Shorting is a trading strategy that involves selling an asset at a high price and buying it back at a lower price, profiting from the price difference. Shorting is also known as going short or taking a short position. Shorting can be done on various types of assets, such as stocks, commodities, currencies, and cryptocurrencies.

Binance is one of the best fiat-to-crypto exchanges that offers margin trading, which allows users to trade with borrowed funds and leverage their positions. Margin trading can amplify both profits and losses, so it is not suitable for beginners or risk-averse traders.

In this guide, we will explain how to short on Binance with margin and futures trading. You can also read our Binance review for a detailed guide on the crypto exchange.

How to short Bitcoin on Binance: Quick Guide

Shorting” on Binance is when you try to make money when the price of a cryptocurrency goes down. Here’s a simple step-by-step guide:

- Create an Account: First, make an account on Binance if you don’t have one already.

- Deposit Funds: Deposit some money or cryptocurrency into your Binance account.

- Select a Cryptocurrency: Choose the cryptocurrency you want to short like Bitcoin (BTC), Ethereum, etc.

- Open a Short Position: Click on “Trade” and then “Futures” on Binance. Select “Sell/Short” to open a short position. You can also perform short-selling crypto on margin trading, options trading, leveraged tokens, or perpetual contracts.

- Set Leverage: Choose how much you want to amplify your bet with leverage. Higher leverage can lead to bigger gains but also bigger losses.

- Enter Amount: Enter how much of the cryptocurrency you want to short.

- Set Stop-Loss: Decide on a price where you want to automatically stop your losses if the price goes against you.

- Confirm: Double-check all your settings and confirm your short position.

- Monitor: Keep an eye on the price. If it goes down, you make money; if it goes up, you may lose.

- Close Position: When you’re satisfied with your profit or want to limit your loss, close your short position by clicking “Close.”

Read More: How To Short On Kucoin

How to short on Binance Margin Trading (Short-selling)

Here is the step-by-step guide for short selling on Binance exchange with margin trading:

- Open an account on Binance and verify your identity

- Activate your margin account

- Transfer funds to your margin account

- Borrow funds in your Margin Account

- Open a short-selling position

- Close your short position and repay the loan

Step 1: Activate your margin account

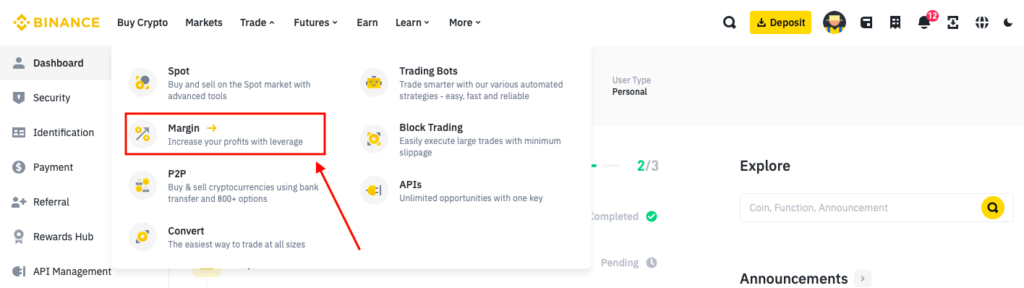

Before you can start margin trading on Binance, you need to activate your margin account. To do this, follow these steps:

- Log in to your Binance account and go to Wallet > Margin.

- Click on “Open Margin Account” and read the terms of service carefully.

- Check the box to agree to the terms and click on “Confirm“.

- You will see a confirmation message that your margin account has been activated.

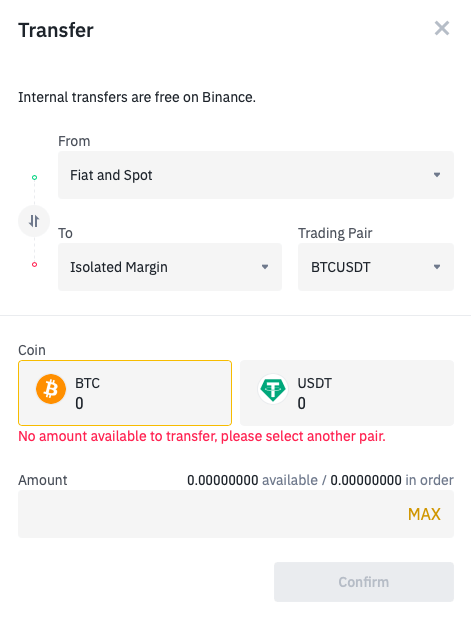

Step 2: Transfer funds to your margin account

After activating your margin account, you need to transfer some funds from your spot wallet to your margin wallet. These funds will serve as collateral for your borrowed funds and margin trades. (Read more: How To Send Bitcoin From Binance To Another Wallet Address).

- Go to Wallet > Margin and click on Transfer.

- Select the coin or token you want to transfer, such as BTC or USDT.

- Enter the amount you want to transfer and choose the direction (from spot wallet to margin wallet or vice versa).

- Click on Confirm Transfer and check the details.

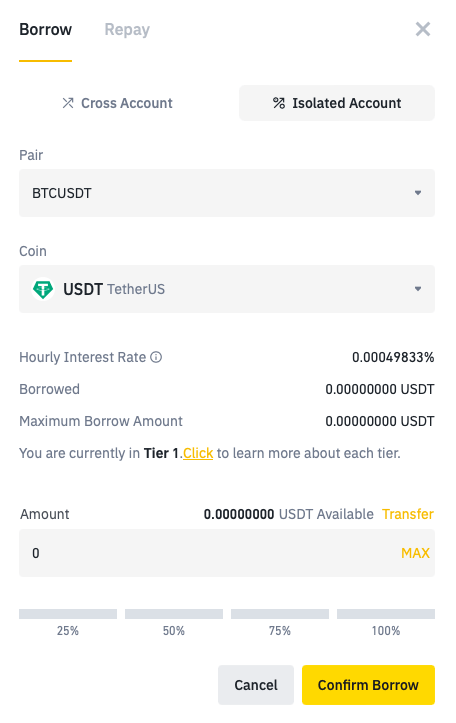

Step 3: Borrow funds in your Margin Account

After transferring funds to your margin account, you can borrow more funds from Binance and use them to open a short position. Borrow funds from Binance or other users. You can choose from various loan sources and interest rates. You can also repay your loans anytime.

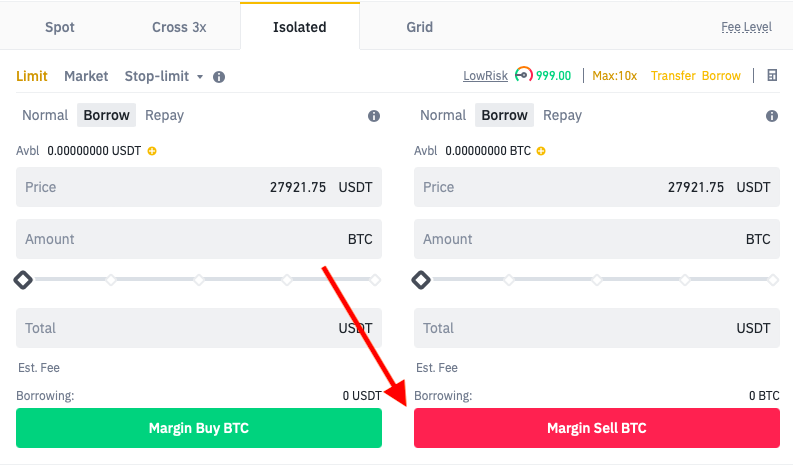

- Go to Trade > Margin and select the trading pair you want to short, such as BTC/USDT or BTC/BUSD.

- Choose the type of margin account you want to use: [Cross] or [Isolated]. Cross margin allows you to share your entire margin balance across all trading pairs, while isolated margin allows you to manage your risk separately for each trading pair.

- On the right side of the trading interface, click on [Borrow/Repay].

- Select the coin or token you want to borrow, such as BTC or USDT.

- Enter the amount you want to borrow or use the slider to adjust it.

- Click on [Borrow] and check the details.

- You will see a confirmation message that your loan has been processed.

- On the left side of the trading interface, switch to the [Short (Buy/Sell)] tab.

Step 4: Open a short position

For example, if you want to short 1 Bitcoin at $50 using isolated margin trading with 5x leverage you need to borrow 1 Bitcoin from Binance or other users and sell it for $50 using a “market or limit order“.

- Limit order means that you set a specific price that you want to buy or sell at.

- Stop-limit order means that you set a trigger price and a limit price for your order.

- Market order means that an order will be placed instantly at market price.

- Stop-market order means that you set a trigger price for your order and it will be executed as a market order when the trigger price is reached.

You can also set a time in force for your order: good till canceled (GTC), immediate or cancel (IOC), or fill or kill (FOK).

- Enter the price and amount of BTC you want to sell (short) or use the market order option for instant execution.

- Click on [Margin Sell BTC] and check the details.

- Click on [Confirm Order] and enter your verification code if required.

Also Read: How to transfer crypto from Binance to Coinbase

Step 5: Close your short position and repay the loan

After opening a short position, you need to monitor the market movements and decide when to close your position and take profits or cut losses. To close your position, you need to buy back the same amount of BTC you sold (shorted) at a lower price.

- Go to Trade > Margin and select the same trading pair you used to open your short position, such as BTC/USDT or BTC/BUSD.

- On the left side of the trading interface, switch to the [Long (Buy/Sell)] tab.

- Enter the price and amount of BTC you want to buy (close) or use the market order option for instant execution.

- Click on [Buy BTC] and check the details.

- Click on [Confirm Order] and enter your verification code if required.

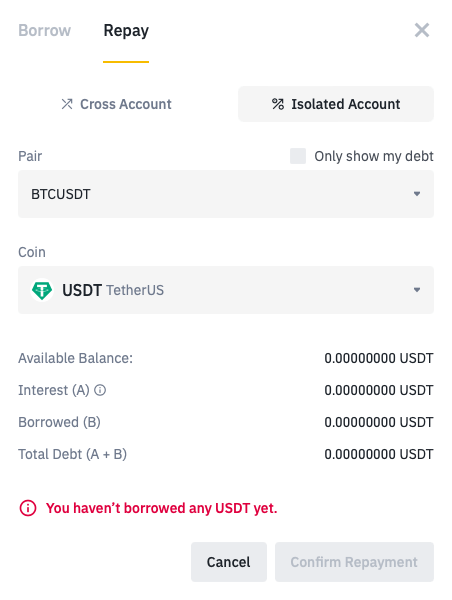

- Now, click on [Borrow/Repay] again.

- Select the coin or token you borrowed, such as BTC or USDT.

- Enter the amount you want to repay or use the slider to adjust it.

- Click on [Repay] and check the details.

- Click on [Confirm Repay] and enter your verification code if required.

How to short on Binance Futures Trading (Sell/Short)

To short sell crypto on Binance futures, follow these steps:

- Sign in to your Binance account and click on the “Derivatives” tab on the top menu bar. Then choose USDⓈ-M Futures or COIN-M Futures depending on which kind of contract you want to trade. USDⓈ-M Futures are paid in USDT or BUSD, while COIN-M Futures are paid in the coin itself.

- Move funds from your spot wallet to your futures wallet by clicking on the “Transfer” button in the top right corner. You can move USDT or BUSD for USDⓈ-M Futures, or any supported coin for COIN-M Futures.

- Pick the level of leverage you want to use by clicking on the Leverage button. You can pick from 1x to 125x leverage for USDⓈ-M Futures, or from 1x to 100x leverage for COIN-M Futures. The higher the leverage, the more risk and reward you will have.

- Pick the right order type (buy or sell) by clicking on the “Order Type” button. You can pick from limit, market, stop-limit, or stop-market orders. To short a futures contract, you need to place a sell order.

- Specify the number of contracts you want to sell by entering the amount in the Quantity field. You can also use the percentage buttons to adjust the amount based on your available balance.

- Check your order details and click on the Sell/Short button to execute your trade. You can see your open positions, unrealized PNL, and margin balance on the right panel.

- You have successfully placed a short trade on Binance futures trading. You can use the Close Position button to close your position at market price.

Related: How To Buy Dogecoin On EToro

Binance Fees for Shorting

- Spot Trading Fees: Binance charges a fixed fee of 0.1% for both makers and takers. However, there are opportunities to reduce this fee. You can enjoy a 25% discount if you opt to pay the fee with Binance’s native token, BNB. Furthermore, individuals with higher trading volumes or those holding a substantial amount of BNB can also benefit from lower trading fees.

- Futures Trading Fees: When it comes to futures contracts on the Binance Futures platform, fees are variable and contingent on several factors. These factors include the contract type, leverage used, and order type. Makers, who provide liquidity to the market, may face fees ranging from 0.02% to 0.075%, while takers, who execute trades, might incur fees ranging from 0.04% to 0.075%. For those looking to reduce fees, Binance offers a 10% discount if you pay using BNB.

- Margin Trading Fees: Binance applies a daily interest rate determined by the borrowed amount and duration. These interest rates can fluctuate between 0.02% to 0.1% per day, depending on the specific cryptocurrency. Similarly, traders with higher trading volumes or significant holdings of BNB may access lower interest rates.

- Deposit and Withdrawal Fees: No Fees for deposits and withdrawals. However, for fiat deposits, the fee varies according to the payment method and currency. This fee can range from 0% to 4.5%.

Also Read: How To Buy Ethereum On EToro

FAQs

What is shorting on Binance?

Shorting on Binance means you borrow an asset, like a crypto, and sell it at the current market price. You hope to buy it back cheaper later and give it back to the lender. This way, you can make money from the price difference if the asset drops in value.

Binance has many options to short an asset, such as margin trading, futures contracts, leveraged tokens, and options.

What is Binance Long/Short Ratio?

Binance Long/Short Ratio tells you the ratio of long positions to short positions on Binance Futures. You get it by dividing the number of long positions by the number of short positions.

For example, if there are 80 long positions and 40 short positions, the ratio is 2 (80/40). A ratio over 1 means there are more long positions than short positions, which shows positive market sentiment for the asset.

Can you short sell on Binance?

Yes, you can short sell on Binance with margin trading or futures contracts. Margin trading lets you borrow money from Binance to trade assets with leverage. Futures contracts are deals to buy or sell an asset at a set price and date in the future.

Can you short on Binance futures?

Yes, you can short on Binance futures with perpetual or quarterly futures contracts. Perpetual futures contracts are contracts that don’t expire and are settled in USDT or BUSD. Quarterly futures contracts are contracts that expire on a certain date and are settled in the underlying asset.

Is short selling on Binance profitable?

Short selling on Binance can be profitable if you guess the market direction right and manage your risk well. But short selling also has high risks and costs. Some of the risks and costs are:

1. Margin interest: You have to pay interest on the borrowed money or assets while your short position is open.

2. Stock loan fees: You have to pay fees for borrowing the assets from Binance or other lenders.

3. Unlimited losses: You can lose more than your initial investment.

Related: