In recent years, the cryptocurrency market has been growing rapidly, providing opportunities for investors to make profits. One of the most popular strategies used by traders to make money is crypto arbitrage.

Crypto arbitrage involves buying and selling cryptocurrencies on different exchanges to take advantage of price differences. However, manually executing trades on multiple exchanges can be time-consuming and challenging. This is where crypto arbitrage bots come in.

In this article, we will discuss the best crypto arbitrage bots available in the digital currency market for Bitcoin trading or other altcoins.

We Recommend: Best Crypto Trading bots

Best Manually Customized Trading bot

- 75+ CEX and DEX cryptocurrency exchanges

- Support over 300,000 crypto coins and 50+ DEX coins supported

- Insider information on where it is profitable to buy and sell tokens

- Free training and cases for clients of service

Proven Success Rate with 1M+ Users

- 16+ Exchange support

- Crypto-signals in Telegram

- Trading view Integration

- DCA, GRID, options, HODL, Smart trading bots

- Marketplace to buy automated trading strategies with success rate

What is Crypto Arbitrage Bot?

Crypto arbitrage is the practice of buying and selling cryptocurrencies on different exchanges to make a profit from price differences. For example, if Bitcoin is trading at $50,000 on Exchange A and $51,000 on Exchange B, you could buy Bitcoin on Exchange A and sell it on Exchange B to earn a profit of $1,000 per Bitcoin.

This is possible because different exchanges have different prices for the same cryptocurrency due to various factors such as supply and demand, trading volume, and geographical location.

When a profitable arbitrage opportunity is detected, the bot will execute the trade automatically. Crypto arbitrage bots are designed to be fast and efficient, allowing traders to take advantage of price differences before they disappear.

Best Bitcoin Arbitrage Bots Compared

| Trading Bot | Types of Trading Bot | Supported Exchanges | Free Features | Website Link |

|---|---|---|---|---|

| Pionex | Grid Trading, Smart Trade, Leveraged Tokens, Spot-Futures Arbitrage | Built-in Exchange (Liquidity from Huobi Global and Binance) | Completely Free | Visit Pionex |

| Cryptohopper | Market Making, Technical Analysis, Copy Trading, Arbitrage | 20+ | -20 open positions/exchange -Portfolio Management -Free manual trading on all exchanges | Visit Cryptohopper |

| 3commas | Grid Trading, Smart Trade, Copy Trading, Options Trading, Futures Trading | 16+ | 1 DCA bot, 1 GRID bot, 1 Options bot, Unlimited scalper terminal, smartTrade | Visit 3commas |

| Bitsgap | Arbitrage, Portfolio Management, Automated Trading, Technical Analysis | 20+ | -2 Active GRID Bots -10 Active DCA Bots – unlimited smart trades | Visit bitsgap |

| Haasbot | Technical Analysis, Arbitrage, Market Making, Scalping | 24 | 1 Trade Bot, Paper trading, 15 max order per bot, portfolio manager | Visit Haasbot |

| Coinrule | Rule-based Trading, Automated Trading, Stop-loss and Take-profit | 10+ | -2 Live Rules -2 Demo Rules -7 Template Strategies -1 Connected Exchange | Visit Coinrule |

| Quadency | Automated Trading, Portfolio Management, Technical Analysis, Backtesting | 20+ | completely Free | Visit Quadency |

Top 7 Best Crypto Arbitrage Bots for Bitcoin Trading

Here are the top 7 best crypto arbitrage bots available in the market:

Bot #1: HaasBot

HaasOnline is a popular arbitrage trading bot that offers a wide range of trading options, including crypto-to-crypto and fiat-to-crypto trading. This bot is easy to use and comes with a variety of features, including customizable trading strategies and technical analysis tools.

HaasOnline also offers a high level of security, ensuring that your funds are safe and secure. The bot also comes with backtesting tools, allowing traders to test their trading strategies before deploying them in the market.

Pros

- Supports multiple exchanges

- User-friendly interface

- Excellent technical support

- Offers backtesting tools

Cons

- Expensive compared to other bots

- Can be complex for beginners

Price: Free Version Available, Premium starts at $49 per month

Bot #2: Coinrule

Coinrule offers various trading bots to automate cryptocurrency trading strategies, including market, limit, stop-loss, take-profit, and trailing stop-loss orders. Users can choose from a variety of pre-built strategies or create their own custom strategies using a simple interface.

The trading bots can be configured to trade across multiple exchanges simultaneously and can be backtested using historical data to evaluate their performance.

Pros

- Easy-to-use interface with no coding required

- Supports multiple exchanges including Binance, Kraken, and Coinbase

- Offers a wide range of trading strategies and indicators

- Offers backtesting and paper trading features

- Provides a free plan with limited features and paid plans with more advanced features

Cons

- Limited customization options compared to other trading bots

- May not be suitable for advanced traders who require more complex strategies and customization

- Some users have reported technical issues and bugs in the past

Price: Free Version is available, Paid version starts at $29.99 per month

Bot #3: Cryptohopper

Cryptohopper is a popular crypto arbitrage bot that allows traders to automate their trading strategies across multiple exchanges.

It offers a user-friendly interface and advanced features such as technical analysis tools, backtesting, and portfolio management. Cryptohopper also has a marketplace where users can buy and sell trading strategies.

Pros

- Automated trading

- Multiple exchanges

- Backtesting

- Technical analysis tools

Cons

- Complex setup

- Limited customizability

- Risk of losses

Price: Free Version, Paid starts at $16.58 per month

Bot #4: 3Commas

3Commas is a popular crypto trading bot that supports multiple exchanges and trading strategies.

It offers advanced features such as technical analysis tools, portfolio management, and social trading. 3Commas also has a user-friendly interface and a helpful customer support team.

Pros

- Customizable automated trading bots

- Advanced portfolio management tools

- Supports multiple exchanges

- User-friendly interface

- Access to trading signals and indicators

Cons

- Subscription fee required

- Security risks with exchange connections

- Slow customer support

- Requires knowledge of cryptocurrency trading and markets

Cost: Free Version is available, Subscription starts at $15/month

Bot #5: Quadency

Quadency is a high-frequency trading bot that specializes in crypto arbitrage. It uses advanced algorithms to monitor price differences across multiple exchanges and execute trades quickly and efficiently. Quadency is also highly customizable and can be configured to suit the needs of individual traders.

Pros

- User-friendly interface

- Supports trading across multiple exchanges

- Offers a range of trading tools and features

- Completely Free to use

Cons

- Expensive pricing model for advanced traders

- Issues with performance and reliability reported by some users

Trading Fees: 0.08% per trade

Bot #6: Bitsgap

Bitsgap is a cloud-based trading bot that offers an arbitrage module. The platform supports more than 15 major cryptocurrency exchanges, including Binance, Bitfinex, and Kraken, among others.

It offers a user-friendly interface and a range of trading tools, including a portfolio tracker and a backtesting tool. The bot also offers a range of trading strategies, including long and short strategies.

Pros

- Supports more than 15 major cryptocurrency exchanges

- User-friendly interface

- Offers a range of trading tools

- Offers a range of trading strategies

- Excellent technical support

Cons:

- Can be expensive compared to other bots

- No Free trial

Price: Paid plan starts at $23 per month

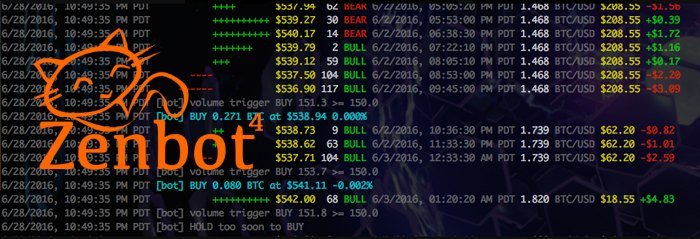

Bot #7: Zenbot

Zenbot is an open-source trading bot that offers an arbitrage module. The platform supports multiple exchanges and is free to use. Zenbot is highly customizable, allowing traders to adjust the bot’s parameters according to their preferences. The bot is also compatible with a range of technical indicators.

Pros

- Free to use

- Highly customizable

- Supports multiple exchanges

- Compatible with a range of technical indicators

Cons

- Limited technical support

- Limited range of trading strategies

- Requires technical knowledge

Price: Completely Free to use

How to Choose the Best Crypto Arbitrage Bot?

🕵️♀️ Research: Do your due diligence and research the different crypto arbitrage bots available in the market. Check reviews, ratings, and feedback from other users.

💰 Cost: Consider the cost of the bot and make sure it aligns with your budget. Some arbitrage bots charge a monthly fee, while others may require a one-time payment.

📈 Performance: Look at the bot’s historical performance and track record. Check the accuracy of the bot’s predictions and whether it has been profitable over time.

📊 Features: Consider the features offered by the bot, such as real-time market data, portfolio management, and trading strategies.

🔒 Security: Make sure the bot is secure and protects your data and funds. Look for bots that have two-factor authentication and encryption.

🤝 Integration: Check if the bot integrates with the cryptocurrency exchanges you use.

🔧 Ease of Use: Look for an arbitrage bot that is easy to set up and use. A user-friendly interface and clear documentation can save you time and frustration.

👨💼 Support: Consider the level of customer support offered by the trading bot’s developers. Are they responsive to inquiries and willing to help you with any issues that may arise?

📈 Flexibility: Look for a bot that allows for customization and flexibility in trading strategies.

👍 Reputation: Consider the reputation of the bot and its developers in the crypto community. A bot with a good reputation is more likely to be trustworthy and reliable.

👨💻 Technology: Look for a bot that uses advanced technology, such as AI and machine learning, to improve its performance and accuracy.

👨👩👧👦 Community: Consider joining a community of users who are using the same arbitrage bot. This can provide you with valuable insights, tips, and strategies.

📉 Risk Management: Look for a bot that has risk management tools, such as stop-loss orders, to protect your investments in case of market fluctuations.

📈 Scalability: Look for a bot that can handle large volumes of trades and scale as your portfolio grows.

🚀 Future Updates: Look for a bot that is actively developed and updated with new features and improvements.

💬 Reviews: Read reviews and feedback from other users to get an idea of their experience with the arbitrage bot.

Related:

- 10 Best Free Crypto Trading Bots

- 8 Best Crypto GRID Trading Bots

- Pionex Vs 3Commas

- 3Commas vs Cryptohopper

- 8 Best Crypto Trading Bots

Advantages of Using an Arbitrage Trading Bot

There are several advantages to using an arbitrage trading bot, including:

- Efficiency: Arbitrage trading bots can execute trades quickly and efficiently, allowing you to take advantage of market inefficiencies and maximize your profits.

- Automation: Using a trading bot can help you automate the trading process, saving you time and allowing you to focus on other aspects of your investment strategy.

- Risk management: Trading bots can help you manage your risk by executing trades based on predetermined parameters and strategies.

Risks of Using Arbitrage Bots

- Technical issues, such as bugs or errors in the software, can cause missed trades or other problems.

- Market volatility can lead to unexpected price movements that the bot may not be able to respond to quickly enough.

- Connectivity issues with exchanges or internet outages can cause disruptions in the trading process.

- Incorrect settings or parameters can lead to unwanted trades or losses.

Types of Crypto Arbitrage Bots

1. Simple arbitrage

This involves identifying price differences for the same cryptocurrency on different exchanges and buying on the lower-priced exchange and selling on the higher-priced exchange.

For example, if Bitcoin is trading at $55,000 on Binance and $55,500 on Coinbase, you could buy Bitcoin on Binance and sell it on Coinbase, making a profit of $500 per Bitcoin.

2. Triangular arbitrage

This involves using three different cryptocurrencies to exploit price differences between exchanges.

For example, you could buy Bitcoin on Exchange A, exchange it for Ethereum on Exchange B, and then exchange the Ethereum for Litecoin on Exchange C. Finally, you could sell Litecoin back to Exchange A, making a profit on the price differences between each exchange.

3. Statistical arbitrage

This involves identifying long-term price trends and buying cryptocurrencies that are undervalued and selling overvalued cryptocurrencies. This strategy requires a lot of data analysis and statistical modeling, but it can be effective over the long term.

4. Cross-exchange arbitrage

This involves exploiting price differences across different cryptocurrency pairs on the same exchange. For example, you could buy Bitcoin with USDT and then sell the Bitcoin for Ethereum with USDT on the same exchange. This strategy is less risky than arbitrage across different exchanges since there are no transfer fees involved.

Final Thoughts

While there are many arbitrage bots available, the best ones are those that are reliable, easy to use, and provide a strong return on investment.

After analyzing and testing several different options, we can confidently say that the top arbitrage bots currently available include Bitsgap, Cryptohopper, 3Commas, and HaasOnline.

These bots offer a range of features, including advanced trading strategies, automated order execution, and real-time market analysis, making them the ideal choice for both experienced and novice traders alike.

FAQs

How can I optimize my Crypto Arbitrage Bot strategy for maximum profitability?

To optimize your crypto arbitrage bot strategy for maximum profitability, consider using multiple bots and strategies simultaneously, monitoring market trends and adjusting your strategy accordingly, setting stop-loss orders to limit potential losses, and conducting regular analysis of your trading performance to identify areas for improvement.

Are all Crypto Arbitrage Bots created equal?

No, not all crypto arbitrage bots are created equal. Different bots may offer different features, strategies, and levels of performance. It’s important to do your research and compare different bots to find one that suits your needs and preferences.

Can I customize my Crypto Arbitrage Bot’s trading strategy?

Yes, many crypto arbitrage bots offer customizable trading strategies that allow you to tailor your bot’s approach to your specific goals and preferences. Some bots may offer pre-built strategies that you can adjust or customize, while others may allow you to create your own strategies from scratch.

Is it Safe to use a Crypto Arbitrage Bot?

The safety of a crypto arbitrage bot depends on a number of factors, including the bot’s reliability, security, and performance. While using a reputable and reliable bot can help to minimize risks, there is always a possibility of technical glitches, bugs, and errors that could result in losses. Additionally, using a bot can expose your assets to security vulnerabilities, so it’s important to choose a bot that has strong security measures in place to protect your assets.