Are you struggling to keep up with the complex world of cryptocurrency taxes? Have you been searching for a solution that makes filing your crypto taxes a breeze?

Look no further than Koinly, the innovative tax software designed specifically for cryptocurrency traders and investors.

In this Koinly review, we’ll take a closer look at this platform, its features, and its pricing to help you determine if it’s the right tool for you.

Key Specifications:

| Key Points | Explanation |

|---|---|

| Type | Tax Reporting and Portfolio Tracker App |

| Supported Exchanges | 400 exchanges and wallets, including Binance, Kucoin, Bybit, and more. |

| Supported Cryptocurrencies | 20,000+ |

| Tax Calculations | FIFO (First-In-First-Out) method |

| Tax Reports | CSV, Excel, and PDF. |

| Integrations | TurboTax and TaxAct |

| Security | 2FA, SSL encryption, and read-only API access. |

| Pricing | Free Plan, paid plan starts at $49 per year |

What is Koinly?

Koinly is a web-based cryptocurrency tax calculator that was launched in 2018. It was founded by Robin Singh, a software developer who was frustrated with the complicated tax reporting process for crypto investments.

The platform supports over 20,000 cryptocurrencies and integrates with more than 400 exchanges and wallets, making it one of the most comprehensive tax calculators on the market.

Its algorithm uses the FIFO (First-In, First-Out) method to calculate your gains and losses, ensuring accuracy and compliance with tax laws.

Pros and Cons of Koinly

| Pros | Cons |

|---|---|

| Supports multiple exchanges and wallets | Limited support for some smaller exchanges |

| Automated syncing of transactions | User interface can be overwhelming for beginners |

| Accurate tax calculations and reporting | Some advanced features require higher-tier pricing plans |

| Integrates with popular tax software | |

| Offers various pricing plans to suit different needs |

How Koinly Tax Reporting Works?

Koinly uses an API connection to import users’ transaction data from various exchanges and wallets.

The platform then uses this data to calculate users’ gains and losses, generate tax reports, and provide useful insights into their cryptocurrency holdings.

Step 1: Import Your Data

To get started with Koinly, users need to connect their exchanges and wallets to the platform using API keys.

The platform supports a wide range of exchanges and wallets, including Coinbase, Binance, Kraken, and more. Once connected, it will automatically import users’ transaction data.

Step 2: Review Your Transactions

Once Koinly has imported your data, users can review their transactions and make any necessary adjustments.

It provides users with a detailed view of their transactions, including the date, type, and amount of each transaction.

Step 3: Generate Your Tax Reports

Once users have reviewed their transactions, Koinly can generate a variety of tax reports, including capital gains reports, income reports, and more.

Users can also generate reports based on specific tax laws and jurisdictions. Once your transactions have been imported, you can generate tax reports in a variety of formats, including PDF, Excel, and CSV.

Koinly Features Review

Dashboard

Koinly’s dashboard provides users with an overview of their crypto portfolio, including their holdings, gains and losses, and a breakdown of their investments by coin and exchange.

The dashboard is easy to navigate and provides users with quick access to their transaction history and tax reports.

It supports various data import options such as CSV file import, exchange API sync, ETH address auto-sync, xPub/yPub/zPub import, and more. It also offers error reconciliation, advanced transaction filtering, and cost analysis.

Other Dashboard features include smart transfer matching, mining, staking, lending, airdrops, exchange and transaction fee tracking, 20,000+ cryptocurrencies, and 6+ years of historical spot prices.

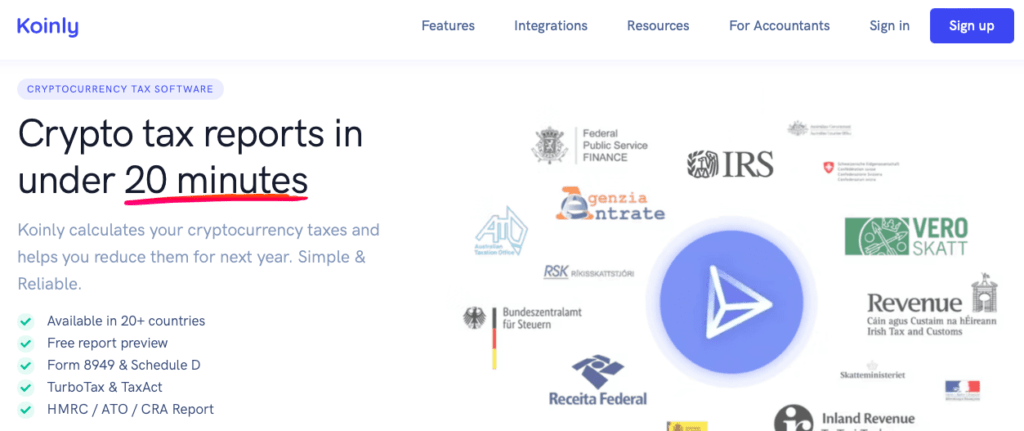

Tax Reports

Koinly offers reliable crypto tax reports for over 20 countries, including pre-filled IRS Form 8949 & Schedule D.

This includes tax reporting and other features like international tax reports, comprehensive audit reports, and export to TurboTax and TaxACT.

It generates income tax reports and provides FIFO, HIFO & LIFO methods. The platform also has a dedicated TurboTax Report and reports for Canada, Sweden, Denmark, France, Finland, Norway, Sweden & Switzerland.

It offers a variety of crypto tax reports, including-

- Transaction history

- Capital gains Report

- Income Report

- Expenses Report

- End-of-year holdings Report

Koinly’s Crypto Income Report lists all crypto income, including DeFi, and supports CSV files. It also provides a detailed crypto earnings report on net capital gains and losses.

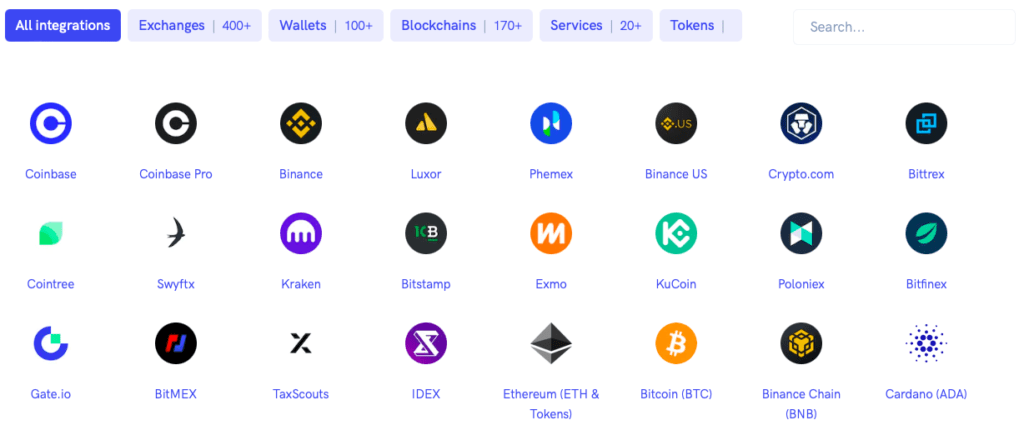

Import and Sync

Koinly supports over 400 exchanges, 100+ crypto wallets, 150+ blockchains, and other platforms, making it easy for users to import their transaction history.

The software also syncs automatically with supported platforms, ensuring that your transaction history is always up to date.

Portfolio Tracker

Koinly is the ideal crypto portfolio tracker that offers effortless management of your crypto assets while ensuring you stay on top of your tax liabilities.

you’ll be able to see how much you’ve invested in your coins and determine your actual return on investment in fiat currency.

In addition, It provides an income overview that breaks down the details of your mining, staking, lending, and other crypto-based income.

It also makes it easy to track your profit/loss and capital gains. You can easily view your realized and unrealized capital gains, and keep track of how much you’ve earned or lost.

Related: Best Crypto Portfolio Tracker Apps

Tax-Loss Harvesting [Not Included]

Tax-loss harvesting is a strategy used by investors to minimize their tax liability by selling assets that have experienced losses and offsetting those losses against gains from other assets.

Koinly does not have a dedicated feature for Tax-loss harvesting, but still you can use its reports for this purpose.

It provides you with detailed insights into your tax liability, including capital gains, income tax, and other taxes. You can see how much tax you owe or how much you can save.

Koinly Supported Exchanges and Wallets

Koinly supports over 20,000 cryptocurrencies and over 400 exchanges and 100 wallets. It also supports adding blockchain addresses and Defi platforms like Haru Invest.

It supports the Binance, Kraken, and BitMEX exchange, including futures, margin, and spot trading.

It also offers to track margin trading, lending, and staking rewards and gains for accurate portfolio management and tax reporting.

Koinly supports MetaMask and Trust Wallet, which are browser extensions that allow you to interact with decentralized applications (dapps) on the Ethereum and BSC blockchain.

The Software can integrate with Hardware wallets like Ledger and Trezor, without sharing any Private keys or seed phrases.

Koinly Pricing and Fees Review

Koinly offers four pricing plans: Free, $49 per tax year for Newbies, $99 per tax year for Hodlers, and $179 per tax year for Traders. Each plan has different features and transaction limits.

- The Free plan includes basic features and can be used forever.

- The Newbie plan is designed for beginners and allows up to 100 transactions.

- The Hodler plan is suitable for casual users with unlimited wallets and up to 1000 transactions.

- The Trader plan is for professionals and offers unlimited transactions and additional features like FIFO/LIFO accounting methods, portfolio tracking, and more.

Koinly Customer Support and Ease of Use

Koinly offers customer support via email for all its pricing plans and live chat support for users on the Essential plan.

The platform also has a comprehensive knowledge base and FAQ section that users can access to get answers to common questions and issues.

It has an intuitive user interface and offers an easy-to-use platform for tracking cryptocurrency portfolios and transactions, and generating tax reports.

How to Get Started [Open Account] With Koinly?

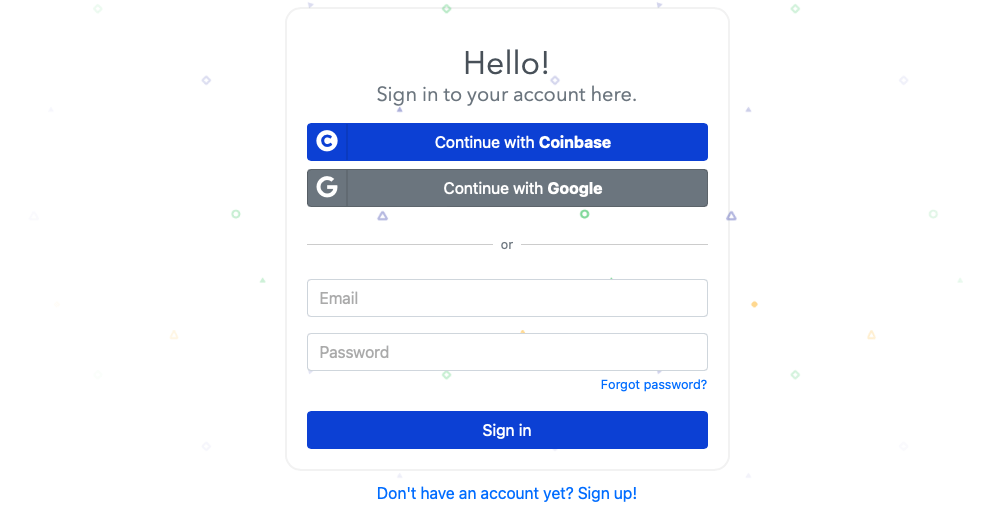

To get started with Koinly and open an account, you can follow these simple steps:

- Go to the Koinly website (https://koinly.io/) and click on the “Get Started for Free” button.

- You will then be asked to sign up for an account by providing your email address and creating a password.

- Once you have signed up, you will be prompted to connect your exchange accounts or wallets by selecting from a list of supported exchanges or wallets.

- Follow the prompts to connect your exchange accounts or wallets by entering your API keys or by uploading your transaction history files.

- Once your accounts have been connected, Koinly will automatically import your transaction history and start generating your tax reports.

- You can customize your tax reports by selecting the tax year, currency, and tax method.

- You can also use Koinly’s portfolio tracking features to keep track of your cryptocurrency holdings, profits, and losses.

Alternatives and Comparisons

| Feature | CoinTracker | Koinly |

|---|---|---|

| Supported assets | 8,000+ | 20,000+ |

| Exchange support | 300+ | 400+ |

| Tax Report | Yes | Yes |

| Real-time sync | Yes | Yes |

| Mobile app | Yes | Yes |

| Tax-loss Harvesting | Yes | No |

| Pricing | $59 – $199 per year | $49 – $179 per year |

| Customer support | Email and chat support | Email and chat support |

| Visit CoinTracker | Visit Koinly |

Related: CoinTracker Review

Final Thoughts: Is Koinly Worth it?

In conclusion of Koinly Review, It is a powerful tax reporting platform that can help cryptocurrency traders and investors stay compliant with tax regulations.

With its user-friendly interface, advanced portfolio tracker, and comprehensive reporting options, Koinly is a great choice for anyone looking to streamline their tax reporting process.

While the pricing can be expensive for users with a large number of transactions, the platform’s features and benefits make it well worth the investment.

FAQs

Is Koinly Safe to Use?

Yes, Koinly is safe to use. The platform takes security very seriously and uses bank-grade security measures to protect user data.

It is fully compliant with regulations, including the GDPR and anti-money laundering regulations. The platform also uses two-factor authentication to ensure that only authorized users have access to the account.

Additionally, Koinly does not have access to user funds or private keys, further ensuring the safety of user data.

Is Koinly Tax Reporting Accurate?

Yes, Koinly’s tax reporting is accurate. The platform uses advanced algorithms and data analysis techniques to ensure that tax reports are accurate and compliant with tax regulations.

Which payment methods does Koinly accept?

Koinly accepts payment via credit card, PayPal, and cryptocurrency. It offers users a range of payment options to choose from, making it easy to pay for a subscription.

The platform accepts a range of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Can I try Koinly for free?

Yes, Koinly offers a free trial for users to test out the platform before committing to a subscription. The free trial provides access to all features and supports up to 10,000 transactions and unlimited Crypto Wallet and Exchange integration.