Cryptocurrency trading has been increasing in popularity, and with it, the use of trading bots to automate trading strategies. Cryptohopper and Quadency are both cloud-based crypto trading bots that automate trading strategies on various exchanges.

In this article, we will compare the features, pricing, ease of use, and overall performance of Cryptohopper vs Quadency to help you decide which one is better.

Similarities and Differences 🔍:

- Cryptohopper charges a monthly subscription fee ($15.58/month) based on the number of trading bots, while Quadency offers tiered pricing plans (0.08% per trade) based on the number of monthly trades.

- Cryptohopper offers more trading strategies than Quadency and has a high success rate and user base.

- Quadency standout against cryptohopper by using smart order router, which combines liquidity from both CEX and DEXs.

We Recommend: Best Crypto Trading bots

Best Manually Customized Trading bot

- 75+ CEX and DEX cryptocurrency exchanges

- Support over 300,000 crypto coins and 50+ DEX coins supported

- Insider information on where it is profitable to buy and sell tokens

- Free training and cases for clients of service

Proven Success Rate with 1M+ Users

- 16+ Exchange support

- Crypto-signals in Telegram

- Trading view Integration

- DCA, GRID, options, HODL, Smart trading bots

- Marketplace to buy automated trading strategies with success rate

Cryptohopper and Quadency Compared

| Points | Cryptohopper | Quadency |

|---|---|---|

| Launched Date 🚀 | 2017 | 2018 |

| Headquarters 🏢 | Amsterdam | Delaware |

| Active Users 🧑🤝🧑 | 200,000+ | 100,000+ |

| Type 🔍 | Crypto Trading bot and Portfolio Management | Crypto trading bot |

| Scam or Legit? 🕵️♂️ | Legit ✅ | Legit ✅ |

| Best For 🏆 | Beginner to Advanced | Professional traders |

| Operating countries 🌍 | Worldwide | Worldwide |

| Supported Exchanges 💱 | 16+ | 6 Exchanges |

| Trading Pairs 📊 | 1000+ | 1200+ |

| Fiat currency Supported 💵 | EUR, USD | USD |

| Types of the trading bot 🤖 | Grid, AI, Market-Making | Grid, Smart Order, Manual |

| Payment Method 💳 | Credit card, PayPal | Credit card, Crypto |

| Pricing 💰 | $15.58-$82/month | 0.08% per trade |

| Extra Trading Fees? 💸 | No | No |

| Mobile App 📱 | Android and IOS | Android and IOS |

| Paper Trading (Demo) 📝 | Yes | Yes |

| Backtesting with Startegies 📊 | Yes | Yes |

| Customer Support 🤝 | 24/7 support Email, Chat | 24/7 support |

| KYC 🔐 | No | No |

| Cryptohopper Review | Quadency Review |

What is Cryptohopper?

Cryptohopper is a cloud-based trading bot that allows traders to automate their trading strategies. It supports more than 16+ exchanges, including Binance, Bybit, and Kucoin.

The platform has a user-friendly interface that makes it easy for beginners to get started with automated trading. It offers a range of tools, such as backtesting, trailing stop-loss, and technical indicators, to help traders create and optimize their trading strategies.

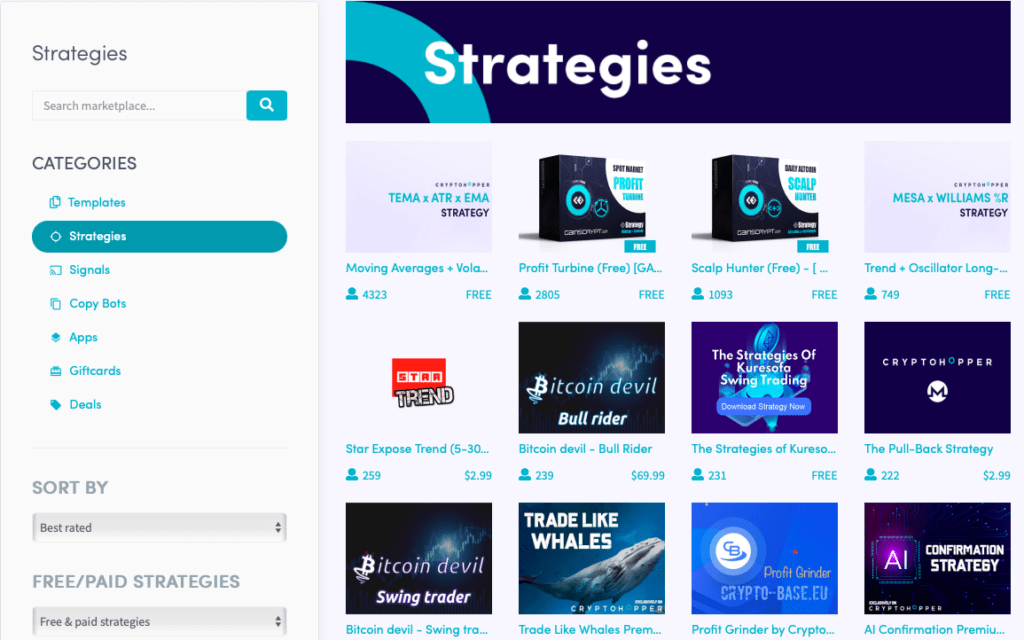

Key Features of Cryptohopper

- Supports more than 16+ exchanges

- GRID and DCA bots

- Backtesting tools

- Trailing stop-loss

- Technical indicators

- Customizable trading strategies

- Marketplace for strategies

- Telegram and email notifications

- Paper trading

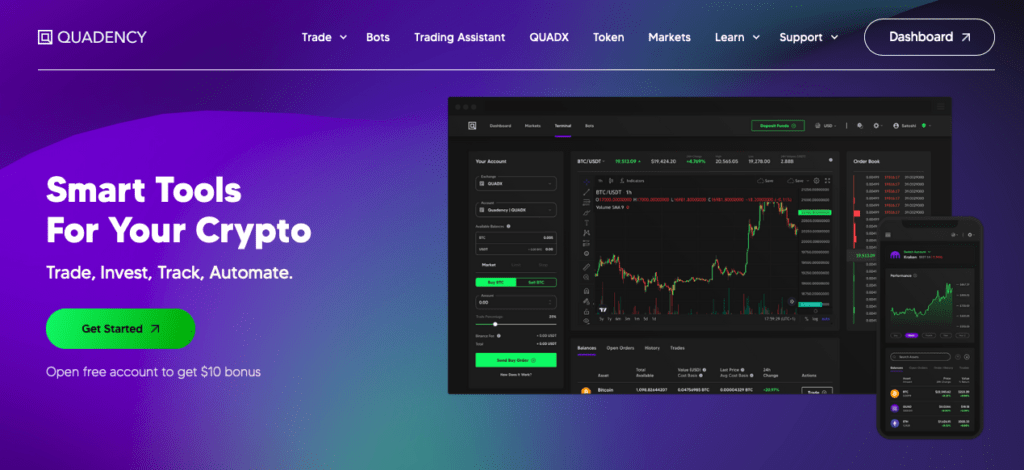

What is Quadency?

Quadency is a multi-exchange trading platform that supports more than 6 exchanges, including Binance, Kucoin, and OKX. It offers a range of tools, such as portfolio tracking, trading signals, and smart order routing, to help traders automate their strategies. The platform has a user-friendly interface that makes it easy for traders to manage their portfolios and trading strategies.

Key Features of Quadency

- Supports more than 6 exchanges

- User-friendly interface

- Portfolio tracking

- Trading signals

- Smart order routing

- Customizable trading strategies

- Backtesting tools

- Paper trading

- Advanced order types

Read: Best Crypto Trading bots

Cryptohopper vs Quadency: Trading Strategies and Tools

Both Cryptohopper and Quadency offer a range of advanced trading strategies and tools that are designed to help traders maximize their profits and minimize their risks.

Smart Order Router (DEX+ CEX)

Quadency offers a smart order router that allows users to access liquidity across multiple exchanges, including both centralized (CEX) and decentralized (DEX) platforms. This means that users can take advantage of a wider range of trading opportunities and access the best possible prices for their trades.

Portfolio Management

Both Cryptohopper and Quadency offer a range of portfolio management tools that are designed to help traders monitor and manage their digital assets. However, Quadency offers a more comprehensive suite of tools, including a portfolio rebalancing feature that automatically adjusts the allocation of assets based on market conditions.

With Cryptohopper, users can monitor their portfolios using a range of customizable dashboards and reporting features. The platform also offers a range of educational resources and tutorials that are designed to help users better understand the strategies and tools available on the platform.

Crypto Swaps

Quadency. offers a built-in swap feature that allows users to execute trades directly within the platform. The platform supports a range of popular cryptocurrencies and allows users to set custom parameters for their trades, including price limits and stop-loss orders.

Cryptohopper Trading bots Explained

- Automatic Trading: This feature allows users to automate their trades using a trading bot. The bot can outperform human traders by quickly analyzing market data and making trades based on predefined criteria. This can save users time and increase their chances of making profitable trades.

- Social Trading: It allows users to follow and copy the trades of successful traders. Users can trade like a pro without having to be an expert themselves.

- Copy Bot: This feature allows users to copy an experienced trader’s trades one-on-one. This can be useful for users who want to learn from successful traders or simply want to replicate their trading strategies.

- Trailing Orders: It allows users to set buy and sell orders that automatically adjust based on the market’s movements.

- DCA: DCA stands for “Dollar Cost Averaging.” This feature allows users to invest in a cryptocurrency at regular intervals, regardless of the market’s current price.

- Strategy Designer: Crypothopper allows users to create their trading algorithms without having to know how to code. You can easily design and test your algorithms to see how they perform in the market.

- AI Trading: This feature allows trading bots to learn and make trading decisions based on data and market trends.

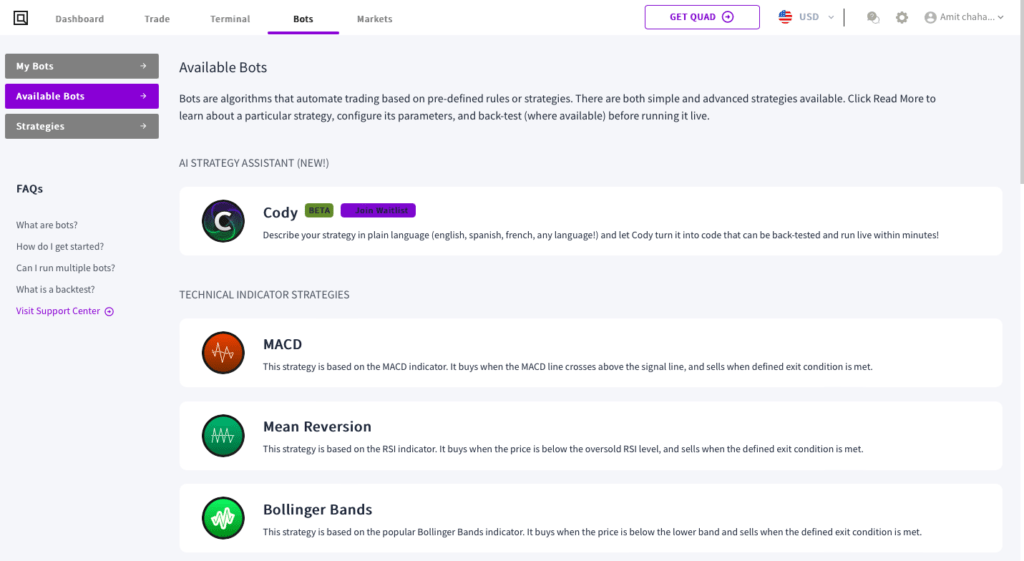

Quadency Trading bots Explained

MACD: This approach initiates a buy order when the MACD line intersects above the signal line and triggers a sell order once a predetermined exit condition is met.

Mean Reversion: It is used to purchases an asset when its price falls below the oversold level according to the RSI indicator and executes a sell order upon meeting the specified exit condition.

Bollinger Bands: This technique buys an asset when its price falls below the lower band of the Bollinger Bands indicator and sells when the designated exit condition is reached.

DMAC: The trading system employs the Dual Moving Average Crossover strategy to execute trades. It places a buy order when the short-term moving average crosses above the long-term moving average and exits upon meeting the predefined exit condition.

Multi-Level RSI: The trading approach aims to buy an asset when its price drops below predetermined RSI levels and averages down by buying more if the price falls further. It sells when either the profit target or stop loss level is attained.

Smart Order: This automated trading bot enables users to place advanced orders with profit targets and stop-loss orders (either trailing or fixed). The bot sends specific orders and monitors the stop-loss and profit target internally (using hidden orders) in real-time.

Accumulator: It is beneficial for accumulating or selling a substantial quantity of assets in low-volume pairs with minimal impact on the price. It slices the total amount into numerous small orders to achieve this.

Market Maker: The trading system executes a real-time market-making strategy by attempting to buy low and sell high. It places two limit orders simultaneously on both sides of the order book and repeats the process once both orders are filled or if the stop-loss is triggered.

Grid Trader: This automated trading bot automates the popular “grid trading” strategy by placing multiple buy and sell limit orders on grid lines within a specified price range.

Portfolio Rebalancer: Quadency enables users to construct a diversified portfolio by selecting desired assets and setting their respective allocations. The portfolio is rebalanced at predetermined intervals when assets gain or drop in value by a given threshold.

Pricing Comparison

Cryptohopper offers four pricing plans: Pioneer, Explorer, Adventurer, and Hero. The first plan, called Pioneer, is completely free with no payment details required. It provides users with unlimited copy bots, 20 open positions per exchange, portfolio management, and free manual trading on all exchanges.

The second plan, called Explorer, costs $16.58 per month and includes everything from the Pioneer plan. In addition, it offers 80 open positions per exchange, 10 min strategy interval checks, scan markets with the power of 15 bots, backtesting, strategy designer, paper trading, and trading signals.

Quadency’s pricing plans are based on trading volume and offer different trading fees.

- Tier 1 has no required holdings or trading volumes and charges a 0.08% trading fee for both bot and QUADX trading.

- Tier 2 requires either $500 holdings, $10,000 bot trading volume, or $10,000 QUADX trading volume, and charges a 0.072% trading fee.

- Tier 3 requires either $1,000 holdings, $50,000 bot trading volume, or $50,000 QUADX trading volume, and charges a 0.064% trading fee.

Cryptohopper vs Quadency: Ease of Use and Mobile App

Both Cryptohopper and Quadency are user-friendly and easy to navigate. Cryptohopper’s visual strategy designer is intuitive and easy to use, while Quadency’s drag-and-drop strategy builder makes creating custom strategies easily.

Both Cryptohopper and Quadency offer mobile apps for iOS and Android devices. The mobile apps allow users to monitor their portfolios, execute trades, and receive alerts

Cryptohopper and Quadency: Performance Comparison

In terms of performance, Cryptohopper has an impressive win rate of 82% according to their website. However, past performance does not guarantee future results. Cryptohopper’s platform is also designed to handle high-frequency trading, which can be beneficial for traders looking to make quick trades.

Quadency, on the other hand, provides users with an AI-powered backtesting feature that allows traders to optimize their trading strategies based on historical data. This can help traders make more informed trading decisions and potentially increase profits.

Customer Support

Both Cryptohopper and Quadency offer excellent customer support. Cryptohopper provides users with 24/7 support via email and chat, while Quadency provides users with 24/7 support via email and chat, as well as phone support during business hours.

Cryptohopper or Quadency: Security and Privacy

Security and privacy are critical factors to consider when choosing a crypto trading bot. Both Cryptohopper and Quadency take security and privacy seriously and have implemented various security measures to protect their users’ accounts and data.

Cryptohopper uses two-factor authentication (2FA), SSL encryption, and API key encryption to protect user accounts. Quadency also uses 2FA, SSL encryption, and API key encryption, as well as a secure server infrastructure to protect user data.

Cryptohopper vs Quadency: Supported Exchanges

Both Cryptohopper and Quadency offer integrations with various exchanges and third-party services. Cryptohopper supports integration with over 16 exchanges, including Binance, Coinbase, and Kraken. Cryptohopper also integrates with various third-party services, such as TradingView, Telegram, and Discord.

Quadency supports integration with over 6 exchanges, including Binance, OKX, and Coinbase Pro. Quadency also integrates with various third-party services, such as TradingView.

Related:

Pros and Cons of Cryptohopper and Quadency

Pros of Cryptohopper:

- Offers a user-friendly and easy-to-use interface for beginner traders.

- Provides a large variety of customizable trading strategies for advanced traders.

- Offers a marketplace for users to buy and sell trading strategies.

- Offers a free trial and affordable pricing plans for different types of traders.

- Supports a wide range of exchanges and cryptocurrencies.

- Provides a mobile app for easy access and trading on the go.

Cons of Cryptohopper:

- The pricing plans may not be suitable for traders with a limited budget.

- The platform is not as customizable as some other trading bots in the market.

- Customer support can be slow to respond to user queries.

Pros of Quadency:

- Offers a wide range of trading features, including portfolio management, backtesting, and trading signals.

- Offers a user-friendly interface and customizable dashboard for traders.

- Supports multiple exchanges and cryptocurrencies.

- Provides affordable pricing plans suitable for traders with different budgets.

- Offers a free plan for traders to test the platform before committing to a paid plan.

- Provides a mobile app for easy trading on the go.

Cons of Quadency:

- The platform may not be suitable for beginner traders due to the complexity of some features.

- The number of trading bots available is limited compared to other trading bot platforms in the market.

- No data on the Success rate

Conclusion: Which is better

In conclusion, Cryptohopper and Quadency are both excellent crypto trading bots that offer unique features and cater to different levels of experience.

Cryptohopper offers more trading indicators and candle patterns, while Quadency offers an AI-powered backtesting feature. Both platforms are user-friendly, have excellent customer support, and take security and privacy seriously.

FAQs

Can I use Cryptohopper and Quadency together?

Yes, you can use both platforms together to improve your trading strategies. For example, you can use Cryptohopper to analyze market trends and generate trading signals, while using Quadency to execute your trades.

What are Cryptohopper and Quadency, and how do they differ?

Cryptohopper and Quadency are both cryptocurrency trading platforms that allow users to automate their trades, but they differ in their features and pricing. Cryptohopper offers a wide range of trading tools, including backtesting, technical analysis, and social trading, while Quadency offers more advanced trading features, such as algorithmic trading and smart order routing.

What trading strategies can I use on Cryptohopper and Quadency?

Both platforms offer a range of trading strategies, including trend following, mean reversion, and momentum trading. Additionally, Quadency offers more advanced trading strategies, such as portfolio rebalancing and options trading.