Ethereum, Solana, and Polygon are all popular blockchain platforms that offer unique features and capabilities.

Ethereum is the largest and most well-known platform, with a strong developer community and a wide range of decentralized applications (dApps) built on top of it.

Solana, on the other hand, is a high-performance blockchain that aims to provide faster transaction speeds and lower fees.

Polygon, formerly known as Matic, is a Layer 2 scaling solution that enables faster and cheaper transactions on Ethereum.

In this post, we will compare and contrast these three platforms, discussing their strengths and weaknesses, and exploring the different use cases for which each may be best suited.

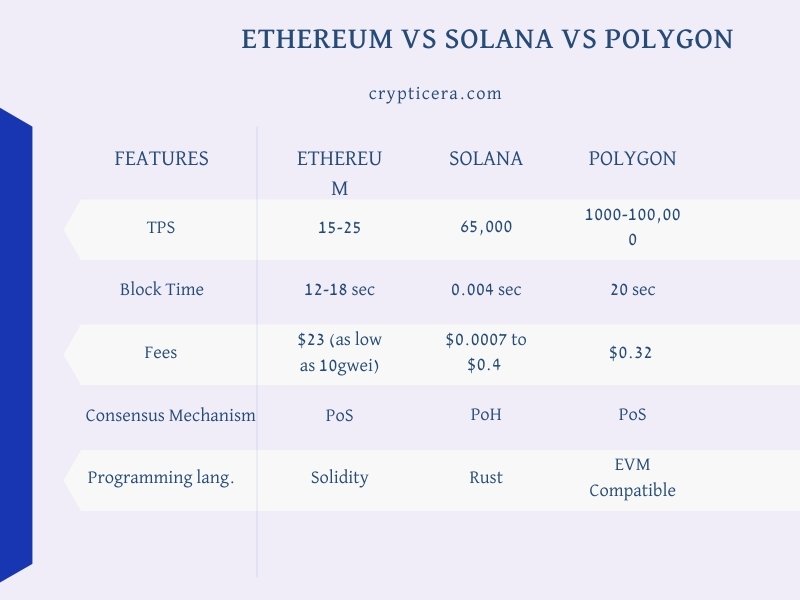

Ethereum vs Solana vs Polygon: At a Glance

“Ethereum vs Solana vs Polygon” compares three distinct blockchain platforms, each with its unique features and use cases.

Ethereum is the first and most popular smart contract platform, and Solana aims to be a high-performance blockchain network. Polygon is a scaling solution (Sharding) for Ethereum that enables faster and cheaper transactions.

| Properties | Ethereum | Solana | Polygon |

|---|---|---|---|

| Ticker | ETH | SOL | MATIC |

| Launched year | 2013 | 2017 | 2017 |

| Market Cap | $190 billion | $8.6 billion | $8.7 billion |

| Smart contracts language | Solidity | Rust, C, C++ | Golang, Solidity, Vyper |

| Throughput | 12-18 tps | 65,000 tps | 50,000-65,000 tps |

| Consensus | PoW | PoH | PoS plasma sidechain |

| Scalability | less scalable | highly scalable | more scalable than Ethereum |

| Gas Fees | High | Low | Medium |

| NFTs | High volume | Medium volume | low volume |

| Security | High | High | High |

| NFT Marketplace | OpenSea | Magic Eden | Opensea |

What is Ethereum (ETH)?

Ethereum is a decentralized, open-source blockchain platform that enables the creation of smart contracts and decentralized applications (dApps).

The Ethereum platform is powered by the Ethereum Virtual Machine (EVM), which can execute scripts using an international network of public nodes.

This allows developers to build and deploy a wide range of decentralized applications, from financial and gaming applications to prediction markets and social networks.

Key Features of Ethereum

- Decentralization: The Ethereum network is not controlled by any single entity, which makes it resistant to censorship and tampering.

- Smart contracts: These are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code.

- Flexibility: The platform can be used to create a wide range of applications, including financial applications, supply chain management systems, and more.

- Security: Ethereum is built on advanced blockchain technology, which makes it secure and resistant to attacks.

- Scalability: It can handle a high volume of transactions, making it suitable for large-scale applications.

- Interoperability: Ethereum is designed to be compatible with other blockchain networks, which allows it to connect with a wide range of systems and technologies.

Pros and Cons of Ethereum

| Pros | Cons |

|---|---|

| Smart contracts and Dapps | slow and high gas fees |

| It has a large and active developer community | scalability issues |

| It is an open-source platform | network Congestion |

| Top NFT Marketplaces on Ether | |

| High Market Cap (high Liquidity) |

What is Solana (SOL)?

Solana is a blockchain platform that aims to provide a high-throughput, low-latency, and low-fee platform for decentralized applications.

It uses a novel consensus algorithm called Proof of History (PoH) to achieve high transaction speeds without sacrificing decentralization.

This allows Solana to process 65,000 transactions per second, making it one of the fastest blockchain platforms currently available.

Key Features of Solana

- High throughput: Solana is designed to handle high transaction volumes, with a reported maximum throughput of 65,000 transactions per second.

- Low latency: Solana’s architecture is optimized for low latency, which means that transactions are confirmed and processed quickly.

- Energy-efficient: It uses a unique consensus algorithm called “Proof of History” that is more energy-efficient than other consensus mechanisms, such as Proof of Work.

- Decentralized: Solana is a decentralized platform that is run by a network of validators, rather than a single entity.

- Scalable: SOL is built to scale, with a modular architecture that allows for easy upgrades and additional functionality.

- Solana is also a permissionless network which means that anyone can join the network and participate in its governance.

Pros and Cons of Solana

| Pros | Cons |

|---|---|

| Smart contracts and Dapps | Still in the Beta version |

| Faster transactions speed (65000 tps) | Limited adoption |

| Larger developer community | network offline issues |

| low transaction fees | |

| Many use cases |

What is Polygon (MATIC)?

Polygon, formerly known as Matic Network, is a decentralized finance (DeFi) platform and infrastructure development chain for Ethereum.

It aims to make it easier for developers to create and deploy decentralized applications (dApps) and to bring more users into the Ethereum ecosystem.

The platform uses a variety of technologies, including proof-of-stake (PoS) consensus, plasma technology, and Ethereum sidechains, to provide a fast and scalable environment for DeFi applications.

Key Features of Polygon

- Scalability: It uses a network of sidechains that are connected to the Ethereum mainchain, allowing for faster and cheaper transactions.

- Security: Polygon uses a consensus mechanism called “Proof of Stake” which allows for a more secure network.

- Interoperability: MATIC Network is compatible with existing Ethereum tools and resources, making it easy to build and deploy decentralized applications.

- Low Latency: Polygon uses a technology called “Plasma” which allows for faster confirmation times, reducing the latency of transactions.

- Decentralization: It is a fully decentralized network, with no central authority controlling its operations.

- Maturity: Polygon is an Ethereum scaling solution that was launched in 2021, and is widely adopted among the community.

Pros & Cons of Polygon

| Pros | Cons |

|---|---|

| low gas fees transaction | less adoption |

| operates seamlessly and lesser carbon footprint | less secure than Ethereum |

| best for Ethereum developers | NFTs are not developed for the larger user base |

| decentralized and secure |

Ethereum vs Solana vs Polygon: The Ultimate Comparison

Comparing Ethereum vs Solana vs Polygon based on key points of blockchain network like transaction speed, block time, fees, consensus mechanism, and smart contract programming language.

History and Development

Ethereum was first proposed in 2013 by Vitalik Buterin and officially launched on July 30th, 2015.

It has a large and active community of developers, with over 20,000 active GitHub repositories.

Solana is a newer blockchain platform that was launched in 2020 by Solana Labs. It has seen rapid growth in recent months and has gained a significant following in the decentralized finance (DeFi) space.

Polygon was launched on May 18th, 2017, by a group of Ethereum developers. It is a layer 2 scaling solution for Ethereum that aims to improve the scalability and speed of the Ethereum network.

scalability

All three of these networks have different approaches to scalability, which is the ability of a blockchain network to handle a large number of transactions and users without experiencing delays or congestion.

Ethereum, which is the most well-known of the three, uses a proof-of-Stake (PoS) consensus mechanism, which is slow and expensive.

Solana, on the other hand, uses a novel consensus mechanism called Proof-of-History (PoH), which is designed to be fast and efficient. (More on this later)

Polygon uses a hybrid approach that combines PoS and sharding to improve scalability.

Its network is designed to be easily customizable, allowing developers to choose the level of scalability that they need for their dApps.

Consensus Mechanism

Ethereum 2.0 uses a consensus mechanism called Proof of Stake (PoS). Under PoS, validators are chosen to create blocks based on the amount of Ether they hold and “stake” as collateral, and they do not need to perform computational work to validate transactions and create new blocks.

Solana uses a consensus mechanism called “Proof of History” (PoH) which is a combination of Proof of Stake (PoS) and a unique data structure called a “Gauged Bloom Filter” (GBF).

PoH is a mechanism that creates a compact proof of the state of the blockchain at a specific point in time, this allows Solana to reach high transaction throughput and low-latency confirmations.

Polygon (formerly Matic) uses a variant of PoS called Plasma Cash, which utilizes child chains to increase scalability and reduce transaction fees.

transaction speed

One of the main challenges with Ethereum is its transaction speed. The Ethereum network is currently able to process around 15-25 transactions per second.

This can lead to delays and congestion when there is a high level of activity on the network.

With Solana, transactions are processed in parallel, allowing for a much higher level of throughput than other blockchain platforms.

In fact, Solana is capable of processing over 65,000 transactions per second, making it one of the fastest blockchain platforms in the world.

Finally, Polygon is a blockchain platform that is focused on providing scalability solutions for Ethereum. It has the capacity to handle 1,000 + TPS. However, Therotically Polygon claims to handle 100,000+ TPS.

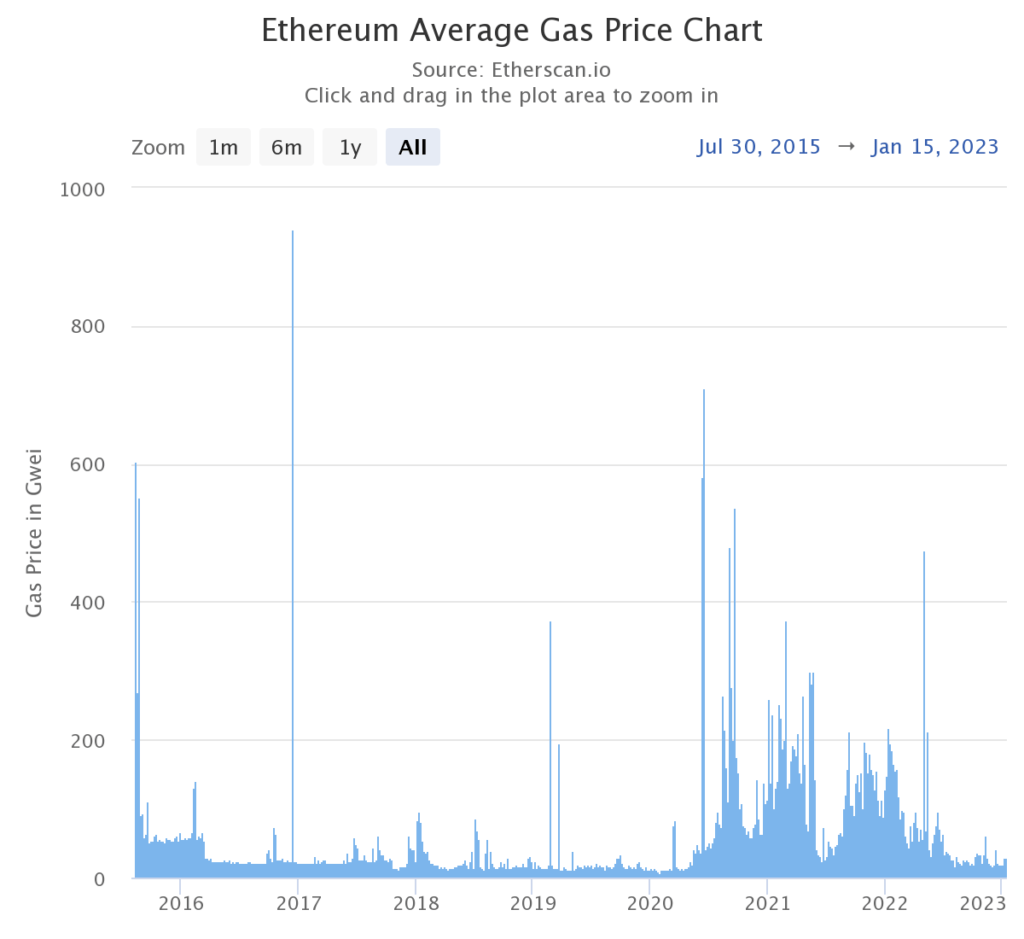

gas fees

In terms of gas fees, Ethereum is known for having relatively high fees compared to other platforms.

- Ethereum Average gas fees: $17.7

- Solana Average Transaction Fees: 0.000005 SOL per signature

- Polygon Average Transaction cost: 0.038564 Polygon

DApps

Here are some examples of DApps built on Ethereum:

- CryptoKitties: a collectible game where players can breed, trade, and sell digital cats

- Uniswap: a decentralized exchange for trading Ethereum-based tokens

- MakerDAO: a platform for creating and managing stablecoins

Here are some examples of DApps built on Solana:

- Serum: a decentralized exchange for fast and inexpensive token trading

- Mirror: a platform for creating and managing synthetic assets (such as synthetic stocks and commodities)

- The Graph: a decentralized query network for indexing and querying data from Ethereum and other blockchains

However, Polygon is not well known for its own DApps but it provides scalability and smart contract solutions to Ethereum blockchain decentralized Apps.

NFT Marketplaces

The debate of Ethereum vs Solana vs Polygon in NFT Space is highly shouted. Ethereum has a greater market dominance with its leading NFT Platform called Opensea.

Solana is not far away from Ethereum with its high-speed NFT Transactions.

Polygon is not well known for its own NFT Marketplace. However, you can buy NFTs on the polygon blockchain using Opensea Marketplace.

Top NFT Platforms on Ethereum

| # | Market | Avg. price | Traders | Volume |

|---|---|---|---|---|

| 1 | OpenSea | $1.17k | 2,476,402 | $32.29B |

| 2 | CryptoPunks | $131.61k | 7,302 | $2.99B |

| 3 | LooksRare | $6.27k | 113,188 | $1.65B |

| 4 | X2Y2 | $594.35 | 172,352 | $957.3M |

| 5 | Rarible | $963.86 | 110,543 | $300.95M |

Top NFT Platforms on Solana

| # | Market | Avg. price | Traders | Volume |

|---|---|---|---|---|

| 1 | Magic Eden | $122.77 | 1,384,190 | $1.94B |

| 2 | Solanart | $895.16 | 244,807 | $665.76M |

| 3 | DigitalEyes Market | $616.01 | 71,555 | $127.6M |

| 4 | Solana Monkey Business | $16.38k | 3,666 | $103.67M |

Top NFT Platform on Polygon

| # | Market | Avg. price | Traders | Volume |

|---|---|---|---|---|

| 1 | OpenSea | $40.32 | 1,305,424 | $786.27M |

| 2 | Aavegotchi | $528.15 | 12,165 | $86.8M |

| 3 | Playdapp marketplace | $2.18 | 27,025 | $3.32M |

| 4 | Element | $19.49 | 69,483 | $2.87M |

ETH Vs SOL Vs MATIC: Token Economics

The Native Token of the Ethereum blockchain is Ether (ETH). It has a total Circulation supply of 122,373,866 ETH with a current market cap of $190 billion.

Solana native token SOL has a market cap of $8.6 billion and a current circulating supply of 370,753,513 SOL.

Polygon, on the other hand, has a market cap of $8.7 billion, just above Solana, with a supply of 8,734,317,475 MATIC.

Ethereum vs Solana vs Polygon: Which is better?

| Feature | Winner |

|---|---|

| Consensus mechanism | All have the same PoS |

| Smart contracts | Ethereum |

| Transaction Speed | Solana |

| Governance | Polygon |

| Interoperability | Polygon |

| Development | Solana |

| Token economics | All |

Conclusion

In the end Ethereum vs Solana vs polygon, the choice is a highly personal one and will depend on the specific needs and goals of your project or application.

It’s important to carefully weigh the pros and cons of each platform before making a decision and to keep in mind that the blockchain industry is constantly evolving, so what works best today may not be the best choice tomorrow.

But one thing is certain, whichever platform you choose, you’ll be joining a vibrant and exciting community of innovators and early adopters who are working to shape the future of blockchain technology.

FAQs

Ethereum vs Solana vs Polygon: Which is More Scalable?

In terms of scalability, Solana is better than Ethereum, and Polygon is a solution to improve Ethereum’s scalability.u003cbru003eu003cbru003eEthereum has been facing scalability issues due to its limited transaction processing capacity. Solana, on the other hand, is a high-performance blockchain that claims to be able to process up to 65,000 transactions per second. u003cbru003eu003cbru003ePolygon is a layer 2 scaling solution for Ethereum that aims to increase the throughput of the Ethereum network by using a sidechain.

Ethereum vs Solana vs Polygon: Which is More Secure?

All three networks Ethereum, Solana, and Polygon have their own consensus mechanism and security features. u003cbru003eu003cbru003eEthereum 2.0 uses a consensus mechanism called u0022u003cstrongu003eProof of Stakeu003c/strongu003eu0022 which is considered to be secure but it’s energy-intensive due to Ethereum’s network congestion. u003cbru003eu003cbru003eSolana uses a consensus mechanism called u0022Proof of Historyu0022 which is said to be more secure than traditional PoS. It uses a unique consensus algorithm called u0022Tower BFTu0022 which is designed to achieve high throughput while maintaining security. u003cbru003eu003cbru003ePolygon uses a consensus mechanism called u0022PoSu0022 which is considered to be secure and it also utilizes Ethereum security infrastructure. u003cbru003eu003cbru003eAll these consensus mechanisms have their own pros and cons, and it is considered that PoS is more secure than PoW because it’s less energy-intensive and less vulnerable to 51% attack.