Cryptocurrencies have become increasingly popular over the years, and Bitcoin is undoubtedly the most well-known of them all.

However, Bitcoin Cash has emerged as a rival cryptocurrency and has gained a significant following.

In this article, we will explore the key differences between “Bitcoin vs Bitcoin Cash“, and help you determine which one might be the best choice for you.

Overview of Bitcoin and Bitcoin Cash

Bitcoin [BTC] was created in 2009 by an anonymous individual or group of individuals using the pseudonym Satoshi Nakamoto.

It was the first decentralized digital currency and operates on a peer-to-peer network, with transactions recorded on a public ledger known as the blockchain.

Bitcoin has a maximum supply of 21 million coins and is currently the most valuable cryptocurrency in the world.

Related: Bitcoin And Its Working: A Powerful Beginners Guide

Advantages of Bitcoin (BTC)

- Bitcoin operates on a decentralized network, meaning it is not controlled by any central authority or government.

- The transactions can be made across borders without the need for intermediaries, such as banks or payment processors.

- The transactions are pseudonymous, meaning they do not reveal personal information unless voluntarily disclosed.

- Bitcoin has the potential to provide financial services to the unbanked and underbanked populations.

- It has transparent and traceable transactions.

Bitcoin Cash [BCH], on the other hand, was created in 2017 as a result of a hard fork from Bitcoin.

It was created by a group of dissenting developers who were dissatisfied with the direction of Bitcoin and sought to increase its block size to allow for more transactions per block.

This resulted in the creation of a new blockchain with larger block sizes, which they dubbed “Bitcoin Cash”.

Advantages of Bitcoin Cash over Bitcoin

- Bitcoin Cash has a larger block size compared to Bitcoin.

- Due to the larger block size, Bitcoin Cash transaction fees tend to be lower than Bitcoin, making it potentially more cost-effective for small transactions.

- Bitcoin Cash aims to prioritize its use as a medium of exchange for everyday transactions, with a focus on low fees and fast confirmations, whereas Bitcoin has been positioned more as a store of value or digital gold.

Bitcoin vs Bitcoin Cash: Block Size

One of the most significant differences between Bitcoin and Bitcoin Cash is the block size limit.

Bitcoin has a block size limit of 1MB, which means that it can only process a limited number of transactions per block. This has led to long transaction times and high fees during times of high network congestion.

On the other hand, Bitcoin Cash has a larger block size limit of 32MB, which allows for faster transaction processing and lower fees. This has made Bitcoin Cash a popular choice for individuals who frequently make transactions or require faster confirmation times.

However, the larger block size limit of Bitcoin Cash also means that its blockchain grows at a faster rate. This could lead to greater centralization as only those with larger storage capacities can participate in the network as full nodes.

Additionally, some argue that a larger block size limit may lead to decreased security as it may be easier for malicious actors to launch a 51% attack.

Related: Best Bitcoin Cloud Mining Apps

Bitcoin or Bitcoin Cash: TPS and Block time

Bitcoin has a TPS of approximately 7, while Bitcoin Cash has a TPS of up to 116. This means that Bitcoin Cash can process significantly more transactions per second than Bitcoin, which can lead to faster confirmation times and lower fees.

In terms of block time, Bitcoin has an average block time of 10 minutes, while Bitcoin Cash has an average block time of 10 minutes as well.

This means that both cryptocurrencies have similar confirmation times, but Bitcoin Cash may still process more transactions due to its larger block size limit.

Bitcoin vs Bitcoin Cash: Transaction Fees

Bitcoin’s transaction fees can be high, particularly during times of high demand on the network. This is because miners prioritize transactions with higher fees, which means that transactions with lower fees can take a long time to confirm.

The average transaction fee for Bitcoin is around $3.50 per transaction, with fees ranging from a few cents to several dollars depending on network congestion. This can make Bitcoin relatively expensive to use for small transactions or micro-payments.

In contrast, the average transaction fee for Bitcoin Cash is significantly lower, currently around $0.01 per transaction. This is due to the larger block size limit of Bitcoin Cash.

Note: Bitcoin (BTC) fees are typically denominated in satoshis per byte (sat/byte), where a higher fee per byte generally results in faster transaction confirmation times and vice-versa.

BTC vs BCH: Market Cap and Total Supply

The market capitalization of Bitcoin is around $585 billion, making it the largest cryptocurrency by market capitalization. In contrast, the market capitalization of Bitcoin Cash is around $2.5 billion, which is significantly smaller than Bitcoin.

Additionally, Bitcoin has a total supply of 21 million BTC coins, with approximately 19.34 million coins already in circulation.

Bitcoin Cash, on the other hand, has a total supply of 21 million BCH coins as well, but only around 19.36 million coins are currently in circulation.

Bitcoin and Bitcoin Cash: Mining Algorithm

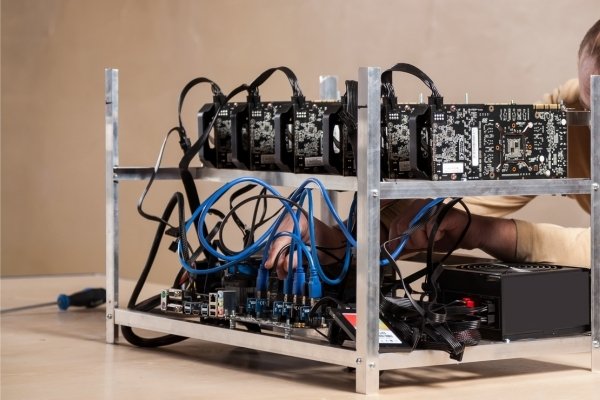

Bitcoin uses a consensus mechanism known as Proof of Work (PoW). Under PoW, miners compete to solve complex mathematical puzzles, with the first miner to solve the puzzle being rewarded with newly minted bitcoins.

This process of solving puzzles requires significant computational power and energy consumption, as miners are constantly working to validate transactions and secure the network.

The mining algorithm used by Bitcoin is SHA-256 (Secure Hash Algorithm 256-bit), which is a cryptographic hashing algorithm.

This algorithm is specifically designed to prevent the creation of fraudulent blocks and to make it difficult for attackers to modify existing blocks.

Bitcoin Cash, on the other hand, also uses a PoW consensus mechanism but has made changes to the mining algorithm and block size limit.

Bitcoin Cash uses the mining algorithm known as SHA-256D, which is a double-SHA-256 hashing algorithm. This algorithm is similar to the one used by Bitcoin, but it includes an additional hashing function, which makes it more difficult for attackers to modify the blockchain.

Read the Full Guide: How Does Bitcoin Mining Work?

Bitcoin vs Bitcoin Cash: Network Security

Bitcoin adjusts its mining difficulty every 2016 block (approximately every two weeks) to ensure that the average block mining time remains around 10 minutes.

This helps to maintain network security by making it harder for miners to gain control of the network.

If Bitcoin’s network is dominated by a few large mining pools, which control a significant portion of the total hash power. This has raised concerns about the centralization of mining power, as it could potentially lead to a 51% attack, where a single entity gains control of more than 50% of the network’s hash power.

Emergency Difficulty Adjustment (EDA): Bitcoin Cash has an EDA mechanism that adjusts mining difficulty more frequently than Bitcoin, allowing for faster block generation times during periods of low hash power.

This helps to maintain transaction confirmations even when the network’s hash power fluctuates.

Read: 7 Best Bitcoin Hardware Wallets

Which One Should You Choose?

If you value decentralization and want to make frequent transactions with lower fees, Bitcoin Cash might be the better option for you.

However, if you are looking for a more established cryptocurrency with wider adoption and a higher market cap, Bitcoin might be the better choice.

Ultimately, both Bitcoin and Bitcoin Cash are valuable cryptocurrencies that have their own unique strengths and weaknesses. It’s up to you to decide which one is the best fit for your needs.

Must Read: How To Read Bitcoin Chart?

Bitcoin History and Events

- January 2009: Bitcoin is created by an unknown person or group using the pseudonym Satoshi Nakamoto. The first block, known as the “genesis block,” is mined, and the Bitcoin network is launched.

- October 2009: The first Bitcoin exchange rate is established, with 1 USD equivalent to 1,309.03 BTC, based on a calculation using electricity costs for mining.

- May 2010: The first real-world transaction with Bitcoin occurs when a user named Laszlo Hanyecz buys two pizzas for 10,000 BTC, marking the first known commercial use of Bitcoin as a currency.

- March 2014: Mt. Gox, once the largest Bitcoin exchange, collapses after revealing that it had lost approximately 850,000 BTC in a massive hack, marking one of the biggest Bitcoin scandals in history.

- August 2017: Bitcoin undergoes a “hard fork” resulting in the creation of a new cryptocurrency called Bitcoin Cash (BCH), due to disagreements within the community over the scalability of Bitcoin.

- May 2020: Bitcoin undergoes its third “halving,” a pre-programmed event that reduces the block reward for miners by half, leading to a decrease in the supply of new Bitcoins being created.

- February 2021: Tesla, the electric car company, announces a $1.5 billion investment in Bitcoin and plans to accept it as payment for its products, leading to increased mainstream acceptance of Bitcoin as a legitimate asset.

- March 2021: Coinbase, one of the largest cryptocurrency exchanges, goes public through a direct listing on the Nasdaq stock exchange, further validating the legitimacy of Bitcoin and the overall cryptocurrency market.

Bitcoin Cash (BCH) History and Events

- Genesis: Bitcoin Cash (BCH) is created as a result of a hard fork from the original Bitcoin (BTC) blockchain on August 1, 2017.

- Increased Block Size: BCH increases the block size limit to 8 MB, allowing for faster and cheaper transactions compared to BTC’s smaller block size.

- Mining Profitability: BCH becomes more profitable to mine than BTC due to lower transaction fees and increased block rewards, attracting miners to switch their computing power to the BCH network.

- BCH undergoes regular network upgrades to improve scalability, security, and functionality, including protocol updates such as Schnorr signatures and OP_CHECKDATASIGVERIFY (CDSV).

Final Thoughts

The Bitcoin vs Bitcoin Cash debate has been a hot topic in the cryptocurrency world. While both cryptocurrencies have similar origins, they have evolved into two different coins with different goals and philosophies.

Bitcoin, with its strong brand recognition and market dominance, is still the preferred choice for most investors and traders. However, Bitcoin Cash offers faster transaction times and lower fees, making it more attractive for those who prioritize speed and cost efficiency.

Ultimately, which cryptocurrency is better depends on individual use cases. Both have their own strengths and weaknesses, and it’s up to each person to do their own research and make an informed decision based on their specific needs.

FAQs

-

What is SegWit?

Segregated Witness, commonly known as SegWit, is a protocol upgrade for certain cryptocurrencies, such as Bitcoin.u003cbru003eu003cbru003eSegWit separates the transaction data into two parts: the transaction information (also known as the u0022witnessu0022 data), and the transaction signature (also known as the u0022scriptSigu0022). The witness data, which includes the transaction’s digital signatures, is removed from the transaction data structure and stored in a separate data structure. u003cbru003eu003cbru003eThis allows for more transaction data to be included in a block, increasing the transaction capacity of the blockchain.

-

How Bitcoin Cash is better than Bitcoin?

Bitcoin Cash (BCH) has been promoted by some of its proponents as potentially better than Bitcoin (BTC) in several ways. u003cbru003eu003cbru003eFirstly, BCH has a larger block size limit, which could result in faster transaction times and lower transaction fees compared to BTC. This makes BCH potentially more suitable for day-to-day transactions and smaller transactions.u003cbru003eu003cbru003eSecondly, BCH supporters believe that it is more decentralized compared to BTC due to its larger block size limit, which may allow for more miners to participate in the network and prevent the concentration of mining power.

-

What is a Hard Fork?

A hard fork refers to a major update or modification to a blockchain network’s protocol. It is not backward compatible, resulting in a permanent split from the existing blockchain.u003cbru003eu003cbru003eIt creates two separate chains with diverging rules. This can result in the creation of a new cryptocurrency, separate from the original one. Users need to upgrade their software to the new protocol to continue participating in the new chain.u003cbru003eu003cbru003eAny transactions or data on the original chain may not be compatible or recognized on the new chain. Hard forks can be initiated for various reasons, such as addressing security vulnerabilities, implementing new features, or resolving disagreements in the community.

READ MORE COMPARISONS: