If you’re an avid crypto investor, you’ve probably heard of Bitfinex before. It’s one of the oldest and most well-established exchanges in the industry, having been founded in 2012.

Over the years, Bitfinex has earned a reputation for offering a wide range of trading pairs, low fees, and robust security features.

I thought it would be a good time to take a closer look at Bitfinex and see how it stacks up against the competition. In this post, we’ll cover everything from trading fees to security measures to help you decide whether It is the right exchange for your needs.

Bitfinex

Summary

Bitfinex allows users to buy and sell various cryptocurrencies. The exchange offers advanced trading features such as margin trading, Lending, borrowing, Staking, and advanced order types. It is known for its high liquidity and attracts large traders and institutions.

Bitfinex: Key Specifications

| Key Takeaway | Description |

|---|---|

| Established | Founded in 2012 |

| Supported cryptocurrencies | 183 |

| Trading Pairs | 400+ |

| Fees | 0.2% trading fees (volume less than $500k) |

| Security | Uses advanced security measures such as 2-factor authentication and multi-signature wallets |

| Liquidity | High Volume and liquidity |

| Margin Trading | Allows margin trading with up to 5x leverage |

| API | Provides an API for programmatic trading |

| Customer Support | Offers responsive customer support via email and live chat |

| Fiat Deposits/Withdrawals | Debit/Credit card, ACH, Wire transfer |

| Mobile App | Yes |

| Bitfinex Token (LEO) | Introduced a native token, LEO, which can be used to reduce trading fees |

| Geographic Restrictions | Available but not regulated in the united states |

| Controversies | Has faced controversies in the past, including a major hack in 2016 |

| Transparency | Has been criticized for lack of transparency and auditability of Tether (USDT) reserves |

Bitfinex Exchange Overview

Bitfinex is a cryptocurrency exchange founded in 2012. It is based in Hong Kong. Bitfinex allows users to trade cryptocurrencies like Bitcoin, Ethereum, and Litecoin. It offers margin trading, lending, and other advanced trading features.

Bitfinex has been the subject of controversy and hack attacks in the past. Despite these controversies, Bitfinex remains one of the most popular cryptocurrency exchanges in the world, with a daily trading volume of over $1 billion. It is particularly popular among professional traders and institutions.

Fact Check 🔍:

- The exchange was founded by a group of traders and developers, including Raphael Nicolle and Giancarlo Devasini.

- Bitfinex is owned and operated by iFinex Inc., which is also the parent company of Tether, a controversial stablecoin that has been accused of inflating the price of Bitcoin.

- In 2016, Bitfinex experienced a major hack that resulted in the loss of 119,756 bitcoins (worth around $72 million at the time). The exchange was able to recover some of the stolen funds.

- Bitfinex has also faced scrutiny from regulators and authorities in the past. In 2018, the New York Attorney General accused Bitfinex of covering up an $850 million loss by using funds from Tether reserves.

Bitfinex Advanced Trading Portal Review

Bitfinex offers advanced trading features, such as limit orders, stop orders, and trailing stop orders, which allow users to automate their trades and set specific conditions for buying and selling.

Margin Trading

Bitfinex margin trading allows traders to borrow funds from the exchange to increase their trading position. Traders can leverage their own funds by up to 5x, allowing them to trade with a larger position than they would be able to with just their own funds.

Margin trading involves taking on additional risk as traders must repay the borrowed funds with interest, and their positions may be liquidated if the market moves against them.

Traders can choose between different margin funding options and can also earn interest on their margin positions. Margin trading is only available to verified users who meet certain eligibility requirements.

Futures and Leverage

Futures trading allows users to speculate on the future price of an asset. Leverage trading enables users to borrow funds to amplify their trading positions. Bitfinex offers up to 100x leverage on certain assets.

Lending Pro

The lending feature allows users to earn interest on their unused cryptocurrency holdings by lending them to other traders who need to borrow them.

Bitfinex’s Lending Pro is an advanced lending management tool for margin trading that uses automation to make lending easier and more efficient. It supports a wide range of digital assets and offers better projections of potential earnings.

The tool is highly customizable, with multiple lending modes to choose from and various automation settings choices.

The Lending Pro dashboard provides easy navigation and tracking, and there are several features such as calculators, settings panel, lending tabs, lending performance widget, distribution widget, balance widget, and today’s earnings widget to help users optimize their lending strategies.

Staking

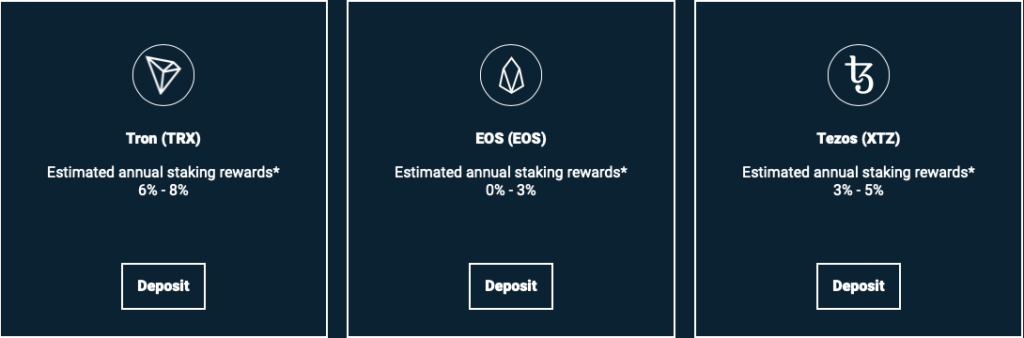

Bitfinex offers a soft-staking program that allows users to earn staking rewards by simply holding their digital tokens on the exchange. The staking rewards can be as high as 8% per year for supported digital tokens such as TRON, Tezos, Cardano, Polkadot, and more.

Users can calculate their potential rewards and deposit their chosen digital tokens into their Bitfinex account to begin staking. Bitfinex automatically deposits staking rewards into user accounts on a weekly basis.

Bitfinex Borrow

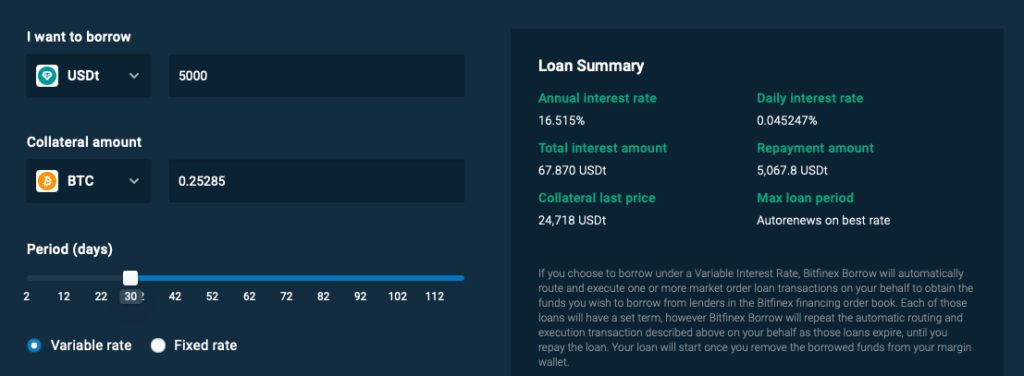

Through Bitfinex Borrow, individuals can leverage their cryptocurrency assets as collateral to obtain funds from other users on a peer-to-peer platform. This lending service allows borrowers to customize the duration of the loan and the interest terms, with no restrictions on how the borrowed funds can be used.

While the maximum amount that can be borrowed is capped at $250,000, the amount is based on the type and quantity of collateral offered. Borrowers can opt for fixed or variable interest rates, and Bitfinex will handle the execution of market order loan transactions on their behalf.

Please note that the rates, payment amounts, and collateral price provided are estimates that are subject to change based on current market conditions.

Bitfinex User Fund Security 🔒

Bitfinex has implemented several measures to ensure the security of its users’ funds. These include:

- Cold Storage: The majority of users’ funds are stored offline in cold storage wallets, which are not accessible through the internet. This reduces the risk of hacking and other security breaches.

- Two-Factor Authentication: Bitfinex requires users to enable two-factor authentication (2FA) to access their accounts, which adds an extra layer of security by requiring a secondary authentication code to be entered in addition to the password.

- IP Address Whitelisting: Users can whitelist their IP addresses, which restricts access to their accounts from any other IP address. This prevents unauthorized access to their accounts.

- Email Notifications: The Exchange sends email notifications to users for any changes made to their accounts, including logins, withdrawals, and changes to security settings.

- Advanced Encryption: Bitfinex employs advanced encryption algorithms to secure all data and communications transmitted between users and the platform.

- Regular Security Audits: It conducts regular security audits to identify and fix any potential vulnerabilities in the platform’s infrastructure.

Bitfinex Supported Coins

Bitfinex is a cryptocurrency exchange platform that supports a wide range of digital assets. The platform offers trading pairs for over 180 cryptocurrencies, including popular coins like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP), as well as newer coins like Polkadot (DOT), Solana (SOL), and Chainlink (LINK).

In addition to these coins, Bitfinex also supports stablecoins like Tether (USDT) and USD Coin (USDC), which are pegged to the value of the US dollar.

With such a diverse selection of supported coins, users have the flexibility to trade and exchange a variety of assets on the Bitfinex platform.

Bitfinex Platform Fees

Bitfinex is a cryptocurrency trading platform that charges fees when you trade cryptocurrencies or derivatives on their platform.

For trading one cryptocurrency for another cryptocurrency (e.g. BTC/ETH), Bitfinex charges a maker fee of 0.1% (if you create an order that doesn’t get immediately matched with another order) or a taker fee of 0.2% (if you take an order that someone else has created). If you hold LEO tokens, you can get a discount on the taker fee, which brings it down to 0%.

For trading a cryptocurrency for a stablecoin (e.g. BTC/USDt), the fees are the same as trading one cryptocurrency for another.

For trading a cryptocurrency for fiat currency (e.g. BTC/USD), the fees are also the same as trading one cryptocurrency for another.

For trading derivatives (e.g. BTC-PERP), Bitfinex charges a maker fee of 0.02% or a taker fee of 0.065%. If you hold LEO tokens, you can get a discount on these fees as well. There is also a maker-and-taker fee discount for high-volume traders.

Bitfinex Fiat and Payment Methods

Bitfinex supports several fiat and payment methods for users to deposit and withdraw funds from their trading accounts. These methods include:

- Bank Wire Transfer: This is a traditional method of transferring funds from a bank account to Bitfinex. Deposits and withdrawals via bank wire transfer are available in multiple currencies, including USD, EUR, JPY, and GBP.

- Credit/Debit Card: Bitfinex allows users to purchase cryptocurrencies with credit and debit cards. However, this option is not available in all countries and has lower purchase limits compared to bank wire transfers.

- Cryptocurrencies: Users can also deposit and withdraw cryptocurrencies to and from their Bitfinex accounts.

- E-wallets: Bitfinex also supports e-wallets, such as Tether (USDT), as a payment method. USDT is a stablecoin pegged to the US dollar and can be used for deposits and withdrawals.

Bitfinex Supported Countries

Bitfinex offers its services globally (in 100+ countries). However, there are some countries where Bitfinex’s services may be limited or unavailable due to regulatory restrictions or other reasons.

According to Bitfinex’s website, the following countries are currently restricted from using its services:

- Afghanistan

- Bosnia and Herzegovina

- Central African Republic

- Democratic Republic of the Congo

- Eritrea

- Guinea-Bissau

- Haiti

- Iran

- Iraq

- Lebanon

- Libya

- Mali

- North Korea

- Somalia

- South Sudan

- Sudan

- Syria

- Uganda

- Vanuatu

- Yemen

- United States (excludes corporate and institutional clients, verified traders, and excluded individual residents of New York and Washington States)

Bitfinex Customer Support

Bitfinex offers customer support through a Help Center, request form, live chat, and social media.

Users can find answers to FAQs, submit a request for assistance, chat with support in real time, or follow Bitfinex on social media to ask questions or report issues.

Pros and Cons of Using Bitfinex Crypto Exchange

Pros

- Wide range of cryptocurrency options available for trading

- High liquidity for trading

- Advanced trading features and tools for experienced traders

- Low transaction fees compared to other exchanges

- Margin trading and lending options available

Cons

- Has experienced security breaches in the past

- Not available to residents of certain countries, including the United States

- Lack of customer support and slow response times

- Some controversy surrounding the exchange’s ownership and operations.

How to Get Started With Bitfinex Exchange

- First, visit the Bitfinex website and create an account by clicking on the “Sign Up” button.

- Once you have signed up, you will need to verify your account by providing personal information and proof of identity.

- After your account is verified, you can deposit funds into your Bitfinex account. You can do this by clicking on the “Deposit” button and selecting the currency you want to deposit.

- Once your funds are deposited, you can start trading on the exchange. Click on the “Trading” button to access the trading platform.

- Select the currency you want to trade, and then choose the type of order you want to place (market, limit, etc.).

- Enter the amount you want to trade and submit your order. Your order will be executed once a matching order is found on the exchange.

- You can track your orders and view your trade history on the “Orders” page.

Alternatives to Consider: Bitfinex vs Binance

| Category | Bitfinex | Binance |

|---|---|---|

| Founded | 2012 | 2017 |

| Headquarters | Hong Kong | Malta |

| Fiat support | Yes (only 3) | Yes (45+) |

| Trading pairs | 350+ | 1000+ |

| Security | Cold storage | 2FA, SAFU fund |

| Fees | Maker 0.2%, Taker 0.2% | Maker 0.1-0.02%, Taker 0.1-0.04% |

| Mobile app | Yes | Yes |

| Margin trading | Yes | Yes |

| Futures trading | Yes | Yes |

Final Thoughts: Is it Worth

In conclusion, Bitfinex exchange is a popular and reliable platform for trading cryptocurrencies.

The exchange offers a wide range of currencies and trading pairs, as well as advanced trading tools and features. Its user interface is user-friendly, making it easy for beginners to get started with trading.

Additionally, Bitfinex has strong security measures in place to protect user funds and data. Overall, if you’re looking for a trustworthy and feature-rich cryptocurrency exchange, Bitfinex is definitely worth considering.

FAQs

Is Bitfinex safe?

Bitfinex has implemented several security measures to protect its users’ funds and personal information, including two-factor authentication and encrypted data storage. However, there have been security incidents in the past, so it is important for users to take additional precautions, such as using strong passwords and keeping their accounts secure.

Does Bitfinex Require KYC?

Yes, Bitfinex has implemented Know Your Customer (KYC) procedures to comply with anti-money laundering (AML) regulations. Users are required to provide personal information and identification documents to verify their identity and prevent fraudulent activity on the platform.

How much can I withdraw from Bitfinex?

The withdrawal limits on Bitfinex depend on the user’s account verification level. Unverified accounts have a daily withdrawal limit of $2,000 USD equivalent, while verified individual accounts have a daily limit of $250,000 USD equivalent. Higher withdrawal limits are available for corporate and institutional accounts.

Related: