In today’s fast-paced world, managing your finances can be a daunting task. With so many different financial tools and platforms available, it can be challenging to find the right one that meets all your needs.

However, Kubera, a personal wealth tracker platform, aims to simplify this task and make it more accessible for everyone.

In this article, we’ll be taking an in-depth look at Kubera’s features, pricing, security, and privacy policies to help you decide whether this platform is the right choice for you.

Introduction: Why Managing Your Finances is Important?

Managing your finances is an essential part of a healthy financial life. It helps you keep track of your spending, create a budget, and make better financial decisions.

Proper financial management can help you achieve your short and long-term financial goals, whether it be saving for retirement, buying a house, or paying off debt.

By using a personal finance management platform like Kubera, you can simplify this process and take control of your financial future.

What is Kubera?

Kubera Wealth Tracker is a digital financial management tool that consolidates financial information from various sources in one place.

With Kubera, users can link all their financial accounts and automatically update the information in real-time.

The platform supports various account types, including bank accounts, investment accounts, credit cards, loans, and cryptocurrencies.

Pros and Cons of Kubera

| Pros | Cons |

|---|---|

| Clear overview of financial holdings | Monthly subscription fee |

| Integrates with financial institutions | Complex user interface |

| Goal-setting and investment tracking | Not suitable for simple financial situations |

| Customization of assets | |

| Detailed performance data for investments | |

| Mobile app for convenient access |

How Does Kubera Work?

Kubera stands out as a platform with an outstanding reputation for its seamless integration and user-friendly interface.

Getting started with Kubera is a simple process – all you need is a Gmail account and a nominal fee of $1 to gain access to the platform for a 14-day trial period.

You can rest assured that you won’t be automatically charged at the end of your trial, as the platform only requires your credit card information for sign-up purposes.

Once you’re logged in, you’ll be welcomed by a dashboard that boasts an impressive range of integration capabilities with a plethora of banks, brokers, and exchanges.

1. Brokerage Integration

Kubera collaborates with over 20,000 banks and brokers globally, allowing you to link your online brokers and banks or input individual ticker symbols effortlessly.

You can easily access all major stock exchanges across the United States, United Kingdom, Europe, Australia, and New Zealand.

Whether you want to add your brokerage accounts or individual stock and ETF holdings, you can do it within minutes and get a detailed breakdown of your investments.

What sets Kubera apart is its ability to show your portfolio’s performance against popular benchmarks such as the S&P 500 or popular stocks like Tesla.

By automatically recognizing the date of purchase for assets linked from your broker, it indicates whether your holdings are positive or negative.

It also tracks the Internal Rate of Return (IRR) for each asset, giving you a clear picture of your overall performance.

2. Asset Portfolio Management

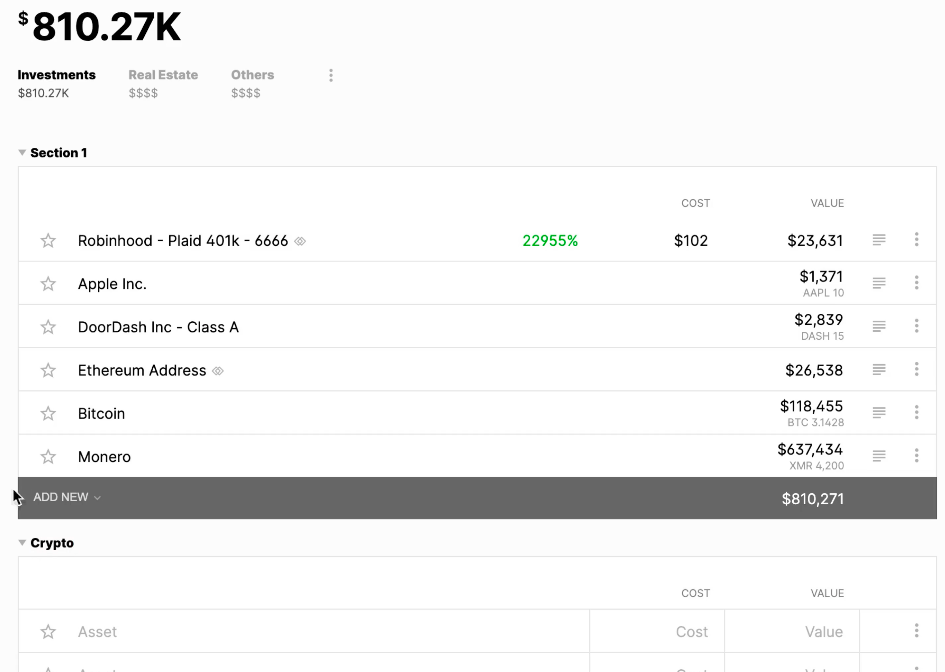

Once you’ve added your brokerage, you’ll be able to incorporate a vast array of assets into your portfolio, thanks to Kubera’s impressive range of supported assets.

From cryptocurrency to NFTs, precious metals to real estate, and cars to domain names, you can add practically any type of asset to your portfolio.

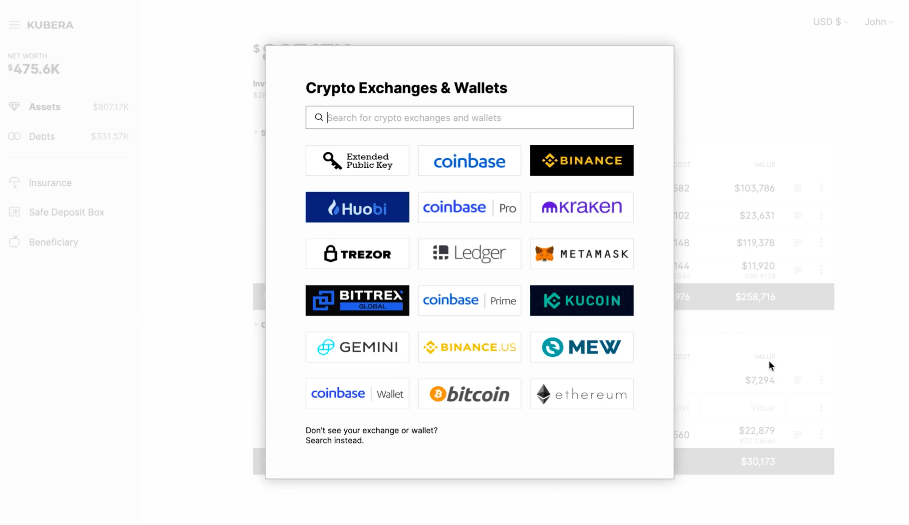

In particular, for those who are serious about their cryptocurrency investments, Kubera is an exceptional portfolio tracker.

It can easily sync with any major Crypto Exchange or wallet, and you can manually add crypto tickers like Bitcoin or Ethereum just like any other investment.

But that’s not all – It also offers DeFi support, which means you can add assets like NFTs or funds you have in a Lending, mining, or staking pool to your portfolio.

Related: Best Crypto Portfolio Tracker Apps

3. Net Worth Tracker

Kubera boasts an all-encompassing visualization of your net worth’s growth or decline, thanks to its exceptional net worth tab.

What’s more, the pie charts on Kubera offer a uniquely insightful representation of your net worth, enabling you to identify areas of improvement and take proactive steps toward achieving your financial goals.

Kubera Pricing and Cost Review

Kubera currently tracks over $25 billion in assets. There are three pricing plans available:

- For Financial Advisors & Portfolio Managers, plans start at $150 per month

- Kubera Personal is for individuals with a lot of money who manage their own portfolios. It costs $150 per year.

- Kubera Family is for families who want to work together to manage their assets. It costs $225 per year.

It offers customer support via email and phone. Users can also access a comprehensive FAQ section on the platform’s website, which provides answers to common questions.

Kubera Security Review

They prioritize protecting user information and do not have access to banking or cryptocurrency account credentials.

To ensure that data remains secure, Kubera employs encryption and conducts regular external security audits. In the unlikely event of a data breach, they have measures in place to deal with the situation.

To further bolster their security protocols, The company employees do not have access to user data, and users are advised not to store highly sensitive information.

Additionally, It is recommended that users enable two-factor authentication for added security.

Furthermore, Its commitment to user privacy is evident in its policy of not selling user data. Any deleted data is also permanently removed from their system.

Alternatives and Comparisons: Crypto Tracker

| Key Points | Kubera | CoinTracker |

|---|---|---|

| Crypto trading | Yes | Yes |

| Supported cryptocurrencies | 3500+ | 10,000+ |

| Pricing | $150 per year | $49 per year |

| Mobile app | Yes | Yes |

| Desktop app | No | Yes |

| Supported Crypto Exchanges | 20+ | 500+ |

How to Use Kubera for Portfolio Tracking?

Here’s a short beginner’s guide on how to use Kubera for portfolio tracking:

- Sign up for Kubera: First, visit the Kubera website and sign up for a free account. You can choose to sign up using your email address or Google account.

- Add your accounts: Once you’ve signed up, you can add all of your investment accounts. This includes your brokerage accounts, retirement accounts, bank accounts, and any other investments you have. Kubera supports over 20,000 financial institutions, so chances are, your accounts are already supported.

- Sync your accounts: After you’ve added your accounts, you can sync them with Kubera. This allows you to pull in your investment data automatically, so you don’t have to manually enter your trades and balances.

- Set up your portfolio: Once your accounts are synced, you can set up your portfolio. It involves categorizing your investments into different asset classes, such as stocks, bonds, and real estate.

- Track your performance: With your portfolio set up, you can start tracking your performance. Kubera provides a dashboard that shows you your portfolio’s performance over time, as well as your overall asset allocation. You can also drill down into individual investments to see how they’re performing.

- Monitor your risks: It also provides tools to help you monitor the risks in your portfolio. This includes tracking your exposure to different asset classes and analyzing the historical performance of your investments.

- Rebalance your portfolio: Based on your analysis, you may need to rebalance your portfolio to ensure that it’s aligned with your investment strategy. Kubera makes it easy to do this by providing recommendations for trades that can bring your portfolio back into balance.

Final Thoughts: Is it Worth your Time?

Kubera offers a wide range of investment options for users to choose from, including pre-built portfolios, custom portfolios, and individual securities.

The platform also provides features like tax-loss harvesting and automatic rebalancing to help users optimize their returns.

Whether you’re a beginner or an experienced investor, it has something to offer for everyone.

With its user-friendly interface and various investment options, Kubera is a reliable platform for those looking to grow their wealth through investing.

FAQs

Is Kubera Safe to Use?

Yes, Kubera is safe. The platform uses bank-level security to encrypt users’ data and prevent unauthorized access.

Additionally, The Platform is registered with the SEC as an investment advisor, which means it is subject to strict regulatory oversight.

What is the minimum investment required to start using Kubera?

The minimum investment required to start using Kubera is $150. However, you can try it out for 14 days for just $1.

Is Kubera suitable for beginner investors?

Yes, Kubera is suitable for beginner investors. It is a user-friendly investment platform that offers a range of investment options, including stocks, bonds, and cryptocurrencies, with low fees and a minimum investment of $1.

It also provides educational resources and tools to help beginner investors make informed decisions and manage their portfolios effectively.