Cryptocurrency exchanges have become the go-to platform for trading digital assets. With the rising popularity of cryptocurrencies, investors and traders are looking for the best exchange to suit their needs. KuCoin and Kraken are two popular exchanges in the crypto industry, but how do they compare?

In this blog post, we will do a comprehensive comparison between KuCoin and Kraken, looking at their features, fees, security, and more.

By the end of this article, you will have a better understanding of which exchange is best suited for your trading needs. So, let’s get started!

Key Takeaways:

- Kucoin is a well-established Global crypto Exchange, while Kraken is well-suited for US Customers for regulatory compliance.

- Kucoin supports more cryptocurrencies and Fiat than Kraken Exchange.

- Kraken has high volume and Liquidity than Kucoin.

Kucoin vs Kraken: Platform Features

| Features | KuCoin | Kraken |

|---|---|---|

| Fiat Currencies | USD, EUR, GBP, RUB, CNY, AUD & 40+ more | USD, EUR, GBP, JPY, CAD, CHF, AUD |

| Supported Cryptocurrencies | 700+ | 185+ |

| Trading Fees | 0.1% | 0.1% / 0.76% |

| Payment methods | Bank Transfer (SEPA), Bank Transfer (ACH), Fedwire, PayPal, Credit Card (not available in USA), Debit Card (not available in USA), Apple Pay, SWIFT, Skrill, SOFORT/iDEAL, Cryptocurrency | Bank Transfer (ACH), Bank Transfer (Fedwire), Crypto Transfer |

| User-friendly | ✔ | ❌ |

| Mobile App | ✔ | ✔ |

| Support | ✔ | ✔ |

| Fund Security | 2FA, Biometric Security, ISO 27001 Certified, Offline Cold Storage | 2FA, PGP Encryption, Global Settings Lock, Master Key |

| Solvent | ✔ | ✔ |

Review

Kucoin Overview

KuCoin is a cryptocurrency exchange platform. It was launched in 2017 and is headquartered in Seychelles. The platform supports the trading of various cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

KuCoin offers a user-friendly interface and a mobile app for trading on the go. It also has a high level of security with features such as two-factor authentication and SSL encryption.

Key Features of Kucoin

- Over 400 trading pairs are available on the platform.

- Advanced security measures to safeguard users’ funds.

- User-friendly interface and a mobile app for easy trading.

- Low trading fees of 0.1% for all trades.

- The native token, KCS, provides trading fee discounts and other benefits.

- Margin trading is available for increased position size.

- Upto 100x Futures trading enables traders to speculate on cryptocurrency prices.

- Staking rewards are available for certain cryptocurrencies.

- 24/7 customer support is provided via live chat, email, and phone.

Pros and Cons of Kucoin

| Pros 👍 | Cons 👎 |

|---|---|

| Bitcoin Cloud Mining with a Yield of up to 300% | Occasional technical issues |

| User-friendly interface for beginners | Not regulated by a well-known financial authority |

| More trading pairs and P2P Trading | Customer support issues |

| Mobile app available for iOS and Android | No Fiat Withdrawal |

| High level of security measures | |

| KuCoin Shares (KCS) offer discounts and other benefits to users | |

| Supports trading in many languages |

Review

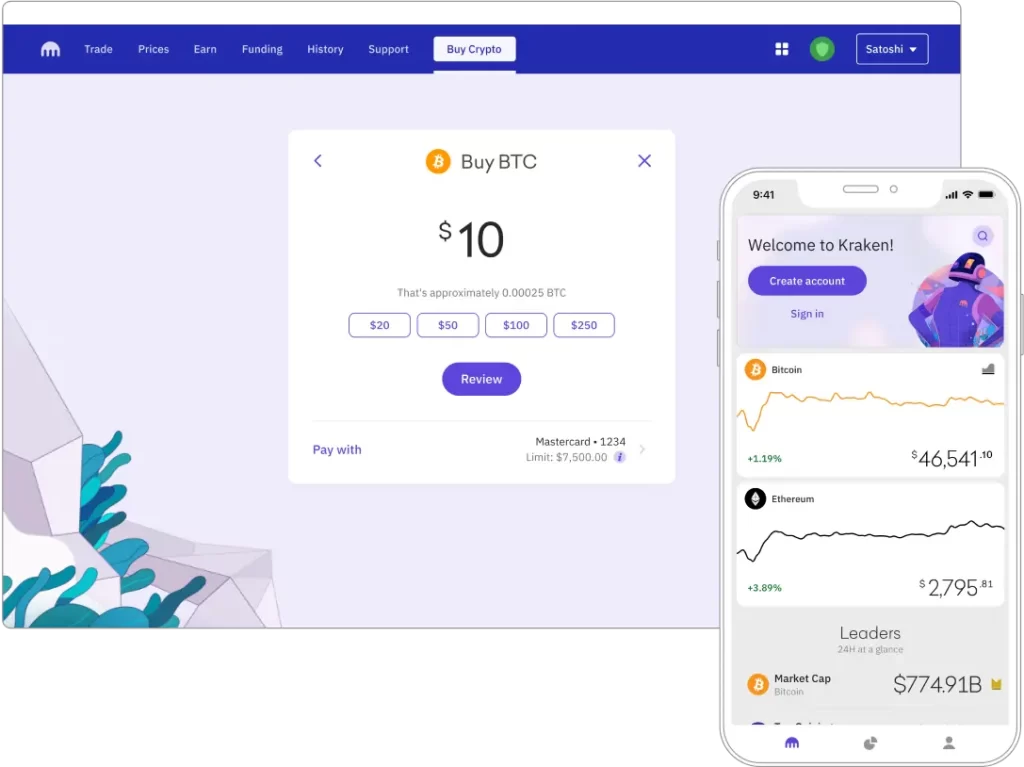

Kraken Overview

Kraken is a cryptocurrency exchange platform. It was founded in 2011 and is based in San Francisco, California. It offers advanced trading features like margin trading and futures trading. Kraken also provides institutional clients with access to its OTC (over-the-counter) trading desk.

The platform has a reputation for security and has never been hacked. Kraken operates in many countries and supports multiple fiat currencies. It has a user-friendly interface and offers 24/7 customer support.

Key Features of Kraken

- Kraken offers multiple cryptocurrencies for trading.

- Advanced trading tools include margin, futures, and options trading, and an intuitive interface.

- Security measures include two-factor authentication, encryption, and cold storage of funds.

- Kraken is a regulated exchange compliant with the laws and regulations of the countries where it operates.

- High liquidity due to its large trading volume.

- Low trading fees, with discounts available for holding Kraken tokens.

- Provides 24/7 customer support via email and live chat and a comprehensive help center.

Pros and Cons of Kraken

| Pros | Cons |

|---|---|

| High liquidity | Limited selection of cryptocurrencies |

| Low transaction fees | Limited fiat currency support |

| Advanced trading tools | Slow customer support |

| High level of security | Limited availability in some countries |

| Well-established reputation | No margin trading for US customers |

| Strong regulatory compliance | Limited payment options for fiat deposits |

| User-friendly interface | |

| Mobile app available |

KuCoin vs Kraken: Similarities and Differences

Payment Methods

KuCoin and Kraken support several fiat currencies, including USD, GBP, and EUR. However, KuCoin supports a larger number of fiat currencies than Kraken, with a total of 46 supported fiat currencies.

Both crypto Exchanges support various deposit methods, including bank transfer, wire transfer, and credit/debit cards. Additionally, KuCoin also supports SEPA, Apple Pay, and other deposit methods, while Kraken supports Google Pay in addition to the other deposit methods

Winner: Kucoin supports more fiat and deposit methods.

Supported Cryptocurrencies

KuCoin supports a larger number of cryptocurrencies than Kraken. It is well known for low market cap digital assets and Fractional NFTs tokens like Hidoodles, HiAzuki, HiBAYC, etc.

- KuCoin supports 806 cryptocurrencies.

- Kraken supports 222 cryptocurrencies.

Winner: Kucoin offers more trading pairs than Kraken

Trading Types

KuCoin and Kraken are both cryptocurrency exchanges that offer a variety of trading options. In terms of trading types, both exchanges offer margin trading, leverage trading, spot trading, and copy trading. However, there are differences between the two exchanges in terms of the features and functionality they offer for each type of trading.

Margin Trading

Margin trading allows traders to borrow funds from the exchange to increase their trading position. Both KuCoin and Kraken offer margin trading, but KuCoin has a wider range of available assets for margin trading.

KuCoin also offers a lower minimum borrowing amount and a higher maximum borrowing amount compared to Kraken.

In addition, KuCoin allows users to choose between isolated margin and cross-margin trading, while Kraken Pro only offers isolated margin trading.

Leverage Trading

Leverage trading allows traders to open positions with a higher value than their account balance, using borrowed funds.

KuCoin offers leverage trading with up to 100x leverage, while Kraken offers leverage trading with up to 5x leverage. However, Kraken Pro offers more trading pairs for leverage trading compared to KuCoin.

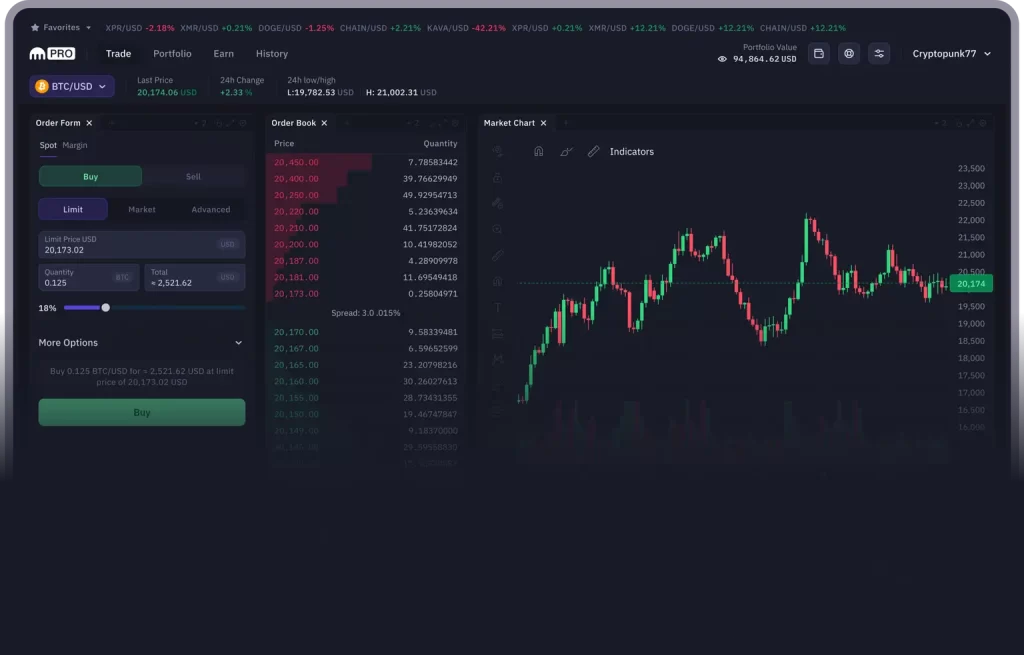

Spot Trading

Spot trading refers to buying and selling cryptocurrencies at the current market price. Both KuCoin and Kraken offer spot trading for a wide range of cryptocurrencies.

However, Kraken offers more advanced trading tools such as market depth charts, order book depth charts, and price alerts.

Copy Trading

Copy trading allows traders to automatically copy the trades of more experienced traders. KuCoin offers copy trading through its social trading feature, which allows users to follow and copy the trades of top traders on the platform. Kraken does not offer a copy trading feature.

Winner: Kucoin has more trading features than Kraken

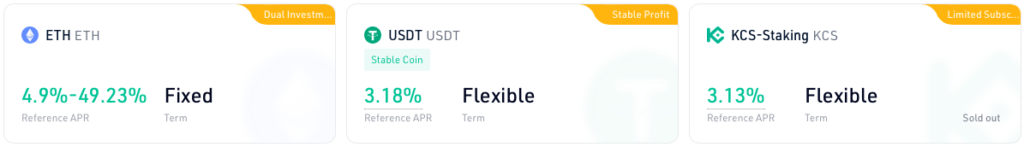

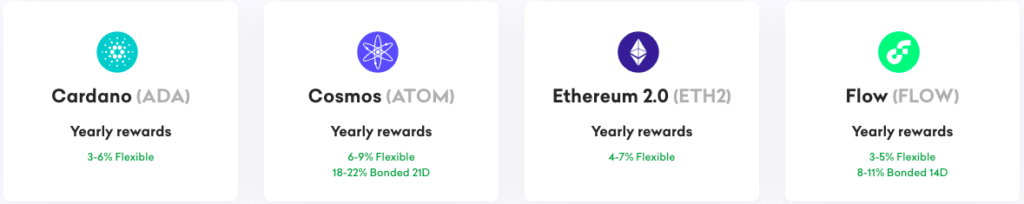

Staking and Earn

Both KuCoin and Kraken offer staking services that allow users to earn rewards by holding certain cryptocurrencies on their platforms.

Here are some key differences between the two:

- Coins supported: KuCoin supports staking for over 40 cryptocurrencies, while Kraken supports staking for only a handful of coins, including Polkadot (DOT), Kusama (KSM), Cosmos (ATOM), and more recently, Ethereum 2.0 (ETH2).

- Rewards: The staking rewards offered by KuCoin are generally higher than those offered by Kraken. For example, at the time of writing, the staking rewards for Polkadot on KuCoin are around 16%, while on Kraken, they are around 12%.

- Fees: Zero fees for staking.

Note: Kraken does not allow staking for US Customers.

Winner: Kucoin for higher staking APY than Kraken

Trading Volume & Liquidity

Kraken is a more established exchange with a larger user base and higher trading volume. According to Coingecko, Kraken currently has a 24-hour trading volume of over $1.5 billion, while Kucoin has a trading volume of around $800 million.

This means that there is more activity and more liquidity on Kraken, which can make it easier for traders to buy and sell cryptocurrencies at favorable prices.

Kraken has high liquidity on major coins with an average score of 830 out of 1,000. In comparison, KuCoin’s average liquidity score is lower at 670. However, KuCoin provides excellent liquidity scores of 650 or higher for popular coin pairs such as USDC, USDT, BTC, and ETH. These scores are crucial for traders to determine if they can place significant orders without experiencing slippage.

Kraken is a spot trading platform that offers superior overall liquidity, making it the ideal choice for seasoned traders dealing with significant orders in cryptocurrency day trading.

Winner: Kraken has more trading volume and Liquidity

Various Exchanges Fees

KuCoin and Kraken offer different fee structures for trading, depositing, and withdrawing cryptocurrencies.

| Kucoin | Kraken | |

|---|---|---|

| Spot (fiat-to-crypto) | 0.1% (maker) / 0.1% (taker) | Instant Buy: 0.1% – 4%, Trading: from 0.1% (maker) / 0.36% (taker) |

| Leverage trading | From 0.025% (maker) / 0.07% (taker) | From 0.03% (maker) / 0.09% (taker) |

Trading fees

KuCoin charges a flat fee of 0.10% per trade for both market makers and takers, regardless of trading volume or cryptocurrency. There are no discounts for high-volume traders. However, KuCoin offers a fee reduction program that allows users to reduce their trading fees by up to 30% by holding and staking the platform’s native token, KCS.

Kraken’s trading fees vary depending on the trading volume and the type of account. For spot trading, Kraken charges a maker fee of 0.16% and a taker fee of 0.26% for the lowest volume tier (less than $50,000 per month). The fees decrease as the trading volume increases, with the highest volume tier (over $10 million per month) having a maker fee of 0.00% and a taker fee of 0.10%. Kraken also offers a fee reduction program for high-volume traders.

Deposit fees

KuCoin does not charge any fees for cryptocurrency deposits. However, the exchange charges a network fee for withdrawals, which varies depending on the cryptocurrency.

Kraken also does not charge any fees for cryptocurrency deposits. However, the exchange charges a deposit fee for some fiat currencies, such as USD and EUR, which can range from 0% to 5%, depending on the deposit method.

Withdrawal fees

KuCoin charges a network fee for withdrawals, which varies depending on the cryptocurrency. The fee is calculated based on the current network congestion and the size of the transaction.

Kraken Pro charges a withdrawal fee for both cryptocurrencies and fiat currencies. The withdrawal fees for cryptocurrencies range from 0.0005 BTC to 0.005 BTC, depending on the cryptocurrency. The withdrawal fees for fiat currencies vary depending on the withdrawal method and the currency.

Margin trading fees

KuCoin offers margin trading for some cryptocurrencies and charges a daily interest rate on borrowed funds. The interest rate varies depending on the cryptocurrency and the amount borrowed.

Kraken pro also offers margin trading for some cryptocurrencies and charges a daily interest rate on borrowed funds. The interest rate varies depending on the currency pair and the amount borrowed.

Winner: Kucoin charges fewer trading Fees. However, For high-volume traders, Kraken charges less fees.

Supported Countries

KuCoin and Kraken are two exchanges that cater to customers all over the world, with a presence in more than 190 countries.

KuCoin has a derivatives market but is restricted in some nations due to regulatory requirements, such as the United States. Nevertheless, it is accessible in all other supported nations and has a massive customer base of over 21 million users, which makes it one of the largest exchanges globally.

Kraken, on the other hand, is a popular exchange that is highly regarded in the United States. Although it lacks the same global reach as KuCoin, Kraken still has over 10 million customers in 150+ countries around the world.

Winner: Kraken is better for the United States, Kucoin is more Globally adopted.

Trading Experience and User-Friendly

Kucoin offers a modern and intuitive user interface that is easy to navigate. The platform is available on both the web and mobile and users can trade a wide variety of cryptocurrencies.

One of the unique features of Kucoin is the ability to earn rewards through its loyalty program. Kucoin’s customer service is also highly regarded, with a dedicated support team available 24/7.

Kraken Pro has a clean and professional user interface that is also easy to use. The platform is available on both the web and mobile, and users can trade a wide range of cryptocurrencies, including some that are not available on other exchanges. Kraken’s customer service is also highly regarded, with a dedicated support team available 24/7.

Must-Read Comparisons:

- Binance Vs Crypto.com

- Gemini Vs Coinbase

- Crypto.com Vs. Kraken

- Binance Vs Kraken

- Binance Vs. Bittrex

- Bybit Vs Kucoin

- Bybit Vs Binance

Are Kucoin and Kraken Solvent?

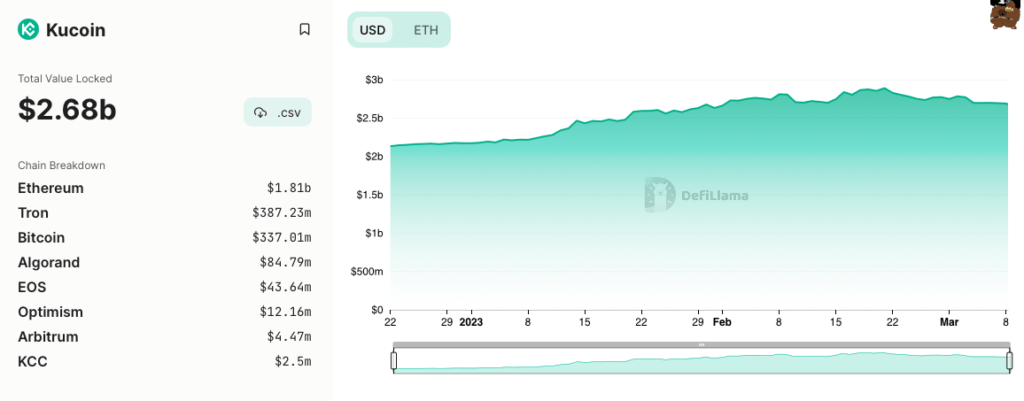

Kucoin is completely solvent with $2.68 billion in Reserve Assets. According to on-chain data, Kucoin holds:

- Ethereum: $1.81b

- Tron: $387.23m

- Bitcoin: $337.01m

- Algorand: $84.79m

- EOS: $43.64m

- Optimism: $12.16m

- Arbitrum: $4.47m

- KCC: $2.5m

According to Armanino, Kraken also holds a 100% assets-to-collateral Ratio. You can also check Kraken’s solvency using its official website.

How to Signup and Trade on Kucoin Exchange?

Here’s a step-by-step guide to signing up and trading on the Kucoin exchange:

- Go to the Kucoin website: Use this Link for a $500 Mystery Box

- Click on the “Sign Up” button in the upper right-hand corner.

- Enter your email address and create a strong password.

- Agree to the terms of service and click on “Sign Up”.

- Verify your email by clicking on the link sent to your inbox.

- Log in to your Kucoin account.

- Click on “Assets” in the top menu and then “Deposit” to add funds to your account.

- Choose the cryptocurrency you want to deposit and follow the instructions provided to transfer it to your Kucoin wallet.

- Once your funds have been added to your account, go to the “Markets” tab in the top menu and choose the trading pair you want to trade.

- Click on “Trade” and choose the type of order you want to place (market, limit, stop-limit).

- Enter the amount of cryptocurrency you want to buy or sell and review the details of your order.

- Click on “Buy” or “Sell” to execute your trade.

How to Register and Trade on Kraken?

- Go to the Kraken website and click on the “Sign Up” button.

- Enter your email address and create a strong password.

- Verify your email address by clicking on the verification link in your email.

- Fill out your personal information, such as your name, birthdate, and country of residence.

- Set up two-factor authentication (2FA) to secure your account.

- Upload your ID verification documents, such as a passport or driver’s license, to verify your identity.

- Once your account is verified, deposit funds into your account by selecting the deposit method of your choice and following the instructions.

- Choose the cryptocurrency you want to trade and select the trading pair. For example, if you want to trade Bitcoin for Ethereum, select the BTC/ETH trading pair.

- Choose the type of order you want to place, such as a market order or a limit order.

- Enter the amount of cryptocurrency you want to buy or sell, and review the order details.

- Confirm the order and wait for it to be executed.

Kucoin vs Kraken: NFT Marketplaces

Kucoin has recently launched its own NFT marketplace, which offers a range of digital collectibles, such as artwork, music, and gaming assets. The platform supports a variety of blockchains, including Ethereum, Binance Smart Chain, and KuCoin Community Chain, which allows users to trade NFTs from different ecosystems.

Kucoin also offers a user-friendly interface and low fees for buying and selling NFTs. However, the selection of NFTs on Kucoin is still relatively limited compared to other marketplaces.

Kraken is a platform that allows users to trade NFTs in a secure environment. It provides industry-leading security to protect users’ NFTs from theft or hacking attempts.

Additionally, Kraken NFT offers zero gas fees for trades, which means users can avoid paying transaction fees that are commonly associated with NFT trading. Kraken NFT also allows users to track the rarity rankings of their NFTs, which can help them understand the value of their collection. Furthermore, users can pay for NFTs with cash or a wide variety of cryptocurrencies, including 185+ options.

Another advantage of Kraken NFT is that users can collect NFTs across multiple blockchains, giving them access to a wider range of NFTs. Lastly, Kraken NFT offers customer support 24/7, 365 days a year, ensuring users can get help whenever they need it.

KuCoin vs. Kraken: Exchange and Fund Security

Both KuCoin and Kraken are reputable cryptocurrency exchanges that take security seriously. Here’s a comparison of their security features:

KuCoin and Kraken:

- Multi-layer security architecture: Both use a multi-layer security architecture that includes industry-standard practices like two-factor authentication (2FA) and anti-phishing code.

- Cold storage: The majority of user funds on KuCoin are stored in cold wallets that are isolated from the internet, making them less vulnerable to hacking attempts.

- Security audits: KuCoin and Kraken regularly conduct security audits to identify and fix potential vulnerabilities.

Final Thoughts: Kucoin or Kraken (which is better?)

In conclusion, both Kucoin and Kraken are reputable and reliable crypto exchanges that offer a range of features and services for their users. Kucoin is a newer exchange that offers a wide selection of altcoins and low trading fees, while Kraken is a more established exchange that offers advanced trading tools and security features.

If you’re looking to trade a variety of altcoins and want to keep trading fees low, then Kucoin may be the better option. However, if you’re more interested in advanced trading tools and security features, then Kraken may be the better choice.

FAQs

Is Kraken a safe crypto exchange?

Kraken has established itself as a reputable and secure crypto exchange platform, with a strong focus on security measures and regulatory compliance. Kraken has never been hacked since its launch in 2011, and it employs various security measures, such as two-factor authentication, PGP/GPG encryption, and cold storage for user funds. Additionally, Kraken is fully licensed and regulated in multiple jurisdictions, including the United States, Canada, and the European Union.

Is Kucoin a safe crypto exchange?

Kucoin has experienced a security breach in the past, but since then, it has implemented significant security improvements to protect its users’ funds. These measures include multi-factor authentication, withdrawal address whitelist, and regular security audits. Kucoin is also registered and licensed in various jurisdictions, including Seychelles, Malta, and Australia, which helps provide regulatory oversight.

Is Kraken as good as Binance?

Kraken and Binance are both reputable and well-established crypto exchanges, but they differ in terms of their strengths and weaknesses. Kraken is known for its strong regulatory compliance and security measures, while Binance has a more extensive selection of cryptocurrencies and trading options