming language. Once you have everything installed, create a new project directory for your DApp.

Write your smart contract: The core of your DApp will be your smart contract. Solana uses a programming language called Rust to write smart contracts. You can use the Solana CLI tool to create a new smart contract template and begin writing your code.

Compile and deploy your smart contract: Once you have written your smart contract, you will need to compile it into a binary format that can be deployed to the Solana network. You can use the Solana CLI tool to compile and deploy your smart contract.

Build your DApp front end: After your smart contract is deployed, you can begin building your DApp front end. You can use web frameworks like React or Vue.js to create a user interface for your DApp.

Connect your front end to your smart contract: To interact with your smart contract from your front end, you will need to use the Solana API. The Solana API provides a set of functions that allow you to interact with the Solana network from your front end.

Test and deploy your DApp: Once your front end is connected to your smart contract, you can begin testing your DApp. You can use the Solana CLI tool to run tests on your smart contract and ensure that everything is working as expected. Once you are satisfied with your DApp, you can deploy it to the Solana network.

Real-World Use Cases of Solana and Algorand

Solana Use Cases:

- Digital Marketplaces: Solana’s fast transactions and low fees make it great for NFT marketplaces, gaming, and e-commerce platforms. For example, Magic Eden is a Solana-based marketplace that enables fast and low-cost trading of cryptocurrencies.

- Decentralized Finance (DeFi): Solana is used for DeFi applications like decentralized exchanges (DEXs), lending protocols, and stablecoins. Serum DEX is an example of a Solana-based exchange that enables fast and cheap trading of various tokens.

- Gaming: Solana’s high-speed processing capabilities make it an ideal choice for gaming applications. Star Atlas is a blockchain-based game platform built on Solana that allows for real-time gaming experiences.

Algorand Use Cases:

- Central Bank Digital Currencies (CBDCs): Algorand is used by various central banks to develop and issue their own CBDCs. Algorand’s blockchain technology provides a secure and scalable platform for digital currency issuance and transaction processing.

- Decentralized Finance (DeFi): Algorand’s smart contract capabilities make it suitable for various DeFi applications, such as decentralized exchanges, yield farming, and lending protocols. Yieldly is an example of a DeFi platform built on Algorand that allows for fast and secure transactions.

- Supply Chain Management: Algorand can be used in supply chain management to track products and transactions across the supply chain. PlanetWatch is using Algorand’s blockchain technology to track air quality data across the globe, providing an immutable and secure record of air quality readings.

Conclusion

Solana and Algorand are both innovative blockchain platforms that offer unique features and benefits.

If fast transaction speeds and low transaction fees are a priority, then Solana may be the better choice. If security and decentralization are more important, then Algorand may be the better choice.

Ultimately, both Solana and Algorand are promising blockchain platforms that are worth considering for a wide range of applications.