Finding the best crypto futures trading platforms is essential for traders looking to maximize profits with high leverage and low fees. Whether you need a no-KYC crypto exchange, high-leverage futures trading, or low-fee crypto futures, choosing the right platform matters.

This guide compares top crypto futures exchanges like MEXC, BYDFi, Binance, Bitget, Bybit, and KuCoin based on supported coins, trading fees, futures contracts, and maximum leverage. If you want a crypto futures exchange with 200x leverage, USDT-margined and coin-margined contracts, or futures copy trading, you will find the best options here.

For traders in the U.S., MEXC and BYDFi allow crypto futures trading without KYC. If you prefer high liquidity and advanced features, Binance, Bitget, and Bybit are excellent choices. KuCoin is ideal for altcoin futures trading.

Table of Contents

Best Crypto Futures Trading Platforms: Our Top Picks

We have reviewed 30+ crypto futures trading platforms based on leverage, trading fees, supported coins, open interest, liquidity, security, and more. Here is our top list of the 6 best crypto futures exchanges:

- MEXC: Best Crypto Futures Platform Without KYC (Accepts US users)

- BYDFi: High Open Interest Futures Platform (Accepts US users)

- Binance: Best Futures Trading Exchange With 125x Leverage

- Bitget: Best Bitcoin Futures Trading Platform

- Bybit: Best Crypto Derivatives Trading Platform

- KuCoin: Best for Futures Altcoin Trading

Best Crypto Perpetual Futures Exchanges Reviewed

Here is a detailed review of each best futures crypto trading platforms:

MEXC: Best Futures Trading Platform Without KYC

MEXC is the best crypto futures trading platform, and you can trade without KYC with full privacy. It serves over 30 million users in more than 170 countries. The platform offers a wide range of digital assets, with over 2,900 tokens available for spot trading and more than 600 futures trading pairs.

For futures trading, MEXC provides leverage options up to 200x. The exchange supports both USDT-margined and coin-margined perpetual futures contracts. In USDT-margined contracts, USDT is used as collateral, while in coin-margined contracts, the underlying cryptocurrency serves as collateral.

MEXC offers various order types to cater to different trading strategies. These include limit orders, market orders, trigger orders, trailing stop orders, and post-only orders. The platform also provides advanced features such as a user-friendly trading terminal, comprehensive liquidity, and low fees. MEXC’s trading engine is capable of processing 1.4 million transactions per second.

In terms of security, MEXC employs multiple measures to protect user assets, including identity verification, two-factor authentication, and anti-phishing codes. The exchange’s servers are hosted independently across multiple countries to ensure data integrity and security.

MEXC Futures Key Features |

|

|---|---|

| Supported Coins | 600+ futures markets |

| Futures Trading Fees | 0.01% maker and 0.04% taker |

| Types of Futures Contracts | USDT-M and Coin-M contracts |

| U.S. Availability | Yes (Without KYC with VPN) |

| Maximum Leverage | 200x |

| Security | Very High (trusted by 30M users) |

| Volume and Liqudity | Over $10 Billion Daily Volume (Source: CMC data) |

Pros

- No-KYC trading available for U.S users with VPN

- Offers up to 200x leverage for futures trading.

- Over 2,900 tokens are available.

- Supports USDT and coin-margined futures contracts.

- Low trading fees compared to competitors.

- High transaction speed, 1.4 million orders per second.

Cons

- Limited customer support options.

- Does not offer crypto options trading

BYDFi: High Open Interest Futures Platform

BYDFi is another futures cryptocurrency exchange that started in 2019. It is also a no-KYC exchange for U.S. futures traders. It is based in Singapore and operates in over 150 countries. The platform offers more than 400 cryptocurrencies for trading. You can trade popular coins like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). The exchange provides both spot and derivatives trading options.

BYDFi offers perpetual contracts. These contracts do not have an expiration date. You can trade with leverage up to 200 times your investment. The platform charges competitive fees. For perpetual contracts, the maker fee is 0.02%, and the taker fee is 0.06%. For spot trading, the fee is 0.1%. These fees are lower than the industry average.

BYDFi has a user-friendly interface. It offers advanced charting tools powered by TradingView. These tools help you analyze market trends and make informed trading decisions. The platform also provides a demo account with 100,000 USDT in virtual funds. This feature allows you to practice trading without risking real money.

Security is a priority for BYDFi. The exchange uses multi-signature cold storage to keep most user funds offline. This approach reduces the risk of hacking. BYDFi is also registered as a Money Services Business with FinCEN in the U.S. and FINTRAC in Canada.

Read: Safest crypto exchanges

BYDFi Futures Key Features |

|

|---|---|

| Supported Coins | 400+ futures markets |

| Futures Trading Fees | 0.02% maker and 0.06% taker |

| Types of Futures Contracts | USDT-M, Coin-M contracts, and Leveraged Tokens |

| U.S. Availability | Yes (Without KYC) |

| Maximum Leverage | 200x |

| Security | Very High |

| Trading Volume and Liquidity | Highest Open Interest (Source: CMC data) |

Pros

- Trade without KYC with full privacy

- Leverage up to 200x for futures trading.

- Low maker fee of 0.02%.

- Supports over 400 cryptocurrencies.

- Offers demo accounts with 100,000 USDT.

Cons

- Limited fiat deposit options.

- Not highly popular related to established futures exchanges like Binance or MEXC

Binance: Best Futures Trading Platform With 125x Leverage

Binance is one of the biggest and best crypto futures trading platforms, founded in 2017 by Changpeng Zhao, also known as CZ. The platform supports trading for over 350 digital assets, including Bitcoin, Ethereum, and many altcoins. Binance is popular due to its low trading fees and a wide range of trading options. It has around 250 million users and aims to reach 1 billion. It operates in more than 200 countries and continues expanding despite regulatory challenges.

Binance offers different types of futures contracts, including USDT-margined and coin-margined contracts. The platform provides advanced trading tools, including various order types, risk management features, and trading bots. It also offers leverage up to 125x.

Related: Best crypto staking platforms

Binance Futures Key Features |

|

|---|---|

| Supported Coins | 350+ futures markets |

| Futures Trading Fees | 0.02% maker and 0.05% taker |

| Types of Futures Contracts | USDT-M, USDC-M, Coin-M contracts, and Leveraged Tokens |

| U.S. Availability | No |

| Maximum Leverage | 125x |

| Security | Very High |

| Trading Volume and Liquidity | Over $50 billion per day |

Pros

- Low fees compared to other exchanges.

- Offers up to 125x leverage on futures.

- Supports 350+ cryptocurrencies.

- Available in 20+ countries.

Cons

- Legal issues, including $4 billion fine in 2023

- Futures trading is not supported for the U.S. traders

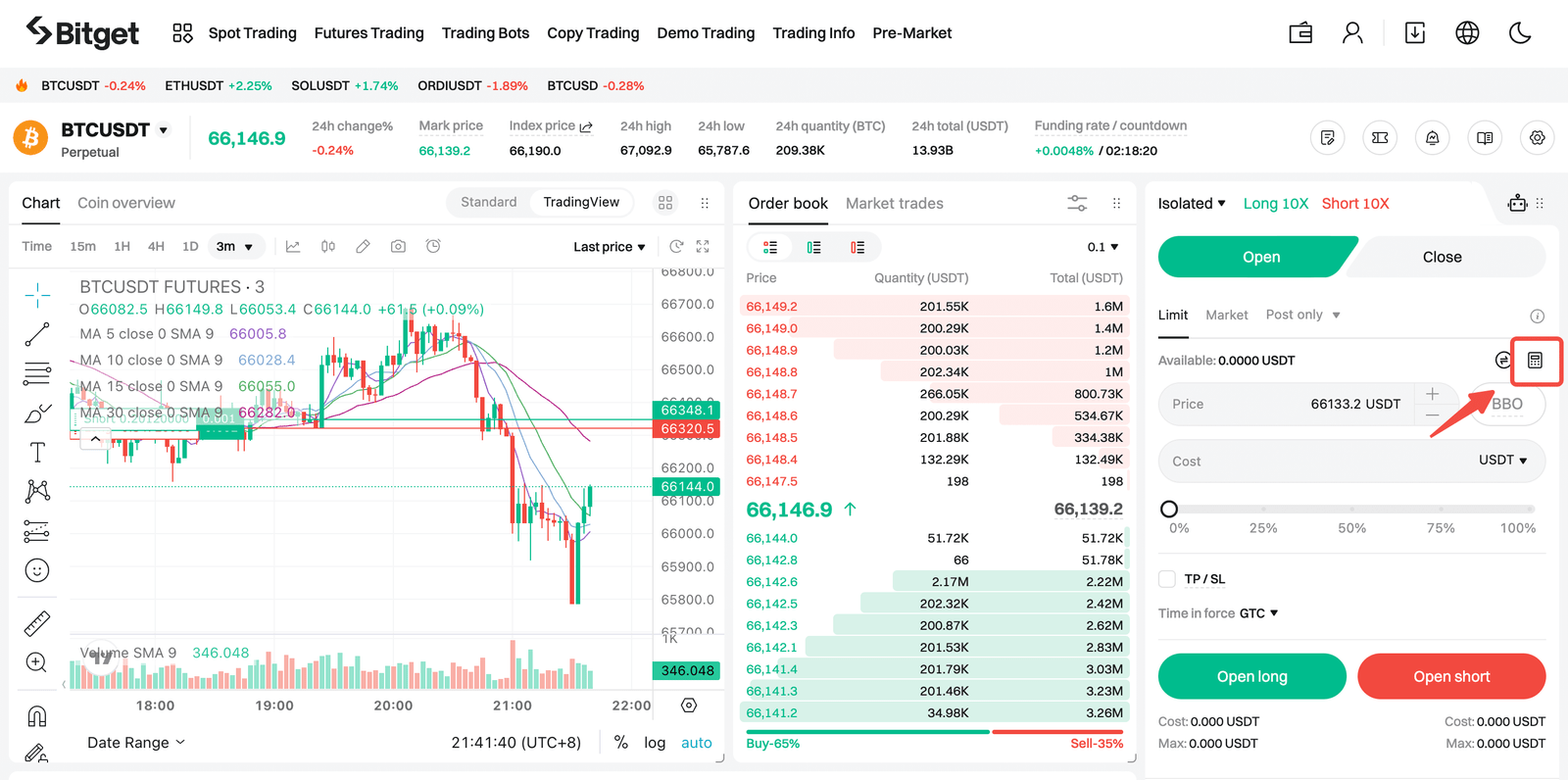

Bitget: Best Bitcoin Futures Trading Platform

Bitget is another best crypto futures trading platforms that started in 2018. It is based in Seychelles and serves over 45 million users in more than 170 countries. The platform focuses on providing a secure and comprehensive trading experience. It offers services like spot trading, futures trading, and copy trading.

In futures trading, Bitget provides several options. These include USDT-Margined (USDT-M) futures, USDC-Margined (USDC-M) futures, and Coin-Margined (Coin-M) futures. USDT-M and USDC-M futures are settled in stablecoins like USDT and USDC. Coin-M futures are settled in cryptocurrencies such as Bitcoin or Ethereum. The platform allows leverage of up to 125x for futures trading. It also offers copy trading for perpetual contracts with high leverage.

In terms of fees, Bitget charges a 0.1% fee for both makers and takers in spot trading. For futures trading, the fees are 0.02% for makers and 0.06% for takers. Holding the platform’s native token, BGB, can provide discounts on these fees. Bitget supports over 500 cryptocurrencies, offering a wide range of trading pairs. The platform also provides various financial products, including savings, staking, and crypto loans, to help you manage and grow your assets.

Bitget Futures Key Features |

|

|---|---|

| Supported Coins | 500+ futures markets |

| Futures Trading Fees | 0.02% maker and 0.06% taker |

| Types of Futures Contracts | USDT-M, USDC-M, and Coin-M contracts (including futures copy trading) |

| U.S. Availability | No |

| Maximum Leverage | 125x |

| Security | Very High |

| Trading Volume and Liquidity | Over $20 billion per day |

Pros

- Offers up to 125x leverage in futures trading.

- Supports over 500 cryptocurrencies and pairs.

- Secure with cold storage and multi-signature wallets.

- Low fees: 0.02% maker, 0.06% taker for futures.

- Futures copy trading for beginners.

Cons

- Limited fiat deposit options.

- Some regions face restricted access (e.g. U.S.)

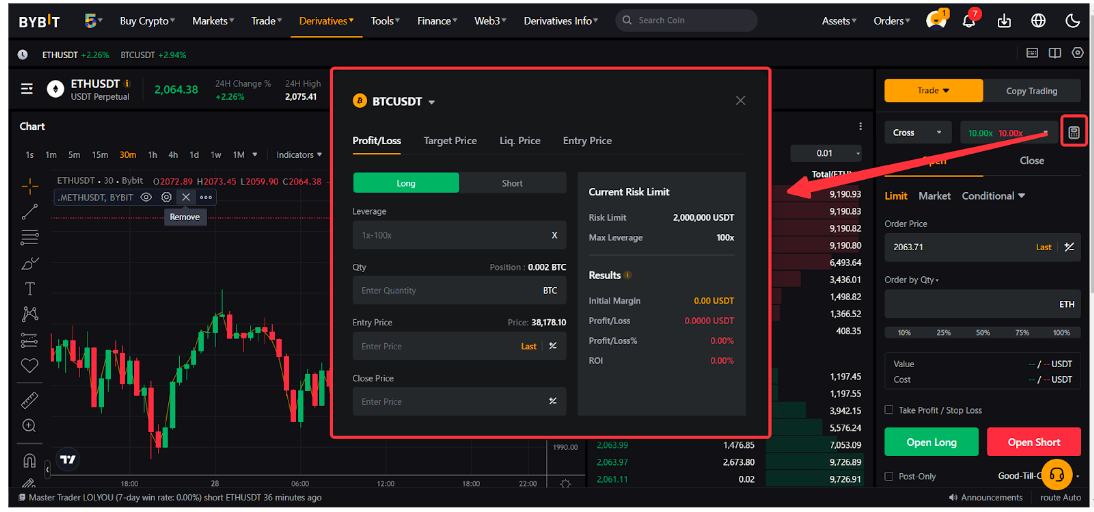

Bybit: Best Crypto Derivatives Trading Platform

Bybit is a crypto derivatives trading platform that started in 2018. It is based in Dubai. Bybit has over 60 million users worldwide. The platform offers more than 1,650 cryptocurrencies for trading. Bybit is known for its strong security measures, including cold storage and two-factor authentication.

Bybit provides various trading options. One of them is futures trading. The platform supports both inverse and USDT perpetual contracts. Inverse contracts are settled in cryptocurrencies like Bitcoin, while USDT contracts are settled in Tether (USDT).

Bybit also offers various order types, such as limit, market, and conditional orders, to help manage your trades effectively. The exchange also supports futures grid bots. It is also one of the best crypto options trading platforms.

Bybit Futures Key Features |

|

|---|---|

| Supported Coins | 600+ futures markets |

| Futures Trading Fees | 0.02% maker and 0.055% taker |

| Types of Futures Contracts | Inverse and USDT perpetual contracts (including futures grid bots) |

| U.S. Availability | No |

| Maximum Leverage | 100x |

| Security | Very High |

| Trading Volume and Liquidity | Over $40 billion per day |

Pros

- High leverage up to 100x

- Over 1,650 cryptocurrencies supported

- Advanced trading tools like futures, margin trading, and options trading

- Strong security features with cold storage and insurance fund

- No withdrawal fees and very low futures fees

Cons

- Not available in the US

KuCoin: Best for Futures Altcoin Trading

KuCoin is among the best crypto futures trading platforms for altcoins and new crypto assets. It lets you buy, sell, and trade many digital coins. The exchange is based in Seychelles and has over 30 million users worldwide.

On KuCoin, you can trade more than 700 different cryptocurrencies. This includes popular ones like Bitcoin and Ethereum, as well as many lesser-known coins. The platform offers various trading options, such as spot trading, margin trading, and futures trading. KuCoin offers two types of futures contracts: USDT-margined and coin-margined.

KuCoin upgraded its futures trading platform to Futures 2.0. This upgrade improved pricing, made clearing faster, and introduced new features like trial funds for new users and better API support for traders.

KuCoin Futures Key Features |

|

|---|---|

| Supported Coins | 700+ futures markets |

| Futures Trading Fees | 0.02% maker and 0.05% taker |

| Types of Futures Contracts | Inverse and USDT perpetual contracts |

| U.S. Availability | No |

| Maximum Leverage | 125x |

| Security | Very High |

| Trading Volume and Liquidity | Over $17 billion per day |

Pros

- Over 700 cryptocurrencies available for trading

- Futures trading with leverage up to 125x

- Low fees, starting at 0.2%

- Fast transaction speed and liquidity

Cons

- Legal issues and fines in the U.S.

- Limited customer support

Comparing Best Futures Crypto Trading Exchanges

Here is a comparison table of the 6 best crypto futures trading platforms and exchanges based on supported coins, trading futures fees, type of futures contracts, and maximum leverage:

| Exchange | Supported Coins | Futures Trading Fees | Types of Futures Contracts | Maximum Leverage |

|---|---|---|---|---|

| MEXC | 600+ futures markets | 0.01% maker, 0.04% taker | USDT-M and Coin-M contracts | 200x |

| BYDFi | 400+ futures markets | 0.02% maker, 0.06% taker | USDT-M, Coin-M contracts, and Leveraged Tokens | 200x |

| Binance | 350+ futures markets | 0.02% maker, 0.05% taker | USDT-M, USDC-M, Coin-M contracts, and Leveraged Tokens | 125x |

| Bitget | 500+ futures markets | 0.02% maker, 0.06% taker | USDT-M, USDC-M, and Coin-M contracts (including futures copy trading) | 125x |

| Bybit | 600+ futures markets | 0.02% maker, 0.055% taker | Inverse and USDT perpetual contracts (including futures grid bots) | 100x |

| KuCoin | 700+ futures markets | 0.02% maker, 0.05% taker | Inverse and USDT perpetual contracts | 125x |

Read: Best crypto leverage trading platforms in the US

How to Choose the Best Crypto Futures Trading Platforms

1. Trading Pairs & Liquidity

Why It Matters:

Liquidity determines how easily you can execute trades at your desired price without significant slippage. The more trading pairs a platform offers, the better your options for diversifying strategies.

Key Factors to Consider:

- Available Trading Pairs: A good platform supports major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Solana (SOL), and XRP, along with stablecoins such as USDT, USDC, and BUSD. Some best crypto futures trading platforms also offer altcoin futures for high-risk, high-reward trading.

- Market Liquidity: Higher liquidity means tighter bid-ask spreads and lower slippage. Platforms with deep order books ensure smoother transactions, even for large trades.

- 24/7 Trading Volume: Choose platforms with high 24-hour trading volume, which indicates active traders and ensures a more efficient market execution.

Related: Best lowest fee crypto exchanges

2. Leverage & Margin Trading Options

Why It Matters:

Leverage amplifies profits but also increases risks. Different best crypto futures trading platforms offer varying leverage ratios, so choosing the right one depends on your risk tolerance and trading experience.

Key Factors to Consider:

- Leverage Ratio: Some platforms offer up to 100x leverage (Binance, Bybit), while others cap it at 10x-50x for risk management.

- Cross vs. Isolated Margin:

- Cross Margin: Uses your entire account balance as collateral. Good for long-term traders but increases liquidation risk.

- Isolated Margin: Limits collateral to a specific trade, reducing potential losses. Ideal for short-term trading strategies.

- Risk Management Tools: Look for features like auto-deleveraging (ADL), stop-loss orders, and liquidation protection to minimize risk.

Read more: Best Ethereum exchanges

3. Security & Regulation

Why It Matters:

The best crypto futures trading platforms handle large sums of money, making them targets for hacks. Regulatory compliance ensures fund safety and fair trading practices.

Key Factors to Consider:

- Regulatory Compliance: Platforms registered under licensed authorities (CFTC, FINRA, MAS, FCA, ASIC, etc.) are safer.

- Fund Protection Measures: Look for platforms that offer:

- Cold Wallet Storage (majority of funds stored offline)

- Multi-Signature Withdrawals

- Insurance Funds (Binance SAFU, BitMEX Insurance Fund)

- Two-Factor Authentication (2FA): Helps secure your account against unauthorized access.

- Proof of Reserves (PoR): Some exchanges provide real-time proof of reserves, ensuring transparency.

4. Futures Fees & Commissions

Why It Matters:

Trading fees affect profitability. The best crypto futures trading platforms involve multiple fees, so choosing a cost-effective platform improves long-term returns.

Key Factors to Consider:

- Maker vs. Taker Fees:

- Maker Fees: Charged when you add liquidity to the order book (usually lower).

- Taker Fees: Charged when you remove liquidity (higher than maker fees).

- Funding Rates: If you hold futures contracts overnight, you may pay funding fees, which vary based on market conditions.

- Withdrawal Fees: Some best crypto futures trading platforms like Kraken and Coinbase charge high fees for crypto withdrawals.

5. User Experience & Trading Tools

Why It Matters:

A well-designed best crypto futures trading platform with advanced tools improves trading efficiency and profitability.

Key Factors to Consider:

- Interface & Order Execution: The platform should provide fast order execution with minimal latency.

- Trading Indicators & Charting Tools: Features like TradingView integration, technical indicators (RSI, MACD, Bollinger Bands), and customizable candlestick charts enhance strategy-building.

- Automated Trading: Some platforms support API trading, trading bots, and copy trading.

- Order Types: Supports market orders, limit orders, stop-loss, take-profit orders, trailing stops, etc.

6. Mobile App

Why It Matters:

A robust mobile app allows you to trade on the go, ensuring you don’t miss profitable opportunities.

Key Factors to Consider:

- App Speed & Reliability: The best crypto futures trading app should offer fast order execution without lags.

- Charting & Indicators: Ensure the app provides real-time market data, price alerts, and advanced indicators.

- Security Features: Look for features like biometric login, withdrawal whitelists, and push notifications.

- Compatibility: The app should be available on iOS & Android with regular updates.

What is Crypto Futures Trading?

Crypto futures trading is a type of derivatives trading where you speculate on the future price of a cryptocurrency without actually owning it. Instead of buying or selling the asset directly, you enter into a contract that obligates you to buy or sell it at a predetermined price on a specific date. This allows traders to profit from both rising and falling markets by taking long or short positions.

One of the key features of crypto futures trading is leverage, which lets you control a larger position with a smaller amount of capital. However, high leverage also increases the risk of liquidation. Most exchanges offer different leverage ratios, ranging from 5x to 100x.

Crypto futures contracts come in two main types: perpetual and standard futures. Perpetual contracts have no expiry date and rely on funding rates to keep prices aligned with the spot market. Standard futures have a set expiration date, after which the contract settles.

Crypto Futures vs. Perpetual Contracts

Here is a comparison table between Crypto Futures Contracts and Perpetual Contracts:

| Feature | Crypto Futures Contracts | Perpetual Contracts |

|---|---|---|

| Expiration Date | Has a fixed expiry date (weekly, monthly, or quarterly). | No expiry date, trades indefinitely. |

| Settlement | Automatically settled at expiration. | Never settles; traders close positions manually. |

| Funding Fees | No funding fees; settlement occurs at expiration. | Funding fees are charged periodically to maintain price balance. |

| Price Tracking | Can deviate from spot price until expiration. | Closely follows spot price due to funding mechanism. |

| Best for | Traders looking to hedge or speculate on a fixed timeline. | Traders who want to hold positions indefinitely. |

| Risk Management | Requires careful planning due to contract expiration. | Requires monitoring of funding fees to avoid unexpected costs. |

| Leverage | Typically lower leverage than perpetual contracts. | Often higher leverage, up to 200x on some platforms. |

| Market Popularity | Less popular than perpetual contracts. | More widely used by retail and professional traders. |

| Examples | Quarterly BTC Futures, ETH Monthly Futures. | Binance Perpetual, Bybit USDT Perpetual. |

USDT-M vs Coin-M Perpetual Contracts

Here is a comparison table between USDT-M Perpetual Contracts and Coin-M Perpetual Contracts:

| Feature | USDT-M Perpetual Contracts | Coin-M Perpetual Contracts |

|---|---|---|

| Margin Type | Uses USDT (or USDC) as collateral. | Uses the underlying crypto (BTC, ETH, etc.) as collateral. |

| Settlement | Settled in USDT/USDC. | Settled in the crypto asset itself (e.g., BTC contracts pay in BTC). |

| Price Stability | More stable due to USDT being a stablecoin. | More volatile since crypto prices fluctuate. |

| Risk Exposure | Lower risk as profits are in USDT, avoiding crypto price fluctuations. | Higher risk since profits and losses are tied to the crypto’s value. |

| Ideal for | Traders who prefer stable, fiat-like settlements. | Traders who want to accumulate more crypto. |

| Leverage Offered | Typically higher leverage (up to 125x on Binance). | Often lower leverage (up to 50x on Binance). |

| Trading Fees | Slightly lower fees compared to Coin-M contracts. | May have slightly higher trading fees. |

| Market Popularity | More popular among retail and institutional traders. | Used by traders looking to hedge or grow their crypto holdings. |

| Examples | BTC/USDT Perpetual, ETH/USDT Perpetual. | BTC/USD Perpetual, ETH/USD Perpetual. |

How do crypto futures differ from spot trading?

Crypto futures trading and spot trading are two different ways to trade cryptocurrencies, each with distinct characteristics.

Ownership of Assets

In spot trading, you buy and own the actual cryptocurrency. If you purchase Bitcoin (BTC) in the spot market, it is stored in your wallet, and you can hold, transfer, or use it. In futures trading, you do not own the actual asset. Instead, you trade a contract that represents the price of the cryptocurrency, agreeing to buy or sell at a later date.

Leverage & Capital Efficiency

Spot trading requires full capital investment. If Bitcoin is priced at $50,000, you need $50,000 to buy one BTC. Futures trading allows you to use leverage, meaning you can control a large position with a smaller amount of capital. With 10x leverage, you could enter a $50,000 BTC position with just $5,000. However, this increases both potential profits and risks.

Long & Short Positions

In spot trading, you profit only when prices increase because you hold the asset. In futures trading, you can take short positions, meaning you profit when the price goes down. This makes futures trading useful for hedging against price drops.

Market Volatility & Liquidity

Futures markets tend to be more liquid than spot markets because they attract high-volume traders and institutional investors. This leads to tighter bid-ask spreads and better execution for large trades. Spot markets can have higher volatility, especially for low-cap cryptocurrencies.

Funding & Fees

Spot traders pay trading fees when buying or selling. In futures trading, fees include maker and taker fees, funding rates (for perpetual contracts), and potential liquidation fees. Funding rates in perpetual futures ensure the contract price stays close to the spot price.

Settlement & Expiration

Spot trades settle immediately because you buy and own the asset. Futures contracts can have expiration dates (weekly, monthly, or quarterly) or be perpetual with no expiration. Perpetual contracts rely on funding rates to maintain price stability.

Benefits and risks of futures trading trading

Benefits of Crypto Futures Contract Trading

1. Leverage & Capital Efficiency

Crypto futures allow you to trade with leverage, meaning you can open larger positions with less capital. For example, with 10x leverage, a $1,000 deposit allows you to control a $10,000 position. This increases profit potential compared to spot trading.

2. Ability to Profit in Any Market Condition

Unlike spot trading, where you can only profit if the price goes up, futures trading allows you to short-sell. If you expect Bitcoin’s price to fall, you can open a short position and make a profit as the price declines.

3. Hedging Against Price Drops

Investors and miners use futures contracts to hedge risk. If a Bitcoin miner fears BTC price drops, they can short Bitcoin futures to offset potential losses.

4. High Liquidity & Lower Slippage

Futures markets are highly liquid, meaning large orders execute efficiently with minimal slippage. Major best crypto futures trading platforms like Binance, Bybit, and MEXC process billions in daily trading volume.

5. No Need to Own the Asset

You don’t need a crypto wallet or worry about asset storage. Since you trade contracts, you avoid risks like hacks, wallet mismanagement, and private key loss.

Risks of crypto futures contract trading

1. Liquidation Risk Due to High Leverage

While leverage increases profit potential, it also amplifies losses. If your margin balance falls below the maintenance margin, your position is liquidated, meaning you lose your invested amount.

2. Funding Fees on Perpetual Contracts

In perpetual futures trading, you pay funding fees periodically. If you hold a position for an extended time, these fees can accumulate, reducing profits.

3. High Market Volatility

Crypto markets are highly volatile, and price swings can lead to rapid margin calls and liquidations. Without proper risk management, traders can lose funds quickly.

4. Complex Trading Mechanics

Futures trading involves understanding leverage, margin, liquidation prices, funding rates, and contract expiration. Beginners may struggle with these mechanics, leading to costly mistakes.

5. Exchange & Counterparty Risk

If the futures trading crypto exchange experiences a hack, outage, or regulatory crackdown, your funds may be at risk. Some best crypto futures trading platforms have insurance funds to protect traders, but not all do.

Perpetual Contract Trading Fees Types

When trading perpetual futures contracts in cryptocurrency, you encounter several types of fees:

- Trading Fees

- Maker Fees: Charged when you place limit orders that provide liquidity and are not immediately matched. These fees are usually lower than taker fees.

- Taker Fees: Applied when you place market orders that are immediately executed, removing liquidity from the order book.

- Funding Fees

- Positive Funding Rate: When the contract price is higher than the spot price, long position holders pay short position holders.

- Negative Funding Rate: When the contract price is lower than the spot price, short position holders pay long position holders.

- Funding fees are charged periodically, often every 8 hours, and vary based on market conditions.

- Settlement Fees

- Some futures contracts have an expiration date, and when they reach settlement, a fee is charged for closing the position.

- Settlement fees are more common in traditional futures contracts rather than perpetual contracts.

- Leverage Fees

- When trading with leverage, the best crypto futures trading platforms charge fees for borrowing funds.

- These can include interest fees for holding leveraged positions over time.

- Deposit and Withdrawal Fees

- Some exchanges charge fees for depositing or withdrawing funds, especially when using specific payment methods.

- Cryptocurrency withdrawals may also have network fees, which depend on blockchain congestion.

Types of Crypto Futures Markets

Perpetual Futures

Perpetual futures contracts are a popular type of crypto futures. Unlike traditional futures, they do not have an expiration date. You can hold a position for as long as you want. Exchanges use a funding rate mechanism to keep the contract price close to the spot price.

- Funding Rate: If the perpetual contract price is higher than the spot price, long traders pay a fee to short traders. If it is lower, short traders pay long traders.

- Advantages: No expiry date, high liquidity, and ability to use leverage.

- Disadvantages: Funding fees can accumulate over time, making long-term holding costly.

Delivery Futures

Delivery futures are contracts with a set expiration date. When the contract expires, the asset is either settled in cash or delivered physically.

- Expiry Dates: Usually weekly, monthly, or quarterly.

- Advantages: No funding fees like perpetual futures. Useful for long-term strategies.

- Disadvantages: Must manage contract expiration to avoid forced settlement.

Inverse Futures

Inverse futures contracts are priced in cryptocurrency rather than stablecoins or fiat currency. For example, in an inverse Bitcoin futures contract, BTC is used as the margin and settlement currency instead of USDT.

- Advantages: Useful for traders who hold large amounts of crypto and want to hedge against market fluctuations.

- Disadvantages: Market downturns can reduce both margin and profit value in crypto terms.

How to Trade Bitcoin Futures?

Step 1. Choose the Best Crypto Futures Exchange

Select a reliable and best crypto futures trading platform. Some popular platforms include Binance, Bybit, KuCoin, and MEXC. Check fees, leverage options, and security features before signing up. You must complete identity verification (KYC) on most exchanges before trading.

Step 2. Fund Your Futures Account

Deposit funds into your trading account. Some exchanges require stablecoins like USDT or BUSD, while others allow direct deposits in Bitcoin or Ethereum. Make sure you transfer funds to your futures wallet, not your spot wallet.

Step 3. Understand Futures Contracts

Crypto futures contracts are agreements to buy or sell a cryptocurrency at a fixed price in the future. There are two main types:

- Perpetual Contracts – They do not have an expiry date. You can hold them as long as you maintain margin requirements.

- Fixed-Term Contracts – They expire on a specific date. You must settle them before expiry.

Step 4. Learn Leverage and Margin

Futures trading involves leverage, which lets you trade with more money than you deposit. For example, if you use 10x leverage, a $100 deposit allows you to trade $1,000 worth of crypto. Higher leverage increases profit potential but also increases risk.

Margin is the amount you must keep in your account to hold a position. There are two types:

- Initial Margin – The minimum deposit to open a trade.

- Maintenance Margin – The minimum balance needed to keep the position open. If your balance falls below this, the exchange will liquidate your trade.

Step 5. Open a Long or Short Position

You have two trading options:

- Long Position – You bet the price will go up. If the price rises, you make a profit.

- Short Position – You bet the price will go down. If the price falls, you earn money.

Choose your position based on market analysis.

Step 6. Set Stop-Loss and Take-Profit Orders

Stop-loss orders automatically close your trade if the price moves against you, preventing large losses. Take-profit orders close your trade when your profit target is reached. Setting both helps manage risk.

Step 7. Monitor Your Trade

Check market trends, news, and technical indicators to decide when to exit. If the market moves in your favor, adjust your stop-loss to secure profits. If the market moves against you, decide whether to close the trade or wait.

Step 8. Close Your Position

You can manually close your position to secure profits or cut losses. If you hold a fixed-term contract until expiry, it will settle automatically.

Step 9. Withdraw Profits

After closing your position, transfer profits from your futures wallet to your main wallet. Withdraw funds to your bank or crypto wallet as needed.

Best Practices in Cryptocurrency Futures Trading

1. Managing Leverage & Avoiding Liquidation

Leverage allows you to trade with more money than you actually have, increasing both potential profits and risks. While it can amplify gains, it also makes losses more severe. If your losses exceed your margin balance, your position gets liquidated, meaning you lose your entire invested amount. Properly managing leverage is a key best practice to avoid liquidation and sustain long-term trading success.

Understanding Leverage and Its Risks

Leverage is expressed as a ratio, such as 5x, 10x, or 50x. A 10x leverage means you are trading with ten times your actual capital. While this increases your profit potential, it also means that a small price movement in the wrong direction can wipe out your funds. For example, if you use 20x leverage, a 5% price drop can result in liquidation.

2. Understanding Market Volatility

Before you trade cryptocurrency futures, you must understand how the market works. Futures trading involves contracts where you agree to buy or sell a cryptocurrency at a future date and price. You can trade with leverage, meaning you borrow money to increase your position. This can lead to high returns but also heavy losses.

It is important to study market trends, price movements, and historical data. You need to analyze candlestick charts, volume indicators, and market sentiment. You should also stay updated with news that can affect crypto prices, such as regulatory decisions, exchange updates, and global financial events.

3. Risk Management Strategies

Risk management is essential in futures trading. Since leverage can increase your gains or losses, you should never risk more than you can afford to lose. Use stop-loss orders to close your trade when the price reaches a certain level. This prevents large losses if the market moves against you.

Position sizing is another important risk management strategy. Instead of putting all your money into one trade, divide it into smaller trades. This way, a single loss won’t wipe out your funds.

You should also control your emotions. Fear and greed often cause traders to make poor decisions. Stick to a trading plan and avoid overtrading.

To protect your funds and minimize losses, you should follow these risk management strategies.

1. Use Stop-Loss and Take-Profit Orders

Stop-loss orders automatically close your trade when the price reaches a certain level, preventing excessive losses. Take-profit orders secure profits by closing your position at a target price before the market reverses. These tools help you control risks and avoid emotional decision-making.

2. Limit Leverage Usage

Leverage allows you to trade with borrowed funds, increasing potential profits but also amplifying losses. High leverage can wipe out your funds quickly if the market moves against you. Using low leverage, such as 2x or 3x instead of 10x or 20x, reduces the risk of liquidation.

3. Diversify Your Trades

Avoid putting all your money into a single trade or one cryptocurrency. Diversification spreads risk across multiple assets and reduces the impact of a single loss. If one trade fails, gains from other trades can help balance the losses.

4. Maintain Proper Position Sizing

Never risk more than a small percentage of your total capital on a single trade. A common rule is to risk only 1-2% of your portfolio per trade. This prevents large losses and ensures you have enough funds to continue trading.

5. Monitor Market News and Events

Cryptocurrency prices are highly affected by news, regulations, and global financial events. Sudden announcements about government regulations, exchange hacks, or macroeconomic shifts can cause price swings. Staying updated helps you make informed decisions and avoid unexpected losses.

6. Avoid Emotional Trading

Fear and greed often lead to poor decisions. Overtrading, revenge trading after a loss, or holding onto losing positions due to hope can lead to bigger losses. Stick to a well-planned strategy, follow risk management rules, and trade based on logic instead of emotions.

4. Using Technical and Fundamental Analysis

Successful traders use technical and fundamental analysis to make informed decisions. Technical analysis involves studying price charts and indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). These help predict price movements.

Fundamental analysis focuses on factors that influence a cryptocurrency’s value. This includes adoption rate, partnerships, technological developments, and market demand. Keeping up with news about regulations and major events in the crypto space can help you make better trading decisions.

Best Crypto Futures Trading Strategies

1. Trend Following Strategy

This strategy involves trading in the direction of the market trend. If the price is rising, you take a long position (buy). If the price is falling, you take a short position (sell). Traders use moving averages, trendlines, and technical indicators like the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) to confirm trends. If the price moves above a key moving average, it signals a buying opportunity. If it moves below, it signals a selling opportunity.

2. Breakout Trading Strategy

A breakout happens when the price moves beyond a key level of resistance or support with high volume. This signals the start of a new trend. Traders place orders above the resistance level to buy or below the support level to sell. They use tools like Bollinger Bands and volume indicators to confirm breakouts. If the price breaks a strong resistance level, it often moves up further. If it breaks a support level, it may fall sharply.

3. Scalping Strategy

Scalping is a short-term trading strategy where you enter and exit trades within minutes. The goal is to make small profits multiple times throughout the day. Traders use high leverage and focus on small price movements. They rely on technical indicators like the Stochastic Oscillator and VWAP (Volume Weighted Average Price) to find entry and exit points. This strategy requires fast decision-making and strict risk management.

4. Range Trading Strategy

This strategy is useful when the market is not trending. The price moves within a fixed range between support and resistance levels. Traders buy at the support level and sell at the resistance level. They use tools like Bollinger Bands and the Average True Range (ATR) to identify price ranges. When the price reaches the upper boundary, traders take a short position. When it reaches the lower boundary, they take a long position.

5. Funding Rate Arbitrage Strategy

In perpetual futures contracts, exchanges charge funding fees between long and short traders. If the funding rate is positive, long traders pay short traders. If it is negative, short traders pay long traders. Traders take advantage of this by opening opposite positions on different exchanges. This strategy earns passive income with low risk.

6. News-Based Trading Strategy

Crypto markets react quickly to news. Traders monitor news sources, social media, and official announcements to predict price movements. Positive news, like a big company adopting crypto, can cause prices to rise. Negative news, like regulatory bans, can cause prices to fall. Traders enter trades before the market fully reacts to maximize profits.

7. Hedging Strategy

Hedging reduces risk by opening opposite positions. If you own Bitcoin and expect a short-term drop in price, you open a short position in Bitcoin futures. If the price falls, the short position profits and offsets your loss in Bitcoin holdings. This strategy protects your portfolio from volatility.

8. Grid Trading Strategy

Grid trading involves placing buy and sell orders at fixed price intervals. If the price moves up and down within a range, the orders execute automatically, generating profits. This strategy works best in sideways markets. Bots often manage grid trading for efficiency.

Conclusion: Best Futures Trading Platform for Crypto

To sum up, the best crypto futures trading platforms are MEXC, BYDFi, Binance, Bybit, Bitget, KuCoin, and Deribit due to multiple perpetual contracts, low fees, and high leverage. When choosing the best futures trading platform for crypto, factors like fees, liquidity, leverage, and security matter the most.

MEXC stands out as the top choice due to its ultra-low fees (0.01% maker, 0.04% taker), deep liquidity, and up to 200x leverage. It also supports over 600 trading pairs, making it ideal for both beginners and experienced traders. Additionally, MEXC operates with no mandatory KYC, allowing global access, including from restricted regions via VPN. If you want a cost-effective and feature-rich platform for crypto futures trading, MEXC is the best option.

FAQs

What is the best platform to trade cryptocurrency futures?

MEXC is the best platform for cryptocurrency futures trading. It offers over 600 trading pairs and allows up to 200x leverage, providing traders with extensive options and flexibility. The platform is renowned for its deep liquidity, ensuring efficient trade execution. Additionally, MEXC maintains a competitive fee structure, with maker fees at 0.01% and taker fees at 0.04%, making it a cost-effective choice for traders.

What Happens When Futures Contracts Expire?

When a futures contract reaches its expiration date, the agreement between the buyer and seller concludes. At this point, the contract is settled, meaning the underlying asset is either delivered physically or settled in cash, depending on the contract’s terms. This settlement finalizes any profits or losses incurred during the contract’s duration.

How to trade crypto futures on Binance?

To trade crypto futures on Binance, start by creating and verifying your account. Once verified, transfer funds into your futures wallet. Navigate to the ‘Futures’ section on the platform, select your desired contract, and adjust leverage settings as needed. You can then place orders based on your market analysis. Binance offers a user-friendly interface with various tools to assist both novice and experienced traders.

How to trade crypto futures in the U.S.?

In the United States, trading crypto futures is subject to regulatory restrictions. However, some traders opt to use the best crypto futures trading platforms like MEXC, which operates without mandatory KYC (Know Your Customer) procedures. By employing a Virtual Private Network (VPN), U.S. residents can access MEXC’s services, enabling them to trade crypto futures with ease.

Can beginners trade crypto futures?

Beginners can indeed trade crypto futures, but it’s crucial to approach with caution. Futures trading involves significant risk due to leverage, which can amplify both gains and losses. It’s advisable for newcomers to thoroughly educate themselves, start with lower leverage, and utilize demo accounts if available to practice before committing substantial funds.

What is the funding rate in crypto futures trading?

The funding rate in crypto futures trading is a periodic payment exchanged between long and short positions. Its purpose is to keep the futures contract price in line with the spot market price. When the funding rate is positive, traders in long positions pay those in short positions, and vice versa when the rate is negative. These payments occur at regular intervals, typically every eight hours.

Are crypto futures trading platforms regulated?

Regulation of the best crypto futures trading platforms varies by jurisdiction. Some platforms operate under strict regulatory frameworks, ensuring compliance with local laws, while others may operate in regions with less oversight. Traders should conduct due diligence to understand the regulatory status of a platform before engaging in trading activities.

Are crypto futures always open?

Yes, crypto futures trading is 24/7. Crypto futures contracts can have set expiration dates, upon which they are settled. However, many best crypto futures trading platforms offer perpetual contracts, which do not have an expiration date and allow traders to hold positions indefinitely, provided they meet margin requirements and pay any associated funding fees.

What is the cheapest futures trading platform for crypto?

MEXC is recognized as one of the most cost-effective platforms for crypto futures trading. It offers a maker fee of 0.01% and a taker fee of 0.04%, making it an attractive option for traders seeking to minimize transaction costs.