Are you an investor in the cryptocurrency market? If yes, then you must be aware of the complexities involved in managing your cryptocurrency investments and tax filing.

Keeping track of the trades, transactions, and tax liabilities can be quite a challenge, especially when you have multiple exchanges and wallets.

Fortunately, there are several portfolio and tax tracking tools available in the market that can help simplify this process.

One such tool is CoinTracking. In this article, we’ll review CoinTracking, its features, pricing plans, and whether it’s a safe and reliable option for managing your cryptocurrency portfolio and taxes.

What is CoinTracking?

CoinTracking is a cryptocurrency portfolio and tax tracker that was launched in 2013.

The platform claims to offer a comprehensive solution for managing your cryptocurrency investments, including portfolio management, tax reporting, and trade analysis.

CoinTracking supports over 10,000 cryptocurrencies and allows you to import your trades and transactions from over 110+ exchanges and wallets.

The platform also offers a variety of reporting options, including capital gains reports and tax reports, to help you manage your taxes more effectively.

Pros and Cons

| Pros 👍 | Cons 👎 |

|---|---|

| Automated trade import from 110+ exchanges | Limited customer support options |

| Comprehensive reporting options | Some advanced features require a paid plan |

| Tax calculator and tax reporting | |

| User-friendly interface | |

| Two-factor authentication (2FA) for security |

CoinTracking Features Review

1. Portfolio Management

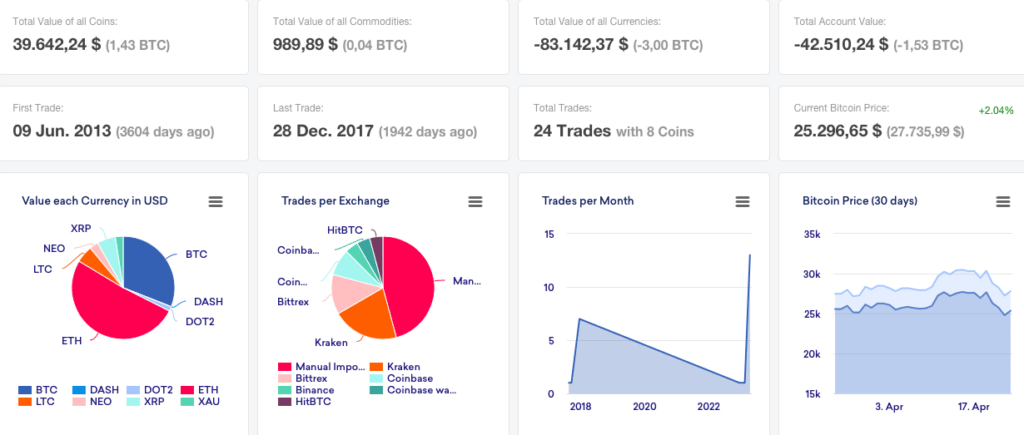

CoinTracking’s portfolio management tool offers a seamless way to keep track of your cryptocurrency investments regardless of where they are stored.

With support for more than 10,000 cryptocurrencies, the platform allows you to manually add transactions or import them from exchanges and wallets.

You can monitor your profit and loss, view your current holdings, and analyze your investments over time.

With CoinTracking, you have access to 25 customizable crypto reports, interactive charts for trades and coins, and profit/loss and audit reports.

You can also see realized and unrealized gains to help you identify investment opportunities and risks.

Related: Best Crypto Portfolio Tracker Apps

2. Tax Reporting

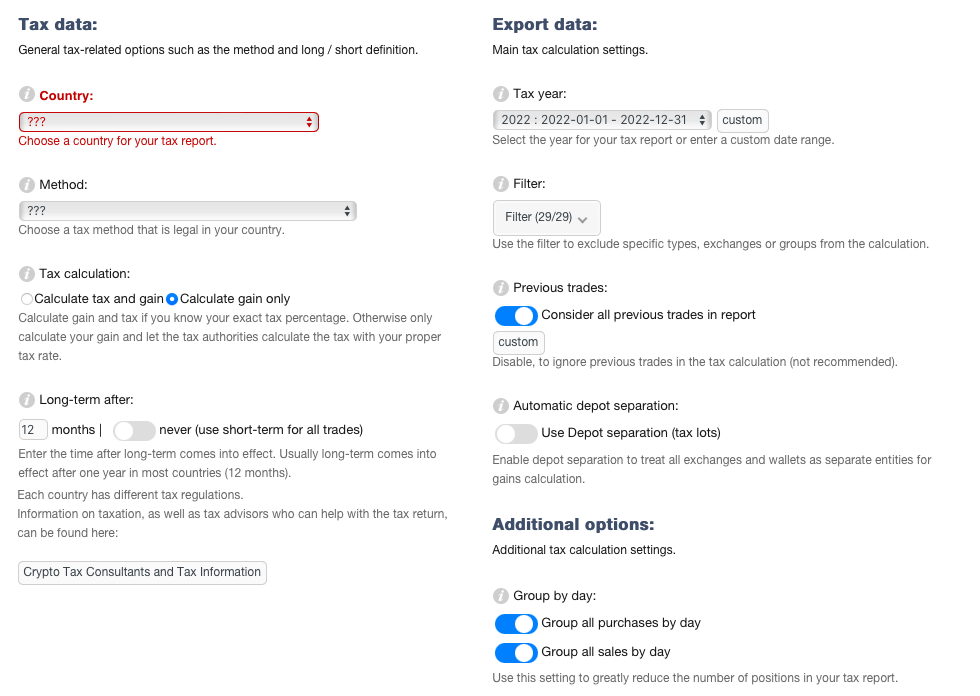

CoinTracking has an extensive range of tax reports available, including income reports, capital gains reports, and donation reports.

What’s more, it offers users a variety of tax accounting methods, including FIFO, LIFO, and HIFO, to help them calculate their tax liabilities more accurately.

This flexible approach ensures that every user can choose the most suitable option for their needs.

With coverage in over 100 countries, The platform provides tax reports for a range of tax types, from capital gains and income to mining. And with 13 tax methods available, such as FIFO, LIFO, and AVCO, users can select the best method that suits their preferences.

You can export your tax data to CPAs and tax offices, ensuring that you have all the necessary documents to file your taxes correctly.

3. Coin Charts & Trade Imports

CoinTracking offers a comprehensive coin charting system that covers the history of all 24,006 coins, the latest prices for all coins, top coins by trades and volume, and coin trends, statistics, and analysis.

You can also sync your trades directly with the blockchain and automatically import via APIs. CoinTracking supports export in Excel, PDF, CSV, XML & JSON formats.

CoinTracking Supported Exchanges and Wallets

CoinTracking supports over 110 cryptocurrency exchanges and wallets, including:

Exchanges:

Wallets:

- Ledger Nano X

- Trezor

- MyEtherWallet

- Exodus

- Electrum

- Atomic wallet

The platform also allows manual entry of trades and transactions, so users can add data from exchanges or wallets that are not directly supported by CoinTracking.

Related: Best Bitcoin Hardware Wallets

CoinTracking Security Review

CoinTracking takes security very seriously and employs various measures to ensure that users’ data and assets are protected.

Here are some of the security features:

- Data and API encryption: CoinTracking encrypts all data and API connections to prevent unauthorized access.

- Two-factor authentication (2FA): Users can enable 2FA to add an extra layer of security to their accounts. This can be done using an authenticator app, such as Google Authenticator.

- Trade backups: Users can create and restore trade backups to ensure that their trade history is never lost.

- No access to exchanges required: CoinTracking does not require users to give it access to their exchange accounts. Instead, users can import their trade history using APIs or by uploading CSV files.

- Regular backups: CoinTracking regularly backs up its data to ensure that users’ data is always safe and secure.

CoinTracking Pricing and Fees

CoinTracking offers four different pricing plans for its users: Free, Pro, Expert, and Unlimited.

- The Free plan is best suited for new crypto investors and offers to track up to 200 transactions, manual exchange imports, personal exports, and tax and capital gains reporting.

- The Pro plan [$9.99] is designed for advanced investors and offers to track up to 3,500 transactions, 5 auto imports for each coin, and unlimited manual imports.

- The Expert plan [$16.99] is best for experienced investors and offers to track up to 20,000 transactions, 10 auto imports for each coin, and unlimited manual imports.

- The Unlimited plan [$59.99] provides the full power of CoinTracking for professional investors with unlimited transactions, 50 auto imports for each coin, and unlimited manual imports.

Alternatives and Comparison

| Key Points | CoinTracking | CoinTracker | CoinLedger |

|---|---|---|---|

| Supported Exchanges | 110+ | 300+ | 400+ |

| Tax Reporting | Yes | Yes | Yes |

| Price Tracking | Yes | Yes | Yes |

| Portfolio Analysis | Yes | Yes | Yes |

| Mobile App | Yes | Yes | No |

| Free Version | Yes (limited) | Yes (limited) | Yes |

| Paid Plans | Starts at $9.99 per year | Starts at $49/year | Starts at $9.99/per year |

How to Open an Account with CoinTracking?

To open an account with CoinTracking, you can follow these steps:

- Go to the CoinTracking website (cointracking.info) and click on the “Register” button at the top right corner of the homepage.

- Enter your email address, choose a secure password, and confirm your password.

- Read and accept the terms of service and privacy policy.

- Check your email inbox for a verification email from CoinTracking and click on the verification link provided.

- Once you have verified your email address, log in to your account on the CoinTracking website.

- From the dashboard, you can start adding your trades and transactions by importing data from exchanges or by manually entering them.

- You can also set up various features and options, such as tax reports, portfolio tracking, and alerts.

Final Thoughts: Is it Worth Your Time?

CoinTracking is a powerful tool for cryptocurrency traders that offers a range of features to help users track their portfolios, trades, and taxes.

Its user-friendly interface, automated trade import, and tax calculator make it a popular choice among cryptocurrency traders. Additionally, its affordable pricing plans make it accessible to traders of all levels.

Overall, CoinTracking is a safe and reliable portfolio and tax tracker that offers a range of features to help traders stay on top of their trading activity.

With its comprehensive reporting options, 2FA, and encryption, users can trust that their data is secure.

FAQs

Is CoinTracking Safe and legitimate?

CoinTracking is a reputable cryptocurrency portfolio tracking and tax reporting platform that follows bank-level security measures to protect user data and assets.

It has gained the trust of over 500,000 users worldwide and has received positive reviews for its comprehensive features and user-friendly interface.

Can CoinTracking calculate my taxes accurately?

Yes, CoinTracking can calculate your taxes accurately based on your cryptocurrency trading activity. It uses various tax calculation methods, including FIFO (First-In-First-Out), LIFO (Last-In-First-Out), and HIFO (Highest-In-First-Out), to calculate your tax liability.

It also supports different tax jurisdictions and allows you to set your tax rates and thresholds. It provides a detailed tax report that includes your gains, losses, fees, and taxes due, which can be used to file your tax returns.

Can CoinTracking generate tax reports for multiple countries?

Yes, CoinTracking can generate tax reports for multiple countries based on their specific tax laws and regulations. It supports over 50 fiat currencies and over 15,000 trading pairs, making it easy to track your investments from anywhere in the world.

CoinTracking also provides detailed tax reports that are compliant with the tax laws of different countries, including the United States, Canada, Germany, and the United Kingdom.

You can easily switch between different tax jurisdictions and generate accurate tax reports for each one.

Does CoinTracking charge any fees?

CoinTracking offers both free and paid plans. The free plan allows you to track up to 200 trades, whereas paid plan starts at $9.99 per year.