Shorting in cryptocurrency trading is essentially betting that the price of a particular cryptocurrency will decrease. It can be a profitable strategy during bear markets or when you anticipate a specific cryptocurrency’s decline.

KuCoin is one of the best margin and futures trading crypto exchanges that allows traders to short various cryptocurrencies. Let’s dive into the process of “How to short Bitcoin on Kucoin“.

How to Short on Kucoin with Margin (Short Selling)

Here are the steps for short selling on Kucoin cryptocurrency exchange with margin:

- Transfer collateral to your margin account

- Borrow the asset you want to short

- Open a short position by selling the borrowed asset

- Monitor your debt ratio and margin level

- Close your short position by buying back the asset

- Repay your liabilities and interest

- Take your profit or loss

Step 1: Transfer collateral to your margin account

Before you can short any asset, you need to move some collateral to your margin account. You can choose BTC or USDT as collateral for the BTC/USDT pair in “isolated margin“, or any supported token in “cross margin“. You can do this by going to the “funding account” or “trading account”, where you hold your assets.

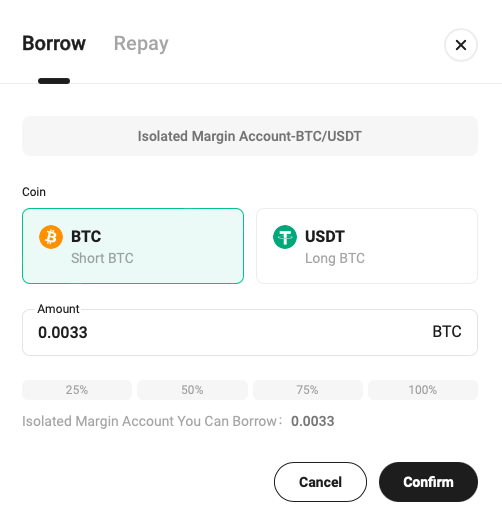

Step 2: Borrow the asset you want to short

Now, go to “margin trading”. You can borrow the asset you want to short from the margin C2C market. For example, if you want to short BTC, you can borrow BTC from other users who offer it. You will have to pay interest on the borrowed amount.

Step 3: Sell the borrowed asset to open a short position

After borrowing the asset, you can sell it at a relatively high price in the margin trading market. This is how you open a short position. You are hoping the price of the asset will drop in the future, so you can buy it back at a lower price.

Choose your leverage amount – KuCoin offers up to 5x leverage for cross-margin and 10x for isolated-margin. Specify your short trade entry price and the fund’s portion, then execute the trade. Be aware that trading fees are applicable to all executed trades.

💡 Note: While holding a short position, you need to keep an eye on your debt ratio and margin level. The debt ratio is the percentage of your borrowed amount to your total assets in your margin account. The margin level is the ratio of your equity (total assets minus liabilities) to your borrowed amount. If your debt ratio is too high or your margin level is too low, you may face the risk of liquidation.

Step 4: Buy back the asset to close your short position

When the price of the asset drops as you expected, you can buy it back at a lower price in the margin trading market. This is how you close your short position. You will return the same amount of assets that you borrowed plus interest to your lender.

Step 5: Repay your liabilities and interest

After closing your short position, you need to repay your liabilities and interest in your margin account. You can do this by clicking the “Repay” button on the margin trading page. You will see how much you owe and how much interest you have accrued.

Take your profit or loss: The difference between the price at which you sold and bought back the asset is your profit or loss from shorting. You can transfer your remaining assets from your margin account to your main account or continue trading with them.

Related: How to short on Binance

How to short on Kucoin with Futures (Short-sell)

Step 1: Sign in to your Kucoin account and add funds

You need a Kucoin account and some funds in your main account to start trading futures. You need to provide your name, DoB, password, address, and selfie for identity verification (KYC). Also, deposit funds to your account. You can deposit crypto through network transfer or deposit fiat currencies using Debit/Credit cards.

Step 2: Move funds to your futures account

You need to move some funds from your main account to your futures account to trade futures. You can do this by clicking the “Transfer” button on the top right corner of the futures page. You can pick between USDT-margined and coin-margined futures contracts.

Step 3: Sell the futures contract to enter a short position

You can short-sell any futures contract that is available on Kucoin. You can find the list of futures contracts on the left side of the [futures page]. You can search for the contract you want by typing its name or symbol. For example, if you want to short BTC/USDT, you can type “BTC” or “USDT” in the search box.

After choosing the futures contract you want to short, you can sell the contract at the current market price or at a limit price that you set. You can adjust the leverage, order size, and stop-loss/take-profit settings according to your preference. You can also use advanced order types such as post-only, iceberg, or time-weighted average price (TWAP).

Once, you get your profit or loss, you can close the position. You have successfully sell/short the futures position.

What is “Short Selling” in Cryptocurrency?

Shorting, also known as “short selling,” involves borrowing a cryptocurrency from someone and selling it on the market with the expectation that its price will fall. Later, you can buy the same amount of cryptocurrency at a lower price to repay the borrowed amount, pocketing the difference as profit.

But, why short on KuCoin? It is a reputable and easy-to-use cryptocurrency exchange that offers a wide range of trading options, including shorting in futures and margin trading. Here’s why you might consider shorting on KuCoin:

- Diverse Cryptocurrency Options: KuCoin offers a variety of cryptocurrencies to short, allowing you to choose from 100+ digital assets.

- User-Friendly Interface: It provides an intuitive platform suitable for both beginners and experienced traders.

- Liquidity: KuCoin’s high trading volume ensures liquidity, making it easier to enter and exit short positions.

Related: Full Kucoin Exchange Review

Kucoin fees (Spot + Margin + Futures)

| Fee Type | Amount (maker/taker) |

|---|---|

| Spot Trading Fee | 0.1% |

| Spot Trading Fee with KCS | 0.08% (20% discount) |

| Futures Trading Fee | 0.02% / 0.06% |

| Deposit Fee | Free |

| Withdrawal Fee | Varies by coin (only network fees) |

| 24h Withdrawal Limit | 1,000,000 |

Margin fees on Kucoin crypto trading platform are the costs of borrowing money and using leverage. Margin fees have three parts: interest, platform fee, and insurance fund.

- Interest: The market decides the interest rate and it changes by coin. The interest is based on the borrowed amount and the borrowing time. The lender gets the interest.

- Platform fee: The platform fee is 5% of the interest and it goes to Kucoin.

- Insurance fund: The insurance fund is 10% of the interest and it covers the losses if liquidation happens.

How to short Ethereum on Kucoin?

These are the steps to short Ethereum on Kucoin margin trading platform:

- Sign in to Kucoin and create a margin trading account. Go to “TRADE” and pick “Margin” from the menu. Click on “Open Margin Account” and follow the steps.

- Add USDT to your account. USDT is a stablecoin that matches the US dollar. It is the collateral for margin trading. To send USDT, go to “Assets” and choose “Main Account”. Click on “Deposit” next to USDT and copy the address or scan the QR code. Transfer USDT from another wallet or exchange to this address.

- Move collateral to margin account. Go to “Assets” and pick “Transfer”. Choose “Main Account” as the source account and “Margin Account” as the target account. Enter how much USDT you want to move and click on “Confirm”.

- Click on “Borrow/Repay” on the top right corner. Pick ETH as the asset you want to get and enter how much. You can also change the leverage ratio and interest rate. Click on “Borrow” and confirm.

- Now, choose ETH/USDT as the trading pair and click on “Sell/Short”. Enter the price and amount of ETH you want to sell and click on Sell ETH. You can also use market order or limit order as you like.

- Pay back your debt. Click on “Borrow/Repay” on the top right corner. Pick ETH as the asset you want to pay back and enter how much. Click on “Repay” and confirm.

Read More: How To Buy Ethereum On EToro

What is the best crypto to short?

Determining the best crypto to short lacks a definitive answer, as traders’ preferences and strategies vary.

Key factors to consider:

- Liquidity and Volatility: Opt for cryptos with high liquidity and volatility to enhance trading opportunities and swift exits.

- Borrowing and Selling Costs: Select cryptos that are readily borrowable and have low transaction costs on platforms like Kucoin.

- Market Sentiment and Trend: Favor cryptos with negative sentiment and downtrends, indicating potential for further price declines.

Some of the best coins to short on Kucoin are Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Bitcoin Cash (BCH), and Litecoin (LTC). However, these are not recommendations, so conduct thorough research before shorting any crypto.

Check this out: How To Send BTC From Binance To Another Wallet Address

How risky is shorting Bitcoin?

Shorting Bitcoin involves a high-risk trading strategy where you bet on Bitcoin’s price decreasing. This approach can be profitable if you accurately predict the direction and extent of Bitcoin’s price movements. However, it also comes with significant risks:

- Price Volatility: Bitcoin is renowned for its price volatility, meaning it can undergo sudden and substantial price swings. This makes it challenging to precisely forecast and time market movements, potentially resulting in unforeseen losses or liquidation.

- Unlimited Losses: Unlike going long on Bitcoin, where your maximum loss is confined to your initial investment, shorting exposes you to limitless losses. There’s no cap on how high Bitcoin’s price can rise, meaning you could lose more than your initial investment or collateral if the price surges contrary to your expectations.

- Borrowing Costs: Shorting Bitcoin necessitates borrowing it from a lender or a platform like Kucoin, incurring interest and fees. These costs can eat into your profits or escalate your losses. The interest and fees can fluctuate based on Bitcoin’s supply and demand in the market.

Related: How To Buy Bitcoin On EToro

Related FAQs: Shorting on Kucoin

What is Buy/Long and Sell/Short in Futures Trading on Kucoin?

In futures trading on Kucoin, traders have two types of positions: Buy/Long and Sell/Short.

Buy/Long means you anticipate the asset’s price will go up, so you purchase a futures contract at a lower price and sell it later at a higher price to profit. Sell/Short means you predict the asset’s price will drop, so you sell a futures contract at a higher price and buy it back at a lower price later to make a profit.

What is Kucoin Margin Trading?

Kucoin Margin Trading lets traders borrow money to trade more than they have. It has two modes: Cross Margin and Isolated Margin.

In Cross Margin, all assets are used as collateral and share the same risk level. In Isolated Margin, each trading pair has its own risk account.

What is Kucoin Futures Trading?

Kucoin Futures Trading is a service that allows traders to trade contracts that derive their value from the performance of an underlying asset, such as Bitcoin or Ethereum.

Futures Trading supports two types of contracts: USDT-Margined Contracts and Coin-Margined Contracts.

USDT-Margined Contracts are settled in USDT and use USDT as collateral. Coin-Margined Contracts are settled in the base currency of the trading pair and use coins as collateral

Can you short sell crypto on KuCoin?

Yes, you can short sell crypto on KuCoin using various methods, such as margin trading, futures trading, leveraged tokens, or options trading.

Can you short and long on KuCoin?

Yes, you can short and long on KuCoin using different services and products, such as spot trading, margin trading, futures trading, leveraged tokens, or options trading. Shorting and longing are two opposite trading strategies that aim to profit from the price movements of crypto assets.

Is short selling profitable on Kucoin?

Short selling can be profitable on Kucoin if you correctly predict the direction and magnitude of the price movements of crypto assets. However, short selling also involves high risks, such as price volatility, liquidation, or margin calls.

Therefore, you should only short sell if you are confident in your analysis and risk management skills.

Can you short on KuCoin without KYC?

No, You can not short on Kucoin without KYC. It recently launched a mandatory identity verification for all users.