If you’re a cryptocurrency trader, you know that the market is constantly changing. And, as a result, it can be challenging to keep up with the fluctuations in prices and make the most of every trading opportunity. That’s where crypto scalping bots come in.

Crypto scalping bots are automated trading tools that allow you to execute trades automatically based on pre-determined criteria. They can help you take advantage of market fluctuations and make more trades than you could do manually. In this article, we’ll take a closer look at the 7 best crypto scalping bots on the market today.

Key Takeaways:

- Crypto scalping bots are a popular tool for traders looking to capitalize on small price movements in the crypto market.

- When choosing a scalping bot, it’s important to consider factors such as ease of use, security, supported Exchange, API encryption, trading strategies, and pricing.

- Some of the best crypto scalping bots on the market include 3Commas, Pionex, HaasOnline [Haasbot], and Cryptohopper.

Best Crypto Scalping bots Comparison table

| Trading Bot | Types of Trading Bot | Supported Exchanges | Free Features | Website Link |

|---|---|---|---|---|

| Pionex | Grid Trading, Smart Trade, Leveraged Tokens, Spot-Futures Arbitrage | Built-in Exchange (Liquidity from Huobi Global and Binance) | Completely Free | Visit Pionex |

| Cryptohopper | Market Making, Scalping, Technical Analysis, Copy Trading, Arbitrage | 20+ | -20 open positions/exchange -Portfolio Management -Free manual trading on all exchanges | Visit Cryptohopper |

| 3commas | Grid Trading, Smart Trade, Copy Trading, Options Trading, Futures Trading | 16+ | 1 DCA bot, 1 GRID bot, 1 Options bot, Unlimited scalper terminal, smartTrade | Visit 3commas |

| Bitsgap | Arbitrage, Portfolio Management, Automated Trading, Technical Analysis | 20+ | -2 Active GRID Bots -10 Active DCA Bots – unlimited smart trades | Visit bitsgap |

| Haasbot | Technical Analysis, Arbitrage, Market Making, Scalping | 24 | 1 Trade Bot, Paper trading, 15 max order per bot, portfolio manager | Visit Haasbot |

| Shrimpy | Portfolio Rebalancing, Social Trading, Backtesting, Automation | 25 | 1 Trade Bot, Paper trading, 15 max orders per bot, portfolio manager | Visit Shrimpy |

| Coinrule | Rule-based Trading, Scalping, Stop-loss, and Take-profit | 10+ | -2 Live Rules -2 Demo Rules -7 Template Strategies -1 Connected Exchange | Visit Coinrule |

| Kucoin | Technical Analysis, Scalp Trading Automation, GRID, DCA | Built-in Exchange | completely Free | Visit Kucoin |

| Quadency | Automated Trading, Portfolio Management, Technical Analysis, Backtesting | 20+ | completely Free | Visit Quadency |

| Bybit | GRID trading, DCA, Copy Trading | Built-in Exchange | Completely Free | Visit Bybit |

We Recommend: Best Crypto Trading bots

Best Manually Customized Trading bot

- 75+ CEX and DEX cryptocurrency exchanges

- Support over 300,000 crypto coins and 50+ DEX coins supported

- Insider information on where it is profitable to buy and sell tokens

- Free training and cases for clients of service

Proven Success Rate with 1M+ Users

- 16+ Exchange support

- Crypto-signals in Telegram

- Trading view Integration

- DCA, GRID, options, HODL, Smart trading bots

- Marketplace to buy automated trading strategies with success rate

Best Crypto Trading bots for Scalpers [Review]

1. 3Commas Scalping Bot

3Commas Scalping Bot is an automated cryptocurrency trading tool that executes trades based on pre-set parameters and market analysis. It is designed to execute high-frequency trades to make small profits on each trade.

The bot offers a user-friendly interface, customizable trading strategies, and integration with multiple cryptocurrency exchanges.

Price and Fees: Free Plan is Available and the premium plan starts at $15 per month.

Pros and Cons

| Pros 👍 | Cons 👎 |

|---|---|

| Efficiently executes high-frequency trades | Requires a subscription fee |

| Minimizes emotional trading decisions | Relies heavily on market analysis accuracy |

| Provides continuous monitoring of the market | May be affected by sudden market fluctuations |

| Offers flexibility in trading strategies | Limited control over the execution of trades |

| Saves time and effort by automating trades | Requires knowledge of technical analysis to fully utilize |

| Offers a user-friendly interface |

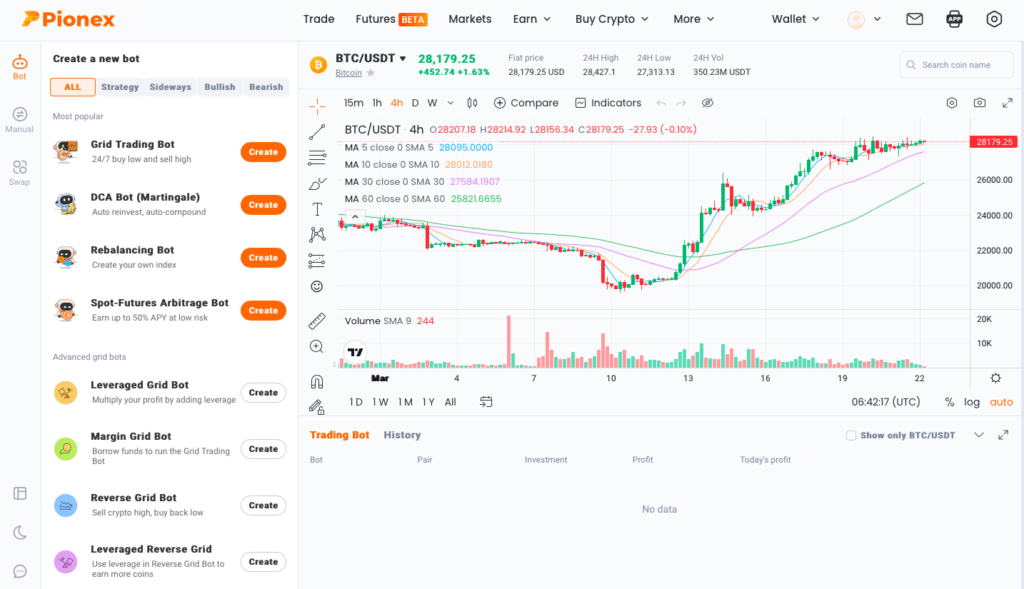

2. Pionex Grid Trading Bot

Pionex Grid Trading Bot is a trading bot designed for cryptocurrency trading. It offers various features that make it unique and effective. Some of its key features are:

- Grid Trading Strategy: The bot uses a grid trading strategy to maximize profits in a volatile market.

- Trading Pairs: It supports a wide range of trading pairs, allowing users to diversify their portfolios.

- Automatic Trading: The bot automatically buys and sells cryptocurrencies based on market conditions.

- Stop Loss and Take Profit: It has built-in stop-loss and take-profit features to help users manage their risk.

Price and Cost: Bots are Free to use, with 0.05% per trade platform trading fees

Pros and Cons

| Pros 👍 | Cons 👎 |

|---|---|

| Built-n Cryptocurrency Exchange | Limited Trading Options |

| Low Fees | Reliance on Grid Trading Strategy |

| Customizable and user friendly | Dependence on Internet Connection |

| High Liquidity and volume |

3. Bitsgap Scalper Bot

Bitsgap is a trading bot that uses advanced algorithms to analyze the market and execute trades in real-time. The bot supports multiple cryptocurrency exchanges, including Binance, Bitfinex, Bitstamp, Bittrex, Coinbase Pro, and more. Some key features are:

- Portfolio management: Bitsgap’s portfolio management tools allow users to track the performance of their investments across multiple exchanges and wallets.

- Trading signals: The platform provides real-time trading signals and market analysis to help users make informed trading decisions.

- Arbitrage trading: Bitsgap’s arbitrage trading tool scans multiple exchanges for price discrepancies and automatically executes trades to take advantage of them.

Price and Cost: Free Plan Available for 7-days only, Premium starts at $23 per month

Pros and Cons

| Pros 👍 | Cons 👎 |

|---|---|

| High-Speed Trading | Risk of Losses |

| Multiple Exchange Support | Limited Strategy Options |

| Advanced Trading Signals | Dependence on Trading Signals |

| Customizable Trading Parameters | High Volatility |

| User-Friendly Interface | Subscription Fees |

4. Quadency

Quadency offers a trading bot that allows users to create customized automated trading strategies using a drag-and-drop interface. The bot supports multiple trading strategies and can trade on multiple exchanges at the same time.

It also provides advanced risk management tools to minimize exposure to market volatility. Quadency also includes a portfolio tracker, performance analytics, and advanced charting tools.

Price and cost: Quadency scalping bot is free to use, with a $0.08%/trade trading fee.

Pros and Cons

| Pros 👍 | Cons 👎 |

|---|---|

| Multi-exchange support | Limited number of exchanges supported |

| Smart order router (CEX+DEX) | Relatively high pricing compared to some competitors |

| Advanced trading strategies | No mobile app available |

| Comprehensive Portfolio Management | Limited customer support options |

| Backtesting and paper trading |

5. Haasbot Scalping bot

Haasbot was developed by Haasonline Software, a company based in the Netherlands, and is designed to work with multiple exchanges, including Binance, Kucoin, and Coinbase. It supports various trading indicators, including MACD, RSI, and Bollinger Bands, and offers advanced order types, such as limit orders, stop orders, and trailing stops.

It is compatible with Windows, Linux, and macOS and provides robust security measures, including two-factor authentication and encryption of user data.

Price and Cost: Free Plan is available, Standard plan starts at $49 per month.

Pros and Cons

| Pros 👍 | Cons 👎 |

|---|---|

| Advanced trading features | High cost compared to other scalping bots |

| Wide range of supported exchanges and trading pairs | Steep learning curve |

| Customizable bots with pre-built strategies | Requires technical knowledge and trading experience |

| Good customer support and active community | Limited free trial period |

| Constantly updated with new features |

6. Coinrule Trading bot

With Coinrule, you can create and customize your trading rules using a simple drag-and-drop interface, which can then be backtested on historical data to ensure their effectiveness. It offers a range of order types, including market, limit, and stop-loss orders. You can also set up conditional orders, such as “if this, then that” rules, to trigger trades based on specific market conditions.

Coinrule provides users with a range of analytical tools for trading and scalping strategies, including real-time market data, technical analysis indicators, and sentiment analysis tools.

Pricing Plans: It does offer a Free plan with limited features, and premium plans start at $29.99 per month.

Pros and Cons

| Pros 👍 | Cons 👎 |

|---|---|

| Integrations with major exchanges | Limited exchange support |

| Advanced security features | No mobile app available |

| Live performance tracking and reports | |

| Trading signals and alerts |

7. Kucoin Scalper bot

The KuCoin scalping bot can execute trades automatically, and it is designed to minimize risks and maximize profits. It has features such as stop-loss orders, trailing stops, and take-profit orders that help to manage trades efficiently.

The bot can be accessed through a web-based interface or a mobile app, and it provides real-time market data and analysis to help traders make informed decisions.

Price: Free to use, Exchange trading costs 0.05 – 0.1%% per trade depending on trading volume.

Pros and Cons

| Pros 👍 | Cons 👎 |

|---|---|

| Wide selection of cryptocurrencies | Limited fiat currency support |

| Low trading fees | Limited payment options |

| Advanced trading features | Some negative user reviews |

| High daily withdrawal limit | Limited customer support options |

| Mobile app available for trading | Security breaches in the past |

| Fast transaction processing | |

| Reward programs for users |

What Are Crypto Scalping Bots?

Simply put, a scalping bot is a software program designed to automate the process of buying and selling cryptocurrency to make a profit on small price movements. Scalping is a trading strategy that involves making small profits on multiple trades throughout the day.

These bots use various algorithms and technical indicators to identify opportunities for scalping. Once a trade is executed, the bot will monitor the price movement and exit the trade when it reaches a predetermined profit target or stops loss.

How Do Crypto Scalping Bots Work?

Scalping bots are typically integrated with cryptocurrency exchanges through APIs (Application Programming Interfaces). The bot will have access to your exchange account and can place trades on your behalf.

The first step in using a scalping bot is to set your trading parameters. This includes choosing which cryptocurrencies to trade, the size of your trades, and the profit targets and stop losses for each trade.

Once you’ve set your parameters, the bot will start monitoring the market for opportunities. When it identifies a potential trade, the bot will execute the trade and monitor the price movement. If the price moves in the desired direction, the bot will exit the trade at a predetermined profit target. If the price moves against the trade, the bot will exit the trade at a predetermined stop loss.

Benefits of Using Crypto scalping bots

Crypto scalping bots can offer several benefits, including:

- Speed: Crypto scalping bots can execute trades faster than human traders, which can be critical when trying to capitalize on small price movements.

- Efficiency: Scalping bots can work around the clock without getting tired or making mistakes, making them more efficient than human traders.

- Accuracy: Bots can be programmed to follow a set of rules and parameters precisely, removing the emotional bias that can affect human traders.

- Risk management: Scalping bots can be set up to use stop-loss orders, reducing the risk of significant losses in volatile markets.

- Profitability: By taking advantage of small price movements, scalping bots can generate consistent profits over time, even in markets that are otherwise stagnant.

Risks Associated With Scalping bots

- Technical issues: Scalping bots can encounter technical issues, such as software bugs or connectivity problems, that can result in incorrect trades or missed opportunities.

- Market volatility: Cryptocurrency markets can be highly volatile, and even small price movements can result in significant losses if the bot’s settings or parameters are not optimized correctly.

- Lack of control: When using a scalping bot, the trader may have less control over the trading process, as the bot operates based on pre-programmed rules and parameters.

- Market manipulation: In some cases, other traders or entities may attempt to manipulate the market to take advantage of scalping bots, potentially resulting in losses for the bot’s users.

How to Choose the best Crypto Scalping bot?

🤖 When choosing the best crypto scalping bot, consider the following factors:

1️⃣ Trading Strategy: Look for a bot that offers a scalping strategy that aligns with your trading goals and preferences.

2️⃣ Reputation: Choose a bot with a good reputation in the market, backed by positive reviews and testimonials.

3️⃣ User Interface: The bot’s user interface should be intuitive and user-friendly, allowing you to easily navigate and customize your trading settings.

4️⃣ Security: Ensure that the bot is secure and your funds are protected from hacks and theft.

5️⃣ Supported Exchanges: Check which exchanges the bot supports and whether it’s compatible with the ones you want to trade on.

6️⃣ Customer Support: Choose a bot with a reliable and responsive customer support team, who can assist you in case of any issues or queries.

Final Thoughts

After researching and testing various options, we have compiled a list of the best crypto scalping bots currently available. These include 3Commas, Pionex, and Cryptohopper, each with its unique features and capabilities.

It’s important to remember that even the best bots cannot guarantee profits and trading always carries risks. Therefore, it’s crucial to have a solid understanding of trading concepts and strategies, as well as risk management, before using any bot.

FAQs

How can I optimize my crypto scalping bot for maximum profitability and minimize risk?

To optimize your crypto scalping bot, you should focus on backtesting and tweaking your trading strategies to find the settings that work best for your goals. You should also keep a close eye on market trends and adjust your bot’s parameters accordingly to minimize risk.

What are the best trading strategies to use with a crypto scalping bot?

Some of the best trading strategies to use with a crypto scalping bot include mean reversion, momentum trading, and arbitrage. To set up your bot properly, you should carefully define your trading goals and then choose a strategy that aligns with those goals.

What are the most common mistakes people make when using a scalping bot?

Some of the most common mistakes people make when using a crypto scalping bot include setting unrealistic expectations, not properly configuring their bot, and failing to monitor their bot’s performance. To avoid these mistakes, be sure to thoroughly research your bot and its capabilities, and monitor its performance closely.

How do I choose the right exchange to use with my crypto scalping bot?

When choosing an exchange to use with your crypto scalping bot, you should consider factors such as liquidity, trading fees, security, and the availability of the cryptocurrency pairs you want to trade. Be sure to research multiple exchanges and compare their features before making a decision.

What are the most important metrics to track when using a scalping bot?

Some of the most important metrics to track when using a crypto scalping bot include win rate, profit factor, and maximum drawdown. To analyze these metrics effectively, you should use a combination of statistical analysis tools and visualizations to gain insights into your bot’s performance over time.