Cryptocurrency trading has been on the rise in recent years, and with that, trading bots have become increasingly popular among traders.

One such bot that has gained a lot of attention is “Cryptohopper“. With its advanced features and customizable options, it has become a favorite among traders.

In this cryptohopper review, we will look at its performance, bot features, types of trading bots, price, and API security features.

Cryptohopper

Summary

Cryptohopper bots use advanced algorithms to analyze market trends and execute trades in real-time. It offers a variety of customizable features, including trading signals, technical analysis tools, and a marketplace for buying and selling strategies.

Cryptohopper Overview: Key Specifications

| Specification | Description |

|---|---|

| Owner | Cryptohopper BV |

| Location | Amsterdam, The Netherlands |

| Domain registered | July 2017 |

| Supported exchanges | 16 exchanges including Binance, Coinbase Pro, Kraken, KuCoin, etc. |

| Trading bots | Automatic trading bots, social trading, copy bot, trailing orders, DCA, paper trading, backtesting, strategy designer, AI trading, and many more |

| Trading features | Signal bot, mirror trading, market-making bot, arbitrage bot, exchange arbitrage bot |

| Pro tools | Trading terminal, crypto tweeter, taxes, and reporting |

| Pricing plans | Free, Explorer ($16/month), Adventurer ($41/month), Hero ($83/month) |

| Marketplace | Buy and sell signals, strategies, templates, and educational material |

| Demo Trading | Explore the platform without connecting an exchange or using real funds |

| Tournaments | Compete with other traders and win prizes |

| Referral program | Earn commissions by inviting others to join Cryptohopper |

| Affiliate | Yes |

| Support | Documentation page, community forum, email, support ticket system, and a chatbot |

What is Cryptohopper?

Cryptohopper is a platform that lets you use automated crypto trading bots that can trade for you 24/7. You can customize your bot with different features and options to suit your preferences and goals.

For example, you can copy other traders, use trading signals, or let your bot learn from the market trends. You can also manage your portfolio from one place and connect to multiple exchanges. Your bot is hosted in the cloud and runs even when you are offline.

Cryptohopper also has a marketplace where you can get and use templates, strategies, and signals from other traders. You can also learn from the community and the academy, or join tournaments and competitions to show your skills and win prizes.

It offers different pricing plans depending on your needs and budget. You can start with a free trial and upgrade later to a paid plan that gives you more benefits and access to advanced tools.

Pros and Cons of Cryptohopper

Pros 👍:

- Easy-to-use platforms for beginners

- Does not charge any trading fees, only monthly subscriptions

- 90+ candlestick patterns for market analysis

- Built-in marketplace for selling your own strategies and earning money

Cons 👎:

- Only popular crypto exchanges supported

- Monthly subscription can be higher for some users

How does Cryptohopper Work?

It works by connecting to cryptocurrency exchanges via API keys. This allows it to access real-time market data and execute trades on behalf of the user.

Once connected, the user sets their trading strategy by configuring various parameters such as buy and sell signals, technical indicators, and risk management settings. The bot then continuously analyzes the market and executes trades based on the user’s strategy.

To get started, the user first creates an account and connects it to one or more cryptocurrency exchanges. They then choose a pre-built strategy or create their own custom strategy using the bot’s strategy designer. The bot also offers a marketplace where users can purchase pre-built strategies or sell their own strategies to other users.

In addition to trading, It also provides users with a variety of tools to monitor and analyze their portfolio, including detailed performance reports and real-time market data.

Cryptohopper Features Review

- Create and run bots that trade 24/7 based on your strategy, signals, or market conditions.

- Follow and copy experienced traders, or share your trades with others. Join the community and learn or compete with them.

- Create your trading algorithms using indicators, candle patterns, and technical analysis tools. Backtest and optimize your strategies.

- Practice and test your trading skills without risking real money. Use simulated funds and trade on real or historical data.

- Use advanced features for professional traders, such as arbitrage, market-making, exchange/market arbitrage, or flash crashes.

- Manage your portfolio from one place, and stay updated on the latest news & trends.

1. Paper Trading (Demo Trading)

Paper trading is also known as simulated trading or demo trading. It is a way for traders to practice their trading strategies without risking real money. Users can set up their trading strategies and run them on the simulated market data provided by Cryptohopper.

Users can also view detailed reports of their paper trading performance, including profit and loss, win rate, and other performance metrics. This allows users to refine their strategies and make adjustments before actually implementing them with real money.

2. Social Trading or Mirror Trading

Cryptohopper’s social trading feature allows users to follow and copy the trades of other successful traders. Users can view the trading strategies and performance metrics of other traders, and choose to follow and replicate their trades automatically.

This feature is especially useful for users who are new to trading or who do not have the time or expertise to develop their own trading strategies.

3. Automated Trading Bot

With Cryptohopper’s automated trading, users can set up a range of trading strategies using a variety of indicators, signals, and technical analysis tools. These strategies can then be automated and executed on various cryptocurrency exchanges.

To set up an automated trading strategy, users can choose from a wide range of technical analysis indicators, such as moving averages, MACD, and RSI. They can also use signals from external sources such as TradingView, or create their own custom signals based on their trading strategy.

Once a strategy is set up, Cryptohopper will continuously monitor the market for trading opportunities and execute trades based on the pre-defined strategy. Users can also set up stop-loss and take-profit orders to manage their risk and maximize their profits.

Related: Best Free Crypto Trading Bots

4. DCA Bot

Dollar Cost Averaging (DCA) involves investing a fixed amount of money into an asset at regular intervals, regardless of the asset’s price.

The bot buys more when the price is low and less when the price is high. This helps to reduce the risk of investing a large amount of money at one time. It can also be set to buy on a fixed Interval of time.

Must Read: Best Crypto GRID Trading Bots

5. Trailing Stop Loss

A trailing stop loss order is a type of order that is placed at a specified percentage or dollar amount below the market price when you buy a cryptocurrency asset. The stop-loss order is used to limit your losses if the price of the asset drops.

However, with a trailing stop loss, the stop loss price moves up or down with the market price as the asset price increases.

So, if the market price goes up, the trailing stop loss will follow it, but if the price goes down, the trailing stop loss will not move until the market price recovers.

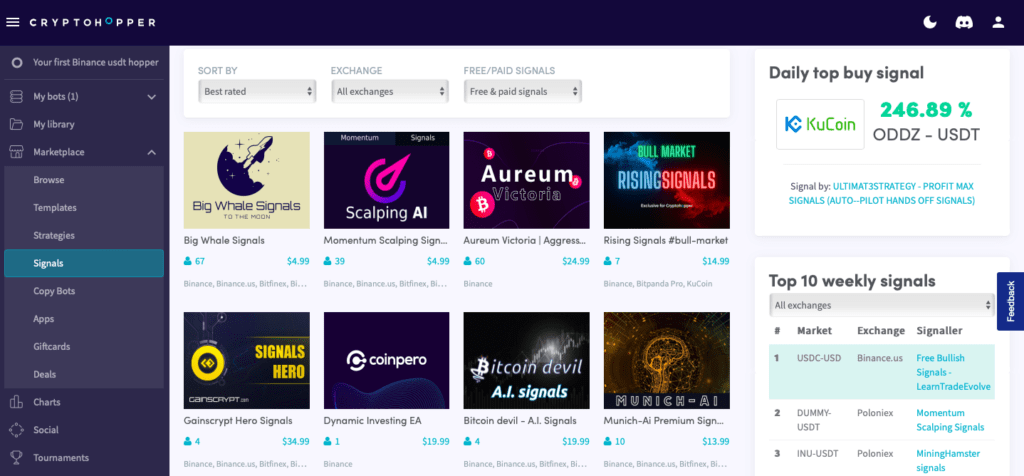

Cryptohopper Marketplace Review

The Cryptohopper marketplace includes a wide range of strategies and indicators, from simple to complex, and from low-risk to high-risk.

You can also use the Marketplace to find different services from other sellers. These include signals, templates, strategies, and copy bots.

It is good for both new and experienced traders.

- If you are new, you can use the Marketplace to start trading with bots easily. You don’t need to make your own strategies or indicators. You just need to pick a service that fits your style and risk level.

- If you are experienced, you can use the Marketplace to make more money by selling your trading skills. You can also learn from other traders and get better at trading by following their signals or copying their bots. You can also find advanced tools like DCA, market-making, arbitrage, or charting software.

The Marketplace has many services to choose from. They work with different exchanges, currencies, time frames, and methods.

You can search by ratings, popularity, price, or performance. You can also read what each service does and how it works. You can see what other users think about it too.

The Marketplace is also social. You can chat with the sellers and other users on Cryptohopper. You can ask questions, give feedback, or talk about trading ideas. This can help you learn more and trade better.

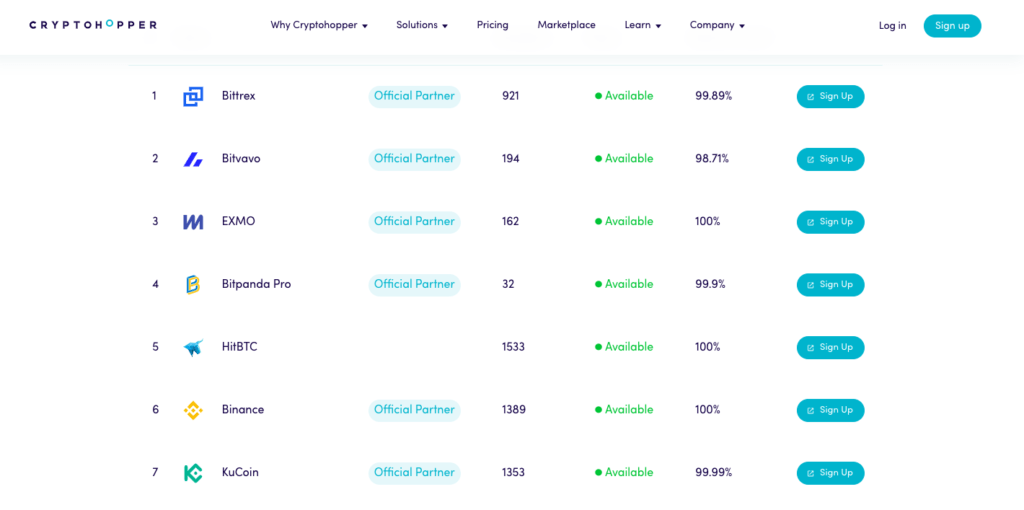

Cryptohopper Supported Exchanges Review

Cryptohopper supports 16 crypto exchanges currently and more are coming soon. You can see the list of supported exchanges.

- Binance

- Binance US

- Bitfinex

- Bitpanda Pro

- Bitvavo

- Bybit

- Coinbase Pro

- Crypto.com

- HitBTC

- Huobi Global

- Kraken

- KuCoin

- OKEX

- Poloniex

- ProBit Global

- Upbit

Related: Kucoin Review

Cryptohopper Security and Safety Review

Cryptohopper takes security and safety very seriously and has implemented a range of measures to protect users’ accounts and data.

- Two-Factor Authentication (2FA) to secure accounts

- Secure Socket Layer (SSL) encryption to protect user data

- API key permissions to limit access to accounts

- Strong password policies to ensure password complexity

- Protection against Distributed Denial of Service (DDOS) attacks

- Account activity monitoring and notifications for suspicious activity

- Data protection through secure storage and limited data collection

- Regular security audits to identify and address potential vulnerabilities

- Dedicated support team is available to assist with security concerns or issues.

Cryptohopper Pricing Review

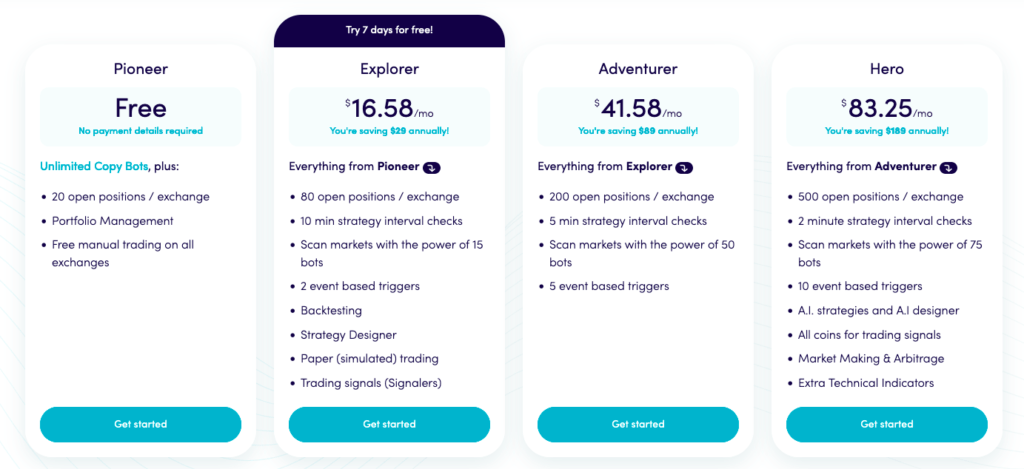

- Pioneer: Free with unlimited Copy Bots, 20 open positions per exchange, portfolio management, and manual trading on all exchanges.

- Explorer: $16.58 per month with everything from Pioneer, plus 80 open positions per exchange, 10-minute strategy interval checks, scan markets with 15 bots, 2 event-based triggers, backtesting, strategy designer, paper trading, and trading signals.

- Adventurer: $41.58 per month with everything from Explorer, plus 200 open positions per exchange, 5-minute strategy interval checks, scan markets with 50 bots, and 5 event-based triggers.

- Hero: $83.25 per month with everything from Adventurer, plus 500 open positions per exchange, 2-minute strategy interval checks, scan markets with 75 bots, 10 event-based triggers, A.I. strategies and designer, all coins for trading signals, market making and arbitrage, and extra technical indicators.

All plans come with a 7-day free trial, and users can cancel their subscriptions at any time.

Cryptohopper Payment Methods Review

It supports several payment methods to make it easy for users to subscribe to their chosen plan. These payment methods include:

- Credit and debit cards: The platform accepts payments made using major credit and debit cards such as Visa, Mastercard, and American Express.

- PayPal: Users can also pay for their subscription using their PayPal account.

- Cryptocurrencies: Cryptohopper accepts payment in various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

- iDeal: This payment method is available for users in the Netherlands, allowing them to pay directly from their bank account.

Customer Support Review

Customers can email Cryptohopper’s support team at “support@cryptohopper.com” with any questions or issues they may have.

It also provides support through a help center with articles and FAQs, live chat on its website, and a community forum.

The trading bots also has a “positive” rating on Trustpilot with an average score of 4.1 out of 5 stars based on over 2810 reviews.

Mobile App and Ease of Use

Cryptohopper has a mobile app available for both iOS and Android devices. The app is designed to be user-friendly and easy to navigate, allowing users to manage their trading strategies and monitor their portfolios on the go.

The platform itself is also considered to be quite user-friendly, with many users praising its ease of use and intuitive interface.

Related:

- Best Crypto Trading Bots

- How do Bybit Trading Bots Work

- Pionex Trading Bot Review

How to Set up Cryptohopper Trading Bots?

- Sign up for a Cryptohopper account and log in.

- Create a new Hopper by clicking on “Your Hoppers/View all Hoppers” in the top left corner and then clicking on “New” in the top right corner.

- Select the exchange you want to trade on and enter your API keys. You can find detailed instructions on how to create API keys for different cryptocurrency exchanges on their platforms.

- Select your quote currency, which is the currency you use to buy and sell coins.

- Select how you want your bot to trade: by following signals from third-party analysts or by building your own strategy using technical indicators and settings.

- Save your Hopper and enable it to start trading.

Alternatives and Comparison: Pionex vs Cryptohopper

| Features | Cryptohopper | Pionex |

|---|---|---|

| Supported Exchanges | 16+ | Built-in Exchnage |

| Trading Bots | ✔️ | ✔️ |

| Automated Trading | ✔️ | ✔️ |

| Mobile App | ✔️ | ✔️ |

| Trading Fees | $16 monthly plan | Free (0.05% to 0.1% per trade) |

| API Trading | ✔️ | ❌ |

| Social Trading | ✔️ | ❌ |

| Backtesting | ✔️ | ✔️ |

| Trading Signals | ✔️ | ✔️ |

Read: pionex vs Cryptohopper

Cryptohopper vs 3Commas

Cryptohopper supports 16 exchanges, while 3Commas supports 23 exchanges and the number of coins depends on the exchange. Both platforms allow users to design their own trading strategies using various indicators and candlestick patterns, but Cryptohopper may have more options in this regard.

Both platforms also have paper trading and backtesting features to test the strategies without risking real money, as well as risk management, features such as trailing stop-loss and stop-buy.

However, 3Commas has some unique features that Cryptohopper does not offer, such as a smart trading terminal that lets users manage multiple accounts.

You can trade manually with advanced tools, DCA bots that automatically buy more coins when the price drops to lower the average cost, grid bots that place buy and sell orders within a predefined price range, and options bots that trade crypto options contracts.

Read Full Comparison: 3Commas vs Cryptohopper

We Recommend: Best Crypto Trading bots

Best Manually Customized Trading bot

- 75+ CEX and DEX cryptocurrency exchanges

- Support over 300,000 crypto coins and 50+ DEX coins supported

- Insider information on where it is profitable to buy and sell tokens

- Free training and cases for clients of service

Proven Success Rate with 1M+ Users

- 16+ Exchange support

- Crypto-signals in Telegram

- Trading view Integration

- DCA, GRID, options, HODL, Smart trading bots

- Marketplace to buy automated trading strategies with success rate

Final Thoughts: Is Cryptohopper Worth it?

Cryptohopper is a powerful cryptocurrency trading bot that allows traders to automate their trading strategies across multiple exchanges with ease.

It offers a user-friendly interface, an extensive marketplace of trading strategies, and risk management tools.

However, traders should exercise caution and thoroughly research any strategy or bot before committing funds to it.

Cryptohopper Review: FAQs

What is the minimum buy amount for Cryptohopper?

Cryptohopper does not have a minimum buy amount. Instead, the minimum amount you can trade depends on the minimum order size of the exchange you are using.

For example, if the minimum order size on Binance is 0.001 BTC, then the minimum trade amount on Cryptohopper would also be 0.001 BTC.

Is Cryptohopper a good trading bot?

Yes, Cryptohopper is a good and trustworthy automated trading bot.

You can pick different trading strategies, signals, indicators, and settings to make your bot fit your needs and goals.

The platform also has many features and tools to help you improve your trading results, such as backtesting, paper trading, AI trading, social trading, and more.

How profitable is Cryptohopper?

Cryptohopper can be profitable if you use it smartly and regularly. The profitability of your bot depends on many things, such as the market conditions, the exchange fees, the trading strategy, the risk management, and the settings you pick.

Is Cryptohopper safe to use?

Cryptohopper is safe to use as it does not keep or touch your funds. Your funds stay on the exchange you connect to Cryptohopper with your API keys.

You can also set up different security measures on your account, such as 2FA authentication, IP whitelist, and email notifications. Cryptohopper also follows GDPR regulations and uses SSL encryption to protect your data.

Can I use Cryptohopper for free?

You can use Cryptohopper for free with the Pioneer plan, which lets you trade up to $500 with one bot on one exchange. The Pioneer plan also gives you access to some basic features and tools, such as signals, paper trading, trailing stop-loss, and more. If you want to trade with higher amounts or use more advanced features and tools, you can upgrade to a paid plan that suits your needs.

Cryptohopper has three paid plans: Explorer ($19/month), Adventure ($49/month), and Hero ($99/month). You can also get discounts if you pay yearly or with HOP tokens.

Related Article: