Are you ready to take a dive into the world of Avalanches? The Avalanche ecosystem is home to a plethora of coins and tokens, each with its own unique features and potential for growth.

In this blog post, we’ll be showcasing the top Avalanche ecosystem coins that you should keep an eye on in the crypto market.

From established players to up-and-coming projects, these coins are poised to make a big impact in the industry.

So buckle up and get ready to discover the future of Avalanche!

Key Takeaways:

- The top avalanche ecosystem coins are JOE, Snowball, sushiswap, etc., which are decentralized exchanges or DEX.

- AVAX has been getting a lot of attention nowadays. It is currently the 12th largest cryptocurrency by market capitalization, according to Coinmarketcap.

Top Avalanche Ecosystem Coins by Market Capitalization

| Name | Price | Category | M.Cap |

|---|---|---|---|

| JOE | $0.2462 | Defi, DEx | $79,789,368 |

| Anyswap | $5.43 | Defi, DEx | $102,674,030 |

| REEF | $0.003958 | Web3, gaming | $79,159,396 |

| Sushiswap | $ 1.33 | Defi, DEx | $169,520,268 |

| BIFI | $390.40 | Defi, DEx | $28,206,537 |

| Snowball | $0.02914 | Dapp, Staking | $150,417 |

| Pangolin | $0.0538 | DEx | $6,725,900 |

List of Top Avalanche Ecosystem Coins

- JOE: Best DEx among AVAX Ecosystem coins

- Pangolin: DEx that uses AMM approach on AVAX

- Snowball: Best DApp for NFTs on Avalanche ecosystem

- Sushiswap: High Market cap DEx on AVAX

- AnySwap: Another famous swapping DEx on the avalanche ecosystem

- REEF: NFT and gaming-based Defi project on Avalanche

- BIFI: Muti chain DApp for Interest in Avalanche ecosystem

Must Read: Avalanche vs Cosmos Ecosystem

1. TraderJOE (JOE)

Trader JOE is one of the most popular DEX (Decentralised Exchange) platforms among the Avalanche ecosystem coins. JOE provides yield farming, staking, and lending. Trader Joe’s delivers all of the features of a modern DEX, as well as a user-friendly interface and quick and low-cost transactions.

Users can contribute liquidity by participating in one of the yield farms and earning JOE (JOE), which can then be staked and used to vote on governance initiatives.

Some features of Trader JOE include:

- Decentralized: Trader Joe is decentralized, which means that it operates without a central authority or intermediary. This makes it resistant to censorship and tampering and allows users to retain control over their assets.

- Fast and cheap: Trader Joe is built on the Avalanche blockchain, which is known for its fast transaction speeds and low fees. This makes it an attractive platform for traders who want to buy and sell assets quickly and cheaply.

- Easy to use: Trader Joe has a user-friendly interface that makes it easy for users to buy and sell assets on the platform.

- Secure: Trader Joe uses advanced security measures to protect users’ assets and prevent fraud.

- Multiple assets: Trader Joe supports a wide range of assets, including cryptocurrencies, stablecoins, and tokens. This gives users the ability to trade a variety of different assets on the platform.

2. Pangolin

Pangolin is also one of the top DEx platforms among the avalanche ecosystem coins. PNG provides liquidity pools on its platform. Pangolin is a DEX based on Avalanche that uses the same automated market-making (AMM) mechanism as Uniswap.

It has a native governance token called PNG that is fully community distributed and can trade all Ethereum and Avalanche tokens.

Pangolin provides three crucial advantages: quick and inexpensive trades, community-driven development, and fair and transparent token distribution.

Some of the features of the Pangolin include:

- A simple and intuitive interface for managing transactions and interacting with the Avalanche blockchain.

- Support for multiple networks, including the main Avalanche network and test networks.

- A built-in wallet for securely storing and managing Avalanche assets.

- Integration with the Avalanche Explorer, a tool for exploring and analyzing the state of the Avalanche blockchain.

- Support for staking and voting, allowing users to participate in the governance of the Avalanche network.

- An API for developers to build applications on top of the Avalanche blockchain.

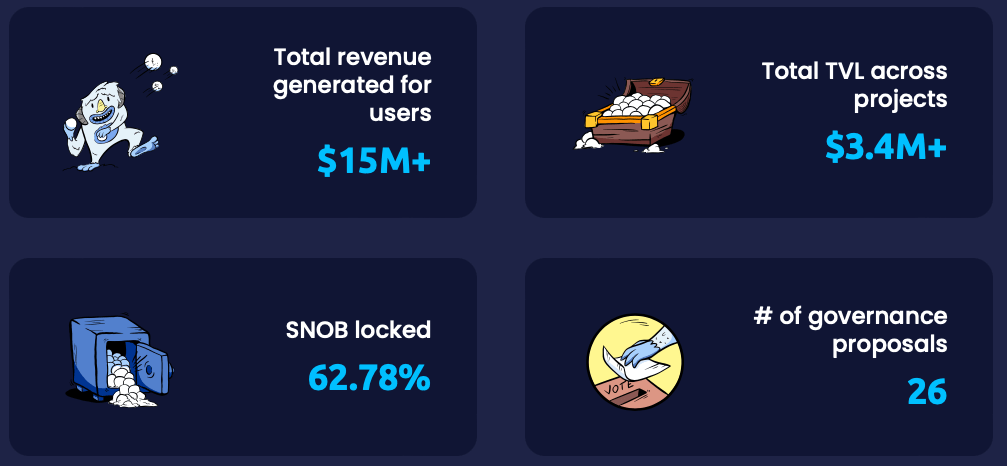

3. Snowball (SNOB)

Snowball (SNOB) is a protocol for the Avalanche blockchain that allows users to propose and vote on the addition or removal of nodes to the network.

It is designed to be a decentralized, self-governance mechanism that allows the Avalanche community to collectively maintain and improve the network.

Here are some key features of Snowball:

- Decentralized: Snowball is designed to be decentralized and allow users to propose and vote on node changes without the need for a central authority.

- Self-governance: Snowball allows the Avalanche community to collectively govern the network and make decisions about which nodes should be added or removed.

- Improved network performance: By allowing users to propose and vote on the addition or removal of nodes, Snowball can help improve the overall performance of the Avalanche network by ensuring that it is populated with high-quality, reliable nodes.

- Community involvement: Snowball encourages community involvement and allows users to have a say in the direction and development of the Avalanche network.

4. Sushiswap

SushiSwap (SUSHI) is an instance of a market maker that is automated (AMM). AMMs are decentralized exchanges that employ intelligent contracts to generate specified pairs of coins, becoming extremely prevalent among crypto enthusiasts.

DEX launched in September 2020 as a derivative of Uniswap, the Automated market maker that has become popular with the decentralized finance (Defi) movement and the ensuing Defi token trading explosion.

SushiSwap intends to expand the AMM market while introducing new features not seen on Uniswap, such as higher benefits for network users via the SUSHI token.

Key Features:

- Automated market-making (AMM): SushiSwap uses a liquidity pool model, which allows users to provide liquidity to the exchange and earn trading fees in return. This allows for continuous market-making and improved liquidity, as there are always buyers and sellers available to match orders.

- Token staking: SushiSwap uses a token staking system to incentivize users to provide liquidity and contribute to the exchange. Staking SUSHI tokens allows users to earn a share of the trading fees collected by the exchange, as well as governance rights to make decisions about the direction of the platform.

- Governance system: SushiSwap has a decentralized governance system that allows token holders to vote on various proposals and make decisions about the direction of the platform. This includes everything from new feature development to token listings and other operational matters.

- Integration with other platforms: SushiSwap has integrations with other popular cryptocurrency platforms, such as MetaMask and Uniswap, which allows for easy access and trading for users of these platforms.

- Community involvement: SushiSwap has a strong focus on community involvement and encourages users to get involved in the development and governance of the platform. This includes hosting regular community calls, allowing users to propose and vote on governance proposals, and hosting hackathons and other events.

5. Anyswap

AnySwap, a decentralized system was established in 2020 to allow tokens from multiple platforms to be traded.

It’s one of several networks that have joined the Defi industry to make cross-token exchanges and trade easier.

Fusion is the engine that drives Anyswap. To ensure asset security, the Fusion Network employs a mechanism known as private key sharding, in which the private key is divided into many pieces and handled by several network nodes.

To increase security, the separate components of the private key are never joined during transactions or trading.

6. REEF

The REEF is a Defi, NFT, and Gaming-focused Reliable Extensible Efficient Fast Layer-1 Blockchain. It’s built using Substrate Framework and offers excellent scalability, allowing for practically immediate minimal transfers.

It also supports Solidity and EVM and enables developers to move their Decentralized applications from ETH with few code changes.

It’s built using Substrate Framework and offers excellent scalability, allowing for practically immediate minimal transfers. It also supports Solidity and EVM and enables developers to move their Decentralized applications from ETH with few code changes.

Pros & Cons

REEF is a native token that may be used for various things.

- Costs for payment analysis and information storage.

- They are staking REEF coins to operate validator nodes.

- Choosing which validator nodes to include in the network.

7. BIFI

Beefy Finance is a multi-chain, decentralized profit optimization application that enables them to generate compound interest on their digital currencies.

Beefy Finance optimizes user benefits from different liquidity pools (LPs), automated market-making (AMM) initiatives, and other yield farming possibilities in the Defi ecosystem using a set of investing techniques protected and enforced by smart contracts.

How does Avalanche Work?

Avalanche is a consensus protocol that is designed to provide fast and secure transaction finality in decentralized networks. It works by allowing multiple validators to propose and vote on the next block of transactions in the network.

Here’s a high-level overview of how Avalanche works:

- Validators propose transactions and create blocks: Validators (also known as “nodes”) in the network propose new transactions and package them into blocks. These blocks are then broadcast to the rest of the network.

- Validators vote on blocks: Other validators in the network receive the proposed blocks and vote on their validity. They do this by creating and signing a special type of transaction called a “vote”. Votes are used to indicate whether a validator supports a particular block.

- The block with the most votes is chosen: The block with the most votes is considered the “winning” block, and it is added to the blockchain. If there is a tie, the protocol uses a random number generator to choose the winning block.

- The network reaches consensus: As new blocks are added to the chain, the network eventually reaches consensus on the state of the ledger. This means that all validators agree on the set of transactions that have been processed and the order in which they were processed.

Must Read: Avalanche vs Solana- Which is better?

Key Features of Avalanche (AVAX)

- Fast transaction speeds: Avalanche can process thousands of transactions per second

- High scalability: Suitable for large-scale applications

- Decentralized governance: powered by a decentralized network of validators

- Smart contract support: enables creation and execution of self-executing contracts

- Cross-chain interoperability: ability to connect with other blockchains

- Customizable consensus algorithms: allows users to choose from a variety of consensus algorithms like PoS

Difference between AVAX vs. Ethereum vs. Bitcoin vs. Polkadot

| Properties | Bitcoin | Ethereum | Polkadot | Avalanche |

|---|---|---|---|---|

| Transactions Throughput | 7 tps | 14 tps | 1500 tps | > 4500 tps |

| Transactional Finality | 60 min | 6 min | 60 sec | < 2 sec |

| energy efficient | No | No | Yes | Yes |

| Technology | PoW | PoW | PoS | PoS |

| Safety Threshold | 51% | 51% | 33% | >80% |

How to Store Avalanche Ecosystem Coins?

There are several good options for storing Avalanche and its ecosystem coins. Here are a few popular options:

- Ledger Nano X: This hardware wallet is a secure option for storing your Avalanche coins. It supports a wide range of cryptocurrencies, including AVAX, P-Chain, and X-Chain.

- Trezor Model T: This is another hardware wallet that is popular for storing Avalanche coins. It has a large display and supports a wide range of cryptocurrencies.

- Avalanche Wallet: This is the official wallet for the Avalanche platform, and it is available for both desktop and mobile devices. It supports all of the cryptocurrencies in the Avalanche ecosystem, including AVAX, P-Chain, and X-Chain.

- MetaMask: This is a browser extension that allows you to store and manage your Avalanche coins in your browser. It is available for Chrome, Firefox, and Brave.

- MyEtherWallet: This is a popular online wallet that supports a wide range of Ethereum-based tokens, including those in the Avalanche ecosystem.

Where to Buy Avalanche Ecosystem Coins?

The top Decentralized Exchanges to buy Avalanche ecosystem tokens are Pangolin, JOE, Sushiswap, Anyswap, etc.

The top Centralized Exchanges to buy Avalanche Ecosystem Coins are Kucoin, Gate.io, Huobi Global, etc.

AVAX ecosystem coins, such as AVAX, P-Chain, and X-Chain, can be purchased on cryptocurrency exchanges. Here are a few popular exchanges that support AVAX:

- Binance: This is a large and well-known exchange that supports a wide range of cryptocurrencies, including AVAX.

- Bitfinex: This exchange also supports AVAX and a range of other cryptocurrencies.

- OKEx: This exchange supports AVAX and many other cryptocurrencies.

- Huobi Global: This exchange supports AVAX and a wide range of other cryptocurrencies.

Conclusion

In conclusion, the Avalanche ecosystem includes a range of coins that are built on the Avalanche platform. Some of the top coins in the ecosystem include AVAX, TraderJOE, and Pangolin.

Each of these coins has its own unique features and capabilities, and they are all supported by the fast and efficient Avalanche platform.

Whether you are a developer looking to build decentralized applications or an investor looking for new opportunities, the Avalanche ecosystem is definitely worth exploring. As with any cryptocurrency, it is important to do your own research and carefully consider the risks before investing.

However, the Avalanche ecosystem has a lot of potential and could be a great opportunity for those who are willing to take the risk.