Are you on the hunt for the next big thing in cryptocurrency investments? Look no further than the face-off between the two top cryptocurrencies, Polkadot Vs Solana.

Both blockchain networks have been making waves in the industry, but which one is the real game-changer?

In this blog post, we’ll dive deep into the inner workings of both Polkadot and Solana. Compare their strengths and weaknesses to help you make an informed decision on which one is the better investment for you.

Comparison between Polkadot and Solana

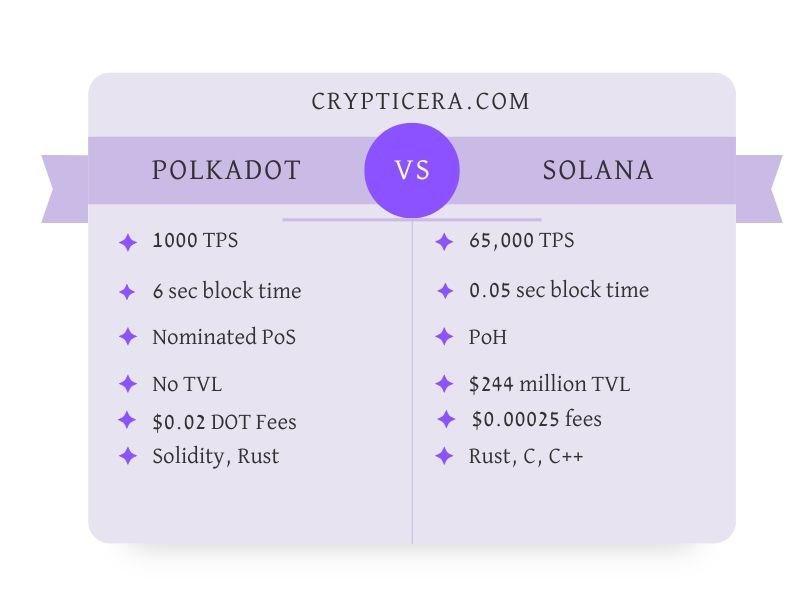

| Category | Polkadot | Solana |

|---|---|---|

| Launched date | May 2020 | April 2020 |

| Founders | Dr. Gavin Wood, Jutta Steiner, Peter Czaban | Anatoly Yakovenko |

| Transaction speed | ~10-1000 TPS | ~65,000 TPS |

| Network fees | 0.02 DOT (low) | $0.00025 (Very low) |

| Programming language | Solidity | Rust, C, C++ |

| Smart Contracts Security | Layer-based security | High-throughput based security |

| Scalability | High | High |

| Consensus mechanism | GRANDPA | PoS |

| NFT Marketplaces | No | Yes (Magic Eden, Solsea, Solanart) |

| Open Source | Yes | Yes |

| DApps | No | Yes |

What is Polkadot (DOT) and How does it Work?

Polkadot is not just any ordinary blockchain, it’s a revolutionary force that’s about to shake up the entire crypto-sphere!

Think of it like a bustling city where different blockchain projects coexist and flourish, connected by a network of seamless highways.

This network, known as Polkadot, allows for the free flow of data and value between different blockchains, creating endless possibilities for collaboration and innovation.

Gone are the days of siloed blockchain projects, existing in their isolated worlds. With Polkadot, different types of blockchains, whether public or private, can talk to each other, share resources, and build on one another’s strengths.

It’s a game-changer, a true Web 3.0 technology. This protocol’s unique multi-chain architecture allows for parallel processing, meaning transactions can happen at lightning-fast speeds, making it one of the most scalable and efficient blockchain networks out there.

From developers, and investors to enterprise users, everyone is eager to hop on the Polkadot bandwagon, and for good reason.

The project is a visionary step towards building a truly decentralized web, where power is truly in the hands of the people, and the possibilities are endless.

What is Solana (SOL) and how does it Work?

Solana is a high-speed blockchain platform that promises to revolutionize the way transactions are processed. Its innovative consensus algorithm, “Proof of Stake Time” (PoST), allows the network to blaze through transactions at lightning speeds, reaching up to 65,000 transactions per second.

With its launch in 2020, Solana has quickly established itself as a force to be reckoned with in the blockchain world.

The native token of the Solana ecosystem is SOL, used as a means of exchange for transaction fees on the network.

The project is backed by Solana Labs, a company based in San Diego, California, focused on developing and maintaining the Solana platform.

It aims to provide a platform for decentralized applications and decentralized finance (DeFi) projects, which could potentially change the way we interact with finance and money.

With its cutting-edge technology and a team of talented developers, Solana is poised to become a major player in the blockchain space and a catalyst for the next generation of decentralized applications.

Polkadot vs. Solana: Pros and Cons

Polkadot offers interoperability between different blockchains (Especially on the Ethereum Blockchain network), whereas Solana allows for the creation of decentralization apps.

They both use a different consensus mechanism, Polkadot uses a governance-based mechanism called GRANDPA and Solana uses a high-performance mechanism called Proof-of-History (PoH).

Pros of Polkadot

- Allows for interoperability between different blockchain networks

- Uses a governance-based consensus mechanism that allows for flexible upgrades to the protocol

- Provides for “parachains,” which are separate blockchain networks that can run in parallel to the main Polkadot blockchain

Cons of Polkadot

- The network is still relatively new and under development, so it may be less battle-tested than other platforms

- GRANDPA consensus mechanism is more complex than others like PoS, it may require more resources to run a full node.

Pros of Solana

- Extremely high throughput and low latency, making it well-suited for high-speed trading and other high-performance use cases

- Solana uses a high-performance consensus mechanism called Proof-of-Stake (PoS)

- Solana has been battle-tested on various high-performance applications like Serum, a decentralized exchange

Cons of Solana

- Currently, Solana does not have built-in interoperability between different blockchain networks

- Solana’s high performance also comes with high energy consumption

Polkadot vs Solana: Similarities and Differences

Transaction Speed

Solana is a single-chain blockchain that utilizes a unique consensus mechanism called “Proof of Stake Slot” (PoS) that allows it to process a whopping 65,000 transactions per second.

It’s like a well-oiled machine that can handle a high volume of transactions with lightning-fast speed.

On the other hand, Polkadot operates on a multi-chain architecture, where different “parachains” work in parallel to process transactions.

Think of it like a network of efficient assembly lines working simultaneously to achieve a high level of throughput.

This sharding mechanism allows Polkadot to achieve an impressive theoretical transaction processing speed of up to tens of thousands of TPS. However, the current (Practical) transaction speed of the Polkadot network is 1000 TPS.

Winner: Solana (SOL)

Scalability

Polkadot is a multi-chain platform that enables interoperability between different blockchain networks.

It uses a unique multi-chain architecture called a “relay chain” that allows different chains (called “parachains“) to communicate with each other and with external networks, such as Ethereum.

This allows for high throughput and low latency, allowing many different projects to run on the same network.

Solana, on the other hand, is a single blockchain platform that uses a technology called “Proof of History” to achieve high throughput.

It uses a technique called “gossip protocol” to propagate transaction data throughout the network, which enables it to process 65000 tps.

Winner: Solana (SOL)

Interoperability

Both networks may have different approaches, different focuses, and different ways of enabling interoperability.

At the end of the day, both are trying to achieve one goal – breaking down the barriers between different blockchain systems and allowing them to connect, communicate and cooperate with one another.

Polkadot, with its relay chain, acts as a central hub where different chains, known as “parachains,” can connect and exchange data, creating a symphony of interoperability, a multi-chain ecosystem if you will.

Its ability to connect many chains and its flexibility in the type of data that can be shared makes it a conductor of a decentralized orchestra.

Solana is tailor-made for high-frequency, low-value transactions such as DeFi and gaming, providing a frictionless and seamless experience for all its users. It is not well known for high interoperability.

Winner: Polkadot (DOT)

Security

Both Solana and Polkadot aim to provide secure blockchain platforms, but they use different methods to achieve them.

Solana uses a distributed proof-of-stake consensus mechanism and a combination of other techniques to improve security and scalability.

Polkadot, on the other hand, uses a unique consensus mechanism called “NPoS” which allows multiple independent chains or “parachains” to connect and work together within the Polkadot ecosystem.

it also has its own security mechanisms, called “collators” to maintain the security of the network.

Smart Contract Language

Polkadot allows developers to build and deploy smart contracts using various programming languages including Solidity, Rust, and more through its Substrate framework.

Solana Blockchain, on the other hand, supports the development of DApps using Rust as its main programming language.

DApps Ecosystem

On Polakdot, a gaming DApp on one parachain can interact with a DeFi DApp on another, creating new types of experiences.

Furthermore, with its ability to handle multiple parallelized transactions, Polkadot enables high-throughput DApps which can support a large number of users simultaneously without sacrificing performance.

Please Note: Polkadot does not allow the development of DApps but it leverages the existing DApps on other blockchains.

Solana’s ecosystem is more focused on DeFi where its high-performance capability is well utilized for quick execution and low cost for transactions.

Here is the total value locked (TVL) in Solana’s Defi Ecosystem-

| Name | Category | TVL |

|---|---|---|

| Marinade Finance | Liquid Staking | $105.17m |

| Orca | Dexes | $38.79m |

| Lido | Liquid Staking | $38.16m |

| Raydium | Dexes | $33.53m |

| Quarry | Yield | $30.29m |

| Saber | Dexes | $21.69m |

DOT Vs. SOL: Tokens Price Analysis

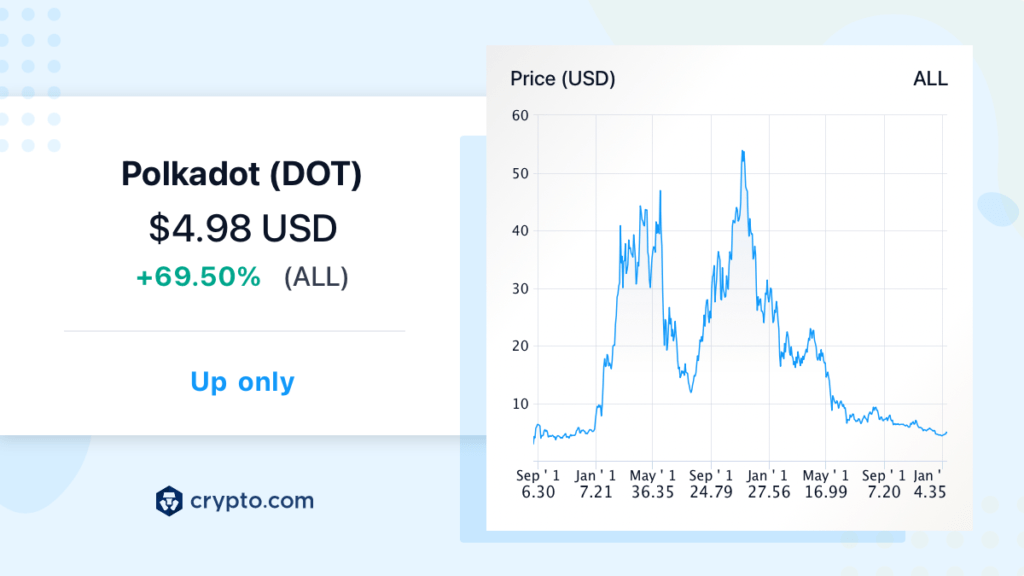

Polkadot (DOT) Price chart

On November 4th, 2021, Polkadot reached its pinnacle of prosperity as it soared to its all-time high of $54.98. However, just a year prior, on August 22nd, 2020, it hit rock bottom, trading at its all-time low of $2.82.

Although it’s currently experiencing a dip, with a cycle low of $4.23 and a cycle high of $5.06, experts predict that the sentiment towards Polkadot is bearish. The Fear & Greed Index also reflects this sentiment, with a score of 26 indicating a state of fear.

Currently, the circulating supply of Polkadot is 987.58 million DOT, out of its maximum supply of 1 billion DOT. The yearly supply inflation rate stands at 10.02%, which means that in the last year, 89.92 million DOT was created.

In terms of market capitalization, Polkadot is ranked #6 in the Proof-of-Stake Coins sector and #10 in the Layer 1 sector.

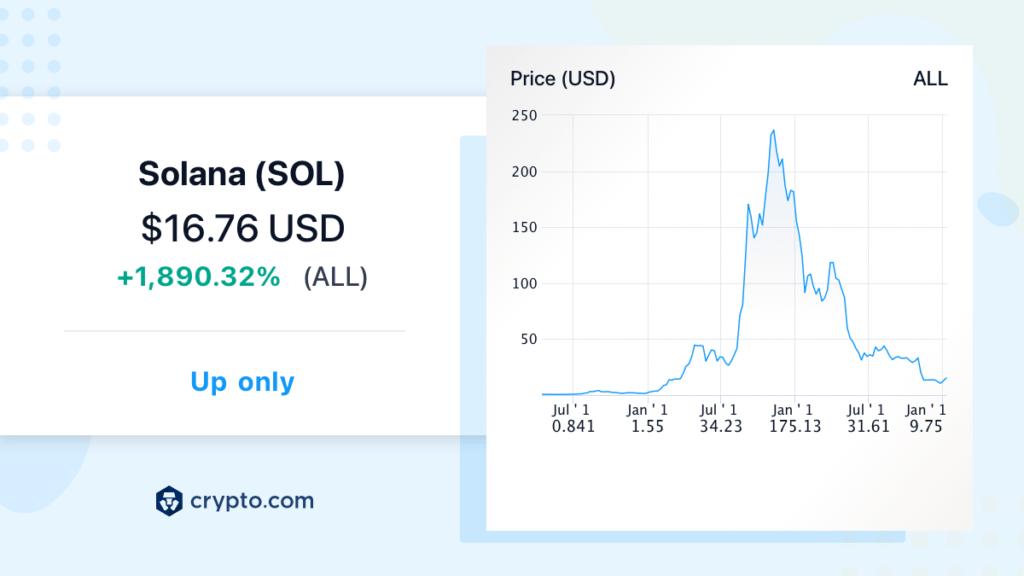

Solana (SOL) Price Chart

On November 6th, 2021, Solana reached a new pinnacle, trading at an unprecedented $259.52, its all-time high. Despite this achievement, the digital asset also experienced a nadir, hitting its all-time low of $0.00 at an unspecified date.

Since then, Solana has undergone fluctuations in value, with a cycle low of $8.09 and a cycle high of $17.33. Currently, sentiment towards the cryptocurrency is neutral and the Fear & Greed Index is signaling a level of fear at 26.

With a circulating supply of 362.91 million SOL and a maximum supply of 533.68 million, the Solana network has a yearly inflation rate of 16.49%, adding 51.36 million SOL to the ecosystem in the last year.

In terms of market capitalization, Solana is a major player in the Proof-of-Stake Coins sector, ranking fourth, and is also a prominent force in the Solana Network and Layer 1 sectors, where it holds the second and seventh positions, respectively.

Conclusion

Polkadot and Solana are two blockchain technologies that offer unique advantages for users. While Polkadot is great for scalability and interoperability, Solana is the faster and more secure option.

Whether you choose Polkadot or Solana, you can rest assured that you’re investing in an innovative technology that will revolutionize the way we interact with the blockchain.

So get ready to join the future of blockchain technology with Polkadot or Solana!

Related FAQs

Is Polkadot a good investment?

Polkadot is a blockchain protocol that aims to enable interoperability between different blockchain networks, allowing for the transfer of data and assets between them. This makes it an interesting project with a lot of potential, as it could allow for the creation of a truly decentralized web where different blockchain-based applications can communicate with each other.

It has a number of unique features like multi-chain architecture, multiple governances, and the capability of creating custom parachains that sets it apart from other blockchain projects. As a result, it has been gaining more attention and adoption recently.

Is Solana better than Polkadot?

Solana has gained popularity due to its fast transaction speeds, scalability, and low fees, making it a popular choice for decentralized finance (DeFi) applications. It also has a strong community of developers and supporters, which could lead to continued growth and adoption.

Polkadot, on the other hand, offers a unique multi-chain infrastructure that allows for interoperability between different blockchains. It also has a strong focus on governance and allows for customizability through its Substrate framework. This could lead to potential use cases in areas such as supply chain management and decentralized identity.

Related: