Cryptocurrency trading is rapidly gaining popularity among investors worldwide. However, it can be a daunting task to keep track of the ever-changing market trends and make informed trading decisions.

That’s where cryptocurrency-automated trading platforms like Bitsgap come in. In this Bistgap review, we’ll explore the features, pros, and cons of Bitsgap to help you decide if it’s the right platform for you.

Bitsgap

Summary

With a user-friendly interface, top-notch security measures, and a variety of useful features including trading bots and Portfolio tracking, Bitsgap is a reliable platform for cryptocurrency traders of all levels.

Bitsgap: Key Specifications

| Platform | Bitsgap trading platform |

| Features | Trading bots, portfolio management, technical analysis, arbitrage trading |

| Supported Exchanges | 25+ cryptocurrency exchanges |

| Trading Pairs | 10,000+ trading pairs |

| Security | 2FA, API key encryption, withdrawal restrictions, IP whitelisting |

| Demo Mode | Available |

| Pricing | Free trial, paid plans starting from $23/month |

| Payment Options | Credit card, PayPal, cryptocurrency |

| Fiat Currency | USD and EUR |

| Integration Method | API |

| Customer Support | 24/7 live chat, and email support |

| Mobile App | No |

| Languages | English, Spanish, Russian, Chinese, and more |

| Geographical Restrictions | depends on Exchange |

What is Bitsgap?

Bitsgap is an all-in-one platform that helps traders manage their cryptocurrency investments. It offers a range of tools, including automated trading bots, portfolio management, and arbitrage trading. The platform was launched in 2018 and has since then gained popularity among traders worldwide.

Bitsgap works by connecting to various cryptocurrency exchanges, including Binance, Bybit, and Bitfinex. Once connected, users can trade directly from the platform, without having to switch between different exchanges. This feature is particularly useful for those who trade across multiple exchanges as it saves time and effort.

To start trading on Bitsgap, users need to create an account and connect their exchange accounts. Once connected, they can access a range of features, including automated trading bots, manual trading, and portfolio management tools.

Pros and Cons of Bitsgap

| Pros 👍 | Cons 👎 |

|---|---|

| Multiple exchanges supported | High subscription fees |

| Access to advanced trading tools and features | Steep learning curve |

| Automated trading bots are available | No mobile App |

| Portfolio management and tracking | No social trading |

| User-friendly interface | |

| Demo trading account is available | |

| Backtesting and strategy testing |

Bitsgap Features Explained

- Arbitrage: Take advantage of price differences across exchanges to maximize profits.

- Trading Terminal: Access multiple exchanges and perform spot and futures trading with a single interface.

- Futures Trading Bots: Develop bots that can trade futures automatically.

- Crypton Signals: Detect market anomalies to make informed trading decisions.

- Portfolio Management: Monitor portfolio performance and earnings in real-time.

- Trading Bots: Use pre-configured bots that are optimized with machine learning.

- Security Measures: The platform uses API keys to connect to exchange accounts, and does not handle any deposits. The system also employs 2048-bit encryption for enhanced security.

- Paper Trading: Demo Trading is available to backtest your strategies and understand the platform features.

Bitsgap Automated Trading bots

Bitsgap offers a range of automated trading bots that use advanced algorithms to analyze market trends and make trading decisions. The bots are fully customizable, allowing users to set their own trading strategies and risk management parameters.

1. DCA Bot

The Bitsgap DCA bot is an automated trading bot that uses the Dollar Cost Averaging strategy to buy and sell cryptocurrencies. Essentially, the bot is designed to automatically buy small amounts of cryptocurrency at regular intervals, regardless of the price.

This can help investors take advantage of price dips and potentially build a more stable investment portfolio over time.

For example, let’s say that an investor wants to invest $1,000 in Bitcoin using the DCA strategy. They could set up the Bitsgap DCA bot to automatically buy $100 worth of Bitcoin every week for 10 weeks.

This means that the bot will automatically purchase Bitcoin at the current market price, up to a maximum of $100 each week, regardless of whether the price goes up or down.

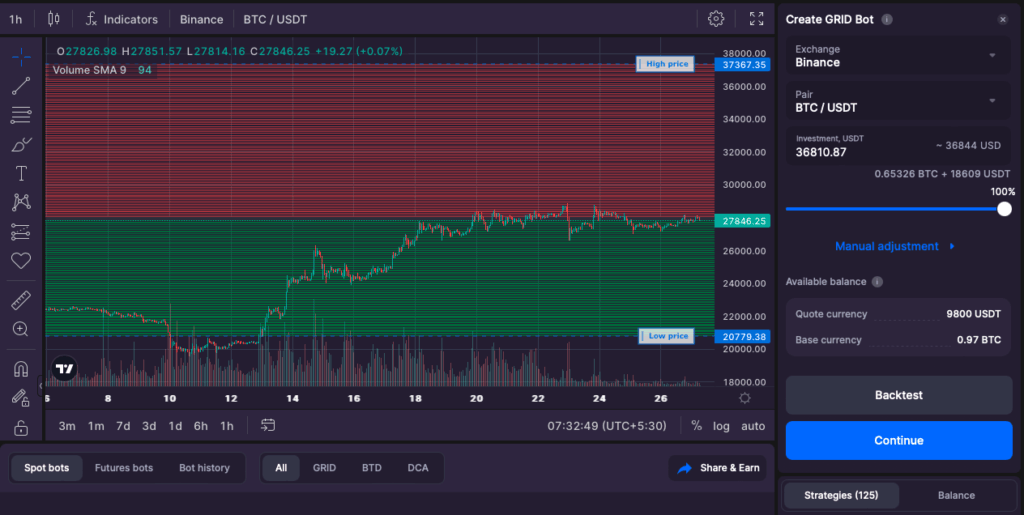

2. Grid Bot

The bot works by placing a series of buy and sell orders at predetermined price levels, creating a grid of orders that can generate profits as the price of the asset moves up and down.

For example, let’s say you want to use the Bitsgap GRID bot to trade Bitcoin on an exchange. You would start by setting up the bot with your preferred parameters, such as the price range you want to trade in and the number of orders you want to place.

Once you’ve set up the bot, it will start placing buy and sell orders at regular intervals within your chosen price range. For example, if you set your price range as $50,000 to $55,000, the bot might place buy orders at $50,000, $51,000, $52,000, and so on, and sell orders at $55,000, $54,000, $53,000, and so on.

As the price of Bitcoin moves up and down, the bot will automatically adjust the placement of its buy and sell orders to try to capture profits.

3. BTD bot

BTD stands for “Buy The Dip,” which means the bot is designed to buy cryptocurrencies when their prices are low, and then sell them when their prices go up.

For example, let’s say the BTD bot is set up to monitor the price of Bitcoin. If the price of Bitcoin drops by 10%, the bot will automatically buy Bitcoin. Then, if the price of Bitcoin goes up by 15%, the bot will automatically sell the Bitcoin and make a profit.

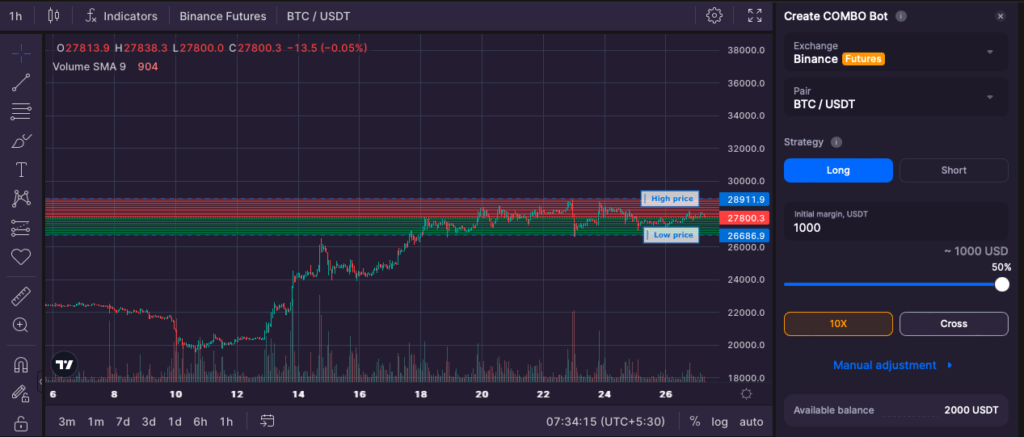

4. COMBO bot (Futures Bot)

Bitsgap Combo Bot is a trading bot that utilizes both DCA (Dollar-Cost Averaging) and grid trading strategies in futures markets. You can use leverage up to 10x in the futures market.

For example, let’s say a trader wants to trade Bitcoin futures. The trader sets up the Bitsgap Combo Bot and sets a grid with a 5% distance between each order. The bot also has a DCA feature enabled with a 3% interval. If the price of Bitcoin goes down, the bot will automatically buy more Bitcoin futures at the predetermined intervals, lowering the average cost of the asset.

If the price of Bitcoin goes up, the bot will sell futures contracts at the predetermined levels of the grid, taking profits as it goes. The combination of both DCA and grid trading allows the trader to make profits regardless of the direction of the market.

5. Arbitrage Trading bots

Bitsgap’s arbitrage trading feature allows you to take advantage of price differences across multiple exchanges. Essentially, you buy low on one exchange and sell high on another to make a profit.

The feature scans 25+ cryptocurrency exchanges and 10,000+ trading pairs in real-time to identify profitable arbitrage opportunities.

When an opportunity arises, you can execute the trade directly from the platform. Bitsgap also includes a smart order-routing system that automatically selects the best exchange to execute the trade based on factors such as liquidity and fees.

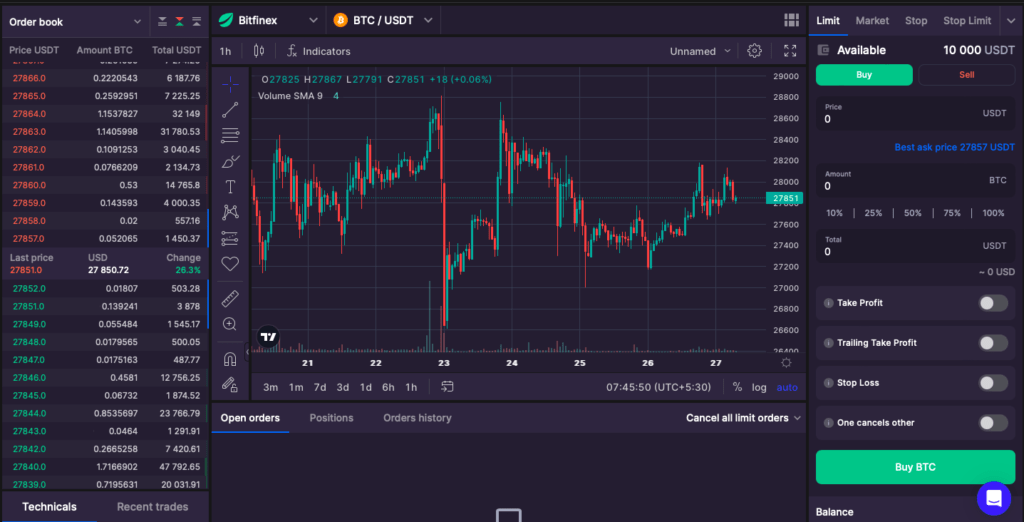

Bitsgap Trading Terminal Review

The Bitsgap Trading Terminal has a variety of features that make it a useful tool for traders. For example, the platform offers real-time market analysis, automated trading bots, and a customizable trading interface.

It includes a feature called “Smart Trade,” which allows users to set stop-loss and take-profit orders simultaneously. This can help traders manage risk and maximize profits.

The platform offers a range of trading indicators that can be used to analyze market trends and make informed trading decisions. These indicators include popular tools such as MACD, RSI, and Bollinger Bands.

It connects to multiple exchanges. This means that users can trade on a variety of different cryptocurrency exchanges without having to log in to each one separately.

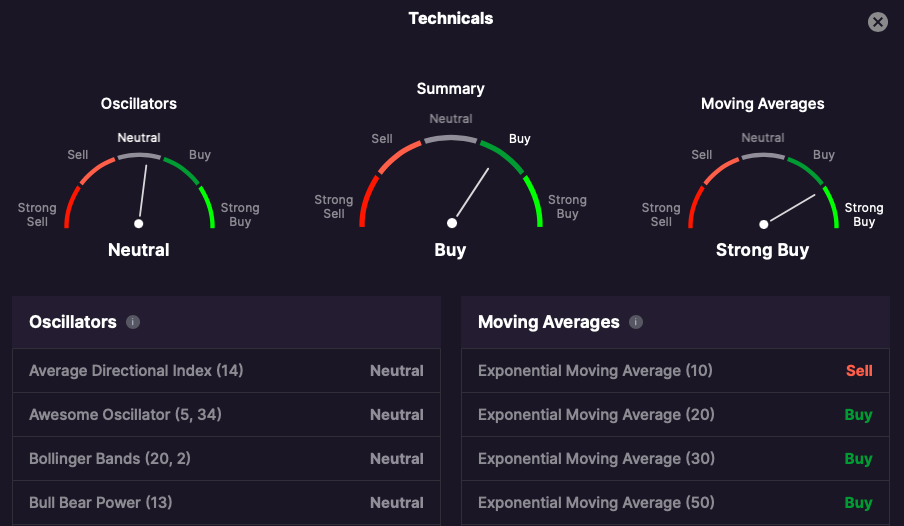

Bitsgap Technical Indicators

The Bitsgap Trading Terminal includes a wide range of technical indicators that can be used to develop trading strategies. Some of the most commonly used technical indicators are:

- Moving Average (MA): This indicator is used to identify trends by smoothing out price fluctuations over a period of time. A moving average can be calculated for different time periods, such as 10-day, 20-day, or 50-day moving averages.

- Relative Strength Index (RSI): The RSI is a momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine the overbought and oversold conditions of an asset.

- Bollinger Bands: This indicator consists of three lines that are plotted based on the moving average and standard deviation of price data. Bollinger Bands can be used to identify potential support and resistance levels for an asset.

- MACD (Moving Average Convergence Divergence): This indicator is used to identify changes in momentum and trend direction. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA.

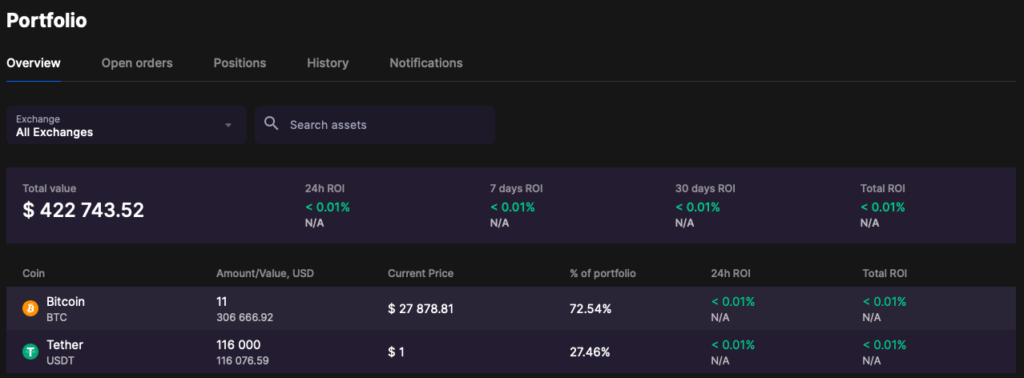

Bitsgap Portfolio Management

Bitsgap portfolio management feature allows users to track the performance of their trades across multiple exchanges in real-time. This can be especially useful for traders who are managing a diverse portfolio of cryptocurrencies.

The dashboard provides an overview of the user’s portfolio, including total assets, total profit and loss, and the performance of individual assets. Users can see the current value of their holdings, as well as their cost basis and profit and loss for each asset.

The trading history tool allows users to view a detailed history of their trades across multiple exchanges. This can be useful for identifying areas of strength and weakness in trading strategies.

What Crypto Exchanges can I use with Bitsgap?

The Bitsgap Trading Terminal supports 25 popular cryptocurrency exchanges, including:

- Binance

- Bitfinex

- Bybit

- Bitstamp

- Bittrex

- Coinbase Pro

- HitBTC

- Huobi

- Kraken

- Poloniex

- OKX

- KuCoin

Bitsgap Review: Security Measures

As with any platform that deals with sensitive financial information, security is a top priority. Bitsgap employs various security measures to ensure the safety of user funds. Here are some of the key security features:

- Two-Factor Authentication (2FA)

- Industry-standard encryption algorithms

- Secure Socket Layer (SSL)

- IP Whitelisting

- Anti-phishing measures (Domain blacklisting and email verification)

- Regular security audits

Bitsgap Customer Support

Bitsgap offers customer support via email and live chat. The platform also has a comprehensive knowledge base that includes tutorials, FAQs, and trading guides. The customer support team is available 24/7 to assist users with any issues they may encounter.

User Reviews and Testimonials

Overall, user reviews and testimonials of Bitsgap are positive. Users appreciate the range of features offered by the platform, as well as its user-friendly interface. Some users have reported issues with the platform’s automated trading bots, but these issues appear to be relatively rare.

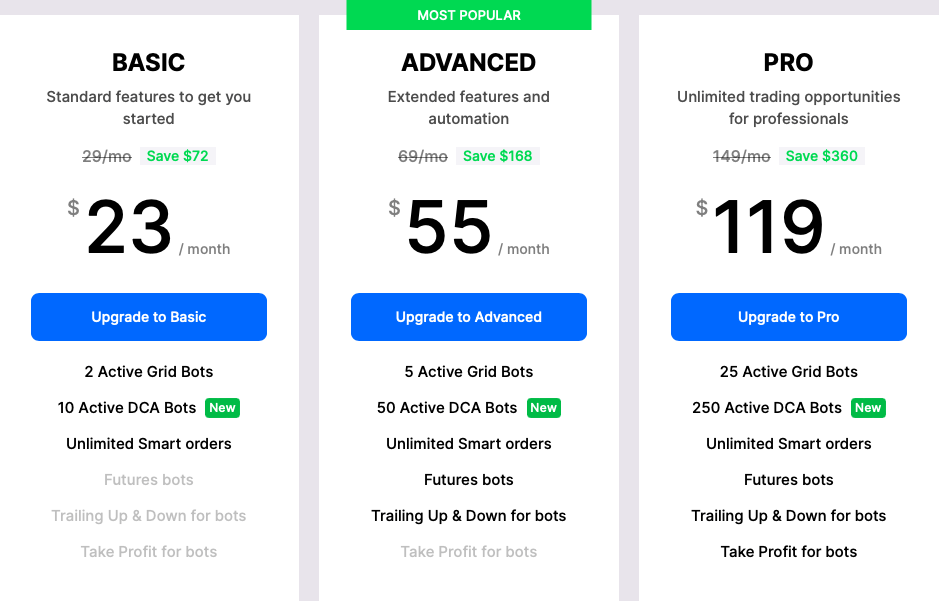

Bitsgap Pricing and Plans

The pricing plans for Bitsgap are as follows:

- Basic – This plan costs $29 per month (or $23 per month if paid annually) and includes 2 active Grid bots, 10 active DCA bots, unlimited smart orders, futures bots, trailing up & down for bots, and take profit for bots.

- Advanced – This plan costs $69 per month (or $55 per month if paid annually) and includes 5 active Grid bots, 50 active DCA bots, unlimited smart orders, futures bots, trailing up & down for bots, and take profit for bots.

- Pro – This plan costs $149 per month (or $119 per month if paid annually) and includes 25 active Grid bots, 250 active DCA bots, unlimited smart orders, futures bots, trailing up & down for bots, and take profit for bots.

All plans come with a free 14-day trial, and you can upgrade or downgrade your plan at any time. Additionally, all plans include access to features such as backtesting, portfolio tracking, and a user-friendly interface.

Alternatives vs Comparison

- 3Commas – 3Commas is a popular trading platform that allows users to automate their trading strategies across multiple exchanges. Like Bitsgap, 3Commas offers features such as smart orders, trailing stop-loss, and grid bots.

- Pionex – Pionex is a cryptocurrency exchange with a built-in trading bot. The platform offers a range of pre-built trading bots that users can deploy, as well as a drag-and-drop bot builder for more advanced users. Pionex also offers features such as smart orders and grid trading.

- Cryptohopper offers features such as backtesting, paper trading, and social trading. While Cryptohopper may be a good fit for traders who are looking for a feature-rich and customizable trading platform.

Final Thoughts: Is it Safe to use?

In summary, the Bitsgap bot is a powerful and intuitive trading tool that can help traders navigate the complexities of cryptocurrency trading.

With its advanced trading bots, portfolio management tools, and arbitrage trading features, the Bitsgap bot is an excellent choice for both novice and experienced cryptocurrency traders.

You Might be Interested: