The crypto market has been gaining popularity in recent years, with more people investing in digital currencies. As a result, various crypto exchanges and platforms have emerged, including Uniswap and Pancakeswap, which are decentralized exchanges (DEXs).

Both of these platforms allow users to trade cryptocurrencies without intermediaries, enabling them to have full control over their assets. However, each platform has its unique features and benefits that may appeal to different users.

In this article, we’ll delve into the differences between Uniswap vs Pancakeswap and help you decide which one is the best fit for your crypto trading needs.

MEXC

Uniswap vs Pancakeswap: Key Differences and Similarities

| Criteria | Uniswap | PancakeSwap |

|---|---|---|

| Launch Year | 2018 | 2020 |

| Blockchain Network | Ethereum | Binance Smart Chain |

| Liquidity Pools | Yes | Yes |

| Token Support | ERC-20 | BEP-20 |

| Transaction Fees | High, due to Ethereum network congestion | Lower, due to Binance Smart Chain’s lower transaction fees |

| Trading Volume | Very High | High |

| Trading Interface | Not user friendly | User-friendly and easy-to-use interface |

| Governance | Uniswap DAO, giving UNI token holders a say in platform changes | Semi-Centralized |

| Security | High | High |

| Innovation | Pioneered the automated market maker (AMM) model | Liquidity Farming, Staking pools, Lotteries |

| Cross-chain Support | Limited cross-chain support | High |

What is Uniswap?

Uniswap is a decentralized exchange built on the Ethereum blockchain. It was launched in 2018 and quickly gained popularity due to its user-friendly interface and ability to provide liquidity to token pairs automatically. The platform has become one of the most popular DEXs in the crypto market, with a daily trading volume of over $1 billion.

Key Features

Here are some key features of Uniswap:

- Automated Market Maker (AMM) Model: It uses an automated market maker model for trading. Instead of relying on order books like traditional exchanges, Uniswap uses a mathematical formula to determine the price of tokens based on supply and demand.

- Decentralized: Uniswap is completely decentralized and operates on the Ethereum blockchain. There is no central authority controlling the exchange, and all trades are executed via smart contracts.

- Liquidity Pools: It uses liquidity pools to facilitate trades. Anyone can add liquidity to a pool by depositing an equal value of two tokens. In return, they receive liquidity provider (LP) tokens which represent their share of the pool. Traders can then trade against the pool and pay a small fee which is distributed to the LPs.

- No Listing Fees: Unlike centralized exchanges, Uniswap does not charge any listing fees for new tokens. This allows for greater accessibility for smaller projects and reduces barriers to entry.

- Uniswap Token (UNI): It has its governance token called UNI. Holders of UNI can participate in the governance of the platform and receive a share of the trading fees generated by the exchange.

- Metamask Integration: Uniswap is integrated with Metamask, a popular Ethereum wallet. This allows for easy and secure trading directly from a user’s wallet.

- Integration with other Platforms: It is integrated with several other decentralized finance (DeFi) platforms such as Compound, Aave, and MakerDAO, allowing for seamless trading and liquidity provision across multiple platforms.

- Continuous Innovation: The DEX is constantly evolving and improving. The Uniswap V3 upgrade, released in May 2021, introduced new features such as concentrated liquidity and multiple fee tiers, providing greater flexibility for liquidity providers.

What is Pancakeswap?

PancakeSwap is a decentralized exchange (DEX) built on the Binance Smart Chain (BSC). It allows users to swap cryptocurrencies and earn rewards in the form of CAKE, the platform’s native token. Launched in September 2020, PancakeSwap quickly gained popularity among cryptocurrency traders due to its low fees and high liquidity.

Key Features

Here are some key features of PancakeSwap:

- Automated Market Maker (AMM): PancakeSwap uses an AMM model for trading, which means that trades are executed using smart contracts and liquidity pools rather than through a traditional order book.

- Low Fees: It has some of the lowest fees among DEXs, with a trading fee of just 0.2% (0.17% for CAKE holders) and no gas fees for trading on the Binance Smart Chain.

- Yield Farming: PancakeSwap offers yield farming, allowing users to earn rewards in the form of CAKE by staking their cryptocurrencies in liquidity pools. Users can also earn additional rewards through liquidity provision and staking CAKE.

- Non-Fungible Token (NFT) Marketplace: It has a built-in NFT marketplace called PancakeSwap Collectibles, where users can buy, sell, and trade NFTs.

- User-Friendly Interface: PancakeSwap has a user-friendly interface that is easy to navigate, making it accessible to both experienced and novice cryptocurrency traders.

- Security: The Platform takes security seriously and has implemented measures such as two-factor authentication and contract audits to ensure the safety of user funds.

Related: Best Decentralized Crypto Exchanges

Comparison between Uniswap and Pancakeswap

1. User Interface

Pancakeswap has a more polished and user-friendly interface, making it easier for beginners to navigate and trade cryptocurrencies. The platform has a simple design, and users can easily view the price and liquidity of different tokens.

Uniswap, on the other hand, has a more cluttered interface that may be confusing for new users. However, experienced traders may prefer uniswap’s advanced trading features, such as limit orders and stop-loss orders.

2. Supported Cryptocurrencies

Uniswap only supports tokens on the Ethereum blockchain, which limits the number of tokens available for trading.

Pancakeswap, on the other hand, supports both Ethereum-based and Binance Chain-based tokens, providing users with a more extensive selection of tokens to trade.

3. Fees

In terms of fees, both Uniswap and PancakeSwap charge a percentage fee on each trade that goes to liquidity providers and the respective platform itself. However, the fee structures and rates are different.

Uniswap charges a flat fee of 0.3% on each trade, which is split between liquidity providers and the platform. The fee is taken in the form of the cryptocurrency being traded. For example, if you trade 1 ETH for 100 USDT, the fee would be 0.3 USDT Worth of ETH.

PancakeSwap, on the other hand, charges a fee of 0.25% on each trade, which is split between liquidity providers (0.17%) and the platform. The fee is taken in the form of the cryptocurrency being received.

It’s also worth noting that PancakeSwap offers lower fees due to its use of the Binance Smart Chain, which has lower transaction fees compared to the Ethereum network used by Uniswap. This can make PancakeSwap a more cost-effective option for smaller trades.

4. Liquidity

Both Uniswap and Pancakeswap provide liquidity to token pairs automatically through an algorithmic market-making mechanism. However, Uniswap has a more established liquidity pool, with a higher volume of trades and liquidity providers. This results in lower slippage and faster execution times.

Pancakeswap is still growing, and its liquidity pool may not be as deep as Uniswap’s, resulting in higher slippage and slower execution times.

5. Security

Uniswap and Pancakeswap are decentralized exchanges, which means they do not hold users’ funds or personal information. Instead, users have full control over their assets through their private keys.

However, like all decentralized systems, there is always a risk of smart contract bugs or hacks. Both have taken measures to enhance their security, such as conducting audits and implementing bug bounty programs.

6. Governance

Uniswap uses a protocol-based governance system where holders of the UNI token can vote on proposals and upgrades to the protocol.

Pancakeswap, on the other hand, uses a community-driven governance model, where users can submit proposals and vote on them using the CAKE token. This model allows for greater participation and decision-making power among users.

7. Liquidity and Volume

Uniswap has historically had larger trading volumes than PancakeSwap. Data from CoinMarketCap shows that Uniswap has consistently ranked among the top DEXs in terms of volume, while PancakeSwap has usually ranked lower.

However, PancakeSwap has experienced significant growth in trading volume in recent months and has become one of the most active DEXs in the BSC ecosystem.

8. Transaction Speed

Ethereum has struggled with high transaction costs, which has created an opportunity for more efficient platforms with smart contract capabilities, like PancakeSwap.

PancakeSwap, which runs on the Binance Smart Chain (BSC), can offer significantly lower transaction costs compared to Ethereum.

Transaction costs on BSC are just pennies, while fees on Ethereum can reach hundreds of dollars.

In addition to lower costs, BSC also offers faster transaction speeds. This is particularly a problem for Uniswap users who may be trading small amounts and could see their profits eaten up by high gas fees on Ethereum.

Uniswap Versions Overview (V1, V2, and V3)

Uniswap v1

Uniswap v1 was the first version of the platform, launched in November 2018. It allowed users to trade any ERC-20 token for another ERC-20 token without the need for an order book or an intermediary. Instead, Uniswap used a constant product market maker algorithm that relied on pools of tokens to determine the exchange rate.

For example, if you wanted to trade 1 ETH for DAI (a stablecoin), you would deposit 1 ETH and a corresponding amount of DAI into a liquidity pool. The pool would then determine the exchange rate based on the ratio of the two tokens in the pool. This allowed users to trade without the need for a buyer or seller on the other side of the trade.

Uniswap v2

Uniswap v2 was launched in May 2020 and introduced several new features, including the ability to trade any ERC-20 token with ETH. It also introduced a new algorithm that improved price accuracy and reduced the risk of impermanent loss for liquidity providers.

In addition, Uniswap v2 introduced flash swaps, which allowed users to borrow tokens without the need for collateral. Flash swaps enabled developers to build new financial applications on top of Uniswap, such as arbitrage bots and liquidation services.

Uniswap v3

Uniswap v3 was launched in May 2021 and introduced several new features aimed at improving capital efficiency and reducing slippage for traders. The key innovation in Uniswap v3 is the introduction of concentrated liquidity.

Concentrated liquidity allows liquidity providers to concentrate their liquidity within a price range, rather than providing liquidity for the entire trading range. This means that traders can execute larger trades with less slippage, while liquidity providers can earn higher returns by concentrating their liquidity within a narrower price range.

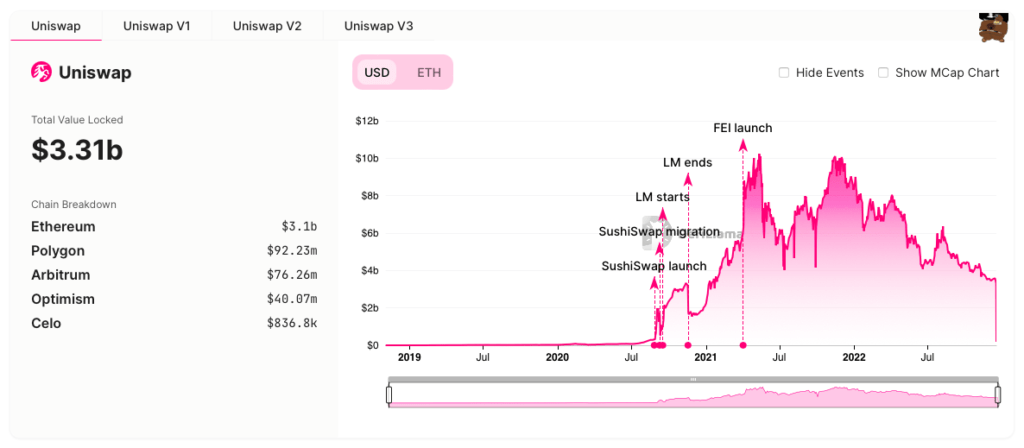

Total Value Locked (TVL): Uniswap vs Pancakeswap

Uniswap

The total value Locked on uniswap Defi is $3.31 billion.

- Ethereum blockchain: $3.1 billion

- Polygon: $92.23 million

- Arbitrum: $76.26 million

- Optimism: $40 million

- Celo: $836k

Pancakeswap

The total value locked on pancakeswap defi is $2.22 billion.

- Binance smart chain: $2.19 billion

- Aptos: $18.67 million

- Ethereum: $10.82 million

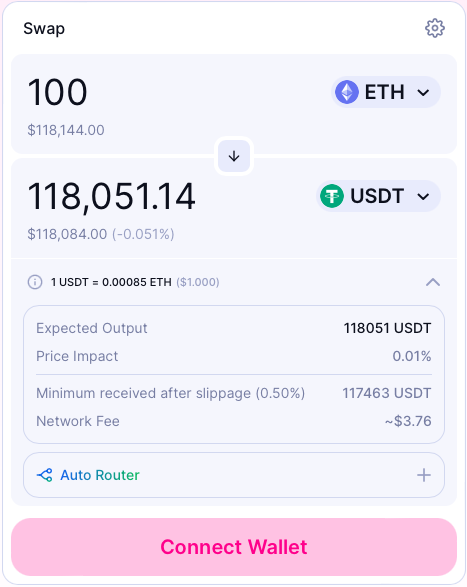

How to swap Tokens on Uniswap or Pancakeswap?

- Go to the Pancakeswap or Uniswap DEX and connect your wallet.

- Choose the tokens you want to swap and enter the amount you wish to trade.

- Select the token you want to receive in exchange and the platform will automatically calculate the estimated rate.

- Adjust the slippage tolerance based on the liquidity of the tokens you’re trading. A higher slippage tolerance can result in a faster trade but also a higher risk of price fluctuations.

- Review the transaction details and confirm the swap.

What is Automated Market Maker (AMM)?

An AMM system uses a pool of funds to facilitate trades. This pool, also known as a liquidity pool, is made up of two cryptocurrencies that are paired together. For example, a pool could consist of 1 ETH and 100 DAI.

When a user wants to make a trade, they send their cryptocurrency to the liquidity pool in exchange for the other cryptocurrency in the pair. The price of the trade is determined by a mathematical formula that takes into account the ratio of the two cryptocurrencies in the pool.

The more a particular cryptocurrency is traded, the more the price of that cryptocurrency will increase. Conversely, the more of a cryptocurrency that is traded, the more its price will decrease. This helps to maintain a relatively stable price for both cryptocurrencies in the pool.

Final Thoughts: Which is better?

If you are looking to trade a wide range of tokens and value a more community-driven governance model, then Uniswap may be the better choice for you. However, if you are looking for lower transaction fees and fast transaction speeds, then Pancakeswap may be the better option.

Regardless of which decentralized exchange you choose, it is important to always exercise caution when trading cryptocurrencies. Decentralized exchanges can still be subject to hacking and other security risks, so it is important to keep your assets secure and be aware of potential risks.

FAQs

How do I use Uniswap or PancakeSwap?

To use Uniswap or PancakeSwap, you will need a compatible Ethereum or Binance Smart Chain wallet, respectively. You can then access the exchange through the wallet’s interface or by visiting the Uniswap or PancakeSwap website. From there, you can search for the token you want to buy or sell, enter the desired amount, and confirm the transaction.

Is it safe to use Uniswap or PancakeSwap?

As with any decentralized exchange, there are some risks to consider when using Uniswap or PancakeSwap. These risks include the possibility of smart contract vulnerabilities, losses due to market volatility, and the risk of losing access to your wallet if you lose your private keys. To minimize these risks, it is important to use a secure wallet and to carefully review the terms and conditions of any contract before entering into it.

Are there fees on Uniswap or PancakeSwap?

Yes, both Uniswap and PancakeSwap charge fees for each trade. The fees on Uniswap are 0.3% of the trade value, while the fees on PancakeSwap are 0.25%. Additionally, both exchanges may charge a small amount of cryptocurrency (e.g., a few cents worth of Ether) to cover the cost of executing the transaction on the blockchain.