As the world of cryptocurrencies continues to evolve, so does the way traders interact with the market. One notable trend that has gained traction in recent years is the use of trading bots within crypto exchanges.

These automated tools offer a range of benefits, from improved efficiency to reduced risks, and have become increasingly popular among both novice and experienced traders alike.

In this blog post, we’ll explore two prominent players in the crypto trading bot space – Pionex vs Kucoin. We’ll delve into the features, advantages, and differences between these platforms, shedding light on how they can enhance your trading experience within their respective Platforms.

Key Takeaways:

- Pionex generally has lower trading fees than Kucoin, making it a more cost-effective option for day traders.

- Pionex offers a variety of advanced trading bots, such as Mean Reversion trading bots and smart trading, which are not available on Kucoin.

- Kucoin offers a larger selection of trading pairs compared to Pionex, with 800+ altcoins.

- Kucoin has a slightly stronger track record of security, having successfully recovered from a major hack in the past, while Pionex is a relatively newer exchange with no such incidents.

Pionex vs Kucoin: Comparison (Which Should You Choose)

| Criteria | Pionex | Kucoin |

|---|---|---|

| Exchange Type | Centralized exchange | Centralized exchange |

| Fees | Maker fee: 0.05%, Taker fee: 0.05% | Maker fee: 0.1%, Taker fee: 0.1% |

| Trading Pairs | 320+ | 1200+ |

| Supported Coins | 210+ | 800+ |

| Deposit Methods | SEPA, Bank, crypto | Bank transfer, Credit/Debit cards, crypto, 3rd party |

| Withdrawal Methods | Cryptocurrency | Cryptocurrency |

| Types of Trading bots | 13+ trading bots including Mean Reversion bot, Leverage bot, TWAP bot, etc. | Grid Trading Bot, Futures Grid Bot and DCA Bot |

| Mobile App | Mobile and iOS | Mobile and iOS |

| Liquidity | Low | High |

| Customer Support | Email, live chat, and social media support | 24/7 customer support |

| Staking | Yes | Yes |

| Referral Program | Yes | Yes |

| Pionex Review | Kucoin Review |

Pionex vs Kucoin: Types of Trading Bots

KuCoin boasts a trio of trading bots, namely the Classic Grid Trading Bot, Futures Grid Bot, and DCA Bot. Among traders, the Classic Grid Trading Bot is the most coveted. By utilizing the Classic Grid Trading Bot, traders can take advantage of market volatility by automatically placing buy and sell orders at predetermined intervals.

This allows traders to sell high and buy low, making the Classic Grid Trading Bot a “volatility killer” among traders.

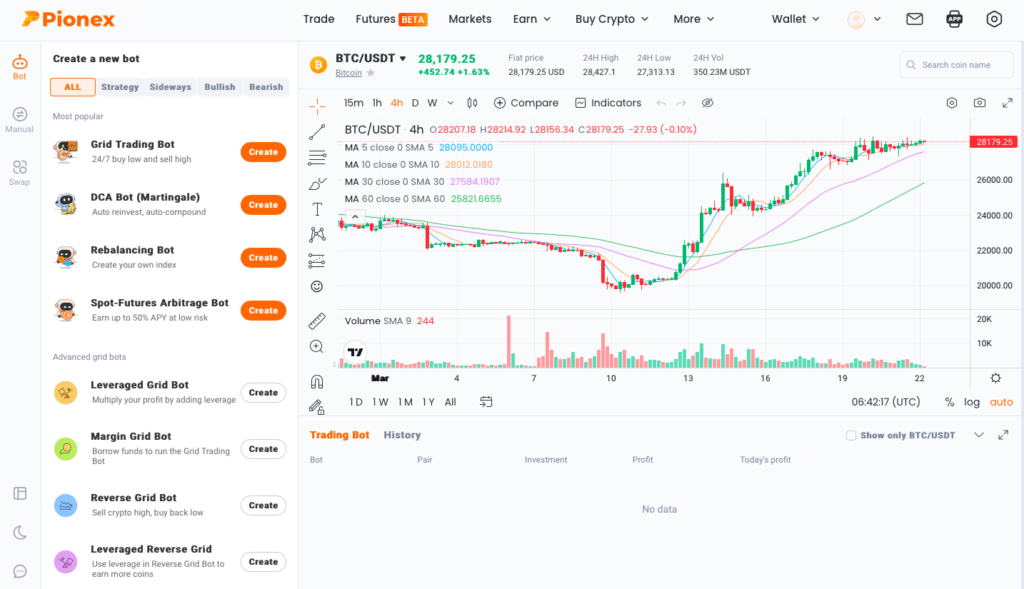

In contrast, Pionex presents a broader selection of trading bots, including 13 unique types such as the Grid Trading Bot (or Classic Grid) and DCA Bot.

Pionex’s Grid Trading Bots are more intricate, and the platform also offers other bots that provide passive income with low risks. This array of options accommodates traders with diverse trading preferences and varying levels of risk tolerance.

Kucoin Trading bots

Classic Grid Trading Bot

The Kucoin Classic Grid Trading Bot is a powerful tool that allows you to trade within a predefined price range, leveraging market volatility to generate profits.

This bot automatically places multiple buy and sell orders at set intervals above and below the current market price, creating a grid of orders. As the price fluctuates, the bot buys low and sells high, capturing profits from the price movements.

The Kucoin Grid Bot is highly customizable, allowing you to set your own trading parameters, such as grid spacing, number of grids, and order size, to suit your trading style and risk tolerance.

Related: 8 Best Crypto GRID Trading Bots

Futures Grid Bot

For those who are more experienced and adventurous in the world of cryptocurrency derivatives trading, the Futures Grid Bot is a game-changer.

This advanced bot is designed specifically for trading perpetual futures contracts, which offer high leverage and allow you to go long or short on a cryptocurrency with leverage.

The Kucoin Futures Grid Bot uses a similar grid trading strategy as the Classic Grid Trading Bot, but on the futures market. It places to buy and sell orders on both sides of the market, capturing profits from the price movements in both directions.

DCA Bot

The Dollar-Cost Averaging (DCA) Bot is a popular choice for long-term investors who prefer a passive investment approach.

This Kucoin bot automates the strategy of Dollar-Cost Averaging, which involves buying a fixed amount of a cryptocurrency at regular intervals, regardless of the market price. The DCA Bot spreads your investment over time, reducing the impact of market volatility and potentially lowering your average purchase price.

You can set your own DCA strategy, including the frequency of purchases, the amount to invest, and the duration of the investment period.

Read: 10 Best Free Crypto Trading Bots

Pionex Trading bots

Pionex also offers DCA and GRID trading bots. But apart from these, it offers 13 more automated bots with different strategies:

- Reverse Grid Bot: Pionex’s Reverse Grid Bot is a unique trading tool that takes a contrarian approach. Instead of buying low and selling high like traditional trading bots, it does the opposite. It sells high and buys low, aiming to profit from price reversals. This bot is suitable for traders who believe in countertrend trading strategies.

- Arbitrage Bot: The Arbitrage Bot takes advantage of price differences across multiple exchanges. It scans for price disparities and automatically executes buy and sell orders to capitalize on the price gaps, generating profits with minimal risk.

- TWAP Bot: The TWAP (Time-Weighted Average Price) Bot offered by Pionex is a smart trading tool that helps traders execute orders at an average price over a specified time period. It’s commonly used for large-volume trades to minimize market impact and slippage, ensuring optimal execution.

- Mean Reversion Bot: Pionex’s Mean Reversion Bot is a strategy that aims to profit from the tendency of asset prices to revert to their historical mean. It uses statistical analysis to identify overbought or oversold assets and executes trades based on the expectation of price reversal.

- Portfolio Rebalancing Bot: It helps traders maintain a balanced investment portfolio. It automatically rebalances the portfolio by buying or selling assets based on predefined weightings, ensuring that the portfolio remains aligned with the desired asset allocation strategy.

Related: 10 Best Crypto Trading Bot Strategies

Pionex and Kucoin: Trading Platform Features

Margin Trading

Both Pionex and KuCoin offer margin trading, which allows users to trade with leverage and potentially amplify their profits or losses. Pionex offers maximum leverage of up to 5x on its margin trading platform, while KuCoin offers leverage of up to 10x.

This means that KuCoin provides a higher leverage option for traders who are looking for more aggressive trading strategies.

Staking

Both Pionex and KuCoin also offer staking, which allows users to earn passive income by locking up their cryptocurrencies for a certain period of time. However, there are some differences between the two platforms in terms of staking.

Pionex supports staking for a limited number of cryptocurrencies, including popular ones like Bitcoin, Ethereum, and Binance Coin.

On the other hand, KuCoin supports staking for a wider range of cryptocurrencies, including some lesser-known ones, providing more options for users to choose from.

Copy Trading

While Pionex does not offer copy trading, KuCoin has a feature called “Copy Trading” that allows users to follow and copy the trades of professional traders.

This can be beneficial for beginner traders who want to learn from experienced traders and potentially earn profits by copying their successful trades.

KuCoin’s Copy Trading feature provides a social trading platform where users can interact with and follow other traders, while Pionex does not have a similar feature.

Read: How To Choose The Best Crypto Trading Bot

Pionex vs Kucoin: Supported Cryptocurrencies

Pionex supports over 210 cryptocurrencies, including popular ones like Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and Ripple (XRP), as well as many lesser-known altcoins.

KuCoin supports over 800 cryptocurrencies, which is a larger selection compared to Pionex. KuCoin also has its native token, KuCoin Token (KCS), which provides various benefits to its users, such as lower trading fees, a share of the platform’s revenue, and access to exclusive features.

Pionex and Kucoin: Platform Fees

The trading fees for manual trading on Pionex are generally competitive, ranging from 0.05% to 0.02% per trade, depending on the user’s trading volume and the specific trading pair being traded.

KuCoin charges trading fees based on the user’s trading volume and KuCoin Shares (KCS) holding status. The more KCS a user holds, the lower their trading fees will be. The trading fees on KuCoin range from 0.1% to 0.02% per trade.

Kucoin or Pionex: Payment Methods

KuCoin supports fiat currency deposits and withdrawals, allowing users to buy cryptocurrencies using traditional methods such as bank transfers, credit/debit cards, and third-party payment processors like Simplex and Banxa.

Pionex supports SEPA and Credit/Debit cards for funding your account. Withdrawals are only allowed in cryptocurrencies and network transfers.

Kucoin vs Pionex: Security

KuCoin has implemented robust security measures, including multi-factor authentication (MFA), cold storage for the majority of user funds, and regular security audits. However, it has experienced a security breach in the past, which resulted in a loss of funds.

Pionex also employs strong security measures, such as MFA and cold storage for user funds. It has not experienced any significant security breaches to date, maintaining a good security track record.

We Recommend: Best Crypto Trading bots

Best Manually Customized Trading bot

- 75+ CEX and DEX cryptocurrency exchanges

- Support over 300,000 crypto coins and 50+ DEX coins supported

- Insider information on where it is profitable to buy and sell tokens

- Free training and cases for clients of service

Proven Success Rate with 1M+ Users

- 16+ Exchange support

- Crypto-signals in Telegram

- Trading view Integration

- DCA, GRID, options, HODL, Smart trading bots

- Marketplace to buy automated trading strategies with success rate

Final Thoughts: Which is better?

Both Pionex and Kucoin are reliable and secure cryptocurrency exchanges that offer a wide range of trading features and benefits.

However, Pionex stands out with its trading bots, low trading fees, and multi-currency wallet. On the other hand, Kucoin offers margin trading, high security, and a user-friendly interface.

We hope this article has helped you make an informed decision on which exchange to use.

Read: 8 Best Crypto Trading Bots

FAQs

What is Pionex?

Pionex is a cryptocurrency exchange that was launched in 2019. The exchange is based in Singapore and is operated by Pionex Pte Ltd. Pionex offers its users a wide range of cryptocurrencies to trade, including BTC, ETH, USDT, and many more. The exchange boasts of being the first exchange to offer trading bots that enable traders to automate their trading strategies.

What is Kucoin?

Kucoin is a cryptocurrency exchange that was launched in 2017. The exchange is based in Seychelles and is operated by Kucoin Co., Ltd. Kucoin offers its users a wide range of cryptocurrencies to trade, including BTC, SOL, ADA, and many more. The exchange is known for the availability of lesser-known Altcoins and NFT-ETFs.

Is Pionex better than KuCoin?

Pionex is known for its advanced trading tools, automated trading bots, and low fees. On the other hand, KuCoin offers a wider range of cryptocurrencies and a user-friendly interface. Kucoin also supports Copy Trading, NFT Marketplace, Cloud mining, Liquidity mining, and Launchpad, whereas Pionex does not.

Learn more about Trading bots: